Market Overview

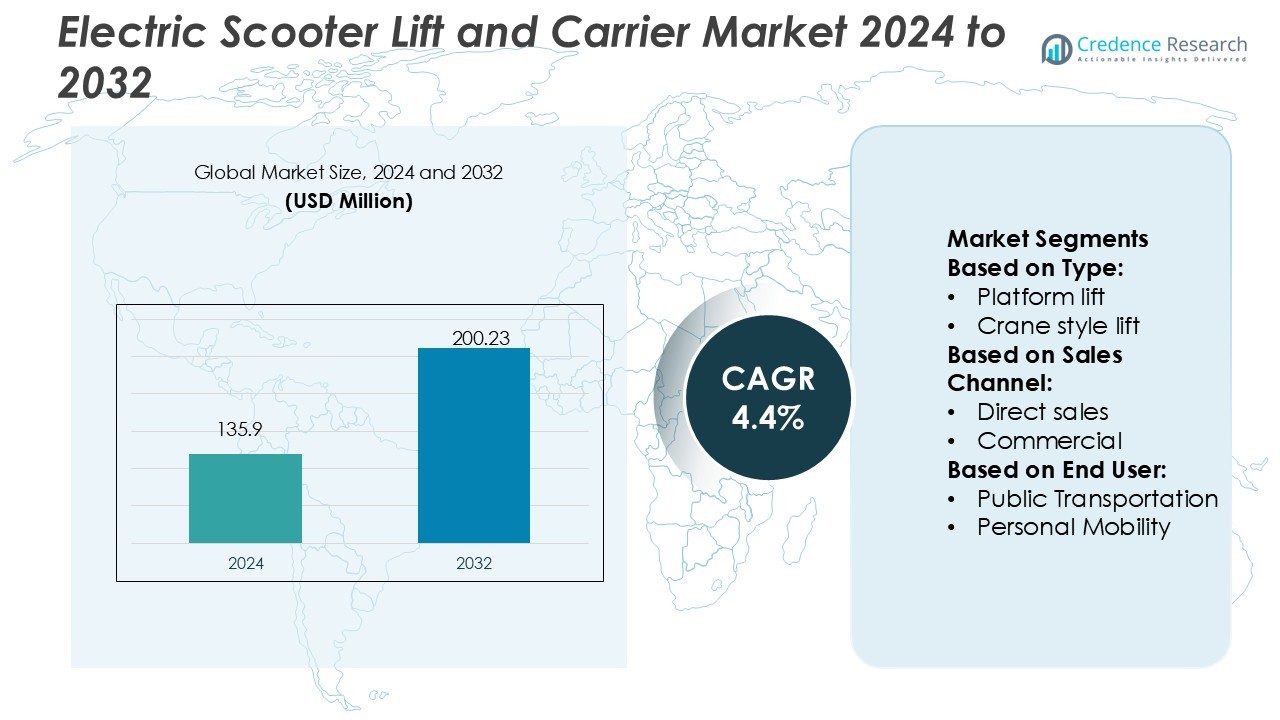

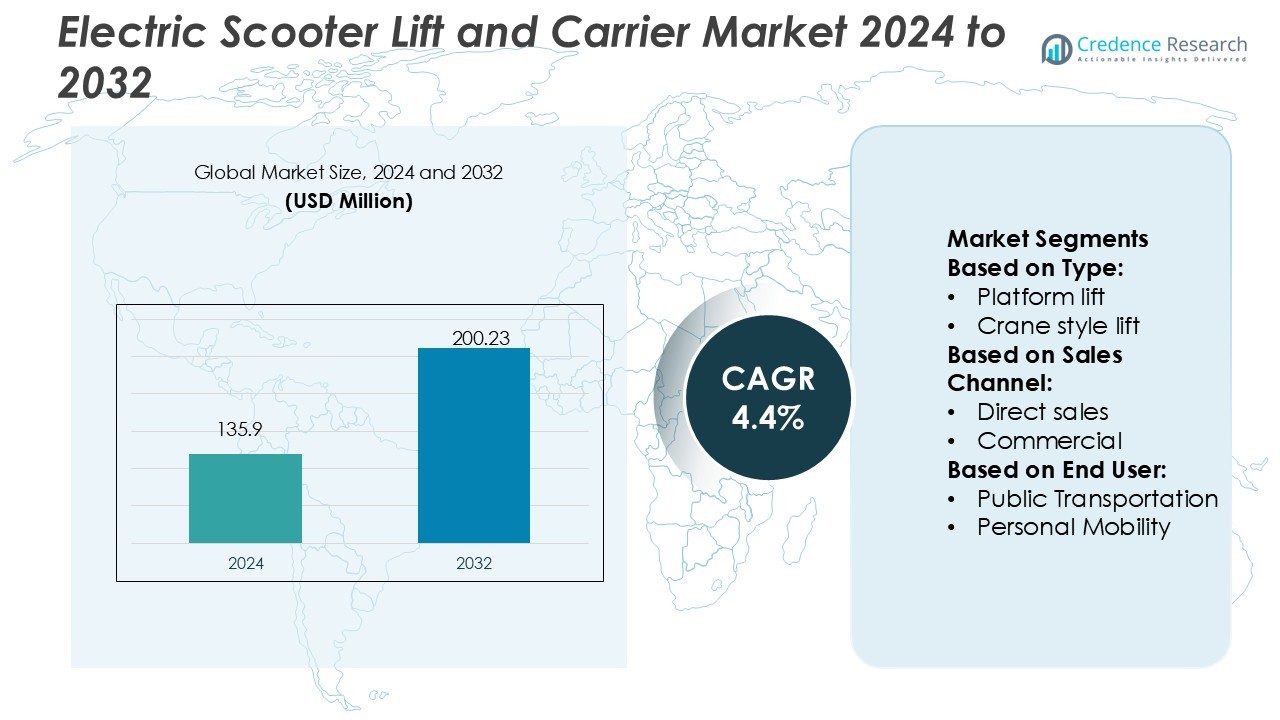

Electric Scooter Lift and Carrier Market size was valued USD 135.9 million in 2024 and is anticipated to reach USD 200.23 million by 2032, at a CAGR of 4.4% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Electric Scooter Lift and Carrier Market Size 2024 |

USD 135.9 Million |

| Electric Scooter Lift and Carrier Market, CAGR |

4.4% |

| Electric Scooter Lift and Carrier Market Size 2032 |

USD 200.23 Million |

The Electric Scooter Lift and Carrier Market is driven by key players including Discount Ramps, Harmar, EZ Carrier USA, Superior Van & Mobility, Pride Mobility Products Corp., All-Terrain Medical & Mobility LLC, Bruno Independent Living Aids, Inc., Wheelchair Carrier, Ford Smart Mobility LLC, and Allied Motion Technologies Inc. These companies focus on technological innovation, automation, and user-centered design to enhance accessibility and performance. North America leads the global market with a 38% share, supported by strong adoption of mobility-assistive devices, advanced healthcare infrastructure, and favorable reimbursement programs. Continuous product innovation and growing partnerships across distribution networks further strengthen regional market dominance.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Electric Scooter Lift and Carrier Market was valued at USD 135.9 million in 2024 and is projected to reach USD 200.23 million by 2032, growing at a CAGR of 4.4%.

- Market growth is driven by increasing demand for personal mobility aids, rising elderly populations, and advancements in automated and smart lifting technologies.

- Key trends include the integration of IoT-enabled control systems, lightweight materials, and modular designs to improve efficiency and user convenience.

- Competitive intensity remains high as major players focus on innovation, affordability, and expanding digital distribution networks to strengthen global reach.

- North America dominates with a 38% share, followed by Europe and Asia Pacific, while the exterior lift segment holds the largest share due to its ease of installation and compatibility with multiple vehicle types.

Market Segmentation Analysis:

By Type

The exterior lift segment dominates the Electric Scooter Lift and Carrier Market, accounting for the largest share in 2024. Exterior lifts, including outside and hitch mount lifts, are widely preferred for their compatibility with most vehicles and ease of installation. These systems enable quick loading and unloading without major vehicle modifications, making them ideal for users with mobility challenges. Rising demand for compact, weather-resistant, and user-friendly designs continues to strengthen adoption among elderly users and healthcare service providers seeking reliable outdoor mobility solutions.

- For instance, Harmar’s AL100 hitch-mount platform lift supports scooters up to 350 lb and weighs just 83 lb installed—this design balance helps drive acceptance of exterior lifts.

By Sales Channel

The direct sales segment leads the market, supported by strong manufacturer-to-customer relationships and tailored service offerings. Manufacturers increasingly offer direct online and dealership-based sales to provide customized installation, after-sales support, and financing options. Direct sales channels also ensure better product knowledge transfer and customer trust, particularly for mobility-assistive devices. The growing trend of e-commerce integration by key players, coupled with digital marketing campaigns targeting personal mobility users, further enhances visibility and market penetration across both developed and emerging regions.

- For instance, Harmar offers the AL100 and AL100HD platform lifts, rated for 350 lb and 400 lb respectively. The AL100DE has an installed weight of 83 lb and is compatible with most vehicles.

By End User

The personal mobility segment holds the dominant share in the market due to increasing elderly populations and rising cases of physical disabilities. Consumers prefer electric scooter lifts and carriers for daily transportation convenience and improved independence. Lightweight, foldable, and battery-powered designs have enhanced accessibility for individuals using scooters for errands or travel. Technological advancements such as automatic securing mechanisms and smartphone-enabled controls also contribute to user comfort. The segment’s growth is supported by rising government initiatives promoting assistive mobility solutions and increasing household spending on accessibility equipment.

Key Growth Drivers

Rising Adoption of Personal Mobility Solutions

The growing elderly population and individuals with mobility impairments are fueling demand for electric scooter lifts and carriers. Consumers increasingly prefer convenient and automated lifting systems that support independent mobility. Advances in lightweight materials and compact mechanisms have improved product usability for home and vehicle applications. Additionally, healthcare and rehabilitation centers are integrating these solutions to enhance accessibility, further stimulating market expansion across developed and emerging economies.

- For instance, EZ Carrier’s EZCLA full-automatic lift is available with a 32″ x 60″ deck and supports up to 500 lb on a Class III hitch. It includes an integrated anti-theft lock and a wiring harness (10-gauge wiring with a 30-amp breaker).

Technological Advancements in Lift Mechanisms

Continuous innovation in lift and carrier designs is driving market growth. Manufacturers are introducing electric and hydraulic-powered systems with enhanced safety features, such as automatic locking and remote-control operation. Integration of IoT and sensor-based feedback improves efficiency and reduces manual effort. These advancements make lifts compatible with various vehicle models, increasing consumer convenience. Such technological developments support product adoption across both residential and commercial segments, accelerating global market demand.

- For instance, Superior Van & Mobility offers commercial ADA lifts, including models with 800 to 1,000 lb capacities, for installation in paratransit vans.

Growing Government Support for Accessibility Equipment

Government initiatives promoting disability-friendly infrastructure and mobility assistance programs are major growth drivers. Subsidies and reimbursement policies for assistive mobility devices increase affordability and awareness. Countries such as the U.S., Canada, and the UK have implemented standards for mobility aid transport, ensuring safety and compliance. This supportive regulatory environment encourages innovation and boosts adoption rates. The increased public and private investment in accessibility infrastructure further reinforces steady market growth.

Key Trends & Opportunities

Integration of Smart and Automated Features

Smart technologies are transforming the electric scooter lift and carrier market. Modern systems now include Bluetooth connectivity, automatic height adjustment, and safety sensors to prevent overloading. These innovations enhance convenience and reduce user effort. Manufacturers are focusing on developing app-based controls for remote operation, appealing to tech-savvy users and caregivers. The integration of automation presents an opportunity for premium product differentiation in a competitive market landscape.

- For instance, VivaLift! Ultra PLR-4955 lift recliner supports 400 lb and uses “True-Infinite” positioning—backrest and footrest move independently for precise adjustment.

Expansion of E-Commerce and Direct-to-Consumer Channels

Online platforms are becoming key distribution channels for lift and carrier products. Consumers increasingly prefer online purchases for better product comparisons, installation support, and direct brand engagement. Manufacturers are investing in virtual demonstrations and online service booking tools to improve customer experience. This digital shift allows companies to reach underserved markets and offer customized products, creating significant opportunities for global expansion and stronger customer loyalty.

- For instance, Allied Motion develops motors, drives, and motion control modules for mobility systems. Their KinetiMax 95 HPD outer-rotor brushless motor delivers 2 Nm torque at 2,300 RPM for 480 W continuous output, and is only 37 mm long.

Key Challenges

High Installation and Maintenance Costs

Despite technological advances, the high cost of installation and maintenance remains a major restraint. Many electric lift systems require specialized installation and periodic servicing, which increases the total cost of ownership. This challenge particularly affects price-sensitive consumers in developing regions. Manufacturers must balance innovation and affordability to improve market accessibility and ensure sustained adoption among residential and commercial users.

Compatibility and Design Limitations

Product compatibility with diverse vehicle types poses a persistent challenge. Variations in vehicle size, load capacity, and mounting systems limit the universal application of lift devices. Consumers often face difficulties finding models that fit their specific vehicles without modification. This restricts product versatility and adds customization costs. To overcome this issue, manufacturers are focusing on modular designs and adjustable fittings to broaden compatibility and simplify installation.

Regional Analysis

North America

North America leads the Electric Scooter Lift and Carrier Market with a 38% share in 2024. The region’s dominance is driven by strong demand from elderly and disabled populations, supported by government programs promoting mobility assistance. The U.S. accounts for most sales due to advanced healthcare infrastructure and high adoption of electric mobility devices. Key players such as Harmar Mobility and Bruno Independent Living Aids focus on product innovation and dealer partnerships. Growing awareness of accessible transportation and the availability of reimbursement schemes continue to enhance market growth across both residential and commercial sectors.

Europe

Europe holds a 29% market share, supported by well-established accessibility regulations and mobility aid programs. The UK, Germany, and France represent the major contributors, driven by growing aging populations and national healthcare support for assistive devices. Regional manufacturers emphasize sustainable materials and automated lift systems to meet European quality standards. Strong e-commerce distribution and rehabilitation center adoption further boost market reach. In addition, increased government spending on disability-friendly transportation infrastructure is creating long-term opportunities for manufacturers offering cost-effective and customizable mobility lift solutions across the region.

Asia Pacific

Asia Pacific captures a 22% share of the global market, showing the fastest growth rate during the forecast period. Rapid urbanization, rising disposable incomes, and expanding healthcare access are driving adoption in countries such as Japan, China, and Australia. Increasing elderly demographics and government-backed initiatives for senior mobility support regional demand. Domestic manufacturers are introducing compact, affordable lift systems tailored to smaller vehicles and urban spaces. The growing influence of e-commerce and regional innovation in lightweight materials are further supporting large-scale adoption across both personal and institutional applications.

Latin America

Latin America accounts for a 6% share of the Electric Scooter Lift and Carrier Market, driven by gradual improvements in healthcare accessibility and mobility awareness. Brazil and Mexico lead regional adoption, supported by urban rehabilitation programs and increasing imports of mobility-assistive devices. However, high product costs and limited insurance coverage hinder widespread adoption. Manufacturers are targeting partnerships with local distributors to improve market penetration. As awareness of inclusive mobility rises, the region presents steady growth potential, particularly through government-backed social welfare programs and aging population support initiatives.

Middle East and Africa

The Middle East and Africa region holds a 5% market share, representing an emerging opportunity for manufacturers. Growth is primarily driven by increasing healthcare investment and the rising prevalence of chronic mobility disorders. The UAE, Saudi Arabia, and South Africa lead adoption, supported by modernization in medical facilities and growing demand for home-based assistive equipment. Limited local manufacturing and high import dependency currently restrain expansion. However, ongoing policy reforms for disability inclusion and growing collaborations with international brands are expected to strengthen product availability and regional market growth in the coming years.

Market Segmentations:

By Type:

- Platform lift

- Crane style lift

By Sales Channel:

By End User:

- Public Transportation

- Personal Mobility

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Electric Scooter Lift and Carrier Market features prominent players such as Discount Ramps, Harmar, EZ Carrier USA, Superior Van & Mobility, Pride Mobility Products Corp., All-Terrain Medical & Mobility LLC, Bruno Independent Living Aids, Inc., Wheelchair Carrier, Ford Smart Mobility LLC, and Allied Motion Technologies Inc. The Electric Scooter Lift and Carrier Market is characterized by strong innovation, expanding product portfolios, and rising strategic collaborations. Companies focus on developing lightweight, automated, and user-friendly lifting systems that enhance convenience for individuals with mobility limitations. Technological advancements such as hydraulic-powered mechanisms, remote-control operation, and IoT connectivity are becoming standard features to improve safety and performance. Manufacturers are also investing in customization and modular designs to meet diverse vehicle and end-user needs. Additionally, growing emphasis on digital sales channels, after-sales support, and compliance with international safety standards strengthens brand positioning and market reach globally.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In January 2024, Riley Scooter, a Cambridge-based company proposed plans to introduce RS3 Electric Scooter, a fully foldable electric scooter in the U.S. at the Consumers Electronics Show held in Las Vegas.

- In January 2024, Hero MotoCorp announced stepping up its electric vehicle (EV) play by launching three new electric scooters in 2024. This new launch will be in mid, affordable, and business-to-business (B2B) segments, considering all types of usage requirements.

- In December 2023, Gogoro, a Taiwanese player unveiled Gogoro CrossOver GX250 domestically produced electric scooter in India. The company offers a tailor smart scooter to Indian riders. The introduction of these models marked a strategic move for Komatsu to tap into the Indian electric scooter market.

- In March 2023, Yadea Technology Group Co, Ltd, launched the range of products YADEA Fierider, YADEA VoltGuard Scooter, and YADEA Keeness Electric Motorcycle in Vietnam. The products offered by the company have premium-level quality and exceptional rider experience which provide a competitive edge to the company.

Report Coverage

The research report offers an in-depth analysis based on Type, Sales Channel, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand with growing adoption of personal mobility and assistive devices.

- Technological innovations will drive demand for automated and smart lifting systems.

- Integration of IoT and sensor-based safety features will enhance user convenience.

- Manufacturers will focus on lightweight, durable, and energy-efficient materials.

- Direct-to-consumer and online sales channels will strengthen global market reach.

- Partnerships with healthcare institutions will boost product adoption in rehabilitation sectors.

- Government initiatives supporting disability-friendly transport will sustain long-term growth.

- Customizable and modular lift designs will gain popularity among diverse vehicle users.

- Emerging economies will offer new growth opportunities through improved healthcare access.

- Continuous R&D investment will ensure product innovation and stronger competitive differentiation.