Market Overview

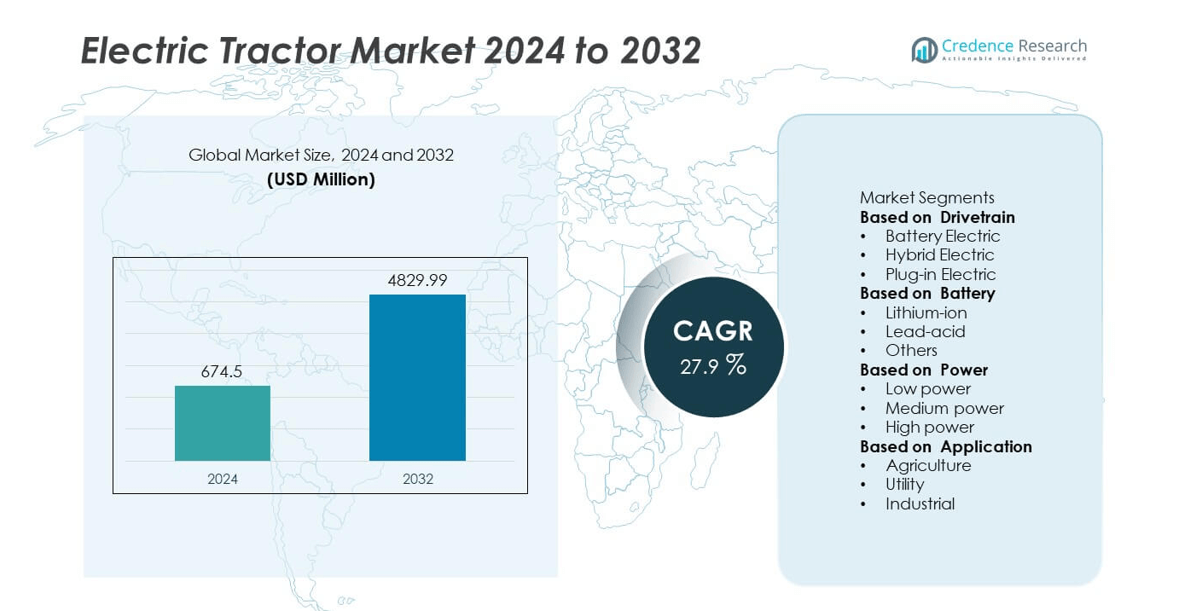

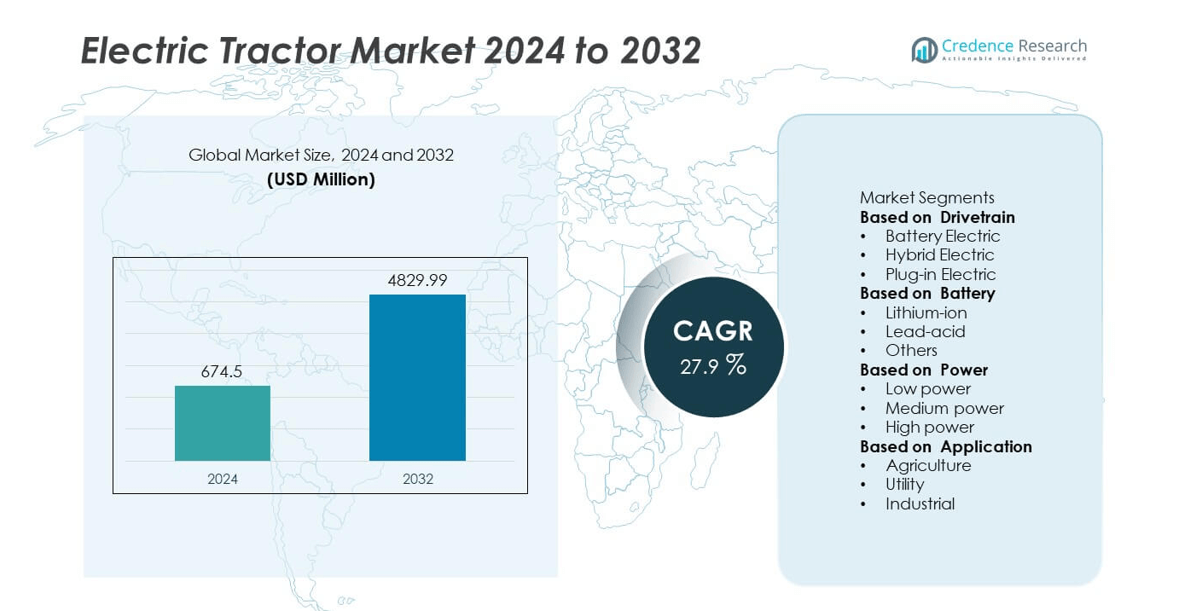

The Electric Tractor Market was valued at USD 674.5 million in 2024 and is projected to reach USD 4,829.99 million by 2032, expanding at a CAGR of 27.9 % during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Electric Tractor Market Size 2024 |

USD 674.5 million |

| Electric Tractor Market, CAGR |

27.9% |

| Electric Tractor Market Size 2032 |

USD 4,829.99 million |

The Electric Tractor Market is led by major players such as Monarch Tractor, John Deere, Mahindra and Mahindra, CNH Industrial, Solectrac, Kubota, Yanmar, AGCO, AutoNxt, and CLAAS. These companies dominate through innovations in battery efficiency, autonomous technology, and smart connectivity. Monarch Tractor and Solectrac lead in North America with strong adoption across commercial farms, while John Deere and CNH Industrial maintain a stronghold in Europe through advanced electric and hybrid models. Asia-Pacific, holding 35 percent of the global market share in 2024, is driven by Mahindra and Mahindra and Kubota, supported by rising demand for compact, cost-efficient tractors in India and Japan.

Market Insights

- The Electric Tractor Market was valued at USD 674.5 million in 2024 and is projected to reach USD 4,829.99 million by 2032, growing at a CAGR of 27.9 percent during the forecast period.

- Rising adoption of sustainable agriculture practices and government subsidies promoting clean farming are driving strong market growth.

- The market is witnessing trends such as integration of autonomous technology, IoT-enabled control systems, and improved battery efficiency to enhance productivity.

- Key players such as Monarch Tractor, John Deere, Mahindra and Mahindra, CNH Industrial, and Solectrac are focusing on developing high-performance, energy-efficient, and mid-power tractors to meet diverse farming needs.

- Asia-Pacific held the largest market share of 35 percent in 2024, followed by North America with 32 percent and Europe with 25 percent, while the battery-electric drivetrain segment led with 61 percent share due to growing adoption in small and medium-scale farms.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Drivetrain

The battery electric segment dominated the Electric Tractor Market in 2024, accounting for 63 percent of the total share. Its leadership is driven by zero-emission performance, low maintenance, and reduced operational costs compared to diesel-powered models. Battery electric tractors are increasingly adopted by small and medium farms due to their quiet operation and efficiency in precision agriculture. Advancements in motor efficiency and lithium-ion battery capacity further strengthen segment growth. Supportive government incentives and improved rural charging infrastructure continue to enhance adoption rates, positioning battery electric tractors as the preferred drivetrain technology.

- For instance, Monarch Tractor’s MK-V model operates with a 40 kWh lithium-ion battery pack, providing up to 14 hours of runtime on a single charge. The tractor is equipped with a 70 hp electric motor and supports full driver-optional autonomous operation through its AutoDrive system, integrating over 6 cameras and 2 radar sensors for real-time obstacle detection and path planning.

By Battery

The lithium-ion battery segment held the largest share of 72 percent in 2024, driven by superior energy density, longer lifespan, and faster charging capabilities. Farmers prefer lithium-ion-powered tractors for their ability to support extended field operations and higher power output. The declining cost of lithium-ion cells and technological improvements in thermal management are improving affordability and safety. Manufacturers are investing in recyclable and modular battery systems to enhance sustainability and operational flexibility. The growing use of lithium-ion technology across agricultural machinery continues to reinforce its dominance in the electric tractor market.

- For instance, Solectrac’s e25 compact electric tractor utilizes a 22 kWh lithium-ion battery pack and provides an 18 kW (25 HP) category motor output. The tractor offers a runtime of 3 to 6 hours per charge, depending on the load. It supports charging via a 220 VAC, 30-amp outlet in 8 hours or a 120 VAC, 15-amp outlet in 12 hours.

By Power

The medium power segment led the market with a 49 percent share in 2024, as it provides the ideal balance between performance, cost, and versatility. Medium-powered electric tractors, typically ranging from 30–60 horsepower, are widely used in crop cultivation, orchard maintenance, and light-duty transport. Their adaptability for both small and large farms makes them the most preferred category. Increasing government subsidies and rural electrification programs are boosting adoption in developing regions. Continuous product development focusing on enhanced torque, longer run times, and multi-implement compatibility supports sustained segment growth.

Key Growth Drivers

Government Incentives and Electrification Policies

Supportive government policies promoting electric mobility in agriculture are a key growth driver for the Electric Tractor Market. Subsidies, tax credits, and low-interest financing are encouraging farmers to transition from diesel-powered tractors to clean electric alternatives. Initiatives focused on reducing greenhouse gas emissions and achieving carbon-neutral farming are driving adoption globally. Countries such as the United States, India, and Germany are actively investing in electric farm machinery programs. These incentives lower ownership costs and accelerate market expansion across both developed and emerging economies.

- For instance, Mahindra & Mahindra’s OJA platform, a collaboration with Mitsubishi Mahindra Agriculture Machinery of Japan, features multiple models intended for both domestic and international markets.

Rising Fuel Costs and Demand for Cost Efficiency

Escalating diesel prices and the need to minimize long-term operational expenses are boosting demand for electric tractors. Electric models offer significantly lower running and maintenance costs while providing consistent torque and energy efficiency. Farmers are increasingly recognizing the economic advantages of reduced fuel dependency and minimal mechanical wear. The lower cost per operating hour and the ability to recharge using renewable energy sources make electric tractors an economically sustainable solution for modern agriculture.

- For instance, AutoNxt Automation’s X45H2 electric tractor operates with a 45 hp equivalent motor, powered by a 35 kWh or 38.4 kWh lithium-ion battery, and can run for up to 8 hours on a single charge. The model is advertised to have significantly lower operating and maintenance costs compared to diesel alternatives and provides sustainability through its zero-emission electric powertrain.

Technological Advancements in Battery and Motor Systems

Continuous advancements in battery chemistry and electric drivetrains are transforming tractor performance and efficiency. Innovations such as fast-charging lithium-ion batteries, regenerative braking, and high-torque motors enhance productivity and operating range. Integration of smart control systems and telematics allows precision farming and real-time performance monitoring. Manufacturers are developing modular battery packs for easier maintenance and scalability. These technological improvements are reducing downtime, improving power delivery, and making electric tractors more competitive with traditional internal combustion models.

Key Trends and Opportunities

Integration of Smart Farming and IoT Technologies

The integration of Internet of Things (IoT) technologies and precision farming systems is reshaping the electric tractor market. Connected electric tractors equipped with GPS, sensors, and AI-based analytics enable farmers to monitor performance, optimize energy consumption, and automate repetitive tasks. This trend enhances crop yield, operational accuracy, and sustainability. The growing demand for data-driven agriculture and autonomous machinery offers manufacturers opportunities to expand into digital farming solutions, creating a strong convergence between electrification and smart agriculture technologies.

- For instance, John Deere’s autonomous 9RX tractor integrates 16 stereo cameras and AI-based object detection software to navigate fields without manual input. The tractor connects via 4G LTE and StarFire GPS networks, enabling farmers to remotely monitor progress and receive machine health alerts through the John Deere Operations Center digital platform.

Expansion of Compact and Multi-Utility Electric Tractors

The market is witnessing increased demand for compact, multi-utility electric tractors suited for small farms and horticultural applications. These lightweight models offer ease of handling, low noise, and efficient operation in confined or specialty farming environments. Manufacturers are focusing on modular designs that allow attachments for mowing, hauling, and spraying tasks. The expanding use of electric tractors in greenhouse farming, municipal landscaping, and vineyard operations presents new growth opportunities, particularly in regions with smaller farm holdings and sustainability goals.

- For instance, Kubota introduced its LXe-261 electric compact tractor powered by a lithium-ion battery, providing an average of three to four hours of continuous operation. The tractor supports multiple implement attachments for green space management like mowing, hauling, and fertilization.

Key Challenges

Limited Charging Infrastructure and Range Constraints

Inadequate rural charging infrastructure remains a major challenge for large-scale electric tractor adoption. Many agricultural regions lack access to reliable electricity or fast-charging facilities, restricting long operating cycles. Farmers operating in remote areas often face downtime due to range limitations. While portable charging and swappable battery solutions are emerging, their deployment is still limited. Addressing this issue will require coordinated investment between manufacturers, governments, and energy providers to ensure adequate charging availability in farming communities.

High Initial Cost and Technology Awareness Gaps

The high upfront cost of electric tractors compared to diesel variants continues to deter small and medium-scale farmers. Although lifetime savings are significant, the initial purchase price remains a barrier, especially in developing economies. Limited awareness of long-term benefits and lack of familiarity with electric machinery further slow adoption. Manufacturers are introducing financing programs, leasing options, and awareness campaigns to improve affordability and acceptance. However, continued cost optimization and farmer education will be essential for achieving widespread market penetration.

Regional Analysis

North America

North America held a market share of 28 percent in 2024, driven by strong government incentives promoting agricultural electrification and sustainable farming practices. The United States leads the regional market with increasing adoption of compact and medium-power electric tractors. Investments in precision farming technologies, coupled with high awareness of carbon reduction, are fueling growth. Manufacturers are introducing models with advanced battery systems and autonomous capabilities. Supportive policies such as tax credits for electric machinery and the expansion of rural charging infrastructure continue to enhance adoption across both commercial and small-scale farms.

Europe

Europe accounted for 33 percent of the Electric Tractor Market in 2024, supported by stringent emission regulations and strong commitment to sustainable agriculture. Countries such as Germany, France, and the Netherlands are leading in electric tractor deployment through government-backed green farming initiatives. The European Union’s focus on reducing carbon emissions and improving energy efficiency in agriculture drives market momentum. Manufacturers are developing lightweight and high-torque electric models suitable for diverse terrains. Expanding renewable energy integration and growing demand for smart, automated farming solutions further strengthen market growth across the region.

Asia-Pacific

Asia-Pacific dominated the global Electric Tractor Market with a 35 percent share in 2024, fueled by rapid agricultural modernization in India, China, and Japan. Increasing fuel costs, government subsidies, and initiatives promoting clean energy in farming are accelerating adoption. India is emerging as a major market due to strong domestic manufacturing and expanding rural electrification. Local manufacturers are focusing on low-cost, high-efficiency tractors tailored for small and medium farms. The region’s growing investment in agricultural automation and electric vehicle infrastructure supports sustained growth and export potential for electric tractor manufacturers.

Middle East and Africa

The Middle East and Africa captured 2 percent of the Electric Tractor Market in 2024, driven by early-stage electrification efforts and growing emphasis on sustainable agriculture. Countries such as South Africa, Kenya, and the UAE are witnessing pilot projects for electric farm machinery. Government programs promoting renewable energy integration and water-efficient farming are supporting gradual adoption. Limited charging infrastructure and high equipment costs remain key challenges. However, international collaborations and renewable-powered charging solutions are expected to improve accessibility, driving market growth across selective high-potential agricultural regions.

Latin America

Latin America accounted for 2 percent of the Electric Tractor Market in 2024, led by emerging demand in Brazil and Mexico. Rising awareness of sustainable farming and growing participation in carbon-neutral agricultural programs are encouraging adoption. Government incentives promoting electric mobility and renewable energy integration in rural areas are supporting market expansion. Local distributors are collaborating with international manufacturers to introduce affordable, low-power models suitable for small farms. While adoption remains in the early phase, improvements in rural infrastructure and supportive financing schemes are expected to strengthen regional growth prospects.

Market Segmentations:

By Drivetrain

- Battery Electric

- Hybrid Electric

- Plug-in Electric

By Battery

- Lithium-ion

- Lead-acid

- Others

By Power

- Low power

- Medium power

- High power

By Application

- Agriculture

- Utility

- Industrial

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Electric Tractor Market includes key players such as Monarch Tractor, CNH Industrial, Mahindra and Mahindra, Solectrac, CLAAS, John Deere, Yanmar, AutoNxt, AGCO, and Kubota. These companies are focusing on innovation, sustainability, and product diversification to strengthen their market presence. Leading manufacturers are investing in advanced battery technologies, autonomous driving systems, and telematics-based smart farming solutions. Strategic collaborations with technology firms and agricultural equipment distributors are helping expand global reach. Companies are also introducing compact and medium-power models to meet demand from small and mid-sized farms. Continuous product launches, coupled with government-supported pilot projects and precision farming integration, are shaping the competitive dynamics of the market. Manufacturers emphasizing low operating costs, high torque performance, and connectivity features are gaining an edge in this rapidly evolving electric agriculture sector.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In August 2025, Monarch Tractor launched the MonarchOne AI platform to provide embedded autonomy, energy management, and fleet intelligence to off-highway OEMs.

- In May 2025, Monarch Tractor partnered with Scout to deliver a “digital implement” that adds AI-supported sensing to existing farm tools.

- In February 2025, Monarch Tractor began the commercial rollout of its Autodrive feature as a driver-optional autonomy capability on its MK-V tractor.

- In 2025, John Deere publicly showcased its autonomous tractor prototypes integrating 16 cameras and onboard Nvidia GPUs for real-time processing.

Report Coverage

The research report offers an in-depth analysis based on Drivetrain, Battery, Power, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand rapidly due to increasing adoption of eco-friendly agricultural machinery.

- Government incentives and emission regulations will continue to accelerate electric tractor adoption.

- Advancements in lithium-ion batteries will enhance power efficiency and operational range.

- Autonomous and AI-integrated tractors will gain traction in precision farming applications.

- Farmers will increasingly shift toward low-maintenance and energy-efficient electric models.

- Expansion of charging infrastructure in rural areas will improve usability and uptime.

- Manufacturers will focus on modular designs and power scalability for varied farm sizes.

- Strategic partnerships between OEMs and battery suppliers will strengthen production capabilities.

- Growth in smart farming and IoT-based solutions will drive market modernization.

- Asia-Pacific will remain the dominant region supported by strong agricultural activity and policy support.