Market Overview

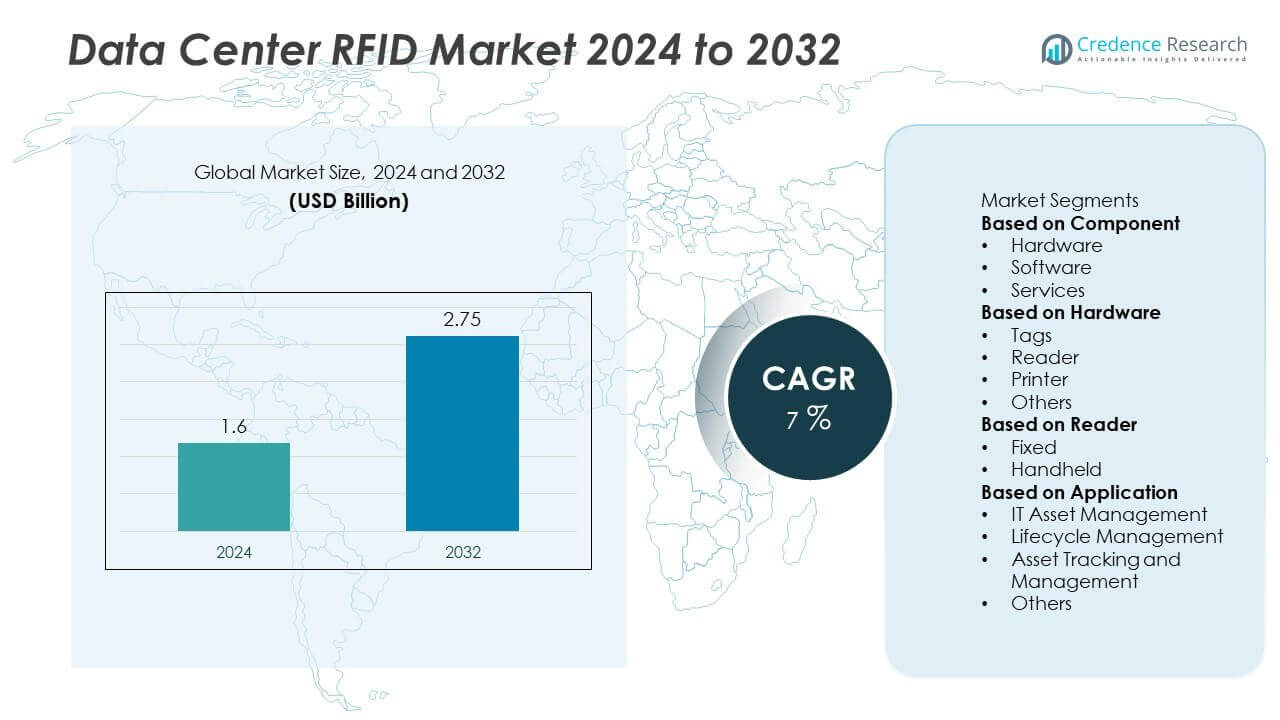

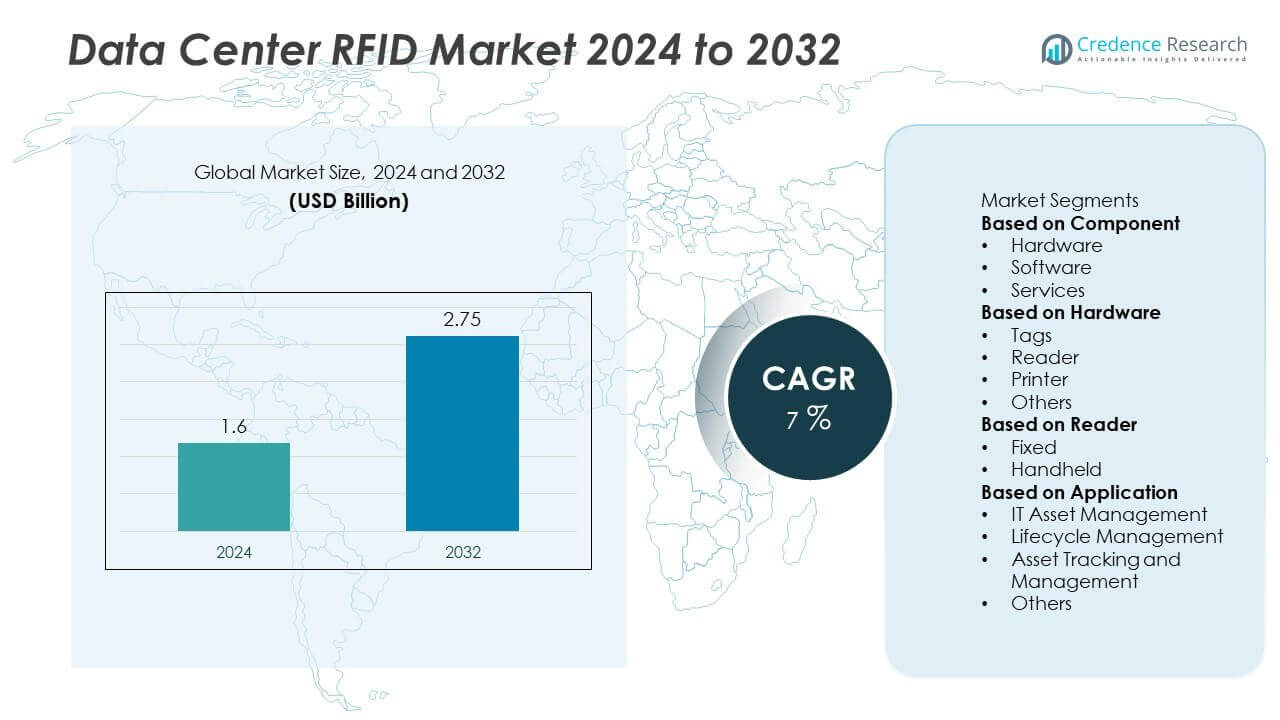

The Data Center RFID market was valued at USD 1.6 billion in 2024 and is projected to reach USD 2.75 billion by 2032, growing at a CAGR of 7% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Data Center RFID Market Size 2024 |

USD 1.6 Billion |

| Data Center RFID Market, CAGR |

7% |

| Data Center RFID Market Size 2032 |

USD 2.75 Billion |

The Data Center RFID market is led by major players including Impinj, Inc., AVERY DENNISON CORPORATION, Honeywell International Inc., Confidex, MOJIX, Nedap, Alien Technology, GAO Group, HID Global, and Detego. These companies focus on developing advanced RFID hardware and software solutions to enhance data center asset tracking, inventory management, and security operations. North America dominated the global market with a 37% share in 2024, supported by widespread adoption in hyperscale and colocation data centers. Europe followed with 29%, driven by regulatory compliance and sustainability goals, while Asia-Pacific held 25%, reflecting rapid cloud infrastructure expansion and technological modernization.

Market Insights

- The Data Center RFID market was valued at USD 1.6 billion in 2024 and is projected to reach USD 2.75 billion by 2032, growing at a CAGR of 7%.

- Growth is driven by rising demand for automated asset tracking, real-time monitoring, and enhanced operational efficiency in hyperscale and colocation data centers.

- Key trends include integration of RFID with IoT and AI for predictive maintenance, and growing adoption of passive UHF tags for cost-efficient large-scale deployments.

- Major players such as Impinj, AVERY DENNISON CORPORATION, and Honeywell International dominate through innovation and strategic collaborations with cloud providers.

- North America leads the market with 37% share, followed by Europe at 29% and Asia-Pacific at 25%, while the hardware segment holds 61% share led by RFID tags contributing 47% within the category.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Component

The hardware segment dominated the Data Center RFID market in 2024 with a 61% share. Hardware includes tags, readers, and printers, which form the foundation of RFID infrastructure. Demand for hardware is fueled by the growing need for automated equipment tracking and inventory management in hyperscale and colocation data centers. Software and services segments also gain traction as enterprises adopt advanced analytics and cloud-based RFID solutions for real-time visibility, maintenance, and security monitoring across expanding data networks.

- For instance, Impinj, Inc. introduced its E910 RAIN RFID reader chip capable of processing up to 1,100 tag reads per second with a sensitivity of –92 dBm. The chip supports high-density data environments with an operational frequency range of 860–960 MHz, enhancing read accuracy across multiple server racks.

By Hardware

Within hardware, RFID tags held the dominant share of 47% in 2024. Tags are essential for identifying and tracking IT assets such as servers, cables, and racks. Their rising use improves inventory accuracy and minimizes downtime by enabling faster audits and equipment identification. The growth of cloud data centers and increased regulatory focus on asset traceability are key drivers. Readers, printers, and other supporting hardware continue to grow as integration with IoT sensors enhances automation and data precision.

- For instance, Avery Dennison Corporation offers various RFID products, including the AD Squarewave M780 inlay and the Dogbone Impinj M780 tag, both of which feature an Impinj M780 IC with 496-bit EPC and 128-bit user memory. The Impinj M780 chip itself offers a 50% increase in read range over its predecessor.

By Reader

The fixed reader segment led the reader category with a 58% market share in 2024. Fixed readers are preferred for continuous monitoring in large data centers, offering higher read accuracy and wider coverage than handheld types. Their adoption is driven by the need for 24/7 visibility of high-value equipment and environmental parameters. Handheld readers, though smaller in share, are growing steadily as portable solutions for maintenance and spot auditing tasks in modular or edge data center environments.

Key Growth Drivers

Rising Demand for Automated Asset Management

Data centers increasingly rely on RFID systems to automate asset tracking and reduce manual errors. RFID enables precise, real-time visibility of servers, cables, and racks, improving operational efficiency. The shift toward large-scale and hyperscale facilities drives the adoption of RFID for optimizing space utilization and ensuring compliance with maintenance protocols. Automation also helps operators minimize downtime and enhance energy efficiency, supporting scalability as global data generation and cloud service usage continue to expand rapidly.

- For instance, Mojix provides its ytem™ SaaS platform for real-time, item-level inventory visibility and traceability. It is built on a scalable, high-security SaaS platform that integrates with existing ERP systems via APIs.

Expansion of Hyperscale and Colocation Data Centers

The growing deployment of hyperscale and colocation data centers fuels RFID market growth. These facilities demand advanced asset monitoring solutions to manage vast IT infrastructures efficiently. RFID systems improve security, reduce human intervention, and ensure continuous operational control. As cloud computing, AI workloads, and edge networks expand, RFID technology becomes essential for tracking physical infrastructure, reducing asset loss, and optimizing maintenance cycles across multi-tenant and large-scale data environments.

- For instance, Honeywell International Inc. offers fixed RFID readers and sensors for asset and inventory management applications in enterprise and industrial environments. Its solutions provide high performance and can be scaled for low-cost deployments.

Integration with IoT and AI for Predictive Monitoring

The integration of RFID with IoT and AI enhances predictive maintenance and operational intelligence. IoT-connected RFID tags enable data-driven insights into asset conditions, movement, and lifecycle management. AI algorithms further analyze this data for forecasting maintenance needs and detecting anomalies. These smart integrations support automation, improve uptime, and lower operational costs. The trend aligns with digital transformation initiatives among data center operators seeking real-time performance visibility and smarter infrastructure control.

Key Trends & Opportunities

Shift Toward Cloud-Based RFID Solutions

Cloud-managed RFID platforms are gaining traction as they offer scalability and centralized control. These systems enable operators to manage multi-location facilities through unified dashboards and analytics. The trend supports remote asset monitoring and enhances integration with enterprise resource planning systems. As data centers globalize operations, cloud-based RFID solutions present opportunities for cost-effective deployment, reduced on-site IT dependency, and seamless data synchronization across distributed assets.

- For instance, Nedap expanded its iD Cloud Platform, enabling RFID-based asset visibility across more than 10,000 stores globally. The scalable platform collects data in a cloud-based repository and integrates with a retailer’s existing systems to provide inventory visibility and analytics.

Adoption of Passive UHF Tags and Advanced Readers

Passive UHF RFID tags are emerging as preferred solutions due to their low cost and wide read range. Combined with high-performance fixed readers, they enable efficient monitoring of thousands of assets simultaneously. This technology enhances speed, accuracy, and traceability in high-density data environments. The growing emphasis on scalability and sustainability encourages further adoption, providing opportunities for RFID vendors to innovate in eco-friendly and power-efficient product designs.

- For instance, Confidex launched the Ironside Micro UHF RFID tag designed for data-center and industrial applications, achieving read ranges up to 7 meters on metal surfaces. The tag operates in the 860–960 MHz band and withstands temperatures from –35 °C to +85 °C while maintaining IP68 protection.

Key Challenges

High Initial Implementation and Integration Costs

The high cost of RFID hardware, installation, and integration limits adoption, particularly among small and mid-sized data centers. Deploying tags, readers, and management software requires significant capital investment and specialized technical expertise. Integration with existing IT systems and ensuring compatibility with legacy infrastructure also increase complexity. These financial and operational barriers can delay ROI realization, making large-scale RFID deployment challenging for cost-sensitive organizations.

Data Security and Privacy Concerns

The use of RFID systems raises concerns over unauthorized access and data breaches. Unsecured RFID networks can expose sensitive asset information, creating vulnerabilities in critical data center operations. As data centers handle vast amounts of confidential information, maintaining encryption, authentication, and compliance with security standards becomes vital. Growing regulatory scrutiny and cybersecurity risks compel operators to adopt advanced protection protocols, increasing operational complexity and implementation costs.

Regional Analysis

North America

North America led the Data Center RFID market with a 37% share in 2024. The region’s growth is driven by strong investments in hyperscale data centers and advanced IT infrastructure. Major cloud providers such as Amazon Web Services, Google, and Microsoft are expanding facilities across the U.S. and Canada, creating high demand for automated asset tracking and monitoring. Increasing regulatory focus on data security and equipment management further promotes RFID adoption. Continuous innovation and early technology adoption sustain North America’s leadership in the global market.

Europe

Europe accounted for 29% of the Data Center RFID market share in 2024. The region benefits from expanding data center networks in Germany, the Netherlands, and the U.K. RFID implementation is supported by sustainability goals and EU regulations emphasizing energy efficiency and operational transparency. Growing adoption of edge computing and digital transformation initiatives across industries strengthen the market. Local players and technology integrators are enhancing RFID-based solutions tailored to regional data protection and compliance standards, ensuring steady market growth.

Asia-Pacific

Asia-Pacific held a 25% share of the Data Center RFID market in 2024. Rapid expansion of cloud infrastructure in China, India, Japan, and South Korea fuels RFID adoption. Growing investments from hyperscale operators like Alibaba, Tencent, and NTT Communications drive large-scale deployments. The need for automated asset management and real-time equipment visibility accelerates demand across new data centers. Government-led digitalization programs and the rising number of colocation facilities further support market expansion throughout the region.

Latin America

Latin America captured a 6% share of the Data Center RFID market in 2024. Brazil and Mexico lead regional growth due to rising cloud adoption and investments from global data center operators. Increasing enterprise demand for improved efficiency, reduced downtime, and enhanced asset tracking drives RFID deployment. Local infrastructure modernization and supportive policies for data management strengthen adoption. However, limited technological expertise and high installation costs remain moderate restraints on widespread implementation across smaller markets.

Middle East & Africa

The Middle East & Africa region accounted for a 3% share of the Data Center RFID market in 2024. The growth is supported by smart city projects and increased data center investments in the UAE, Saudi Arabia, and South Africa. RFID systems are being integrated to improve operational security and asset tracking in mission-critical facilities. Expansion of digital services, cloud platforms, and government initiatives to enhance data infrastructure further stimulate market growth, although limited technical resources slow full-scale adoption in emerging economies.

Market Segmentations:

By Component

- Hardware

- Software

- Services

By Hardware

- Tags

- Reader

- Printer

- Others

By Reader

By Application

- IT Asset Management

- Lifecycle Management

- Asset Tracking and Management

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Data Center RFID market includes key players such as Impinj, Inc., Confidex, MOJIX, AVERY DENNISON CORPORATION, Honeywell International Inc., Nedap, Alien Technology, GAO Group, HID Global, and Detego. These companies compete through innovations in RFID tags, readers, and software platforms designed for efficient data center asset management. Leading vendors focus on developing high-frequency and ultra-high-frequency RFID solutions to enhance accuracy and real-time tracking. Strategic partnerships with cloud service providers and data center operators strengthen market presence. Continuous R&D efforts emphasize energy-efficient and scalable RFID systems to meet the growing demands of hyperscale and colocation facilities. Moreover, acquisitions and collaborations help firms expand global footprints and integrate RFID with IoT and AI technologies for predictive analytics, driving competitiveness and long-term customer retention in this fast-evolving market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Impinj, Inc.

- Confidex

- MOJIX

- AVERY DENNISON CORPORATION

- Honeywell International Inc.

- Nedap

- Alien Technology

- GAO Group

- HID Global

- Detego

Recent Developments

- In October 2024, Honeywell announced it was winding down its “Global Tracking” business, which includes satellite and search and rescue solutions, to focus on other core areas.

- In October 2024, Mojix, Inc. announced its merger with Seagull Software, enabling its “ytem™” RFID traceability platform to handle over 100 billion labels annually across 175 countries

- In 2024, Avery Dennison Corporation announced the opening of its new RFID and digital-ID facility in Querétaro, Mexico, aimed at producing high-volume RFID inlays and tags for industries including data centers.

- In 2024, Impinj, Inc. disclosed that it would feature its Gen2X RAIN RFID reader chips at NRF 2025, highlighting enhanced read-range and tag density capabilities designed for asset-dense environments such as data centers.

Report Coverage

The research report offers an in-depth analysis based on Component, Hardware, Reader, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for RFID systems will rise with the expansion of hyperscale and edge data centers.

- Integration of RFID with IoT and AI will enhance predictive asset monitoring capabilities.

- Cloud-based RFID management platforms will gain traction for multi-site data control.

- Adoption of passive UHF tags will increase due to their cost efficiency and scalability.

- RFID-enabled automation will become a core feature in next-generation data centers.

- Energy-efficient and sustainable RFID hardware designs will attract greater investments.

- Real-time analytics from RFID systems will support smarter operational decisions.

- Partnerships between RFID vendors and data center operators will strengthen service innovation.

- Regulatory focus on data transparency and equipment tracking will drive compliance-led adoption.

- Emerging markets in Asia-Pacific and the Middle East will experience rapid RFID deployment growth.