Market Overview:

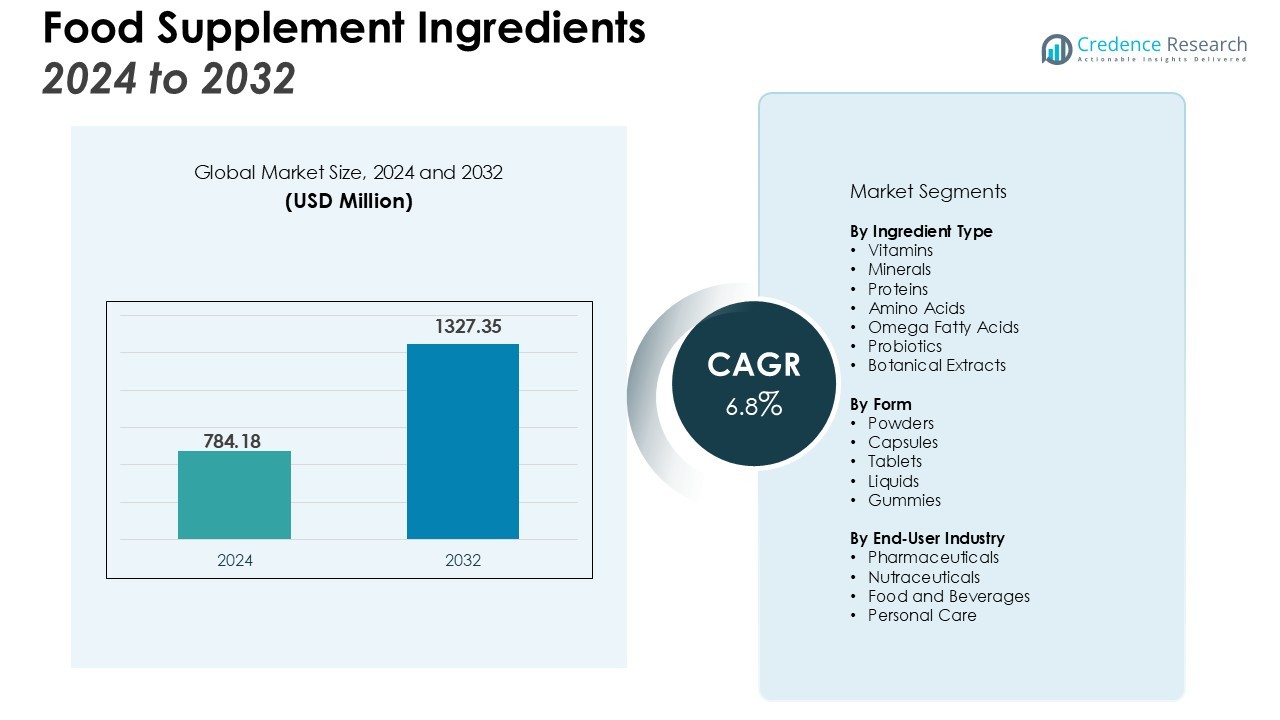

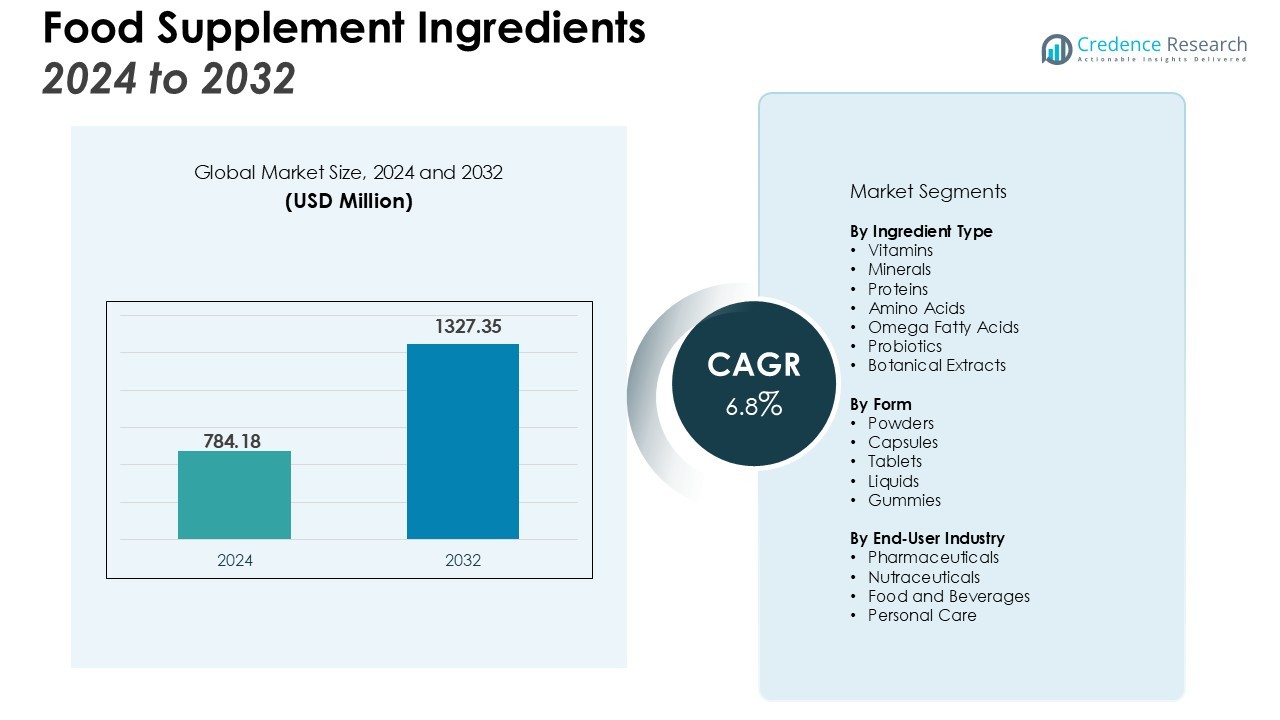

The Food Supplement Ingredients Market size was valued at USD 784.18 million in 2024 and is anticipated to reach USD 1327.35 million by 2032, at a CAGR of 6.8% during the forecast period (2024-2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Food Supplement Ingredients Market Size 2024 |

USD 784.18 Million |

| Food Supplement Ingredients Market, CAGR |

6.8% |

| Food Supplement Ingredients Market Size 2032 |

USD 1327.35 Million |

Growth is driven by rising health consciousness and preventive healthcare awareness. Increasing prevalence of lifestyle-related conditions such as obesity, diabetes, and cardiovascular diseases encourages consumers to seek supplements enriched with vitamins, minerals, proteins, and omega fatty acids. Regulatory support for clean-label and natural ingredients also accelerates innovation in product formulations. Additionally, e-commerce expansion broadens product accessibility, enabling manufacturers to capture diverse consumer bases.

Regionally, North America leads the market due to high supplement consumption, well-established healthcare awareness, and robust product innovation. Europe follows, supported by strict regulatory frameworks and growing demand for natural ingredients. Asia-Pacific is expected to register the fastest growth, fueled by rapid urbanization, a rising middle-class population, and increasing investments in nutraceutical manufacturing. This regional momentum highlights strong opportunities for ingredient suppliers and supplement brands worldwide.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Food Supplement Ingredients Market size was USD 784.18 million in 2024 and will reach USD 1327.35 million by 2032, registering a CAGR of 6.8%.

- Rising health consciousness and preventive healthcare awareness fuel demand for supplements enriched with vitamins, minerals, proteins, and omega fatty acids.

- Increasing preference for natural, plant-based, and clean-label products drives reformulation efforts and supports strong consumer trust.

- E-commerce platforms expand global accessibility, with direct-to-consumer models enhancing engagement and personalized product adoption.

- Strict regulations and compliance requirements challenge smaller players, creating higher operational costs and longer approval cycles.

- North America leads with 38% share due to high supplement adoption, innovation, and FDA-backed regulatory trust.

- Asia-Pacific, holding 24% share, is the fastest-growing region, supported by urbanization, middle-class expansion, and strong nutraceutical investments.

Market Drivers:

Rising Focus on Preventive Healthcare and Wellness

The Food Supplement Ingredients Market benefits from growing awareness of preventive healthcare. Consumers are actively choosing supplements to support immunity, mental well-being, and long-term vitality. The rise in chronic diseases has strengthened the role of dietary supplements in daily routines. Companies highlight scientifically backed formulations to meet this rising demand. The trend reinforces the importance of nutrition-driven health management.

- For instance, Natural Alternatives International, Inc. announced that its TriBsyn™ beta-alanine complex increased plasma beta-alanine levels 4.5-fold compared to conventional beta-alanine supplements in a clinical trial.

Increased Demand for Natural and Clean-Label Products

The Food Supplement Ingredients Market is expanding with a shift toward natural and clean-label solutions. Consumers prefer plant-based, organic, and chemical-free ingredients that align with healthier lifestyles. It drives manufacturers to reformulate supplements with minimal additives and transparent labeling. Regulatory approvals for natural extracts further strengthen trust among buyers. The market is witnessing strong innovation in botanical and functional ingredients.

E-Commerce Growth and Wider Consumer Access

The Food Supplement Ingredients Market gains momentum through online retail channels and digital platforms. E-commerce improves access to diverse products, enabling global reach for suppliers. It also provides consumers with tailored choices supported by data-driven recommendations. Direct-to-consumer models strengthen engagement and build trust through transparency. Expanding digital distribution supports faster adoption of supplement-based health routines.

- For instance, Amway, a key player in the direct-to-consumer model, empowers a network of over 1 million Independent Business Owners globally, enhancing consumer access to its nutritional products through a robust e-commerce platform.

Technological Advancements in Ingredient Development

The Food Supplement Ingredients Market advances with innovations in bioavailability and formulation technology. It allows manufacturers to deliver enhanced nutrient absorption and targeted health benefits. Controlled-release systems and microencapsulation techniques increase the effectiveness of supplements. The industry invests in R&D to differentiate product offerings with clinical validation. Technology-driven innovation shapes competitive advantage and strengthens market growth potential.

Market Trends:

Growing Popularity of Personalized Nutrition and Functional Formulations

The Food Supplement Ingredients Market is witnessing strong growth through the adoption of personalized nutrition. Consumers seek products tailored to specific health needs, such as weight control, digestive health, or cognitive performance. It reflects the shift toward individualized wellness solutions supported by genetic testing and lifestyle assessments. Brands invest in functional ingredients like probiotics, adaptogens, and plant proteins to create targeted formulations. Evolving consumer preferences drive companies to integrate advanced research with innovative product design. The trend supports the premiumization of supplements, encouraging higher spending on specialized health solutions.

- For instance, the personalized wellness company InsideTracker utilizes a sophisticated algorithm that analyzes up to 48 blood biomarkers.

Expansion of Plant-Based and Sustainable Ingredient Portfolios

The Food Supplement Ingredients Market is shaped by rising demand for plant-based and sustainable ingredient choices. Consumers increasingly prefer supplements made from natural extracts, algae, and alternative proteins. It aligns with global priorities for environmental responsibility and ethical sourcing. Companies respond with investments in eco-friendly processes, recyclable packaging, and supply chain transparency. The emphasis on sustainability extends to the development of bio-based vitamins and mineral blends. Industry players strengthen market positioning by offering products that combine health benefits with environmental responsibility. The trend accelerates global adoption of supplement ingredients aligned with clean living and responsible consumption.

- For instance, IFF showcased its commitment to plant-based innovation at Vitafoods™ Europe 2025 by presenting a portfolio of at least 7 distinct dietary supplement ingredients, including advanced solutions like SeaGel®, a plant-derived alternative for vegan softgels.

Market Challenges Analysis:

Stringent Regulatory Frameworks and Compliance Issues

The Food Supplement Ingredients Market faces challenges due to strict regulations and evolving compliance standards. Authorities enforce rigorous quality checks, labeling requirements, and safety assessments that delay product launches. It creates barriers for smaller players with limited resources to manage approvals. Frequent changes in global regulations increase operational complexity and raise compliance costs. The market must balance innovation with adherence to legal frameworks. Delays in approvals restrict the speed of introducing novel ingredients and formulations.

Rising Raw Material Costs and Supply Chain Disruptions

The Food Supplement Ingredients Market is challenged by fluctuating raw material prices and supply chain instability. Volatility in agricultural production, energy costs, and global trade tensions increases pressure on ingredient sourcing. It impacts pricing strategies and profit margins for manufacturers. Unstable supply chains also cause shortages that limit product availability across regions. Companies are required to secure long-term partnerships and diversify suppliers to reduce risk. These cost pressures affect both large-scale producers and emerging market participants.

Market Opportunities:

Expansion in Emerging Economies with Rising Health Awareness

The Food Supplement Ingredients Market presents strong opportunities in emerging economies driven by increasing consumer health awareness. Rising disposable incomes and urbanization encourage greater adoption of dietary supplements. It supports demand for vitamins, minerals, and functional ingredients tailored to regional health needs. Governments in Asia-Pacific, Latin America, and Africa promote preventive healthcare, boosting supplement acceptance. Local players and global brands expand presence through affordable product lines. Strategic collaborations with healthcare providers enhance consumer trust and adoption in these markets.

Innovation Through Advanced Formulations and Bioavailability Solutions

The Food Supplement Ingredients Market creates opportunities through innovations that improve nutrient delivery and absorption. It enables manufacturers to differentiate products with enhanced effectiveness. Developments in microencapsulation, controlled-release systems, and biotechnology offer new possibilities for functional ingredients. Companies invest in research to combine scientific validation with consumer-friendly formats such as gummies, powders, and fortified beverages. Rising demand for personalized nutrition further accelerates innovation. This trend positions technologically advanced suppliers to capture greater market share and strengthen competitiveness.

Market Segmentation Analysis:

By Ingredient Type

The Food Supplement Ingredients Market is segmented into vitamins, minerals, proteins, amino acids, omega fatty acids, probiotics, and botanical extracts. Vitamins and minerals hold a significant share due to their essential role in preventive healthcare and disease management. Proteins and amino acids witness strong demand from sports nutrition and weight management segments. Omega fatty acids and probiotics gain traction with growing interest in cardiovascular and digestive health. Botanical extracts expand with rising adoption of plant-based supplements supported by clean-label demand.

- For instance, in a 2015 in-vitro study, Melaleuca’s proprietary amino acid-oligosaccharide complex used for its mineral supplements demonstrated a 4.4-fold increase in the bioavailability of zinc compared to inorganic mineral forms.

By Form

The market is categorized into powders, capsules, tablets, liquids, and gummies. Powders and capsules dominate due to convenience and higher stability in nutrient delivery. Tablets continue to serve traditional demand across pharmacies and retail outlets. Liquids cater to children and elderly consumers who require easy-to-consume formats. Gummies show rapid growth, driven by consumer preference for flavored, functional, and innovative delivery options. It reflects the diversification of supplement formats tailored to modern lifestyles.

By End-User Industry

The market serves pharmaceuticals, nutraceuticals, food and beverages, and personal care. Nutraceuticals represent the leading segment, fueled by consumer demand for preventive health solutions. Pharmaceuticals adopt supplement ingredients to support therapeutic formulations and strengthen recovery. The food and beverage sector integrates fortified ingredients into functional foods and drinks. Personal care applications expand through supplements focused on skin health, beauty, and anti-aging benefits. Each end-user sector enhances market scope through targeted applications.

- For instance, in 2023, Ausnutria launched its Probiotics Industrialization Production Demonstration Line, a smart factory capable of producing 33 probiotic powder variations in 8 types annually for the nutraceutical and food sectors.

Segmentations:

By Ingredient Type

- Vitamins

- Minerals

- Proteins

- Amino Acids

- Omega Fatty Acids

- Probiotics

- Botanical Extracts

By Form

- Powders

- Capsules

- Tablets

- Liquids

- Gummies

By End-User Industry

- Pharmaceuticals

- Nutraceuticals

- Food and Beverages

- Personal Care

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America Leading with High Supplement Adoption and Innovation

North America accounted for 38% share of the Food Supplement Ingredients Market in 2024. The region holds dominance supported by high consumer awareness and strong adoption of preventive healthcare. It benefits from advanced research capabilities and frequent product launches by established nutraceutical companies. The market is strengthened by robust distribution networks across retail, pharmacies, and digital platforms. Regulatory support from the FDA ensures product quality and safety, which builds consumer confidence. Rising demand for clean-label and plant-based supplements further drives innovation in ingredient sourcing.

Europe Strengthened by Regulatory Standards and Natural Ingredient Demand

Europe captured 29% share of the Food Supplement Ingredients Market in 2024. It is shaped by strict regulatory frameworks that ensure quality and transparency across dietary supplements. The region benefits from a mature consumer base seeking natural, organic, and sustainable ingredients. Countries such as Germany, the UK, and France are key contributors, driven by high demand for functional nutrition. European companies invest in research and collaborate with health organizations to validate product claims. Distribution through pharmacies and specialty health stores supports consistent growth across the region.

Asia-Pacific Emerging as the Fastest-Growing Regional Market

Asia-Pacific represented 24% share of the Food Supplement Ingredients Market in 2024. It is expanding rapidly with rising health awareness and growing middle-class populations across key economies. Growth is fueled by increasing investments in nutraceutical manufacturing and supportive government policies promoting preventive healthcare. China, India, and Japan represent major markets with high supplement consumption across vitamins, minerals, and herbal products. Local and international players expand through affordable product lines and e-commerce platforms. Rising urbanization and lifestyle changes further boost supplement adoption among younger demographics.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

Competitive Analysis:

The Food Supplement Ingredients Market is highly competitive with global and regional players focusing on innovation, partnerships, and regulatory compliance to strengthen their positions. Leading companies such as BASF SE, DSM Nutritional Products, Kerry Group, Archer Daniels Midland Company, and DuPont de Nemours invest heavily in research to develop advanced formulations that improve bioavailability and product differentiation. It emphasizes clean-label, plant-based, and sustainable ingredients to meet evolving consumer preferences. Regional firms expand through cost-effective offerings and localized supply chains, enhancing accessibility in emerging economies. Strategic mergers, acquisitions, and collaborations support portfolio expansion and geographic reach. Intense competition drives continuous innovation, with companies aligning closely to health trends, regulatory frameworks, and consumer demand for transparent labeling. This competitive landscape highlights a balance between global corporations with strong R&D capabilities and regional players that offer tailored solutions to niche markets.

Recent Developments:

- In September 2025 dsm-firmenich launched the next generation of Dairy Safe™ all-in-one cultures for various cheese varieties.

- In October 2025 BASF launched “xarvio® HEALTHY FIELDS for RiTA” in Japan, a yield guarantee service for rice farmers.

Report Coverage:

The research report offers an in-depth analysis based on Ingredient Type, Form, End-User Industry and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The Food Supplement Ingredients Market will experience strong growth driven by rising health awareness.

- Demand for personalized nutrition will expand, supported by genetic testing and lifestyle-based solutions.

- Plant-based and sustainable ingredients will gain wider adoption as consumers prioritize eco-friendly choices.

- E-commerce will remain a key distribution channel, with direct-to-consumer models enhancing accessibility.

- Technological advances in bioavailability and controlled-release systems will shape next-generation formulations.

- Partnerships between ingredient manufacturers and healthcare providers will strengthen consumer trust and product adoption.

- Pharmaceutical and nutraceutical companies will integrate functional ingredients into therapeutic and preventive health solutions.

- Emerging economies in Asia-Pacific and Latin America will offer significant opportunities through rising disposable incomes.

- Regulatory frameworks will continue to evolve, encouraging quality compliance while challenging smaller market entrants.

- Continuous R&D investment will drive differentiation, positioning innovation as the core of competitive advantage.