Market Overview

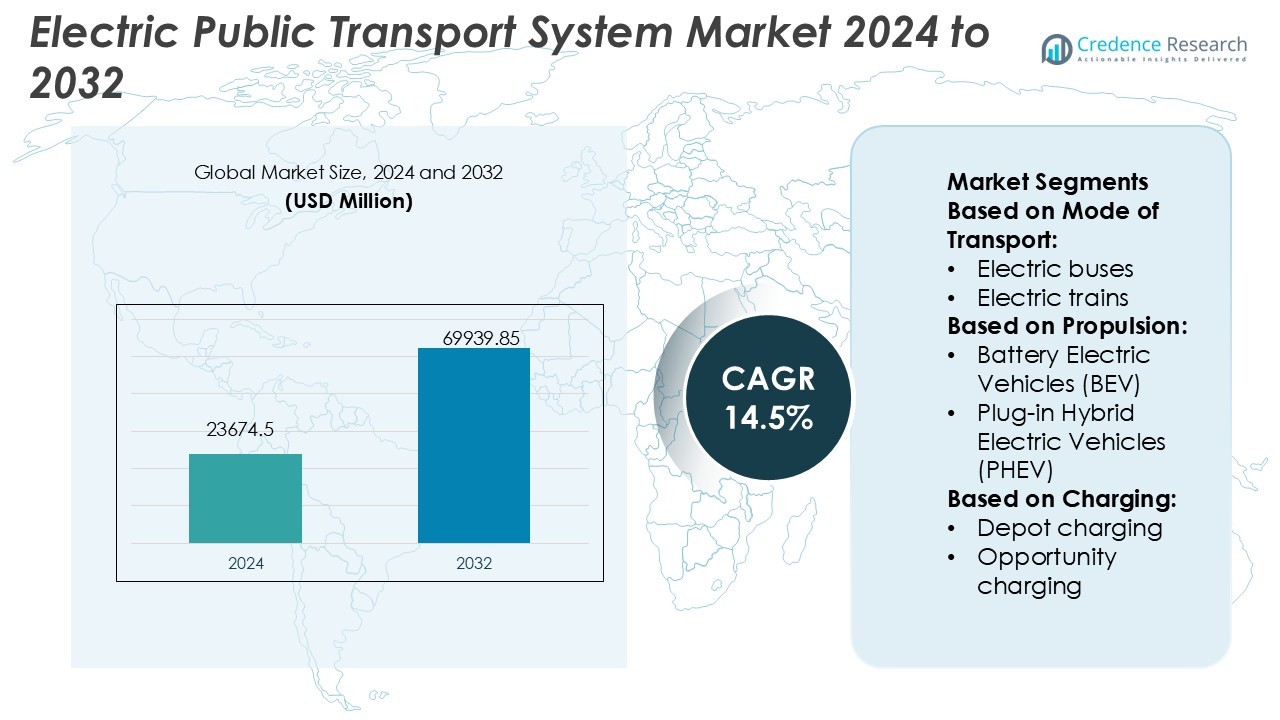

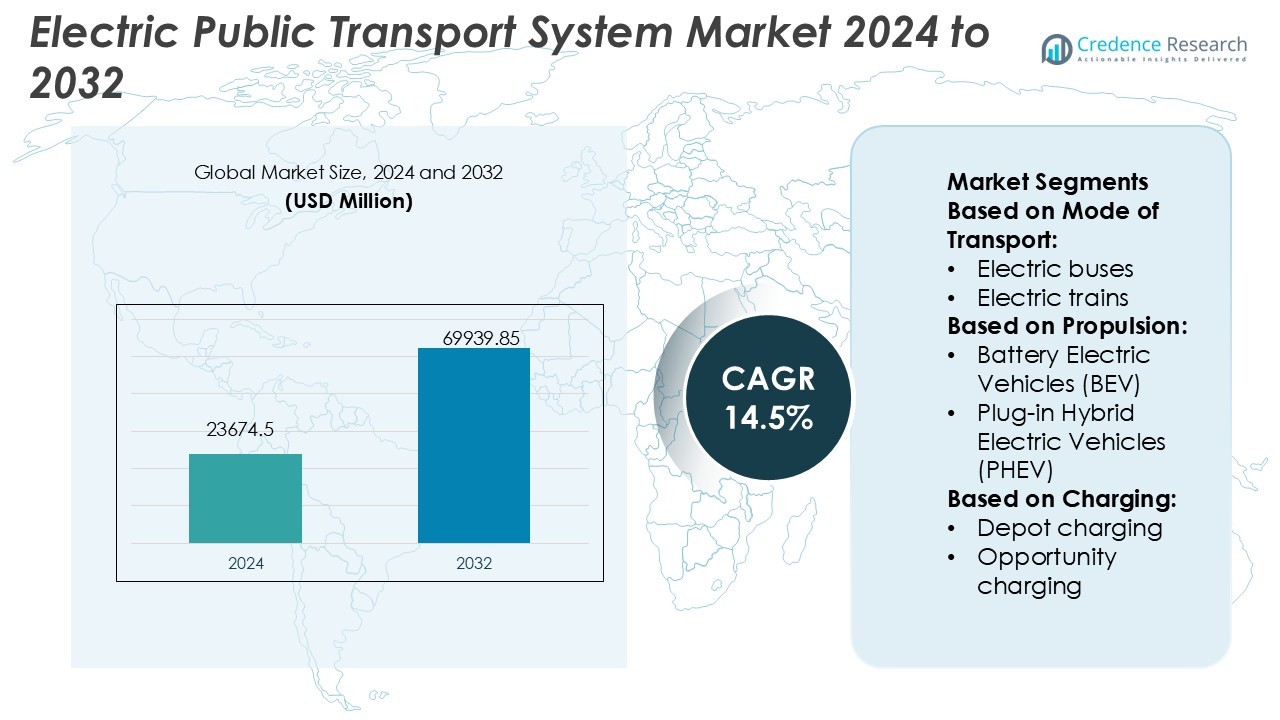

Electric Public Transport System Market size was valued USD 23674.5 million in 2024 and is anticipated to reach USD 69939.85 million by 2032, at a CAGR of 14.5% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Electric Public Transport System Market Size 2024 |

USD 23674.5 Million |

| Electric Public Transport System Market, CAGR |

14.5% |

| Electric Public Transport System Market Size 2032 |

USD 69939.85 Million |

The Electric Public Transport System Market features prominent players such as Volvo, Hitachi Rail, Yutong Bus, Tata Motors, EasyMile, Siemens Mobility, BYD, Heliox, VDL Bus & Coach, and Alstom. These companies focus on advancing electric mobility through innovation in battery systems, charging infrastructure, and digital fleet management. BYD and Yutong Bus lead global electric bus production, while Siemens Mobility and Alstom dominate the electric rail segment with smart and sustainable technologies. Volvo and Tata Motors emphasize fleet electrification in urban transit. Asia Pacific emerged as the leading region in 2024, capturing a 36% market share, supported by strong government policies, extensive manufacturing capacity, and rapid adoption of electric public transport systems across major cities.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Electric Public Transport System Market was valued at USD 23674.5 million in 2024 and is projected to reach USD 69939.85 million by 2032, growing at a CAGR of 14.5%.

- Market growth is driven by government electrification initiatives, emission reduction goals, and increasing adoption of electric buses and trains across urban centers.

- Rising integration of battery advancements, smart charging systems, and autonomous mobility solutions is shaping key market trends and improving operational efficiency.

- The market is highly competitive, with companies such as BYD, Siemens Mobility, Alstom, and Volvo leading through innovation, partnerships, and large-scale deployment.

- Asia Pacific dominates with a 36% share, supported by strong policy frameworks and large fleet deployment, while the electric bus segment leads globally with widespread adoption across city transportation networks.

Market Segmentation Analysis:

By Mode of Transport

Electric buses dominated the Electric Public Transport System Market, holding a 46% share in 2024. Their dominance stems from large-scale fleet electrification programs and government-backed subsidies in urban centers. Cities like Shenzhen and London have already achieved full electrification of their public bus networks, cutting emissions significantly. Rising investments in long-range battery systems and fast-charging depots enhance operational efficiency. Meanwhile, electric trains continue to expand across intercity and metro networks, while electric taxis and ferries are emerging in smaller but fast-growing niches driven by tourism and smart mobility demand.

- For instance, Mubea developed a transversal blade spring that replaces multi‑link axles, removing 20 kg of weight and freeing battery installation space in BEVs It enhances passenger safety while ensuring better stability at higher speeds.

By Propulsion

Battery Electric Vehicles (BEV) represented the leading propulsion category, accounting for 58% of the total market share in 2024. BEVs are favored for their lower operating costs, simple design, and zero tailpipe emissions. Continuous improvements in lithium-ion battery density and lifecycle performance strengthen BEV adoption across public transport fleets. Governments support this through direct purchase incentives and fleet electrification mandates. Plug-in Hybrid Electric Vehicles (PHEV) follow, offering flexibility for regions with limited charging infrastructure, while Fuel Cell Electric Vehicles (FCEV) gain attention in long-distance and heavy-duty transport applications.

- For instance, Dongfeng’s Aeolus Haohan PHEV uses the world’s first 4-speed power-split plus series-parallel hybrid system. It delivers a combined output of 265 kW and 615 Nm of torque, achieving a claimed range of 1,350 km.

By Charging

Depot charging systems dominated the charging segment with a 55% market share in 2024. This method suits overnight fleet operations, ensuring full battery capacity for daily service without schedule interruptions. Transit agencies prefer depot systems due to their reliability, controlled environment, and lower installation costs compared to public infrastructure. Opportunity charging, using fast chargers at stations and stops, is expanding in high-frequency routes to reduce downtime. Wireless charging and battery swapping are in early adoption phases but are expected to gain traction as automation and smart-grid integration improve efficiency and scalability.

Key Growth Drivers

Government Policies and Electrification Initiatives

Global governments are actively promoting public transport electrification through subsidies, tax incentives, and emission mandates. Policies like the EU Green Deal, India’s FAME II, and China’s NEV program accelerate electric bus and train adoption. These initiatives encourage fleet operators to replace diesel vehicles with battery-electric and hybrid models. In addition, low-emission zones in cities drive public agencies to invest in sustainable fleets, reinforcing infrastructure development for charging and grid integration. The combined policy support significantly strengthens the market’s long-term growth outlook.

- For instance, EP’s lithium batteries are rated for 3,000 cycles or more versus 500–1,000 cycles for lead acid. Warehouse forklifts and reach trucks follow closely, driven by e-commerce expansion and automation in storage facilities.

Advancements in Battery and Charging Technology

Technological progress in lithium-ion and solid-state batteries enhances energy density, reduces charging time, and extends operational range. Fast-charging and modular battery systems enable greater route flexibility for buses, trains, and taxis. Companies like BYD, Volvo, and Heliox are deploying depot and opportunity charging solutions that support high daily usage. These developments reduce operational downtime and total cost of ownership, making electric public transport economically viable. Continuous R&D investments ensure further cost reductions, improving fleet scalability and efficiency across major transit systems.

- For instance, Hyundai’s 25-30-32 BC-9U series offers rated loads of 5,000 to 6,500 lbs (≈ 2.27–2.95 t) with 36 V/48 V lead-acid or Li-ion compatibility and fast lift speeds. Counterbalance battery advancements have extended runtime, improving productivity and flexibility.

Rising Urbanization and Public Transport Demand

Rapid urbanization, especially in Asia-Pacific and Europe, drives the need for efficient, low-emission public mobility. Growing metropolitan populations strain existing infrastructure, encouraging governments to expand electric bus rapid transit (eBRT) systems and urban rail networks. Increasing consumer awareness of sustainability also promotes public preference for eco-friendly commuting options. Major cities like Paris, Beijing, and Mumbai are adopting smart electric fleets integrated with real-time monitoring and route optimization technologies. This urban transition is fueling strong demand for large-scale electrified transport systems worldwide.

Key Trends & Opportunities

Integration of Smart and Connected Transport Systems

The market is witnessing rapid integration of IoT, AI, and cloud technologies in fleet management. Smart systems enable predictive maintenance, route optimization, and real-time energy monitoring. Companies like Siemens Mobility and EasyMile are developing connected solutions that enhance safety and operational efficiency. Data-driven analytics improve scheduling accuracy and passenger experience while reducing energy waste. The growing adoption of digital mobility platforms opens new revenue models through performance-based maintenance and energy optimization services across urban public transport networks.

- For instance, Hyster-Yale’s J330XD–400XD heavy-duty electric trucks use a 350 V integrated lithium-ion battery setup, delivering “ICE-like performance” with zero tailpipe emissions.

Expansion of Public-Private Partnerships (PPP)

Public-private partnerships are becoming key drivers in building sustainable electric transport infrastructure. Governments collaborate with manufacturers and charging providers like Heliox and Alstom to accelerate fleet electrification and charging deployment. PPPs help share financial risk, encourage innovation, and ensure efficient project execution. Such collaborations are particularly vital in emerging economies where infrastructure investment remains limited. This cooperative model expands long-term growth potential by aligning public sustainability goals with private-sector technological expertise and capital efficiency.

- For instance, Clark’s SE15-25T three-wheel electric forklift delivers a true 5,000 lb (≈ 2,268 kg) load capacity at lift height, and features a staggered nested I-beam mast to reduce mast sway.

Growth of Electric Ferries and Ride-Hailing Services

Emerging opportunities are seen in electric ferries and ride-hailing fleets as cities diversify mobility systems. Coastal and island regions are electrifying marine transport to reduce fuel emissions, supported by innovations in battery swapping and rapid charging. Simultaneously, electric taxis and shared mobility platforms are scaling across Europe and Asia. Companies like Tata Motors and BYD are introducing purpose-built electric vehicles for ride-hailing operators. This diversification beyond buses and trains broadens market scope, improving overall sustainability in urban transport ecosystems.

Key Challenges

High Initial Investment and Infrastructure Costs

Despite declining battery prices, the upfront cost of electric buses, trains, and charging systems remains high. Setting up depot or opportunity charging stations requires significant grid upgrades and capital outlay. Many municipal authorities face budget constraints, delaying full-scale deployment. Additionally, the long payback period discourages private fleet operators from early adoption. Without strong financial support and scalable business models, cost barriers continue to hinder rapid transition toward zero-emission public transportation systems, particularly in developing economies.

Limited Charging Infrastructure and Range Constraints

Inadequate charging infrastructure and limited range remain critical challenges for electric public transport fleets. Many cities lack sufficient high-capacity chargers to support continuous operation of large bus networks. Long charging times reduce route flexibility and increase operational downtime. Range limitations particularly affect long-distance or high-frequency routes such as intercity rail and ferry services. To overcome this, operators must invest in advanced charging networks and energy storage solutions. However, grid dependency and infrastructure planning delays restrict the pace of electrification.

Regional Analysis

North America

North America held a 27% share of the Electric Public Transport System Market in 2024. The region’s growth is driven by large-scale electrification projects across the U.S. and Canada. Federal and state incentives under the U.S. Infrastructure Investment and Jobs Act and Canada’s Zero-Emission Transit Fund support fleet modernization. Major cities like New York, Los Angeles, and Toronto are transitioning bus and train fleets to battery-electric and hybrid models. Strong collaboration between transit authorities, manufacturers, and charging providers enhances infrastructure readiness, strengthening North America’s position in sustainable urban mobility initiatives.

Europe

Europe accounted for a 32% share of the global market in 2024, leading adoption through robust environmental regulations and decarbonization goals. Countries such as Germany, France, the Netherlands, and the UK are electrifying public transport networks under EU Green Deal targets. Cities like Amsterdam and Paris operate large fleets of electric buses, while electric trains dominate regional transit routes. Strong manufacturer presence, including Siemens Mobility, Volvo, and VDL Bus & Coach, enhances innovation and infrastructure rollout. Government funding for smart grids and depot charging stations continues to expand Europe’s leadership in zero-emission mobility.

Asia Pacific

Asia Pacific dominated the Electric Public Transport System Market with a 36% share in 2024. Rapid urbanization, population growth, and strong government initiatives across China, India, Japan, and South Korea drive large-scale fleet electrification. China leads globally with extensive electric bus and train deployment supported by BYD and Yutong Bus. India’s FAME II scheme further accelerates adoption in major cities. Advanced battery manufacturing capabilities and public-private investment in charging networks strengthen the region’s ecosystem. Asia Pacific remains the fastest-growing market, driven by its commitment to low-emission transport and affordable electric mobility solutions.

Latin America

Latin America captured an 8% share of the Electric Public Transport System Market in 2024. The region’s adoption is growing, led by initiatives in Brazil, Chile, and Colombia to electrify public bus fleets. Santiago operates one of the largest electric bus systems outside China, supported by partnerships with BYD and Enel X. Regional governments are prioritizing cleaner public mobility to meet sustainability goals and reduce fuel dependency. Although infrastructure gaps and funding constraints persist, expanding renewable energy capacity and private-sector participation are gradually improving adoption rates across Latin American urban centers.

Middle East & Africa

The Middle East & Africa accounted for a 7% share of the market in 2024, with emerging adoption driven by smart city projects and diversification efforts. The UAE and Saudi Arabia are investing in electric buses and rail systems as part of Vision 2030 and Net Zero initiatives. South Africa is also piloting electric bus projects in major cities. Infrastructure development and supportive government policies are creating new growth opportunities. While market penetration remains lower than other regions, ongoing investment in renewable energy and public transport modernization will accelerate regional expansion over the coming years.

Market Segmentations:

By Mode of Transport:

- Electric buses

- Electric trains

By Propulsion:

- Battery Electric Vehicles (BEV)

- Plug-in Hybrid Electric Vehicles (PHEV)

By Charging:

- Depot charging

- Opportunity charging

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Electric Public Transport System Market is highly competitive, with key players including Volvo, Hitachi Rail, Yutong Bus, Tata Motors, EasyMile, Siemens Mobility, BYD, Heliox, VDL Bus & Coach, and Alstom. The Electric Public Transport System Market is characterized by strong competition, rapid innovation, and strategic collaboration among manufacturers, technology providers, and public authorities. Companies are investing heavily in electrification technologies, energy-efficient designs, and digital fleet management systems to enhance operational performance. Partnerships between transport operators and infrastructure developers are driving large-scale deployment of electric buses, trains, and taxis across urban regions. Continuous advancements in battery efficiency, charging speed, and automation support market expansion. Furthermore, sustainability goals and government incentives encourage global players to focus on zero-emission mobility, ensuring long-term competitiveness and environmental impact reduction.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In September 2024, Panasonic Automotive Systems introduced an advanced electric public transport system featuring a smart in-vehicle infotainment platform that integrates voice recognition and gesture control to improve passenger interaction and driver safety.

- In September 2024, CRRC Corporation unveiled a state-of-the-art, ultra-low-floor electric tram with enhanced energy regeneration features, reducing energy consumption by up to 40% and making it ideal for densely populated urban environments.

- In March 2024, Yutong announced that the company delivered 10 Ice12 pure electric buses to Palermo, Sicily, Italy. Ice12 pure electric bus boasts Yutong’s leading electric technology and an efficient battery system, excelling in range performance.

- In March 2024, Volvo introduced the new Volvo 8900 Electric is an electric low-entry bus for city, intercity, and commuter operations. It is offered in two- and three-axle configurations, with a capacity of up to 110 passengers on the longest version, where up to 57 seats can be mounted. The 12-meter capacity is up to 88 passengers (43 seated).

Report Coverage

The research report offers an in-depth analysis based on Mode of Transport, Propulsion, Charging and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The adoption of electric buses and trains will expand rapidly across urban and intercity routes.

- Governments will continue to strengthen policies supporting zero-emission public transportation systems.

- Battery technology advancements will improve range, charging speed, and operational efficiency.

- Charging infrastructure networks will expand to support high-capacity public transport fleets.

- Integration of smart grid and IoT technologies will optimize fleet performance and maintenance.

- Public-private partnerships will increase to accelerate infrastructure development and fleet deployment.

- Autonomous and connected electric vehicles will enhance safety and reduce human intervention.

- Renewable energy integration will make public transport systems more sustainable and cost-effective.

- Asia Pacific will maintain its dominance, while Europe and North America will see steady expansion.

- Continuous innovation in design and materials will lower lifecycle costs and enhance passenger comfort.