Market Overview

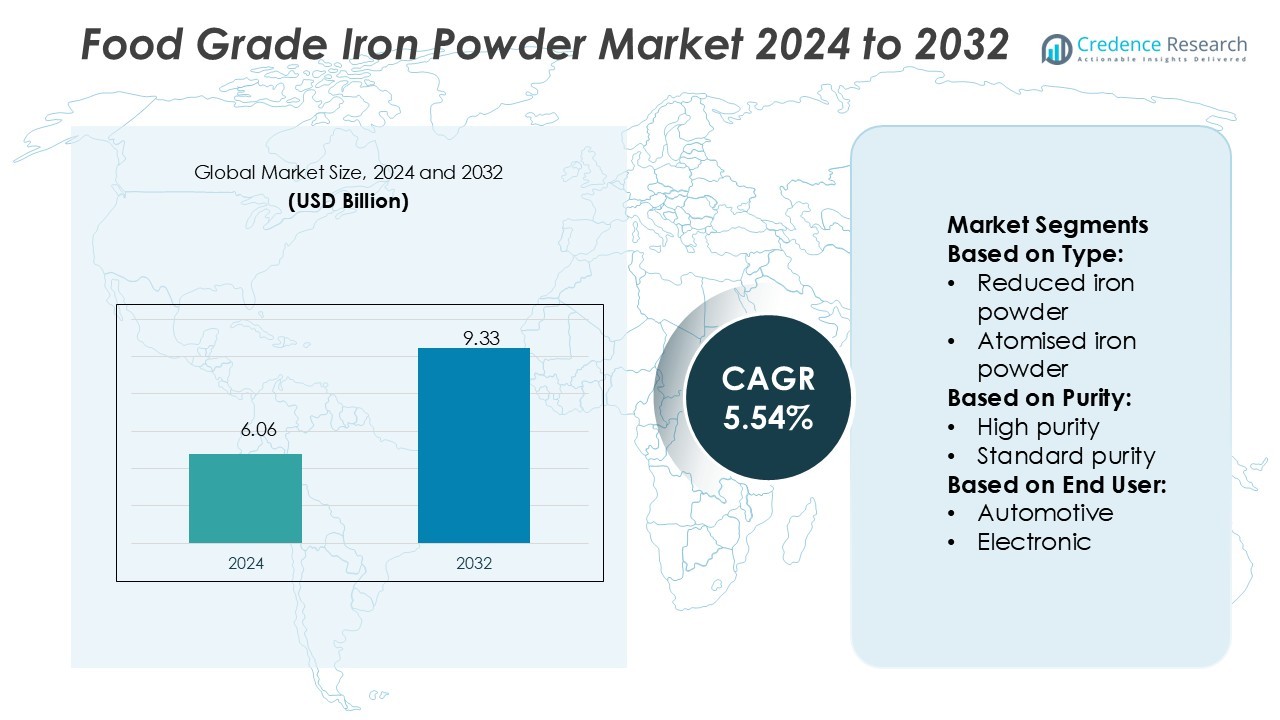

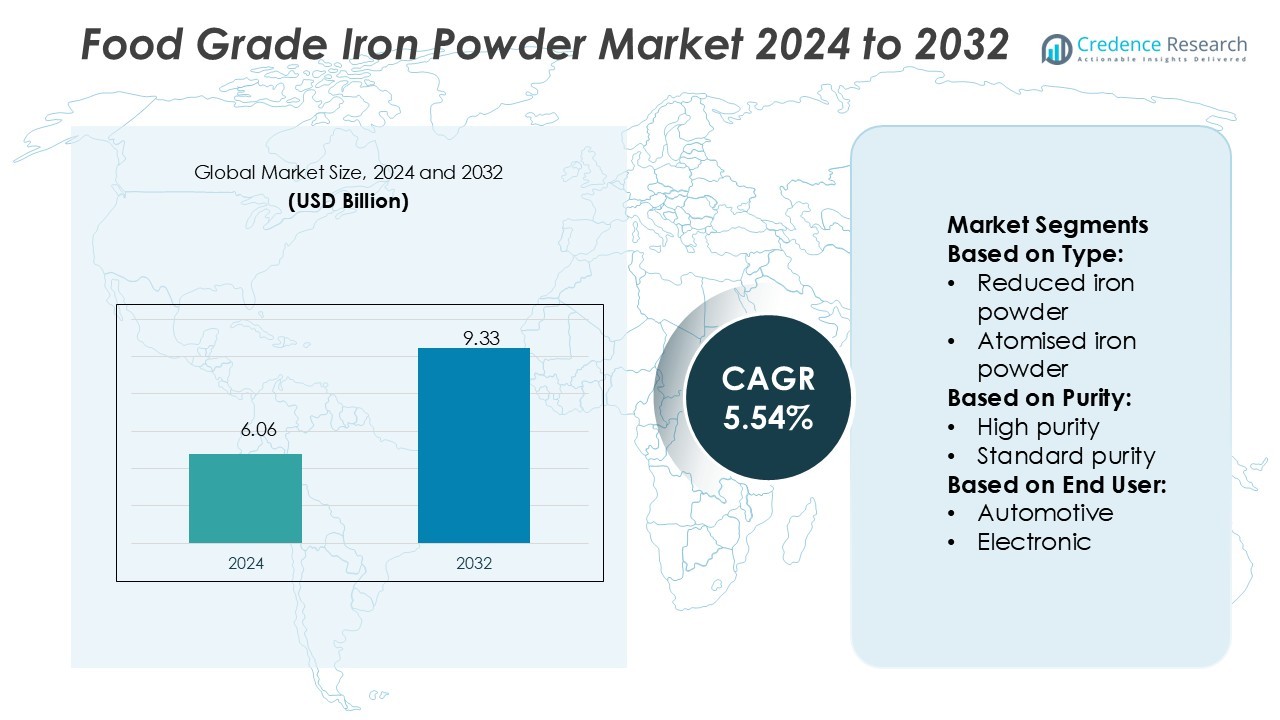

Food Grade Iron Powder Market size was valued USD 6.06 billion in 2024 and is anticipated to reach USD 9.33 billion by 2032, at a CAGR of 5.54% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Food Grade Iron Powder Market Size 2024 |

USD 6.06 Billion |

| Food Grade Iron Powder Market, CAGR |

5.54% |

| Food Grade Iron Powder Market Size 2032 |

USD 9.33 Billion |

The food grade iron powder market is shaped by prominent players including Hoganas, Rio Tinto Metal Powder, BASF SE, JFE Steel Corporation, Industrial Metal Powders (India) Pvt. Ltd., CNPC Powder, Belmont Metals, Pometon, Reade, and SAGWELL USA INC. These companies focus on innovation, regulatory compliance, and strategic partnerships to strengthen their market positions. Hoganas and Rio Tinto Metal Powder leverage advanced technologies and strong global networks, while BASF SE emphasizes high-purity solutions for premium applications. Industrial Metal Powders (India) Pvt. Ltd. and CNPC Powder cater to cost-sensitive markets with competitive offerings. Regionally, Asia-Pacific leads the market with a 34% share, supported by government-led fortification programs, rising consumption of fortified foods, and strong demand for dietary supplements across emerging economies. This leadership underscores the region’s dynamic role in driving global growth.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Food Grade Iron Powder Market was valued at USD 6.06 billion in 2024 and is projected to reach USD 9.33 billion by 2032, growing at a CAGR of 5.54%.

- Rising demand for fortified foods and dietary supplements drives market growth, supported by government-led nutrition programs and consumer focus on preventive healthcare.

- High-purity iron powders are gaining traction as a key trend, with innovation in microencapsulation and solubility enhancement improving product performance and consumer acceptance.

- The market is competitive, with players such as Hoganas, Rio Tinto Metal Powder, BASF SE, and others focusing on advanced technologies, regulatory compliance, and expansion into cost-sensitive markets.

- Asia-Pacific dominates with a 34% share, driven by large-scale fortification programs, while reduced iron powder leads the type segment with over 45% share, highlighting its cost-effectiveness and wide application in fortified cereals and supplements.

Market Segmentation Analysis:

By Type

The food grade iron powder market is segmented into reduced, atomised, and electrolytic iron powders. Reduced iron powder dominates the market with a share exceeding 45%, supported by its cost-effectiveness and wide application in food fortification. Its porous structure enhances absorption, making it a preferred choice for nutritional supplements and fortified cereals. Atomised iron powder follows, driven by use in specialty food formulations requiring high stability. Electrolytic iron powder caters to niche applications due to its high purity but remains limited by higher production costs compared to reduced iron powder.

- For instance, Corbion expanded lactic acid capacity at its Blair, Nebraska plant by about 40%, while simultaneously cutting the cradle-to-gate carbon footprint per ton by 9%, all using 100% renewable electricity at the site.

By Purity

Based on purity, the market is classified into high purity and standard purity iron powders. Standard purity iron powder holds the largest share of 58%, as it meets the requirements for most fortification and consumer applications without significant cost burdens. This segment benefits from strong demand in mass food processing and nutritional product development. High purity iron powder, while smaller in share, is witnessing growing interest in premium supplements and specialized dietary products, where regulatory compliance and superior bioavailability drive adoption despite higher pricing.

- For instance, Brenntag Nutrition developed a plant-based spreadable cheese mix that delivers a low carbon footprint of just 2.15 kg CO₂e per kilogram of product, compared to 12.51 kg CO₂e per kilogram from conventional dairy cheese, as verified by TÜV Rheinland and calculated using Brenntag’s proprietary CO2Xplorer tool.

By End User

The food grade iron powder market by end user includes automotive, electronic, general industries, consumer industries, and construction. Consumer industries lead with a 42% share, primarily driven by strong demand from food and beverage producers for fortified products. Rising consumer focus on nutritional enrichment in packaged foods fuels this dominance. General industries and electronics use iron powders for specific additives and processing needs, but their market share remains secondary. Construction and automotive sectors contribute minimally, as their use is largely limited to technical-grade iron rather than food-grade applications.

Key Growth Drivers

Rising Demand for Fortified Foods

The growing emphasis on addressing iron deficiency has increased the adoption of food grade iron powder in fortified products. Governments and health organizations encourage fortification of cereals, flours, and infant foods, creating strong demand. Consumers seek convenient nutritional solutions, pushing food manufacturers to expand fortified offerings. Reduced iron powder remains the preferred type due to its affordability and bioavailability. This driver significantly supports volume growth in mass-market packaged foods, making fortification a primary growth catalyst for the food grade iron powder market.

- For instance, Kemin partners with U.S. growers to sustainably cultivate rosemary on more than 1,100 acres, supporting traceable extract production for food ingredients. According to Kemin, its rosemary crops, labs, and manufacturing and blending facilities in six worldwide locations are traceable and auditable.

Expansion of Nutraceuticals and Dietary Supplements

The rapid growth of nutraceuticals and dietary supplements strongly contributes to market expansion. Consumers increasingly prioritize wellness, driving demand for iron-based supplements to address anemia and fatigue. High purity iron powder is particularly favored in capsules and tablets due to better absorption rates and compliance with regulatory standards. Companies invest in advanced formulations to improve solubility and effectiveness. The rising acceptance of preventive healthcare solutions ensures steady growth for iron powder applications within nutraceuticals, reinforcing its role in strengthening consumer health and wellness.

- For instance, BASF’s Nutrition & Health division offers specific vitamin A and E ingredients whose product carbon footprints (PCFs) are at least 20% lower than the global market average, as certified by TÜV Rheinland.

Growing Applications in Consumer Industries

Beyond traditional food fortification, food grade iron powder finds growing applications across diverse consumer industries. It is increasingly used in energy drinks, dietary mixes, and specialized health foods. The powder’s versatility supports product innovation, helping manufacturers introduce premium functional food offerings. With urban lifestyles boosting demand for on-the-go nutrition, manufacturers explore formulations that combine iron with vitamins and proteins. This expanding use in consumer-focused applications creates a strong foundation for market growth and allows iron powder producers to tap into evolving consumption patterns worldwide.

Key Trends & Opportunities

Shift Toward High-Purity Iron Powders

A notable trend in the food grade iron powder market is the rising preference for high-purity grades. Consumers show growing awareness about product quality and safety, leading to greater demand for powders with higher bioavailability. Regulatory frameworks increasingly favor high-standard formulations, creating opportunities for manufacturers to differentiate their offerings. Premium dietary supplements and infant nutrition products drive this segment. Companies that invest in high-purity production technologies and certifications stand to capture emerging demand and strengthen their presence in both developed and emerging regions.

- For instance, Roquette’s new Food Innovation Center in Lestrem, France offers the press release confirms the center occupies 5,000+ sqm of applications laboratories and pilots globally, with the new Lestrem center accounting for over 2,500 m² of that total.

Innovation in Food Fortification Programs

Food fortification programs supported by public-private partnerships provide significant opportunities for market players. Governments in Asia, Africa, and Latin America actively promote fortified staple foods to address widespread nutritional deficiencies. This trend opens doors for iron powder suppliers to partner with large-scale food manufacturers. Innovations in microencapsulation technology reduce metallic aftertaste and improve dispersibility in food matrices, enhancing consumer acceptance. The integration of fortified products into mainstream diets ensures long-term growth potential, making fortification innovation a central opportunity in the global market landscape.

- For instance, Tate & Lyle repowered its Brazilian Guarani site powered by 100% renewable energy. Tate & Lyle announced that its manufacturing facility in Guarani, Brazil, had become the first company site.

Key Challenges

High Production and Processing Costs

The cost of producing high-purity iron powders remains a significant challenge for manufacturers. Advanced refining techniques and stringent quality standards increase expenses, making these products less accessible in price-sensitive markets. Manufacturers face pressure to balance affordability with compliance, particularly in emerging economies where large-scale fortification is needed. Price fluctuations in raw materials further add to uncertainty. Companies must innovate cost-efficient production technologies to remain competitive and ensure that high-quality iron powders can be supplied without undermining margins or consumer accessibility.

Regulatory and Quality Compliance Pressures

Compliance with global safety and nutritional regulations poses a key barrier in the food grade iron powder market. Each region enforces strict quality standards, creating challenges for international trade and product approvals. Meeting varying certification requirements demands high investment in testing, monitoring, and documentation. Non-compliance risks product recalls and reputational damage, which can undermine growth strategies. Smaller manufacturers face greater challenges due to limited resources. Ensuring consistent adherence to quality and safety norms while expanding globally remains a complex and ongoing industry hurdle.

Regional Analysis

North America

North America accounts for 28% of the food grade iron powder market, supported by strong demand for fortified foods and dietary supplements. The United States leads regional growth with government-backed nutritional programs targeting anemia and iron deficiency. Rising health awareness and the popularity of nutraceuticals further strengthen demand. Canada contributes steadily, driven by consumer interest in functional foods and regulatory support for fortified staples. Key market players in this region focus on high-purity iron powders to meet strict quality standards, ensuring consistent growth in both mass-market and premium product categories.

Europe

Europe captures 24% of the food grade iron powder market, with demand driven by fortified cereals, bakery products, and infant nutrition. Stringent regulations by the European Food Safety Authority (EFSA) create strong emphasis on high-purity iron powders. Germany, the UK, and France lead in adoption due to advanced food processing industries and consumer preference for clean-label nutritional solutions. Increasing popularity of plant-based and functional foods also drives iron fortification demand. The region benefits from mature supply chains, while rising investments in sustainable production practices position Europe as a steady contributor to global market growth.

Asia-Pacific

Asia-Pacific dominates the market with a 34% share, making it the leading regional segment. Strong demand stems from large-scale government fortification programs in India, China, and Southeast Asia to address iron deficiency. Rising middle-class populations and growing consumption of packaged foods further accelerate growth. High demand for dietary supplements and fortified infant nutrition also supports regional expansion. Local manufacturers increasingly adopt cost-effective production technologies to meet demand at scale, while global players invest in partnerships and joint ventures. This region’s robust growth trajectory makes it the most dynamic market for food grade iron powder.

Latin America

Latin America holds 8% of the food grade iron powder market, with growth driven by government-led nutrition programs and rising demand for fortified staple foods. Brazil leads the region, supported by consumer awareness and expanding middle-class dietary needs. Mexico and Argentina also show strong potential due to increasing adoption of fortified cereals and supplements. Despite economic fluctuations, the region’s emphasis on combating anemia strengthens demand. Limited local production capacity creates opportunities for imports, while companies focusing on affordable solutions see growth potential in this cost-sensitive yet expanding market environment.

Middle East & Africa

The Middle East & Africa region accounts for 6% of the food grade iron powder market, emerging as a growing opportunity. Governments in African countries promote fortification programs to tackle malnutrition, particularly in wheat flour and maize. South Africa, Nigeria, and Kenya lead demand, while the Middle East shows steady adoption in consumer health products. Limited industrial capacity and reliance on imports constrain market expansion, but increasing international collaborations offer growth opportunities. Rising investments in fortified foods and supplements underline the region’s gradual progress, though affordability and supply chain challenges remain key hurdles.

Market Segmentations:

By Type:

- Reduced iron powder

- Atomised iron powder

By Purity:

- High purity

- Standard purity

By End User:

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the food grade iron powder market features key players such as CNPC Powder, SAGWELL USA INC., Reade, Industrial Metal Powders (India) Pvt. Ltd., Pometon, Rio Tinto Metal Powder, JFE Steel Corporation, Hoganas, Belmont Metals, and BASF SE. The food grade iron powder market is highly competitive, shaped by continuous innovation, regulatory compliance, and evolving consumer demand. Companies focus on developing high-purity powders that meet stringent safety standards while ensuring affordability for large-scale food fortification. Strategic partnerships with food manufacturers and government-backed nutrition programs remain key growth strategies. Innovation in microencapsulation and solubility enhancement is gaining momentum, helping improve consumer acceptance of fortified foods. Market players also emphasize sustainable sourcing and advanced production technologies to strengthen their global presence. Competitive success is driven by adaptability, product differentiation, and the ability to serve both premium and mass-market segments.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In March 2025, Höganäs AB announced that it has entered into a partnership with Porite TAIWAN Co., Ltd., a prominent manufacturer of precision components. As per this partnership, Höganäs AB will supply its newly developed zero sponge iron powder to Porite, gradually replacing its currently used standard sponge iron powders.

- In April 2024, Shin-Etsu Chemical Co., Ltd., declared the development of a new plant in Isesaki City, Gunma Prefecture, Japan, for expanding its semiconductor lithography materials business. The new plant will be the fourth manufacturing base for Shin-Etsu in this business.

- In January 2024, JFE Steel Corporation has taken the lead in demonstration eco-friendly innovations in the development of Denjiro, an insulation-coated pure-iron powder. This made it possible to design a slimmer, lighter axial-gap motor with equal or higher efficiency that supports the ever-growing demand for compact, sustainable power solutions both in industry and automotive.

- In October 2023, Ionblox launched its very fast-charging lithium-silicon cells for Evs, achieving 60% charge in 5 minutes and increasing range by 30 to 50%. The cells withstood this performance for over 1,000 cycles with little degradation.

Report Coverage

The research report offers an in-depth analysis based on Type, Purity, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The food grade iron powder market will expand with rising demand for fortified foods.

- Nutraceuticals and dietary supplements will remain a strong growth driver.

- High-purity iron powders will gain preference due to better bioavailability.

- Emerging economies will lead demand through government-backed fortification programs.

- Technological advances in microencapsulation will improve product performance.

- Consumer industries will strengthen their share with functional and health-focused foods.

- Sustainability in sourcing and production will shape competitive strategies.

- Regulatory compliance will continue to influence product development and approvals.

- Partnerships between suppliers and food manufacturers will intensify.

- Global players will expand into cost-sensitive markets through affordable solutions.