Market Overview

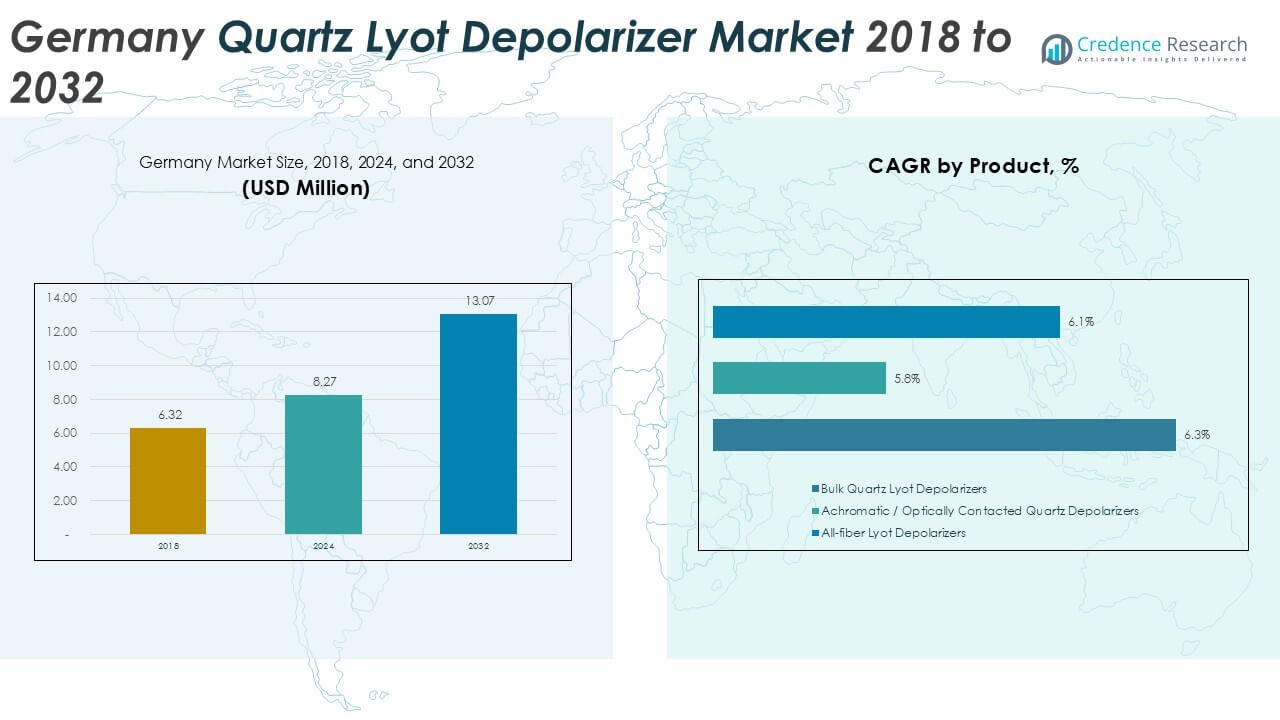

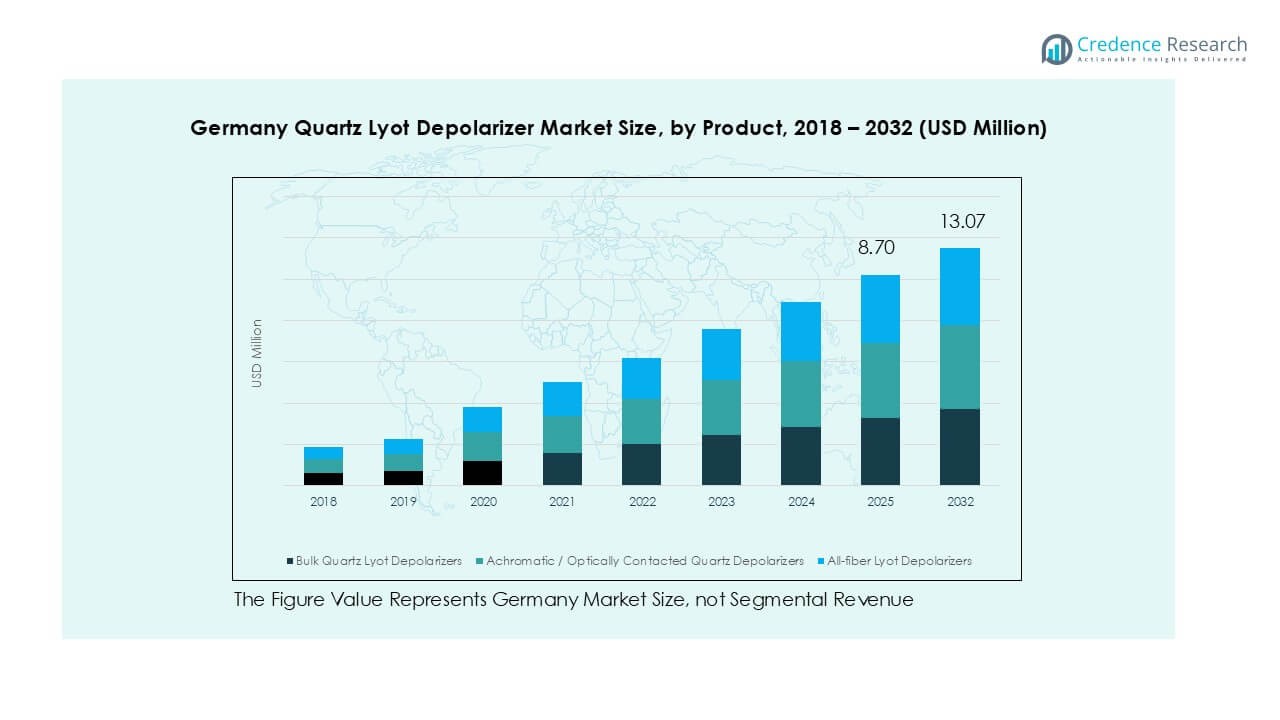

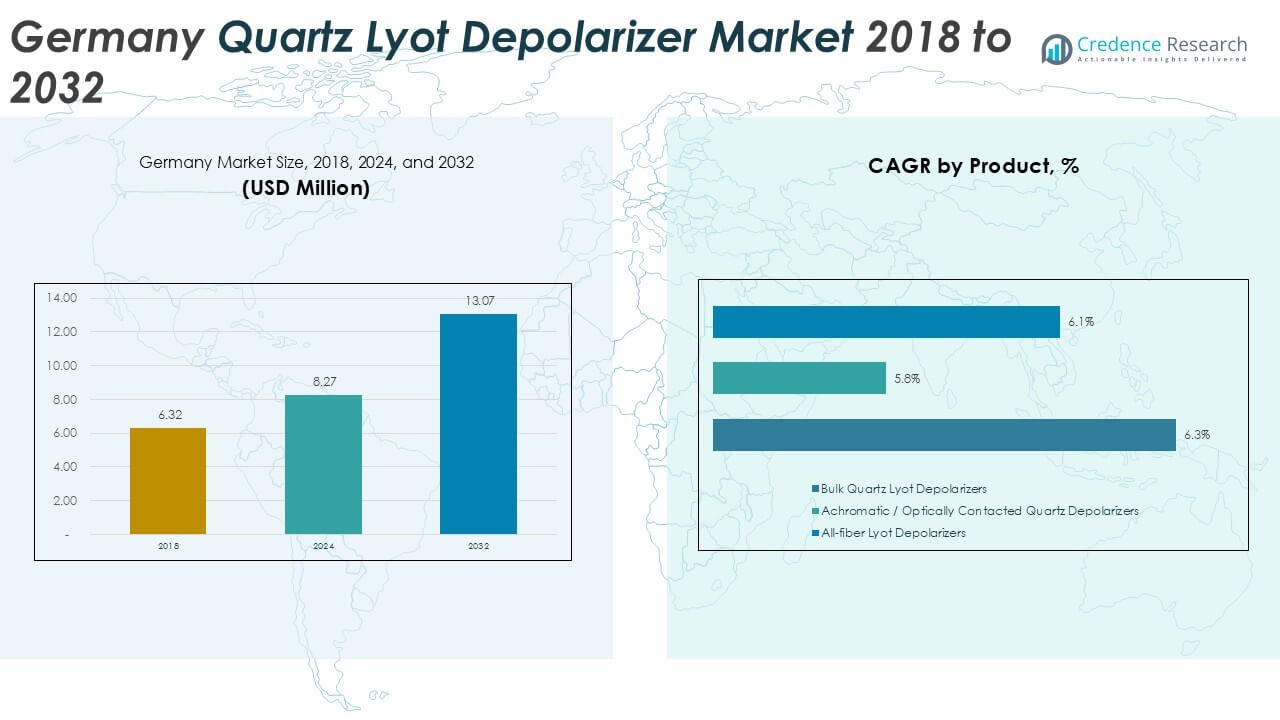

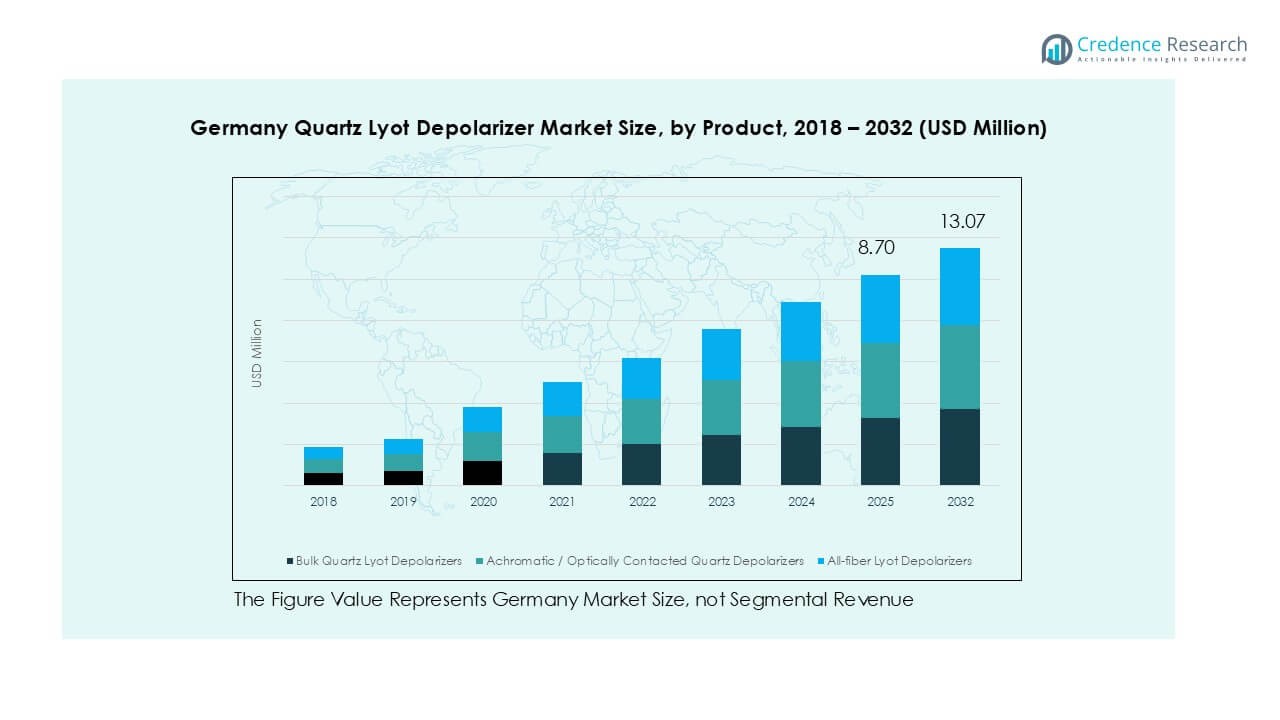

Germany Quartz Lyot Depolarizer market size was valued at USD 6.32 million in 2018, reached USD 8.27 million in 2024, and is anticipated to reach USD 13.07 million by 2032, at a CAGR of 5.89% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Germany Quartz Lyot Depolarizer Market Size 2024 |

USD 8.27 Million |

| Germany Quartz Lyot Depolarizer Market, CAGR |

5.89% |

| Germany Quartz Lyot Depolarizer Market Size 2032 |

USD 13.07 Million |

The Germany Quartz Lyot depolarizer market is shaped by key players including Leysop Ltd, Thorlabs, Inc., Jenoptik AG, Excelitas Technologies Corp., and Tower Optical Corporation, alongside emerging manufacturers such as Foctek Photonics and Hunan Dayoptics. These companies focus on delivering high-performance depolarizers tailored for spectroscopy, telecom, and industrial laser applications, with innovation in broadband and fiber-compatible solutions driving competition. Regionally, North Germany led the market with a 30% share in 2024, supported by strong research infrastructure and optics-focused industries, while South Germany followed with 28%, driven by high-tech clusters and OEM activities.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Germany Quartz Lyot Depolarizer market was valued at USD 8.27 million in 2024 and is projected to reach USD 13.07 million by 2032, growing at a CAGR of 5.89%.

- Rising demand from spectroscopy and imaging applications is driving growth, as research institutions and industrial laboratories increasingly adopt high-precision optical instruments.

- Key trends include the adoption of broadband depolarizers for multi-wavelength applications and growing integration of all-fiber depolarizers into telecom and fiber-optic systems.

- The competitive landscape features players like Leysop Ltd, Thorlabs, Jenoptik AG, Excelitas Technologies, and Tower Optical, with emerging firms such as Foctek Photonics and Hunan Dayoptics strengthening cost-effective offerings.

- Regionally, North Germany led with a 30% share in 2024, followed by South Germany at 28%, West Germany at 25%, and East Germany at 17%; by product, bulk quartz depolarizers dominated, while spectroscopy and imaging remained the largest application segment.

Market Segmentation Analysis:

By Product

In the Germany Quartz Lyot Depolarizer market, bulk quartz Lyot depolarizers held the largest share in 2024, driven by their robustness and wide adoption in optical setups requiring stable polarization control. Their precise birefringence properties make them highly reliable in scientific and industrial environments. Achromatic or optically contacted quartz depolarizers are gaining traction due to their superior performance in multi-wavelength applications, particularly in spectroscopy. Meanwhile, all-fiber Lyot depolarizers are expanding in telecom and fiber-optic systems, where demand for compact, integration-ready solutions continues to rise.

- For instance, Thorlabs GmbH, located in Bergkirchen, Germany, supplies depolarizers, including both bulk and achromatic models, for research and telecom projects across Europe.

By Application

Spectroscopy and imaging dominated the application segment in 2024, supported by strong use across research laboratories and advanced imaging systems. The accuracy and stability offered by quartz depolarizers enhance performance in spectroscopy tools, driving this segment’s share. Telecom and fiber-optic systems are witnessing significant growth, as demand for high-speed communication networks continues. Industrial laser systems and OEM instrumentation also represent steady adoption, fueled by precision optics needs in manufacturing. Scientific research and academic use maintain a consistent share, with universities and institutions driving innovation.

- For instance, Carl Zeiss delivered high-end microscopy and imaging systems for life sciences research and spectroscopy in 2023, supporting universities and laboratories in Germany and worldwide.

By Wavelength

Within the wavelength segment, UV–Visible (200–1100 nm) accounted for the dominant share in 2024. Its strong adoption is linked to widespread use in spectroscopy, imaging, and research-based optical instruments. The demand is largely driven by applications that require high-resolution optical analysis within this range. Near-IR (1100–2600 nm) is gaining attention due to its role in telecom and fiber-optic systems, supporting advanced signal transmission. Broadband sources are also expanding, with applications across multipurpose optical systems, while other wavelength ranges are used for specialized industrial instrumentation.

Key Growth Drivers

Rising Demand in Spectroscopy and Imaging

The Germany Quartz Lyot depolarizer market is primarily driven by growing demand in spectroscopy and imaging applications. These devices are widely used to reduce polarization effects in advanced optical instruments, enabling precise analysis in chemical, biological, and material sciences. Germany’s strong base of research institutions and industrial R&D facilities has accelerated the adoption of high-performance depolarizers for spectroscopy tools. With the country’s expanding life sciences and photonics sectors, quartz Lyot depolarizers are becoming indispensable in imaging devices for both academic and commercial use. Increasing collaborations between universities and optical equipment manufacturers further fuel demand, strengthening this segment’s dominance.

- For instance, in 2023, Carl Zeiss AG continued to be a leading global supplier of advanced microscopy and imaging systems for life sciences and research.

Expansion of Telecom and Fiber-Optic Networks

The expansion of fiber-optic communication networks in Germany is another major growth driver. Quartz Lyot depolarizers are essential in minimizing polarization-related distortions in high-speed data transmission systems. As Germany advances its digitalization agenda and invests heavily in 5G and broadband infrastructure, the demand for depolarizers in telecom applications continues to grow. All-fiber Lyot depolarizers, in particular, are witnessing increased adoption due to their compact design and compatibility with optical communication systems. Rising internet penetration and the push for robust communication channels across industries amplify this trend. The emphasis on low-loss, high-speed data transmission ensures strong market prospects in the telecom sector.

- For instance, Deutsche Telekom laid over 60,000 kilometers of new fiber in 2023 to support 5G and broadband rollout, incorporating polarization-control components such as depolarizers to maintain transmission stability across its expanding optical network.

Growth of Industrial Laser Systems and OEM Instrumentation

Industrial laser systems and OEM instrumentation represent another strong driver for the Germany Quartz Lyot depolarizer market. These depolarizers are crucial in laser-based systems used across manufacturing, precision engineering, and material processing industries. German industries, known for automation and high-precision equipment, require depolarizers to enhance the stability and accuracy of laser instruments. With Industry 4.0 initiatives and growing adoption of laser cutting, welding, and marking, demand for reliable depolarization solutions is increasing. OEMs integrating depolarizers into instruments for export and domestic use also contribute significantly to market expansion. The synergy of industrial innovation and optical advancements reinforces steady growth in this segment.

Key Trends and Opportunities

Rising Adoption of Broadband Optical Sources

One emerging trend in the Germany Quartz Lyot depolarizer market is the growing adoption of broadband optical sources. With demand rising in multi-wavelength spectroscopy, imaging, and industrial analysis, depolarizers capable of handling broad wavelength ranges are gaining traction. Manufacturers are focusing on developing achromatic or optically contacted quartz depolarizers that ensure stable performance across extended spectral ranges. This trend aligns with Germany’s emphasis on advanced photonics research and multi-disciplinary scientific projects. The ability to integrate broadband sources into flexible optical systems presents new opportunities for players, particularly in expanding into applications requiring wide spectral coverage.

- For instance, TOPTICA Photonics SE, based near Munich, manufactures high-end laser and spectroscopy systems that are used for advanced research. In 2023, the company achieved a consolidated group revenue of approximately €130 million, with its products used in fields such as quantum technology and biophotonics.

Integration with Compact and Fiber-Based Systems

Another key opportunity lies in the integration of depolarizers with compact, fiber-based optical systems. The rising adoption of all-fiber Lyot depolarizers in telecom, laser systems, and portable optical devices is fueling market growth. As industries demand smaller, efficient, and integration-ready optical components, manufacturers are prioritizing miniaturization and fiber compatibility. Germany’s telecom infrastructure upgrades and growing reliance on precision optical systems in industrial automation further highlight this opportunity. By investing in advanced design and scalable production, companies can strengthen their position in next-generation optical communication and instrumentation markets.

Key Challenges

High Manufacturing Costs and Complexity

One of the biggest challenges in the Germany Quartz Lyot depolarizer market is the high cost and complexity of manufacturing. Producing high-quality quartz depolarizers requires precision engineering, advanced fabrication techniques, and strict quality control to ensure optical accuracy. The dependence on specialized equipment and skilled labor increases production costs, limiting widespread adoption in cost-sensitive applications. Smaller companies may struggle to compete with established players due to high entry barriers. These factors create pricing pressures, especially as demand rises from OEMs seeking cost-efficient integration into their products.

Competition from Alternative Depolarization Technologies

The market also faces competition from alternative depolarization technologies such as polymer-based depolarizers and liquid crystal solutions. These substitutes often provide lower-cost options and easier integration into specific applications, particularly in non-research markets. While quartz depolarizers remain superior in terms of durability and wavelength range, advancements in alternative technologies threaten to capture market share. Companies in Germany must invest in innovation and customization to retain competitive advantage. Balancing performance with affordability will be key to countering this challenge and maintaining dominance in advanced optical systems.

Regional Analysis

North Germany

North Germany dominated the market with a 30% share in 2024. The regional market size rose from USD 1.90 million in 2018 to USD 2.48 million in 2024, and is projected to reach USD 3.92 million by 2032, registering a CAGR of 5.89%. Growth is fueled by the strong presence of academic research centers and optics-focused industries in cities like Hamburg and Bremen. Continuous investments in photonics and spectroscopy applications strengthen demand for quartz Lyot depolarizers, positioning the north as a leader in Germany’s advanced optics market.

South Germany

South Germany accounted for 28% of the market share in 2024, supported by the concentration of high-tech industries and research institutions. The market size grew from USD 1.77 million in 2018 to USD 2.32 million in 2024, with forecasts reaching USD 3.66 million by 2032, at a CAGR of 5.89%. Cities such as Munich and Stuttgart drive demand, particularly in telecom and industrial laser systems. With strong OEM activity and industrial automation projects, South Germany continues to expand its role in advanced photonics and fiber-optic systems integration.

West Germany

West Germany held 25% of the market share in 2024, marking steady growth driven by industrial laser systems and OEM instrumentation. The region’s market value increased from USD 1.58 million in 2018 to USD 2.07 million in 2024, and is expected to achieve USD 3.27 million by 2032, growing at a CAGR of 5.89%. Strong industrial hubs in North Rhine-Westphalia and Hesse support demand for depolarizers in laser-based manufacturing systems. The west remains a vital contributor, leveraging its industrial base and manufacturing innovation to strengthen market penetration.

East Germany

East Germany represented 17% of the market share in 2024, reflecting its steady but smaller contribution to the national market. The region grew from USD 1.07 million in 2018 to USD 1.41 million in 2024, with projections reaching USD 2.22 million by 2032, at a CAGR of 5.89%. The growth is supported by research institutions and niche industries in Dresden and Leipzig, which increasingly adopt spectroscopy and imaging tools. While smaller in market size, East Germany offers growth opportunities through specialized applications in research-driven optical technologies.

Market Segmentations:

By Product

- Bulk Quartz Lyot Depolarizers

- Achromatic / Optically Contacted Quartz Depolarizers

- All-fiber Lyot Depolarizers

By Application

- Scientific Research & Academic

- Spectroscopy & Imaging

- Telecom & Fiber-optic Systems

- Industrial Laser Systems & OEM Instrumentation

- Others

By Wavelength

- UV–Visible (200–1100 nm)

- Near-IR (1100–2600 nm)

- Broadband Sources

- Others

By Geography

- North Germany

- South Germany

- East Germany

- West Germany

Competitive Landscape

The competitive landscape of the Germany Quartz Lyot depolarizer market is characterized by a mix of global leaders and specialized optical component manufacturers. Companies such as Leysop Ltd, Thorlabs, Inc., and Tower Optical Corporation dominate with strong portfolios in precision depolarizers and customized optical solutions. German-based players like Jenoptik AG further strengthen local production and research, supporting national demand across spectroscopy, telecom, and industrial applications. Emerging suppliers such as Foctek Photonics, Hunan Dayoptics, and Fujian Enlumen Tech are expanding their footprint with cost-efficient, scalable products. Meanwhile, firms like Edmund Optics India Private Limited and OptoSigma Corporation enhance global distribution networks. The market remains highly competitive, with companies focusing on product innovation, expanding wavelength coverage, and improving fiber-compatible designs. Strategic growth is driven by partnerships with OEMs, integration into advanced photonics systems, and R&D investments to meet rising demand from research and telecom sectors. This environment encourages continuous innovation and strengthens Germany’s optics market competitiveness.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Leysop Ltd

- Thorlabs, Inc.

- Tower Optical Corporation

- Jenoptik AG

- Excelitas Technologies Corp.

- Foctek Photonics, Inc.

- Hunan Dayoptics, Inc.

- OptoSigma Corporation

- Edmund Optics India Private Limited

- Fujian Enlumen Tech Co., Ltd.

- Other Key Players

Recent Developments

- In 2023, Thorlabs launched a new generation of integrated depolarizers focused on improving efficiency and reducing device size.

- In 2023, OptoSigma released a smaller, more compact version of its popular depolarizer model.

Report Coverage

The research report offers an in-depth analysis based on Product, Application, Wavelength and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand steadily with rising adoption in spectroscopy and imaging applications.

- Fiber-optic and telecom systems will continue to drive demand for all-fiber depolarizers.

- Industrial laser systems will strengthen usage in precision engineering and manufacturing processes.

- Academic and research institutions will remain strong contributors to product adoption.

- Broadband depolarizers will see higher demand due to multi-wavelength applications.

- Technological innovation will focus on compact and integration-ready depolarizer designs.

- Competition will intensify as global players and regional firms expand portfolios.

- Cost challenges in quartz fabrication may push growth of alternative materials.

- North and South Germany will maintain dominance due to strong research and industrial bases.

- Long-term growth will align with Germany’s advancements in photonics and optical technologies.