Market Overview

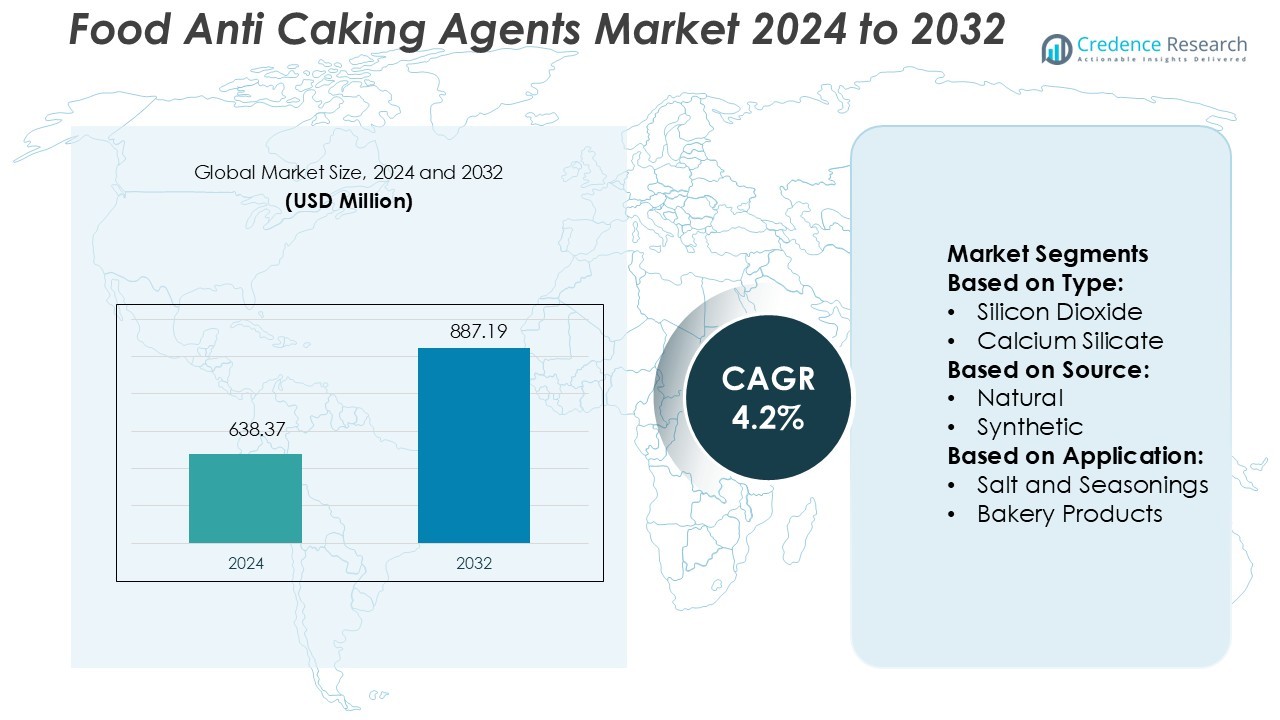

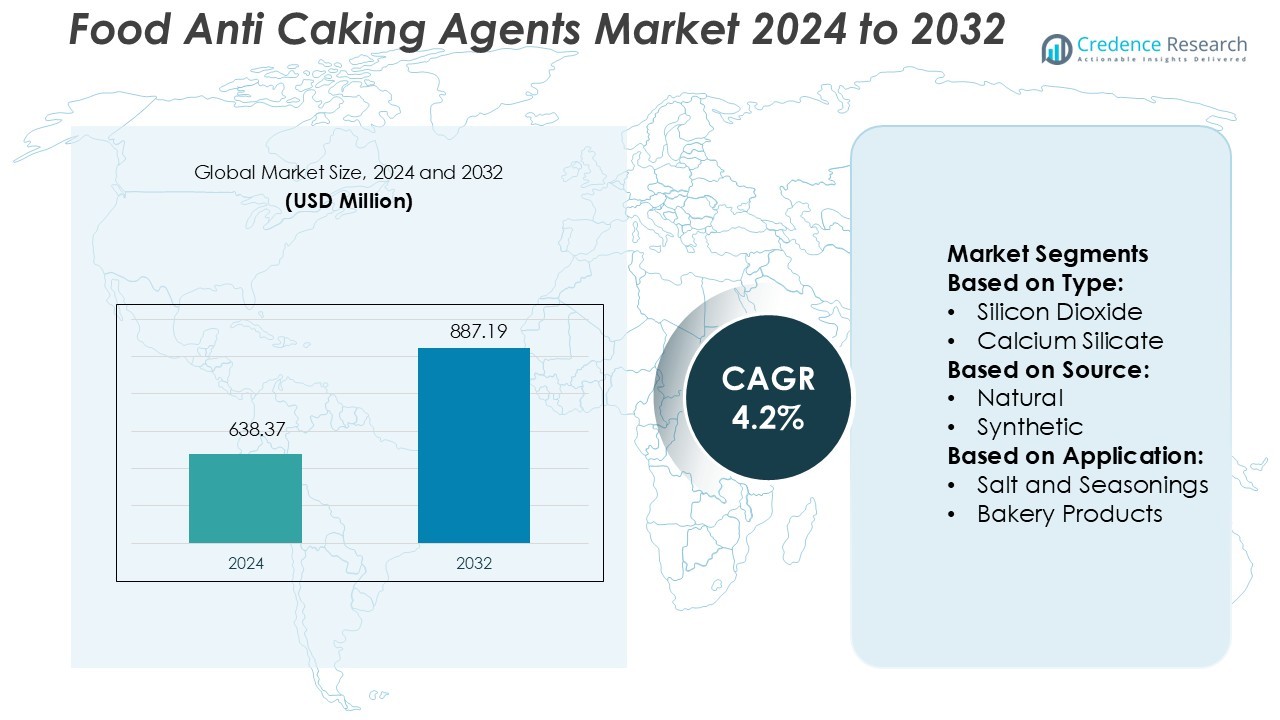

Food Anti Caking Agents Market size was valued USD 638.37 million in 2024 and is anticipated to reach USD 887.19 million by 2032, at a CAGR of 4.2% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Food Anti Caking Agents Market Size 2024 |

USD 638.37 Million |

| Food Anti Caking Agents Market, CAGR |

4.2% |

| Food Anti Caking Agents Market Size 2032 |

USD 887.19 Million |

The Food Anti-Caking Agents Market is supported by leading companies such as Kao Corporation, PPG Industries, Inc., Univar Solutions Inc., IMCD N.V., Evonik Industries AG, Brenntag AG, Silcona GmbH & Co. KG, Huber Engineered Materials (J.M. Huber Corporation), Cargill, Incorporated, and Solvay S.A. These players focus on expanding product portfolios, improving formulation performance, and strengthening global supply chains through strategic partnerships and acquisitions. North America leads the market with a 33% share, driven by advanced food processing technologies, strong regulatory frameworks, and high consumption of processed foods. Continuous innovation and growing demand for clean-label products further enhance the region’s market dominance.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Food Anti-Caking Agents Market was valued at USD 638.37 million in 2024 and is expected to reach USD 887.19 million by 2032, registering a CAGR of 4.2%.

- Rising demand for processed foods and increasing shelf-life requirements drive steady market expansion.

- Clean-label and natural ingredient trends are pushing manufacturers toward sustainable product innovations.

- The market is moderately consolidated, with players investing in new formulations, R&D, and strategic partnerships.

- North America leads with a 33% regional share, supported by advanced processing technologies, while silicon dioxide holds a 38% segment share, strengthening its dominant position in moisture control applications.

Market Segmentation Analysis:

By Type

Silicon dioxide holds the dominant share of 38% in the Food Anti-Caking Agents Market. Its high efficiency in absorbing moisture and maintaining free-flowing powder texture drives its strong adoption across the food industry. The compound’s stability at different temperatures and neutral flavor make it suitable for a wide range of food applications. Calcium silicate and magnesium carbonate also contribute significantly, supporting extended shelf life in processed foods. Increasing use in spice blends and powdered ingredients strengthens the demand for these agents in large-scale food manufacturing.

- For instance, PPG’s FLO-GARD™ precipitated silica products achieved carrying capacities above 66% by weight of sunflower oil in bulk food trials, compared with maltodextrin at 3.75% by weight.

By Source

Synthetic sources dominate the market with a 64% share, driven by their consistent quality and cost-effective production. Manufacturers prefer synthetic anti-caking agents due to their higher purity levels and strong performance in humid conditions. These agents ensure product stability during transportation and storage, supporting bulk food production. Natural sources, while gaining popularity among clean-label product manufacturers, remain secondary due to limited functionality compared to synthetic options. Rising regulatory approvals for safe synthetic additives further boost their usage in mainstream food processing.

- For instance, Univar Solutions opened a 120 m² (1,292 ft²) Foodology kitchen and R&D lab in Essen, Germany in October 2025 to accelerate ingredient innovation and test advanced food formulations.

By Application

Salt and seasonings account for the largest market share at 42%, making them the dominant application segment. The strong need to prevent clumping in table salt, spice mixes, and flavoring powders drives demand for anti-caking agents. These additives enhance flowability, support precise portioning, and improve product appearance. Bakery products and dairy products follow closely, driven by rising packaged food consumption. Expanding applications in beverage mixes and confectionery also contribute to steady market growth as producers focus on longer shelf life and product consistency.

Key Growth Drivers

Rising Demand for Processed and Packaged Foods

The growing consumption of processed and convenience foods is a major growth driver for the Food Anti-Caking Agents Market. These agents help maintain product texture, prevent clumping, and ensure smooth processing during manufacturing. Rising urbanization, changing eating habits, and the expanding retail sector further increase product demand. Large-scale use in instant mixes, bakery, seasoning blends, and powdered dairy products strengthens market growth. Manufacturers are increasing production capacity and adopting advanced food-grade anti-caking technologies to meet high-volume requirements across developed and emerging markets.

- For instance, Evonik’s anti-caking silica solutions require an addition rate of less than 1.5 % by weight to achieve effective clump prevention in powdered food systems.

Increased Focus on Shelf-Life Extension and Product Stability

Food producers are using anti-caking agents to improve shelf stability and reduce moisture absorption in powder-based foods. These agents ensure smooth flowability and prevent lump formation during storage and transport. Growing awareness of food quality and appearance drives adoption across salt, seasoning, and dairy segments. Manufacturers prefer these additives to minimize product returns and enhance supply chain efficiency. The rising export of packaged food products also boosts demand for reliable flow control solutions, making shelf-life enhancement a key growth factor.

- For instance, Brenntag reports that its global Food & Nutrition network spans 31 Innovation & Application Centers, which conduct tailored flow-control trials for powdered ingredients.

Regulatory Support and Technological Advancements

Regulatory approvals from bodies like the FDA and EFSA for safe food-grade anti-caking agents support market expansion. Manufacturers are developing advanced formulations with improved efficiency and compatibility with different food matrices. This drives wider use in bakery, beverage mixes, and seasoning applications. Technological innovations such as micro-particle coating and enhanced moisture absorption properties improve product performance. The strong focus on quality assurance and standardized labeling further increases consumer trust, encouraging global manufacturers to invest in product innovation and compliance.

Key Trends & Opportunities

Rising Preference for Clean-Label and Natural Ingredients

Growing health awareness is pushing manufacturers to develop natural anti-caking solutions. Consumers prefer additive-free or minimally processed foods, creating demand for plant-based and mineral-derived agents. Natural sources like rice flour, calcium silicate, and magnesium carbonate are gaining traction in clean-label products. Regulatory encouragement for natural formulations creates further opportunities. Food companies are reformulating products to align with clean-label claims, which is likely to open new market segments and partnerships with sustainable ingredient suppliers.

- For instance, Huber’s “HuberCal® Elite” calcium carbonate product states its lead level is below 0.12 µg/g, enabling very high-purity formulations for food and nutrition applications.

Expansion of Functional Food and Beverage Applications

The increasing popularity of functional foods and fortified beverages presents strong growth opportunities. Anti-caking agents play a critical role in maintaining the stability and flow of powdered nutritional mixes and instant beverages. Rising investments in health-focused products such as protein powders and dietary supplements drive demand. Manufacturers are developing specialized anti-caking solutions to meet the formulation needs of functional products. This trend supports market expansion into new food categories with premium product positioning.

- For instance, Tixosil® 68B FCC grade features a particle size (D50) of 16 µm, designed to cover host-powder particles and prevent clumping by creating particle surface roughness.

Integration of Advanced Manufacturing Technologies

The use of advanced drying, coating, and granulation technologies improves the performance of anti-caking agents. Manufacturers are focusing on fine-tuning particle size distribution and enhancing moisture absorption rates. These innovations enable better compatibility with various ingredients and improve processing efficiency. The adoption of automation and precision mixing systems further enhances production quality. This creates strong opportunities for companies to offer customized solutions to large-scale food processors worldwide.

Key Challenges

Rising Regulatory Scrutiny on Synthetic Additives

Stringent regulations on the use of synthetic additives pose a challenge for manufacturers. Growing health concerns and shifting consumer preferences are pushing companies to reduce or replace synthetic ingredients. Compliance with global safety standards increases production complexity and costs. Delays in regulatory approvals for new formulations can slow market entry. This pressure is leading many manufacturers to invest in reformulation and natural alternatives, which may not offer the same performance or cost advantages as synthetic agents.

Fluctuating Raw Material Availability and Costs

Raw material price volatility and supply chain disruptions affect the stability of production costs. Sourcing minerals like silicon dioxide and magnesium carbonate at consistent quality and cost remains a key concern. Weather fluctuations and logistics constraints further strain supply chains, particularly in developing markets. Rising operational costs can reduce profit margins for manufacturers and increase prices for end-users. Ensuring reliable sourcing and efficient supply chain management is essential to address this challenge effectively.

Regional Analysis

North America

North America leads the Food Anti-Caking Agents Market with a 33% share, supported by high consumption of processed and convenience foods. Strong regulatory frameworks and advanced food processing technologies drive adoption across multiple segments such as seasoning blends, dairy powders, and bakery mixes. Major food manufacturers invest in innovative moisture control solutions to meet quality standards. Increasing consumer demand for clean-label and natural ingredients also accelerates product diversification. The U.S. remains the largest contributor in this region, with strong market penetration in large-scale food processing industries.

Europe

Europe holds a 29% share of the Food Anti-Caking Agents Market, driven by rising demand for premium and clean-label products. Strict EU regulations ensure the use of approved and safe additives in food manufacturing. High adoption in bakery, confectionery, and salt processing industries supports market growth. Key manufacturers focus on natural formulations to meet consumer preferences and regulatory guidelines. Germany, France, and the U.K. are major markets with strong R&D investments in food additive technologies, ensuring steady expansion in both mature and emerging product categories.

Asia Pacific

Asia Pacific accounts for a 24% market share and is the fastest-growing region in the Food Anti-Caking Agents Market. Rapid urbanization, rising disposable incomes, and increasing demand for packaged food drive significant growth. Expanding food processing industries in China, India, and Japan create strong opportunities for suppliers. The region benefits from large-scale seasoning and dairy product consumption, boosting the use of anti-caking agents. Manufacturers are investing in cost-effective and scalable solutions to meet demand from both domestic and export-oriented food sectors.

Latin America

Latin America represents an 8% market share, supported by growing processed food demand and expanding retail channels. Countries like Brazil and Mexico are key contributors due to their strong food and beverage industries. Rising adoption of packaged seasoning mixes and instant products drives product penetration. The region is witnessing increased investment in food processing capacity and technological upgrades. However, limited regulatory harmonization across countries slightly slows down product standardization. Despite this, steady economic growth and changing consumption patterns continue to support market expansion.

Middle East & Africa

The Middle East & Africa region holds a 6% share of the Food Anti-Caking Agents Market. The market is expanding due to rising demand for packaged and fortified foods in urban areas. Countries such as Saudi Arabia, the UAE, and South Africa lead adoption with growing seasoning, bakery, and beverage industries. The region is also witnessing increased import of processed foods, driving the need for moisture control additives. Infrastructure development in food manufacturing and government support for food security are further enhancing market potential across this region.

Market Segmentations:

By Type:

- Silicon Dioxide

- Calcium Silicate

By Source:

By Application:

- Salt and Seasonings

- Bakery Products

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Food Anti-Caking Agents Market is highly competitive, with key players including Kao Corporation, PPG Industries, Inc., Univar Solutions Inc., IMCD N.V., Evonik Industries AG, Brenntag AG, Silcona GmbH & Co. KG, Huber Engineered Materials (J.M. Huber Corporation), Cargill, Incorporated, and Solvay S.A. The Food Anti-Caking Agents Market is characterized by strong competition and continuous innovation. Companies are focusing on developing advanced formulations that improve moisture absorption, flowability, and product stability. Strategic expansion through mergers, acquisitions, and distribution partnerships is helping manufacturers strengthen their global footprint. There is a growing shift toward natural and clean-label solutions to meet changing consumer preferences and regulatory demands. Many players are investing in R&D to enhance product performance for applications such as seasoning blends, dairy powders, and bakery mixes. Sustainable sourcing practices and technological upgrades are also key priorities, driving product differentiation and market leadership.

Key Player Analysis

- Kao Corporation

- PPG Industries, Inc.

- Univar Solutions Inc.

- IMCD N.V.

- Evonik Industries AG

- Brenntag AG

- Silcona GmbH & Co. KG

- Huber Engineered Materials (J.M. Huber Corporation)

- Cargill, Incorporated

- Solvay S.A.

Recent Developments

- In May 2025, GitHub introduced Agent Mode for GitHub Copilot, enhancing the AI-powered coding assistant’s ability to independently iterate on code, identify errors, and implement fixes. This upgrade allows Copilot to interpret high-level requests, generate code across multiple files, and debug its output with minimal human intervention.

- In September 2024, IBM Corporation partnered with Salesforce, inc., to offer AI agents and tools that organizations can implement in their own IT infrastructures, utilizing their specific data while maintaining rigorous oversight of their systems. Through the integration of Agentforce, Salesforce, Inc.’s collection of autonomous agents, with the functionalities from IBM Corporation’s WatsonX, businesses aim to empower customers by leveraging agents’ strength in their daily applications.

- In September 2024, Salesforce and Google Cloud announced the partnership in order to create Salesforce Agentforce Agents. This will allow consumers to deploy autonomous agents that can take action and seamlessly work with the apps utilized by consumers every day.

- In July 2024, BRYTER, an AI workflow automation provider, launched AI Agents, a new product suite, and major updates to its no-code platform. Utilizing specialized trained AI, BRYTER’s AI Agents assist law firms and legal departments in handling their tasks’ repetitive and laborious aspects.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Type, Source, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for natural and clean-label anti-caking agents will continue to rise.

- Manufacturers will focus on sustainable sourcing and eco-friendly production.

- Technological innovation will improve moisture control and flowability.

- Asia Pacific will remain the fastest-growing regional market.

- Strategic partnerships and acquisitions will increase global distribution strength.

- Clean-label trends will push reformulation of synthetic additives.

- New applications in functional foods and beverages will expand market scope.

- Advanced coating and drying technologies will enhance product performance.

- Regulatory frameworks will encourage product standardization and safety compliance.

- Customization for specific food categories will boost product differentiation.