Market Overview

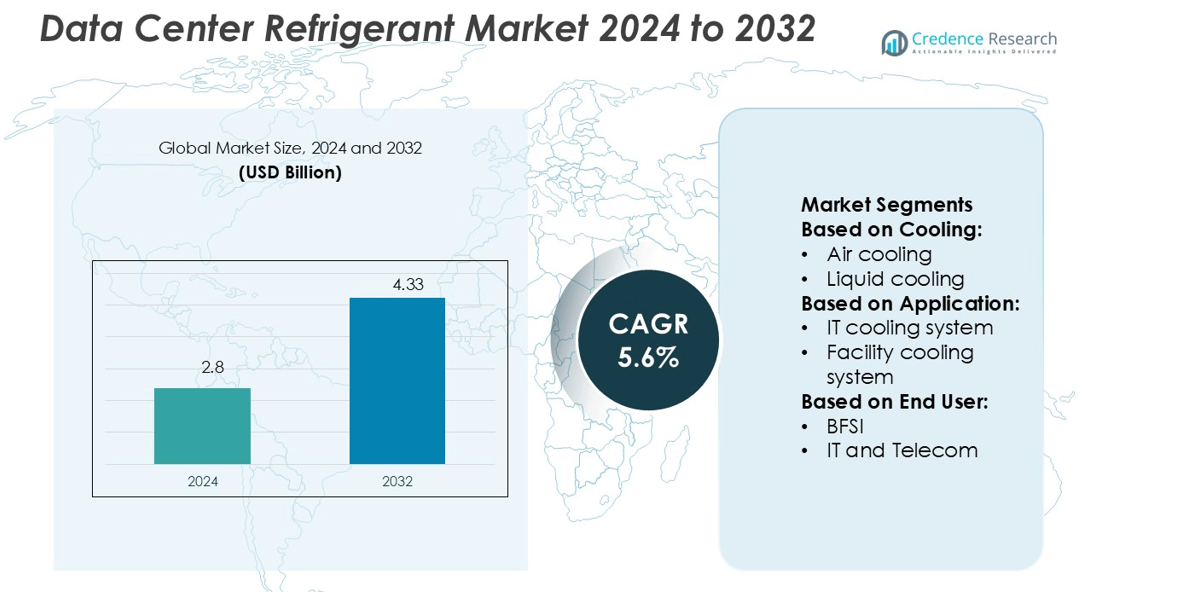

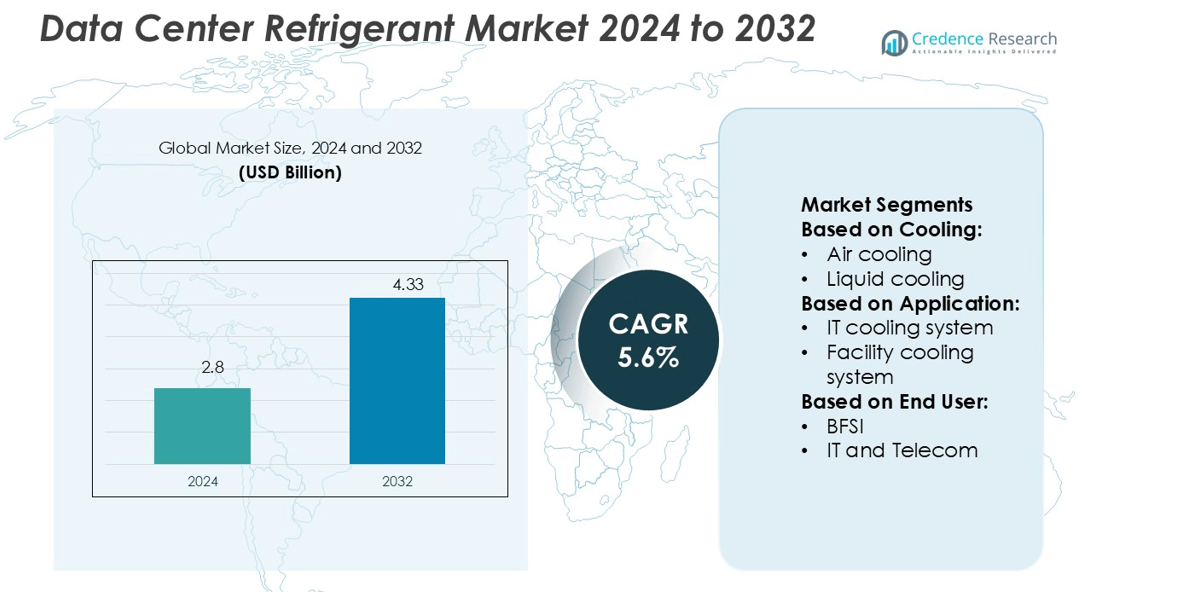

Data Center Refrigerant Market size was valued USD 2.8 billion in 2024 and is anticipated to reach USD 4.33 billion by 2032, at a CAGR of 5.6% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Data Center Refrigerant Market Size 2024 |

USD 2.8 billion |

| Data Center Refrigerant Market, CAGR |

5.68% |

| Data Center Refrigerant Market Size 2032 |

USD 4.33 billion |

The Data Center Refrigerant Market is driven by major companies such as Daikin Industries, Orbia, Honeywell International, Asetek, The Chemours Company, Arkema, 3M, Dow, Climalife, and M&I Materials. These players are focusing on sustainable, low-GWP refrigerant solutions to address tightening environmental regulations and rising demand for energy-efficient cooling. Strategic partnerships, product innovation, and global expansion strengthen their competitive positioning. North America leads the market with a 34.6% share, supported by strong hyperscale data center investments, early adoption of green technologies, and regulatory alignment. This leadership, combined with growing technological capabilities, positions the region as a core hub for refrigerant innovation and deployment.

Market Insights

- The Data Center Refrigerant Market was valued at USD 2.8 billion in 2024 and is expected to reach USD 4.33 billion by 2032, growing at a CAGR of 5.6%.

- Rising demand for low-GWP and energy-efficient refrigerants is driving growth, supported by regulatory pressure and expanding hyperscale and edge data center deployments.

- Market players focus on innovation, strategic partnerships, and global expansion to strengthen their competitive edge in sustainable cooling solutions.

- High retrofit costs and complex regulatory requirements remain key restraints, slowing the transition from traditional refrigerants in existing facilities.

- North America leads with a 34.6% share, followed by Europe and Asia Pacific, while air cooling dominates with 46.8% of the market share.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Cooling

Air cooling dominates the Data Center Refrigerant Market with a 46.8% share in 2025. Air-cooled systems remain popular due to lower upfront costs, easier installation, and lower maintenance compared to liquid systems. Liquid cooling is growing rapidly as high-density racks and AI workloads increase heat loads. Free cooling is gaining adoption in regions with favorable climates to reduce energy consumption and operational costs. Rising energy efficiency regulations and the push for greener data centers are driving the adoption of advanced cooling technologies, improving PUE and lowering emissions.

- For instance, Daikin supplied 71 EWFH-TZ D air-cooled free cooling chillers, 330 fan array units, and 8 control systems at Norway’s OSL-Hamar data center, yielding an average PUE of 1.20.

By Application

IT cooling systems account for 57.2% of the Data Center Refrigerant Market share in 2025. These systems ensure stable rack temperatures and efficient operation of IT infrastructure. The demand for high-capacity servers and storage units is pushing operators to upgrade thermal management. Facility cooling systems follow closely, supporting HVAC operations, power systems, and ambient environmental control. Increased automation and integration with DCIM platforms enhance cooling performance and reduce energy costs. Data centers with high compute density rely heavily on advanced IT cooling systems for optimal uptime.

- For instance, Orbia’s NovoLINC thermal interface materials address cooling bottlenecks for high-density AI racks, reducing junction temperatures by 5–10 °C for GPUs under heavy workloads and achieving an estimated 32% increase in cooling efficiency for liquid-cooled servers.

By End User

The IT and Telecom segment leads the Data Center Refrigerant Market with a 33.5% share in 2025. Rapid expansion of cloud computing, 5G infrastructure, and edge data centers drives demand. BFSI and Government & Defense segments are growing steadily as institutions upgrade secure, high-performance facilities. Healthcare and manufacturing sectors are investing in advanced cooling to support digital transformation. Energy and retail sectors are adopting efficient refrigerant solutions to reduce operational costs. The growing need for high uptime, efficient heat management, and regulatory compliance accelerates refrigerant adoption across industries.

Key Growth Drivers

Rising Demand for Energy-Efficient Data Centers

The growing focus on energy efficiency is a major driver in the Data Center Refrigerant Market. Operators are replacing conventional refrigerants with low-GWP alternatives to meet regulatory standards and reduce power use. High-density computing environments require efficient cooling solutions to maintain optimal performance. Advanced refrigerants help reduce energy consumption and improve overall Power Usage Effectiveness (PUE). The shift toward sustainable infrastructure also attracts green investments. This strong emphasis on operational efficiency continues to push demand for innovative refrigerant technologies across hyperscale, edge, and enterprise data centers.

Expansion of Hyperscale and Edge Data Centers

Rapid growth in hyperscale and edge facilities significantly boosts refrigerant demand. Hyperscale operators deploy high-capacity cooling systems to manage intense heat loads from cloud computing and AI-driven applications. Edge data centers require compact, energy-efficient solutions to maintain performance at remote sites. Refrigerants play a crucial role in supporting stable thermal environments for these advanced infrastructures. The increasing volume of data traffic and low-latency application needs further accelerate deployment. This expansion of distributed computing infrastructure drives the adoption of efficient refrigerant-based cooling systems worldwide.

- For instance, Asetek reported shipping 171,000 sealed-loop liquid cooling units in Q1 2025, supporting compact cooling in dense server racks even in edge environments, while 11 new liquid cooling product models began shipping that quarter.

Stringent Environmental Regulations and Compliance

Global regulatory pressure on high-GWP refrigerants is shaping market growth. Many countries are phasing down HFC use and promoting eco-friendly refrigerants. Data center operators are adopting low-GWP alternatives to comply with international frameworks like the Kigali Amendment. This transition reduces environmental impact and aligns operations with sustainability targets. The shift encourages R&D investments in next-generation refrigerants and retrofitting of legacy systems. Regulatory mandates are turning sustainability from a compliance requirement into a strategic driver, pushing the market toward wider adoption of clean refrigerant technologies.

Key Trends & Opportunities

Adoption of Low-GWP and Natural Refrigerants

The market is witnessing a strong trend toward low-GWP and natural refrigerants like CO₂ and ammonia. These options help operators meet net-zero targets while maintaining efficient thermal management. Natural refrigerants offer long-term cost benefits by lowering regulatory risks and energy expenses. Vendors are innovating to make these solutions safer and more adaptable for data centers. Their rising acceptance creates strong opportunities for suppliers of advanced, environmentally friendly cooling technologies. This shift also aligns with corporate ESG goals and global decarbonization strategies.

- For instance, Chemours launched Opteon™ 2P50, a two-phase immersion cooling dielectric fluid with a GWP of 10 and a design PUE approaching 1, which in field trials has shown up to 90 % cooling energy reduction and up to 40 % total energy savings, and cuts water use nearly to zero.

Integration of AI and Smart Cooling Systems

The growing use of AI and intelligent monitoring is reshaping data center cooling strategies. Smart systems optimize refrigerant use based on real-time thermal loads, reducing energy waste. These systems improve operational reliability and extend equipment life. AI-enabled platforms also allow predictive maintenance, lowering downtime risks and costs. This integration creates strong opportunities for refrigerant manufacturers to align products with smart control technologies. The increasing adoption of such advanced systems is expected to accelerate efficiency gains and support the long-term market outlook.

- For instance, Arkema’s Foranext® 1233zd fluid supports direct-to-chip two-phase cooling to handle the extreme heat from modern microprocessors in data centers, improving overall thermal performance, efficiency, and sustainability.

Rise of Modular and Prefabricated Data Centers

The expansion of modular data centers is creating new opportunities for refrigerant applications. Prefabricated units demand compact, efficient, and scalable cooling solutions. These facilities support rapid deployment and high energy efficiency, making refrigerant systems a key component. Manufacturers offering tailored solutions for modular infrastructure gain a competitive edge. The growing use of modular architectures across telecom, cloud, and edge deployments is expected to fuel steady refrigerant demand, especially in regions with rapid digital infrastructure expansion.

Key Challenges

High Retrofit and Transition Costs

Transitioning from traditional HFCs to low-GWP refrigerants involves significant retrofit investments. Many existing facilities require new equipment or system upgrades to handle alternative refrigerants safely. This cost factor delays large-scale adoption among mid-size operators. Additional expenses related to training, installation, and compliance checks further increase the financial burden. These costs pose a challenge for operators aiming to balance regulatory compliance with profitability, slowing down the overall replacement rate of legacy systems in the market.

Complex Regulatory and Safety Standards

Compliance with evolving environmental regulations remains a key challenge for operators. Different regions enforce varied refrigerant use guidelines, creating complexity for multinational data center operators. Natural refrigerants often involve stricter safety measures, including handling, storage, and monitoring protocols. Meeting these standards requires specialized equipment and skilled personnel. This regulatory and operational complexity increases compliance costs and lengthens project timelines. Navigating these diverse standards effectively is a major hurdle for rapid market expansion and uniform adoption of sustainable refrigerant solutions.

Regional Analysis

North America

North America leads the Data Center Refrigerant Market with a 34.6% share in 2025. The region’s dominance is driven by large hyperscale deployments, advanced digital infrastructure, and strong regulatory focus on energy efficiency. The U.S. hosts major cloud service providers that invest heavily in low-GWP refrigerant solutions to comply with evolving environmental standards. Growing adoption of edge facilities further boosts demand for efficient thermal management systems. Strategic investments in sustainable cooling technologies and early regulatory alignment position North America as a key hub for refrigerant innovation and large-scale adoption across data centers.

Europe

Europe holds a 27.4% share of the Data Center Refrigerant Market in 2025. Strict environmental policies, such as the EU F-Gas Regulation, are accelerating the transition toward low-GWP and natural refrigerants. Countries like Germany, the Netherlands, and Sweden are leading in green data center adoption. Operators are integrating energy-efficient cooling systems to reduce emissions and meet carbon neutrality targets. High investment in renewable-powered facilities supports this transition. The strong emphasis on sustainability and innovation positions Europe as a leading market for eco-friendly refrigerant technologies and next-generation cooling solutions.

Asia Pacific

Asia Pacific accounts for 24.1% of the Data Center Refrigerant Market in 2025. Rapid expansion of cloud services, 5G infrastructure, and edge data centers fuels strong demand for efficient refrigerants. Countries like China, India, Japan, and Singapore are investing heavily in hyperscale facilities to support rising data traffic. The growing presence of global hyperscale operators in the region accelerates advanced cooling adoption. Regulatory bodies are gradually implementing stricter efficiency norms, driving a shift toward low-GWP refrigerants. Asia Pacific’s fast-growing digital economy makes it a critical growth engine for future refrigerant demand.

Latin America

Latin America represents 7.1% of the Data Center Refrigerant Market in 2025. Brazil and Mexico lead regional demand with investments in new colocation and edge facilities. Growing cloud adoption and digital transformation across industries are driving the installation of energy-efficient cooling systems. Operators are adopting low-GWP refrigerants to align with international environmental standards. While regulatory frameworks are less strict compared to Europe, increased foreign investment in sustainable infrastructure is accelerating modernization. Latin America’s improving connectivity and expanding data center footprint support steady market growth for advanced refrigerant technologies.

Middle East & Africa

The Middle East & Africa region holds a 6.8% share in the Data Center Refrigerant Market in 2025. Countries like the UAE, Saudi Arabia, and South Africa are investing in data center infrastructure to support cloud growth and digitalization. High ambient temperatures in many locations increase the need for efficient refrigerant-based cooling solutions. Government-led smart city initiatives and green building programs encourage the use of sustainable refrigerants. Although the market is still developing, rapid infrastructure expansion and regulatory alignment with global standards create strong future growth opportunities in this region.

Market Segmentations:

By Cooling:

- Air cooling

- Liquid cooling

By Application:

- IT cooling system

- Facility cooling system

By End User:

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Data Center Refrigerant Market features key players including Daikin Industries, Orbia, Honeywell International, Asetek, The Chemours Company, Arkema, 3M, Dow, Climalife, and M&I Materials. The Data Center Refrigerant Market is defined by rapid innovation, regulatory alignment, and increasing sustainability commitments. Companies are focusing on developing low-GWP and high-performance refrigerants to meet strict environmental standards. Strategic partnerships with data center operators, equipment manufacturers, and technology providers are strengthening product adoption. R&D investments aim to enhance thermal efficiency, energy savings, and operational safety. Many suppliers are also expanding service capabilities to support retrofitting of existing infrastructure. Intense competition, coupled with rising demand for eco-friendly solutions, is driving continuous technological advancements and shaping a dynamic, innovation-focused market environment.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Daikin Industries

- Orbia

- Honeywell International

- Asetek

- The Chemours Company

- Arkema

- 3M

- Dow

- Climalife

- M&I Materials

Recent Developments

- In May 2025, Samsung Electronics announced acquisition of Flak Group to expand HVAC offering in data center Samsung entered a $1.5 billion agreement to acquire Flak Group, a Germany based HVAC leader. The move strengthens Samsung position in climate.

- In February 2025, Vertiv rolled out a complete services suite for liquid cooling, including its Liebert XDU1350 system for CDU (cooling distribution units). The services target hyperscale and AI-focused data centers transitioning to liquid-based thermal management.

- In December 2024, Schneider Electric introduced new AI-ready data center solutions to meet the energy, and sustainability demands of AI systems. In collaboration with NVIDIA, Schneider Electric launched a reference design for liquid-cooled AI clusters supporting up to 132 kW per rack.

- In January 2024, Modine announced its acquisition of the intellectual property and distinct assets of TMG Core. TMG Core specializes in single- and two-phase liquid immersion cooling technology tailored for data centers with demanding high-density computing needs

Report Coverage

The research report offers an in-depth analysis based on Cooling, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will see rising adoption of low-GWP and natural refrigerants to meet green standards.

- Hyperscale and edge data center growth will increase demand for advanced cooling solutions.

- Energy efficiency regulations will push operators to replace legacy refrigerants.

- Integration of AI-driven cooling systems will optimize refrigerant use and lower costs.

- Retrofitting of existing facilities will create strong opportunities for refrigerant suppliers.

- Modular and prefabricated data centers will boost demand for compact refrigerant systems.

- Regional regulatory alignment will accelerate the transition to sustainable refrigerants.

- Technological innovation will improve system performance and reduce environmental impact.

- Partnerships between refrigerant makers and operators will strengthen market penetration.

- Rising investments in green data centers will shape long-term refrigerant strategies.