Market Overview

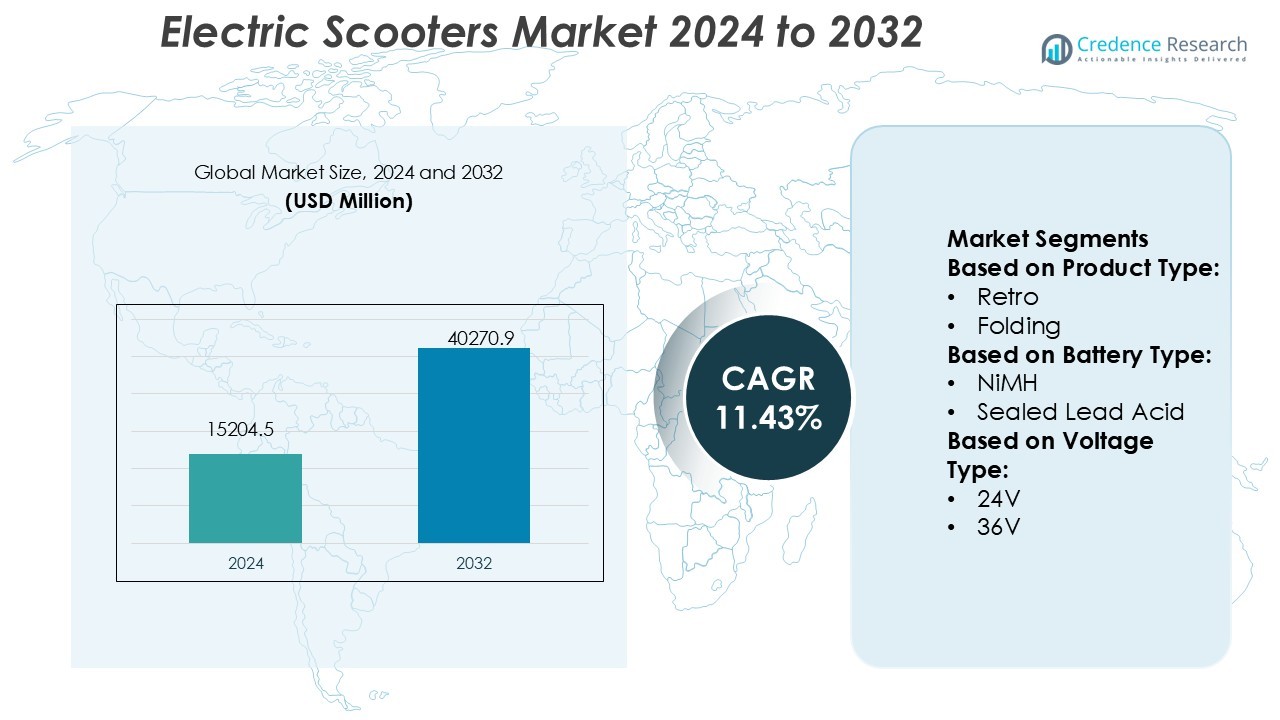

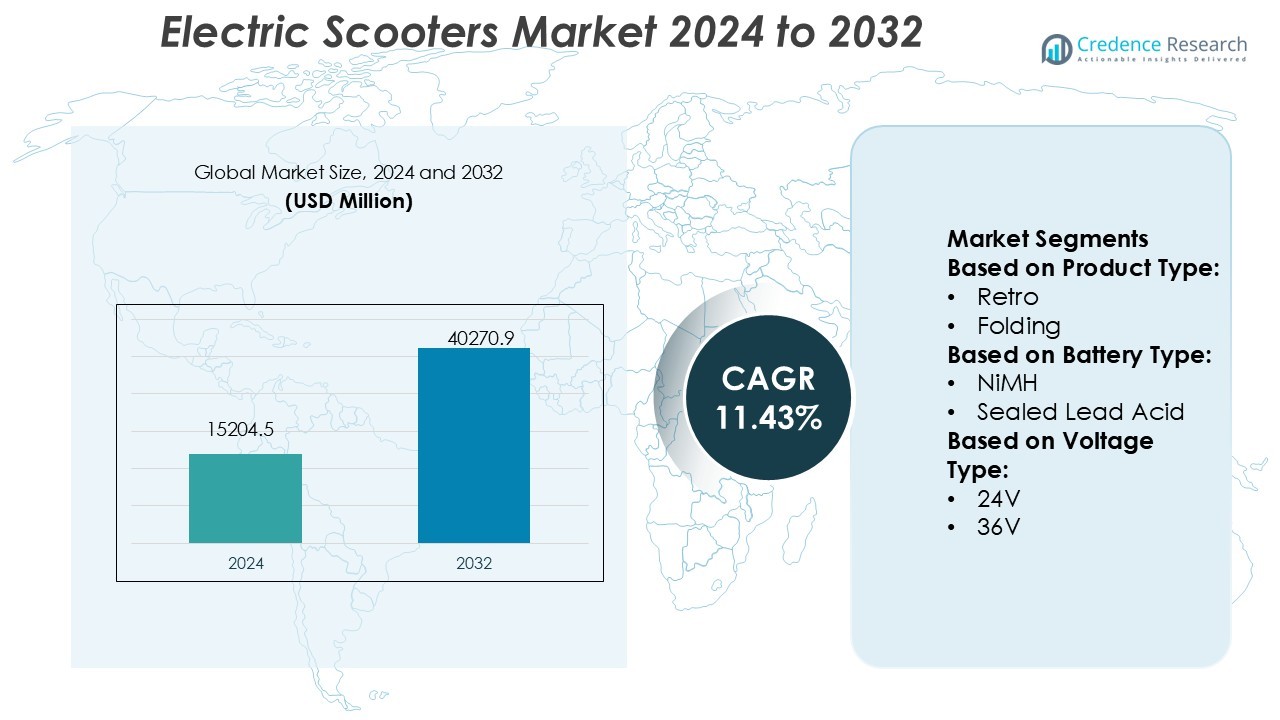

Electric Scooters Market size was valued USD 15204.5 million in 2024 and is anticipated to reach USD 40270.9 million by 2032, at a CAGR of 11.43% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Electric Scooters Market Size 2024 |

USD 15204.5 Million |

| Electric Scooters Market, CAGR |

11.43% |

| Electric Scooters Market Size 2032 |

USD 40270.9 Million |

The Electric Scooters Market is characterized by strong competition among leading players such as Mahindra GenZe, BOXX Corp., Green Energy Motors Corp., Honda Motor Co. Ltd., Jiangsu Xinri E-Vehicle Co., Ltd., BMW Motorrad International, Greenwit Technologies Inc., Gogoro Inc., KTM AG, and AllCell Technologies LLC. These companies focus on innovation in battery performance, connectivity, and sustainable design to strengthen their global presence. Asia-Pacific leads the global Electric Scooters Market with a 39% share in 2024, driven by high urban density, strong government incentives, and large-scale manufacturing capabilities. The region’s dominance is further supported by growing consumer demand for cost-efficient, eco-friendly transportation and rapid adoption of electric mobility solutions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Electric Scooters Market was valued at USD 15,204.5 million in 2024 and is projected to reach USD 40,270.9 million by 2032, growing at a CAGR of 11.43% during the forecast period.

- Rising urbanization, government incentives, and demand for eco-friendly transport solutions are major drivers boosting market expansion across both developed and emerging economies.

- Key trends include rapid adoption of lithium-ion batteries, integration of IoT-based smart features, and growth in shared mobility services enhancing convenience and accessibility.

- Intense competition among major players focusing on battery innovation, energy efficiency, and affordable pricing continues to shape the industry landscape.

- Asia-Pacific leads the market with a 39% share in 2024, followed by Europe with 28%, while the 36V voltage segment remains dominant due to its optimal balance between performance and cost efficiency, supporting widespread adoption across urban commuting applications.

Market Segmentation Analysis:

By Product Type

Standing/Self-Balancing scooters dominated the Electric Scooters Market with a 42% share in 2024. These scooters gained popularity due to their compact design, low maintenance, and suitability for short-distance urban travel. Rising demand from students and young professionals supports their widespread adoption. Manufacturers are integrating advanced gyroscopic sensors and smart balancing systems, enhancing safety and control. Additionally, the growth of shared mobility services and rental platforms further boosts the standing/self-balancing segment’s market presence across major cities worldwide.

- For instance, BOXX’s “BOXX M” model deploys a three-phase brushless motor that produces 111 Nm torque and uses its all-wheel drive system to grip surfaces under load.

By Battery Type

Li-ion battery scooters held the largest market share of 68% in 2024. Their dominance is driven by lightweight structure, high energy density, and longer lifespan compared to NiMH and sealed lead acid batteries. The segment benefits from falling lithium-ion cell costs and rapid advancements in battery management systems (BMS). Governments promoting clean mobility through subsidies and recycling initiatives also strengthen Li-ion adoption. Continuous innovation in fast-charging technology and higher range per charge keeps this segment at the forefront of electric scooter advancements.

- For instance, Intertek Group plc operates advanced EV battery laboratories globally, offering testing services that include lifecycle, performance, and abuse testing at the cell, module, and pack level. Some of Intertek’s battery testing labs are equipped to handle current loads up to 1,200 amperes, and its battery emulators can reach 1,000 volts DC.

By Voltage Type

The 36V segment accounted for the highest share, representing 39% of the Electric Scooters Market in 2024. These scooters offer a balance between performance, efficiency, and affordability, making them ideal for city commuters. The segment’s growth is supported by demand for mid-range scooters with moderate speed and longer runtime. Manufacturers increasingly deploy 36V systems for compact and lightweight models to optimize energy use. Their compatibility with urban transport needs and reduced charging times further position this voltage range as a market leader globally.

Key Growth Drivers

Rising Urbanization and Demand for Efficient Mobility

Rapid urbanization and traffic congestion are fueling the need for compact, energy-efficient vehicles. Electric scooters offer quick mobility and easy parking, making them ideal for short urban commutes. Governments promote e-mobility through subsidies and charging infrastructure, further boosting adoption. The growing preference for eco-friendly transportation, combined with the expansion of shared mobility platforms, continues to drive strong demand for electric scooters across major metropolitan areas worldwide.

- For instance, SGS has expanded battery testing capacity significantly at its Suwanee (Georgia) lab, increasing overall capacity by 20 % and enabling tests on modules/cellblocks rated up to 100 V and 1,200 A.

Technological Advancements in Battery and Motor Efficiency

Advancements in lithium-ion battery technology have improved range, charging speed, and overall performance. Manufacturers are developing lightweight, high-capacity batteries and efficient brushless DC motors, enhancing power output and longevity. Smart connectivity features such as app-based diagnostics and GPS tracking increase user convenience. These innovations reduce maintenance costs and improve ride experience, strengthening market penetration among both individual and fleet users seeking sustainable and high-performing mobility options.

- For instance, Applus+ opened a new EV battery lab at its UK 3C Test centre. The facility features an 11 m³ climatic chamber that operates between –70 °C and +180 °C, which is coupled with a shaker rated at 200 kN for random vibration and 400 kN for shock.

Government Policies Supporting Green Transportation

Governments across regions are implementing strict emission regulations and offering incentives to promote electric mobility. Subsidies for electric vehicle purchases, tax benefits, and investments in public charging networks are accelerating market adoption. Countries like India, China, and the U.S. have launched dedicated e-mobility programs encouraging manufacturers and consumers to transition toward zero-emission vehicles. These policies are creating a favorable ecosystem for electric scooter manufacturing and adoption.

Key Trends & Opportunities

Expansion of Shared Mobility Platforms

The rapid rise of app-based rental and sharing platforms is transforming the electric scooter landscape. Companies like Lime, Bird, and Spin are expanding operations in urban centers, offering affordable and convenient short-distance rides. This shift supports sustainable mobility and reduces dependence on personal vehicles. Growing integration of fleet management and IoT technology enhances operational efficiency and user experience, presenting significant growth opportunities for electric scooter manufacturers and mobility service providers.

- For instance, UL opened its North America Advanced Battery Laboratory in Auburn Hills, Michigan, a 89,000 ft² facility that includes mechanical shock testing up to 100 g acceleration, vibration tables rated at 350 kN and 200 kN, and pack crush capability up to 300 kN force for module and pack tests.

Integration of Smart and Connected Features

Smart connectivity is emerging as a major differentiator in the electric scooter market. Features such as remote locking, mobile tracking, anti-theft alerts, and regenerative braking are becoming standard. Integration with mobile apps enables real-time monitoring of battery life, location, and performance. Manufacturers are also investing in AI-based predictive maintenance and over-the-air updates, enhancing safety and personalization. These technological upgrades attract tech-savvy urban users seeking intelligent commuting solutions.

- For instance, TÜV SÜD manages high-power testing for electric vehicle battery modules, with capabilities extending to 1,200 V and 1,000 A, including environmental, vibration, and abuse tests.

Key Challenges

Limited Charging Infrastructure

Despite strong growth, the lack of widespread and reliable charging infrastructure remains a major hurdle. In many developing regions, inconsistent access to public charging stations limits user confidence and adoption. Range anxiety continues to affect long-distance usage potential. Although portable charging and battery-swapping technologies are emerging, large-scale implementation requires substantial investment and coordination between governments and private stakeholders to ensure sustained market growth.

High Initial Cost of Ownership

The high upfront cost of electric scooters, primarily due to battery expenses, poses a challenge for mass adoption. While operational costs are lower than traditional scooters, many consumers remain price-sensitive. Manufacturers are exploring cost reductions through local sourcing, modular battery systems, and economies of scale. However, until battery prices decrease significantly, affordability will continue to restrict demand, especially in price-conscious markets across Asia-Pacific and Latin America.

Regional Analysis

North America

North America accounted for a 24% share of the Electric Scooters Market in 2024. The region’s growth is driven by increasing adoption of eco-friendly mobility solutions and strong expansion of shared scooter services in urban areas. The U.S. leads the market due to rising fuel costs and government support for green transportation. Technological innovations, such as smart connectivity and improved battery life, further enhance demand. Canada is witnessing growing adoption for short-distance commuting, supported by infrastructure investments and sustainability programs across major metropolitan cities.

Europe

Europe held a 28% share of the Electric Scooters Market in 2024, driven by stringent emission regulations and strong government incentives. Countries like Germany, France, and the Netherlands are leading due to their advanced urban transport infrastructure and environmental awareness. The rise in micro-mobility services and expanding charging networks further boost demand. Manufacturers in the region focus on lightweight materials and enhanced battery safety. Increasing consumer preference for sustainable commuting options and smart mobility integration continues to propel Europe’s dominance in the global electric scooter landscape.

Asia-Pacific

Asia-Pacific dominated the Electric Scooters Market with a 39% share in 2024. China, India, and Japan lead the regional growth, driven by high urban population density, cost-effective production, and strong government initiatives promoting electric mobility. The presence of major manufacturers such as Hero Electric and Yadea contributes to large-scale adoption. Government-backed subsidies and infrastructure expansion programs enhance accessibility. Growing demand for affordable, energy-efficient vehicles among urban commuters continues to make Asia-Pacific the largest and fastest-growing regional market for electric scooters globally.

Latin America

Latin America captured a 6% share of the Electric Scooters Market in 2024. The region’s growth is supported by rising fuel prices, increasing environmental awareness, and the introduction of electric vehicle incentives. Brazil and Mexico lead the market due to urban congestion and expanding charging infrastructure. The popularity of shared mobility platforms also encourages adoption. However, limited local manufacturing and high import costs restrain rapid expansion. Continued policy support and partnerships between global manufacturers and local firms are expected to strengthen market presence in the coming years.

Middle East & Africa

The Middle East & Africa accounted for a 3% share of the Electric Scooters Market in 2024. The market is gradually expanding due to government-led sustainability initiatives and the promotion of electric mobility under regional development programs. The UAE and South Africa are emerging as key adopters, focusing on smart city projects and green transport integration. Limited charging infrastructure remains a challenge, but rising investment in renewable energy and pilot programs for e-scooter rentals are creating new growth avenues across urban centers in the region.

Market Segmentations:

By Product Type:

By Battery Type:

By Voltage Type:

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Electric Scooters Market features prominent players including Mahindra GenZe, BOXX Corp., Green Energy Motors Corp., Honda Motor Co. Ltd., Jiangsu Xinri E-Vehicle Co., Ltd., BMW Motorrad International, Greenwit Technologies Inc., Gogoro Inc., KTM AG, and AllCell Technologies LLC. The Electric Scooters Market is marked by rapid innovation, strategic partnerships, and expanding global footprints. Companies are focusing on enhancing battery efficiency, motor performance, and connectivity features to strengthen their market position. Advancements in lithium-ion technology, lightweight materials, and IoT integration have improved range and durability, attracting a broader consumer base. Manufacturers are also investing in sustainable production methods and local assembly to reduce costs and meet regulatory requirements. The competition remains intense, with firms emphasizing design innovation, digital integration, and after-sales support to capture market share and enhance brand loyalty.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Mahindra GenZe

- BOXX Corp.

- Green Energy Motors Corp.

- Honda Motor Co. Ltd.

- Jiangsu Xinri E-Vehicle Co., Ltd.

- BMW Motorrad International

- Greenwit Technologies Inc.

- Gogoro Inc.

- KTM AG

- AllCell Technologies LLC

Recent Developments

- In July 2025, the Kinetic DX electric scooter in India is priced at Rs 1.11 lakh (ex-showroom) and Rs 1.17 lakh (ex-showroom), with bookings limited to 35,000 units via the Kinetic EV website. Delivery starts in September 2025.

- In January 2025, Yadea, has already launched multiple models powered by sodium-ion chemistry and is rapidly expanding related infrastructure with plans for thousands of fast charging and battery swap stations.

- In January 2024, Riley Scooter, a Cambridge-based company proposed plans to introduce RS3 Electric Scooter, a fully foldable electric scooter in the U.S. at the Consumers Electronics Show held in Las Vegas.

- In December 2023, Gogoro, a Taiwanese player unveiled Gogoro CrossOver GX250 domestically produced electric scooter in India. The company offers a tailor smart scooter to Indian riders. The introduction of these models marked a strategic move for Komatsu to tap into the Indian electric scooter market.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Battery Type, Voltage Type and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Electric Scooters Market will continue expanding due to rising urban mobility demand.

- Government incentives and emission regulations will further encourage electric vehicle adoption.

- Advancements in battery technology will extend range and reduce charging time.

- Shared mobility platforms will play a key role in driving market penetration.

- Smart connectivity and IoT integration will enhance user experience and fleet management.

- Manufacturers will focus on lightweight designs and cost-efficient production methods.

- Expansion in charging infrastructure will improve accessibility and reduce range anxiety.

- Asia-Pacific will remain the leading region, supported by strong manufacturing and policy support.

- Partnerships between automakers and technology firms will accelerate innovation and scalability.

- Growing consumer awareness of sustainability will strengthen long-term electric scooter adoption.