Market Overview:

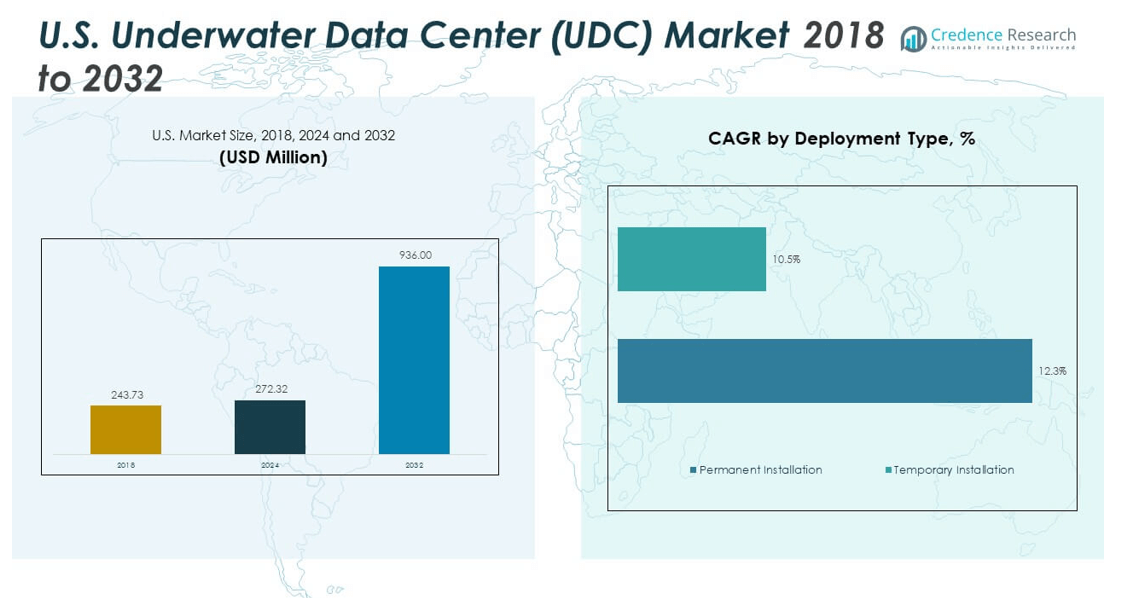

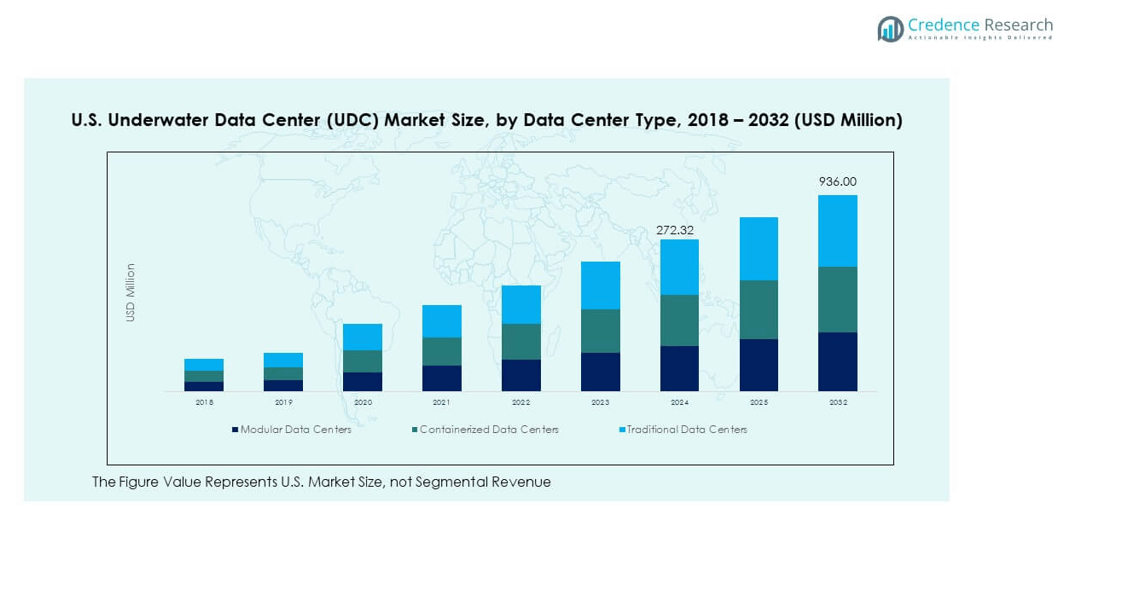

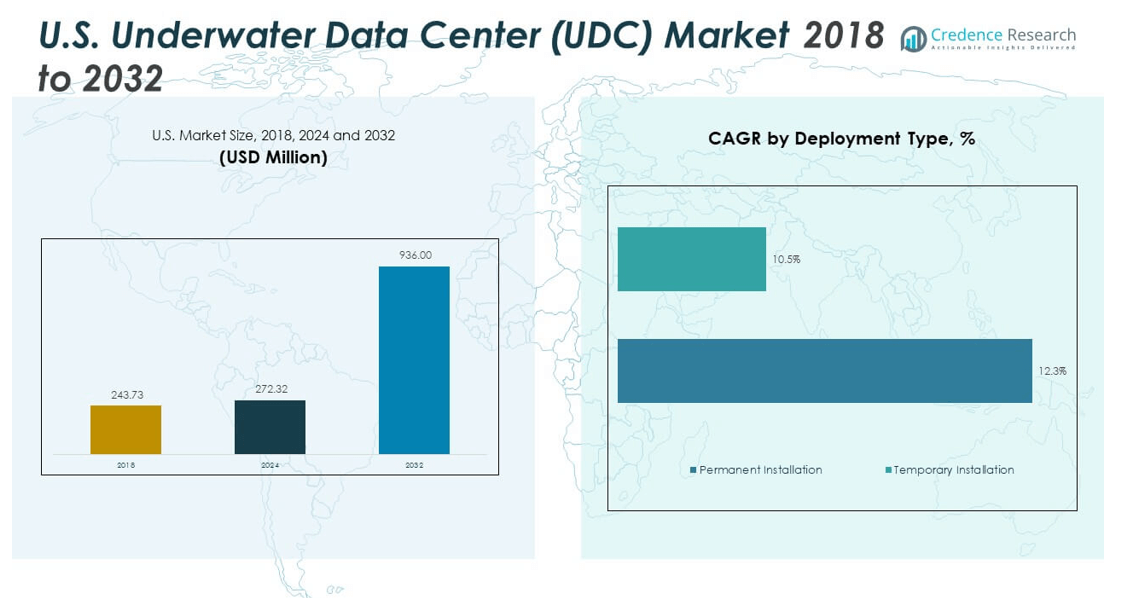

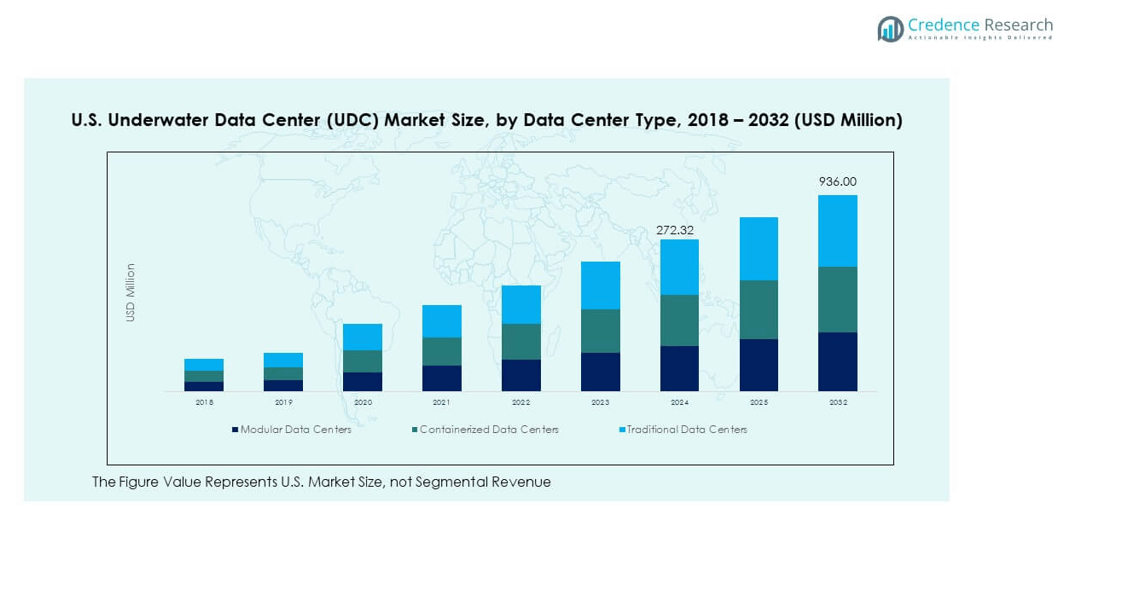

The U.S. Underwater Data Center (UDC) Market size was valued at USD 243.73 million in 2018 to USD 272.32 million in 2024 and is anticipated to reach USD 936.00 million by 2032, at a CAGR of 16.69% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| U.S. Underwater Data Center (UDC) Market Size 2024 |

USD 272.32 million |

| U.S. Underwater Data Center (UDC) Market, CAGR |

16.69% |

| U.S. Underwater Data Center (UDC) Market Size 2032 |

USD 936.00 million |

Growing demand for efficient, sustainable, and scalable data storage drives market expansion. Companies are adopting UDC solutions to reduce land use, cut cooling costs, and enhance energy efficiency. The push for greener infrastructure, rising cloud adoption, and increasing data consumption across industries further boost demand. Enterprises are prioritizing UDC systems for their ability to lower carbon footprints while improving operational reliability. Government support and private investments in innovative subsea technologies continue to shape growth in the U.S. market.

Regionally, the U.S. leads adoption due to advanced technology infrastructure and significant digitalization across industries. Coastal regions with dense data traffic and strong internet connectivity serve as prime deployment hubs. Emerging interest is seen in areas with renewable energy sources, supporting sustainable operations. States with major tech clusters, research centers, and cloud data demand show rapid uptake. The U.S. dominance also sets the benchmark for other regions, while developing economies are gradually exploring underwater data solutions for future deployment.

Market Insights:

- The U.S. Underwater Data Center (UDC) Market was valued at USD 243.73 million in 2018, reached USD 272.32 million in 2024, and is projected to attain USD 936.00 million by 2032, growing at a CAGR of 16.69%.

- The West Coast leads with about 45% share due to strong tech clusters and renewable offshore energy integration, followed by the East Coast with 35% share driven by enterprise demand and financial hubs, while Central and Southern regions contribute 20% as emerging deployment areas.

- The fastest-growing region is the Central and Southern U.S., accounting for nearly 20% share, supported by coastal expansion in Texas and Florida and rising renewable projects.

- Modular data centers dominate with nearly 50% share in 2024, driven by scalability and fast deployment advantages across enterprises.

- Containerized data centers capture close to 30% share, while traditional data centers account for the remaining 20%, reflecting a shift toward modern and flexible designs.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Growing Demand for Sustainable and Energy-Efficient Infrastructure

The U.S. Underwater Data Center (UDC) Market is driven by the rising focus on sustainability and energy efficiency. Enterprises are increasingly adopting UDCs to minimize land usage and reduce energy consumption. Submersion in water provides natural cooling, lowering operational costs. This approach helps companies cut carbon emissions and meet green energy targets. Demand for renewable energy integration strengthens adoption across coastal regions. The push for net-zero commitments by major corporations accelerates investment. It positions UDCs as a strategic solution in meeting environmental regulations.

- For instance, Nautilus Data Technologies’ Stockton facility is able to operate at a Power Usage Effectiveness (PUE) as low as 1.15, reducing cooling energy consumption by up to 70% compared to conventional data centers, directly supporting client sustainability goals.

Expansion of Cloud Computing and Data-Intensive Applications

Rapid growth of cloud services, artificial intelligence, and big data analytics is fueling adoption of UDCs. These technologies require high-performance computing environments with scalable storage. The U.S. market has a strong digital ecosystem, increasing the need for efficient infrastructure. UDCs offer high-capacity, low-latency solutions critical for real-time applications. They also provide resilience against natural disasters compared to traditional land facilities. Businesses prioritize subsea centers to ensure data integrity and continuity. It helps address the surging demand from enterprise and consumer markets.

Increasing Investments from Tech Giants and Government Bodies

Significant funding from leading technology companies is propelling market growth. Firms are investing in underwater prototypes to test efficiency, reliability, and environmental impact. The U.S. government supports such projects through grants and policies encouraging sustainable practices. This backing helps de-risk early-stage deployments and drives commercialization. Major cloud service providers are exploring large-scale rollouts to enhance competitiveness. Investments create technological innovations in subsea cabling, cooling, and data management. It strengthens the foundation for UDC expansion across multiple states.

Growing Urbanization and Rising Internet Penetration

The rise in connected devices and digital services is pushing data demand to new levels. Urbanization increases reliance on digital platforms, streaming, and e-commerce activities. Traditional land-based facilities face space shortages and high energy costs. UDCs emerge as alternatives capable of meeting this rising demand. They reduce dependence on costly cooling systems and provide higher scalability. Growing internet penetration and 5G deployment further enhance market potential. It aligns with the need for resilient, distributed, and energy-efficient infrastructure.

Market Trends:

Adoption of AI and Automation for Underwater Operations

The U.S. Underwater Data Center (UDC) Market is witnessing a trend toward integrating artificial intelligence and automation. AI-driven monitoring systems enhance performance, detect faults, and predict failures before they occur. Robotics and autonomous vehicles support installation and maintenance of subsea facilities. These technologies reduce risks, improve safety, and cut operational costs. Enhanced data analytics capabilities allow continuous optimization of energy use. Automation streamlines repair processes in hard-to-access underwater environments. It strengthens confidence among enterprises adopting subsea solutions for critical operations.

- For instance, Microsoft’s Project Natick pilot involving a data center pod off the coast of Scotland operated for just over two years. The pod ran with remote, automated controls and was designed for “lights out” operation.

Integration with Renewable and Offshore Energy Projects

A strong trend is the alignment of UDCs with renewable energy projects, including offshore wind farms. Combining subsea centers with offshore energy infrastructure reduces transmission losses and costs. This synergy supports a sustainable ecosystem for data operations. Companies are exploring co-location models to maximize efficiency. Offshore power generation strengthens reliability and helps achieve environmental goals. It also creates new investment channels for energy and tech companies. This integration is shaping a long-term trend of energy-data convergence.

- For instance, Highlander Digital’s underwater data center initiative near Shanghai is powered by over 95% renewable energy and is co-deployed with offshore wind, sharply reducing dependence on grid-based fossil fuels.

Focus on Modular and Scalable Designs

Market participants are shifting toward modular designs that enable faster deployment and scalability. Modular structures reduce construction time and simplify maintenance activities. These designs allow incremental capacity expansion to meet growing digital needs. Scalability helps manage costs while supporting enterprise flexibility. Modular UDCs also enable easier relocation when required. Providers prioritize standardization to ensure compatibility across regions and technologies. It ensures long-term adaptability and market readiness for diverse applications.

Collaboration Between Technology and Maritime Industries

The market is seeing partnerships between technology providers and maritime specialists. Shipbuilders and subsea engineers contribute expertise in design, deployment, and maintenance. Technology companies bring in advanced data processing and cloud capabilities. Such collaboration ensures reliable performance under challenging oceanic conditions. It also supports the development of durable materials and subsea cabling. Partnerships are creating new standards for marine-compliant data operations. It marks a growing trend of cross-industry cooperation shaping the U.S. market.

Market Challenges Analysis:

High Capital Expenditure and Technical Complexity

The U.S. Underwater Data Center (UDC) Market faces barriers due to high upfront investment requirements. Construction, subsea deployment, and maintenance demand substantial capital. Technical complexities such as waterproofing, pressure resistance, and power connectivity add to costs. Specialized vessels, robotics, and skilled labor increase financial burdens. Many smaller firms struggle to compete with tech giants in entering this field. Risk of technological failures further discourages wide adoption. It creates entry barriers that may slow expansion in early years.

Environmental Concerns and Regulatory Uncertainty

The market also faces challenges tied to environmental impact and uncertain regulatory frameworks. Concerns exist regarding potential harm to marine ecosystems during installation and operation. Strict environmental clearances can delay projects and raise compliance costs. Regulations vary across states and federal levels, creating inconsistencies. Long approval processes slow large-scale deployment plans. Community opposition may also arise in coastal regions sensitive to ecological balance. It highlights the need for clear policies and standards. Addressing these concerns is critical for long-term acceptance.

Market Opportunities:

Rising Potential for Edge Computing Integration

The U.S. Underwater Data Center (UDC) Market presents opportunities through integration with edge computing. Edge deployments enhance low-latency applications such as IoT, AR/VR, and autonomous systems. UDCs close to coastal cities reduce latency and support data-intensive tasks. Growing reliance on real-time processing strengthens demand for such models. Enterprises see subsea centers as reliable nodes in distributed networks. It positions UDCs as critical to next-generation digital infrastructure.

Expansion into Emerging Coastal and Offshore Areas

Emerging coastal hubs offer untapped opportunities for new UDC installations. Population growth and industrial expansion in these areas create strong digital demand. Offshore sites with renewable energy resources strengthen the case for sustainable projects. Tech companies can leverage these regions for pilot deployments and future scaling. Collaboration with local authorities fosters acceptance and development. It enables diversification of the U.S. market beyond primary hubs.

Market Segmentation Analysis:

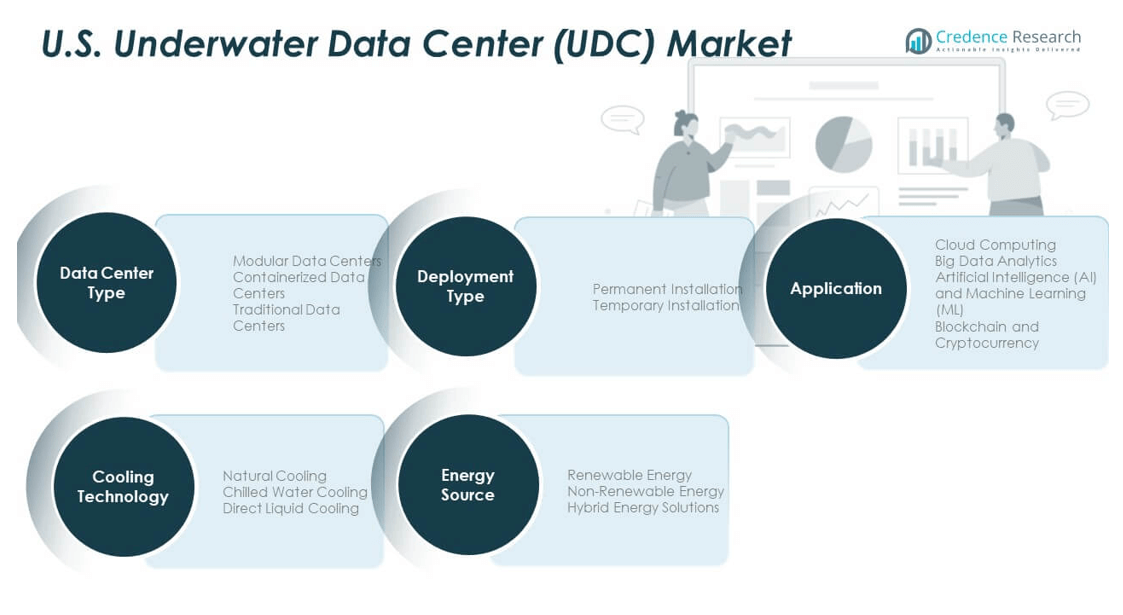

By Data Center Type

The U.S. Underwater Data Center (UDC) Market is segmented into modular, containerized, and traditional facilities. Modular data centers dominate due to their scalability, flexibility, and faster deployment. Containerized models gain traction for temporary or pilot projects, offering cost efficiency. Traditional data centers hold a smaller share as they face challenges in adapting to subsea conditions. It highlights the shift toward modularization to meet growing data demands.

- For instance, the joint modular deployment model by Nautilus Data Technologies and Overwatch Capital features 5 MW-class facilities with commissioning times reduced by up to 50% versus standard on-shore builds.

By Application

Cloud computing is the leading application, supported by rising adoption of enterprise and consumer cloud services. Big data analytics follows closely, driven by increasing demand for advanced data processing. Artificial intelligence and machine learning are emerging as critical applications, requiring low-latency, high-performance environments. Blockchain and cryptocurrency also contribute, benefiting from secure and energy-efficient storage offered by UDCs.

- For instance, NetworkOcean announced plans for an underwater test center in San Francisco Bay to deliver up to 500kW for GPU-intensive workloads and target sub-20ms latency.

By Energy Source

Renewable energy drives strong adoption, aligning with sustainability goals of major corporations. Non-renewable energy maintains relevance but faces declining preference due to environmental concerns. Hybrid energy solutions emerge as practical options, balancing reliability with eco-friendly initiatives. It supports broader integration of UDCs with clean power ecosystems.

By Technology (Deployment Type)

Permanent installations dominate due to their reliability and long-term utility. Temporary installations are deployed for testing, pilot projects, and short-term data needs. It provides flexibility while supporting experimentation in emerging markets.

By Cooling Technology

Natural cooling remains the core method, utilizing ocean water to optimize energy use. Chilled water cooling supports additional efficiency in specific conditions. Direct liquid cooling emerges as a high-performance solution for advanced workloads, enabling greater energy savings and stability.

Segmentation:

By Data Center Type

- Modular Data Centers

- Containerized Data Centers

- Traditional Data Centers

By Application

- Cloud Computing

- Big Data Analytics

- Artificial Intelligence (AI) and Machine Learning (ML)

- Blockchain and Cryptocurrency

By Energy Source

- Renewable Energy

- Non-Renewable Energy

- Hybrid Energy Solutions

By Technology (Deployment Type)

- Permanent Installation

- Temporary Installation

By Cooling Technology

- Natural Cooling

- Chilled Water Cooling

- Direct Liquid Cooling

Regional Analysis:

West Coast

The West Coast leads the U.S. Underwater Data Center (UDC) Market with a share of nearly 45%. States such as California, Washington, and Oregon dominate due to their strong technology clusters, high-density internet traffic, and access to renewable offshore energy. Silicon Valley and Seattle serve as major hubs, hosting operations of global cloud providers and research institutions. Subsea infrastructure in this region benefits from proximity to trans-Pacific data routes, making it ideal for latency-sensitive applications. Investments by Microsoft and Google reinforce the West Coast’s leadership position. It continues to shape innovation, driving large-scale deployment of sustainable underwater data facilities.

East Coast

The East Coast contributes around 35% share, supported by major financial centers, dense urban populations, and strong enterprise demand. States such as New York, Virginia, and Massachusetts are key markets due to their proximity to trans-Atlantic cable networks and large data exchange hubs. Northern Virginia, often referred to as “Data Center Alley,” anchors much of the regional growth with high adoption of advanced IT infrastructure. The region also benefits from policy support and corporate commitments to sustainability. Strong presence of global enterprises accelerates investments in subsea centers to meet efficiency and resilience needs. It remains a strategic region for balancing data demand across the eastern seaboard.

Central and Southern U.S.

The Central and Southern regions hold a combined share of nearly 20%, representing emerging opportunities for expansion. Texas and Florida are key growth areas due to their growing tech presence, industrial expansion, and access to coastal deployment zones. Florida’s proximity to Latin American markets enhances its importance in cross-regional data flow. Central states show slower adoption but demonstrate potential as companies diversify operations beyond traditional hubs. Rising energy projects, renewable initiatives, and state-level incentives attract pilot deployments. It signals a gradual spread of UDC adoption across the broader U.S. landscape.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

Competitive Analysis:

The U.S. Underwater Data Center (UDC) Market is highly competitive, driven by major cloud providers and technology innovators. Leading companies such as Microsoft, Google, Amazon Web Services, and IBM invest heavily in pilot projects and large-scale deployments to secure first-mover advantages. Niche players like Nautilus Data Technologies and NetworkOcean focus on modular and energy-efficient solutions, targeting sustainability-focused clients. It remains a dynamic space where collaboration with maritime firms and renewable energy providers strengthens growth potential. Competitive strategies center on innovation, scalability, and sustainability, ensuring long-term adoption across industries.

Recent Developments:

- In September 2025, Nautilus Data Technologies, a leader in facility-scale liquid cooling, launched its expanded EcoCore product line specifically designed for AI-ready cooling solutions and signed a multi-megawatt modular data center partnership with Overwatch Capital to deliver high-density, sustainable infrastructure across the U.S. market.

Report Coverage:

The research report offers an in-depth analysis based on data center type, application, energy source, deployment technology, and cooling technology. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Demand for modular subsea centers will accelerate as enterprises seek scalable solutions.

- Integration with renewable offshore energy projects will strengthen sustainable adoption.

- West Coast will continue leading deployment, supported by major tech hubs.

- East Coast will expand with strong enterprise and financial sector demand.

- Central and Southern states will emerge gradually as pilot deployment regions.

- Artificial intelligence and machine learning workloads will fuel low-latency demand.

- Blockchain applications will gain traction with energy-efficient subsea infrastructure.

- Hybrid energy-powered facilities will balance cost efficiency with sustainability.

- Direct liquid cooling adoption will rise for high-performance data requirements.

- Strategic partnerships between tech and maritime industries will shape long-term innovation.