Market Overview

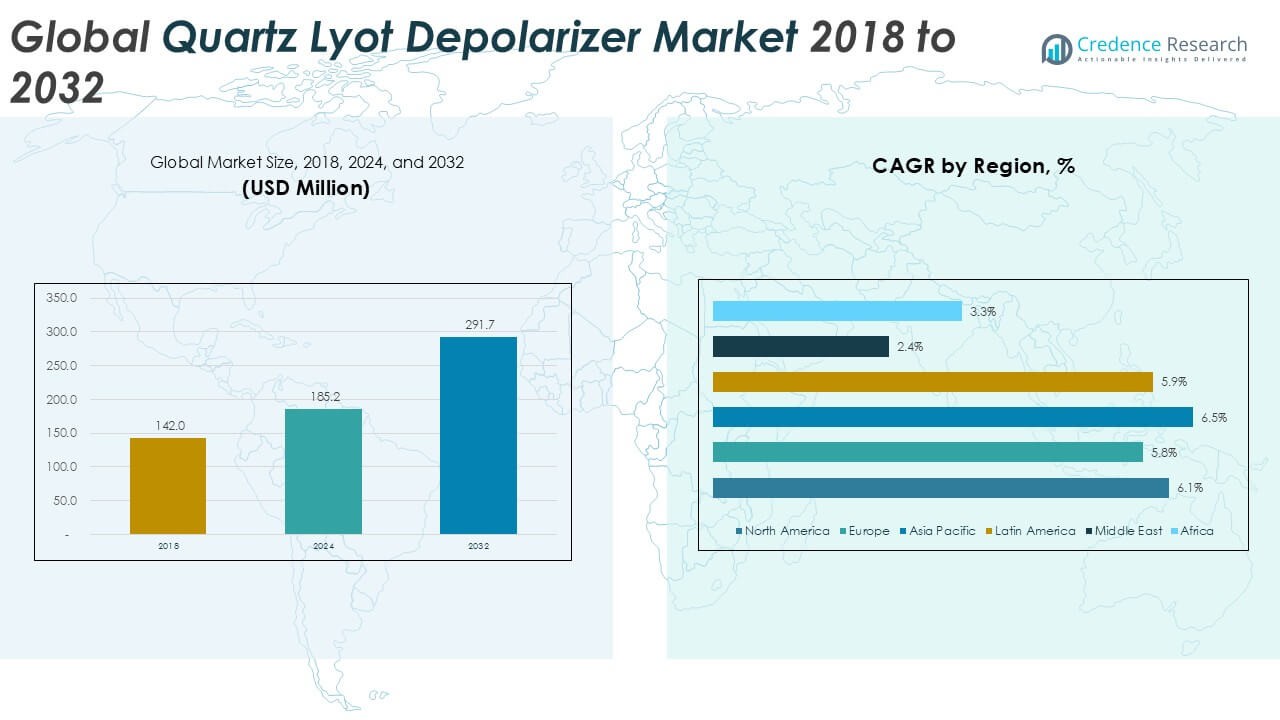

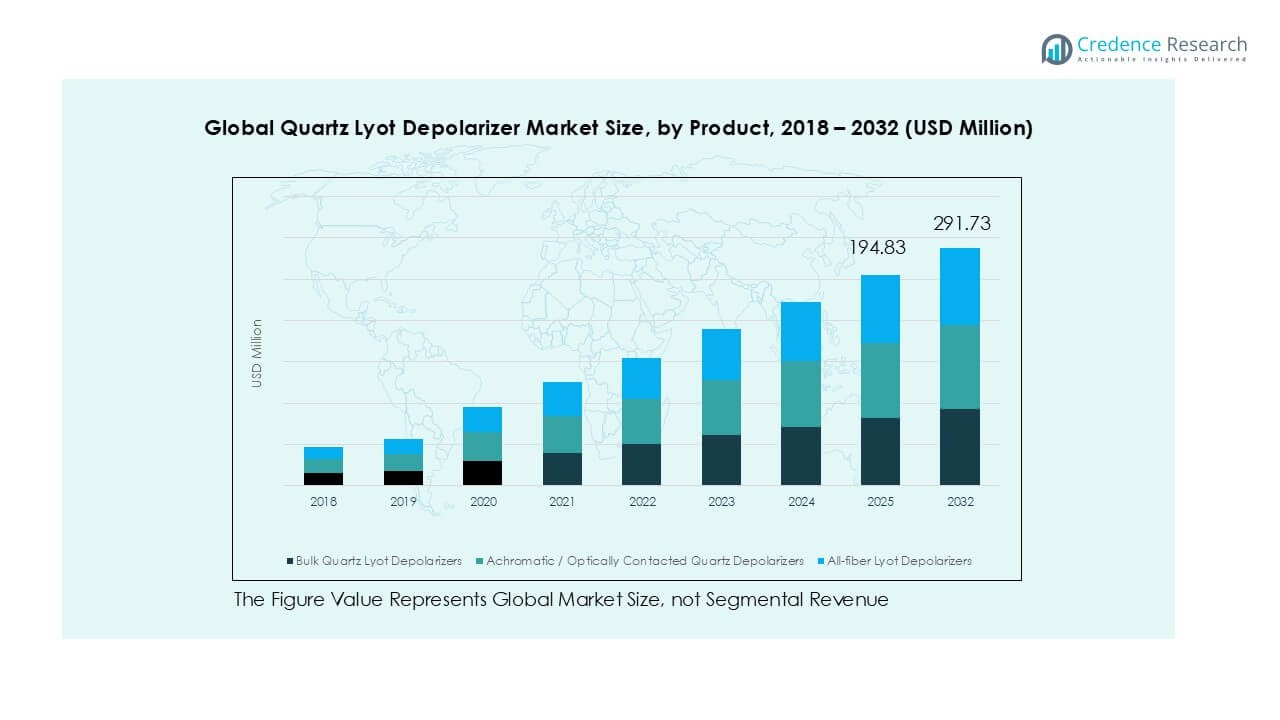

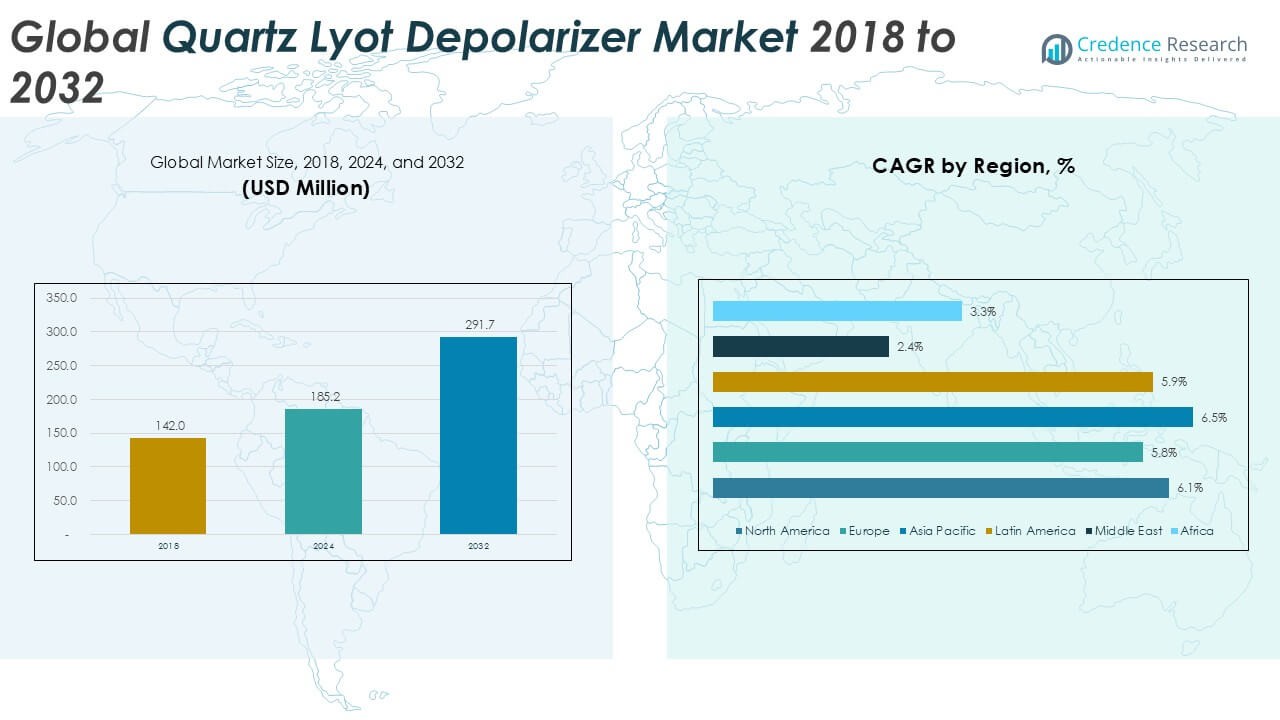

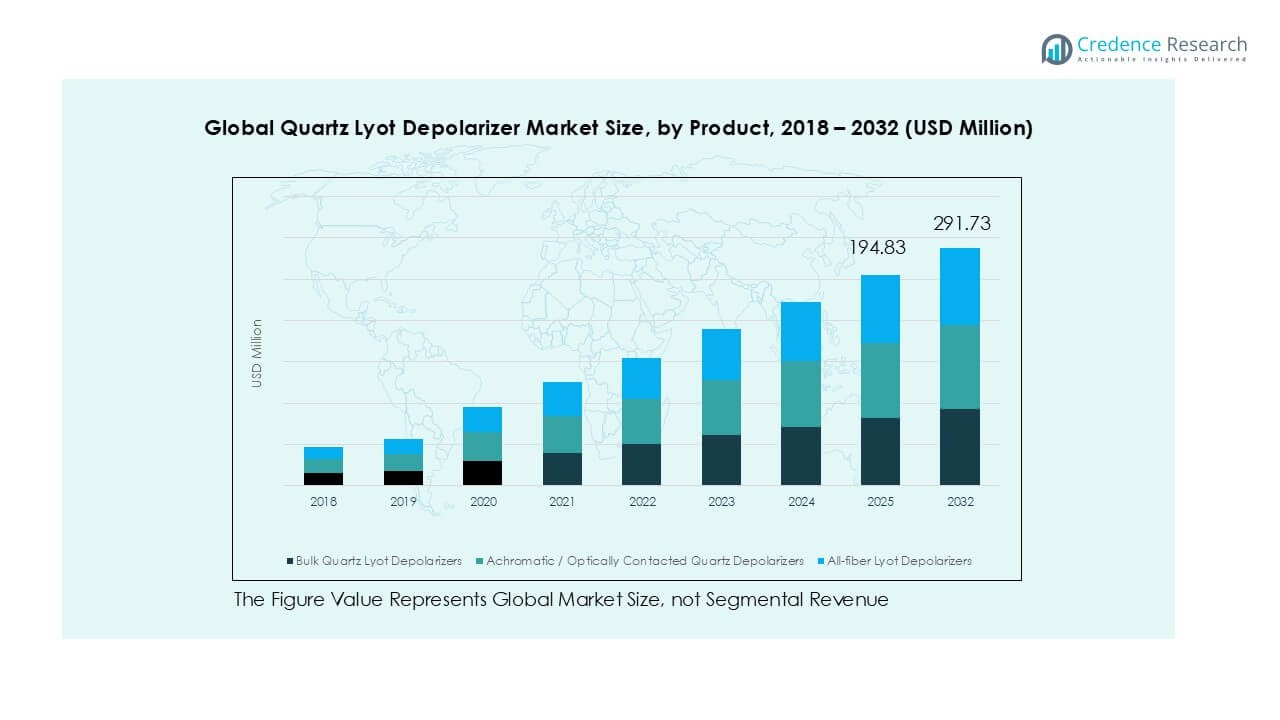

The global quartz Lyot depolarizer market size was valued at USD 142.0 million in 2018 and reached USD 185.2 million in 2024. It is anticipated to grow further and reach USD 291.7 million by 2032, expanding at a CAGR of 5.94% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Quartz Lyot Depolarizer Market Size 2024 |

USD 185.2 Million |

| Quartz Lyot Depolarizer Market, CAGR |

5.94% |

| Quartz Lyot Depolarizer Market Size 2032 |

USD 291.7 Million |

The global quartz Lyot depolarizer market is led by major players including Newport Corporation, Thorlabs, Jenoptik AG, Excelitas Technologies Corp., Tower Optical Corporation, Edmund Optics, Foctek Photonics, Hunan Dayoptics, OptoSigma Corporation, and Fujian Enlumen Tech. These companies dominate through broad product portfolios, precision optical solutions, and strong partnerships with OEMs across spectroscopy, telecom, and industrial laser applications. Regionally, North America held the largest share of 34.2% in 2024, supported by advanced R&D facilities and high demand in spectroscopy and fiber-optic systems. Asia Pacific followed with 26.9%, driven by rapid telecom expansion and photonics research, while Europe accounted for 21.9%, benefiting from strong academic and industrial optics infrastructure.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The global quartz Lyot depolarizer market was valued at USD 185.2 million in 2024 and is projected to reach USD 291.7 million by 2032, growing at a CAGR of 5.94%.

- Rising demand in spectroscopy and imaging, along with expanding telecom and fiber-optic systems, is driving steady market growth. Bulk quartz depolarizers lead the product segment, accounting for over 45% share in 2024, due to wide use in research and instrumentation.

- Market trends highlight increasing adoption of all-fiber depolarizers for compact photonics systems and rising opportunities in broadband and multi-wavelength applications supporting telecom and advanced spectroscopy.

- The competitive landscape is shaped by leading players such as Newport Corporation, Thorlabs, Jenoptik AG, and Excelitas Technologies, alongside regional manufacturers like Foctek Photonics and Hunan Dayoptics focusing on cost-effective solutions.

- North America led with 34.2% share in 2024, followed by Asia Pacific at 26.9% and Europe at 21.9%, while Latin America, Middle East, and Africa contributed smaller but growing shares.

Market Segmentation Analysis:

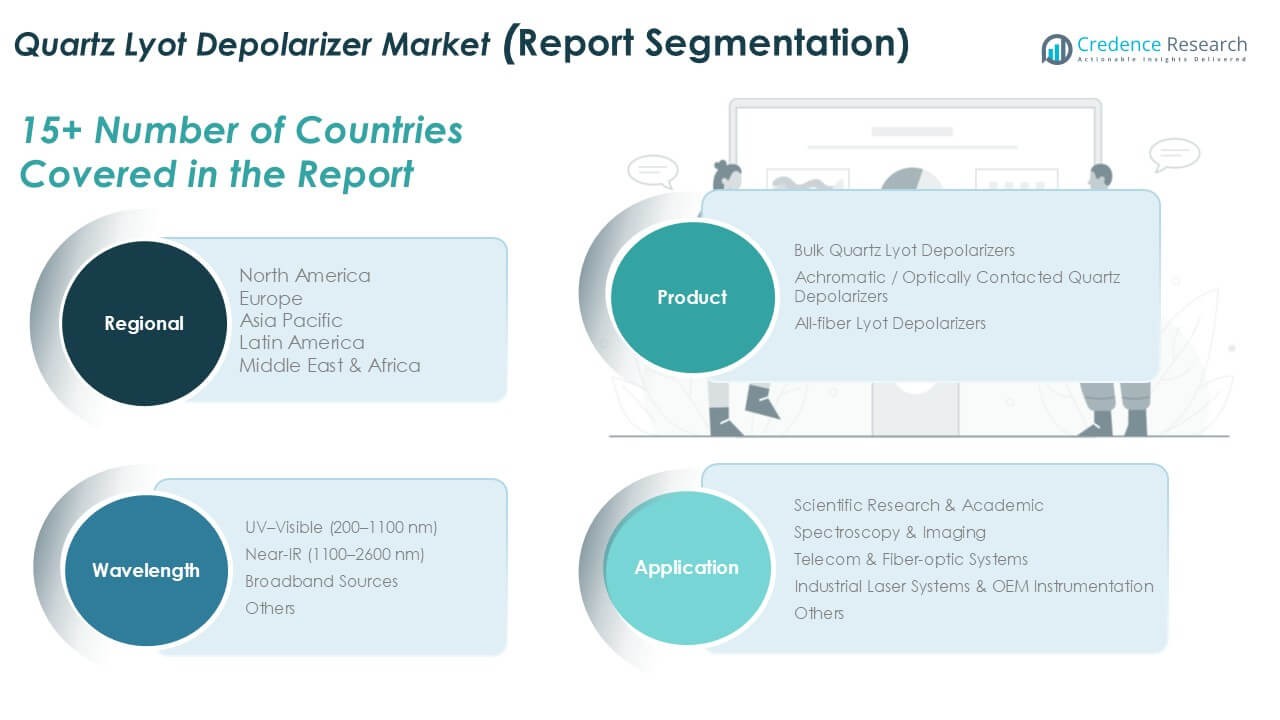

By Product

Bulk quartz Lyot depolarizers held the dominant share in 2024, accounting for over 45% of the market. Their strong position comes from wide adoption in spectroscopy, fiber-optic testing, and laser-based research due to reliable depolarization efficiency across varying wavelengths. Achromatic or optically contacted quartz depolarizers are gaining traction for high-precision imaging and metrology applications, where stability and wavelength independence are critical. All-fiber Lyot depolarizers are emerging as a preferred choice in integrated optical systems, driven by compact design, low insertion loss, and growing demand in telecom and photonics instrumentation.

- For instance, Thorlabs manufactures a variety of quartz depolarizers, including achromatic models used in spectroscopy and laser research. The company is a global supplier, with sales across numerous countries.

By Application

Spectroscopy and imaging applications captured the largest market share, representing nearly 40% in 2024. The growth is fueled by expanding use of depolarizers in high-resolution imaging, biomedical diagnostics, and advanced spectroscopic instruments. Telecom and fiber-optic systems also account for a significant portion, as depolarizers ensure signal stability and minimize polarization-related errors in high-speed optical networks. Scientific research and academic use continue to expand, driven by adoption in laboratories and advanced optical studies. Industrial laser systems and OEM instrumentation form another strong segment, benefitting from rising demand for precision manufacturing tools.

- For instance, Newport (a brand of MKS Instruments) supplies depolarizer units, among a vast portfolio of other photonics and vacuum solutions, that support the telecom and precision imaging markets worldwide.

By Wavelength

The UV–Visible range (200–1100 nm) dominated the market, contributing to more than 50% share in 2024. Its leadership stems from broad usage in spectroscopy, microscopy, and laser-based imaging, where high accuracy in depolarization is critical. Near-IR (1100–2600 nm) depolarizers are expanding due to their application in fiber-optic communications and defense systems, where infrared laser technologies are prevalent. Broadband sources are also witnessing steady growth, catering to multi-wavelength applications in research and industrial instrumentation. The “Others” segment includes customized wavelength solutions designed for niche applications in high-end optical devices.

Key Growth Drivers

Rising Demand in Spectroscopy and Imaging

Spectroscopy and imaging applications are major drivers of quartz Lyot depolarizer adoption, with increasing use in biomedical diagnostics, material science, and advanced research tools. High-resolution imaging systems and spectroscopic instruments require precise depolarization to eliminate polarization artifacts and improve measurement accuracy. The demand is reinforced by strong investment in life sciences research and clinical diagnostics, where accurate optical data is critical. Universities and laboratories are expanding procurement of depolarizers as part of advanced photonics research facilities. With the healthcare and academic sectors prioritizing imaging and analytical technologies, quartz Lyot depolarizers continue to benefit from consistent demand in core scientific and diagnostic applications.

- For instance, Horiba Scientific is a global supplier of scientific instruments, including spectroscopy systems, for a variety of research and industrial applications. Its offerings in the biomedical and analytical fields support research worldwide.

Expansion of Telecom and Fiber-optic Networks

Telecom operators are increasingly integrating quartz Lyot depolarizers in fiber-optic systems to stabilize signals and reduce polarization-related distortion. The expansion of 5G infrastructure, high-capacity data centers, and long-haul communication networks is driving the requirement for high-quality optical components. Depolarizers ensure improved signal consistency, which is critical for high-bandwidth transmissions and photonic sensing. As data demand continues to surge globally, telecom suppliers and network equipment manufacturers are adopting depolarizers to optimize performance and minimize optical errors. This steady expansion of broadband services and telecom investments in Asia-Pacific and North America reinforces the growth trajectory for quartz Lyot depolarizers.

- For instance, Fujikura is a major supplier of optical fiber and related infrastructure, such as fusion splicers, for advanced telecommunication systems. The company is involved in Asia-Pacific 5G rollouts by supplying high-performance fibers and high-density fiber optic cables to help meet the high-capacity demands of modern networks

Advancements in Industrial Lasers and OEM Instrumentation

The growing adoption of industrial lasers across manufacturing, defense, and semiconductor sectors is creating new growth avenues for quartz Lyot depolarizers. Precision laser machining, lithography, and defense-grade targeting systems require depolarizers to manage polarization and enhance system reliability. OEMs producing spectroscopic instruments, imaging devices, and optical sensors increasingly integrate depolarizers into their systems to meet performance standards. Rising automation in production environments also boosts demand for laser systems with enhanced optical stability, directly driving adoption of depolarizers. With industries prioritizing precision-based optical components, quartz Lyot depolarizers are becoming a critical enabler of advanced instrumentation and laser-based processes.

Key Trends & Opportunities

Shift Toward All-fiber Lyot Depolarizers

A key trend shaping the market is the rising adoption of all-fiber Lyot depolarizers in compact and integrated optical systems. Their smaller footprint, reduced insertion loss, and compatibility with modern photonic circuits make them well-suited for telecom, sensor arrays, and next-generation photonics instrumentation. Unlike bulk or optically contacted designs, all-fiber configurations support seamless integration in fiber-optic communication lines, driving efficiency for high-speed data transmission. With telecom operators seeking miniaturized and efficient solutions, the adoption of all-fiber depolarizers represents a major opportunity for manufacturers to address emerging integration challenges in optical systems.

- For instance, Corning delivered a substantial amount of optical fiber in 2023, including advanced fiber components like depolarizers, which are widely deployed in global 5G and data center networks to enhance high-speed transmission stability.

Opportunities in Broadband and Multi-wavelength Applications

Broadband Lyot depolarizers are gaining momentum as multi-wavelength optical applications expand across research and industry. Instruments used in spectroscopy, microscopy, and multi-band imaging increasingly demand devices capable of handling wide wavelength ranges. Broadband depolarizers reduce polarization sensitivity across the UV, visible, and IR spectrum, enhancing accuracy and operational versatility. Manufacturers are focusing on developing customizable solutions tailored to specific bandwidths, creating opportunities in OEM instrumentation and scientific devices. The rise of quantum optics and photonic computing also presents new opportunities where broadband depolarizers could play a critical role in system stability.

Key Challenges

High Manufacturing Complexity and Costs

Producing quartz Lyot depolarizers involves high-precision optical fabrication, alignment, and bonding processes, which contribute to elevated production costs. Achromatic and optically contacted depolarizers, in particular, require stringent quality control and advanced manufacturing expertise, leading to limited scalability. These costs often translate to higher prices for end-users, restricting adoption in price-sensitive markets such as small research labs and developing regions. Additionally, the lack of standardized designs across applications raises customization costs. This challenge emphasizes the need for manufacturers to optimize production efficiency and explore cost-effective fabrication techniques without compromising optical performance.

Limited Awareness and Integration Barriers in Emerging Markets

While quartz Lyot depolarizers have strong adoption in advanced research, telecom, and industrial settings, awareness in emerging markets remains limited. Many small-scale OEMs and research institutions lack familiarity with the advantages of depolarizers, leading to slow adoption. Integration barriers in cost-sensitive telecom networks also restrict penetration outside high-investment regions like North America and Europe. Furthermore, competition from alternative polarization control techniques creates additional barriers. Addressing these challenges requires strong industry outreach, partnerships with local equipment providers, and demonstration of cost-benefit advantages to accelerate adoption in untapped markets.

Regional Analysis

North America

North America dominated the global quartz Lyot depolarizer market with a 34.2% share in 2024, valued at USD 63.48 million, up from USD 48.11 million in 2018. The region is projected to reach USD 101.46 million by 2032, expanding at a CAGR of 6.1%. Growth is driven by extensive adoption in spectroscopy, imaging, and advanced telecom networks. Strong R&D investments, coupled with a robust academic and industrial research base, reinforce market leadership. High adoption in OEM instrumentation and industrial lasers further strengthens North America’s dominant position in global market share.

Europe

Europe accounted for 21.9% of the quartz Lyot depolarizer market in 2024, valued at USD 40.60 million, compared to USD 31.39 million in 2018. The market is expected to expand to USD 63.22 million by 2032, recording a CAGR of 5.8%. Europe’s strong research infrastructure, supported by university labs and advanced optics companies, drives steady adoption. Increasing demand in spectroscopy, microscopy, and industrial laser applications supports regional growth. With rising integration into telecom and fiber-optic systems, Europe continues to maintain a significant share, supported by regulatory focus on precision research and photonics innovation.

Asia Pacific

Asia Pacific captured 26.9% of the global market in 2024, valued at USD 49.86 million, rising from USD 37.07 million in 2018. The region is projected to reach USD 81.68 million by 2032, growing at the fastest CAGR of 6.5%. Rapid telecom infrastructure expansion, increasing adoption of fiber-optic communication, and industrial laser applications drive demand. Research and academic institutions in China, Japan, and South Korea play a key role in accelerating adoption. With strong manufacturing ecosystems and high demand for spectroscopy and photonics instrumentation, Asia Pacific is emerging as a major growth engine for the market.

Latin America

Latin America held a 10.8% share of the quartz Lyot depolarizer market in 2024, valued at USD 19.95 million, up from USD 15.30 million in 2018. The market is forecast to reach USD 31.39 million by 2032, expanding at a CAGR of 5.9%. Growing academic research, rising investments in spectroscopy-based environmental testing, and industrial laser adoption are fueling demand. Brazil and Mexico lead the region in applications across research laboratories and OEM instrumentation. While the market remains smaller compared to North America and Asia, expanding telecom integration creates steady opportunities in the region.

Middle East

The Middle East contributed 4.1% of the quartz Lyot depolarizer market in 2024, valued at USD 7.52 million, increasing from USD 6.79 million in 2018. The market is projected to reach USD 9.04 million by 2032, with a modest CAGR of 2.4%. Adoption is primarily concentrated in scientific research centers and limited industrial laser applications. Countries such as the UAE and Saudi Arabia drive most demand through their growing research investments and technology hubs. However, reliance on imports and limited manufacturing infrastructure restrict large-scale deployment, keeping the Middle East a smaller but stable market.

Africa

Africa represented 2.0% of the global quartz Lyot depolarizer market in 2024, valued at USD 3.81 million, up from USD 3.31 million in 2018. The market is projected to grow to USD 4.93 million by 2032, at a CAGR of 3.3%. Growth is largely driven by academic research institutions and early-stage adoption in industrial applications. South Africa remains the key contributor due to its research facilities and photonics programs. However, limited funding and technological infrastructure restrain widespread adoption. Despite its small share, Africa shows gradual progress, particularly in university-led spectroscopy and optical research initiatives.

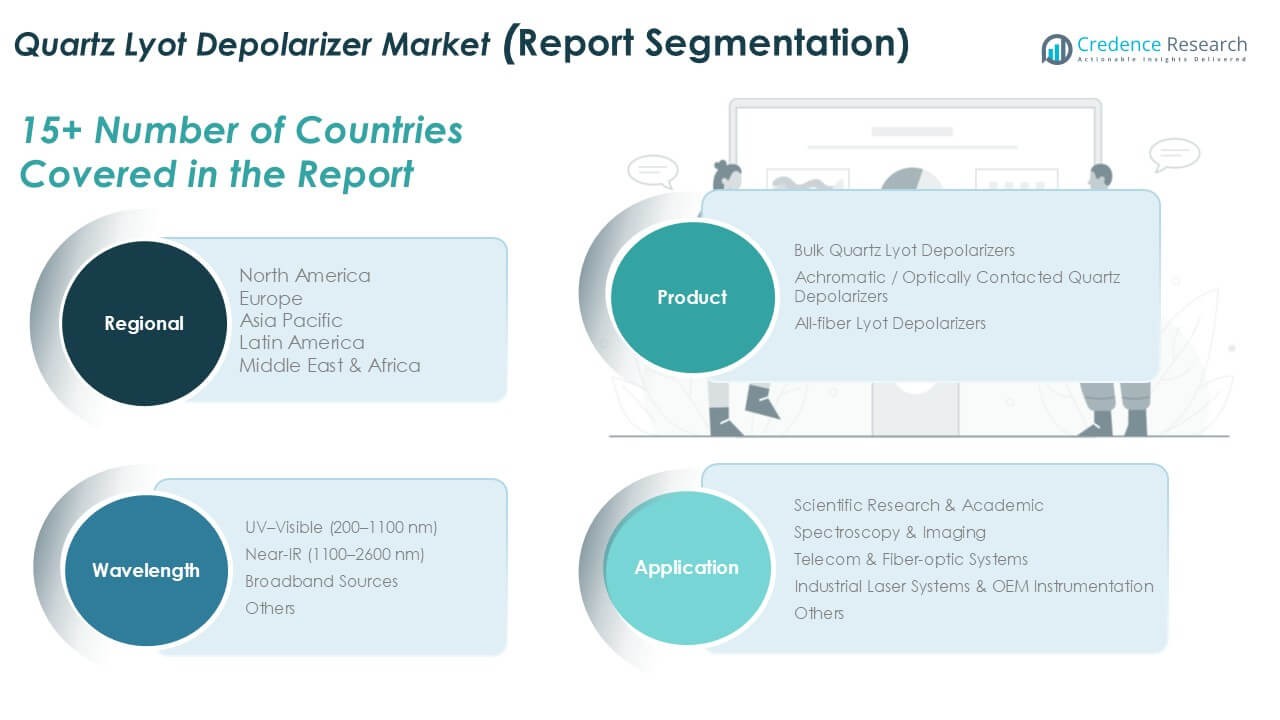

Market Segmentations:

By Product

- Bulk Quartz Lyot Depolarizers

- Achromatic / Optically Contacted Quartz Depolarizers

- All-fiber Lyot Depolarizers

By Application

- Scientific Research & Academic

- Spectroscopy & Imaging

- Telecom & Fiber-optic Systems

- Industrial Laser Systems & OEM Instrumentation

- Others

By Wavelength

- UV–Visible (200–1100 nm)

- Near-IR (1100–2600 nm)

- Broadband Sources

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The global quartz Lyot depolarizer market is moderately consolidated, with a mix of established photonics companies and specialized optics manufacturers competing for market share. Key players such as Newport Corporation, Thorlabs, Jenoptik AG, and Excelitas Technologies dominate through extensive product portfolios and global distribution networks. Regional players like Hunan Dayoptics, Foctek Photonics, and Fujian Enlumen Tech are gaining traction by offering cost-effective solutions tailored for telecom and research applications. Companies emphasize innovation in broadband and all-fiber depolarizers to capture demand in high-speed communication and spectroscopy markets. Strategic partnerships with OEMs, expansion into emerging markets, and investments in manufacturing precision remain core growth strategies. At the same time, players are strengthening R&D to enhance wavelength stability and reduce production costs. The competitive environment is shaped by product differentiation, pricing strategies, and technological innovation, with larger firms leveraging scale advantages while smaller companies focus on niche, customized solutions to sustain competitiveness.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Newport Corporation

- Thorlabs, Inc.

- Tower Optical Corporation

- Jenoptik AG

- Excelitas Technologies Corp.

- Foctek Photonics, Inc.

- Hunan Dayoptics, Inc.

- OptoSigma Corporation

- Edmund Optics India Private Limited

- Fujian Enlumen Tech Co., Ltd.

- Other Key Players

Recent Developments

- In 2023, Thorlabs launched a new generation of integrated depolarizers focused on improving efficiency and reducing device size.

- In 2023, OptoSigma released a smaller, more compact version of its popular depolarizer model.

Report Coverage

The research report offers an in-depth analysis based on Product, Application, Wavelength and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand steadily with strong adoption in spectroscopy and imaging applications.

- Telecom and fiber-optic systems will drive demand as high-speed data networks grow globally.

- Bulk quartz depolarizers will retain dominance, but all-fiber designs will gain faster traction.

- Industrial laser applications will increasingly integrate depolarizers for precision manufacturing and instrumentation.

- Research institutions and academic laboratories will continue to be key end users.

- Broadband depolarizers will see rising demand to support multi-wavelength optical systems.

- Asia Pacific will emerge as the fastest-growing region due to rapid telecom and photonics expansion.

- North America will maintain leadership supported by advanced R&D and industrial adoption.

- Competition will intensify with global leaders focusing on innovation and regional players on cost efficiency.

- Rising miniaturization and integration trends in photonics will create new opportunities for compact depolarizer solutions.