Market Overview

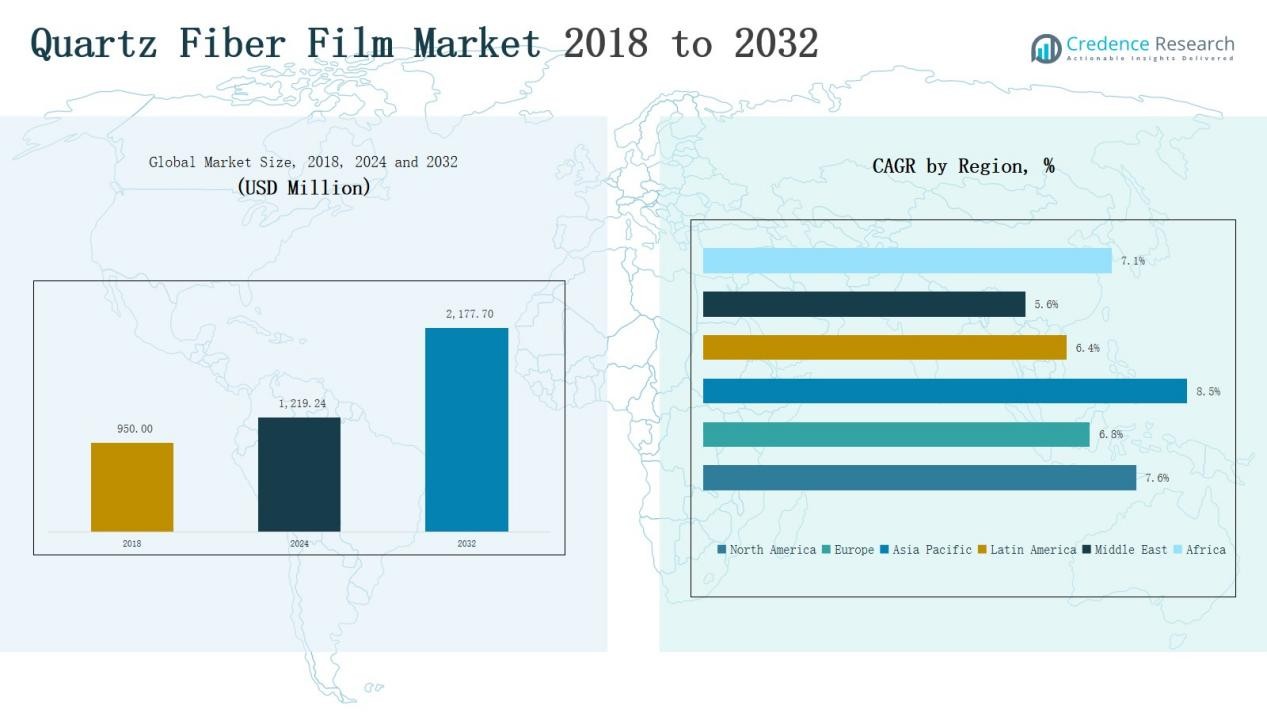

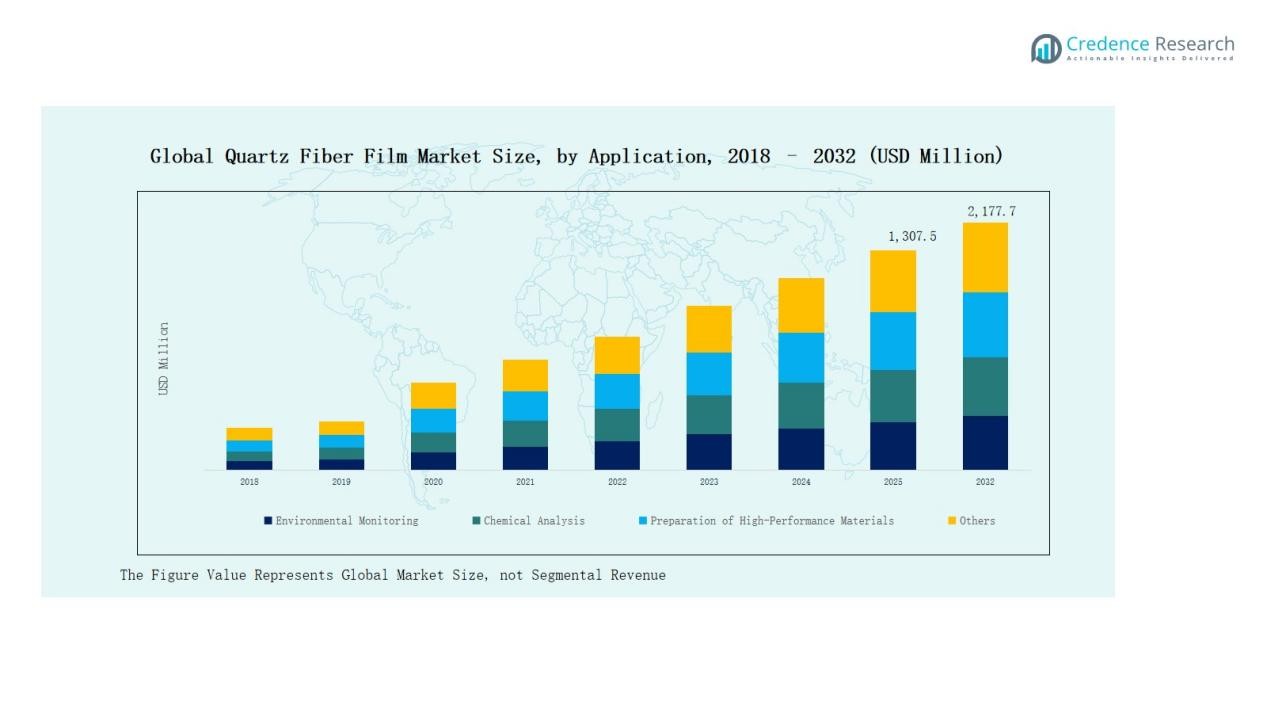

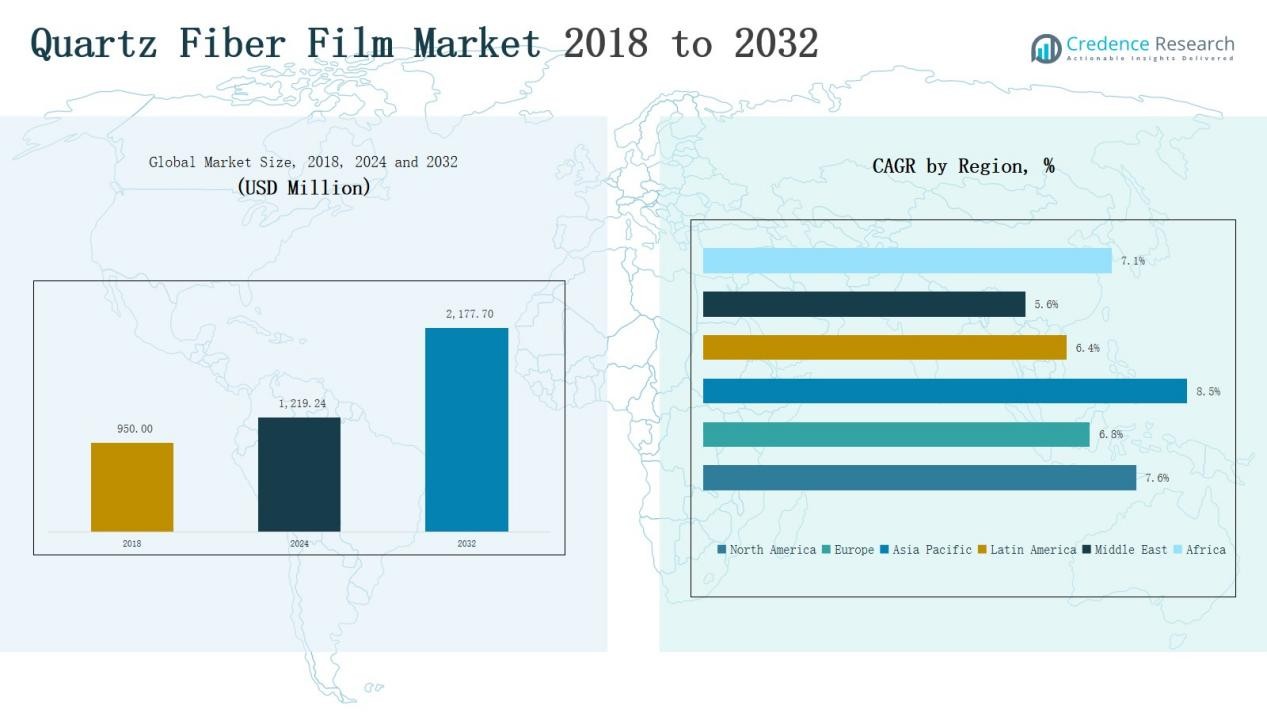

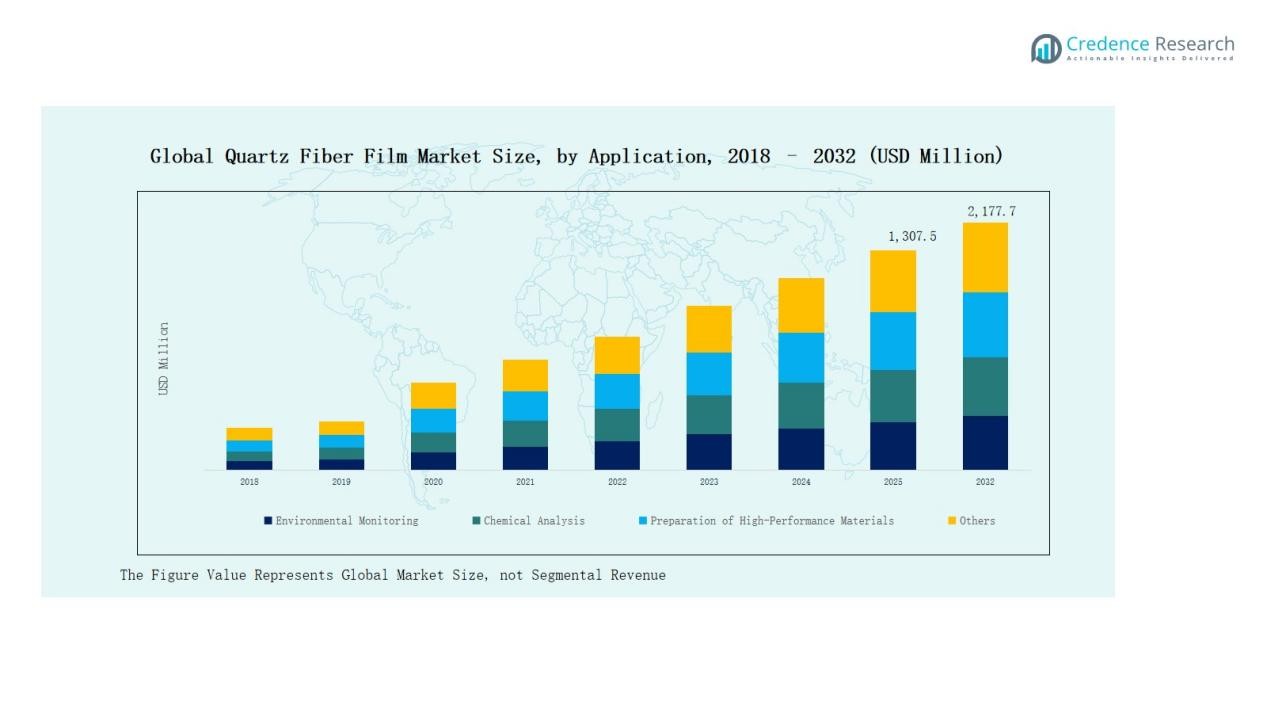

The Global Quartz Fiber Film Market size was valued at USD 950.00 million in 2018, increased to USD 1,219.24 million in 2024, and is anticipated to reach USD 2,177.70 million by 2032, growing at a CAGR of 7.56% during the forecast period (2024–2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Quartz Fiber Film Market Size 2024 |

USD 1,219.24 Million |

| Quartz Fiber Film Market, CAGR |

7.56% |

| Quartz Fiber Film Market Size 2032 |

USD 2,177.70 Million |

The Quartz Fiber Film Market is led by key players such as Cytiva, GVS Life Sciences, Hitex Composites, Hubei Feilihua Quartz Glass, JPS Composite Materials, Merck Millipore, Munktell Filter, Pall Corporation, QSIL Group, Saint-Gobain Quartz, Sterlitech, and Tosoh Corporation. These companies focus on product innovation, high-purity material development, and process efficiency to strengthen their global footprint. Strategic investments in advanced manufacturing and collaborations with research institutions support sustained competitiveness. Asia Pacific emerged as the leading regional market in 2024, accounting for 35.0% of global revenue, driven by strong industrial growth, expanding electronics manufacturing, and robust demand for high-performance materials across China, Japan, and South Korea.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Global Quartz Fiber Film Market grew from USD 950.00 million in 2018 to USD 1,219.24 million in 2024, projected to reach USD 2,177.70 million by 2032 at a 56% CAGR.

- Asia Pacific led the market in 2024 with a 0% share, driven by expanding electronics manufacturing and strong demand in China, Japan, and South Korea.

- The Multi-Layer Film type dominated with a 4% share in 2024, supported by superior durability, insulation, and heat resistance for aerospace and electronics applications.

- The Chemical Analysis application segment held a 7% share in 2024, fueled by rising use in laboratory filtration and analytical testing.

- Major players such as Cytiva, GVS Life Sciences, Merck Millipore, Pall Corporation, QSIL Group, and Saint-Gobain Quartz focus on innovation, advanced manufacturing, and research collaborations to maintain competitiveness.

Market Segment Insights

By Type

The Quartz Fiber Film Market by type is segmented into Single-Layer Film and Multi-Layer Film. The Multi-Layer Film segment held the dominant market share of 62.4% in 2024, driven by its superior thermal resistance, durability, and high insulation properties. These films are widely adopted in aerospace, electronics, and high-performance material applications. The Single-Layer Film segment continues to gain traction due to lower production costs and growing use in laboratory and optical testing setups.

- For instance, Stanford Advanced Materials (SAM) supplies GP5513 Quartz Fiber Powder used in aerospace and semiconductor applications for its outstanding heat resistance up to 1700℃ and tensile strength of 3600 MPa.

By Application

The Quartz Fiber Film Market by application includes Environmental Monitoring, Chemical Analysis, Preparation of High-Performance Materials, and Others. The Chemical Analysis segment dominated with a 38.7% share in 2024, supported by the increasing demand for high-purity films in laboratory filtration and analytical procedures. The Preparation of High-Performance Materials segment is expected to grow rapidly, driven by rising use in advanced composites and semiconductor manufacturing processes requiring exceptional heat and corrosion resistance.

- For instance, Johnson Test Papers offers quartz fiber filters made from pure quartz micro-fibers that are chemically inert and thermally stable up to 900°C, widely used in trace level determinations and atomic absorption spectroscopy.

Key Growth Drivers

Rising Demand from Electronics and Semiconductor Industries

The Quartz Fiber Film Market is witnessing strong growth due to expanding applications in electronic and semiconductor manufacturing. These films offer exceptional heat resistance, dielectric strength, and stability under extreme environments, making them ideal for insulation and substrate use. The rapid advancement of microelectronics and miniaturized circuit design has further increased demand for quartz-based components. Continuous technological innovation and the adoption of high-performance materials are key factors enhancing market growth within this segment.

- For instance, quartz plates are crucial in semiconductor processes like lithography and etching, where their high optical transparency and resistance to plasma enable precise pattern transfers and material removal, supporting advanced microelectronics production

Expansion of Environmental Monitoring Applications

Increasing emphasis on air and water quality monitoring has fueled the adoption of quartz fiber films in filtration and analytical instruments. Their superior chemical inertness and high purity levels make them suitable for environmental testing and pollutant sampling. Government regulations promoting sustainable monitoring practices and pollution control have accelerated market expansion. The segment’s steady demand from laboratories, industrial analyzers, and environmental agencies continues to strengthen overall growth prospects for quartz fiber films.

- For instance, Agilent Technologies integrated low-impurity quartz fiber substrates into its gas sampling modules to improve particulate collection accuracy in industrial emission analysis.

Advancements in Material Science and Manufacturing

Technological progress in precision manufacturing and material engineering has improved the quality and scalability of quartz fiber films. Enhanced fabrication techniques such as plasma coating, chemical vapor deposition, and high-temperature sintering have enabled better film uniformity and performance consistency. These innovations are reducing production costs while expanding the films’ applicability in aerospace, optics, and advanced materials. The growing focus on lightweight and thermally stable materials continues to support steady long-term market growth.

Key Trends & Opportunities

Integration in High-Performance Composite Materials

A major trend shaping the Quartz Fiber Film Market is its growing integration into high-performance composites. Manufacturers are combining quartz fiber films with resins and polymers to produce lightweight yet durable materials for defense, automotive, and aerospace applications. This trend aligns with global initiatives promoting sustainability through improved energy efficiency and material recyclability. The use of quartz composites enhances structural strength, insulation, and resistance to extreme environments, unlocking new opportunities across emerging industrial sectors.

- For instance, Saint-Gobain Advanced Ceramic Composites supplies Quartzel® quartz fibers used extensively in aerospace radomes, including advanced air-to-air targeting systems for non-civilian aircraft and commercial aircraft Ku band radomes enabling SATCOM WiFi connectivity.

Increasing Research on Optical and Photonic Applications

Ongoing research into optical and photonic technologies presents significant opportunities for quartz fiber films. Their superior transparency and minimal optical loss make them ideal for sensors, imaging devices, and fiber-optic communication systems. The rise of laser-based manufacturing, medical imaging, and precision optics has amplified product relevance. Growing collaboration between research institutions and manufacturers to develop advanced quartz-based materials for photonic circuits and micro-optics is expected to create new market avenues in the coming decade.

- For instance, photonic-crystal fibers developed at the University of Bath have enabled advanced light confinement techniques, enhancing fiber-optic communication and sensing applications.

Key Challenges

High Production and Processing Costs

The manufacturing process for quartz fiber films involves high-temperature melting and precise drawing, which increases operational costs. Specialized equipment and stringent purity standards further elevate production expenses. These cost challenges limit widespread adoption, particularly among small and medium manufacturers. The lack of scalable and energy-efficient fabrication technologies continues to hinder price competitiveness, making cost optimization a key priority for market players aiming to expand their presence in emerging economies.

Limited Raw Material Availability

The Quartz Fiber Film Market faces constraints due to limited availability of high-purity quartz raw materials. Mining and refining processes are capital-intensive and regionally concentrated, leading to supply fluctuations. Dependence on specific geographic sources increases vulnerability to trade disruptions and price volatility. As demand rises from electronics and chemical sectors, ensuring consistent raw material quality and availability remains a critical challenge, pushing manufacturers to explore alternative supply chains and material synthesis methods.

Technical Limitations in Large-Scale Applications

Despite strong potential, quartz fiber films face technical limitations in large-scale or flexible applications. Their inherent brittleness and processing complexity restrict use in applications requiring high flexibility or extensive surface coverage. Integrating quartz films into modern flexible electronics and composite manufacturing demands advanced adaptation techniques. Addressing these mechanical and structural constraints through material modification and hybridization is essential for expanding commercial use and achieving broader industrial acceptance.

Regional Analysis

North America:

The North America Quartz Fiber Film Market was valued at USD 278.35 million in 2018, growing to USD 351.17 million in 2024 and projected to reach USD 627.42 million by 2032, expanding at a CAGR of 7.38%. The region accounted for a 28.8% market share in 2024, driven by strong demand from the aerospace, semiconductor, and defense sectors. High investments in advanced materials research and increasing adoption of quartz-based insulation in high-temperature applications further strengthen regional growth across the United States and Canada.

Europe:

The Europe Quartz Fiber Film Market reached USD 240.35 million in 2018, increased to USD 305.27 million in 2024, and is expected to attain USD 538.73 million by 2032, with a CAGR of 7.35%. Europe captured a 25.0% share in 2024, supported by growing use in environmental monitoring and chemical analysis. The presence of major glass and composite manufacturers in Germany, France, and the UK, coupled with strict environmental compliance standards, continues to drive sustained regional demand.

Asia Pacific:

The Asia Pacific Quartz Fiber Film Market stood at USD 327.75 million in 2018, rising to USD 426.69 million in 2024, and is anticipated to reach USD 778.91 million by 2032, growing at a CAGR of 7.78%. The region dominated with a 35.0% market share in 2024, led by expanding electronics manufacturing in China, Japan, and South Korea. Rapid industrialization, favorable government initiatives, and rising adoption of high-performance materials in semiconductor and optical applications position Asia Pacific as the fastest-growing regional market.

Market Segmentations:

By Type

- Single-Layer Film

- Multi-Layer Film

By Application

- Environmental Monitoring

- Chemical Analysis

- Preparation of High-Performance Materials

- Others

By Region

North America

Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Southeast Asia

- Rest of Asia Pacific

Latin America

- Brazil

- Argentina

- Rest of Latin America

Middle East

- GCC Countries

- Israel

- Turkey

- Rest of Middle East

Africa

- South Africa

- Egypt

- Rest of Africa

Competitive Landscape

The Quartz Fiber Film Market features a moderately consolidated competitive landscape, dominated by key global and regional players focusing on technological innovation and material enhancement. Major companies such as Cytiva, GVS Life Sciences, Hitex Composites, Hubei Feilihua Quartz Glass, JPS Composite Materials, Merck Millipore, Munktell Filter, Pall Corporation, QSIL Group, Saint-Gobain Quartz, Sterlitech, and Tosoh Corporation collectively account for a significant market share. These firms emphasize advanced production processes, product purity, and performance optimization to serve demanding industries such as electronics, aerospace, and environmental monitoring. Strategic collaborations, acquisitions, and capacity expansions are central to strengthening their market position. Increasing research into thin-film processing and hybrid composite applications further intensifies competition. Asia Pacific-based producers are also gaining prominence through cost-effective manufacturing and expanding supply networks. Overall, the competitive environment is defined by continuous innovation, quality assurance, and sustainability-driven production advancements in high-performance quartz materials.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Players

- Cytiva

- GVS Life Sciences

- Hitex Composites

- Hubei Feilihua Quartz Glass

- JPS Composite Materials

- Merck Millipore

- Munktell Filter

- Pall Corporation

- QSIL Group

- Saint-Gobain Quartz

- Sterlitech

- Tosoh Corporation

Recent Developments

- In June 2025, Triumph Composites and Quartz Fiber entered a merger approval process following Owens Corning India’s divestment of its glass reinforcements business, signaling consolidation within advanced composite materials.

- In August 2024, Teijin Group’s subsidiary Renegade Materials Corporation received NCAMP certification for its low-dielectric quartz fiber prepreg, strengthening its position in aerospace-grade composite applications.

- In February 2025, Hexcel announced a new HexPly M51 rapid-curing prepreg for aerospace & automotive composites.

- In October 2025, Rock West Composites delivered radomes using Quartz Btcy1-A/4581 as a material in their panels.

Report Coverage

The research report offers an in-depth analysis based on Type, Application and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for high-purity quartz fiber films will continue rising in semiconductor and electronics manufacturing.

- Increasing adoption of quartz films in optical and photonic devices will support future growth.

- Advancements in multi-layer film design will improve thermal performance and structural stability.

- Expansion of environmental monitoring applications will drive consistent product demand worldwide.

- Manufacturers will focus on cost reduction through automation and energy-efficient production methods.

- Collaborations between research institutions and material companies will accelerate product innovation.

- Growth in aerospace and defense sectors will enhance the use of quartz-based composites.

- Asia Pacific will maintain its dominance due to expanding industrial and technological bases.

- Sustainability and recycling initiatives will influence production processes and material sourcing.

- Integration of quartz fiber films into high-performance composite materials will unlock new market opportunities.