Market Overview

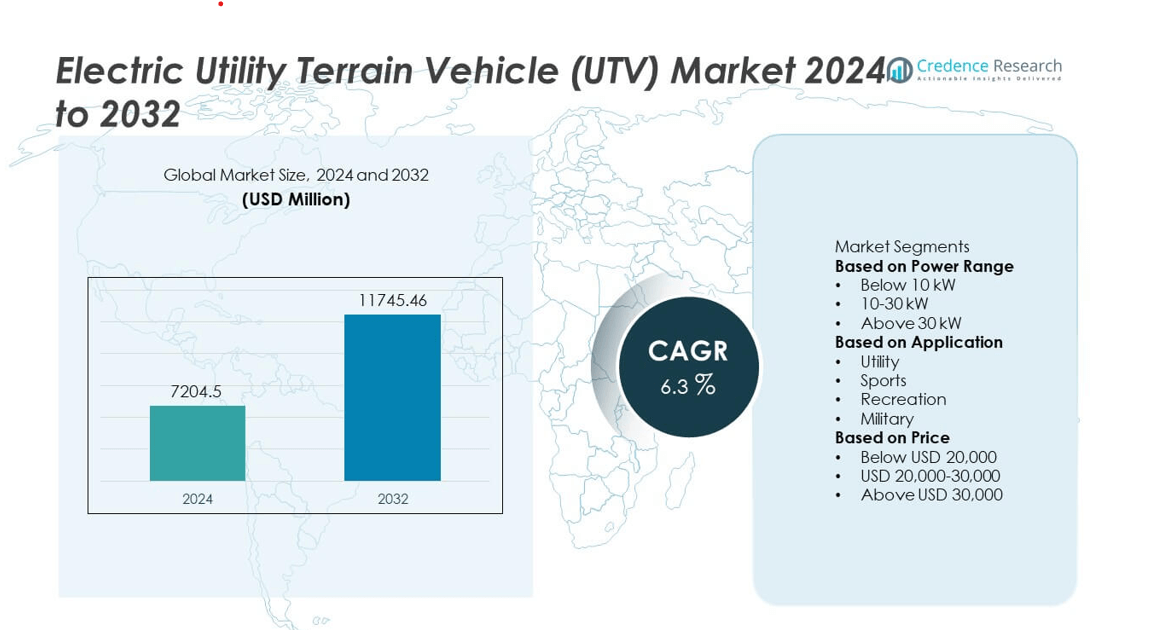

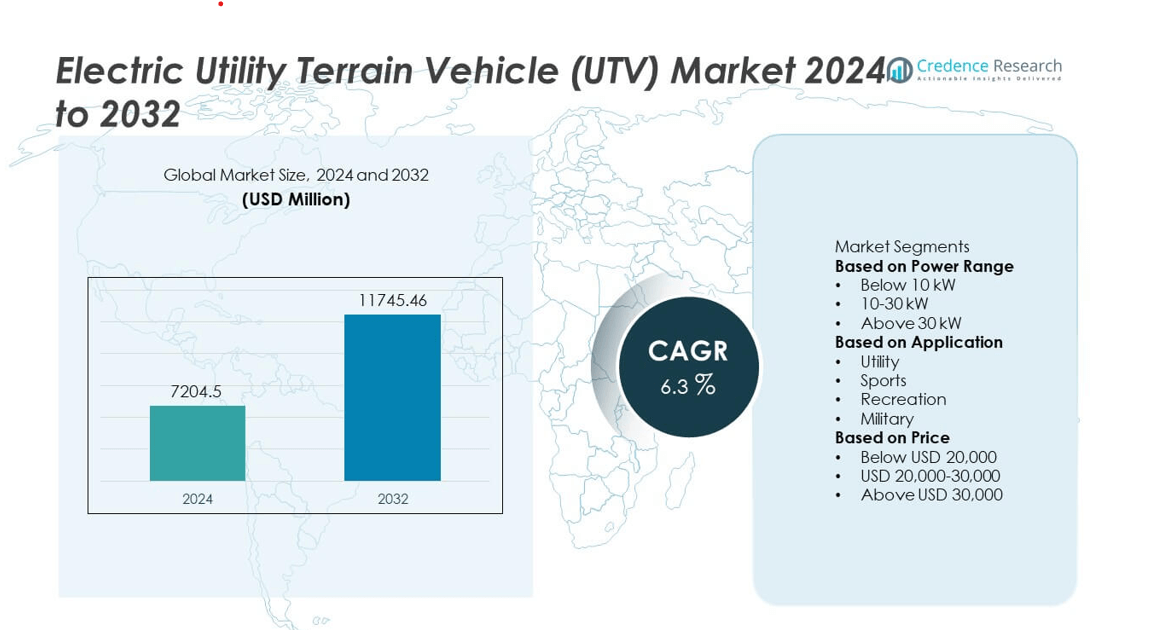

The Electric Utility Terrain Vehicle (UTV) Market was valued at USD 7,204.5 million in 2024 and is projected to reach USD 11,745.46 million by 2032, growing at a CAGR of 6.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Electric Utility Terrain Vehicle (UTV) Market Size 2024 |

USD 7,204.5 million |

| Electric Utility Terrain Vehicle (UTV) Market, CAGR |

6.3% |

| Electric Utility Terrain Vehicle (UTV) MarketSize 2032 |

USD 11,745.46 million |

The Electric Utility Terrain Vehicle (UTV) Market is led by key players such as TRACKER OFF ROAD, HuntVe, Hisun Motors Corporation USA, TUATARA VEHICLES, INTIMIDATOR LLC, Vanderhall Motor Works Inc., DRR USA, Polaris Inc., Kaxa Motos, and American LandMaster. These companies focus on enhancing battery efficiency, vehicle durability, and off-road performance to meet the needs of utility, recreational, and defense applications. Strategic collaborations and R&D investments are driving innovation in range and payload capacity. North America dominated the global market with a 43% share in 2024, supported by strong agricultural, recreational, and defense demand. Europe followed with 28%, while Asia-Pacific accounted for 21%, reflecting rising adoption in farming and industrial operations.

Market Insights

- The Electric Utility Terrain Vehicle (UTV) Market was valued at USD 7,204.5 million in 2024 and is projected to reach USD 11,745.46 million by 2032, growing at a CAGR of 6.3% during the forecast period.

- Growth is driven by the rising demand for eco-friendly off-road vehicles across agriculture, construction, and defense sectors, supported by emission regulations and electrification incentives.

- Market trends highlight advancements in lithium-ion battery technology, integration of smart connectivity, and the emergence of high-performance electric drivetrains for rugged applications.

- Leading players such as Polaris Inc., Hisun Motors Corporation USA, TRACKER OFF ROAD, and HuntVe focus on expanding electric product lines and enhancing vehicle range and power efficiency.

- North America leads the market with a 43% share, followed by Europe at 28% and Asia-Pacific at 21%, while the 10–30 kW power range segment dominates with a 52% share due to balanced performance and affordability.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Power Range

The 10–30 kW segment dominated the Electric Utility Terrain Vehicle (UTV) Market in 2024, accounting for a 52% market share. This range offers the best balance between power, efficiency, and affordability, making it ideal for both utility and recreational use. Vehicles in this category deliver strong torque and extended battery life suitable for off-road, farming, and light-duty transport. Manufacturers such as Polaris, Hisun, and Textron are focusing on mid-power electric models that combine rugged performance with low maintenance. The segment’s versatility and practicality continue to drive widespread adoption across industrial and commercial sectors.

- For instance, Polaris’ Ranger XP Kinetic is equipped with a 110 hp (82 kW) dual electric motor system delivering 140 lb-ft of torque and powered by a 29.8 kWh lithium-ion battery pack. The model achieves a range of up to 130 km per charge and supports fast charging at 3 kW to 6 kW, balancing high power output with work-ready endurance for both utility and recreational purposes.

By Application

The utility segment led the market in 2024 with a 49% market share, driven by increasing use in agriculture, forestry, and construction. Electric UTVs are replacing traditional fuel-based vehicles for farm logistics, equipment hauling, and maintenance tasks. Their quiet operation, lower operating costs, and minimal emissions make them ideal for sustainable fieldwork and municipal operations. Companies such as John Deere and Kubota are expanding their electric UTV portfolios for professional and industrial use. The growing focus on productivity and eco-friendly mobility solutions continues to strengthen the dominance of the utility segment.

- For instance, John Deere’s Gator TE Electric UTV is powered by a 48V DC, separately excited, wound direct-drive motor that produces 6 hp. The vehicle uses eight 6V deep-cycle batteries, specifically Trojan T-105s. It has a payload capacity of 900 lbs (408 kg) and a towing capacity of 500 lbs (227 kg).

By Price

The USD 20,000–30,000 price range segment held a 46% market share in 2024, reflecting the balance between affordability and advanced performance features. Electric UTVs in this range offer durable build quality, higher payload capacity, and longer battery life suited for both work and recreation. Consumers prefer this segment for its combination of technology, comfort, and value. Leading manufacturers are introducing mid-range electric UTVs with enhanced range and digital control systems. As production efficiency improves and battery costs decline, this price segment is expected to remain the preferred choice for most commercial and individual buyers.

Key Growth Drivers

Rising Demand for Sustainable Off-Road Mobility

The growing focus on sustainability and emission reduction is driving the adoption of electric UTVs across industries. Agricultural, forestry, and mining sectors are increasingly replacing fuel-powered vehicles with electric alternatives to lower operational costs and environmental impact. Electric UTVs provide silent operation, high torque, and lower maintenance requirements, making them ideal for eco-sensitive and high-efficiency operations. As governments tighten emission norms and promote green mobility, demand for electric UTVs is expected to accelerate in both commercial and recreational applications.

- For instance, the Hisun Motors Corporation Sector E1 electric UTV is powered by a 48V AC induction motor and supports a towing capacity of 680 kilograms. The vehicle is designed for quiet, emission-free operation, making it suitable for tasks in environmentally sensitive areas.

Advancements in Battery and Powertrain Technology

Continuous improvements in battery energy density and electric drivetrains are enhancing the performance and reliability of electric UTVs. Modern lithium-ion and solid-state batteries offer longer driving ranges, faster charging, and greater durability, improving operational productivity. Manufacturers are integrating regenerative braking, thermal management systems, and modular battery packs to extend vehicle lifespan. These advancements make electric UTVs competitive with traditional models while ensuring cost savings over time. Enhanced power output and vehicle range are expanding use across rugged terrains and industrial environments.

- For instance, Vanderhall Motor Works developed the Brawley GTS with a 40 kWh lithium-ion battery pack and a quad-motor electric drivetrain delivering a combined 404 hp (301 kW). The vehicle provides a driving range of 225 km per charge and includes an advanced liquid thermal management system for sustained power delivery and battery longevity across extreme terrain conditions.

Increasing Utility and Commercial Applications

Expanding use of electric UTVs in utility, defense, and construction sectors is a key market growth driver. These vehicles offer superior torque and load capacity for hauling, maintenance, and inspection tasks. Industries are adopting electric UTVs to meet internal sustainability goals and reduce fuel dependency. Their low noise operation makes them ideal for use in residential, resort, and conservation areas. Manufacturers are developing customizable platforms with enhanced safety and telematics features to cater to diverse industrial applications, supporting steady growth in global electric UTV adoption.

Key Trends & Opportunities

Integration of Smart Connectivity and Telematics

Manufacturers are increasingly integrating IoT, GPS tracking, and data analytics into electric UTVs for improved efficiency and monitoring. Connected systems allow users to track performance, schedule maintenance, and optimize routes. Fleet operators benefit from real-time data insights, ensuring higher utilization and reduced downtime. The integration of digital dashboards, remote diagnostics, and over-the-air updates enhances user experience. This trend aligns with Industry 4.0 practices, creating opportunities for intelligent fleet management and expanding the role of electric UTVs in professional operations.

- For instance, American LandMaster introduced its AMP electric UTV with a 48V AC drive system and Bluetooth diagnostics. This system allows users to monitor vehicle health and adjust performance settings, such as increasing the maximum speed, via a smartphone app.

Expansion of Recreational and Tourism Applications

The recreational sector is emerging as a major opportunity for electric UTV adoption. Silent operation and zero emissions make these vehicles ideal for parks, resorts, and adventure tourism. Rising consumer preference for sustainable outdoor experiences is boosting demand for electric off-road models. Manufacturers are developing high-performance recreational variants with extended range and enhanced comfort features. Growth in eco-tourism and off-road leisure activities, combined with government support for clean mobility, is expected to further accelerate adoption in the recreational segment.

- For instance, the Intimidator’s Classic EV UTV is equipped with a 30 peak hp 48V AC electric motor delivering a top speed of 37 km/h (23 mph). The vehicle features a quiet AC brushless motor, regenerative braking, and a direct-drive transmission.

Key Challenges

High Initial Cost and Limited Model Availability

Electric UTVs remain costlier than conventional gasoline-powered models due to expensive battery systems and limited economies of scale. High upfront prices restrict adoption among small businesses and individual buyers. The range of available models is also narrower compared to traditional UTVs, limiting choice across performance categories. Manufacturers are addressing this challenge through local assembly, modular battery options, and financing programs. As production expands and battery costs decline, affordability will improve, making electric UTVs more accessible to broader market segments.

Charging Infrastructure and Range Limitations

Insufficient charging infrastructure in remote or off-road regions limits the practicality of electric UTVs for extended use. Many rural and industrial areas lack reliable access to fast-charging facilities, leading to operational downtime. Limited battery range remains a concern for heavy-duty applications requiring continuous operation. To overcome these challenges, manufacturers and governments are investing in portable charging units, solar-powered systems, and modular battery-swapping solutions. Expanding charging accessibility and improving range capabilities are essential to support the full transition toward electric off-road mobility.

Regional Analysis

North America

North America held a 43% market share in 2024, driven by strong adoption in the U.S. and Canada. The region benefits from widespread recreational use, advanced off-road infrastructure, and increasing electrification of farming and industrial operations. Government incentives for electric vehicle adoption and the presence of leading manufacturers such as Polaris, Textron, and John Deere support market growth. Demand for high-performance electric UTVs in defense, agriculture, and utility sectors continues to rise. Expanding charging networks and technological innovations in powertrains further strengthen North America’s dominant position in the global market.

Europe

Europe accounted for a 28% market share in 2024, fueled by strict emission standards and sustainability-driven initiatives. Countries like Germany, France, and the United Kingdom are promoting electric mobility in agriculture, forestry, and municipal operations. Manufacturers are focusing on developing compact, high-torque electric UTVs suited for diverse terrain and industrial applications. Increasing government support for carbon-neutral transport and advancements in battery efficiency drive regional adoption. Additionally, growing popularity of eco-friendly recreational vehicles and rural electrification efforts strengthen Europe’s role as a major hub for electric UTV innovation and production.

Asia-Pacific

Asia-Pacific captured a 21% market share in 2024, driven by expanding agricultural activities and rising interest in electric mobility solutions. China, Japan, and India are leading adoption with government initiatives promoting clean energy and rural electrification. Local manufacturers are entering the market with cost-effective, durable electric UTV models designed for farming, construction, and logistics. Rapid industrialization and improving charging infrastructure further support growth. Increasing demand for efficient and low-maintenance vehicles in agriculture and mining sectors continues to position Asia-Pacific as a fast-growing market for electric UTVs.

Latin America

Latin America held a 5% market share in 2024, with growing adoption in Brazil, Mexico, and Chile. Rising fuel costs and growing awareness of sustainability are encouraging the shift toward electric off-road vehicles. Governments are supporting clean energy transitions through incentives and pilot programs. Electric UTVs are being deployed in agriculture, mining, and tourism for efficient, low-emission operations. Although infrastructure remains limited, regional assembly initiatives and partnerships with global manufacturers are expanding product availability. The region shows strong potential for growth as electric mobility initiatives continue to evolve.

Middle East & Africa

The Middle East and Africa accounted for a 3% market share in 2024, supported by increasing focus on sustainable industrial and defense operations. Countries such as the UAE, Saudi Arabia, and South Africa are investing in electric mobility to diversify their energy use and reduce carbon emissions. Electric UTVs are gaining traction in mining, construction, and desert patrol applications due to their durability and low maintenance. While adoption is at an early stage, infrastructure improvements and government sustainability programs are expected to drive gradual growth in the coming years.

Market Segmentations:

By Power Range

- Below 10 kW

- 10-30 kW

- Above 30 kW

By Application

- Utility

- Sports

- Recreation

- Military

By Price

- Below USD 20,000

- USD 20,000-30,000

- Above USD 30,000

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Electric Utility Terrain Vehicle (UTV) Market includes leading manufacturers such as TRACKER OFF ROAD, HuntVe, Hisun Motors Corporation USA, TUATARA VEHICLES, INTIMIDATOR LLC, Vanderhall Motor Works Inc., DRR USA, Polaris Inc., Kaxa Motos, and American LandMaster. These companies are actively developing advanced electric UTV models with higher torque, longer range, and improved battery efficiency. Strategic partnerships with battery suppliers and technology firms are helping enhance product performance and reduce operating costs. Manufacturers are also expanding production capabilities to meet growing demand in agriculture, construction, and defense applications. The focus on smart connectivity, all-terrain versatility, and low-maintenance operation continues to shape product innovation. Market competition is intensifying as regional players introduce cost-effective solutions while established brands invest in premium, high-performance electric UTVs designed for commercial and recreational use.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- TRACKER OFF ROAD

- HuntVe

- Hisun Motors Corporation USA

- TUATARA VEHICLES

- INTIMIDATOR, LLC

- Vanderhall Motor Works Inc.

- DRR USA

- Polaris Inc.

- Kaxa Motos

- American LandMaster

Recent Developments

- In June 2024, Polaris Inc. announced the development of an off-road Trail Charging Network in Michigan to support its electric lineup, including the Ranger XP Kinetic. The initiative features fast-charging stations with Level 3 DC capability, designed to recharge vehicles to 80% in less than 90 minutes.

- In May 2024, TRACKER OFF ROAD unveiled the Ox EV electric UTV, featuring a 14.9 hp motor paired with a 48-volt battery system. The model delivers a payload capacity of 900 lbs, a dump bed capacity of 500 lbs, and achieves a top speed of 16.5 mph, targeting light-duty farm and ranch applications.

- In February 2024, Polaris Inc. launched the Pro XD Kinetic electric UTV designed for commercial and industrial applications. The model integrates a 14.9 kWh lithium-ion battery, supports a cargo capacity of 1,250 lbs, and provides a towing capability of 2,500 lbs, ensuring optimal worksite productivity

Report Coverage

The research report offers an in-depth analysis based on Power Range, Application, Price and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The electric UTV market will expand steadily as industries adopt sustainable off-road solutions.

- Advancements in battery efficiency will enhance range, torque, and operational performance.

- Manufacturers will focus on lightweight materials to improve durability and energy efficiency.

- Agricultural and construction sectors will drive strong demand for high-torque electric UTVs.

- Recreational and adventure applications will see rising adoption of quiet, zero-emission vehicles.

- Integration of smart connectivity and telematics will optimize fleet management and maintenance.

- Government incentives and emission regulations will continue to accelerate electrification.

- Expanding charging infrastructure will support wider use across remote and industrial areas.

- Collaborations between automakers and battery suppliers will strengthen technological innovation.

- Growing preference for low-maintenance and cost-efficient vehicles will shape long-term market growth.