Market Overview

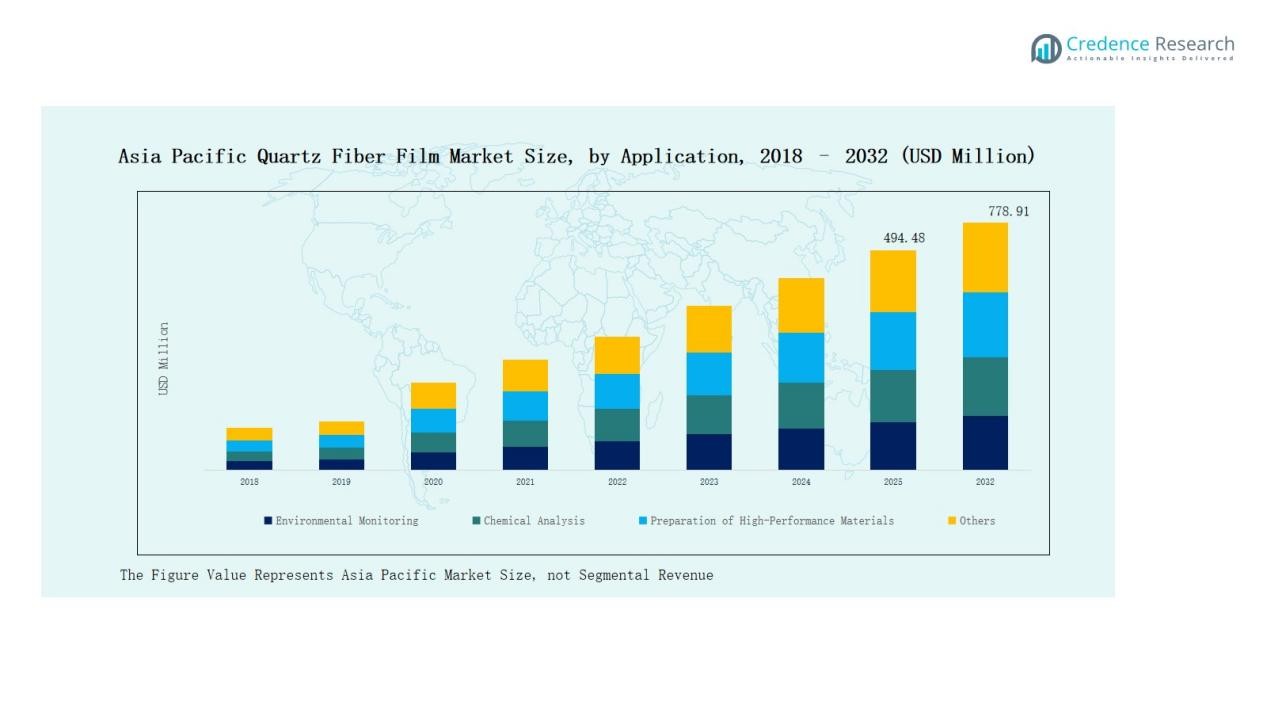

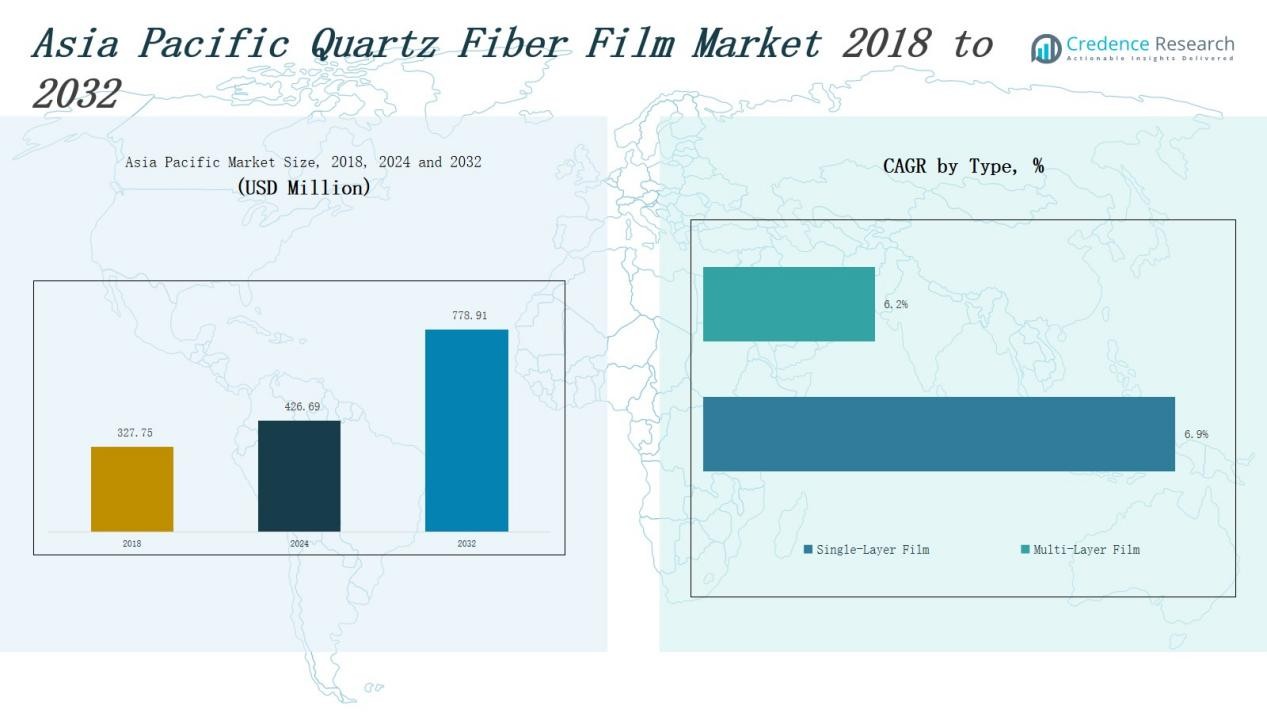

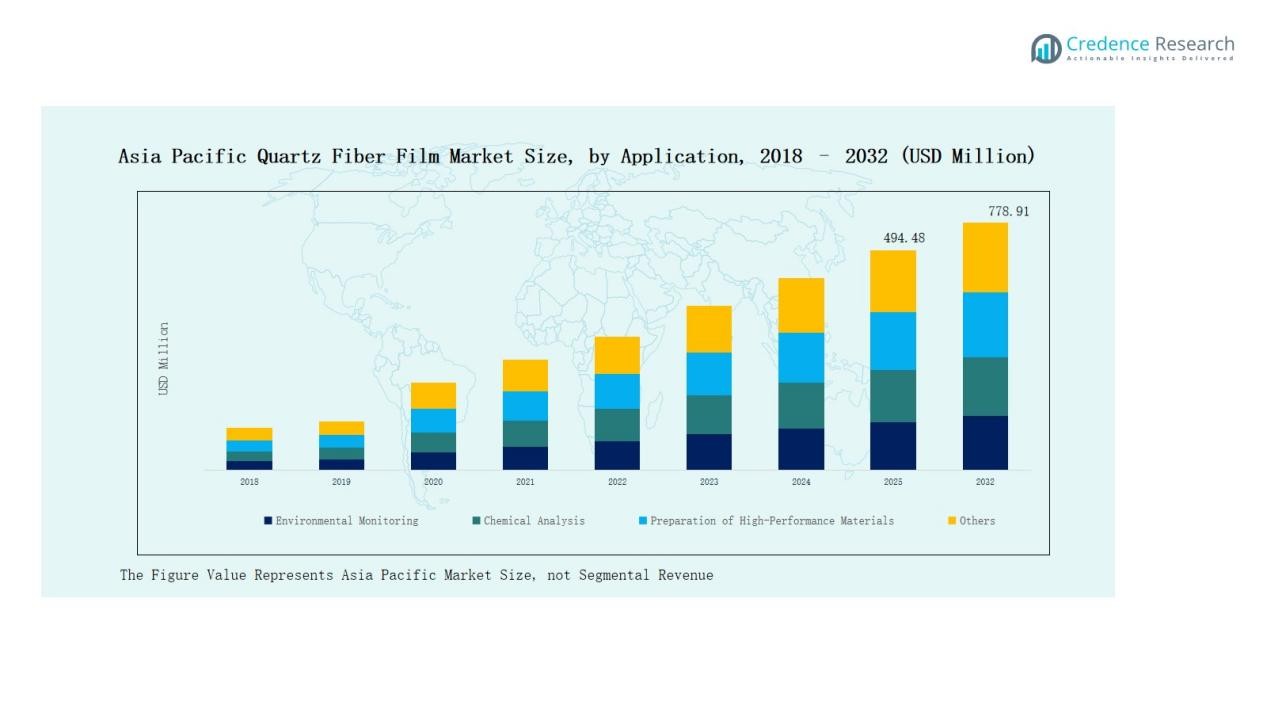

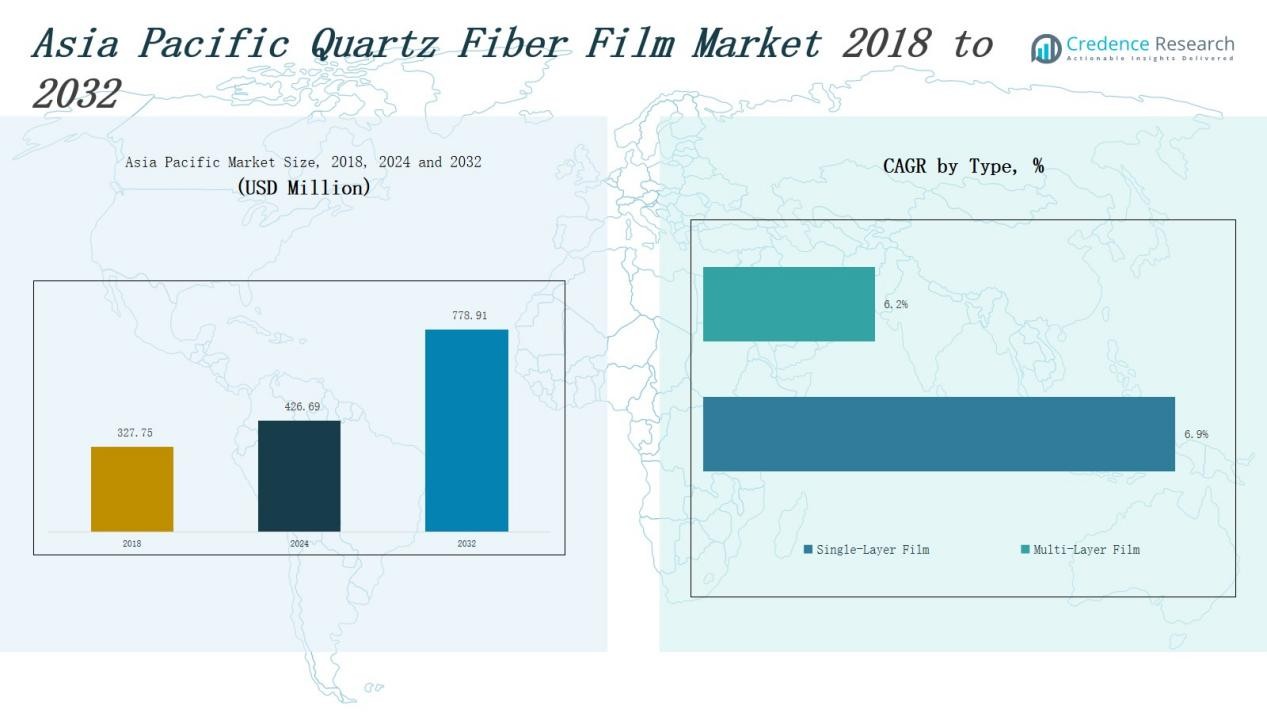

The Asia Pacific Quartz Fiber Film Market size was valued at USD 327.75 million in 2018, increased to USD 426.69 million in 2024, and is projected to reach USD 778.91 million by 2032, growing at a CAGR of 7.77%.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Asia Pacific Quartz Fiber Film Market Size 2024 |

USD 426.69 Million |

| Asia Pacific Quartz Fiber Film Market, CAGR |

7.77% |

| Asia Pacific Quartz Fiber Film Market Size 2032 |

USD 778.91 Million |

The Asia Pacific Quartz Fiber Film Market features key players such as Cytiva, GVS Life Sciences, Hubei Feilihua Quartz Glass, Merck Millipore, Pall Corporation, QSIL Group, Saint-Gobain Quartz, Feilihua, Munktell Filter, and Zhongtian Junda Fiberglass Products. These companies compete through innovation, product quality, and expansion across semiconductor, optical, and environmental applications. Global leaders focus on advanced manufacturing and high-purity material development, while regional firms strengthen domestic production capacity and cost efficiency. China remains the leading region, commanding 39% of the market share in 2024, supported by its robust electronics industry and large-scale manufacturing infrastructure.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Asia Pacific Quartz Fiber Film Market was valued at USD 327.75 million in 2018, reached USD 426.69 million in 2024, and will hit USD 778.91 million by 2032, growing at 7.77%.

- China led the region with a 39% market share in 2024, supported by strong semiconductor manufacturing, large-scale production, and rising demand in environmental monitoring and electronics.

- The Single-Layer Film segment dominated with a 58.2% share, while Multi-Layer Films gained traction for high-performance composites and semiconductor applications across Japan and South Korea.

- The Environmental Monitoring segment held a 32.4% share, followed by Chemical Analysis at 29.7% and Preparation of High-Performance Materials at 25.6%, showing strong industrial diversification.

- Key players include Cytiva, GVS Life Sciences, Hubei Feilihua Quartz Glass, Merck Millipore, Pall Corporation, QSIL Group, Saint-Gobain Quartz, Feilihua, Munktell Filter, and Zhongtian Junda Fiberglass Products.

Market Segment Insights

By Type

The Single-Layer Film segment dominated the Asia Pacific Quartz Fiber Film Market with a 58.2% share in 2024. Its high purity, heat resistance, and uniform thickness make it ideal for filtration, insulation, and optical applications. The Multi-Layer Film segment, holding 41.8%, is expanding steadily due to its superior mechanical strength, dimensional stability, and suitability for high-performance composites and semiconductor manufacturing across China, Japan, and South Korea.

- For instance, Shin-Etsu Chemical began producing single-layer quartz fiber films optimized for aerospace insulation panels at its Gunma, Japan plant.

By Application

The Environmental Monitoring segment led the market with a 32.4% share in 2024, driven by increasing pollution control and air quality initiatives. The Chemical Analysis segment followed with 29.7%, supported by laboratory and material testing activities. The Preparation of High-Performance Materials segment, at 25.6%, is the fastest-growing category with a projected CAGR of 8.12% through 2032. Others, including research and nanotechnology, contributed 12.3%, reflecting ongoing innovation in advanced material science.

- For instance, Shimadzu Corporation launched the Nexis GC-2030 Plus, a high-sensitivity gas chromatograph designed for trace-level chemical identification across environmental and industrial labs.

Key Growth Driver

Expanding Electronics and Semiconductor Manufacturing

The rapid expansion of the electronics and semiconductor industries across China, Japan, and South Korea drives strong demand for quartz fiber films. These films are essential in microelectronic fabrication and high-temperature insulation due to their purity and thermal stability. Rising investments in chip manufacturing facilities and cleanroom applications are further accelerating adoption. Government-backed industrial initiatives and technological advancements in substrate materials continue to strengthen the region’s production capabilities, reinforcing market growth momentum through 2032.

Rising Demand for High-Performance Materials

The increasing use of quartz fiber films in aerospace, optical devices, and composite materials supports steady market expansion. Their mechanical strength, low dielectric constant, and resistance to extreme environments make them ideal for high-performance engineering applications. The surge in lightweight material innovation, coupled with growing R&D in advanced composites, enhances regional production. Manufacturers in Japan and China are scaling production capacity to cater to the growing need for durable, high-purity quartz materials.

- For instance, quartz fiber silicone composites have been applied to aircraft fuselage, wings, and aero-engine components, significantly reducing weight while maintaining structural strength and providing excellent resistance to high temperatures and abrasion.

Environmental Monitoring and Analytical Applications

The growing emphasis on pollution control, air sampling, and environmental safety significantly boosts the quartz fiber film market. These films provide superior filtration precision and thermal resistance, making them ideal for analytical instruments. Expanding regulatory frameworks and investments in air quality monitoring systems across Asia Pacific are strengthening demand. Research laboratories and environmental agencies increasingly rely on quartz-based filters to ensure accurate and reliable measurement under extreme temperature and chemical exposure.

- For instance, Cipla’s deployment of quartz filters in high-temperature air sampling systems demonstrates their effectiveness in measuring particulate matter in harsh industrial environments.

Key Trend & Opportunity

Shift Toward Multi-Layer Film Technologies

Manufacturers are shifting toward multi-layer quartz fiber films that offer enhanced strength, dimensional stability, and performance in semiconductor and aerospace applications. This transition supports efficiency in high-stress environments and allows broader usage in optical and electronic systems. Continuous innovation in lamination and bonding techniques is enabling thinner, more flexible, and durable films. The rising focus on advanced multilayer composites presents new opportunities for regional producers to differentiate through precision engineering.

- For instance, Saint-Gobain Quartz expanded its multilayer quartz fabric line for precision optical systems, achieving enhanced modulus and dielectric uniformity suited for extreme ultraviolet (EUV) lithography environments.

Integration of Automation and Precision Manufacturing

Automation and precision engineering are transforming the quartz fiber film manufacturing process. Companies are adopting automated coating, inspection, and curing systems to improve quality consistency and reduce waste. This trend enhances production scalability and supports compliance with stringent purity standards required in electronics and laboratory applications. The integration of smart manufacturing technologies and digital monitoring tools provides opportunities for higher output, cost efficiency, and customized product development across the Asia Pacific region.

- For instance, advanced Automated Fiber Placement (AFP) technology is employed to precisely place composite fibers with real-time digital monitoring, enhancing product quality and reducing defects.

Key Challenge

High Production and Processing Costs

Quartz fiber film production requires high-purity raw materials, complex fabrication methods, and strict quality control, which increase manufacturing costs. Advanced equipment and precise thermal treatment add further capital burdens for new entrants. Limited regional suppliers of ultra-pure quartz materials also contribute to cost pressures. These high production costs pose challenges for manufacturers seeking price competitiveness, especially in markets dominated by cost-sensitive applications like environmental testing and industrial filtration.

Supply Chain Dependence and Material Sourcing Issues

The market faces supply chain vulnerabilities due to its reliance on specialized quartz raw materials and limited global suppliers. Disruptions in raw material availability or geopolitical tensions can impact production timelines. Import dependence for precision components and equipment increases exposure to logistical risks. Manufacturers in emerging economies are focusing on local sourcing strategies and vertical integration to reduce dependency, but achieving consistency in purity and quality remains a key obstacle.

Technical Limitations in Large-Scale Applications

Despite their superior properties, quartz fiber films face technical challenges in scaling for large industrial applications. Their brittleness, handling complexity, and limited thickness uniformity restrict broader adoption in flexible systems. Ensuring consistent film performance under high mechanical or thermal stress remains difficult. Ongoing R&D focuses on improving flexibility, bonding strength, and adaptability, but widespread commercialization across sectors like flexible electronics and advanced composites still requires significant material innovation.

Regional Analysis

Regional Analysis

China

China held the largest share of 39% in the Asia Pacific Quartz Fiber Film Market in 2024. Strong industrial infrastructure and extensive production of semiconductors and optical materials drive regional leadership. It benefits from large-scale manufacturing capacities, lower production costs, and high domestic consumption. The government’s focus on technological advancement and clean energy applications supports the use of high-purity quartz materials. Rapid expansion in environmental monitoring and electronics sectors strengthens growth momentum. It remains the core supplier base for major global and regional manufacturers.

Japan

Japan accounted for 23% of the regional market share in 2024. Its leadership in electronics and precision manufacturing supports consistent demand for quartz fiber films. Japanese producers emphasize quality, purity, and advanced coating technologies for optical and analytical applications. The market benefits from investments in semiconductor innovation and aerospace material development. Growing R&D in nanomaterials and laboratory equipment enhances domestic production. It continues to be a key exporter of premium-grade quartz films to global markets.

South Korea

South Korea represented 16% of the market share in 2024. Expanding semiconductor fabrication facilities and strong government support for advanced materials sustain market demand. Local producers focus on developing films for microelectronics and high-temperature insulation. The integration of automation technologies has improved production efficiency. Increasing exports to Southeast Asia and North America strengthen the country’s competitive edge. It continues to attract investments aimed at expanding high-purity quartz processing capabilities.

India

India captured 10% of the regional market share in 2024. Rapid industrialization and government-backed environmental monitoring programs drive product adoption. The growing presence of research institutions and manufacturing hubs supports domestic demand. Expanding clean energy projects create opportunities for quartz fiber films in insulation and composite applications. The market benefits from increasing imports of advanced materials and manufacturing technologies. It is expected to record the fastest CAGR through 2032, supported by strong policy incentives.

Australia

Australia accounted for 6% of the regional share in 2024. Strong focus on environmental testing, research infrastructure, and clean energy projects supports growth. Demand for high-purity films in analytical and scientific applications is increasing. Local distributors import specialized materials from Japan and China to meet technical standards. The presence of research-based industries strengthens the application of quartz films in advanced testing systems. It continues to emerge as a niche market for high-precision laboratory use.

Southeast Asia

Southeast Asia held 6% of the market share in 2024. Rapid economic development and growing industrial output in countries like Vietnam and Malaysia are driving adoption. The expansion of electronics and semiconductor assembly units boosts product demand. Local industries are adopting high-performance materials to improve efficiency and sustainability. Rising investments in pollution control and clean air programs increase usage in environmental analysis. It remains an emerging growth hub within the regional market ecosystem.

Market Segmentations:

By Type

- Single-Layer Film

- Multi-Layer Film

By Application

- Environmental Monitoring

- Chemical Analysis

- Preparation of High-Performance Materials

- Others

By Region

- China

- Japan

- South Korea

- India

- Australia

- Southeast Asia

Competitive Landscape

The Asia Pacific Quartz Fiber Film Market is moderately consolidated, with competition driven by technological capability, product quality, and regional presence. Leading companies such as Cytiva, GVS Life Sciences, Hubei Feilihua Quartz Glass, Merck Millipore, Pall Corporation, QSIL Group, and Saint-Gobain Quartz dominate through strong material innovation and advanced manufacturing processes. Local players like Feilihua and Zhongtian Junda Fiberglass Products strengthen domestic supply chains, focusing on cost efficiency and high-volume production. Global manufacturers emphasize purity, heat resistance, and structural consistency to meet stringent standards in electronics, aerospace, and laboratory applications. Strategic collaborations with research institutes and government-supported material innovation programs are shaping long-term competitiveness. It is witnessing a gradual shift toward automation, sustainability, and high-performance multi-layer film technologies, reinforcing the dominance of companies investing in R&D and process optimization across China, Japan, and South Korea.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Players

- Cytiva

- Feilihua

- GVS Life Sciences

- Hubei Feilihua Quartz Glass

- Merck Millipore

- Munktell Filter

- Pall Corporation

- QSIL Group

- Saint-Gobain Quartz

- Zhongtian Junda Fiberglass Products

Recent Developments

- In September 2024, Changfei Quartz introduced new meter-level synthetic quartz products featuring low stress and high transparency to enhance performance in advanced optical and semiconductor applications.

- In 2024, Teijin announced a strategic partnership with Hilleman Laboratories to expand business in Asia-Pacific, including use of low-dielectric quartz fiber prepreg.

- In 2024, Momentive Technologies merged with a competitor to enhance its quartz / specialty materials position.

Report Coverage

The research report offers an in-depth analysis based on Type, Application and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for high-purity quartz fiber films will increase across electronics and semiconductor industries.

- China will continue leading production, supported by strong domestic manufacturing capacity.

- Japan and South Korea will focus on advanced film technologies for optical and aerospace uses.

- India will emerge as a fast-growing market driven by environmental monitoring and research activities.

- Multi-layer film adoption will expand due to superior strength and thermal performance.

- Automation in production will enhance precision, quality control, and cost efficiency.

- Growing investments in clean energy and composite materials will boost film applications.

- Partnerships between manufacturers and research institutes will strengthen innovation pipelines.

- Regional players will focus on expanding export capacity and building global supply networks.

- Sustainability and material recycling initiatives will shape future product development strategies.

Regional Analysis

Regional Analysis