Market Overview

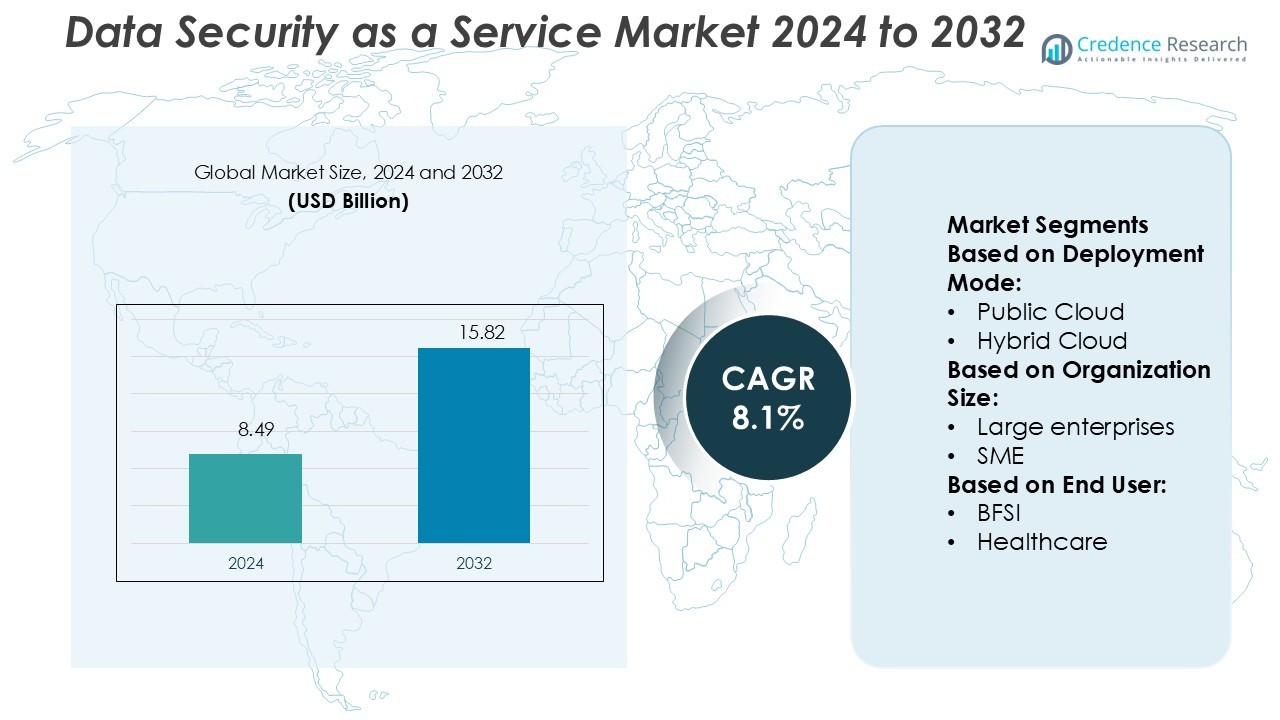

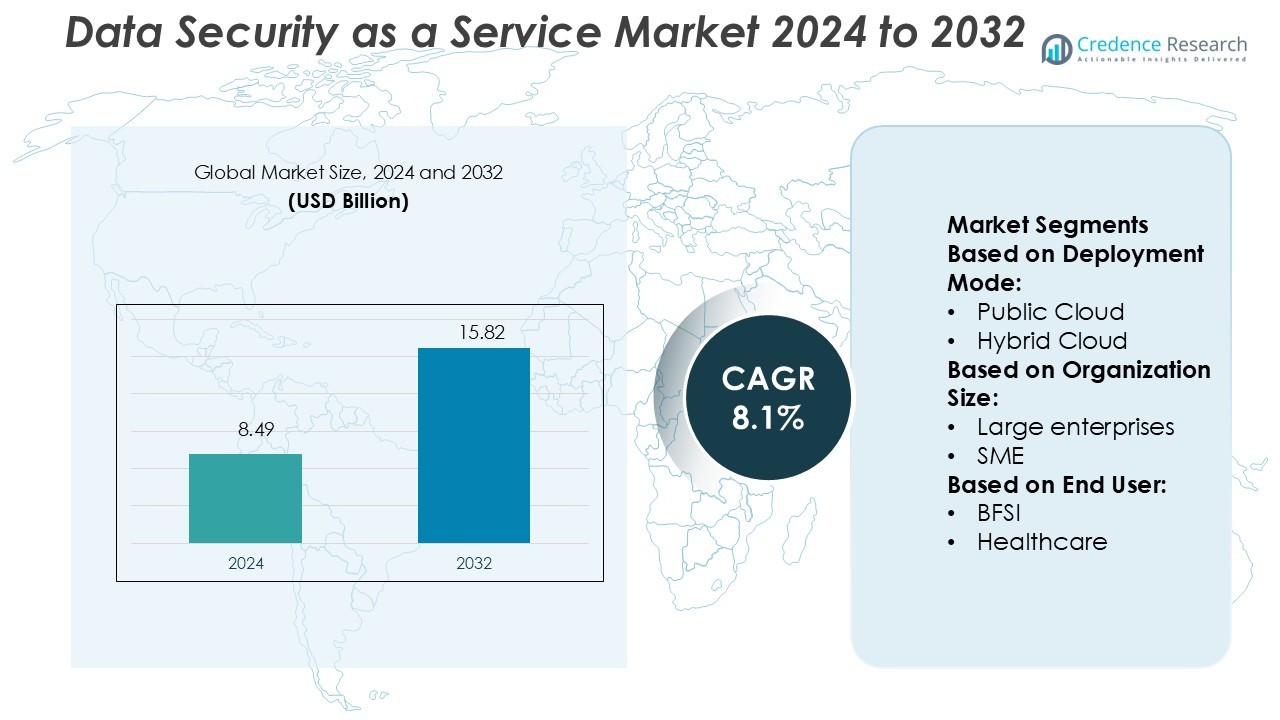

Data Security as a Service Market size was valued USD 8.49 billion in 2024 and is anticipated to reach USD 15.82 billion by 2032, at a CAGR of 8.1% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Data Security as a Service Market Size 2024 |

USD 8.49 Billion |

| Data Security as a Service Market, CAGR |

8.1% |

| Data Security as a Service Market Size 2032 |

USD 15.82 Billion |

The Data Security as a Service Market Microsoft, Varonis Systems, Thales, Quisitive, Sophos Professional Services, Veritas Technologies, OpenText Corporation, NetApp, Imperva, and Micro Focus are the leading players in the Data Security as a Service (DSaaS) market. These companies provide advanced cloud-based security solutions, including real-time threat detection, encryption, identity access management, and compliance monitoring. North America is the leading region, holding approximately 38% market share, driven by high cloud adoption, stringent regulatory standards, and rising cyber threats across BFSI, IT, healthcare, and government sectors. The U.S. dominates due to extensive investments in cybersecurity infrastructure and digital transformation initiatives. Strong innovation, AI integration, and hybrid cloud deployments by top vendors further consolidate North America’s position, making it the most competitive and lucrative market for DSaaS solutions globally.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Data Security as a Service market was valued at USD 8.49 billion in 2024 and is projected to reach USD 15.82 billion by 2032, growing at a CAGR of 8.1% during the forecast period.

- North America leads the market with approximately 38% share, supported by high cloud adoption, regulatory compliance, and strong cybersecurity infrastructure, while Europe and Asia Pacific follow with notable growth potential.

- Public cloud deployment dominates the market, preferred for scalability and cost efficiency, and large enterprises account for the majority of adoption due to complex IT needs and high security requirements.

- Key drivers include rising cyber threats, strict regulatory standards, and increasing digital transformation across BFSI, IT, healthcare, and government sectors, encouraging organizations to adopt cloud-based security solutions.

- Market growth faces challenges from data privacy concerns and integration complexity with legacy systems, while trends include AI-powered threat detection, hybrid cloud adoption, and expansion into SME segments.

Market Segmentation Analysis:

By Deployment Mode:

The public cloud dominates the Data Security as a Service (DSaaS) market, capturing approximately 45% of the deployment segment. Its growth is driven by scalability, cost-efficiency, and easy integration with existing IT infrastructure. Hybrid cloud adoption follows closely, offering flexibility by combining on-premises security with cloud capabilities, appealing to organizations requiring compliance and data sovereignty. Private cloud adoption remains moderate, favored by large enterprises prioritizing sensitive data protection. Increasing cyber threats, rising regulatory compliance requirements, and the need for secure remote access continue to accelerate adoption across all deployment models.

- For instance, OpenVault, the average monthly data usage per fixed broadband household in the U.S. reached approximately 652 gigabytes in 2023, up from an average of 521.7 gigabytes in 2022.

By Organization Size:

Large enterprises lead the market segment, accounting for around 60% of overall DSaaS adoption. Their preference stems from complex IT environments, higher budgets, and stringent security requirements, especially in data-sensitive sectors. SMEs are increasingly investing in DSaaS due to cloud affordability, regulatory compliance, and growing cyberattack exposure. Drivers include rising digital transformation initiatives, the need for 24/7 data monitoring, and scalable solutions that minimize in-house security overhead. The trend indicates SMEs will gain momentum, but large enterprises remain the primary revenue contributor in this segment.

- For instance, Equinix and its joint venture partner GIC developed the SL2x and SL3x xScale data centers in Seoul, which together will have over 45 MW of power capacity.

By End-User:

The IT & Telecommunications sector holds the dominant position with roughly 30% market share, driven by high data traffic and the need for robust cybersecurity frameworks. BFSI follows, requiring strong encryption and compliance with regulatory standards, while healthcare relies on DSaaS to protect sensitive patient data and support telemedicine. Retail, manufacturing, and government sectors are increasing adoption due to digital operations and growing threat vectors. Key drivers include regulatory mandates, rising cyber threats, cloud migration trends, and demand for real-time threat intelligence across all end-user industries.

Key Growth Drivers

Rising Cybersecurity Threats:

Escalating cyberattacks, including ransomware, phishing, and insider threats, drive DSaaS adoption across industries. Organizations increasingly require advanced, real-time security solutions to safeguard sensitive data and prevent operational disruption. The demand is particularly high among BFSI, healthcare, and IT sectors, where breaches can cause severe financial and reputational damage. DSaaS providers offer continuous monitoring, threat intelligence, and automated response mechanisms, enabling businesses to manage risks efficiently. This heightened focus on proactive cybersecurity strongly fuels market growth and adoption of cloud-based security services.

- For instance, Eaton is helping lead the shift to 800 V high-voltage direct current (HVDC) infrastructure to support 1 megawatt racks in AI data centers, collaborating with NVIDIA on reference architectures.

Regulatory Compliance Requirements:

Strict data privacy and compliance regulations, such as GDPR, HIPAA, and PCI DSS, push organizations toward DSaaS solutions. Businesses face penalties and reputational risks if they fail to meet these standards. DSaaS platforms help maintain compliance through encryption, access control, and audit-ready reporting. Industries handling sensitive customer or patient information, including BFSI, healthcare, and government, increasingly rely on cloud-based security to simplify regulatory adherence. This regulatory pressure continues to serve as a major driver, encouraging adoption across enterprise and SME segments.

- For instance, IBM introduced its Power11 server lineup, engineered to maintain just 30 seconds of unplanned downtime per year, and equipped with AI-driven security that detects ransomware in under 60 seconds.

Digital Transformation Initiatives:

Rapid digitalization and cloud migration are fueling DSaaS market expansion. Companies adopting remote work, SaaS platforms, and IoT devices need secure data management solutions to prevent breaches. DSaaS provides scalable, cost-effective security infrastructure without heavy on-premises investment. Organizations in IT, retail, and manufacturing increasingly integrate DSaaS with existing IT operations for seamless protection. The convergence of digital transformation and evolving cyber threats positions DSaaS as a critical component of enterprise IT strategies, driving strong and sustained market growth.

Key Trends & Opportunities

Integration with AI and Machine Learning:

AI-powered DSaaS platforms are gaining traction by enabling real-time threat detection, predictive analytics, and automated response. Machine learning algorithms enhance anomaly detection and reduce false positives, improving operational efficiency. Enterprises increasingly leverage AI-driven insights for proactive security management, particularly in high-risk sectors like BFSI and healthcare. This trend presents an opportunity for providers to offer advanced, intelligent security solutions that differentiate their offerings and meet growing demands for faster, more accurate threat mitigation.

- For instance, Cisco’s new P200 AI networking chip consolidates 92 traditional chips into one, reducing power consumption in data center routers by 65 %. Cisco 8223 router system supports 51.2 Tbps throughput over a single ASIC platform to carry AI traffic across distributed facilities.

Cloud-Native Security Adoption:

Organizations are shifting toward cloud-native DSaaS solutions that integrate seamlessly with existing cloud infrastructure. This approach reduces latency, improves scalability, and ensures consistent security across multi-cloud environments. Adoption is driven by public cloud dominance, hybrid deployment models, and the rise of SaaS applications. Cloud-native security presents opportunities for providers to develop specialized solutions for real-time monitoring, endpoint protection, and compliance management, catering to both large enterprises and SMEs seeking flexible, cost-effective security services.

- For instance, Schneider’s liquid cooling portfolio includes direct-to-chip and immersion options, supporting rack densities up to 100 kW per rack, with coolant distribution units (CDUs) and manifold systems tuned for high heat loads.

Expansion in SME Segment:

SMEs are increasingly adopting DSaaS due to limited in-house IT resources and rising cyber threats. Cloud-based security offers affordable, scalable solutions that allow smaller businesses to meet compliance and data protection requirements. Providers can target this segment with tailored packages, automated monitoring, and simplified deployment options. Expanding DSaaS adoption in SMEs represents a significant growth opportunity, particularly in emerging markets where digitalization is accelerating, and businesses increasingly recognize the need for professional-grade cybersecurity services.

Key Challenges

Data Privacy Concerns:

Organizations remain cautious about storing sensitive information in cloud environments due to potential data breaches and unauthorized access. Concerns over multi-tenant architectures, cross-border data transfer, and vendor reliability limit DSaaS adoption in highly regulated industries. Providers must ensure strong encryption, compliance certifications, and transparent policies to address these concerns. Overcoming data privacy apprehensions is critical to market growth, as trust in cloud security directly influences enterprise decisions to migrate critical workloads to DSaaS platforms.

Integration Complexity with Legacy Systems:

Enterprises face challenges in integrating DSaaS with existing IT infrastructure and legacy security solutions. Compatibility issues, inconsistent policies, and migration difficulties can delay adoption and increase costs. Large enterprises with complex environments often require customized deployment and professional services to ensure seamless integration. This complexity poses a barrier for both DSaaS providers and organizations, necessitating user-friendly solutions and flexible integration frameworks to accelerate adoption and maintain operational continuity.

Regional Analysis

North America:

North America leads the Data Security as a Service (DSaaS) market, holding around 38% share. Growth is driven by high adoption of cloud computing, stringent regulatory frameworks, and rising cyber threats in IT, BFSI, and healthcare sectors. The U.S. dominates due to advanced cybersecurity infrastructure, large-scale digital transformation, and investment in AI-powered security solutions. Canada contributes through increasing cloud migration among SMEs. Continuous innovation, strong presence of key DSaaS providers, and government initiatives to strengthen data protection further reinforce regional dominance, positioning North America as a critical hub for DSaaS adoption and technological advancements.

Europe:

Europe accounts for approximately 28% of the DSaaS market, driven by GDPR compliance requirements and rapid cloud adoption across enterprises. The U.K., Germany, and France lead with strong investments in cybersecurity infrastructure and increasing awareness of data protection. BFSI, healthcare, and government sectors are primary adopters due to regulatory mandates and the need for secure data management. Hybrid cloud deployments gain traction as organizations seek flexibility and compliance adherence. The region’s growth is fueled by rising cyber threats, collaboration with technology vendors, and the expansion of cloud-native security solutions, supporting continued DSaaS market penetration across Europe.

Asia Pacific:

Asia Pacific holds about 22% of the DSaaS market, driven by digitalization, cloud migration, and rising cyber threats in IT, BFSI, and retail sectors. Countries like China, Japan, and India are investing heavily in secure cloud infrastructures and advanced threat detection solutions. SMEs increasingly adopt DSaaS due to cost efficiency and scalability, while large enterprises integrate cloud-native security for compliance and operational resilience. The market benefits from growing AI integration, government cybersecurity initiatives, and increased awareness of data privacy. Strong economic growth and technology adoption present significant opportunities for DSaaS providers in the region.

Latin America:

Latin America captures roughly 7% market share, supported by rising digital adoption and increased cybersecurity awareness across BFSI, government, and healthcare sectors. Brazil and Mexico lead due to expanding cloud infrastructure and growing investments in threat monitoring solutions. SMEs are accelerating DSaaS adoption to overcome limited in-house IT capabilities. Regulatory initiatives and the growing frequency of cyberattacks drive regional demand. Providers focusing on cost-effective, scalable solutions can capitalize on the market potential. Latin America presents opportunities for DSaaS growth through hybrid deployments and cloud-native security services tailored to address regional compliance and security challenges.

Middle East & Africa:

The Middle East & Africa (MEA) holds around 5% share, driven by government-led digital transformation, cloud adoption, and rising cyber threats in BFSI, healthcare, and public sectors. UAE, Saudi Arabia, and South Africa lead DSaaS adoption through investments in cloud security infrastructure and compliance-driven solutions. Organizations increasingly prefer hybrid and public cloud deployments for scalable and secure operations. Regulatory mandates, growing awareness of data protection, and demand for real-time threat intelligence contribute to market growth. MEA offers opportunities for providers to deliver tailored DSaaS solutions, focusing on compliance, enterprise scalability, and integration with emerging technologies.

Market Segmentations:

By Deployment Mode:

- Public Cloud

- Hybrid Cloud

By Organization Size:

By End User:

By Geography

- North America

- Europe

- Germany

- France

- Italy

- U.K.

- Russia

- Rest of Europe

- Asia-Pacific

- India

- China

- Japan

- Rest of Asia-Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East and Africa

- GCC Countries

- South Africa

- Rest of Middle East and Africa

Competitive Landscape

The Data Security as a Service (DSaaS) market players such as Microsoft, Varonis Systems, Thales, Quisitive, Sophos Professional Services, Veritas Technologies, OpenText Corporation, NetApp, Imperva, and Micro Focus. The Data Security as a Service (DSaaS) market is highly competitive, driven by rapid digital transformation and rising cyber threats across industries. Organizations increasingly adopt cloud-based security solutions to protect sensitive data, ensure regulatory compliance, and maintain operational continuity. The market emphasizes advanced features such as real-time threat detection, AI-powered analytics, encryption, and identity access management. Hybrid and public cloud deployments are gaining traction due to scalability and flexibility. Strong demand from BFSI, healthcare, IT, and government sectors fuels continuous innovation. Vendors focus on delivering cost-effective, scalable, and integrated solutions to address evolving security challenges, enhance enterprise resilience, and meet the growing need for reliable data protection across global markets.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Microsoft

- Varonis Systems

- Thales

- Quisitive

- Sophos Professional Services

- Veritas Technologies

- OpenText Corporation

- NetApp

- Imperva

- Micro Focus

Recent Developments

- In August 2024, Commvault expanded its cybersecurity ecosystem by integrating with leading partners: Acante, Dasera, Google Cloud, Splunk, and Wiz. The strategic integration aims to deliver a more resilient and versatile data protection strategy, addressing the evolving challenges in cybersecurity.

- In June 2024, Oracle and Google Cloud entered a strategic Multicloud partnership aimed at accelerating their respective cloud services and assist customers with enhanced flexibility, integration, and improved solutions. The newly developed offering is made available in 11 different regions enabling users to manage their workloads without extra changes for cross-cloud transfers.

- In November 2023, Schneider Electric, renowned for its leadership in energy management and automation, announced a substantial multi-year agreement with Compass Datacenters.

- In March 2023, Cisco, a prominent provider of networking, cloud, and cybersecurity solutions, unveiled ambitious plans to strengthen its commitment to India. This initiative includes establishing a new data center in Chennai, introducing advanced risk-based capabilities across its security portfolio for hybrid and multi-cloud environments, and launching enhanced features for its Duo Risk-Based Authentication solution.

Report Coverage

The research report offers an in-depth analysis based on Deployment Mode, Organization Size, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Cloud-based security adoption will continue to rise across enterprises and SMEs.

- AI and machine learning integration will enhance threat detection and response.

- Hybrid cloud deployments will gain traction for flexibility and compliance.

- Regulatory compliance requirements will drive continuous investment in DSaaS solutions.

- SMB adoption will increase due to affordable and scalable security offerings.

- Real-time monitoring and automated threat intelligence will become standard features.

- Integration with existing IT and legacy systems will improve for seamless deployment.

- Demand from BFSI, healthcare, and government sectors will remain strong.

- Vendors will focus on developing cloud-native and multi-tenant security solutions.

- Growing cyber threats and remote work trends will sustain long-term market growth.