Market Overview:

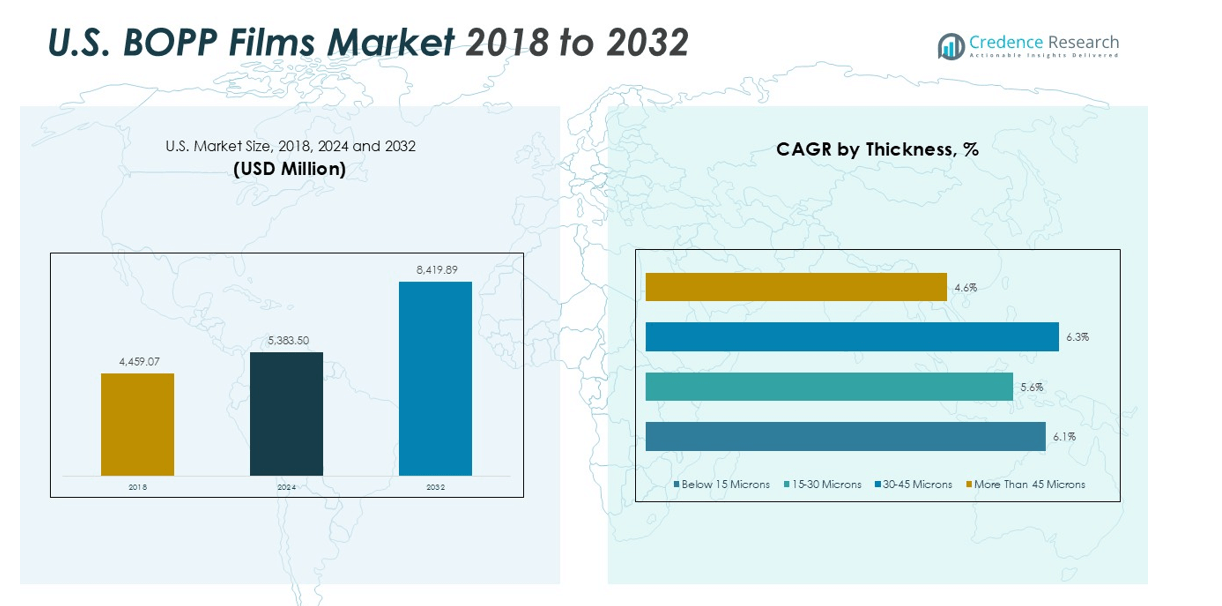

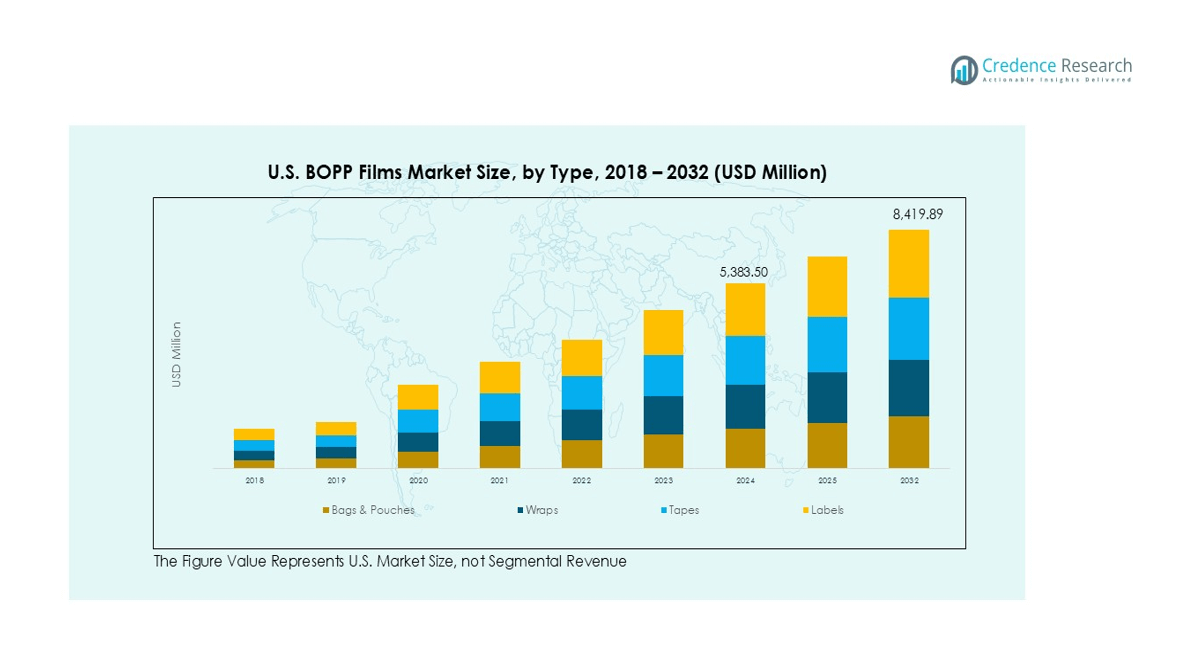

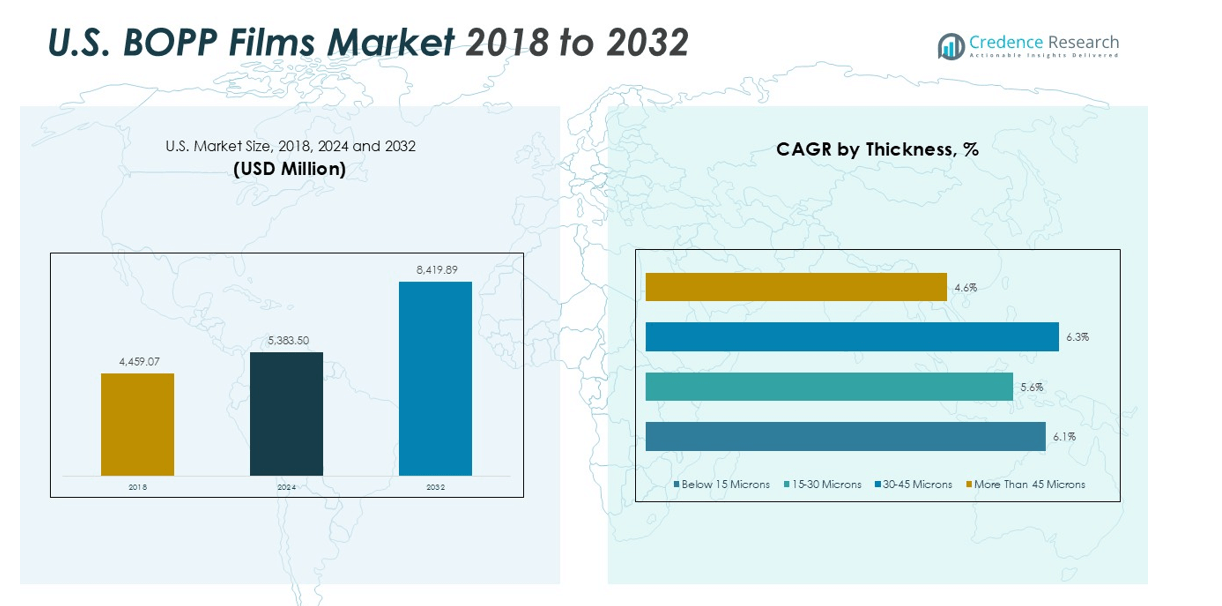

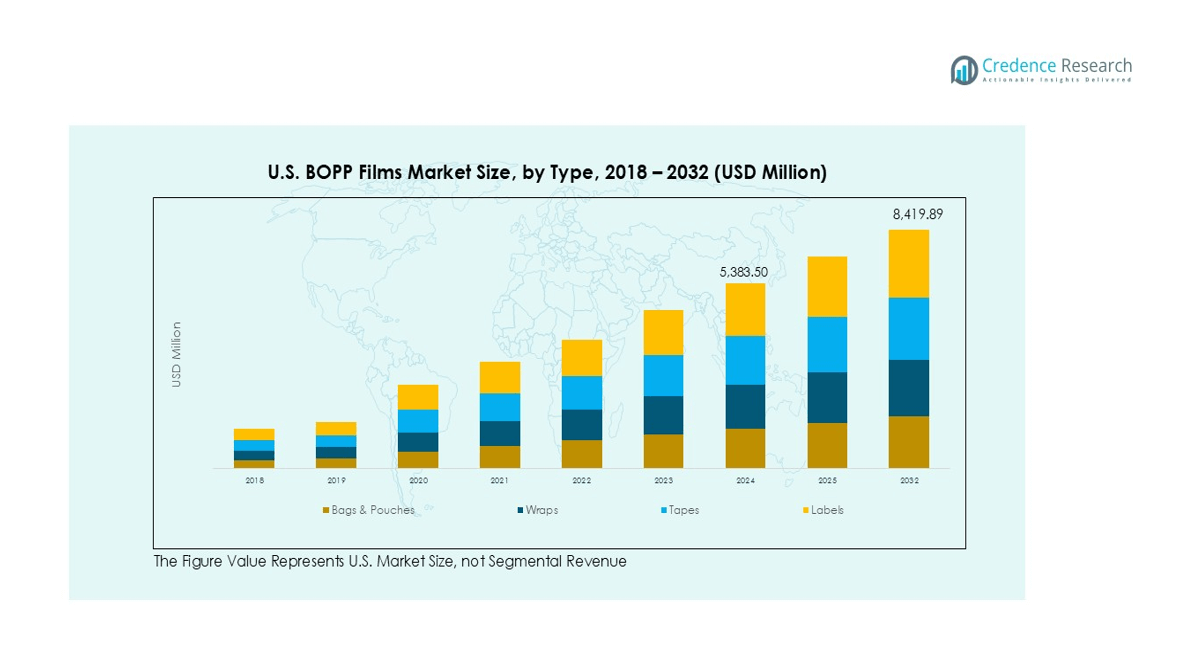

The U.S. BOPP Film Market size was valued at USD 4,459.07 million in 2018 to USD 5,383.50 million in 2024 and is anticipated to reach USD 8,419.89 million by 2032, at a CAGR of 5.75% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| U.S. BOPP Film Market Size 2024 |

USD 5,383.50 million |

| U.S. BOPP Film Market, CAGR |

5.75% |

| U.S. BOPP Film Market Size 2032 |

USD 8,419.89 million |

Strong demand for eco-friendly packaging materials and the rise of e-commerce are key growth factors. Advancements in film manufacturing technologies, such as multi-layer extrusion and metallization, enhance film performance and durability. Producers are focusing on recyclable and bio-based film variants to meet stringent U.S. packaging regulations and sustainability goals.

Regionally, the United States dominates the North American BOPP Film Market due to its advanced packaging sector and large consumer goods manufacturing base. Expanding food and beverage production, coupled with investments in high-performance packaging technologies, strengthens the country’s leadership. Increasing demand for transparent, printable, and moisture-resistant films in industrial and consumer packaging continues to support steady market expansion across major states including California, Texas, and New York.Top of Form

Market Insights:

- The U.S. BOPP Film Market was valued at USD 5,383.50 million in 2024 and is projected to reach USD 8,419.89 million by 2032, expanding at a CAGR of 5.75%.

- Eco-friendly and recyclable packaging materials are driving film adoption across food, beverage, and personal care industries seeking to reduce plastic waste.

- Technological progress in multi-layer extrusion, metallization, and surface treatment enhances tensile strength, printability, and moisture resistance of BOPP films.

- The U.S. dominates North America with a 72% market share, supported by its advanced packaging industry and strong domestic manufacturing network.

- Texas, Ohio, and California account for 58% of national production, offering favorable infrastructure and access to key petrochemical feedstocks.

- Sustainable and high-barrier films contribute 41% of total revenue, reflecting increased demand for recyclable and high-performance packaging solutions.

- Supply chain disruptions and fluctuating polypropylene resin prices remain key challenges, but ongoing R&D and circular economy investments strengthen long-term market resilience.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Demand for Sustainable and Lightweight Packaging Solutions

The U.S. BOPP Film Market benefits from the strong shift toward eco-friendly and recyclable packaging materials. Manufacturers across food, beverage, and personal care industries are replacing traditional plastics with BOPP films to reduce environmental impact. These films offer recyclability, low carbon footprint, and cost efficiency, aligning with corporate sustainability goals. The growing preference for lightweight materials in flexible packaging further drives film demand across retail and e-commerce sectors.

Technological Advancements in Film Manufacturing Processes

Continuous innovation in film production technologies supports the market’s growth. The introduction of multi-layer co-extrusion, metallized coatings, and improved surface treatment methods enhances clarity, tensile strength, and barrier properties. These advancements allow producers to deliver high-performance films suitable for printing, lamination, and labeling. It supports product differentiation and extends shelf life, creating advantages for packaging converters and brand owners across the United States.

- For instance, in September 2025, PureCycle Technologies successfully produced 16,000 meters of BOPP film using its recycled PureFive™ resin.

Expanding Applications Across Food, Beverage, and Consumer Goods Sectors

The extensive use of BOPP films in packaging for snacks, bakery, and frozen foods continues to accelerate demand. The films’ moisture and gas barrier capabilities preserve product freshness and safety. It also supports attractive product presentation through superior gloss and transparency. The expansion of organized retail and consumer preference for convenient, single-use packs reinforce adoption across various packaging formats.

- For instance, PureCycle Technologies validated its recycled resin by manufacturing a 25-micron, multi-layer film where the recycled material comprised three of the five layers.

Regulatory Push Toward Eco-Friendly Packaging Materials

Stringent U.S. regulations on plastic waste management and recycling drive innovation in sustainable packaging. Federal and state initiatives encourage the use of recyclable and biodegradable materials, boosting demand for BOPP films. Manufacturers invest in circular economy models to meet compliance requirements and corporate ESG targets. It strengthens the market’s growth outlook by promoting environmentally responsible packaging adoption across industries.

Market Trends:

Growing Integration of Recyclable and Bio-Based BOPP Films in Packaging Solutions

The U.S. BOPP Film Market is witnessing a rapid shift toward recyclable and bio-based film solutions driven by sustainability mandates and changing consumer behavior. Packaging manufacturers are adopting polypropylene films derived from renewable feedstocks such as sugarcane and corn to minimize environmental impact. It supports corporate sustainability targets and compliance with U.S. federal and state-level recycling regulations. Leading producers are expanding product lines with mono-material structures designed for full recyclability within existing polyethylene recycling streams. Retail brands increasingly prefer bio-based BOPP films for food packaging, labels, and wraps to enhance their green credentials. Continuous investment in R&D for barrier coatings and improved thermal stability strengthens the use of these films in diverse packaging applications.

- For instance, Amcor’s AmLite Ultra Recyclable high-barrier polyolefin film, launched in 2019, offers high-barrier protection and is certified by the cyclos-HTP Institute for its recyclability.

Rising Adoption of High-Performance Films for Advanced Printing and Labeling Applications

The demand for specialty BOPP films tailored for advanced printing, lamination, and labeling is gaining momentum across the United States. Manufacturers are focusing on high-clarity, matte, and pearlized finishes that enable premium packaging designs for FMCG and personal care products. It enhances visual appeal while maintaining moisture and oxygen barrier performance. The market is experiencing strong growth in heat-sealable and metallized variants used in snacks and ready-to-eat food packaging. Smart packaging integration, including QR codes and NFC tags printed on BOPP films, is expanding brand engagement opportunities. Rapid technological advancements in extrusion and coating processes continue to improve film performance, durability, and sustainability, reinforcing its long-term market potential.

- For instance, in April 2025, Innovia Films inaugurated a new 40-meterlong coating line in the UK dedicated to its eco-friendly, PVC-free Rayoart™ film.

Market Challenges Analysis:

Volatility in Raw Material Prices and Supply Chain Disruptions

The U.S. BOPP Film Market faces challenges due to fluctuations in polypropylene resin prices, which directly affect production costs. Global crude oil volatility and supply chain disruptions influence raw material availability and pricing stability. It pressures manufacturers to manage margins while maintaining competitive pricing for packaging converters and brand owners. Import dependencies for resin and additives increase exposure to logistics delays and trade uncertainties. The market requires strategic sourcing and long-term supply contracts to stabilize operations. Limited domestic resin production capacity further heightens cost sensitivity for mid-sized producers.

Environmental Concerns and Recycling Infrastructure Limitations

The market contends with growing environmental scrutiny and inconsistent recycling infrastructure across U.S. states. It complicates large-scale collection and processing of BOPP film waste. While the films are technically recyclable, the lack of standardized recycling systems restricts recovery rates. Manufacturers face regulatory pressure to design fully recyclable or compostable films without compromising performance. Investments in recycling technologies and collaboration with waste management firms are essential to address this challenge. Strong consumer awareness and brand commitments to sustainability are driving producers to enhance circular economy practices and improve waste traceability.

Market Opportunities:

Expansion of Circular Economy and Sustainable Packaging Initiatives

The U.S. BOPP Film Market presents strong opportunities through the expansion of circular economy initiatives and sustainable packaging programs. Government policies and brand commitments toward waste reduction create new demand for recyclable and bio-based films. It encourages investment in closed-loop manufacturing and chemical recycling technologies that improve material recovery rates. Film producers are collaborating with consumer goods companies to design mono-material packaging structures compatible with recycling systems. The increasing focus on extended producer responsibility (EPR) programs promotes innovation in film formulation and end-of-life management. Growing adoption of sustainability certifications and traceable supply chains strengthens the competitive positioning of environmentally responsible manufacturers.

Growth in E-Commerce and High-Performance Flexible Packaging Demand

The rising e-commerce sector in the United States drives higher consumption of durable and lightweight packaging materials. BOPP films are gaining preference for their strength, clarity, and superior barrier protection across shipping and retail applications. It supports the development of tamper-evident and printed packaging formats suitable for online retail. The growing trend toward single-serve food and personal care products increases demand for advanced sealable and printable film grades. Technological innovation in lamination and coating processes enhances product versatility and shelf-life performance. These factors create significant opportunities for film manufacturers to diversify applications and capture new market segments.

Market Segmentation Analysis:

By Type

Bags and pouches dominate the U.S. BOPP Film Market due to strong demand in food and beverage packaging. The segment benefits from lightweight, durable, and transparent film properties that improve shelf appeal and extend freshness. Wraps hold a notable share owing to extensive use in snack, confectionery, and frozen food applications. Labels and tapes continue to expand steadily with industrial and retail adoption supported by strong adhesion, clarity, and printability. It reflects the market’s move toward flexible and recyclable packaging materials.

- For instance, supporting the expansion of the labels segment, Innovia Films invested in a new 8.8-meter-wide multilayer co-extrusion line, which increased its annual production capacity by 35,000 tons for highly engineered thin-gauge label films.

By Application

The food segment leads the market due to extensive use of BOPP films in bakery, dairy, and processed food packaging. It provides excellent moisture and gas barriers, ensuring product integrity and longer shelf life. The beverage and personal care segments also demonstrate strong growth driven by flexible and visually appealing packaging demand. Pharmaceutical and electronics sectors increasingly rely on BOPP films for protective and hygienic packaging requirements. Expanding e-commerce and single-use packaging trends further support growth across all applications.

- For instance, advancing sustainability in food packaging, PureCycle Technologies successfully produced 16,000 meters of BOPP film suitable for food-grade applications.

By Thickness

Films between 15–30 microns represent the largest share, offering the ideal balance of strength, flexibility, and cost efficiency. This range is preferred across food packaging, lamination, and labeling applications. Films above 30 microns cater to heavy-duty industrial packaging where durability is essential. Films below 15 microns are used in lightweight wrapping and lamination processes. It underscores the market’s focus on precision thickness optimization to enhance packaging performance and sustainability.

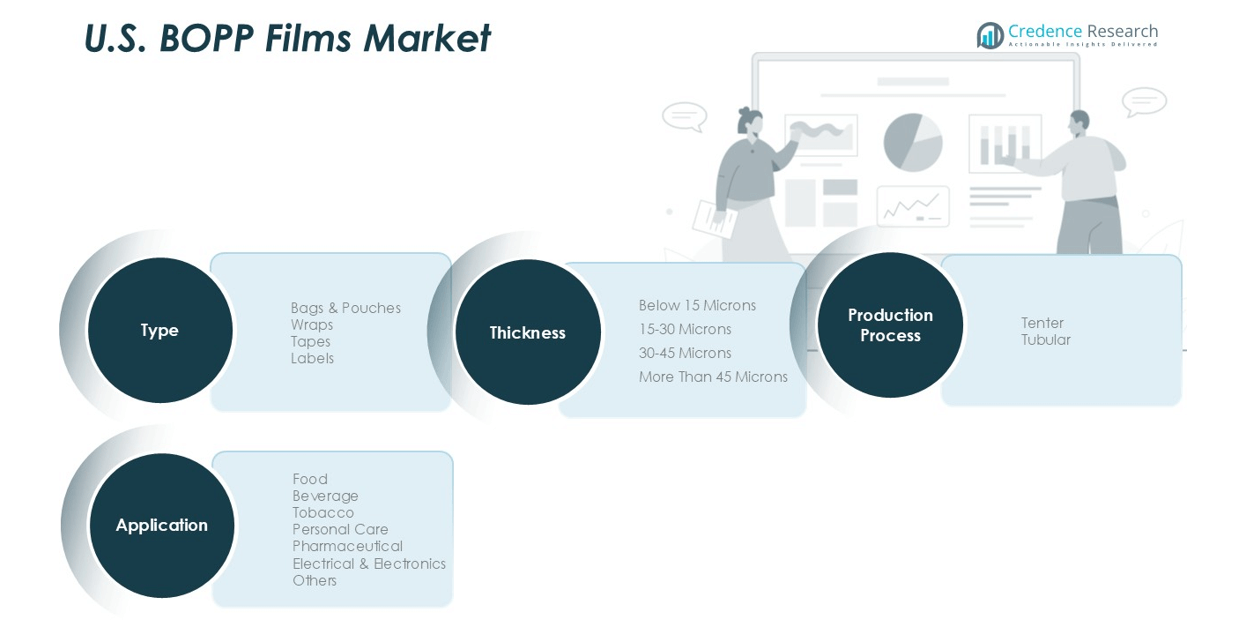

Segmentations:

By Type:

- Bags & Pouches

- Wraps

- Tapes

- Labels

By Application:

- Food

- Beverage

- Tobacco

- Personal Care

- Pharmaceutical

- Electrical & Electronics

- Others

By Thickness:

- Below 15 Microns

- 15–30 Microns

- 30–45 Microns

- More Than 45 Microns

By Production Process:

Regional Analysis:

Dominance of the United States in the North American BOPP Film Industry

The U.S. BOPP Film Market accounted for 72% of the North American market share in 2024. Its strong position is driven by an advanced packaging ecosystem and robust industrial manufacturing base. High demand from food, beverage, and consumer goods sectors continues to propel film usage nationwide. It benefits from a reliable supply chain, advanced processing technologies, and major global producers’ presence. Continuous R&D investments and production upgrades strengthen domestic competitiveness. Sustainability-focused regulations and consumer preference for recyclable packaging further reinforce market dominance.

Regional Concentration of Production and Consumption Hubs

Texas, Ohio, and California collectively represent 58% of the U.S. BOPP film production share. These states serve as critical manufacturing and consumption centers due to strong infrastructure and industry integration. It enables efficient distribution to packaging converters and FMCG clients. The southern and midwestern regions offer access to petrochemical feedstocks, skilled labor, and export facilities. High demand in populous consumer markets supports consistent sales volume. Continuous technological advancements in extrusion and coating enhance production yield and energy efficiency across these hubs.

Rising Investments in Sustainable and High-Barrier Film Development

Sustainable and high-barrier film products captured 41% of total U.S. BOPP film revenue in 2024. Producers are intensifying investments in recyclable and bio-based film solutions aligned with circular economy goals. It encourages collaboration between polymer innovators and packaging manufacturers. Partnerships with food, personal care, and e-commerce brands drive customized film adoption. Expanding capacity in high-performance barrier films strengthens the country’s export potential. Continuous modernization of U.S. facilities enhances operational efficiency and global market competitiveness.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

Competitive Analysis:

The U.S. BOPP Film Market features strong competition among key players such as Cosmo Films Limited, Taghleef Industries, CCL Industries, Sibur Holdings, Inteplast Group, Uflex Ltd., and Toray Industries. These companies focus on expanding production capacities, improving recyclability, and enhancing product performance through advanced extrusion and coating technologies. It emphasizes innovation in high-barrier, heat-sealable, and bio-based films to meet sustainability and regulatory goals. Strategic developments include mergers, acquisitions, and new plant expansions to strengthen domestic supply chains and reduce import dependency. Partnerships with food, beverage, and personal care brands help broaden product applications. Continuous investment in R&D and automation supports higher production efficiency and quality consistency, ensuring competitive advantage within the growing flexible packaging industry.

Recent Developments:

- In September 2025, Taghleef Industries announced the launch of SHAPE360® TDSW, a high-performance, floatable, white polyolefin TD shrink sleeve film.

- In September 2025, Cosmo Films launched CSP Dualcoat, a new product offered under its Cosmo Synthetic Paper brand.

Report Coverage:

The research report offers an in-depth analysis based on Type, Application, Thickness and Production Process. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The U.S. BOPP Film Market will witness sustained growth driven by the shift toward sustainable and recyclable packaging solutions.

- Demand for bio-based and mono-material BOPP films will rise as companies align with circular economy goals.

- Expanding e-commerce and food delivery sectors will boost the need for durable, flexible, and moisture-resistant films.

- Manufacturers will focus on developing high-barrier films that enhance product protection and extend shelf life.

- Smart packaging integration with QR codes and traceable labeling will gain traction among consumer brands.

- Technological advancements in multi-layer extrusion and metallization will improve clarity, strength, and printability.

- Regional production capacity will increase through new plant expansions and modernization of existing facilities.

- Partnerships between film producers and packaging converters will strengthen value chain efficiency and product customization.

- Regulatory initiatives promoting recyclable and low-carbon packaging materials will drive market innovation.

- Investments in digital printing and automation technologies will enhance operational efficiency and reduce waste, supporting long-term competitiveness.