Market Overview

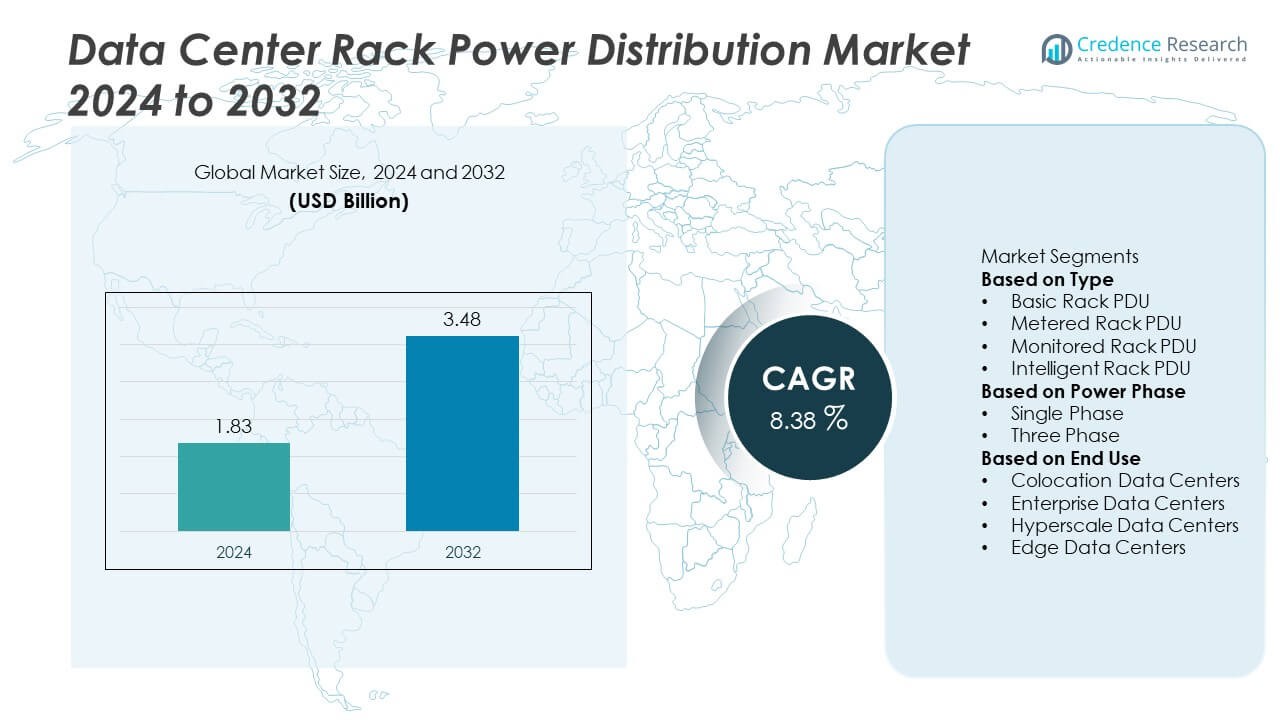

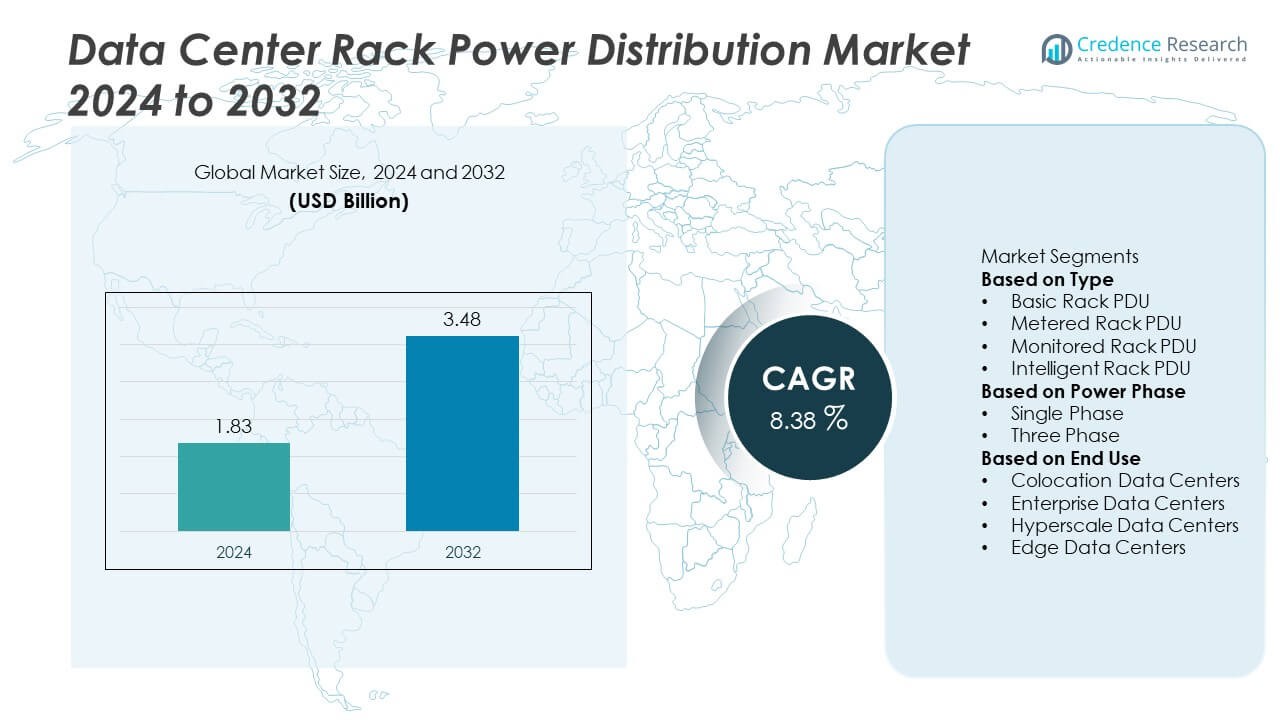

The Data Center Rack Power Distribution market size was valued at USD 1.83 billion in 2024 and is anticipated to reach USD 3.48 billion by 2032, growing at a CAGR of 8.38% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Data Center Rack Power Distribution market Size 2024 |

USD 1.83 Billion |

| Data Center Rack Power Distribution market , CAGR |

8.38% |

| Data Center Rack Power Distribution market Size 2032 |

USD 3.48 Billion |

The Data Center Rack Power Distribution market is led by major players including Vertiv Group Corp, Eaton, Leviton Manufacturing Co., Inc., Server Technology, Inc., Hewlett Packard Enterprise Development LP, Tripp Lite, Enlogic, Cyber Power Systems (USA), Inc., Raritan, Inc., and Schneider Electric. These companies dominate the market through advanced power management technologies, intelligent PDUs, and strong service networks. North America held the largest share of 38% in 2024, driven by the expansion of hyperscale and colocation data centers. Europe followed with a 29% share, supported by growing investments in green data centers, while Asia-Pacific accounted for 24%, fueled by rapid digital transformation and cloud infrastructure development across China, India, and Japan.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Data Center Rack Power Distribution market was valued at USD 1.83 billion in 2024 and is projected to reach USD 3.48 billion by 2032, growing at a CAGR of 8.38% during the forecast period.

- Rising demand for efficient power distribution solutions in hyperscale and colocation data centers is driving market growth, supported by increasing cloud adoption and high computing power requirements.

- The market is witnessing trends such as the growing use of intelligent PDUs with real-time monitoring, remote management, and integration with DCIM systems for enhanced energy optimization.

- Key players including Vertiv, Eaton, and Schneider Electric are focusing on developing energy-efficient rack power solutions, smart distribution systems, and modular designs to strengthen market competitiveness.

- North America leads with a 38% share, followed by Europe at 29% and Asia-Pacific at 24%; by type, intelligent rack PDUs dominate with a 46% share due to their role in improving data center reliability and uptime.

Market Segmentation Analysis:

By Type

The intelligent rack PDU segment dominated the Data Center Rack Power Distribution market in 2024, holding a 42% share. Intelligent PDUs are increasingly preferred for their ability to monitor power usage in real time, enhance energy efficiency, and prevent system downtime. Their integration with data analytics and remote management tools supports predictive maintenance and operational transparency. Growing adoption of high-density servers and virtualization technologies is driving demand for advanced PDUs with automated load balancing features, strengthening the leadership of intelligent PDUs across hyperscale and enterprise data centers.

- For instance, some of Schneider Electric’s APC NetShelter Advanced Rack PDUs enable per-outlet power metering, with select 9000-series models offering a power draw accuracy of ±1%. These units are compatible with optional environmental sensors for monitoring, and allow remote configuration and management through the EcoStruxure IT software for data center fleets.

By Power Phase

The three-phase segment accounted for a 61% share of the Data Center Rack Power Distribution market in 2024. Three-phase PDUs are widely used in large data centers due to their higher load capacity, power stability, and improved efficiency in high-density environments. They enable balanced power distribution and reduced circuit complexity, making them ideal for hyperscale and colocation facilities. The rising trend of power-hungry AI workloads and edge computing deployments is boosting the installation of three-phase systems, supporting scalable power management and reduced energy losses across modern data infrastructures.

- For instance, Vertiv’s PowerIT High-Density PDU delivers up to 57.6 kW per unit with three-phase 415V input. Its hot-swappable monitoring modules allow for upgrades and maintenance without interrupting power.

By End Use

The hyperscale data centers segment led the market in 2024 with a 46% share. Hyperscale operators rely heavily on intelligent and three-phase PDUs to ensure reliable, efficient power distribution across vast server networks. The segment’s growth is fueled by global cloud expansion, data-intensive applications, and rising investments by major tech firms in large-scale facilities. Hyperscale centers prioritize real-time energy monitoring, fault detection, and high-density rack solutions to optimize uptime. Continuous innovation in modular PDUs and sustainability-focused energy systems further strengthens their dominance in the global data center power distribution landscape.

Key Growth Drivers

Rising Demand for Energy-Efficient Data Centers

The growing emphasis on energy efficiency in data centers is a major driver for rack power distribution systems. Operators are adopting advanced PDUs that provide real-time power monitoring, load balancing, and remote management to optimize energy use. Governments and enterprises are setting sustainability targets that promote efficient power infrastructure. Intelligent PDUs help reduce energy waste and improve operational visibility. As data traffic and computing loads surge, energy-efficient power distribution solutions are becoming essential for cost control and environmental compliance.

- For instance, Schneider Electric’s EcoStruxure Data Center solution integrates intelligent PDUs with AI-based analytics to enable proactive power management and optimize energy flows for efficiency and reliability.

Rapid Expansion of Hyperscale and Colocation Facilities

The increasing development of hyperscale and colocation data centers is fueling demand for high-capacity rack power distribution units. These large facilities require robust, scalable, and intelligent PDUs to support multi-rack operations and high-density computing. Hyperscale operators are integrating digital PDUs to enable remote control and predictive maintenance, improving uptime and efficiency. Rising investments from cloud service providers and tech giants further drive adoption. The need to manage complex workloads and power distribution at scale strengthens market growth across global data center hubs.

- For instance, Eaton’s G4 HDX Rack PDU series includes models that support three-phase 415 V input, delivering up to 46 kW for high-density applications like AI infrastructure. These managed PDUs can feature dual Gigabit Ethernet ports on a hot-swappable network module, allowing secure remote monitoring of individual outlets, along with the ability to daisy-chain up to 32 units.

Adoption of Intelligent and Modular Power Distribution Units

The shift toward intelligent and modular PDUs is driving significant innovation in the market. These systems enable real-time monitoring, automated fault detection, and adaptable configurations to support dynamic workloads. Modular PDUs offer flexibility for scaling power capacity as demand increases, reducing downtime and installation costs. Their integration with AI-driven analytics helps identify power inefficiencies and optimize rack performance. As digital transformation accelerates, enterprises and colocation operators increasingly invest in intelligent power distribution systems to enhance reliability and sustainability.

Key Trends & Opportunities

Integration of IoT and AI for Predictive Power Management

IoT and AI technologies are revolutionizing power distribution by enabling predictive insights and automated control. Smart PDUs equipped with sensors collect granular data on voltage, current, and temperature. AI-driven analytics use this data to predict potential overloads and optimize energy consumption. These capabilities improve uptime and extend equipment lifespan. The trend toward intelligent power management offers new opportunities for manufacturers to deliver value-added services and data-driven energy solutions for next-generation data centers.

- For instance, Vertiv’s PowerIT rack PDU embeds bi-stable outlet relays and real-time monitoring hardware. The onboard analytics can send alarms when user-defined thresholds are exceeded, which helps prevent overloads.

Expansion of Edge Data Centers and Cloud Infrastructure

The rapid growth of edge computing and distributed cloud infrastructure is creating new demand for compact and efficient rack power distribution systems. Edge data centers require PDUs that combine space efficiency with high power reliability to support localized workloads. Manufacturers are developing ruggedized and intelligent PDUs suited for remote deployment. This expansion provides significant growth potential as 5G networks and IoT applications drive demand for decentralized computing. The ability to deliver scalable and remotely managed power systems is becoming a key competitive advantage.

- For instance, Schneider Electric’s NetShelter Advanced PDUs for edge sites support a 4-in-1 outlet design and integrate into EcoStruxure IT with remote monitoring. Each PDU monitors current draw on 48 outlets at 1-second polling intervals, enabling efficient power management in compact edge racks deployed in micro data centers.

Growing Focus on Sustainability and Green Data Centers

Sustainability initiatives are reshaping power management strategies in data centers. Companies are investing in energy-efficient PDUs that minimize carbon footprints and comply with environmental standards. The use of recyclable materials, renewable power integration, and power usage effectiveness (PUE) monitoring are key focus areas. As governments promote carbon-neutral data center operations, eco-friendly power distribution systems offer strong opportunities for differentiation. The shift toward green IT infrastructure is expected to accelerate innovation in low-loss and smart energy control technologies.

Key Challenges

High Initial Costs and Complex Installation

The deployment of intelligent and high-capacity PDUs involves significant upfront investment and complex installation processes. Advanced monitoring and networking features increase product costs, limiting adoption among small and mid-sized facilities. Integrating new systems into existing data center architectures often requires downtime and skilled technicians, adding to operational expenses. Although long-term savings justify the investment, high initial costs remain a barrier for widespread adoption, especially in emerging markets with budget constraints.

Cybersecurity Risks in Connected Power Systems

As PDUs become more connected through IoT and cloud platforms, cybersecurity has emerged as a critical concern. Unauthorized access to networked power systems can lead to outages or operational disruptions. Data center operators face challenges in ensuring secure communication between PDUs and management software. Vendors are increasingly embedding encryption, authentication, and access control features into intelligent PDUs to address these threats. However, evolving cyber risks require constant monitoring and upgrades, posing an ongoing challenge for secure power distribution management.

Regional Analysis

North America

North America held a 38% share of the Data Center Rack Power Distribution market in 2024, driven by strong demand from hyperscale and colocation data centers. The United States leads due to extensive cloud infrastructure, advanced IT ecosystems, and early adoption of intelligent PDUs. Increasing investments by major tech firms in expanding data capacity and renewable-powered facilities support growth. Canada contributes through data localization initiatives and green data center developments. The region’s focus on energy efficiency, automation, and digital monitoring continues to strengthen its dominance in global rack power distribution adoption.

Europe

Europe accounted for a 29% share of the Data Center Rack Power Distribution market in 2024, supported by strict energy regulations and rising investments in green data centers. Germany, the United Kingdom, and the Netherlands lead the region, driven by digital transformation and hyperscale facility expansion. EU policies promoting sustainability and efficient energy usage are accelerating adoption of intelligent PDUs. Colocation providers are upgrading infrastructure with modular and remote management capabilities. Growing emphasis on decarbonization and demand for AI-ready data centers continue to shape Europe’s market trajectory in the coming years.

Asia-Pacific

Asia-Pacific captured a 24% share of the Data Center Rack Power Distribution market in 2024, emerging as a major growth hub. China, India, and Japan are key contributors, driven by rapid digitalization, expanding cloud services, and data sovereignty initiatives. The surge in 5G networks and e-commerce platforms has increased data traffic, fueling the need for efficient power distribution. Local and international operators are investing in high-density and edge data centers. Government-backed infrastructure development and renewable energy integration further enhance the region’s attractiveness for advanced PDU deployments.

Latin America

Latin America held a 6% share of the Data Center Rack Power Distribution market in 2024, driven by expanding cloud adoption and digital transformation initiatives in Brazil, Mexico, and Chile. The growth of hyperscale projects and investments in regional data hubs are strengthening the demand for efficient rack power solutions. Energy efficiency and cost optimization are key priorities for operators in emerging economies. However, limited infrastructure in rural areas and higher equipment costs restrain faster expansion. Ongoing partnerships with global data center providers are expected to boost technology adoption across the region.

Middle East & Africa

The Middle East and Africa accounted for a 3% share of the Data Center Rack Power Distribution market in 2024. The region’s growth is driven by increasing investments in smart city projects, digital transformation, and expanding cloud infrastructure. The UAE and Saudi Arabia are leading adopters, supported by hyperscale facility developments and government initiatives promoting data localization. Africa’s market is gaining traction with new data centers in South Africa, Kenya, and Nigeria. Although high capital costs and power limitations persist, improving connectivity and renewable energy integration are fostering steady market development.

Market Segmentations:

By Type

- Basic Rack PDU

- Metered Rack PDU

- Monitored Rack PDU

- Intelligent Rack PDU

By Power Phase

By End Use

- Colocation Data Centers

- Enterprise Data Centers

- Hyperscale Data Centers

- Edge Data Centers

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Data Center Rack Power Distribution market features key players such as Vertiv Group Corp, Eaton, Leviton Manufacturing Co., Inc., Server Technology, Inc., Hewlett Packard Enterprise Development LP, Tripp Lite, Enlogic, Cyber Power Systems (USA), Inc., Raritan, Inc., and Schneider Electric. These companies dominate through technological innovation, extensive distribution networks, and strong brand presence across global data center operations. Market leaders focus on developing intelligent PDUs with remote monitoring, load balancing, and power metering features to enhance energy efficiency and uptime. Strategic initiatives such as mergers, partnerships, and R&D investments in smart power infrastructure are expanding product portfolios and service capabilities. Manufacturers are also emphasizing modular designs and sustainability-driven solutions to meet growing demand for high-density, energy-efficient data centers. Continuous advancements in automation, edge computing support, and AI-integrated power systems are helping leading players maintain a competitive advantage in the evolving data center ecosystem.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In October 2025, Vertiv also launched a PDU for AI-data centers offering advanced load balancing and internal component enhancements for reliability under high densities.

- In September 2025, Vertiv Group Corp expanded its PowerIT rack PDU portfolio to include units rated up to 57.6 kW, targeting high-power AI and HPC workloads.

- In November 2023, Eaton released its Rack PDU G4 line featuring combined C39 outlets that accept both C14 and C20 plugs and support up to 48 outlet measurement.

Report Coverage

The research report offers an in-depth analysis based on Type, Power Phase, End Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for intelligent and metered PDUs will rise with growing focus on energy monitoring.

- Adoption of AI and IoT-enabled rack power systems will enhance operational efficiency.

- Modular and scalable PDU designs will support next-generation hyperscale data centers.

- Growth in edge computing will increase deployment of compact rack power distribution units.

- Manufacturers will focus on developing low-loss, high-efficiency PDUs to reduce energy waste.

- Integration with DCIM and remote management tools will become a standard feature.

- Rising cloud infrastructure investments will drive large-scale PDU installations globally.

- Sustainability initiatives will promote the use of recyclable and energy-efficient materials.

- Strategic partnerships between OEMs and data center operators will expand innovation capabilities.

- Asia-Pacific will witness strong growth driven by digital transformation and data localization policies.