Market Overview

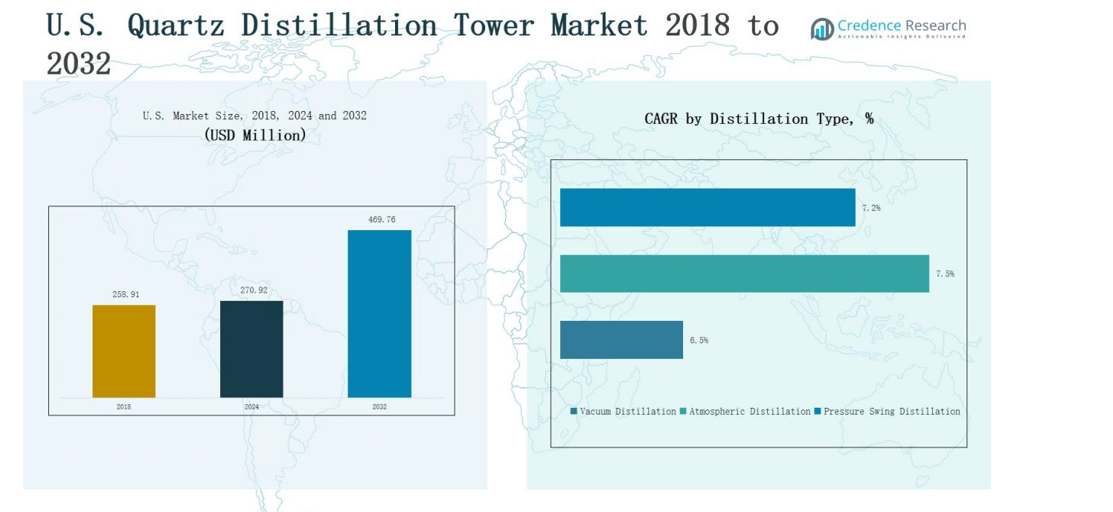

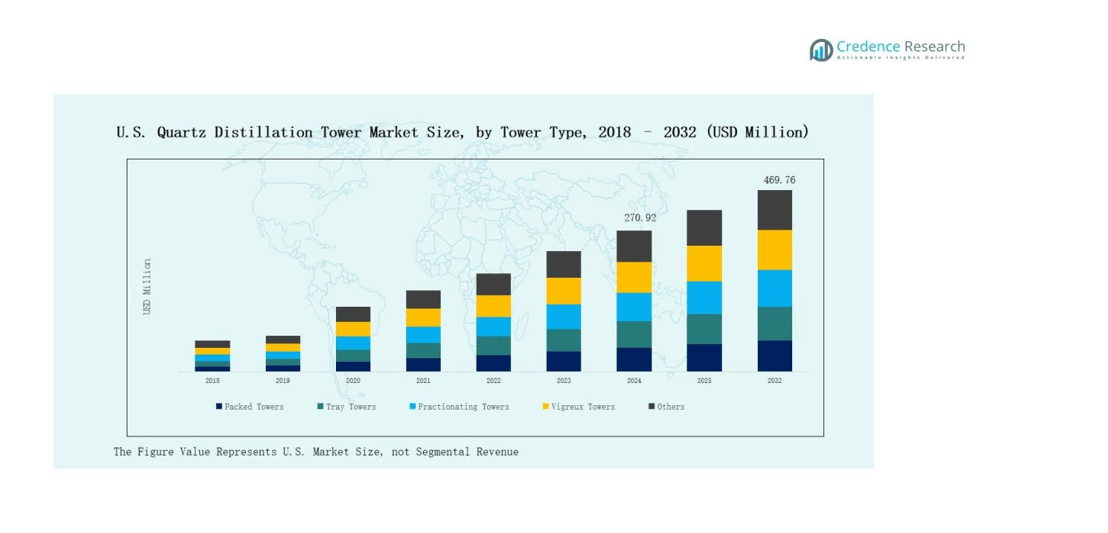

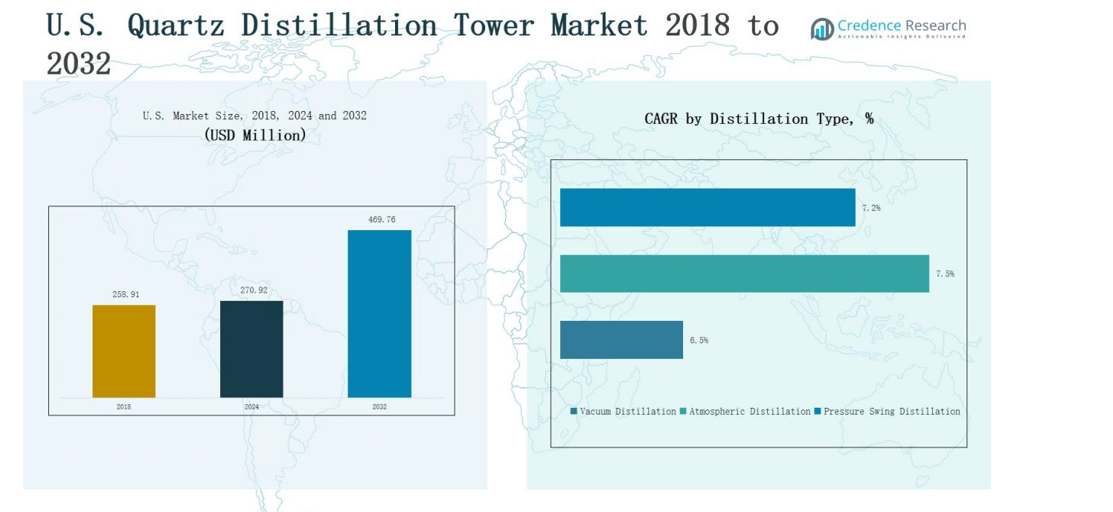

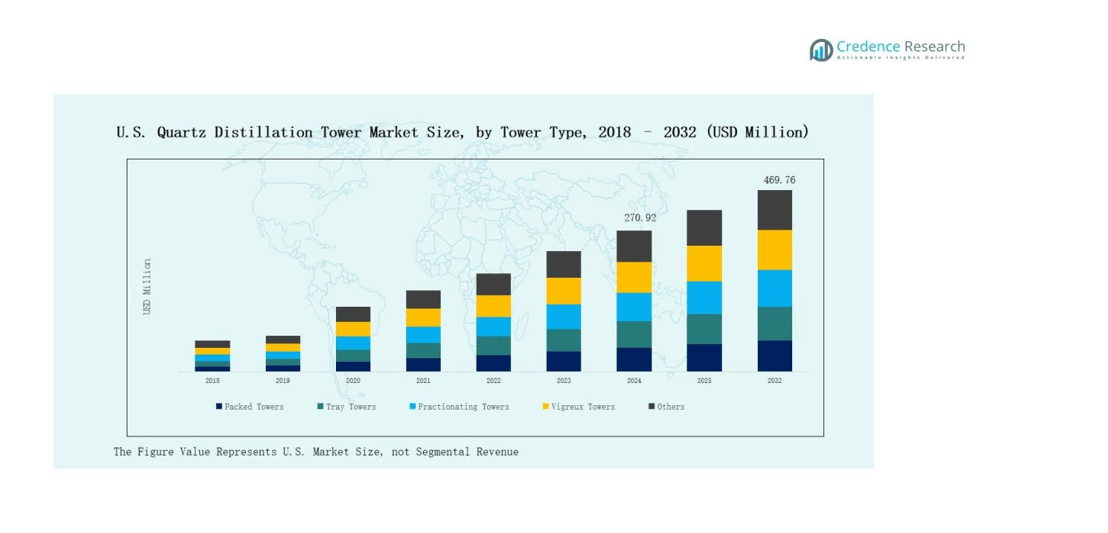

The U.S. Quartz Distillation Tower Market size was valued at USD 258.91 million in 2018, increased to USD 270.92 million in 2024, and is anticipated to reach USD 469.76 million by 2032, growing at a CAGR of 7.12% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| U.S. Quartz Distillation Tower Market Size 2024 |

USD 270.92 million |

| U.S. Quartz Distillation Tower Market, CAGR |

7.12% |

| U.S. Quartz Distillation Tower Market Size 2032 |

USD 469.76 million |

The U.S. Quartz Distillation Tower Market is led by major companies such as Saint-Gobain, Heraeus, Pall Corporation, Koch-Glitsch, Sulzer Ltd., Fenix Process Technologies, Ferrotec, Hoya Corporation, Glassco, and Nikon Corporation. These players emphasize high-purity quartz engineering, energy-efficient designs, and automation to enhance process reliability across semiconductor, pharmaceutical, and chemical sectors. Continuous R&D investment and strategic partnerships strengthen their technological edge and production capabilities. Among all regions, the West emerged as the leading region in 2024, commanding 29% of the total market share due to its robust semiconductor infrastructure and advanced research ecosystem.

Market Insights

- The S. Quartz Distillation Tower Market grew from USD 258.91 million in 2018 to USD 270.92 million in 2024 and is projected to reach USD 469.76 million by 2032, registering a 7.12% CAGR.

- The market is led by Saint-Gobain, Heraeus, Pall Corporation, Koch-Glitsch, Sulzer Ltd., Fenix Process Technologies, Ferrotec, Hoya Corporation, Glassco, and Nikon Corporation, focusing on high-purity engineering and automation.

- The Packed Towers segment held the highest share of 36% in 2024, driven by superior efficiency, corrosion resistance, and use in semiconductor and chemical processing.

- The Vacuum Distillation segment dominated the distillation type category with 41% share, favored for processing temperature-sensitive materials in semiconductor and pharmaceutical sectors.

- The Stainless Steel segment led by 48% share in 2024, valued for its durability and corrosion resistance, while the West Region commanded 29% of the market, supported by strong semiconductor and R&D infrastructure.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segment Insights

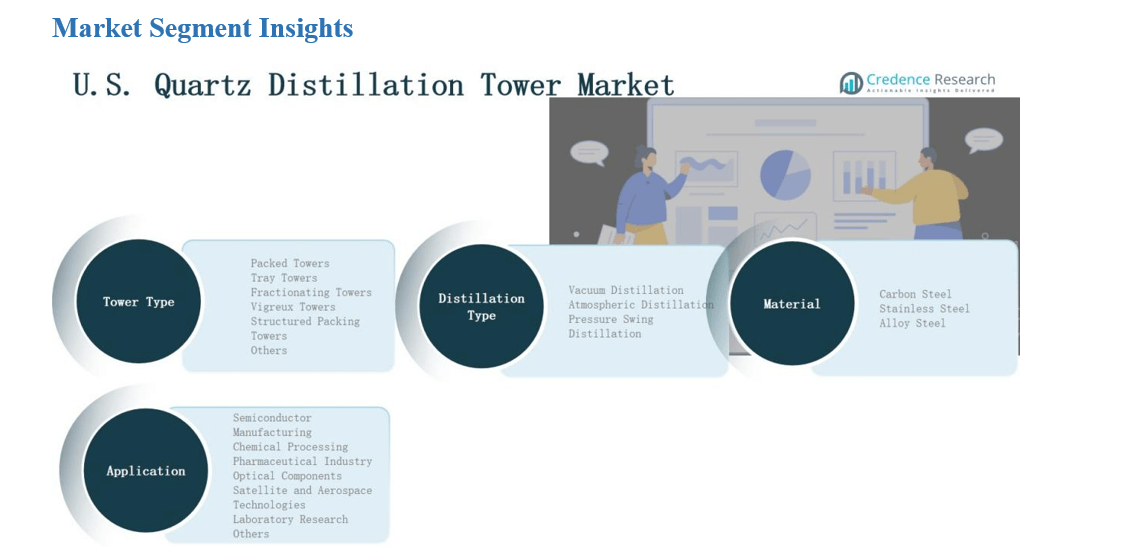

By Tower Type

The Packed Towers segment dominated the U.S. Quartz Distillation Tower Market, accounting for 36% of the total share in 2024. These towers are preferred for their superior mass transfer efficiency, corrosion resistance, and low maintenance. Their use in semiconductor and chemical processing plants drives strong adoption. The growing demand for compact, high-performance distillation systems and ongoing advancements in packing materials strengthen their position across energy-efficient and high-purity distillation operations.

- For instance, Corning uses a vapor deposition process to produce some of the world’s purest glass for products like optical fiber, telescope mirrors, and flat glass for electronics. This is a high-temperature process where glass particles are deposited in layers on a surface.

By Distillation Type

The Vacuum Distillation segment held the largest share of 41% in 2024. Its dominance stems from its ability to process temperature-sensitive materials efficiently while maintaining high purity. This method is widely used in semiconductor and pharmaceutical manufacturing for precision separation under controlled pressure conditions. Increasing demand for low-contamination distillation and energy-saving processes further supports segment growth, making vacuum-based systems integral to advanced industrial and research applications.

- For instance, BÜCHI Labortechnik AG introduced its new Rotavapor R-300 Pro vacuum distillation line optimized for energy-efficient solvent recovery in research laboratories.

By Material

The Stainless Steel segment led the U.S. Quartz Distillation Tower Market with a 48% share in 2024. Its dominance is attributed to excellent thermal stability, corrosion resistance, and mechanical strength. Stainless steel towers ensure durability in high-temperature and high-purity operations, essential for chemical and semiconductor sectors. Continuous improvements in alloy composition and fabrication technology enhance reliability, making stainless steel a preferred material for cost-effective and long-lasting distillation infrastructure.

Key Growth Drivers

Rising Semiconductor Fabrication Demand

The growing semiconductor manufacturing base in the United States drives strong demand for quartz distillation towers. These towers ensure ultra-pure chemical processing and thermal stability essential for wafer production. Expanding investments by chipmakers and the CHIPS Act initiatives have increased cleanroom and high-purity infrastructure needs. The focus on high-yield production and contamination-free environments positions quartz distillation systems as critical components in achieving process precision and reliability.

- For instance, SemiMat, a key player in precision quartz components, produces ultra-pure quartz parts such as rings and process chambers used in epitaxy and plasma etching, essential for contamination-free semiconductor fabrication.

Advancements in Material Engineering

Continuous innovation in high-purity quartz and precision fabrication enhances tower performance across industries. Manufacturers focus on developing corrosion-resistant and thermally stable quartz structures to support demanding distillation environments. Integration of advanced forming and polishing technologies ensures longer equipment life and improved separation efficiency. These engineering upgrades not only lower operational costs but also increase energy efficiency, driving adoption across pharmaceutical, chemical, and semiconductor facilities.

- For instance, Saint-Gobain manufactures high-purity quartz and advanced ceramic materials used in industrial applications that require resistance to corrosion and high temperatures, such as those found in chemical processing equipment.

Expanding Pharmaceutical and Specialty Chemical Applications

The U.S. pharmaceutical and specialty chemical industries increasingly rely on high-purity distillation for sensitive compound processing. Quartz distillation towers provide superior resistance to chemical reactivity, maintaining purity and consistency. Rising drug development, biotechnology innovation, and clean manufacturing regulations create opportunities for advanced quartz systems. The push for sustainable, contamination-free production processes continues to reinforce demand from laboratory, pilot-scale, and commercial production setups.

Key Trends & Opportunities

Shift Toward Energy-Efficient Distillation Systems

Energy optimization has become a core focus in distillation tower design. Quartz towers integrated with structured packing and advanced insulation reduce energy losses and improve operational efficiency. Companies are investing in hybrid systems that combine vacuum and atmospheric modes for higher throughput and purity. The trend toward sustainable manufacturing encourages adoption of automation and digital monitoring, creating growth opportunities for suppliers offering energy-efficient and intelligent quartz-based solutions.

- For instance, Honeywell’s advanced distillation solutions incorporate digital monitoring and automation technologies, enabling more precise control and energy savings in industrial separation processes.

Growing Integration of Automation and Digital Control

Automation and data-driven control systems are transforming tower operations in the U.S. market. Modern quartz distillation units now incorporate real-time temperature, pressure, and flow monitoring systems to improve accuracy and reduce downtime. These digital solutions enhance process consistency and predictive maintenance, appealing to semiconductor and pharmaceutical users. Integration of IoT-enabled systems positions manufacturers for competitive advantage through precision operation, resource efficiency, and quality assurance.

- For instance, as of 2024 Sustainability Report, Momentive Performance Materials continues to integrate digital and innovation tools as part of its “Vision 2025” goals to enhance efficiency and sustainability across its operations.

Key Challenges

High Initial Investment and Fabrication Cost

Quartz distillation towers require precision manufacturing and high-purity materials, leading to substantial initial costs. Custom fabrication and specialized handling increase production complexity. Small and medium manufacturers face challenges in adopting these systems due to capital constraints. The high entry cost limits penetration in emerging sectors, compelling companies to seek modular, scalable, and cost-efficient alternatives without compromising purity or durability.

Limited Availability of High-Quality Quartz Material

Dependence on limited sources of high-purity quartz creates a major supply constraint. Variations in raw material availability affect production timelines and cost structures. The U.S. relies on imports for specific grades used in advanced distillation applications, making the market sensitive to global supply disruptions. Manufacturers are investing in domestic sourcing and recycling initiatives to ensure steady material flow and supply resilience.

Technical Complexity in Maintenance and Operation

Quartz distillation systems demand specialized operation and maintenance expertise. Improper handling or cleaning can lead to material stress, cracking, or contamination, reducing system lifespan. Maintaining purity standards in complex setups requires trained personnel and precise environmental control. The need for specialized technicians and costly repair cycles presents operational challenges, particularly for smaller facilities adopting these advanced systems.

Regional Analysis

West Region

The West dominated the U.S. Quartz Distillation Tower Market, accounting for 29% of the total share in 2024. It benefits from a strong semiconductor manufacturing base and advanced R&D facilities in California and Oregon. The region hosts key technology hubs supporting the integration of high-purity quartz systems in chip fabrication and chemical refining. Investments in clean energy and precision materials also strengthen demand. The presence of leading research universities and technology parks further drives innovation in quartz tower design and automation.

Midwest Region

The Midwest held 22% of the market share in 2024, supported by its strong chemical and industrial manufacturing base. States such as Illinois and Ohio contribute significantly to adoption across process industries and research facilities. It remains a hub for engineering advancements, focusing on energy-efficient and durable distillation systems. Local collaborations between industrial manufacturers and material suppliers enhance production efficiency. The demand for quartz towers in chemical distillation and specialty materials continues to grow across industrial clusters.

Northeast Region

The Northeast accounted for 21% of the market share in 2024. Its growth is driven by pharmaceutical and biotechnology companies in states like New York, Massachusetts, and Pennsylvania. It benefits from high investment in laboratory infrastructure and clean manufacturing facilities. The region’s focus on high-purity research applications supports adoption of advanced quartz systems. Increasing government support for healthcare R&D and innovation drives long-term opportunities for quartz-based distillation solutions.

South Region

The South captured 28% of the total market share in 2024. Rapid industrialization, expanding aerospace programs, and growing semiconductor assembly facilities are strengthening regional demand. Texas and Florida are key contributors, supported by large-scale chemical and aerospace production networks. It is witnessing increasing investment in cleanroom infrastructure and material science research. The region’s combination of industrial expansion and supportive manufacturing policies ensures sustained adoption of quartz distillation systems across multiple high-tech sectors.

Market Segmentations:

By Tower Type

- Packed Towers

- Tray Towers

- Fractionating Towers

- Vigreux Towers

- Structured Packing Towers

- Others

By Distillation Type

- Vacuum Distillation

- Atmospheric Distillation

- Pressure Swing Distillation

By Material

- Carbon Steel

- Stainless Steel

- Alloy Steel

By Application

- Semiconductor Manufacturing

- Chemical Processing

- Pharmaceutical Industry

- Optical Components

- Satellite and Aerospace Technologies

- Laboratory Research

- Others

By Region

- West Region

- Midwest Region

- Northeast Region

- South Region

Competitive Landscape

The U.S. Quartz Distillation Tower Market features a competitive landscape shaped by global and domestic manufacturers focusing on advanced material engineering and high-purity system design. Leading companies such as Saint-Gobain, Heraeus, Pall Corporation, Koch-Glitsch, Sulzer Ltd., and Fenix Process Technologies dominate through strong product portfolios and extensive R&D investments. These firms emphasize precision manufacturing, automation, and energy-efficient solutions to enhance tower durability and operational reliability. Strategic collaborations with semiconductor, chemical, and pharmaceutical companies strengthen their market presence. Mid-tier players, including Ferrotec, Hoya Corporation, and Glassco, focus on customized quartz assemblies for specialized applications. Continuous innovation in process automation, corrosion resistance, and modular tower construction enhances competitiveness. The market remains moderately consolidated, with innovation-led differentiation and customer-specific engineering serving as key growth strategies among both established and emerging participants.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Players

- Saint-Gobain

- Heraeus

- Glassco

- Koch-Glitsch

- Sulzer Ltd.

- Pall Corporation

- Fenix Process Technologies

- Ferrotec

- Hoya Corporation

- Nikon Corporation

Recent Developments

- In December 2024 / January 2025, SCHOTT AG acquired QSIL GmbH Quarzschmelze Ilmenau (quartz glass production business).

- In March 2025, Heraeus Covantics opened a new quartz manufacturing plant in Shenyang (focus: high-purity synthetic quartz).

- In mid-2024, Sibelco announced the acquisition of Strategic Materials, Inc. (SMI) to expand its glass recycling and raw material processing operations across North America.

Report Coverage

The research report offers an in-depth analysis based on Tower Type, Distillation Type, Application, Material and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for high-purity quartz towers will rise with expanding semiconductor manufacturing capacity.

- Adoption of automated and digitally monitored distillation systems will increase operational precision.

- Pharmaceutical and biotechnology sectors will drive steady demand for contamination-free distillation.

- Investments in energy-efficient and sustainable distillation technologies will continue to grow.

- Domestic quartz sourcing and recycling initiatives will strengthen supply chain reliability.

- Integration of modular tower designs will support flexible and scalable industrial applications.

- Rising adoption in optical and aerospace component production will enhance market diversity.

- Collaboration between material science firms and process equipment manufacturers will accelerate innovation.

- Replacement demand for older distillation systems will boost aftermarket service opportunities.

- Government incentives for clean manufacturing and semiconductor resilience will support long-term market expansion.