Market Overview

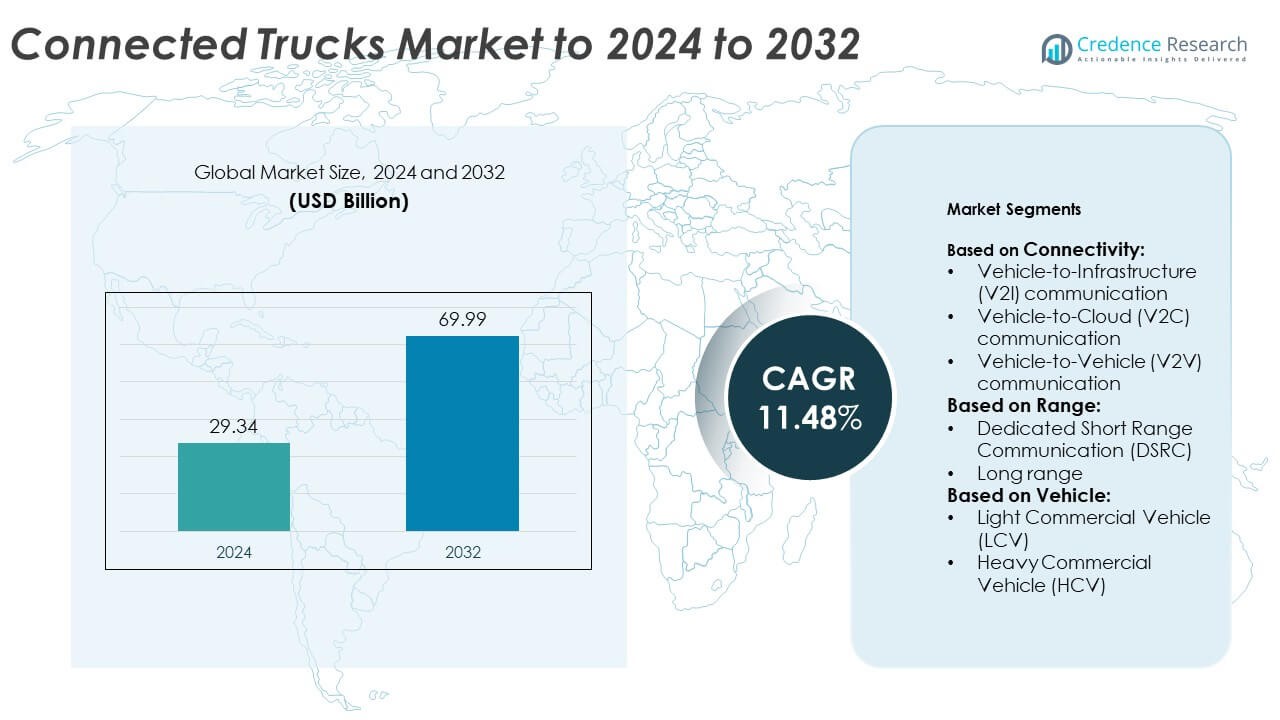

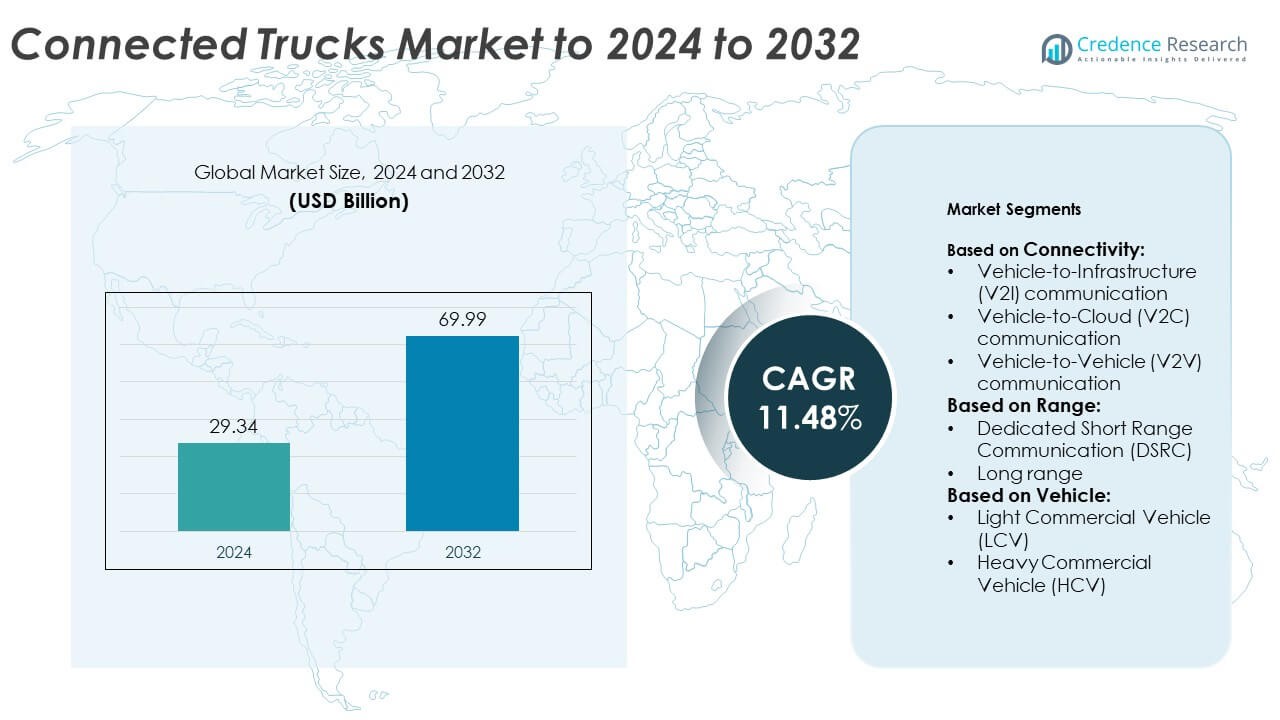

Connected Trucks Market size was valued at USD 29.34 billion in 2024 and is anticipated to reach USD 69.99 billion by 2032, at a CAGR of 11.48% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Connected Trucks Market Size 2024 |

USD 29.34 Billion |

| Connected Trucks Market, CAGR |

11.48% |

| Connected Trucks Market Size 2032 |

USD 69.99 Billion |

The Connected Trucks Market is dominated by major players such as PACCAR Inc., Volvo Group, Trimble Inc., ZF Friedrichshafen AG, and Samsara Networks Inc. These companies focus on integrating telematics, IoT, and AI technologies to enhance fleet management, predictive maintenance, and driver safety. Strategic partnerships and R&D investments in 5G-based connectivity and cloud analytics are driving technological advancements. North America led the market in 2024 with a 37% share, supported by strong digital infrastructure, advanced logistics networks, and regulatory initiatives promoting connected and autonomous vehicle technologies across commercial fleets.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Connected Trucks Market was valued at USD 29.34 billion in 2024 and is projected to reach USD 69.99 billion by 2032, growing at a CAGR of 11.48%.

- Growing demand for real-time fleet monitoring, predictive maintenance, and IoT-based telematics is driving market growth globally.

- Integration of AI, 5G, and vehicle-to-cloud communication is reshaping logistics operations and improving efficiency across connected fleets.

- The market is competitive, with key players investing in R&D and strategic alliances to expand connected mobility solutions and telematics platforms.

- North America led the market in 2024 with 37% share, followed by Europe at 32% and Asia Pacific at 22%, while the Vehicle-to-Cloud (V2C) communication segment held the largest share due to its ability to enable seamless data exchange and remote diagnostics.

Market Segmentation Analysis:

By Connectivity

Vehicle-to-Cloud (V2C) communication dominated the Connected Trucks Market in 2024, accounting for nearly 46% of the total share. V2C enables real-time data exchange between vehicles and centralized platforms, supporting predictive maintenance, route optimization, and over-the-air software updates. The demand is fueled by logistics digitalization and the integration of telematics systems across fleets. Companies such as Volvo Trucks and Daimler Truck AG are enhancing cloud connectivity to improve fleet performance analytics and remote diagnostics, further strengthening V2C’s leadership in connected ecosystems.

- For instance, Volvo Trucks reported over 1,000,000 connected trucks worldwide by 2025, including 218,000 in North America.

By Range

Dedicated Short Range Communication (DSRC) held the largest market share of about 58% in 2024. Its low-latency data transmission supports collision avoidance and traffic management functions crucial for commercial fleets. DSRC ensures reliable vehicle-to-vehicle and vehicle-to-infrastructure connectivity, making it preferred for safety-critical operations. Manufacturers are incorporating DSRC modules in advanced driver assistance systems (ADAS) to enhance situational awareness. Growing government mandates for road safety communication technologies also contribute to DSRC’s continued dominance in connected truck platforms.

- For instance, Scania’s network of connected vehicles has been growing, with mid-year 2024 figures showing over 638,000 vehicles in the network, a number that has since been surpassed

By Vehicle

Heavy Commercial Vehicles (HCVs) led the segment in 2024, securing around 62% of the total share. These vehicles benefit the most from connected technologies due to long-haul operations requiring fleet tracking, fuel optimization, and remote maintenance. OEMs such as Scania and PACCAR are deploying connected solutions to enhance uptime and operational transparency for heavy-duty fleets. Increasing adoption of IoT-enabled fleet management and compliance with emission regulations further boost HCV connectivity integration across global logistics and freight networks.

Key Growth Drivers

Rising Demand for Fleet Management Efficiency

Fleet operators are increasingly adopting connected truck technologies to improve route planning, fuel efficiency, and vehicle uptime. Real-time telematics, GPS tracking, and remote diagnostics enhance operational control and reduce downtime. Companies such as Volvo and MAN Truck & Bus integrate advanced fleet management systems that allow continuous monitoring of driver performance and vehicle health. The demand for cost-efficient logistics and predictive maintenance makes fleet optimization a primary growth driver in the connected trucks market.

- For instance, Navistar’s OnCommand Connection analyzes sensor inputs from over 375,000 connected vehicles, interpreting more than 70 telematics parameters.

Increasing Integration of IoT and AI Technologies

The integration of IoT and AI enables trucks to communicate seamlessly with infrastructure, cloud systems, and other vehicles. These technologies support autonomous driving, driver assistance, and predictive analytics. OEMs like Daimler and Scania are embedding AI-based analytics into connected truck platforms to improve decision-making and operational safety. The growing reliance on smart sensors and cloud platforms for data-driven logistics performance fuels adoption, making IoT and AI integration a significant driver of market growth.

- For instance, Volvo Trucks claims its fleet generates ~20 GB of data per minute, from over 100 sensors per vehicle.

Government Regulations Promoting Safety and Emission Standards

Governments across regions are enforcing stringent emission and safety norms that push fleets to adopt connected solutions. Vehicle-to-everything (V2X) communication and telematics help operators comply with these standards by monitoring driving patterns and vehicle efficiency. The U.S. and European authorities promote mandatory installation of safety and connectivity features in new trucks. Such policies drive accelerated adoption of connected systems, positioning regulatory compliance as a critical growth driver in the market.

Key Trends & Opportunities

Growth of 5G Connectivity for Real-Time Communication

5G technology enhances communication reliability and bandwidth for connected trucks, enabling instant data transmission between vehicles, infrastructure, and control centers. This advancement supports functions like remote diagnostics, collision alerts, and vehicle platooning. Companies such as Volvo and Hyundai are testing 5G-enabled trucks to improve real-time responsiveness. As telecom infrastructure expands globally, 5G connectivity opens major opportunities for connected fleet operations and autonomous logistics applications.

- For instance, Scania migrated its back-end systems to AWS to support over 20,000 messages per second and reduce latency by ~80 %.

Rising Adoption of Predictive Maintenance Solutions

Predictive maintenance powered by AI and cloud analytics is becoming a key trend in connected truck operations. It allows continuous monitoring of engine performance, tire pressure, and fuel systems, minimizing unexpected breakdowns. Leading OEMs like PACCAR and Navistar are integrating predictive systems that analyze sensor data to optimize service schedules. This trend enhances fleet productivity and reduces operational costs, creating opportunities for aftermarket service providers and technology integrators.

- For instance, using OnCommand Connection, Navistar has helped reduce maintenance costs by up to 40 % and vehicle downtime by up to 40 %.

Key Challenges

High Implementation and Integration Costs

The initial investment for connected truck infrastructure remains a major restraint, especially for small fleet operators. Installing sensors, telematics units, and cloud-based software requires significant capital. Integration with existing fleet systems adds further complexity. Despite long-term efficiency benefits, the high cost of technology deployment and maintenance limits adoption in cost-sensitive markets, slowing overall growth in developing regions.

Data Security and Privacy Concerns

Connected trucks generate vast amounts of sensitive data related to routes, performance, and driver behavior. This creates vulnerability to cyberattacks and data breaches. Unauthorized access or manipulation of vehicle data can disrupt fleet operations or compromise safety. Manufacturers and software providers are investing in encryption, firewalls, and blockchain-based systems to protect data integrity. However, growing cybersecurity risks remain a critical challenge restraining broader adoption of connected trucking technologies.

Regional Analysis

North America

North America led the connected trucks market in 2024 with a 37% share. The region benefits from advanced telematics adoption, strong digital infrastructure, and supportive government policies for fleet safety and emission reduction. The U.S. dominates due to the presence of major OEMs such as PACCAR, Ford, and Navistar, which focus on integrating AI and 5G-enabled communication. High investment in autonomous trucking and the rapid expansion of logistics networks across the U.S. and Canada continue to drive market penetration and strengthen the region’s leadership in connected transportation technologies.

Europe

Europe accounted for around 32% of the connected trucks market in 2024. The region’s growth is driven by stringent carbon emission regulations, the European Green Deal, and strong adoption of vehicle-to-everything (V2X) systems. Germany, the UK, and France are key contributors, supported by OEMs like Daimler, Volvo, and Scania emphasizing advanced connectivity for long-haul fleets. The rise in smart mobility projects and public–private investments in intelligent transportation systems further accelerates the deployment of connected trucks across European logistics and freight corridors.

Asia Pacific

Asia Pacific held about 22% of the connected trucks market in 2024, led by China, Japan, and India. Rapid industrialization, expanding e-commerce logistics, and large-scale fleet digitalization initiatives support strong regional growth. Chinese manufacturers such as BYD and Dongfeng are investing in connected electric trucks, integrating real-time telematics for fleet optimization. Governments in Japan and South Korea are promoting smart transportation and autonomous logistics corridors. The growing penetration of 5G infrastructure and cloud-based fleet analytics strengthens Asia Pacific’s position as a rapidly expanding market for connected trucking solutions.

Latin America

Latin America represented nearly 6% of the connected trucks market in 2024. The region’s growth is supported by increasing adoption of telematics and digital fleet management systems in Brazil, Mexico, and Argentina. Logistics operators are deploying connected solutions to improve delivery efficiency and reduce operational costs. While high implementation costs remain a barrier, strategic partnerships between technology providers and regional transport firms are expanding connected fleet adoption. The ongoing development of 4G and emerging 5G networks further enhances market potential across Latin America’s logistics and transportation sectors.

Middle East & Africa

The Middle East & Africa accounted for around 3% of the connected trucks market in 2024. Growth is driven by infrastructure modernization and rising demand for efficient long-haul logistics across the Gulf countries and South Africa. Governments are investing in smart mobility frameworks to support intelligent transport and freight safety. Saudi Arabia and the UAE are leading adoption through partnerships with global telematics firms. Though the market remains in an early stage, increasing investment in connected fleet monitoring solutions signals steady progress toward digital transformation in the region.

Market Segmentations:

By Connectivity:

- Vehicle-to-Infrastructure (V2I) communication

- Vehicle-to-Cloud (V2C) communication

- Vehicle-to-Vehicle (V2V) communication

By Range:

- Dedicated Short Range Communication (DSRC)

- Long range

By Vehicle:

- Light Commercial Vehicle (LCV)

- Heavy Commercial Vehicle (HCV)

By Geography:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The connected trucks market is highly competitive and includes leading players such as PACCAR Inc., Teletrac Navman, Volvo Group, Samsara Networks Inc., Trimble Inc., Geotab, Omnitracs, ZF Friedrichshafen AG, Navistar International Corporation, MiX Telematics, Mercedes-Benz Trucks, WABCO Holdings Inc., Scania AB, TomTom Telematics, Verizon Connect, and Telefonaktiebolaget LM Ericsson. Competition is shaped by advancements in telematics, IoT integration, and real-time data analytics solutions. Companies focus on developing connected platforms that enhance fleet efficiency, safety, and predictive maintenance. Strategic collaborations with software developers, telecom providers, and cloud platforms help strengthen service portfolios. Continuous R&D investment supports the development of AI-enabled fleet monitoring, automated diagnostics, and over-the-air update capabilities. Mergers and partnerships remain central to expanding market reach and accelerating the deployment of connected vehicle infrastructure. This dynamic environment encourages innovation across autonomous driving, vehicle-to-everything communication, and 5G-enabled connectivity solutions to meet evolving logistics and safety demands.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- PACCAR Inc.

- Teletrac Navman

- Volvo Group

- Samsara Networks Inc.

- Trimble Inc.

- Geotab

- Omnitracs

- ZF Friedrichshafen AG

- Navistar International Corporation

- MiX Telematics

- Mercedes-Benz Trucks

- WABCO Holdings Inc.

- Scania AB

- TomTom Telematics

- Verizon Connect

- Telefonaktiebolaget LM Ericsson

Recent Developments

- In 2025, Mercedes-Benz Trucks (a Daimler brand) presented its new electric flagship, the eActros 600,At the transport logistic fair.

- In 2025, Volvo Trucks announced it had surpassed one million connected trucks worldwide.

- In 2024, PACCAR continued the rollout of its PACCAR Connect online fleet management platform, which was introduced by its DAF brand in April 2024.

Report Coverage

The research report offers an in-depth analysis based on Connectivity, Range, Vehicle and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The connected trucks market will experience strong growth driven by digital fleet transformation.

- Advancements in AI and IoT will enhance predictive maintenance and route optimization.

- 5G rollout will enable faster communication between vehicles and infrastructure.

- Autonomous trucking technology will expand commercial adoption across logistics networks.

- Fleet operators will increasingly rely on cloud platforms for real-time monitoring.

- Regulatory mandates on safety and emissions will accelerate connected system integration.

- Partnerships between OEMs and tech providers will drive innovation in telematics solutions.

- Cybersecurity investments will grow to protect vehicle data and operational integrity.

- Electric and connected trucks will converge to support sustainable transport goals.

- Developing regions will see rapid adoption with expanding digital infrastructure and logistics demand.