Market Overview:

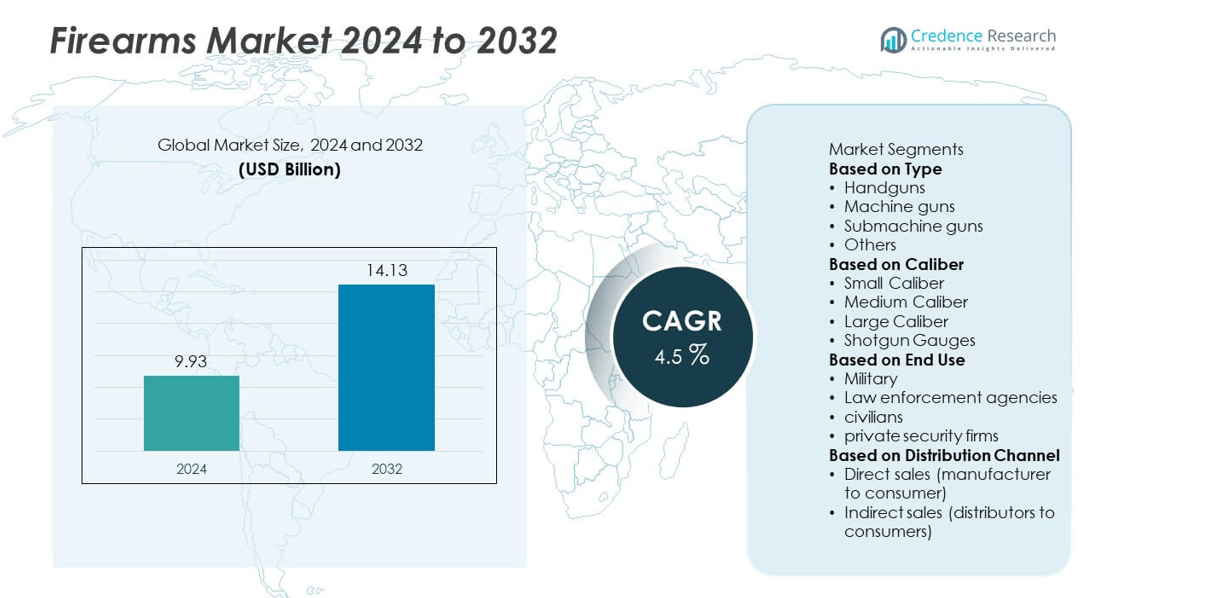

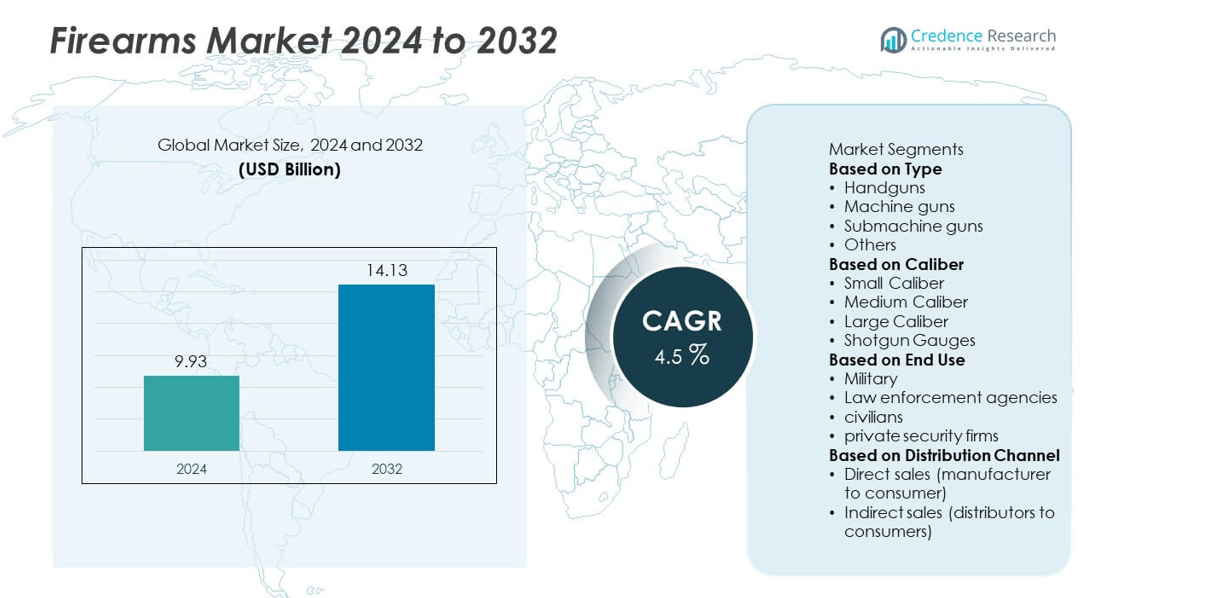

The global firearms market was valued at USD 9.93 billion in 2024 and is projected to reach USD 14.13 billion by 2032, expanding at a CAGR of 4.5% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Firearms Market Size 2024 |

USD 9.93 billion |

| Firearms Market, CAGR |

4.5% |

| Firearms Market Size 2032 |

USD 14.13 billion |

The firearms market is led by major players such as Smith & Wesson, FN HERSTAL, Ruger & Co., Inc., Glock Inc., and SIG SAUER, who maintain strong positions through advanced product portfolios and wide global distribution. These companies focus on innovation in design, safety, and precision to meet the needs of military, law enforcement, and civilian users. Regionally, North America dominated the market in 2024 with 36% share, supported by high civilian ownership and strong defense spending. Europe followed with 28% share, driven by rising law enforcement modernization programs, while Asia-Pacific accounted for 22% share, fueled by increasing defense budgets and border security requirements.

Market Insights

- The global firearms market was valued at USD 9.93 billion in 2024 and is projected to reach USD 14.13 billion by 2032, growing at a CAGR of 4.5% during the forecast period.

- Rising defense budgets, modernization programs, and civilian demand for personal protection drive the market, with handguns leading at 42% share due to widespread adoption across military, law enforcement, and civilian users.

- Key trends include technological advancements in lightweight materials, modular firearm systems, and smart safety features, alongside growing investments in precision and semi-automatic weapons.

- Leading companies such as Smith & Wesson, FN HERSTAL, Ruger & Co., Inc., Glock Inc., and SIG SAUER dominate through innovation, global distribution, and brand strength, while high regulatory restrictions and export controls act as restraints.

- Regionally, North America leads with 36% share, followed by Europe at 28% supported by modernization of law enforcement, while Asia-Pacific holds 22% share driven by rising defense expenditure, and Latin America (8%) and Middle East & Africa (6%) show steady demand growth.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

The handguns segment led the market in 2024 with 41% share, driven by widespread use across military, law enforcement, and civilian applications. Handguns are preferred for their portability, ease of use, and effectiveness in close-range defense. Rising demand for personal protection, coupled with increasing law enforcement procurement, continues to strengthen this category. Machine guns and submachine guns hold relevance in specialized military operations, but their adoption remains lower compared to handguns due to restrictions in civilian use and higher costs of deployment.

- For instance, the Smith & Wesson M&P Shield line is a popular choice for concealed carry among civilians and has also been adopted by some U.S. law enforcement officers for on- and off-duty use, demonstrating its reputation as a compact and reliable sidearm.

By Caliber

The small-caliber segment dominated with 44% share in 2024, as it is extensively used in handguns, rifles, and shotguns. Small-caliber firearms are favored for training, sporting activities, and personal defense because of their affordability, ease of handling, and reduced recoil. Their popularity among civilian users and law enforcement agencies underpins their leadership. Medium and large calibers, though vital for military operations, serve niche requirements, while shotgun gauges are widely adopted in hunting and recreational shooting.

- For instance, Sturm, Ruger & Co. is a prominent producer of .22 LR small-caliber firearms, which are consistently among the highest-volume sellers in the civilian sporting market.

By End Use

The military segment accounted for 46% share in 2024, reflecting the strong demand for firearms in defense modernization programs. Governments worldwide are investing heavily in upgrading weapons systems to improve operational readiness and combat effectiveness. Law enforcement agencies also represent a significant share, driven by rising security threats and the need for advanced tactical weapons. Civilian use, particularly for personal protection and sports shooting, continues to grow, while private security firms contribute steadily, supported by increased demand for armed security in sensitive sectors.

Key Growth Drivers

Rising Defense Modernization Programs

Governments worldwide are increasing investments in defense modernization, which significantly drives firearm demand. Advanced handguns, rifles, and automatic weapons are being procured to strengthen armed forces. Countries such as the U.S., China, and India are actively upgrading infantry weapons to improve combat efficiency. This trend supports large-scale procurement contracts and sustains steady growth for firearm manufacturers. The rising focus on enhancing defense capabilities amid growing geopolitical tensions ensures that military applications remain a dominant driver of the global firearms market.

- For instance, FN Herstal has delivered FN SCAR rifles to U.S. Special Operations Command, with the heavier Mk 17 model seeing greater adoption after the Mk 16 was phased out. This procurement program highlights the modular design and shifting requirements in military acquisitions.

Increasing Civilian Ownership and Personal Security Needs

Growing concerns over personal security and rising crime rates have fueled civilian firearm ownership. In regions like North America and parts of Europe, liberal gun ownership laws boost handgun sales. Sporting activities, hunting, and shooting competitions also contribute to increased civilian demand. With more consumers prioritizing personal safety, compact and user-friendly firearms gain prominence. The growing interest in recreational shooting and home defense strongly supports the long-term demand for civilian firearms, making it a key growth driver for the market.

- For instance, Glock’s produces a significant number of pistols each year for both government contracts and civilian use. Reports indicate Glock is a top supplier of handguns for law enforcement and militaries in dozens of countries, while also being very popular among civilians for self-defense, competition, and recreation.

Expansion of Law Enforcement and Private Security

Rising investments in law enforcement modernization and private security expansion are boosting the firearms market. Police forces globally are upgrading their small arms to improve operational readiness. At the same time, private security firms are equipping personnel with advanced firearms for asset and personnel protection. Increasing demand for tactical handguns and shotguns in urban security scenarios further drives procurement. With rapid urbanization and growing concerns over terrorism, the law enforcement and private security segments are expected to contribute significantly to market growth.

Key Trends & Opportunities

Growth in Smart Firearms and Digital Integration

The market is witnessing a trend toward smart firearms integrated with digital safety features. Technologies such as biometric authentication, tracking systems, and personalized access controls are gaining traction. These solutions enhance safety, prevent unauthorized use, and meet stricter firearm regulations. Defense and civilian users alike are showing interest in smart systems for improved control and accountability. With governments encouraging safe weapon handling, the adoption of smart firearms represents a major opportunity for manufacturers to align innovation with evolving regulatory demands.

- For instance, Biofire Technologies introduced its smart handgun with fingerprint and facial recognition, capable of unlocking in less than one second, and the company secured over 5,000 pre-orders within its initial launch phase.

Rising Popularity of Hunting and Sports Shooting

Sport shooting and hunting activities are contributing to steady growth in firearm demand, particularly in developed economies. Civilian interest in recreational use of rifles and shotguns has boosted sales, supported by hunting clubs and sporting events. Countries like the U.S., Canada, and Germany are key markets where recreational shooting drives firearm adoption. Rising disposable incomes and awareness of shooting sports in developing countries also create new opportunities. This trend supports the expansion of niche firearm segments catering specifically to hunting and sports enthusiasts.

- For instance, Browning Arms Company distributes hunting rifles and shotguns, with strong demand from U.S. and Canadian recreational shooting markets.

Key Challenges

Stringent Government Regulations

Tighter government regulations on firearm ownership and sales pose a significant challenge to market expansion. Policies such as background checks, licensing requirements, and import restrictions limit access for civilian buyers. In Europe and parts of Asia, strict rules reduce sales volumes and increase compliance costs for manufacturers. These regulatory hurdles often delay distribution and adoption. As firearm misuse remains a global concern, regulatory frameworks are likely to tighten further, restricting growth opportunities, especially in the civilian and recreational segments.

Rising Incidents of Gun Violence

The growing number of gun-related crimes and mass shootings poses reputational and operational challenges for firearm manufacturers. Public scrutiny and pressure from advocacy groups lead to stricter laws and reduced civilian demand in some regions. Manufacturers face challenges in balancing market demand with corporate responsibility. Negative perceptions also affect consumer sentiment, discouraging casual buyers. The industry must address safety concerns through innovation in firearm security and responsible marketing to sustain growth in the face of rising global gun violence concerns.

Regional Analysis

North America

North America held the largest share of the firearms market in 2024, accounting for 38%. The United States drives regional growth due to high civilian gun ownership, defense procurement, and strong demand from law enforcement agencies. Favorable firearm regulations in several states, combined with widespread use for hunting, sporting, and self-defense, sustain market leadership. Canada also contributes significantly, supported by defense modernization programs and regulated civilian ownership. With strong domestic manufacturing capabilities and a culture of firearm usage, North America continues to dominate the global firearms market.

Europe

Europe captured 27% share of the firearms market in 2024, driven by defense investments, law enforcement procurement, and growing participation in hunting and sports shooting. Countries like Germany, France, and the United Kingdom lead adoption, supported by stringent quality standards for military and law enforcement weapons. Civilian ownership is more restricted compared to North America, but recreational shooting and hunting activities sustain steady demand. The European Union’s focus on security modernization, counter-terrorism, and cross-border defense cooperation supports firearm procurement, ensuring the region maintains a strong position in the global market.

Asia-Pacific

Asia-Pacific accounted for 24% share of the firearms market in 2024, emerging as one of the fastest-growing regions. China, India, and South Korea lead the demand, supported by large-scale defense modernization, increasing military budgets, and expanding law enforcement needs. Rising geopolitical tensions and border security challenges drive procurement of small arms and advanced weaponry. Civilian ownership is restricted in many countries, limiting non-military demand. However, defense contracts and growing private security adoption make the region a key growth contributor. Asia-Pacific’s increasing role in military expansion ensures its steady rise in the firearms market.

Latin America

Latin America represented 6% share of the firearms market in 2024, with Brazil and Mexico as the leading contributors. Rising concerns over organized crime and drug-related violence drive demand from law enforcement and private security firms. Civilian ownership laws vary across the region, but demand for handguns and shotguns in self-defense remains strong. Government investments in military modernization programs also contribute to firearm procurement. Despite economic challenges and limited local manufacturing, Latin America continues to adopt firearms across defense, law enforcement, and civilian applications, with steady growth projected in coming years.

Middle East & Africa

The Middle East & Africa accounted for 5% share of the firearms market in 2024, reflecting growing adoption across military, law enforcement, and private security sectors. GCC countries, particularly Saudi Arabia and the UAE, lead regional demand with high defense spending and ongoing military modernization programs. In Africa, South Africa and Nigeria represent key markets, driven by security challenges and demand for law enforcement firearms. Civilian ownership remains limited in most countries, but private security adoption is rising. The region’s growth is supported by geopolitical tensions and rising defense expenditures.

Market Segmentations:

By Type

- Handguns

- Machine guns

- Submachine guns

- Others

By Caliber

- Small Caliber

- Medium Caliber

- Large Caliber

- Shotgun Gauges

By End Use

- Military

- Law enforcement agencies

- civilians

- private security firms

By Distribution Channel

- Direct sales (manufacturer to consumer)

- Indirect sales (distributors to consumers)

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

Competitive landscape of the firearms market is shaped by leading players such as Ruger & Co., Inc., FN HERSTAL, Heckler & Koch GmbH, Glock Inc., Colt’s Manufacturing Company LLC, Smith & Wesson, Beretta Holding S.p.A., SIG SAUER, Sturm Ruger & Co., Inc., and Česká Zbrojovka (CZ Group). These companies compete through product innovation, diverse weapon portfolios, and strong distribution networks across global markets. Key strategies include technological advancements in lightweight materials, improved accuracy, and smart gun features to meet growing defense, law enforcement, and civilian demands. Many players focus on expanding in emerging economies where defense spending and civilian ownership are rising. Additionally, collaborations with military agencies and law enforcement institutions strengthen market positions by ensuring long-term contracts and reliability in supply. With growing emphasis on customization, safety enhancements, and digital integration, competition continues to intensify, driving leading manufacturers to balance cost efficiency with advanced technology to secure a competitive edge.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Ruger & Co., Inc.

- FN HERSTAL

- Heckler & Koch GmbH

- Glock Inc.

- Colt’s Manufacturing Company LLC

- Smith & Wesson

- Beretta Holding S.p.A.

- SIG SAUER

- Sturm, Ruger & Co., Inc.

- Česká Zbrojovka (CZ Group)

Recent Developments

- In January 2025, SK Guns announced the collaboration with Phoenix Trinity Manufacturing. The aim of the partnership was to create a double-stack, commander-sized pistol which was designed for concealed carry.

- In November 2024, Sig Sauer came under partnership with Nibe Group to manufacture assault rifles in India. Sig Sauer made contract to supply around 145,000 assault rifles to the Indian Army.

- In June 2023, WATCHTOWER announced the acquisition of F-1 Firearms LLC, to expand its domestic, foreign military and law enforcement markets. The aim is to provide firearms to individuals for self- defense, sporting, and hunting activities

Report Coverage

The research report offers an in-depth analysis based on Type, Caliber, End Use, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for firearms will grow with rising defense modernization programs worldwide.

- Civilian ownership will increase due to rising concerns over personal safety.

- Handguns will remain the dominant firearm type across multiple end-use sectors.

- Smart gun technologies with biometric safety features will gain adoption.

- North America will maintain leadership driven by high civilian and defense demand.

- Europe will see growth supported by law enforcement modernization and strict regulations.

- Asia-Pacific will emerge as the fastest-growing region with expanding defense budgets.

- Manufacturers will focus on lightweight and modular firearm designs.

- Export restrictions and regulatory challenges will continue to limit market expansion.

- Partnerships and acquisitions among firearm manufacturers will strengthen global market presence.