Market Overview

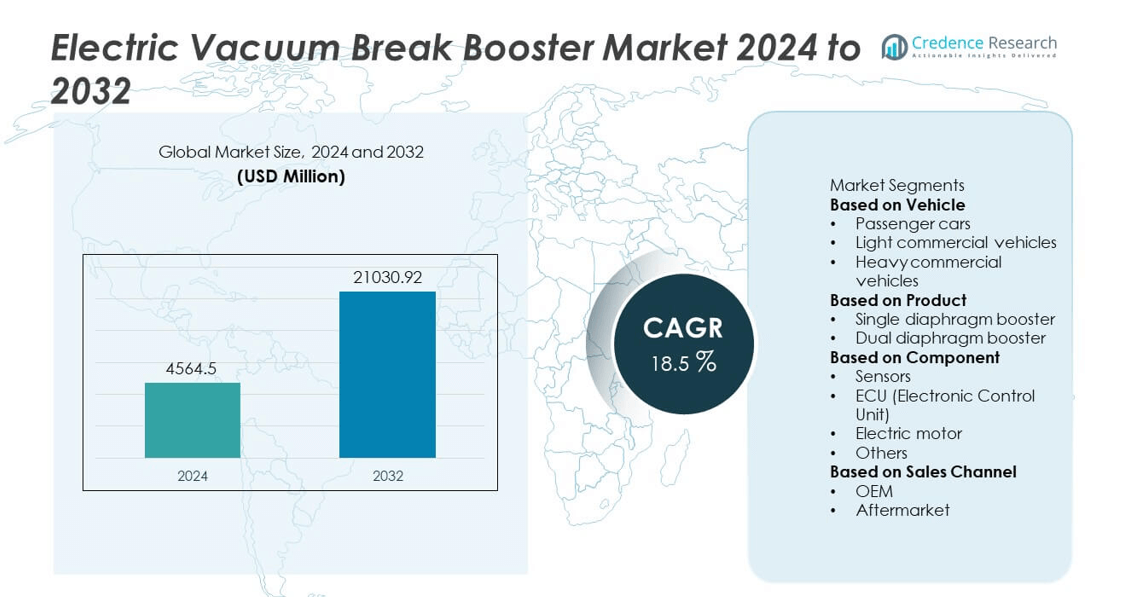

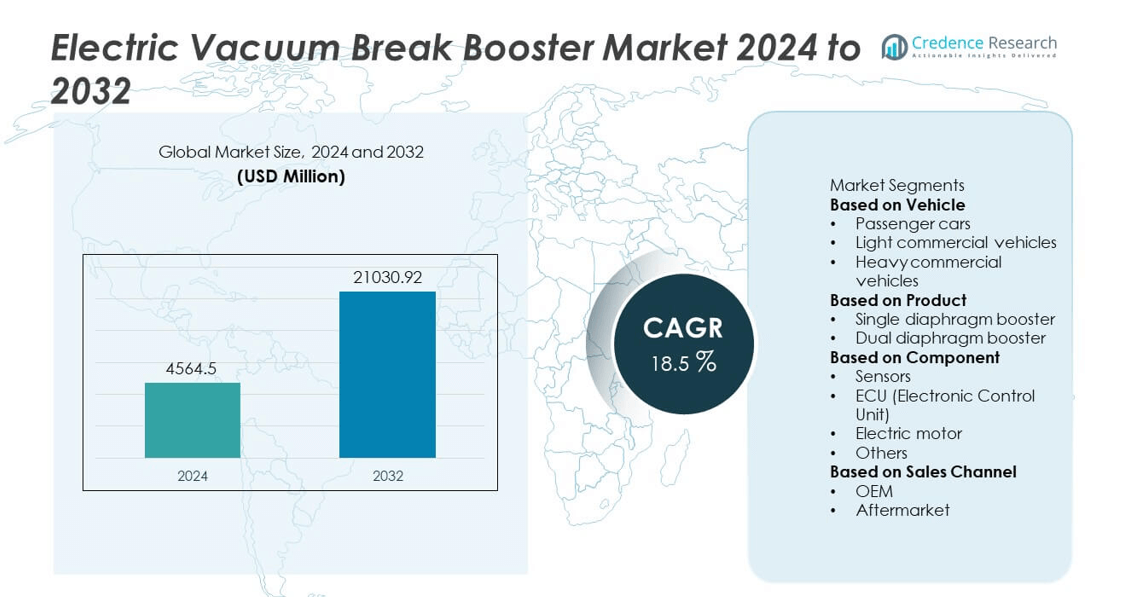

The Electric Vacuum Brake Booster Market was valued at USD 4,564.5 million in 2024 and is projected to reach USD 21,030.92 million by 2032, growing at a CAGR of 18.5% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Electric Vacuum Break Booster Market Size 2024 |

UUSD 4,564.5 million |

| Electric Vacuum Break Booster Market, CAGR |

18.5% |

| Electric Vacuum Break Booster Market Size 2032 |

USD 21,030.92 million |

The Electric Vacuum Brake Booster Market is led by major players such as Knorr-Bremse AG, Mando Corporation, Magneti Marelli, Aisin Corp, Infineon Technologies AG, Hyundai Mobis, Cardone SA, Continental AG, Delphi Technologies, and Cohline GmbH. These companies focus on advanced braking solutions that enhance vehicle safety, energy efficiency, and regenerative performance in electric and hybrid vehicles. Strong investments in sensor integration, electronic control units, and lightweight booster systems are driving innovation. Asia-Pacific dominated the market in 2024 with a 31% share, supported by large-scale EV manufacturing and government electrification programs. North America followed with 34%, and Europe held 29%, driven by stringent safety regulations and high adoption of advanced braking technologies.

Market Insights

- The Electric Vacuum Brake Booster Market was valued at USD 4,564.5 million in 2024 and is projected to reach USD 21,030.92 million by 2032, growing at a CAGR of 18.5% during the forecast period.

- Growth is driven by the increasing adoption of electric and hybrid vehicles, stricter safety regulations, and rising demand for energy-efficient braking systems across passenger and commercial vehicles.

- Market trends highlight advancements in ECU integration, compact electric motor design, and growing use of intelligent braking systems compatible with ADAS and autonomous driving technologies.

- Leading players such as Continental AG, Hyundai Mobis, Aisin Corp, and Knorr-Bremse AG are focusing on R&D, product innovation, and strategic partnerships to enhance performance and reduce system cost.

- North America led with a 34% market share, followed by Europe at 29% and Asia-Pacific at 31%, while the dual diaphragm booster segment dominated with a 58% share due to its higher braking efficiency and reliability.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Vehicle

The passenger car segment dominated the Electric Vacuum Brake Booster Market in 2024 with a 61% market share. This dominance is attributed to the rising production of electric and hybrid passenger vehicles worldwide. Increasing demand for enhanced braking efficiency, lightweight components, and energy-saving systems supports strong adoption in this segment. Automakers are integrating electric vacuum brake boosters to ensure smoother braking and regenerative energy recovery. Growth in electric vehicle models from manufacturers such as Tesla, BYD, and Volkswagen further drives demand, solidifying the passenger car segment’s leadership in the global market.

- For instance, BYD integrates its advanced braking system into the e-Platform 3.0 architecture, which is designed to improve energy recovery and reduce stopping distances across its Han and Tang EV models. This system works in conjunction with regenerative braking, where the electric motor recovers energy during deceleration, reducing reliance on the friction brakes.

By Product

The dual diaphragm booster segment held a 58% market share in 2024, driven by its superior braking force and responsiveness compared to single diaphragm systems. Dual diaphragm designs are widely used in modern electric and hybrid vehicles requiring stable and powerful braking under variable loads. Their enhanced vacuum efficiency ensures improved safety and comfort during operation. Automakers are increasingly favoring dual diaphragm boosters to meet advanced vehicle performance standards and global safety regulations. This segment continues to expand due to its reliability in both passenger and commercial vehicle applications.

- For instance, Aisin Corporation produces cooperative regenerative braking systems for electric vehicles, which maximize energy recovery during deceleration. These systems utilize both regenerative and hydraulic braking to optimize energy efficiency.

By Component

The electric motor segment accounted for a 46% market share in 2024, leading the Electric Vacuum Brake Booster Market. Electric motors play a crucial role in generating consistent vacuum pressure independent of the engine, improving braking reliability and energy efficiency. With the transition toward electric powertrains, demand for motorized boosters has grown significantly. Manufacturers are focusing on compact and high-torque electric motors to enhance performance while reducing noise and vibration. The ongoing shift toward full electrification and the integration of smart braking technologies are expected to maintain this segment’s dominance through the forecast period.

Key Growth Drivers

Rising Adoption of Electric and Hybrid Vehicles

The accelerating shift toward electric and hybrid vehicles is a primary growth driver for the Electric Vacuum Brake Booster Market. Unlike traditional vehicles, EVs lack an engine-driven vacuum source, making electric brake boosters essential for optimal braking performance. Automakers are integrating these systems to improve regenerative braking and safety. Governments worldwide are promoting EV adoption through subsidies and emission norms, further supporting market expansion. As EV production rises, the demand for efficient, power-assisted braking systems continues to grow rapidly across major automotive markets.

- For instance, Continental AG supplies its MK C1 electro-hydraulic braking system to several EV platforms, combining brake booster, master cylinder, and control unit into one module. The system can build up brake pressure significantly faster than conventional hydraulic systems, allowing for faster response times in emergency situations.

Stringent Safety and Emission Regulations

Growing emphasis on road safety and environmental sustainability is fueling the adoption of advanced braking technologies. Regulatory bodies such as the NHTSA and UNECE mandate vehicle safety standards that include improved braking response and system reliability. Electric vacuum brake boosters help reduce braking distance and support energy recovery in EVs, aligning with global emission targets. Automakers are investing in electronically controlled braking systems to comply with these norms. This regulatory shift is accelerating the integration of electric vacuum brake boosters across both passenger and commercial vehicles.

- For instance, Hyundai Mobis developed an Integrated Mobis Electronic Brake (iMEB) system that integrates the pressure supply and pressure control units for the regenerative brake, which includes functionality such as ESC and ABS, into a single electronic unit.

Technological Advancements in Brake Systems

Continuous innovation in brake control systems and electronic integration is enhancing vehicle safety and performance. Modern electric vacuum brake boosters combine sensors, ECUs, and electric motors for precise control and energy efficiency. Advancements in lightweight materials, miniaturized components, and smart diagnostics are improving system reliability and reducing maintenance costs. Automakers are leveraging these innovations to enhance driving comfort and braking accuracy in electric vehicles. As braking technologies become more digitalized, electric boosters are evolving into critical components for next-generation intelligent mobility solutions.

Key Trends & Opportunities

Integration of Advanced Driver Assistance Systems (ADAS)

The rise of ADAS and semi-autonomous driving is creating strong growth opportunities for electric vacuum brake boosters. These systems require reliable, electronically controlled braking for adaptive cruise control and collision avoidance functions. Electric brake boosters enable faster response and consistent braking pressure, supporting automated safety features. As vehicle automation advances, integration between ADAS and brake control modules is becoming essential. This trend is prompting suppliers to develop high-performance, software-compatible boosters that meet the needs of connected and autonomous vehicles.

- For instance, Bosch developed its iBooster 2nd Generation, an electro-mechanical brake booster capable of generating brake pressure up to 11 MPa within 120 milliseconds. The system is fully compatible with Level 2 and Level 3 ADAS architectures, allowing seamless integration with automatic emergency braking and adaptive cruise systems across EV and hybrid platforms.

Growth of Regenerative Braking Systems in EVs

The increasing use of regenerative braking in electric vehicles is expanding the role of electric vacuum brake boosters. These systems work in coordination with regenerative braking to optimize energy recovery and maintain smooth deceleration. Electric boosters help balance mechanical and regenerative braking, ensuring safety and comfort. Manufacturers are developing intelligent braking systems that maximize energy efficiency while minimizing wear on mechanical components. The synergy between regenerative technology and electric brake boosters is driving innovation and efficiency across the EV ecosystem.

- For instance, ZF Friedrichshafen AG introduced its Integrated Brake Control (IBC) system, capable of generating brake pressure up to 6,000 N within 150 milliseconds. The unit manages regenerative and friction braking automatically, recovering up to 18 kWh of energy during urban drive cycles in electric SUVs. Its modular design eliminates the need for a conventional vacuum pump, improving braking response and overall vehicle energy efficiency.

Key Challenges

High Cost of Advanced Braking Components

The high cost of electronic components and advanced sensors used in electric vacuum brake boosters remains a key challenge. Integrating ECUs, electric motors, and diagnostic modules increases manufacturing expenses, limiting adoption in low-cost vehicles. OEMs are under pressure to balance performance, reliability, and affordability. Although economies of scale and mass production are reducing costs, price sensitivity in developing markets remains a hurdle. To address this, manufacturers are focusing on modular designs and cost-optimized production to make advanced braking technology more accessible.

Limited Standardization and System Complexity

The lack of standardization in electronic braking system design across OEMs adds complexity to integration and maintenance. Different vehicle architectures require customized booster configurations, increasing engineering time and costs. Additionally, the complexity of integrating boosters with ECUs, sensors, and regenerative braking systems can lead to software compatibility issues. Manufacturers must ensure interoperability between subsystems to maintain safety and performance. Developing universal design frameworks and robust testing protocols is crucial to overcoming these technical challenges and achieving broader adoption.

Regional Analysis

North America

North America held a 34% market share in 2024, driven by strong adoption of electric and hybrid vehicles across the U.S. and Canada. The region’s strict safety regulations and government incentives for EV production support demand for advanced braking technologies. Key automakers such as Ford, General Motors, and Tesla are integrating electric vacuum brake boosters to enhance braking precision and energy efficiency. Growth in ADAS-equipped vehicles and continuous R&D investments in brake control systems further strengthen North America’s position as a leading market for electric vacuum brake boosters.

Europe

Europe accounted for a 29% market share in 2024, supported by stringent emission regulations and the rapid transition toward electric mobility. Countries including Germany, France, and the United Kingdom are leading adoption through strong EV infrastructure and safety compliance standards. The presence of major OEMs such as BMW, Volkswagen, and Mercedes-Benz drives innovation in advanced brake systems. Rising consumer demand for sustainable and high-performance vehicles boosts the need for energy-efficient braking solutions. Increasing integration of ADAS and autonomous driving technologies further reinforces Europe’s prominence in the market.

Asia-Pacific

Asia-Pacific captured the largest 31% market share in 2024, led by expanding electric vehicle manufacturing in China, Japan, and South Korea. Strong government policies promoting zero-emission transport and local component production drive regional growth. Chinese manufacturers such as BYD and SAIC Motor are incorporating electric brake boosters in mass-produced EVs to enhance safety and efficiency. Growing investments in domestic automotive technology and rising consumer awareness of vehicle safety features are accelerating adoption. Rapid urbanization, coupled with increasing EV exports, continues to position Asia-Pacific as the fastest-growing regional market.

Latin America

Latin America held a 4% market share in 2024, with emerging adoption in Brazil and Mexico. Economic focus on fuel efficiency and lower vehicle emissions is promoting the use of electric brake boosters in passenger and light commercial vehicles. Governments are encouraging EV manufacturing through tax incentives and local assembly initiatives. Although infrastructure limitations remain, international collaborations with global automotive suppliers are expanding product availability. Rising awareness of safety standards and technological modernization in vehicle manufacturing indicate steady growth potential for the electric vacuum brake booster market in the region.

Middle East & Africa

The Middle East and Africa accounted for a 2% market share in 2024, reflecting early-stage adoption of electric braking systems. Countries such as the UAE, Saudi Arabia, and South Africa are leading with investments in electric mobility and smart transportation. Growing interest in EV infrastructure development and government sustainability programs supports gradual market growth. Luxury and premium vehicle segments are early adopters due to higher emphasis on safety and performance. Despite infrastructural challenges, long-term electrification plans and strategic partnerships with global OEMs are expected to drive market expansion in the coming years.

Market Segmentations:

By Vehicle

- Passenger cars

- Light commercial vehicles

- Heavy commercial vehicles

By Product

- Single diaphragm booster

- Dual diaphragm booster

By Component

- Sensors

- ECU (Electronic Control Unit)

- Electric motor

- Others

By Sales Channel

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Electric Vacuum Brake Booster Market includes leading companies such as Knorr-Bremse AG, Mando Corporation, Magneti Marelli, Aisin Corp, Infineon Technologies AG, Hyundai Mobis, Cardone SA, Continental AG, Delphi Technologies, and Cohline GmbH. These players are focusing on developing advanced, energy-efficient braking solutions tailored for electric and hybrid vehicles. Strategic partnerships with OEMs and EV manufacturers are helping expand their global reach and product integration. Continuous R&D investment in compact designs, lightweight materials, and intelligent control systems is enhancing performance and safety. Companies are also leveraging sensor and ECU technologies to improve brake response and diagnostics. The market remains highly competitive, with firms emphasizing regional manufacturing, cost optimization, and compliance with global safety standards to capture a larger share in both passenger and commercial vehicle segments.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Knorr-Bremse AG

- Mando Corporation

- Magneti Marelli

- Aisin Corp

- Infineon Technologies AG

- Hyundai Mobis

- Cardone SA

- Continental AG

- Delphi Technologies

- Cohline GmbH

Recent Developments

- In March 2025, Continental AG advanced its hub-motor braking integration project, combining braking functions directly within the electric wheel hub assembly. The innovation delivers braking torque up to 2,500 Nm per wheel, supporting compact EV architectures and reducing mechanical transmission losses.

- In 2025, Continental AG unveiled its Integrated Brake-by-Wire System that combines the master cylinder, booster, and electronic control into a single compact module. The system achieves a 30% reduction in overall weight and provides faster brake pressure build-up to enhance EV braking performance and energy recovery efficiency.

- In September 2024, Knorr-Bremse AG announced its push toward a full Electromechanical Braking System (EMBS) featuring full “brake-by-wire” capability. The system includes redundant electrical power supply, electronic control unit, and electromechanical actuators, replacing conventional pneumatic or vacuum booster elements.

- In 2024, Knorr-Bremse plans to automate assembly of its electrically powered compressors, a related component in electrified braking systems (which assist vacuum or pressure generation).

Report Coverage

The research report offers an in-depth analysis based on Vehicle, Product, Component, Sales Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The electric vacuum brake booster market will expand rapidly with rising electric and hybrid vehicle production.

- Continuous innovation in compact and lightweight booster designs will enhance energy efficiency.

- Integration with advanced driver assistance systems will improve braking precision and safety.

- Manufacturers will focus on cost reduction through localized production and modular designs.

- Demand for high-performance dual diaphragm boosters will increase across passenger and commercial vehicles.

- Growth in autonomous and connected vehicles will accelerate adoption of electronic braking systems.

- Strategic partnerships between automakers and component suppliers will strengthen product development.

- Expanding EV infrastructure and regulatory mandates will sustain long-term market growth.

- Asia-Pacific will emerge as the fastest-growing region due to large-scale EV manufacturing and technology adoption.

- Advancements in sensor and ECU technologies will drive intelligent braking solutions in future mobility platforms.