Market overview

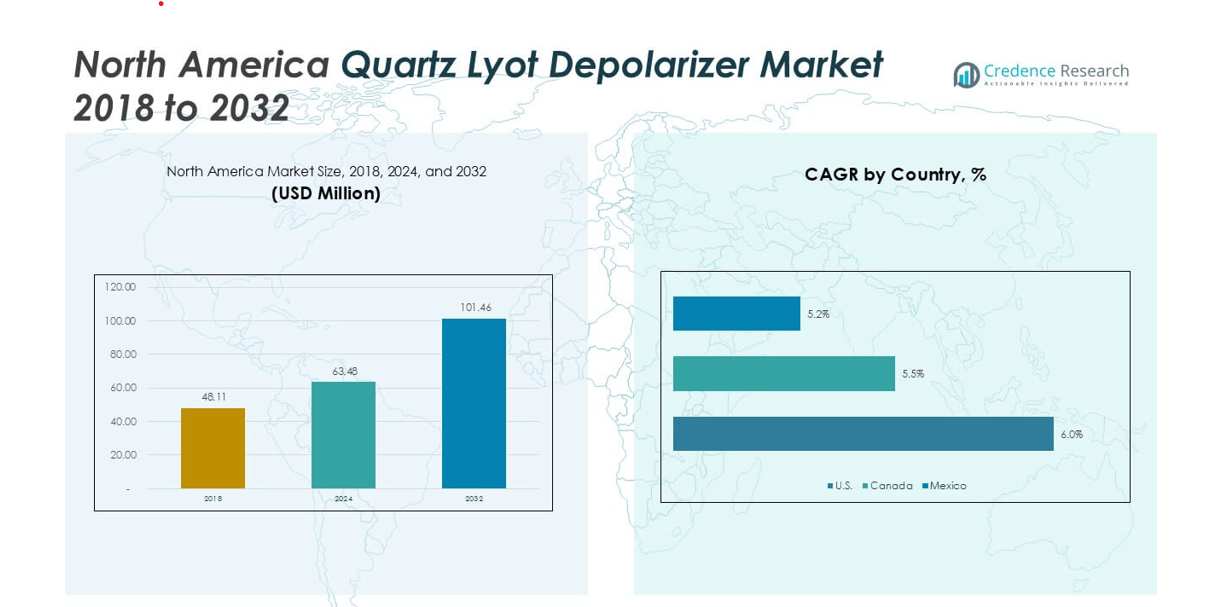

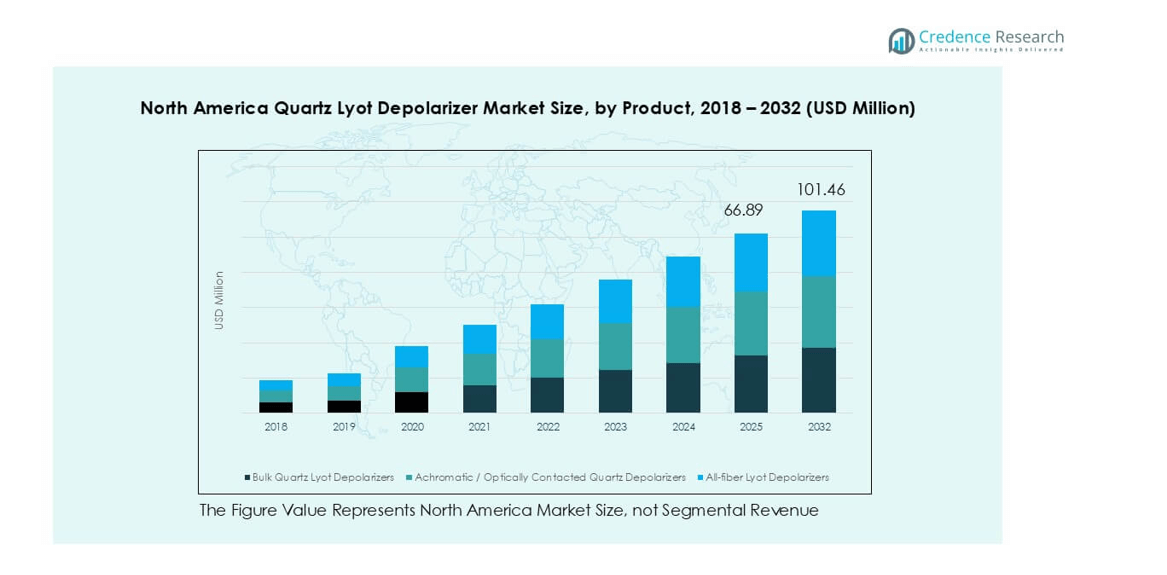

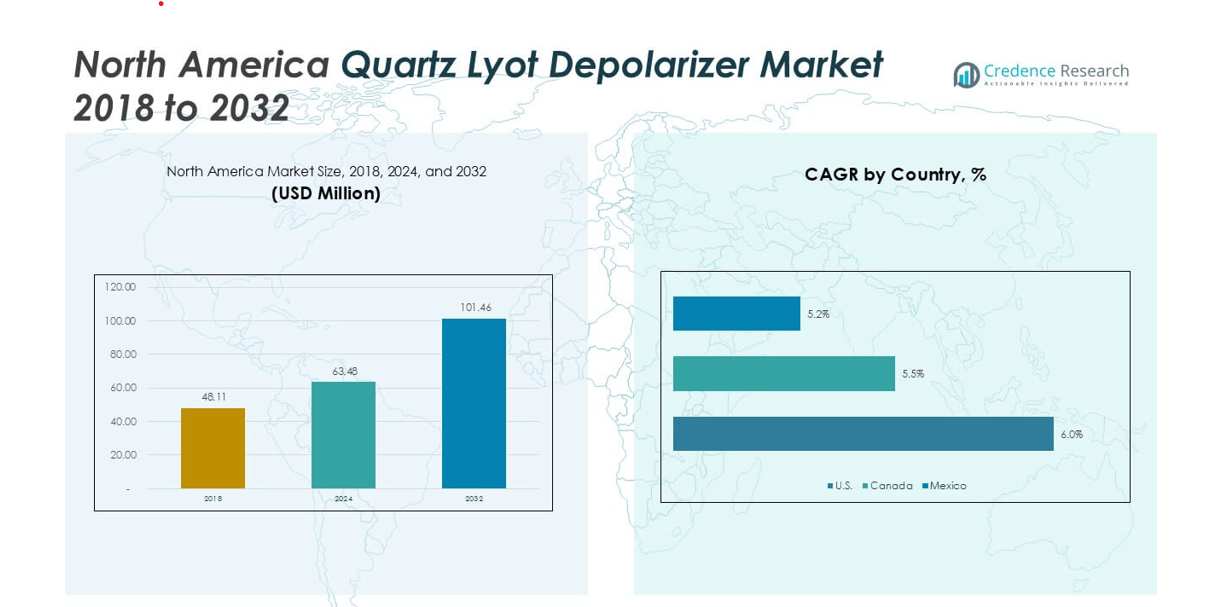

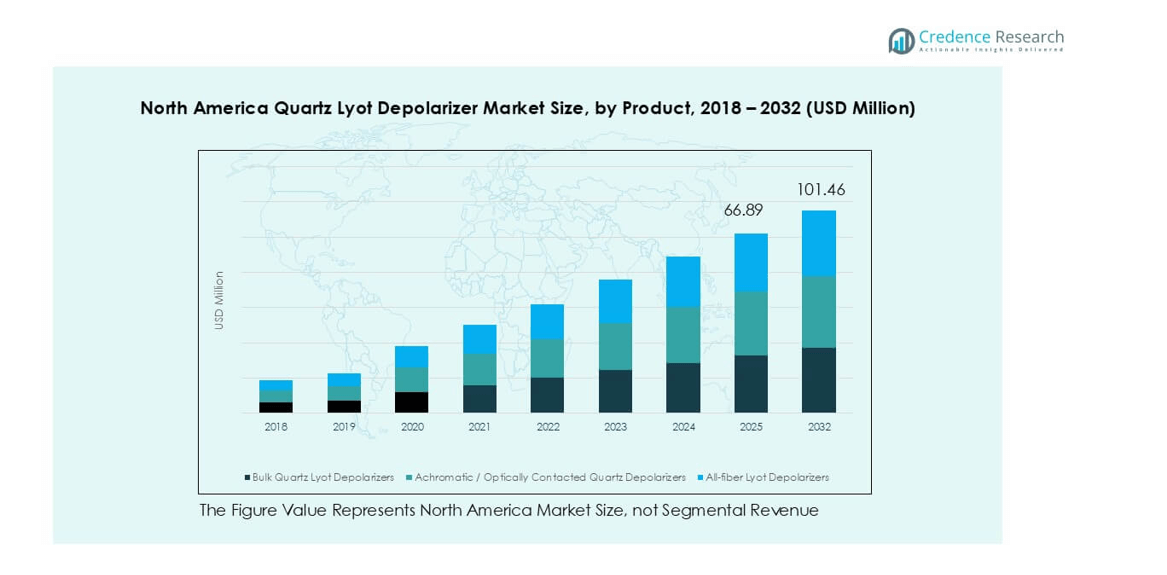

North America Quartz Lyot depolarizer market size was valued at USD 48.11 million in 2018, reaching USD 63.48 million in 2024, and is anticipated to hit USD 101.46 million by 2032, at a CAGR of 6.04% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| North America Quartz Lyot Depolarizer Market Size 2024 |

USD 63.48 million |

| North America Quartz Lyot Depolarizer Market, CAGR |

6.04% |

| North America Quartz Lyot Depolarizer Market Size 2032 |

USD 101.46 million |

The North America Quartz Lyot depolarizer market is dominated by major players including Newport Corporation, Thorlabs, Tower Optical Corporation, Jenoptik AG, Excelitas Technologies Corp., and Edmund Optics. These companies lead with broad product portfolios, advanced R&D capabilities, and strategic collaborations with research institutions, telecom providers, and industrial OEMs. Regional dominance is concentrated in the United States, which held nearly 70% of the market share in 2024, driven by robust telecom infrastructure, strong academic research funding, and widespread industrial adoption. Canada followed with about 20% share, supported by healthcare imaging and optics clusters, while Mexico accounted for the remaining 10%, showing steady growth in telecom and industrial laser applications.

Market Insights

- The North America Quartz Lyot depolarizer market was valued at USD 63.48 million in 2024 and is projected to reach USD 101.46 million by 2032, growing at a CAGR of 6.04%.

- Rising demand from fiber-optic communication and industrial laser systems is driving market expansion, supported by advanced applications in research and spectroscopy.

- A key trend includes the growing adoption of all-fiber Lyot depolarizers in telecom networks and increased integration in biomedical imaging and spectroscopy applications.

- The competitive landscape features leading companies such as Newport Corporation, Thorlabs, Tower Optical, and Jenoptik AG, focusing on product innovation, wavelength customization, and OEM partnerships to maintain market presence.

- Regionally, the United States dominated with nearly 70% share in 2024, followed by Canada at 20% and Mexico at 10%, while by product, bulk quartz depolarizers led with over 40% share, reflecting their wide use in optics and laser systems.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

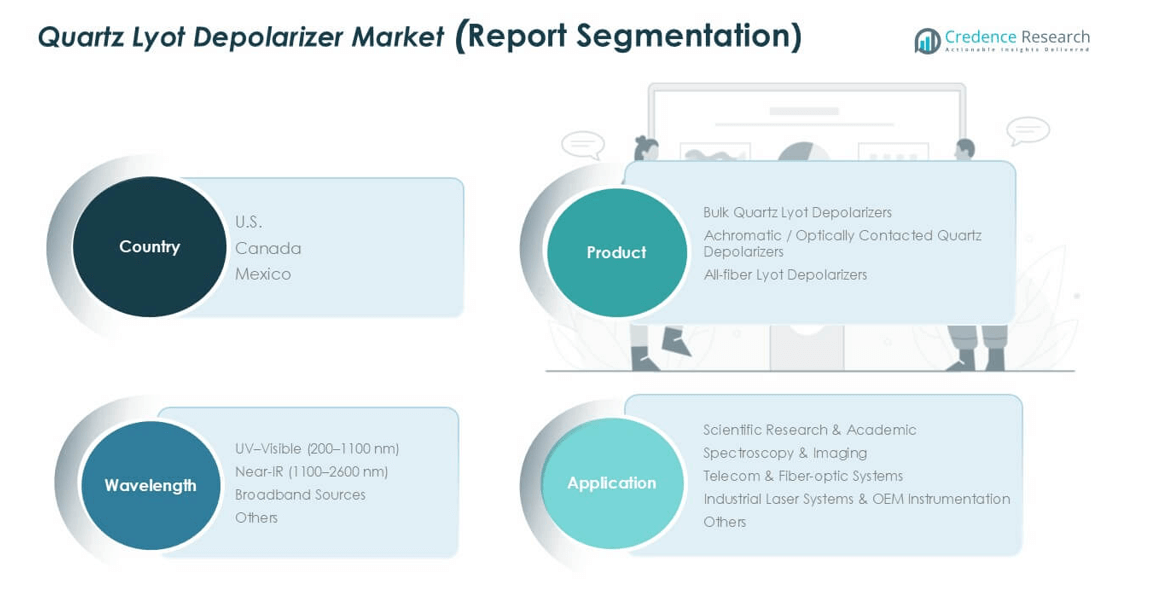

By Product

In the North America Quartz Lyot depolarizer market, bulk quartz Lyot depolarizers accounted for the largest share in 2024, contributing over 40% of total revenue. Their dominance comes from wide adoption in precision optics, laser systems, and laboratory applications where stable polarization control is essential. Achromatic or optically contacted quartz depolarizers follow, supported by demand in high-end spectroscopic research and imaging systems requiring broad wavelength coverage. All-fiber Lyot depolarizers are expanding steadily, driven by the growing need for compact, integrated solutions in fiber-optic networks and advanced telecommunication systems.

- For instance, Crylink reports that its standard quartz Lyot depolarizer achieves a damage threshold of 5 J/cm² for 20 ns pulses at 1064 nm when optically contacted.

By Application

Scientific research and academic use dominated the application segment in 2024, holding nearly 35% share of the regional market. Universities and laboratories rely heavily on depolarizers for spectroscopy, laser experiments, and optical testing, ensuring strong demand. The spectroscopy and imaging segment is also expanding due to rising deployment in medical imaging and analytical instrumentation. Telecom and fiber-optic systems represent another fast-growing application, supported by increasing bandwidth requirements across data centers. Industrial laser systems and OEM instrumentation add consistent demand, particularly from precision manufacturing and material processing.

- For instance, in a university optics lab, an Edmund Optics quartz Lyot depolarizer with a 10×10 mm aperture and <20 arcsec parallelism is used daily to remove unwanted polarization effects from a broadband light source.

By Wavelength

The UV–Visible (200–1100 nm) segment led the market in 2024 with over 38% share. Its leadership stems from broad utilization in spectroscopy, microscopy, and laser diagnostics, where UV–Visible ranges dominate experimental and industrial workflows. The near-IR (1100–2600 nm) segment is growing quickly due to expanding applications in fiber-optic communication and sensing technologies. Broadband sources also contribute significantly, particularly in advanced research setups that require wide spectral coverage. The “Others” category, including custom wavelength depolarizers, continues to serve niche sectors such as defense optics and specialized OEM designs.

Key Growth Drivers

Rising Demand from Fiber-Optic Communication Systems

The rapid expansion of fiber-optic networks across North America is a major driver for the quartz Lyot depolarizer market. Increasing internet traffic, fueled by cloud computing, 5G adoption, and data center growth, has heightened the need for efficient polarization control solutions. Quartz Lyot depolarizers provide stable performance in telecom infrastructure by reducing polarization-dependent noise and improving signal integrity. This performance advantage makes them a preferred choice in long-haul and high-capacity fiber-optic systems. Companies and service providers are investing in next-generation optical transmission technologies, further supporting adoption. With telecom operators continuously upgrading backbone networks, demand for high-quality depolarizers is expected to rise steadily throughout the forecast period.

- For instance, General Photonics’ PolaZero™ fiber depolarizer yields an output degree of polarization (DOP) < 5% while handling input coherence lengths up to 300 m.

Expanding Applications in Scientific Research and Spectroscopy

Scientific research institutions and laboratories remain key contributors to market growth. Quartz Lyot depolarizers are widely used in spectroscopy, laser diagnostics, and imaging applications where precision optical measurements are crucial. North America’s strong academic and research ecosystem, supported by significant federal and private funding, boosts the integration of advanced optical tools in various research domains. The demand extends to life sciences, medical imaging, and material science, where depolarizers improve accuracy by minimizing polarization interference. Universities and laboratories are increasingly equipping their facilities with advanced optical components to support cutting-edge studies. This steady investment in high-end optical research infrastructure strengthens the role of quartz Lyot depolarizers in sustaining long-term market growth.

- For instance, in Raman spectroscopy, a fully polarized input beam can be depolarized to < 0.2% residual polarization using a quasi-monochromatic fiber depolarizer in a 50 MHz linewidth setup.

Industrial Adoption in Laser Systems and OEM Instrumentation

Industrial laser systems and OEM instrumentation represent another powerful growth driver. Manufacturers in precision engineering, semiconductor production, and material processing are incorporating quartz Lyot depolarizers to enhance the stability of laser outputs and ensure uniformity in optical performance. These depolarizers reduce polarization artifacts in high-power laser applications, improving both accuracy and safety in industrial processes. The adoption is further supported by the push toward automation and Industry 4.0, where precision optical tools are vital. OEMs are integrating depolarizers into their systems to offer more reliable and efficient solutions to end-users. This rising integration across multiple industrial verticals makes industrial laser systems a critical growth segment in North America’s quartz Lyot depolarizer market.

Key Trends & Opportunities

Shift Toward All-Fiber Depolarizers in Telecom Applications

One of the major trends is the increasing shift toward all-fiber Lyot depolarizers for telecom and broadband systems. As networks become more compact and demand higher integration, all-fiber solutions provide advantages such as low insertion loss, compact design, and easy compatibility with fiber-optic setups. This trend is fueled by the demand for seamless integration in dense optical networks. With North America focusing on expanding 5G and high-speed internet services, the opportunity for all-fiber depolarizers is significant. OEMs are working on developing optimized fiber-based depolarizers, providing telecom providers with cost-effective and scalable solutions.

- For instance, Newport’s F-DEP-2-FA all-fiber depolarizer exhibits a typical insertion loss of 1.0 dB and a maximum insertion loss of 1.4 dB.

Growing Use in Spectroscopy and Biomedical Imaging

The application of quartz Lyot depolarizers in spectroscopy and imaging is creating new growth opportunities. These devices enhance precision in medical imaging, fluorescence studies, and advanced spectroscopy experiments. With the healthcare sector investing heavily in diagnostic imaging and research, depolarizers are finding broader usage. This is especially relevant in North America, where demand for early disease detection technologies is rising. Spectroscopy in pharmaceuticals and life sciences also supports this trend. Market participants are capitalizing on the need for reliable depolarizers in clinical and biomedical research, opening opportunities in healthcare-driven optical markets.

Key Challenges

High Production Costs and Complexity of Manufacturing

The complex design and precision requirements of quartz Lyot depolarizers create challenges in scaling production cost-effectively. These components require high-purity quartz and advanced fabrication techniques, driving up manufacturing expenses. As a result, the overall cost of depolarizers remains high, limiting accessibility for smaller research institutions and OEMs with constrained budgets. North America’s reliance on specialized suppliers also makes pricing more rigid compared to other optical components. Manufacturers face the dual challenge of reducing production costs while maintaining optical precision. This cost barrier may slow down adoption, particularly in budget-sensitive applications.

Competition from Alternative Polarization Control Technologies

The market faces competition from alternative polarization control devices, such as polarization scramblers and active polarization controllers. These solutions, while sometimes less precise, offer cost advantages and easier integration in certain applications. For telecom providers and OEMs looking for economical solutions, alternatives can replace quartz depolarizers in specific use cases. Additionally, advances in photonic integration and chip-based optical systems are driving interest in compact polarization control technologies. This technological substitution risk could impact quartz Lyot depolarizer adoption in the long term unless manufacturers innovate to maintain differentiation in performance and reliability.

Regional Analysis

United States

The United States accounted for the largest share of the North America Quartz Lyot depolarizer market in 2024, representing nearly 70% of total revenue. Its leadership is supported by strong investments in fiber-optic infrastructure, research institutions, and industrial laser applications. The presence of major telecom providers and a robust scientific research ecosystem further drives adoption. Universities, defense projects, and OEM manufacturers in optics and photonics also contribute to demand. With growing 5G expansion and increased funding for biomedical imaging, the U.S. is expected to maintain dominance throughout the forecast period, sustaining high adoption across industries.

Canada

Canada held around 20% share of the North America Quartz Lyot depolarizer market in 2024, driven by investments in research laboratories, healthcare imaging, and telecom upgrades. Canadian universities and government-supported projects play a central role in expanding demand for depolarizers in spectroscopy and life sciences research. The country’s expanding broadband infrastructure and investments in industrial laser systems also add to market growth. Canadian optics and photonics clusters, particularly in Ontario and Quebec, are fostering technology adoption. With increasing focus on high-speed internet connectivity and biomedical research, Canada is emerging as a strong growth contributor within the regional market.

Mexico

Mexico represented nearly 10% of the regional market share in 2024, supported by gradual adoption in telecom and industrial laser applications. Although smaller compared to the U.S. and Canada, Mexico is steadily expanding its demand base with infrastructure modernization and integration of optical systems in manufacturing sectors. Growth is particularly visible in industrial instrumentation and OEM adoption for material processing and precision manufacturing. Government initiatives to expand broadband access are also supporting deployment of fiber-optic systems. While the market is still developing, Mexico holds promising potential for future expansion in both industrial and telecom applications.

Market Segmentations:

By Product

- Bulk Quartz Lyot Depolarizers

- Achromatic / Optically Contacted Quartz Depolarizers

- All-fiber Lyot Depolarizers

By Application

- Scientific Research & Academic

- Spectroscopy & Imaging

- Telecom & Fiber-optic Systems

- Industrial Laser Systems & OEM Instrumentation

- Others

By Wavelength

- UV–Visible (200–1100 nm)

- Near-IR (1100–2600 nm)

- Broadband Sources

- Others

By Geography

- United States

- Canada

- Mexico

Competitive Landscape

The competitive landscape of the North America Quartz Lyot depolarizer market is characterized by the presence of established optical component manufacturers and specialized photonics companies. Leading players such as Newport Corporation, Thorlabs, and Tower Optical Corporation maintain strong market positions through extensive product portfolios covering bulk, achromatic, and fiber-based depolarizers. These companies are supported by wide distribution networks and partnerships with research institutions, telecom operators, and OEMs. Global players like Jenoptik AG, Excelitas Technologies, and Edmund Optics extend competitive pressure by offering integrated solutions and leveraging cross-industry expertise. Emerging firms including Foctek Photonics and Hunan Dayoptics are strengthening their foothold with cost-competitive products aimed at research and industrial markets. Continuous product innovation, wavelength customization, and investment in advanced materials remain the key strategies shaping competition. Overall, the market shows a balance between global giants and niche suppliers, creating a competitive but innovation-driven ecosystem in North America.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Newport Corporation

- Thorlabs, Inc.

- Tower Optical Corporation

- Jenoptik AG

- Excelitas Technologies Corp.

- Foctek Photonics, Inc.

- Hunan Dayoptics, Inc.

- OptoSigma Corporation

- Edmund Optics India Private Limited

- Fujian Enlumen Tech Co., Ltd.

- Other Key Players

Recent Developments

- In 2023, Thorlabs launched a new generation of integrated depolarizers focused on improving efficiency and reducing device size.

- In 2023, OptoSigma released a smaller, more compact version of its popular depolarizer model.

Report Coverage

The research report offers an in-depth analysis based on Product, Application, Wavelength and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand steadily with increasing adoption in fiber-optic communication systems.

- Demand from scientific research and spectroscopy applications will continue to strengthen growth.

- Industrial laser systems will drive wider use of depolarizers in precision manufacturing.

- All-fiber Lyot depolarizers will gain momentum due to compact design and telecom integration.

- Investments in biomedical imaging and life sciences will create new opportunities.

- Technological innovation will focus on wavelength customization and broadband solutions.

- Competition will intensify as global and regional players expand their product offerings.

- High manufacturing costs may remain a challenge for smaller research institutions.

- The United States will maintain dominance while Canada and Mexico show steady growth.

- Long-term market outlook will remain positive with innovation and research funding shaping demand.