Market Overview

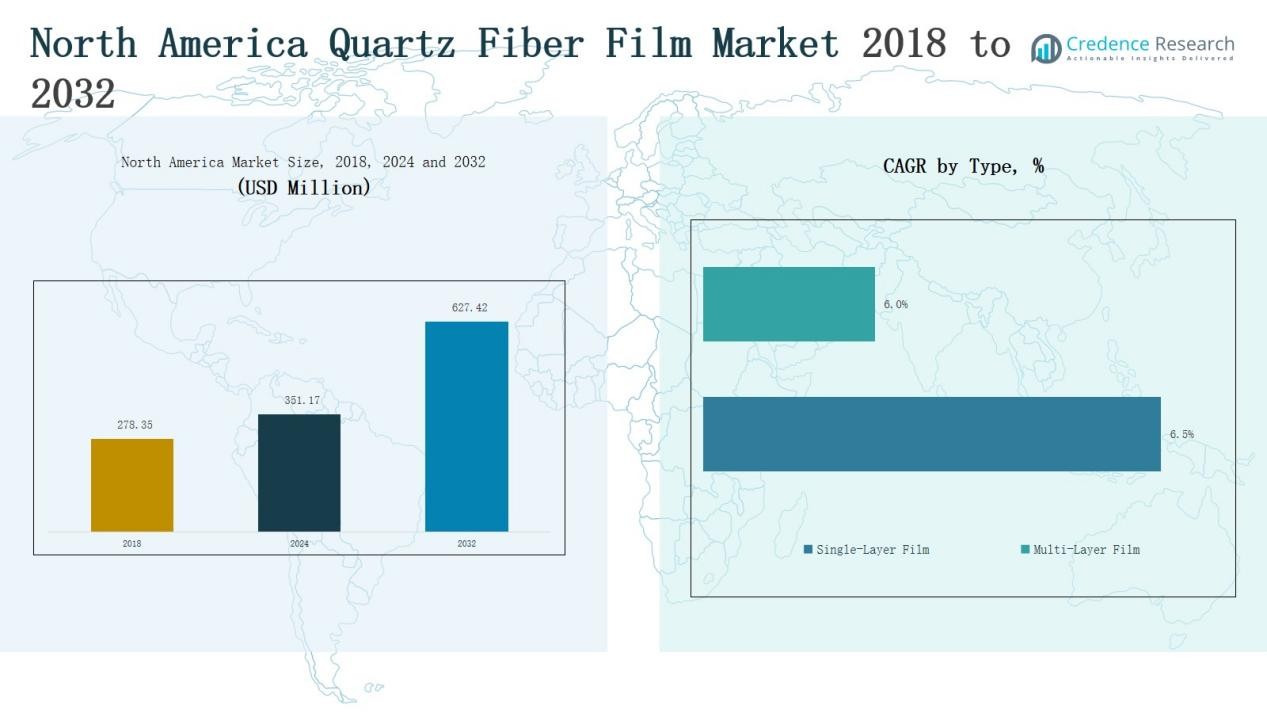

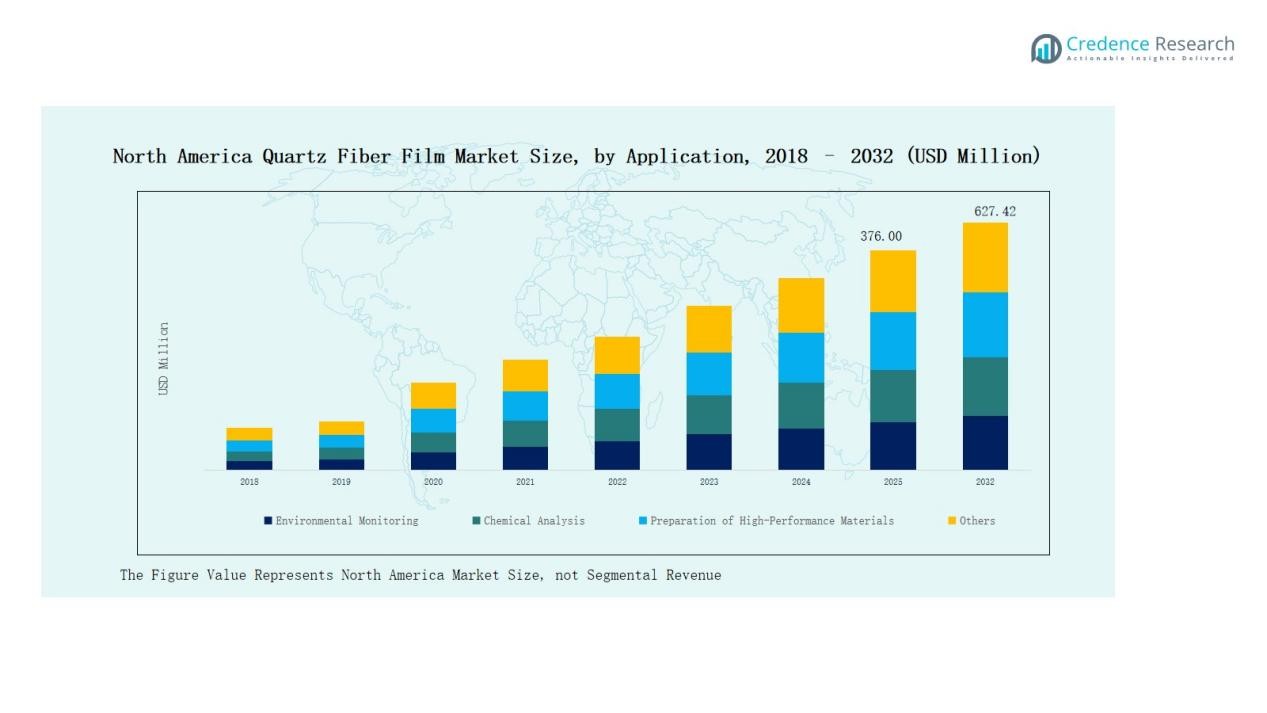

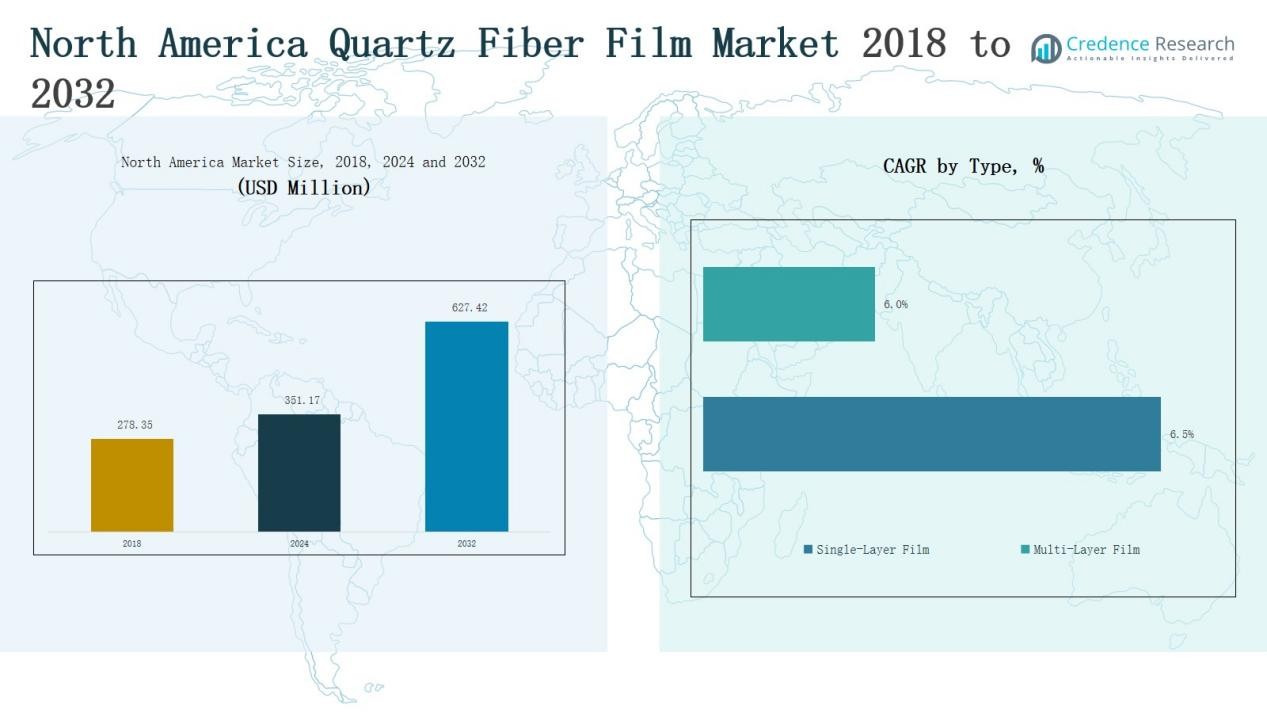

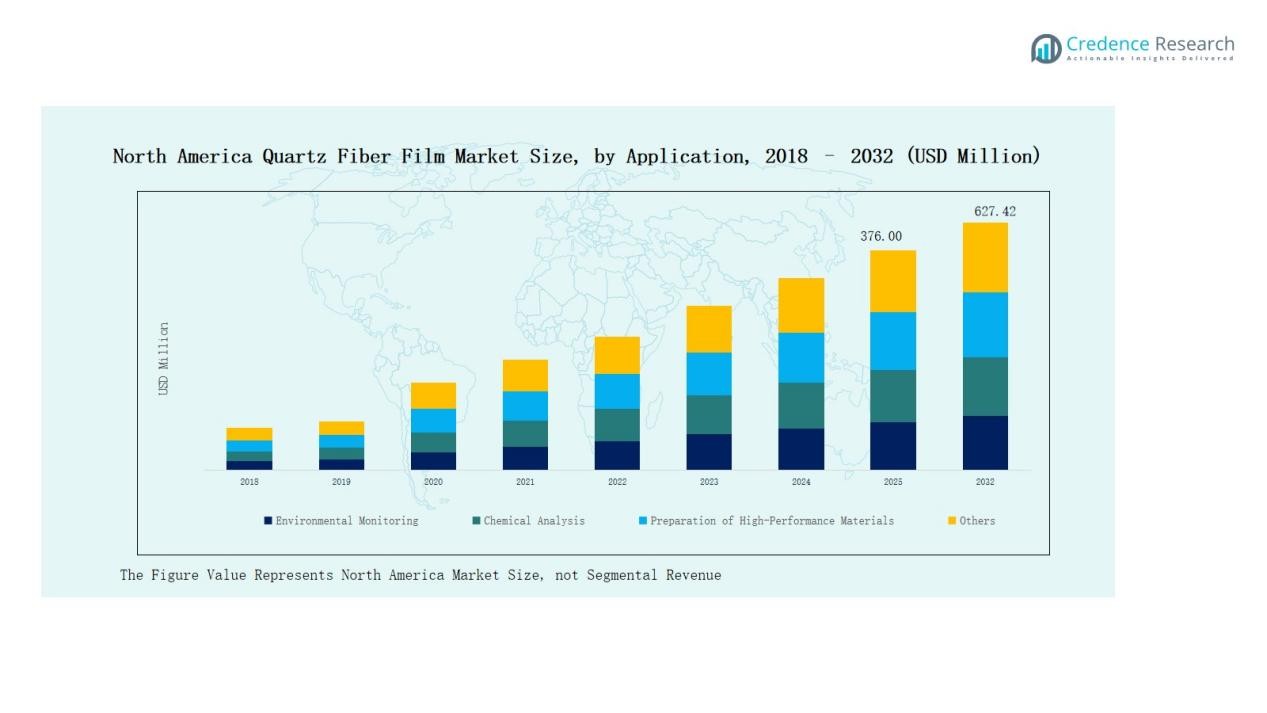

The North America Quartz Fiber Film Market size was valued at USD 278.35 million in 2018, increased to USD 351.17 million in 2024, and is anticipated to reach USD 627.42 million by 2032, growing at a CAGR of 7.62% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| North America Quartz Fiber Film Market Size 2024 |

USD 351.17 Million |

| North America Quartz Fiber Film Market, CAGR |

7.62% |

| North America Quartz Fiber Film Market Size 2032 |

USD 627.42 Million |

The North America Quartz Fiber Film Market is led by major players such as Saint-Gobain Quartz, 3M, Pall Corporation, QSIL Group, Sterlitech Corporation, Tosoh Corporation, AGY Holding Corp., and Aerospace Composite Products (ACP). These companies dominate through advanced manufacturing capabilities, high material purity, and strong distribution networks. They focus on research-driven innovation and sustainable production to meet rising demand from semiconductor, analytical, and environmental sectors. The United States remains the leading regional market, commanding 61% of the total share in 2024, supported by its robust semiconductor base, R&D strength, and expanding high-tech manufacturing ecosystem.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The North America Quartz Fiber Film Market grew from USD 278.35 million in 2018 to USD 351.17 million in 2024 and is expected to reach USD 627.42 million by 2032, expanding at a 62% CAGR.

- The Single-Layer Film segment led with a 4% share in 2024, driven by its superior optical clarity, uniformity, and high thermal stability across semiconductor and analytical applications.

- The Environmental Monitoring segment dominated applications with a 8% share in 2024, supported by strict environmental regulations and advanced air and water testing needs.

- The United States remained the top regional market with a 61% share in 2024, backed by strong semiconductor manufacturing, R&D infrastructure, and industrial innovation.

- Key players including Saint-Gobain Quartz, 3M, Pall Corporation, QSIL Group, Sterlitech, Tosoh Corporation, AGY Holding Corp., and Aerospace Composite Products (ACP) drive competition through technology, material quality, and sustainable production.

Market Segment Insights

By Type

The Single-Layer Film segment led the North America Quartz Fiber Film Market in 2024 with a 63.4% share. Its dominance is driven by high optical clarity, thermal stability, and uniform structure, which suit semiconductor and analytical applications. Growing electronics manufacturing and environmental testing activities across the U.S. and Canada further support demand. The Multi-Layer Film segment, with a 36.6% share, gains traction due to enhanced strength, improved insulation, and superior barrier performance for industrial and scientific uses.

- For instance, Saint-Gobain Quartz expanded its Massachusetts facility to increase output of high-purity single-layer quartz films used in semiconductor wafer inspection systems.

By Application

The Environmental Monitoring segment held the largest share of 34.8% in 2024, supported by stringent environmental regulations and increased use in air and water testing. The Chemical Analysis segment followed with 28.5%, fueled by rising adoption in filtration and spectroscopy. Meanwhile, the Preparation of High-Performance Materials segment accounted for 22.6%, driven by use in semiconductor and composite production. The Others segment, at 14.1%, includes optical and research-based laboratory applications.

- For instance, Thermo Fisher Scientific introduced its iCAP PRO Series ICP-OES systems to enhance multi-element analysis in environmental laboratories.

Market Overview

Key Growth Drivers

Rising Demand from Semiconductor and Electronics Sector

The rapid expansion of the semiconductor and electronics industry drives strong demand for quartz fiber films in North America. These films offer exceptional thermal stability, purity, and dielectric strength, making them ideal for wafer processing and insulation layers. Increased investments in chip fabrication facilities across the U.S. and Canada further support adoption. Government incentives for semiconductor manufacturing and growing reliance on advanced electronic components strengthen long-term market growth and material innovation.

For instance, government incentives in states like California and Texas have supported expansions of semiconductor plants, further driving quartz fiber adoption in electrical insulation applications.

Increasing Adoption in Environmental and Analytical Applications

Quartz fiber films are widely used in environmental monitoring and analytical testing due to their precision and high-temperature resistance. The rise in air quality assessment, emission testing, and laboratory research activities has boosted demand across industrial and academic institutions. Regulatory agencies in North America promote stricter environmental standards, which encourage the use of high-purity quartz media. Expanding R&D initiatives focused on accurate sampling and reduced contamination risks continue to enhance segment performance.

- For instance, Pall Corporation supplied high-purity quartz fiber filters for U.S. EPA PM2.5 air monitoring programs to enhance particulate collection accuracy.

Technological Advancements in Material Processing

Continuous improvements in film fabrication technologies enhance the performance and reliability of quartz fiber products. Innovations such as precision layering, plasma surface treatments, and automated quality control have improved film uniformity and mechanical strength. Manufacturers in North America are investing in process automation and cleanroom production environments to meet stringent industry standards. These advancements help reduce production costs, ensure consistency, and expand application areas, particularly in high-end electronics and aerospace manufacturing.

Key Trends & Opportunities

Growth of Sustainable and Eco-Friendly Manufacturing Practices

Sustainability has become a strategic priority among North American manufacturers. Companies are adopting eco-friendly production techniques, including energy-efficient furnaces and waste reduction systems. Demand for recyclable and long-lasting materials encourages the development of environmentally responsible quartz fiber films. This shift supports compliance with regional sustainability policies and aligns with the growing preference for green materials in industrial and research applications, creating new opportunities for responsible market expansion.

- For instance, Boeing sourced 39% of its electricity from renewable energy in 2023, aiming for 100% by 2030 to reduce carbon emissions across its manufacturing processes.

Rising Investment in Advanced Research and Product Customization

Increasing funding for material research offers new opportunities for customized quartz fiber films tailored to specific industrial and analytical needs. Research institutions and private firms collaborate to develop films with higher temperature thresholds, lower impurity levels, and improved mechanical performance. Demand for application-specific designs—especially in photonics, aerospace, and microelectronics—continues to rise. These developments enhance competitive differentiation and attract new clients seeking precision-engineered materials.

- For instance, Heraeus Conamic partnered with Fraunhofer Institute for Ceramic Technologies and Systems (IKTS) to refine ultra‑pure fused silica films for high‑temperature optical applications.

Key Challenges

High Production Costs and Limited Economies of Scale

Quartz fiber film manufacturing involves high-purity materials and advanced processing techniques, which raise production costs. The requirement for specialized furnaces, cleanroom environments, and strict quality control limits scalability. Smaller manufacturers face challenges competing with large, established producers. High capital investment and limited raw material availability also restrict new market entrants, affecting pricing flexibility and supply chain stability in the region.

Technical Barriers and Product Complexity

Producing defect-free quartz fiber films demands precision, expertise, and advanced processing capabilities. Maintaining consistent thickness, transparency, and strength across large batches remains technically challenging. Any deviation during manufacturing can compromise film performance in sensitive applications like semiconductors and spectroscopy. These technical hurdles slow down innovation and increase rejection rates, limiting operational efficiency for smaller or less technologically equipped manufacturers.

Competition from Alternative High-Performance Materials

The presence of competing materials, such as advanced ceramics and polymer-based films, poses a growing challenge. These alternatives often offer lower production costs and easier scalability, attracting price-sensitive customers. Industries seeking lightweight or cost-efficient options may shift away from quartz fiber films. To counter this, manufacturers must focus on differentiating through superior quality, longevity, and precision performance, ensuring that quartz remains the preferred choice for demanding applications.

Regional Analysis

United States

The North America Quartz Fiber Film Market is primarily driven by the United States, holding 61% of the regional share in 2024. The country leads due to its strong semiconductor manufacturing base, advanced R&D capabilities, and high adoption of analytical technologies. It benefits from major investments in electronics, aerospace, and environmental testing industries that rely on high-purity quartz materials. The presence of key manufacturers and well-established laboratory infrastructure supports growth. Rising federal funding for clean energy and semiconductor expansion further boosts demand. Continuous innovation in material science strengthens the nation’s leadership within the region.

Canada

Canada accounted for 22% of the regional share in 2024, supported by expanding environmental testing and industrial research sectors. The nation’s focus on sustainable technology and cleaner production methods encourages the use of quartz fiber films in air and water monitoring. Growing adoption across analytical laboratories, universities, and government research facilities enhances demand. Manufacturers emphasize product quality and reliability to meet strict regulatory standards. It benefits from increasing partnerships between domestic producers and global suppliers. The rising importance of environmental compliance continues to strengthen market presence across Canada.

Mexico

Mexico held 17% of the regional market share in 2024, driven by the growth of industrial manufacturing and material testing industries. The country is experiencing rising demand for precision films in electronics and automotive component production. Its developing research infrastructure and foreign investments in high-tech manufacturing improve accessibility to quartz fiber materials. Local adoption is also supported by efforts to modernize environmental laboratories and enhance quality monitoring systems. It benefits from regional trade support and proximity to U.S. technology hubs. Mexico’s increasing industrial diversification and emphasis on innovation contribute to a stable growth outlook within North America.

Market Segmentations:

By Type

- Single-Layer Film

- Multi-Layer Film

By Application

- Environmental Monitoring

- Chemical Analysis

- Preparation of High-Performance Materials

- Others

By Region

Competitive Landscape

The North America Quartz Fiber Film Market features a moderately consolidated competitive landscape dominated by established material science and specialty glass manufacturers. Key companies such as Saint-Gobain Quartz, 3M, Pall Corporation, QSIL Group, Sterlitech, Tosoh Corporation, AGY Holding Corp., and Aerospace Composite Products (ACP) lead the market through technological innovation, product reliability, and strong distribution networks. These firms focus on enhancing material purity, heat resistance, and dimensional precision to meet the growing demands of semiconductor, analytical, and environmental applications. Continuous investment in automation, R&D, and sustainable production strengthens their market position. Strategic collaborations with research institutions and regional partners enable expansion into emerging application areas. Competition centers on quality, customization, and supply consistency rather than price, as buyers prioritize technical performance and long-term reliability. The market continues to witness capacity expansions and product differentiation strategies aimed at maintaining leadership in advanced material applications across North America.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Players

- Aerospace Composite Products (ACP)

- Saint-Gobain Quartz

- 3M

- AGY Holding Corp.

- Pall Corporation

- QSIL Group

- Sterlitech Corporation

- Tosoh Corporation

Recent Developments

- In 2025, Owens Corning announced the sale of its Glass Reinforcements Business to Praana Group, aiming to strengthen its focus on core composite solutions and enhance operational efficiency across North America.

- In October 2025, National Manufacturing Groupacquired Fiber-Tech Inc., a leading fiberglass composites producer, to expand its capabilities in advanced fiber materials and strengthen its North American presence.

- In October 2023, Ferroglobe PLCacquired a high-purity quartz mine in South Carolinafor USD 11 million to strengthen domestic supply.

Report Coverage

The research report offers an in-depth analysis based on Type, Application and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for quartz fiber films will rise due to growing semiconductor production in the U.S.

- Manufacturers will focus on automation and high-purity film fabrication to enhance efficiency.

- Environmental monitoring applications will expand with stricter pollution control regulations.

- Investments in research and material innovation will strengthen product customization capabilities.

- Adoption will increase in aerospace and defense sectors for advanced composite materials.

- Partnerships between manufacturers and research institutions will accelerate technology development.

- Sustainable and energy-efficient manufacturing will become a key competitive factor.

- Canada and Mexico will emerge as important markets supported by industrial modernization.

- Product differentiation through improved strength, heat tolerance, and transparency will drive competition.

- Long-term demand growth will be supported by regional technological advancements and government initiatives.