Market Overview

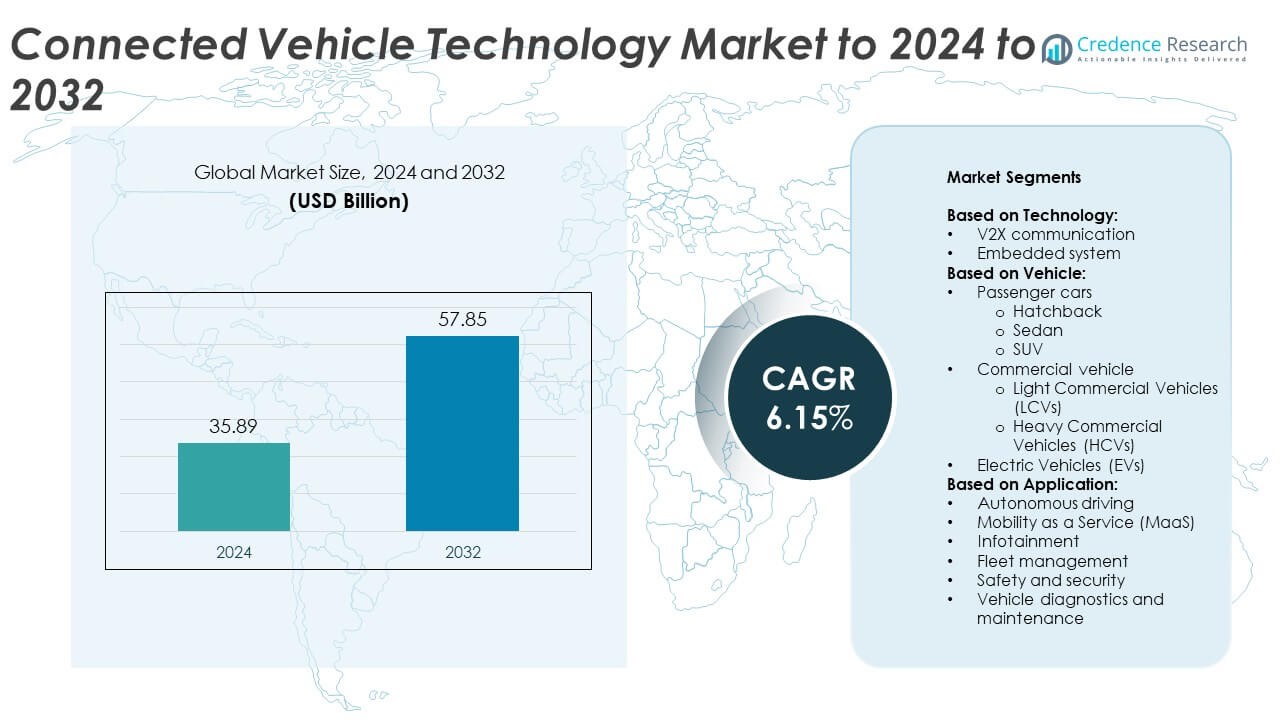

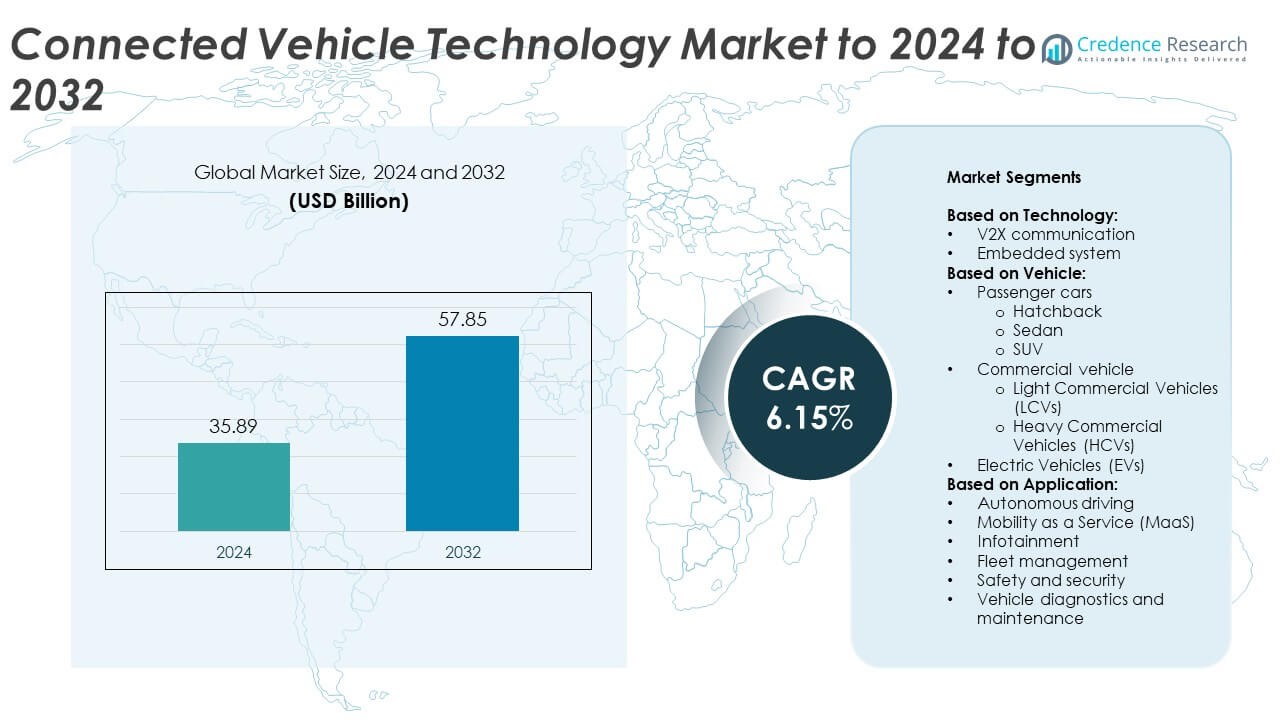

Connected Vehicle Technology Market size was valued USD 35.89 billion in 2024 and is anticipated to reach USD 57.85 billion by 2032, at a CAGR of 6.15% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Connected Vehicle Technology Market Size 2024 |

USD 35.89 Billion |

| Connected Vehicle Technology Market, CAGR |

6.15% |

| Connected Vehicle Technology Market Size 2032 |

USD 57.85 Billion |

The Connected Vehicle Technology Market is led by major players including Waymo, Harman, Microsoft, Denso, Qualcomm, Intel, Cisco, NXP Semiconductors, Ericsson, and Aptiv. These companies are advancing connectivity through V2X communication, telematics, and AI-powered data platforms to enhance vehicle safety, performance, and efficiency. Continuous investments in 5G infrastructure, cloud integration, and cybersecurity solutions are driving technological competitiveness. Regionally, North America dominated the market in 2024 with a 37% share, supported by robust digital infrastructure and early adoption of autonomous and connected vehicles, followed by Europe with 32% and Asia-Pacific with 25%.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Connected Vehicle Technology Market was valued at USD 35.89 billion in 2024 and is projected to reach USD 57.85 billion by 2032, growing at a CAGR of 6.15%.

- Growing integration of ADAS, autonomous driving systems, and 5G networks is driving market expansion across vehicle categories.

- Emerging trends include AI-powered analytics, over-the-air software updates, and increasing deployment of V2X communication, which held a 59% share in 2024.

- The market is moderately competitive, with key players investing in telematics, data security, and cloud-based solutions to enhance connectivity performance.

- North America led the global market with 37% share in 2024, followed by Europe with 32% and Asia-Pacific with 25%, supported by expanding EV adoption and smart mobility initiatives.

Market Segmentation Analysis:

By Technology

V2X communication dominated the Connected Vehicle Technology Market in 2024, capturing around 59% of the total share. The technology’s ability to enable real-time data exchange between vehicles, infrastructure, and pedestrians enhances traffic efficiency and road safety. Governments across North America, Europe, and Asia are promoting V2X deployment through smart city and intelligent transport initiatives. Automakers such as General Motors, Toyota, and Audi have integrated V2X systems to support collision avoidance, adaptive traffic management, and platooning functions, accelerating its widespread adoption across passenger and commercial fleets.

- For instance, the adoption of V2X technology is increasing, with market research indicating that significantly more than 2 million V2X-equipped vehicles were shipped worldwide in 2024.

By Vehicle

Passenger cars led the market in 2024, accounting for nearly 62% of total revenue. Among these, SUVs represented the largest sub-segment due to higher connectivity integration in premium and mid-range models. The growing demand for advanced driver-assistance systems (ADAS), infotainment, and in-car connectivity features supports this leadership. Manufacturers such as BMW, Tesla, and Hyundai are equipping SUVs with advanced telematics and over-the-air software updates to enhance vehicle intelligence and customer experience, driving strong adoption in urban and semi-urban mobility ecosystems.

- For instance, Mobileye reported shipping approximately 29.0 million EyeQ and SuperVision systems in 2024, this represented a decrease from the 37.4 million units shipped in 2023, primarily due to a significant drawdown of excess inventory by customers and reduced shipments to China

By Application

Safety and security dominated the Connected Vehicle Technology Market in 2024, holding approximately 37% of the total share. Rising demand for real-time alerts, automatic emergency braking, and collision detection systems has driven adoption. Integration of AI and IoT-enabled analytics enhances vehicle-to-cloud communication for improved situational awareness. Companies such as Bosch, Continental, and Qualcomm are advancing cybersecurity and safety systems to prevent data breaches and ensure reliable performance. The increasing regulatory emphasis on driver and pedestrian safety continues to strengthen this segment’s dominance globally.

Key Growth Drivers

Rising Demand for Vehicle Safety and ADAS Integration

The increasing focus on road safety and accident prevention remains a primary growth driver for the Connected Vehicle Technology Market. Governments are enforcing regulations that mandate advanced driver-assistance systems (ADAS) and connectivity solutions in vehicles. Automakers such as Volvo and Ford are integrating adaptive cruise control, collision avoidance, and lane-keeping systems through connected technologies. This regulatory push, combined with consumer preference for enhanced safety, is fueling widespread adoption across both passenger and commercial vehicle segments.

- For instance, Aptiv states its active safety tech is deployed in 55+ million vehicles globally.

Expansion of 5G and V2X Infrastructure

The global rollout of 5G networks is a major enabler for connected vehicle growth. High-speed, low-latency connectivity allows vehicles to communicate seamlessly with infrastructure, other vehicles, and cloud platforms. The expansion of 5G coverage supports advanced applications such as real-time navigation, autonomous driving, and predictive maintenance. Companies like Qualcomm and Ericsson are investing in 5G-V2X solutions, accelerating the development of intelligent transport systems that enhance safety and reduce congestion.

- For instance, EU C-ITS deployment is ongoing, leveraging both short-range and cellular technologies to improve cross-border services and road safety. As of a 2021 report, cellular C-ITS services covered over 100,000 km of European roads, while another 20,000 km were equipped with short-range ITS-G5 communication infrastructure, primarily through initiatives involving the C-Roads Platform.

Growth in Autonomous and Electric Vehicle Adoption

The rise of autonomous and electric vehicles has significantly expanded the need for integrated connectivity. Connected systems enable EVs to monitor battery health, optimize charging, and update software remotely. For autonomous vehicles, real-time data exchange ensures improved decision-making and navigation accuracy. Tesla, BYD, and Waymo are at the forefront of integrating advanced connectivity architectures to support automation, mobility services, and sustainability goals, driving long-term market growth.

Key Trends & Opportunities

Emergence of Mobility-as-a-Service (MaaS)

Mobility-as-a-Service represents a major opportunity for connected vehicle technology providers. The shift from vehicle ownership to shared mobility is creating demand for data-driven fleet management and route optimization systems. Companies such as Uber, Didi, and Lyft are adopting connected vehicle solutions for predictive maintenance, driver safety, and efficient dispatching. As cities focus on reducing congestion and emissions, MaaS platforms leveraging connectivity and cloud analytics are gaining prominence in urban mobility networks.

- For instance, Industry analyses forecast that by 2025, there will be significantly more than 250 million connected vehicles with some level of cloud integration.

Integration of AI and Cloud-Based Analytics

Artificial intelligence and cloud computing are transforming connected vehicle operations by enabling real-time data processing and predictive insights. OEMs and technology firms are deploying AI-driven systems for fault detection, remote diagnostics, and personalized infotainment experiences. The use of cloud platforms by companies like Amazon Web Services and Microsoft Azure enhances scalability and over-the-air update capabilities. This integration supports improved performance, security, and vehicle lifecycle management, creating new revenue streams for OEMs and service providers.

- For instance, Urgent.ly, which acquired Otonomo in 2023, leverages a vast volume of connected vehicle data. The Otonomo platform previously reported ingesting over 4 billion data points per day from more than 40 million connected vehicles globally.

Key Challenges

Data Security and Privacy Concerns

Cybersecurity remains a major challenge for the connected vehicle ecosystem. Increasing vehicle connectivity exposes networks to potential data breaches, hacking, and unauthorized access. Automotive firms and tech suppliers must comply with stringent data protection standards, including GDPR and ISO 21434. Companies such as Bosch and Continental are developing advanced encryption and intrusion detection systems, but ensuring end-to-end protection across vehicle-to-cloud communication continues to pose a critical challenge for the industry.

High Implementation and Integration Costs

The high cost of integrating advanced connectivity, sensors, and communication modules limits adoption in mid-range and entry-level vehicles. Developing V2X infrastructure and 5G connectivity also requires significant public and private investment. Smaller manufacturers face barriers due to high development expenses and compatibility issues with legacy systems. Despite long-term benefits, the initial deployment costs for connected platforms remain a restraint, particularly in developing markets with limited infrastructure and technological readiness.

Regional Analysis

North America

North America led the Connected Vehicle Technology Market in 2024, accounting for nearly 37% of the global share. The region’s dominance is driven by strong 5G infrastructure, government safety mandates, and early adoption of autonomous driving technologies. The United States leads with large-scale deployment of V2X communication and connected fleet solutions. Key automakers such as General Motors, Ford, and Tesla are integrating AI-driven telematics and over-the-air software updates. Growing investments in intelligent transportation systems and collaborations between automakers and telecom providers continue to support North America’s leadership in connected mobility innovation.

Europe

Europe held around 32% of the market share in 2024, supported by strict emission norms, data privacy laws, and smart city initiatives. The European Union’s commitment to road safety and carbon reduction has accelerated connected vehicle deployment. Germany, France, and the UK are leading in integrating ADAS, infotainment, and V2X technologies. Major OEMs such as BMW, Mercedes-Benz, and Volkswagen are expanding connected car services through partnerships with tech firms. The region’s focus on interoperability, vehicle cybersecurity, and sustainable mobility solutions further strengthens Europe’s position in the global market.

Asia-Pacific

Asia-Pacific accounted for nearly 25% of the total market share in 2024 and is projected to grow at the fastest pace. China, Japan, and South Korea are investing heavily in 5G networks and autonomous vehicle testing zones. Expanding EV adoption, smart infrastructure development, and government-backed digital mobility programs drive regional growth. Automakers like Toyota, Hyundai, and BYD are enhancing in-vehicle connectivity through real-time diagnostics and cloud-based platforms. Increasing smartphone penetration and consumer demand for digital features continue to transform Asia-Pacific into a major growth hub for connected vehicle technology.

Latin America

Latin America represented about 4% of the Connected Vehicle Technology Market in 2024, driven by gradual improvements in communication networks and urban mobility initiatives. Brazil and Mexico lead regional adoption with growing investments in smart transportation systems and telematics. Connected vehicle integration in fleet management and logistics sectors is gaining traction. Partnerships between automotive OEMs and telecom operators are expanding access to real-time vehicle monitoring. While infrastructure limitations persist, the increasing demand for safety and fuel-efficient solutions supports steady growth across Latin America’s connected vehicle ecosystem.

Middle East & Africa

The Middle East & Africa accounted for approximately 2% of the global market share in 2024. The growth is fueled by the expansion of smart city projects in the UAE, Saudi Arabia, and South Africa. Government-led digital transformation initiatives and rising adoption of electric vehicles are encouraging connected technology integration. Automakers and telecom firms are collaborating on 5G-enabled mobility solutions and fleet connectivity. Although the market is at an early stage, improving infrastructure and increasing awareness of vehicle safety and operational efficiency indicate promising long-term potential for the region.

Market Segmentations:

By Technology:

- V2X communication

- Embedded system

By Vehicle:

- Passenger cars

- Commercial vehicle

- Light Commercial Vehicles (LCVs)

- Heavy Commercial Vehicles (HCVs)

- Electric Vehicles (EVs)

By Application:

- Autonomous driving

- Mobility as a Service (MaaS)

- Infotainment

- Fleet management

- Safety and security

- Vehicle diagnostics and maintenance

By Geography:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Connected Vehicle Technology Market is shaped by leading players such as Waymo, Harman, Microsoft, Denso, Qualcomm, Intel, Cisco, NXP Semiconductors, Ericsson, and Aptiv. These companies are driving innovation through advancements in telematics, V2X communication, cloud computing, and AI-based analytics. The competition centers on developing scalable platforms that enable real-time data exchange, predictive diagnostics, and enhanced driver safety. Strategic alliances between automakers, telecom providers, and software firms are fostering ecosystem integration and interoperability. Market participants are also investing in cybersecurity, edge computing, and over-the-air update capabilities to strengthen product reliability. The growing emphasis on autonomous driving and electric mobility continues to push companies toward intelligent, data-driven connectivity solutions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Waymo

- Harman

- Microsoft

- Denso

- Qualcomm

- Intel

- Cisco

- NXP Semiconductors

- Ericsson

- Aptiv

Recent Developments

- In 2025, Aptiv showcased its sixth-generation Advanced Driver Assistance Systems (ADAS) platform at CES 2025.

- In 2025, Ericsson leveraged 5G networks to enable safer, more sustainable connected vehicle solutions. The company’s technology facilitates autonomous applications like automated trucks and taxis and ensures high-density, low-latency connectivity for in-vehicle sensors critical for positioning and perception.

- In 2023, Cisco contributed critical hardware and software solutions to enable 5G integration and V2X communication in vehicles.

Report Coverage

The research report offers an in-depth analysis based on Technology, Vehicle, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will experience steady growth driven by rising demand for real-time vehicle connectivity.

- Integration of 5G and edge computing will enhance communication speed and data accuracy.

- Autonomous and electric vehicles will increasingly rely on connected technologies for safety and control.

- AI-based predictive maintenance will become a core feature in fleet and passenger vehicles.

- Governments will expand smart infrastructure to support large-scale V2X adoption.

- Cloud-based data analytics will optimize route planning and reduce traffic congestion.

- Partnerships between automakers and telecom companies will accelerate innovation.

- Cybersecurity solutions will advance to protect vehicles from data breaches.

- Over-the-air software updates will become standard for improving system performance.

- Emerging markets will witness faster adoption as digital mobility ecosystems expand.