Market Overview:

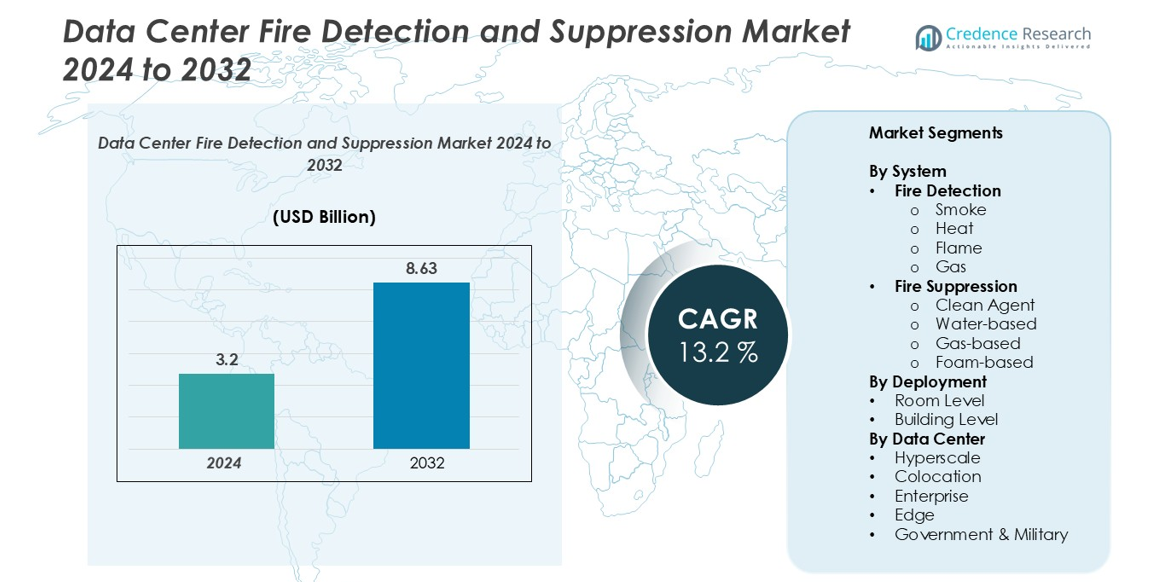

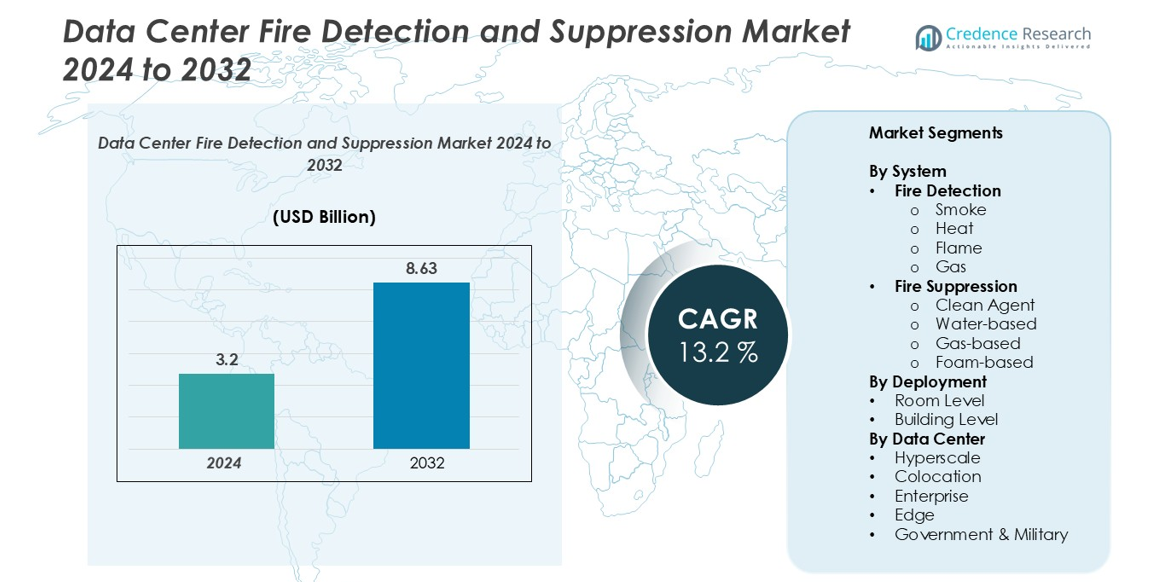

The data center fire detection and suppression market size was valued at USD 3.2 billion in 2024 and is anticipated to reach USD 8.63 billion by 2032, at a CAGR of 13.2% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Data Center Fire Detection and Suppression Market Size 2024 |

USD 3.2 billion |

| Data Center Fire Detection and Suppression Market, CAGR |

13.2% |

| Data Center Fire Detection and Suppression Market Size 2032 |

USD 8.63 billion |

The global data center fire detection and suppression market is led by prominent players such as Honeywell, Siemens, Robert Bosch, Johnson Controls, Minimax, Eaton, FIKE, SEM-SAFE, and ORR, all of which provide advanced, standards-compliant fire protection solutions tailored for critical IT infrastructure. These companies dominate through technological innovation, offering intelligent detection, AI-enabled monitoring, and eco-friendly suppression systems. North America remains the leading region, accounting for approximately 35% of the global market share, driven by stringent safety regulations, extensive hyperscale data center presence, and high adoption of automated fire protection technologies. Europe and Asia-Pacific follow as strong growth regions.

Market Insights

- The global data center fire detection and suppression market was valued at USD 3.2 billion in 2024 and is projected to reach USD 8.63 billion by 2032, growing at a CAGR of 13.2% during the forecast period.

- Key market drivers include the expansion of hyperscale data centers, strict fire safety regulations, and the growing need for uninterrupted data operations and asset protection.

- Emerging trends involve the integration of AI, IoT, and predictive analytics for early fire detection, along with increased adoption of clean agent and eco-friendly suppression systems in sustainable data center designs.

- The competitive landscape is moderately consolidated, with leading players such as Honeywell, Siemens, Johnson Controls, Bosch, and Minimax focusing on innovation and digital monitoring capabilities.

- North America dominates with 35% share, followed by Europe (28%) and Asia-Pacific (25%), while the fire detection segment, particularly smoke detection systems, holds the largest market share.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By System:

The data center fire detection and suppression market, by system, is segmented into fire detection and fire suppression systems. Among these, fire detection systems hold a dominant market share, driven by their critical role in early hazard identification and prevention of equipment damage. Within detection systems, smoke detection leads the sub-segments, accounting for a significant portion of installations due to its sensitivity and reliability in identifying potential threats before combustion occurs. Advancements in optical and aspirating smoke detectors further enhance precision, ensuring uninterrupted data center operations and regulatory compliance.

- For instance, Nxtra by Airtel, a leading Indian data center provider, has implemented Bosch’s AVENAR 8000 panels and AVENAR 4000 series detectors at its data center in pune, with the potential for further deployments.

By Deployment:

Based on deployment, the market is categorized into room-level and building-level systems. The room-level deployment segment dominates the market, primarily because data centers require precise monitoring in server rooms where high heat density and electronic equipment concentration increase fire risks. These systems provide localized detection and suppression, minimizing downtime and protecting valuable IT assets. Increasing demand for modular and micro data centers further supports room-level system adoption, as they offer scalable, easily integrated, and energy-efficient fire safety solutions tailored to critical infrastructure environments.

- For instance, FM Global’s P14042 research report details the findings from large-scale tests conducted in a mock-up data center to characterize airflow, measure smoke concentrations, and evaluate the response of various smoke detectors to different smoke sources.

By Data Center Type:

In terms of data center type, the market is divided into hyperscale, colocation, enterprise, edge, and government & military segments. The hyperscale data center segment holds the largest market share, driven by rapid cloud service expansion and large-scale IT infrastructure investments from technology giants. These facilities demand advanced, automated fire suppression systems such as clean agent and gas-based technologies to safeguard high-value servers and ensure business continuity. Additionally, hyperscale operators prioritize compliance with international safety standards, accelerating adoption of intelligent detection and suppression technologies across global facilities.

Key Growth Drivers

Rising Investments in Data Center Infrastructure:

The rapid global expansion of cloud computing, AI workloads, and digital transformation initiatives is driving large-scale investments in data center infrastructure. Hyperscale operators and colocation providers are constructing new facilities with stringent safety requirements, directly boosting demand for advanced fire detection and suppression systems. With mission-critical servers, storage devices, and networking hardware operating continuously, even minor fire incidents can lead to significant financial and data losses. Hence, operators are integrating early smoke detection, heat sensors, and clean agent suppression systems into both new and existing facilities. Additionally, government incentives for digital infrastructure development in countries like India, Singapore, and the U.S. further fuel the adoption of automated and intelligent fire safety solutions across the data center ecosystem.

- For instance, Microsoft is investing more than $7 billion in Wisconsin to build two hyperscale AI data centers in Mount Pleasant, one of which is named “Fairwater”. The company has claimed that Fairwater will be “the world’s most powerful AI data center.

Stringent Regulatory and Safety Compliance Standards:

Data centers must adhere to strict international and regional safety codes, including NFPA 75, NFPA 76, and ISO 14520, which mandate robust fire detection and suppression mechanisms. These regulations ensure that facilities maintain optimal safety for both personnel and equipment. As data centers host critical applications such as financial services, cloud platforms, and defense systems, regulatory non-compliance can result in severe penalties and reputational damage. Consequently, operators are adopting systems with early warning capabilities, redundant sensors, and environmentally friendly extinguishing agents. This regulatory-driven adoption of advanced, sustainable suppression technologies—such as inert gas and clean agent systems—continues to strengthen market growth, especially across developed economies where data protection and operational resilience are top priorities.

- For instance, Honeywell and other fire suppression companies confirming that clean agent systems using HFC-227ea and FK-5-1-12 can reach extinguishing levels within 10 seconds. These agents are designed to suppress Class A (ordinary combustible), B (flammable liquid), and C (electrical) fires.

Increasing Demand for Continuous Data Availability and Operational Safety:

As businesses and governments rely heavily on uninterrupted digital services, the tolerance for downtime or data loss has reached near-zero levels. This demand for continuous uptime compels operators to invest in intelligent fire detection and suppression systems that can identify potential risks instantly and mitigate them without interrupting operations. The adoption of automated systems with integrated sensors, AI-based monitoring, and centralized control enhances safety and operational continuity. Furthermore, the growth of high-density server architectures, which generate substantial heat loads, has intensified the need for precision fire detection technologies. These systems safeguard IT assets, minimize service disruptions, and preserve the reputation of service providers, making them essential components of modern data center infrastructure.

Key Trends and Opportunities

Integration of AI and IoT in Fire Safety Systems:

The integration of artificial intelligence (AI) and Internet of Things (IoT) technologies in fire detection and suppression systems represents a major market trend. Smart sensors, networked controllers, and predictive analytics enable real-time monitoring, faster detection, and data-driven decision-making. AI algorithms can identify abnormal heat or smoke patterns long before visible signs appear, improving preventive response times. IoT-enabled systems allow remote management and diagnostics, reducing manual intervention and maintenance costs. This trend opens opportunities for manufacturers to develop intelligent, connected fire safety solutions that align with the growing automation and digitalization of data center operations worldwide.

- For instance, Advanced flame detectors that use AI can identify unique light patterns indicative of a real fire and differentiate them from false signals like sunlight or reflections.

Growing Adoption of Clean Agent and Environmentally Friendly Systems:

Sustainability concerns are pushing data centers toward eco-friendly fire suppression solutions. Traditional systems using water or halon substitutes are increasingly replaced by clean agent technologies that are non-corrosive, residue-free, and safe for sensitive electronics. Gases like Novec™ 1230 and FM-200 are widely adopted for their zero ozone depletion potential and rapid suppression capabilities. This transition presents a major opportunity for vendors to innovate in green suppression systems compliant with evolving environmental regulations. As global hyperscale and colocation operators commit to carbon neutrality goals, eco-conscious fire suppression systems are becoming a key differentiator in procurement decisions.

- For instance, Both Novec 1230 and FM-200 are fast-acting, residue-free “clean agent” fire suppressants that minimize collateral damage to electronics and other sensitive equipment, significantly decreasing downtime and revenue losses. While both are safe for use in occupied spaces at correct concentrations, Novec 1230 is the more environmentally friendly and sustainable option, with a much lower global warming potential than FM-200.

Key Challenges

High Installation and Maintenance Costs:

The deployment of advanced fire detection and suppression systems requires significant capital investment, particularly in large-scale hyperscale and enterprise data centers. The costs associated with system integration, continuous monitoring, and periodic maintenance can strain operational budgets, especially for smaller facilities. Moreover, the installation of redundant sensors and clean agent systems demands specialized expertise and adherence to complex safety standards, further raising costs. These financial constraints often limit adoption in developing regions, where data center construction is accelerating but cost sensitivity remains high. Overcoming this challenge will require innovation in modular, scalable, and cost-efficient fire protection technologies.

Complexity in Retrofitting Existing Data Centers:

Upgrading or retrofitting fire detection and suppression systems in operational data centers presents significant technical challenges. Older facilities often lack the necessary infrastructure—such as ducting, space, or sensor networks—to support modern, automated safety systems. Integrating new technologies without interrupting ongoing IT operations or risking equipment damage adds further complexity. Additionally, compatibility issues between legacy hardware and new digital systems can delay implementation. These challenges underscore the need for flexible, retrofit-friendly fire protection solutions that can be seamlessly integrated into existing environments without compromising performance or uptime.

Regional Analysis

North America

North America holds the dominant share in the data center fire detection and suppression market, accounting for over 35% of the global revenue in 2024. The region’s leadership is driven by the strong presence of hyperscale operators such as Amazon Web Services, Microsoft, and Google, alongside stringent safety regulations like NFPA and OSHA standards. Widespread digitalization, coupled with high investments in data center expansion and modernization, fuels demand for intelligent and sustainable fire protection systems. Additionally, growing adoption of clean agent and gas-based suppression technologies further strengthens the region’s market position.

Europe

Europe represents a significant market, contributing approximately 28% of the global share, supported by robust data security regulations such as GDPR and increasing investments in green data centers. Countries like Germany, the U.K., and the Netherlands are major hubs due to extensive colocation and hyperscale operations. The region emphasizes sustainability, leading to strong adoption of environmentally friendly clean agent suppression systems. Moreover, advancements in early warning smoke detection and compliance with EN fire safety standards drive consistent upgrades and retrofits across both new and existing data center facilities.

Asia-Pacific

Asia-Pacific is the fastest-growing region, capturing nearly 25% of the global market share in 2024, driven by rapid cloud adoption, 5G deployment, and digital transformation across economies such as China, India, Singapore, and Japan. Expanding hyperscale and colocation facilities require advanced fire protection systems to safeguard high-value assets and ensure operational continuity. Government initiatives supporting local data center infrastructure development further boost adoption. Increasing preference for automated detection and suppression systems with AI and IoT integration positions Asia-Pacific as a major growth hub for the coming decade.

Latin America

Latin America accounts for around 7% of the global market, led by growing data center investments in Brazil, Mexico, and Chile. Rising demand for cloud computing and regional data storage drives the need for reliable fire detection and suppression solutions. Operators are focusing on implementing cost-effective and modular systems that align with international safety standards. As hyperscale players expand their regional presence, the adoption of clean agent and hybrid suppression technologies is accelerating. Increasing awareness of fire safety and compliance among local data center operators further strengthens market growth prospects.

Middle East & Africa

The Middle East & Africa region holds a smaller but expanding share of about 5% of the global market, supported by growing digital infrastructure in countries such as the UAE, Saudi Arabia, and South Africa. National initiatives like Saudi Vision 2030 and increasing hyperscale investments are driving demand for advanced fire safety technologies. Data centers in the region increasingly deploy intelligent detection systems with remote monitoring to manage high ambient temperatures. Additionally, government-backed smart city projects and cloud infrastructure expansion continue to create strong opportunities for market growth.

Market Segmentations:

By System

- Fire Detection

- Fire Suppression

- Clean Agent

- Water-based

- Gas-based

- Foam-based

By Deployment

- Room Level

- Building Level

By Data Center

- Hyperscale

- Colocation

- Enterprise

- Edge

- Government & Military

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The data center fire detection and suppression market is moderately consolidated, with key players such as Honeywell, Siemens, Robert Bosch, Johnson Controls, Minimax, Eaton, FIKE, SEM-SAFE, and ORR leading global operations. These companies compete on innovation, system reliability, and compliance with international safety standards. Strategic priorities include integrating AI, IoT, and cloud-based monitoring to enhance real-time detection and remote control capabilities. Firms are also focusing on sustainable suppression solutions, such as clean agent and inert gas systems, aligning with data centers’ green initiatives. Mergers, partnerships, and product launches remain common strategies to expand global presence and strengthen service portfolios. For instance, several leading vendors are investing in predictive maintenance technologies and modular fire safety systems designed for hyperscale and edge data centers. The competitive environment continues to evolve as regional players adopt advanced digital safety platforms to meet the growing demand for intelligent, scalable fire protection solutions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In December 2024, NV5 acquired Global Fire Protection Group (Global FPG), expanding its fire safety engineering, inspection, and consulting services.

- In October 2024, Alpine Fire acquired DAS Fire, marking its entry into the data center fire suppression market. DAS Fire, based in the UK and Ireland, specializes in fire detection, suppression system design, installation, and maintenance. This move aligns with Alpine Fire’s diversification strategy, expanding its services beyond aerospace, automotive, and high-hazard industries.

- In September 2024, Nordic LEVEL Technology secured an order from Winthrop Technologies Sweden AB for an advanced fire protection system at a data center in Sodermanland County. The project includes an aspiration-based early fire detection and an evacuation system for a 25,000 square meter facility.

- In July 2024, Pacific Avenue Capital Partners acquired KiddeFenwal, a provider of fire detection and suppression systems for data centers and other industries. The deal includes Kidde Fire Systems and Fenwal Controls, known for gas suppression, smoke detection, and fire control solutions used in mission-critical facilities.

Report Coverage

The research report offers an in-depth analysis based on System, Deployment, Data Center and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market is expected to grow steadily due to increasing global demand for data storage and cloud services.

- Hyperscale and colocation data centers will continue to drive advanced fire detection and suppression adoption.

- AI and IoT-enabled systems will become standard for real-time monitoring and predictive maintenance.

- Clean agent and environmentally friendly suppression technologies will see higher adoption rates.

- Room-level and modular deployment solutions will expand to meet high-density server requirements.

- Integration of fire safety systems with building management and security platforms will increase.

- Retrofitting existing data centers with advanced detection technologies will present new growth opportunities.

- Demand for rapid-response systems in edge and enterprise data centers will rise.

- Regulatory compliance and safety standards will continue to influence system upgrades and installations.

- Manufacturers will focus on innovation and digital solutions to strengthen competitive positioning.