Market Overview

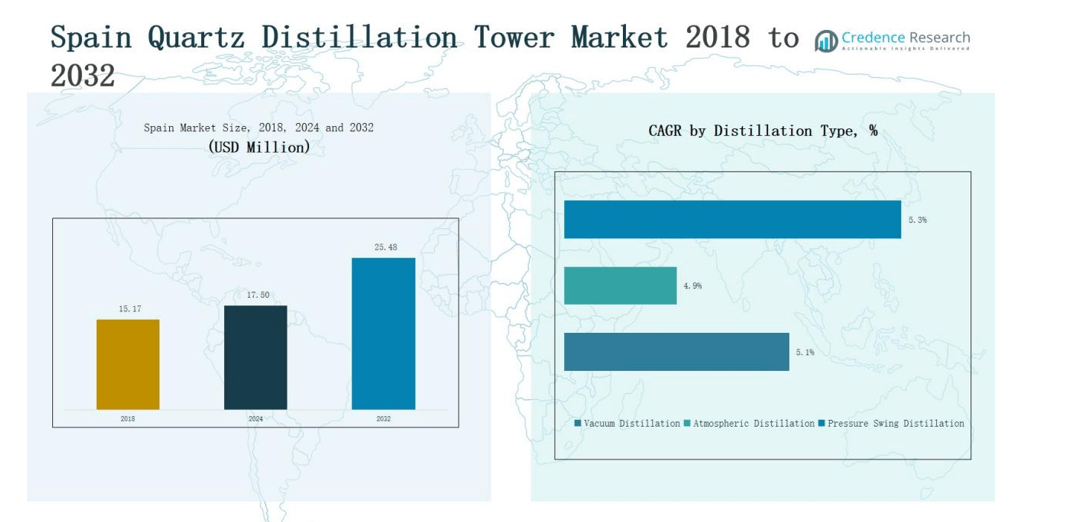

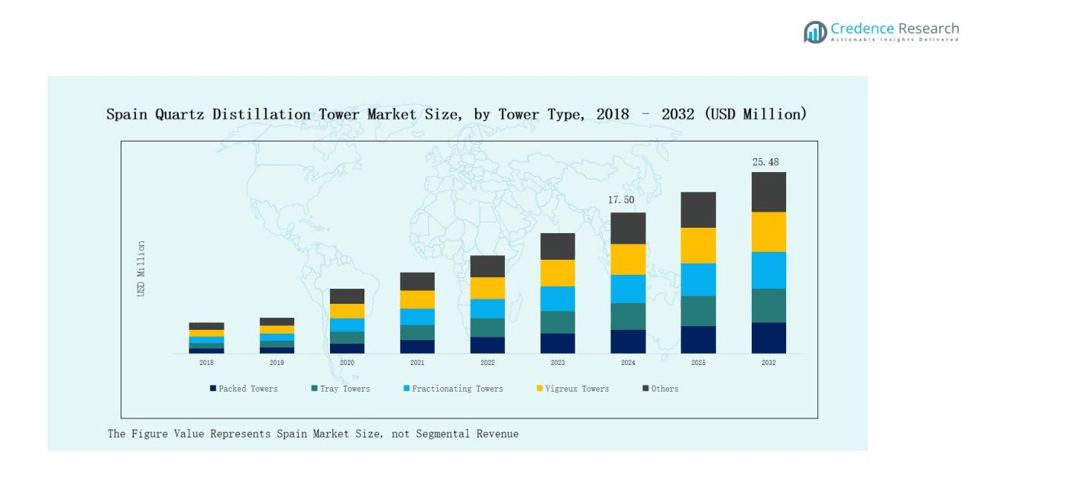

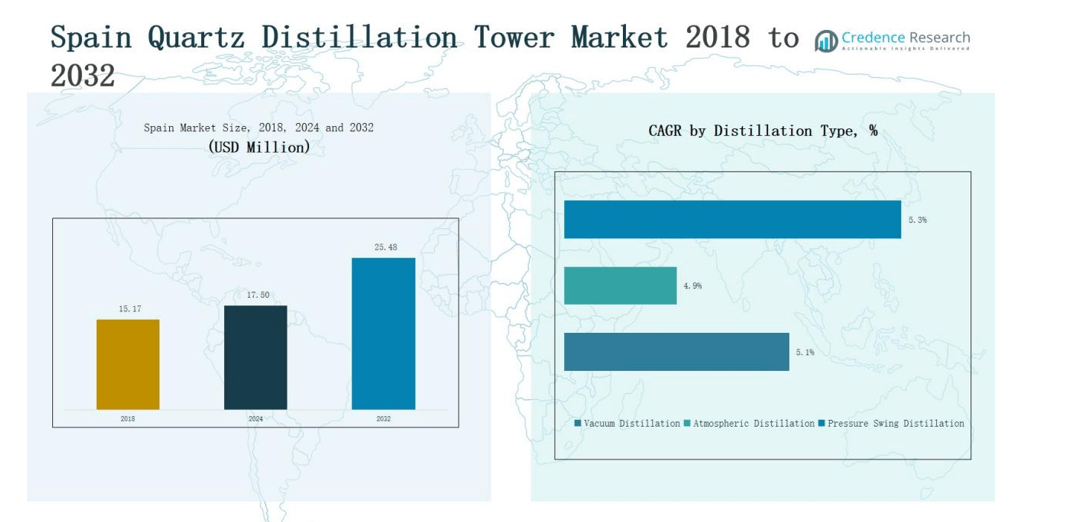

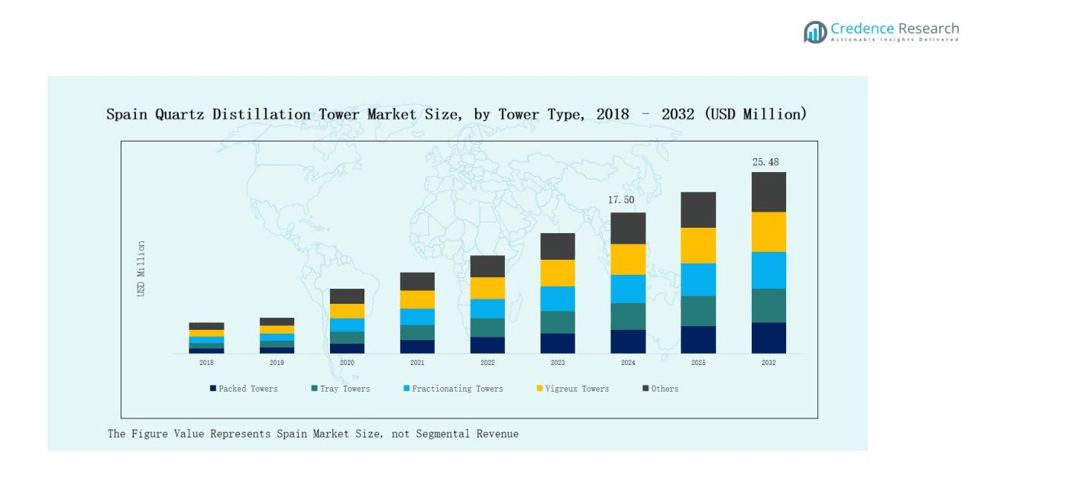

The Spain Quartz Distillation Tower Market size was valued at USD 15.17 million in 2018, increased to USD 17.50 million in 2024, and is projected to reach USD 25.48 million by 2032, growing at a CAGR of 4.81% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Spain Quartz Distillation Tower Market Size 2024 |

USD 17.50 million |

| Spain Quartz Distillation Tower Market, CAGR |

4.81% |

| Spain Quartz Distillation Tower Market Size 2032 |

USD 25.48 million |

The Spain Quartz Distillation Tower Market is shaped by key players such as Helios Italquartz S.r.l., Terme Quartz Internazionale, Glass Processing Company, Stone Italiana S.P.A., Raesch Quarz (Germany) GmbH, WONIK Quartz Europe, Saint-Gobain, Tosoh Quartz, Inc., Sulzer Ltd., Koch-Glitsch, HAT International Ltd., Fenix Process Technologies, Pall Corporation, and Hubei Feilihua Quartz Glass Co., Ltd. These companies emphasize precision manufacturing, advanced material engineering, and automation to enhance purity, energy efficiency, and operational reliability. They focus on developing high-performance quartz towers for semiconductor, pharmaceutical, and chemical applications through continuous innovation and R&D investments. Among all regions, Northern Spain emerged as the leading market in 2024, commanding 34% of the total share, supported by a strong industrial base, expanding semiconductor production, and advanced chemical processing infrastructure.

Market Insights

- The Spain Quartz Distillation Tower Market was valued at USD 15.17 million in 2018, reached USD 17.50 million in 2024, and is projected at USD 25.48 million by 2032, growing at 4.81%.

- Leading players include Helios Italquartz S.r.l., Terme Quartz Internazionale, Stone Italiana S.P.A., Raesch Quarz (Germany) GmbH, and WONIK Quartz Europe, focusing on advanced material engineering and automation.

- The Packed Towers segment dominated with a 41% share in 2024, driven by efficiency, scalability, and use in semiconductor and pharmaceutical distillation processes.

- The Vacuum Distillation segment led by 48% share, favored for high-purity processing of heat-sensitive materials under controlled conditions in chemical and semiconductor applications.

- Northern Spain held the largest regional share of 34% in 2024, supported by its strong industrial base, expanding semiconductor production, and advanced chemical processing facilities.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segment Insights

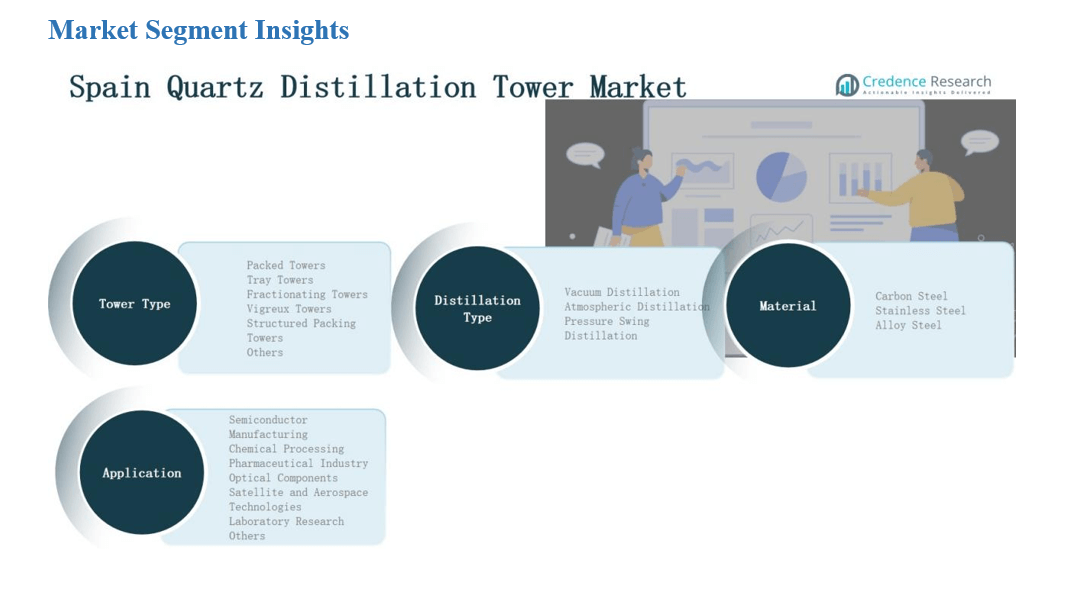

By Tower Type

The Packed Towers segment dominated the Spain Quartz Distillation Tower Market in 2024 with a 41% share. Their popularity stems from superior mass transfer efficiency, lower pressure drop, and easier scalability for industrial operations. These towers are widely used in semiconductor and pharmaceutical processes due to their high purity and corrosion resistance. Continuous innovation in packing materials and the adoption of modular tower designs have strengthened the demand for packed configurations in precision chemical distillation setups.

- For instance, Heraeus manufactures and supplies various grades of high-purity fused quartz and silica, including synthetic grades with parts-per-billion purity, essential for semiconductor manufacturing.

By Distillation Type

The Vacuum Distillation segment led the Spain Quartz Distillation Tower Market in 2024, capturing a 48% share. It is preferred for separating heat-sensitive materials and maintaining product purity under controlled pressure conditions. The technology’s increasing use in semiconductor-grade quartz refining and high-purity chemical synthesis drives its growth. Expanding pharmaceutical and specialty chemical applications that demand temperature-sensitive separation methods further support the adoption of vacuum distillation systems.

- For instance, Elkem expanded its specialty silicones production in 2024, focusing on market growth and sustainability improvements, rather than adopting vacuum-based distillation processes.

By Material

The Stainless Steel segment held the largest share of 46% in the Spain Quartz Distillation Tower Market in 2024. Its dominance is attributed to high durability, corrosion resistance, and compatibility with high-purity quartz components. Stainless steel provides structural stability while maintaining contamination-free performance, crucial for semiconductor and pharmaceutical processes. Ongoing advancements in metallurgical coatings and fabrication precision are enhancing performance reliability, further supporting the preference for stainless-steel-based distillation tower construction.

Key Growth Drivers

Rising Demand in Semiconductor Manufacturing

The Spain Quartz Distillation Tower Market is growing due to the rising adoption of quartz-based systems in semiconductor manufacturing. Increasing production of microchips and sensors requires high-purity quartz towers for precision distillation and contamination-free operations. Advanced fabrication facilities in Spain and Western Europe continue to invest in high-performance distillation systems. The focus on process stability, purity enhancement, and yield optimization strengthens the need for efficient quartz towers within semiconductor manufacturing units.

- For instance, The Quartz Corp has announced new high-performance distillation systems tailored for contaminant-free processes, supporting Spain’s advanced fabrication facilities.

Expansion of Pharmaceutical and Chemical Industries

Strong growth in Spain’s pharmaceutical and chemical processing sectors is a major driver for the quartz distillation tower market. The demand for corrosion-resistant, thermally stable, and contamination-free distillation systems supports high-purity compound synthesis. Investments in cleanroom manufacturing and chemical purification facilities increase product adoption. Furthermore, government initiatives promoting local pharmaceutical production encourage the use of reliable and energy-efficient distillation equipment, enhancing process quality and safety standards.

- For instance, Spain’s Ministry of Industry launched an initiative for supporting local pharmaceutical expansion, providing grants for companies implementing next-generation quartz-based distillation equipment to enhance quality and safety compliance.

Technological Advancements in Material Engineering

Ongoing innovations in material engineering have improved the structural precision and chemical resistance of quartz distillation towers. Spanish manufacturers are integrating automation, advanced sensors, and hybrid metal-quartz combinations to enhance operational control and system longevity. These innovations reduce maintenance costs and improve energy efficiency across industrial operations. The ability to deliver superior purity, heat resistance, and consistent separation efficiency strengthens market demand among high-end process industries.

Key Trends & Opportunities

Shift Toward Energy-Efficient Distillation Systems

The market is witnessing a trend toward energy-efficient quartz distillation systems designed to lower operational costs and environmental impact. Manufacturers are focusing on optimizing heat transfer mechanisms and integrating digital control systems for precision management. Growing demand for sustainable production in semiconductor and chemical sectors encourages adoption of low-energy solutions. Government support for industrial decarbonization and energy optimization in Spain further promotes innovation in eco-efficient distillation technologies.

- For instance, chemical sector innovations using the FluxMax design approach have reduced energy consumption by up to 64% compared to traditional distillation columns through enhanced heat transfer mechanisms.

Growth of Customized and Modular Tower Designs

There is a rising opportunity for modular and custom-designed quartz distillation towers tailored to specific industrial requirements. Industries are increasingly requesting flexible, compact systems that enhance scalability and ease of maintenance. This trend supports quicker installation and better integration with automated production lines. Spain’s expanding R&D and pilot-scale facilities in advanced materials and chemical synthesis are driving the shift toward tailor-made, performance-optimized tower designs.

- For instance, in the energy sector, wind farms leverage modular turbine towers for faster assembly and reduced installation time. In the manufacturing industry, automotive assembly lines adopt modular control centers that allow swift setup and expansion.

Key Challenges

High Production and Maintenance Costs

The Spain Quartz Distillation Tower Market faces challenges from high production and maintenance costs associated with precision quartz components. Manufacturing requires specialized equipment, cleanroom assembly, and skilled labor, increasing overall expenses. Small and mid-sized chemical producers often face cost barriers to adoption. The complexity of repair and replacement of quartz sections further limits accessibility for budget-sensitive industries, restricting wider market penetration.

Limited Raw Material Availability

The availability of high-purity quartz materials remains limited across Spain, creating supply constraints for local manufacturers. Dependence on imports from other European or Asian suppliers increases production lead times and costs. Supply chain disruptions, geopolitical uncertainties, and export restrictions on raw quartz compounds further intensify the challenge. These limitations affect timely delivery and competitiveness for Spain-based equipment producers in global markets.

Technological Integration Constraints

Despite advancements in digital automation, several Spanish manufacturers still face difficulties in fully integrating modern control and monitoring systems. Legacy infrastructure and high retrofit costs slow the transition toward Industry 4.0-ready distillation towers. Lack of technical expertise and compatibility challenges with older systems hinder digital upgrades. These limitations affect production efficiency, data accuracy, and operational transparency across the quartz distillation process chain.

Regional Analysis

Northern Spain

Northern Spain accounted for 34% of the Spain Quartz Distillation Tower Market in 2024. The region’s strong industrial base and presence of advanced chemical and pharmaceutical facilities drive consistent demand. Companies in Basque Country and Navarra invest in high-purity quartz systems to support semiconductor component production and laboratory operations. It benefits from skilled labor, proximity to research hubs, and government-backed technology clusters. Expanding renewable energy and chemical manufacturing sectors further strengthen adoption across industrial applications.

Central Spain

Central Spain held a 27% share of the national market in 2024. Madrid and Castilla-La Mancha serve as key centers for high-tech manufacturing and R&D activities. The concentration of engineering firms and cleanroom research facilities fuels investments in distillation towers designed for semiconductor and pharmaceutical uses. It benefits from modern industrial infrastructure and growing collaborations between public research institutes and private companies. Rising focus on process automation and product purity continues to enhance market growth in the region.

Eastern Spain

Eastern Spain captured a 21% share of the Spain Quartz Distillation Tower Market in 2024. The Valencia and Catalonia regions host major chemical and material processing facilities that rely on precision quartz distillation systems. Strong export-oriented industries support the integration of advanced towers for high-purity applications. It shows increasing adoption in optical and specialty glass manufacturing sectors. Local equipment suppliers also emphasize energy-efficient and modular tower designs to meet evolving industrial requirements.

Southern Spain

Southern Spain accounted for 18% of the market share in 2024. The Andalusian industrial corridor supports expanding demand through its growing chemical and pharmaceutical industries. The region focuses on modernization of production infrastructure to improve purity and yield performance. It benefits from ongoing public investments in industrial innovation and clean technology. Rising collaborations with European technology suppliers and equipment distributors strengthen its role in Spain’s advanced distillation equipment supply chain.

Market Segmentations:

By Tower Type

- Packed Towers

- Tray Towers

- Fractionating Towers

- Vigreux Towers

- Structured Packing Towers

- Others

By Distillation Type

- Vacuum Distillation

- Atmospheric Distillation

- Pressure Swing Distillation

By Material

- Carbon Steel

- Stainless Steel

- Alloy Steel

By Application

- Semiconductor Manufacturing

- Chemical Processing

- Pharmaceutical Industry

- Optical Components

- Satellite and Aerospace Technologies

- Laboratory Research

- Others

By Region

- Northern Spain

- Central Spain

- Southern Spain

- Eastern Spain

Competitive Landscape

The Spain Quartz Distillation Tower Market features a moderately consolidated competitive landscape dominated by established European and international manufacturers. Key companies such as Helios Italquartz S.r.l., Terme Quartz Internazionale, Glass Processing Company, Stone Italiana S.P.A., Raesch Quarz (Germany) GmbH, and WONIK Quartz Europe lead the market through advanced design precision, high-purity material engineering, and automation integration. These players focus on delivering corrosion-resistant and energy-efficient distillation systems for semiconductor, pharmaceutical, and chemical applications. Strategic collaborations with research institutions and end-user industries strengthen product innovation and customization capabilities. Firms are also investing in R&D for modular and hybrid metal-quartz systems that enhance thermal performance and process reliability. Local suppliers and distributors play a growing role in providing tailored installation, maintenance, and retrofitting services, improving accessibility for small-scale industrial users. Continuous focus on digital monitoring and eco-efficient operation supports competitive differentiation and long-term market sustainability across Spain’s industrial ecosystem.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Players

- Helios Italquartz S.r.l.

- Terme Quartz Internazionale

- Glass Processing Company

- Stone Italiana S.P.A.

- Raesch Quarz (Germany) GmbH

- WONIK Quartz Europe

- Saint-Gobain

- Tosoh Quartz, Inc.

- Sulzer Ltd.

- Koch-Glitsch

- HAT International Ltd.

- Fenix Process Technologies

- Pall Corporation

- Hubei Feilihua Quartz Glass Co., Ltd.

Recent Developments

- In April 2025, Gazechim Group acquired Brenntag Química Spain’s liquefied chlorine gas distribution business, strengthening its presence in the Spanish chemical equipment and gas handling sector.

- In April 2025, Applus+ Laboratories acquired Gometrics (Spain) to boost calibration and instrumentation services.

- In July 2025, Esteve (Spain) acquired Regis Technologies (USA), expanding its contract manufacturing footprint.

- In April 2025, Alcoa formed a joint venture with IGNIS EQT (Spain) to support operations at its San Ciprián smelter.

Report Coverage

The research report offers an in-depth analysis based on Tower Type, Distillation Type, Application, Material and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for high-purity quartz towers will rise in semiconductor and chemical sectors.

- Manufacturers will adopt automation and digital monitoring for better process control.

- Modular tower designs will gain traction for faster installation and maintenance.

- Local production capacity will expand to reduce dependence on imported quartz materials.

- Energy-efficient systems will become standard in response to sustainability targets.

- Collaboration between equipment makers and R&D institutes will drive innovation.

- Pharmaceutical applications will strengthen due to increasing focus on purity standards.

- Upgrades of aging industrial infrastructure will boost replacement demand for quartz systems.

- Integration of hybrid metal-quartz technologies will improve heat and corrosion resistance.

- Government incentives for clean technology and industrial modernization will support steady market growth.