Market Overview:

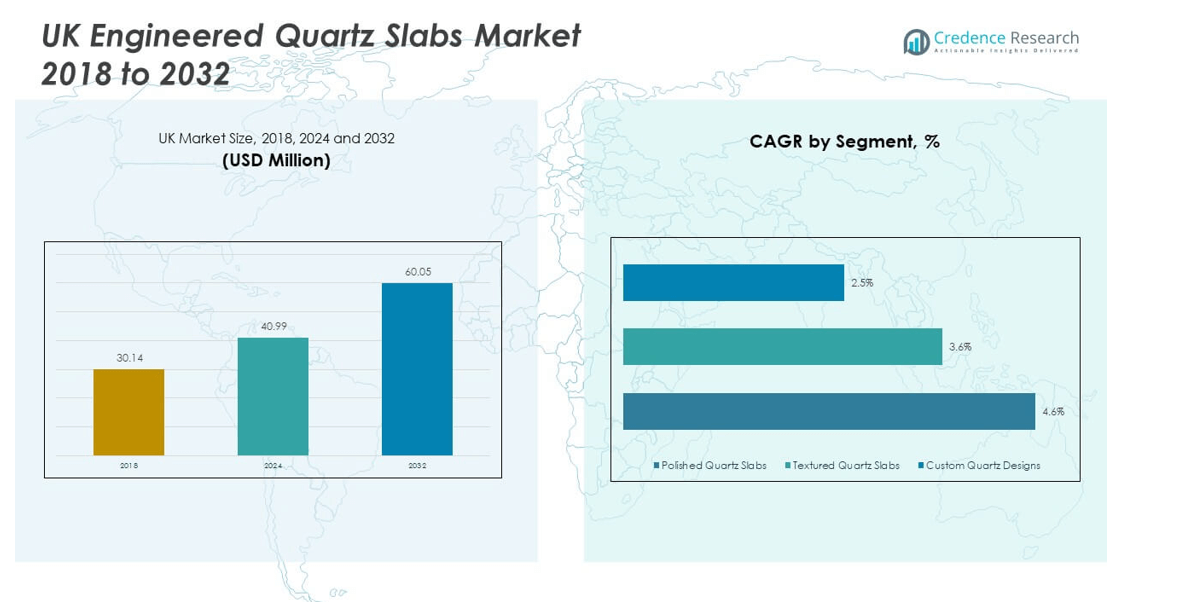

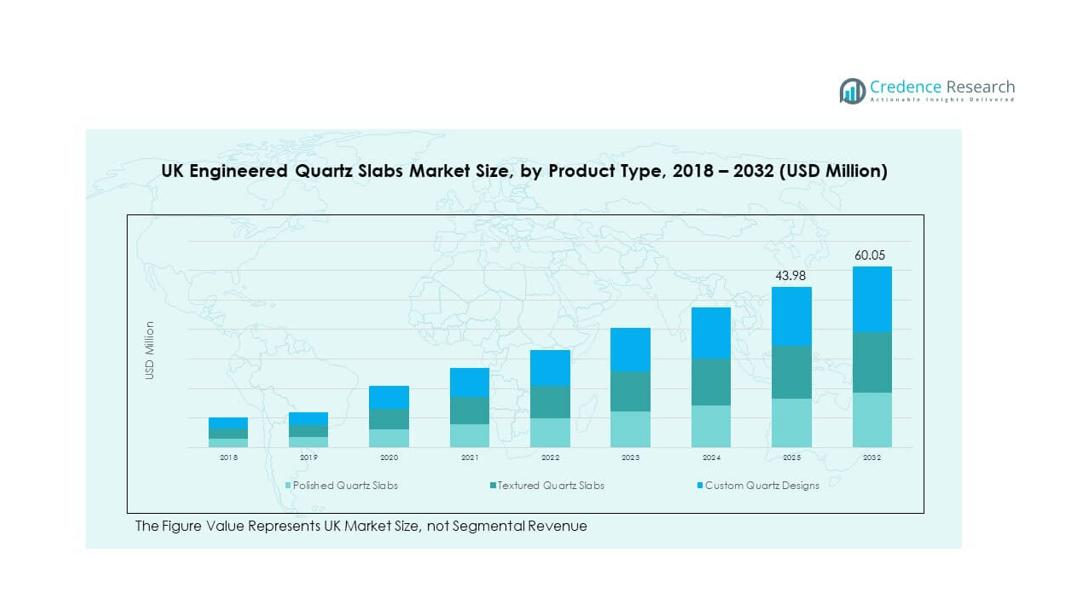

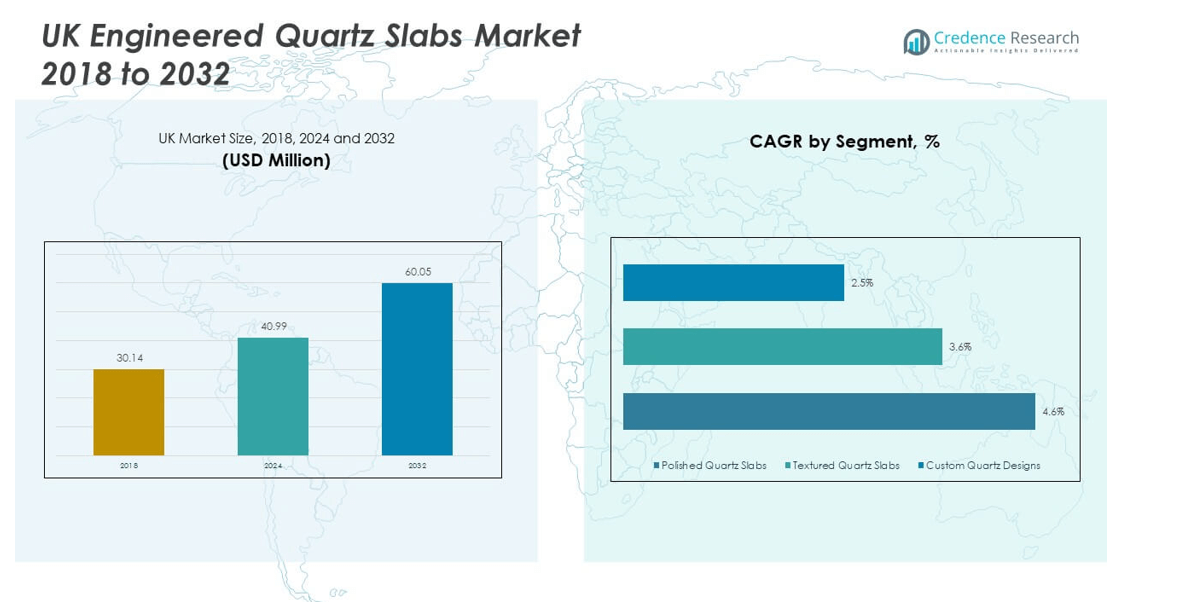

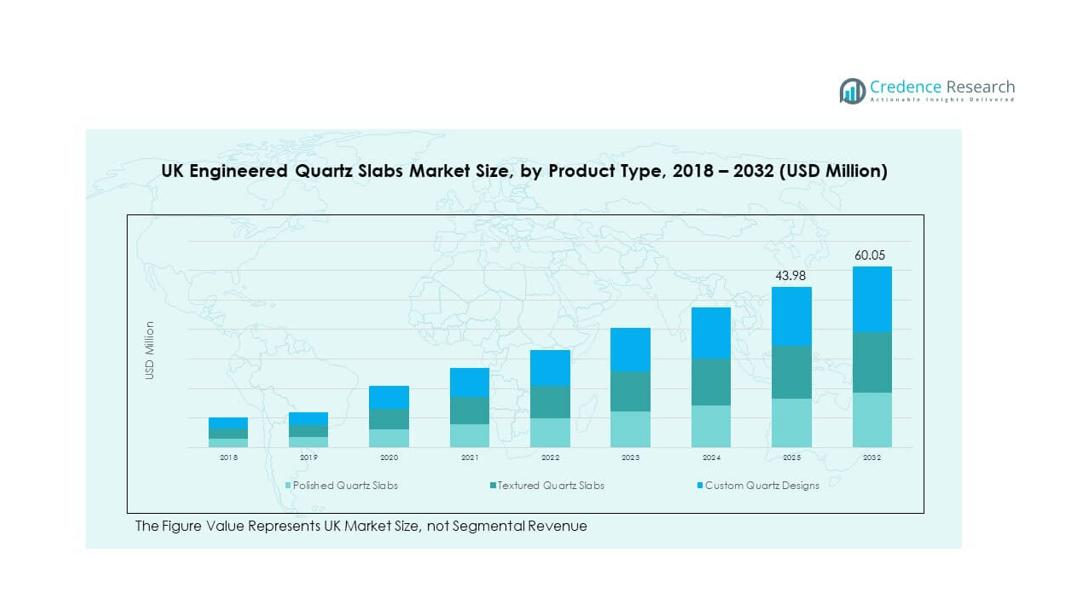

The UK Engineered Quartz Slabs Market size was valued at USD 30.14 million in 2018 to USD 40.99 million in 2024 and is anticipated to reach USD 60.05 million by 2032, at a CAGR of 4.55% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| UK Engineered Quartz Slabs Market Size 2024 |

USD 40.99 million |

| UK Engineered Quartz Slabs Market, CAGR |

4.55% |

| UK Engineered Quartz Slabs Market Size 2032 |

USD 60.05 million |

The market is driven by rising consumer demand for durable, low-maintenance, and visually appealing surfaces. Growth in residential and commercial construction projects boosts adoption, while homeowners prefer quartz slabs for kitchens and bathrooms due to their stain resistance and design versatility. Expanding urban development, coupled with rising disposable incomes, further supports demand. In addition, technological advancements in manufacturing are enabling innovative patterns and finishes, which enhance consumer preference for quartz over traditional natural stones.

Regionally, the UK market benefits from strong adoption in urban hubs with high construction and renovation activity. Southern England leads demand, driven by luxury housing projects and commercial developments. Northern regions show steady growth as affordable housing initiatives gain traction. Emerging demand in Scotland and Wales is also notable, supported by government-backed infrastructure projects and expanding retail and hospitality sectors. This geographic balance underpins both established demand and fresh opportunities across the country.

Market Insights:

- The UK Engineered Quartz Slabs Market was valued at USD 30.14 million in 2018, reached USD 40.99 million in 2024, and is projected to achieve USD 60.05 million by 2032, growing at a CAGR of 4.55%.

- England holds the largest share at 65%, driven by high construction and renovation activity in urban centers. Scotland follows with 20%, while Wales accounts for 10%, reflecting steady growth in regional housing and infrastructure.

- Northern Ireland, with 5% share, is the fastest-growing region, supported by increasing residential projects and gradual adoption in commercial spaces.

- Polished quartz slabs dominate with over 45% share, supported by strong demand in kitchens and bathrooms for their glossy finish and durability.

- Custom quartz designs capture around 30% of the market, driven by luxury housing projects and personalized interior preferences, while textured slabs cover the remaining share with steady growth.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Demand for Premium and Durable Surface Materials

The UK Engineered Quartz Slabs Market is witnessing strong growth driven by increasing consumer preference for durable and premium-quality surfaces. Homeowners and designers are drawn toward quartz due to its stain resistance, scratch resistance, and long-lasting appeal. The rising popularity of modern kitchens and bathrooms has further boosted installations across residential spaces. Growing awareness of low-maintenance materials supports adoption in both homes and commercial projects. The trend of replacing traditional natural stones with quartz also strengthens its competitive edge. It benefits from technological progress that allows new finishes and colors, enhancing consumer choice. Growing urban development and higher disposable incomes continue to elevate the demand base.

- For instance, in 2024, Cosentino announced its new Silestone XM surfaces in the UK, manufactured with Hybriq+ technology using 99% recycled water and renewable electricity, and featuring a maximum of 10% crystalline silica—significantly lower than traditional quartz surfaces—providing enhanced durability and safety for fabricators and users.

Growth in Construction and Renovation Activities Across Urban Areas

The surge in residential and commercial construction across major UK cities fuels market expansion. Urbanization creates demand for modern housing solutions that require durable, attractive, and easy-to-maintain materials. Renovation projects are equally important, as older homes increasingly adopt quartz slabs for kitchens and bathrooms. Government-backed housing programs and private sector investments further drive installation volumes. The UK Engineered Quartz Slabs Market gains from strong consumer spending on interior upgrades. It benefits from rising expectations for luxury finishes in both premium and mid-range properties. Builders and developers rely on quartz due to its performance advantages over marble and granite. The combination of construction growth and renovation demand ensures a steady market trajectory.

- For instance, Cosentino’s Silestone XM, launched in 2024, has been widely adopted in UK renovation projects following its debut at Milan Design Week 2024, where the low-silica technology attracted notable attention for high-traffic kitchen and bathroom applications in new and refurbished urban properties.

Increasing Influence of Lifestyle Changes and Design Preferences

Shifting consumer lifestyle preferences significantly impact the growing adoption of quartz slabs. Demand for minimalistic, sleek, and modern interiors drives higher use of engineered quartz. The UK Engineered Quartz Slabs Market benefits as customers seek stylish options that align with evolving trends. Interior designers prefer quartz due to the wide range of colors and finishes available. Rising awareness of eco-friendly products also supports engineered solutions over natural stone mining. It appeals to younger buyers who value both aesthetics and sustainability. Changing demographics, including younger homeowners with strong design focus, increase market opportunities. The influence of lifestyle choices ensures quartz slabs remain a key interior material.

Technological Advancements Enhancing Quality and Innovation

Continuous innovation in production technologies shapes the market’s competitiveness. Manufacturers are developing advanced processing methods that improve quality, durability, and design versatility. The UK Engineered Quartz Slabs Market benefits from the ability to replicate natural stone aesthetics while delivering better performance. Improved resin formulations enhance slab strength and reduce maintenance requirements. Automation in production also lowers costs, enabling wider market reach. It strengthens competitiveness by meeting varied customer expectations. New textures, patterns, and antibacterial surfaces are also influencing buyer preferences. Innovation ensures quartz slabs remain highly adaptable to modern construction and design requirements.

Market Trends:

Adoption of Sustainable and Eco-Friendly Manufacturing Practices

The market is experiencing a shift toward eco-friendly production processes to align with sustainability goals. Manufacturers are investing in recycled raw materials and green technologies. The UK Engineered Quartz Slabs Market is adapting to meet rising environmental concerns among consumers. Sustainability certifications and reduced carbon emissions strengthen brand reputation and buyer trust. It creates opportunities for companies to market eco-conscious product lines. Growing awareness of responsible sourcing also influences procurement practices. Buyers increasingly prefer products that combine style with eco-sensitivity. The focus on sustainability will continue shaping competitive strategies in the market.

- For instance, Cosentino’s Silestone XM production process in 2024 utilizes 99% recycled water and 100% renewable electric energy, aligning with rigorous third-party certifications for environmental sustainability and meeting lower emission standards for the UK market.

Integration of Quartz Slabs into Commercial and Hospitality Projects

The adoption of engineered quartz in hotels, offices, and retail outlets is rising steadily. Demand for durable surfaces that withstand high traffic makes quartz an attractive choice. The UK Engineered Quartz Slabs Market benefits from projects focused on enhancing aesthetics and functionality. Architects and designers integrate quartz into reception areas, lobbies, and dining spaces. It supports the growing demand for stylish yet long-lasting commercial interiors. The ability to deliver consistency in design across projects makes quartz ideal for large-scale developments. Demand from hospitality renovations also boosts market performance. This trend highlights the expansion beyond residential applications.

- For instance, Cosentino’s Silestone XM, with its low-silica composition and sustainable credentials, has been specified in high-durability commercial interiors—such as hotel lobbies and retail spaces—that require both aesthetics and practicality, as highlighted during its presentation at trade shows like Milan Design Week 2024.

Expansion of Online Retail and Direct-to-Consumer Sales Channels

Digital platforms are becoming an increasingly important sales channel for quartz slabs. Buyers are turning to online retail for convenience and access to wide design catalogs. The UK Engineered Quartz Slabs Market gains from companies that offer direct-to-consumer engagement. Virtual showrooms, digital visualization tools, and customization platforms enhance the shopping experience. It helps brands capture attention from tech-savvy buyers seeking quick comparisons. Growth of e-commerce allows wider outreach across regional markets. This trend ensures greater accessibility of engineered quartz slabs to both retail and commercial buyers. The digital shift is set to become a long-term growth driver.

Rising Customization and Premiumization in Product Offerings

Manufacturers are responding to consumer demand with tailored slabs that reflect unique design needs. Premiumization is evident in the availability of bespoke finishes, colors, and edge styles. The UK Engineered Quartz Slabs Market benefits from rising demand for customized interiors. It supports luxury housing projects where personalization is a strong value factor. Higher-end consumers seek quartz surfaces that deliver exclusivity in both appearance and texture. Product diversification also allows suppliers to target multiple price segments. Customization strengthens brand loyalty while addressing a diverse buyer base. Premium offerings enhance market competitiveness and drive margins.

Market Challenges Analysis:

High Cost of Production and Intense Competitive Pressures

The UK Engineered Quartz Slabs Market faces challenges due to high production costs and pricing pressures. Advanced technology, raw material sourcing, and labor add to overall manufacturing expenses. Rising energy costs in the UK further increase the burden on producers. Intense competition from both domestic and imported brands creates price sensitivity. It forces companies to balance quality and affordability in their offerings. Smaller players struggle to maintain profitability against large, well-established firms. The challenge also lies in maintaining differentiation when product designs often overlap. Managing costs while sustaining innovation is a critical concern for industry participants.

Environmental Regulations and Supply Chain Constraints

Environmental regulations on mining and material processing present compliance challenges for producers. The UK Engineered Quartz Slabs Market must adapt to strict policies related to sustainability and emissions. Supply chain disruptions add another layer of complexity, particularly with imported raw materials. It causes delays in meeting demand and impacts project timelines. Global uncertainties, including trade restrictions, also affect pricing stability. Manufacturers must explore local sourcing options to reduce dependency risks. Compliance costs and supply fluctuations make strategic planning essential. Adapting to both regulatory and logistical challenges remains a priority for long-term growth.

Market Opportunities:

Rising Focus on Renovation and Luxury Housing Projects

The UK Engineered Quartz Slabs Market offers strong opportunities in renovation and luxury housing projects. Homeowners are investing in modern upgrades that emphasize design and functionality. Demand for premium materials like quartz continues to rise in kitchens and bathrooms. It supports growing consumer interest in aesthetics and durability. Urban housing developments also provide opportunities for large-scale installations. Renovation trends will play a critical role in sustaining long-term market demand. Companies that target high-value housing segments can capture significant growth potential.

Expansion into Regional and Commercial Infrastructure Projects

The market also benefits from opportunities in regional development and commercial spaces. Retail centers, hospitality projects, and office buildings increasingly adopt quartz for durability and appeal. The UK Engineered Quartz Slabs Market can expand by meeting diverse commercial requirements. It gains from architects and developers specifying quartz in large-scale projects. Opportunities exist in regional towns experiencing infrastructure investments. Custom solutions for commercial buyers can further expand growth potential. Strong emphasis on design, performance, and sustainability ensures quartz slabs remain a preferred choice.

Market Segmentation Analysis:

By Product Type

Polished quartz slabs hold strong demand due to their glossy finish and suitability for modern interiors. Textured quartz slabs are gaining traction among consumers seeking unique aesthetics and natural stone-like appeal. Custom quartz designs attract premium buyers and designers, offering personalization in patterns, colors, and edge styles. The UK Engineered Quartz Slabs Market benefits from diverse product offerings that align with both functional and design needs. It ensures manufacturers can cater to different price ranges and consumer expectations.

- For instance, Silestone XM by Cosentino offers multiple finishes with clear labelling of silica content (either Q10 or Q40), giving architects and designers transparent product information to satisfy both safety regulations and premium design demands in the UK.

By Application

Residential construction represents the largest share, driven by growing adoption in kitchens and bathrooms. Commercial construction also contributes significantly as quartz surfaces are preferred in offices, retail outlets, and hospitality spaces. Kitchen and bathroom design continues to be a central demand driver due to quartz’s durability and stain resistance. Interior design professionals increasingly recommend quartz for aesthetic consistency across homes and commercial projects. Other applications, including institutional and public infrastructure, are slowly expanding their usage. It reflects the material’s versatility across both traditional and modern spaces.

- For instance, the documented adoption of Cosentino’s Silestone XM across the UK in 2024 encompasses both residential and commercial projects, driven by its advanced mineral formulation, which maintains quartz’s renowned surface performance while reducing silica and increasing sustainable content.

By Country

Regional demand shows strong concentration in England, with urban centers driving premium housing and renovation projects. Scotland and Wales are emerging contributors, supported by infrastructure growth and rising consumer awareness. Northern Ireland presents steady opportunities, particularly in residential applications. Segmentation by country also reflects variations in design preferences and spending capacity. Product type and application categories overlap regionally, reflecting diverse adoption patterns. It ensures balanced growth across multiple geographic zones within the UK.

Segmentation:

By Product Type

- Polished Quartz Slabs

- Textured Quartz Slabs

- Custom Quartz Designs

By Application

- Residential Construction

- Commercial Construction

- Kitchen & Bathroom Design

- Interior Design

- Others

By Country

- Country

- Product Type

- Application

Regional Analysis:

England: Leading Regional Market

England accounts for nearly 65% of the UK Engineered Quartz Slabs Market, making it the largest regional contributor. High demand stems from residential and commercial projects concentrated in London, Manchester, and Birmingham. Rising urbanization and steady investments in luxury housing developments strengthen quartz slab adoption. Kitchen and bathroom design projects dominate usage due to increasing consumer preference for stylish and durable interiors. Renovation activity in metropolitan areas further accelerates growth across both high-end and mid-range properties. It benefits from strong consumer spending and advanced supply chains that support timely delivery.

Scotland and Wales: Emerging Growth Hubs

Scotland represents about 20% of the market, supported by robust construction in residential and commercial sectors. Demand in Edinburgh and Glasgow continues to rise as urban redevelopment projects expand. Wales contributes close to 10% of the UK market, with growth driven by infrastructure improvements and housing upgrades. Both regions show rising interest in polished and textured quartz slabs, reflecting evolving design preferences. It highlights the growing importance of mid-scale developers and contractors in supporting demand. Rising disposable incomes and expanding awareness of quartz benefits strengthen the outlook for these regions.

Northern Ireland: Niche but Steady Contributor

Northern Ireland holds roughly 5% of the UK Engineered Quartz Slabs Market share, yet it remains a steady contributor. Growth is led by residential applications, particularly in kitchens and bathrooms where durability is valued. Local contractors increasingly specify quartz due to its design versatility and low maintenance needs. The region shows gradual uptake in commercial spaces, including offices and retail outlets. It gains support from imports and regional distributors who improve accessibility to varied product types. Market expansion remains modest but consistent, ensuring Northern Ireland maintains a niche role within the national landscape.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Caesarstone

- Silestone

- Cambria

- LG Hausys

- Compac Quartz UK

- Quantum Quartz

- Classic Quartz UK

- Zenith Quartz

- Radianz Quartz

- Silestone

Competitive Analysis:

The UK Engineered Quartz Slabs Market is characterized by strong competition among global and domestic brands. Major players such as Caesarstone, Silestone, Cambria, and LG Hausys dominate with extensive product portfolios and wide distribution networks. It benefits from companies focusing on advanced manufacturing techniques, design innovation, and sustainability-driven offerings. Local brands like Compac Quartz UK, Classic Quartz UK, and Zenith Quartz strengthen competition by catering to region-specific preferences and providing cost-effective options. The market is also influenced by frequent product launches that target premium and mid-range customer groups. Competitive differentiation lies in product quality, design variety, brand reputation, and strategic partnerships. With increasing consumer demand for luxury and durable surfaces, rivalry among players continues to intensify across residential and commercial applications.

Recent Developments:

- In August 2025, Caesarstone UK & ROI announced the launch of two new marble-inspired engineered quartz surfaces named 5116 Calacatta Nectar and 5115 Calacatta Stillstorm, expanding their premium collection for the UK market and reflecting a commitment to sustainable luxury design, quality, and longevity.

- In February 2025, Cosentino introduced the Silestone Ukiyo collection in the UK, unveiling fluted surfaces crafted for contemporary residential and commercial interiors, thereby strengthening its presence in the UK’s engineered quartz slabs market.

- In September 2025, Cambria announced the launch of the Cambria Global EW ETF, which joins its TAX and ENDW offerings, marking a significant expansion of Cambria’s business portfolio in the UK and globally.

- In June 2025, LG Electronics (parent of LG Hausys) acquired OSO Group, Europe’s leading provider of smart, energy-efficient hot water tanks, to enhance its HVAC B2B portfolio and expand in the UK and European heating solutions market.

Report Coverage:

The research report offers an in-depth analysis based on product type, application, and country segments. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Rising demand for premium surfaces will continue to drive adoption across residential projects.

- Commercial construction will expand quartz usage in offices, retail outlets, and hospitality spaces.

- Innovation in textures, finishes, and customization will enhance product attractiveness.

- Sustainability practices will shape consumer preferences and strengthen brand positioning.

- Online retail and digital platforms will expand product accessibility and customer engagement.

- Regional players will capture growth in cost-sensitive markets with tailored solutions.

- Renovation projects in urban areas will generate consistent demand for polished slabs.

- Luxury housing projects will increase uptake of customized and premium quartz designs.

- Supply chain improvements will reduce dependency risks and ensure timely availability.

- Strategic partnerships and product diversification will sustain competitive advantages.