Market Overview

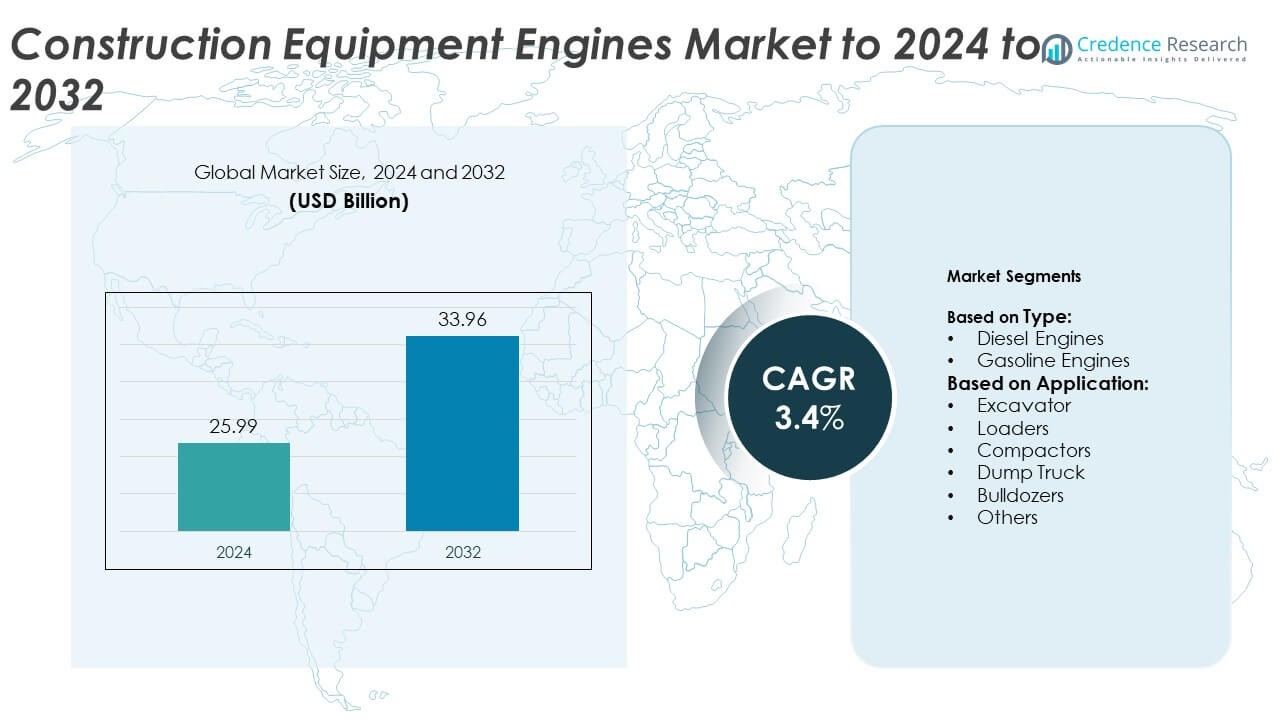

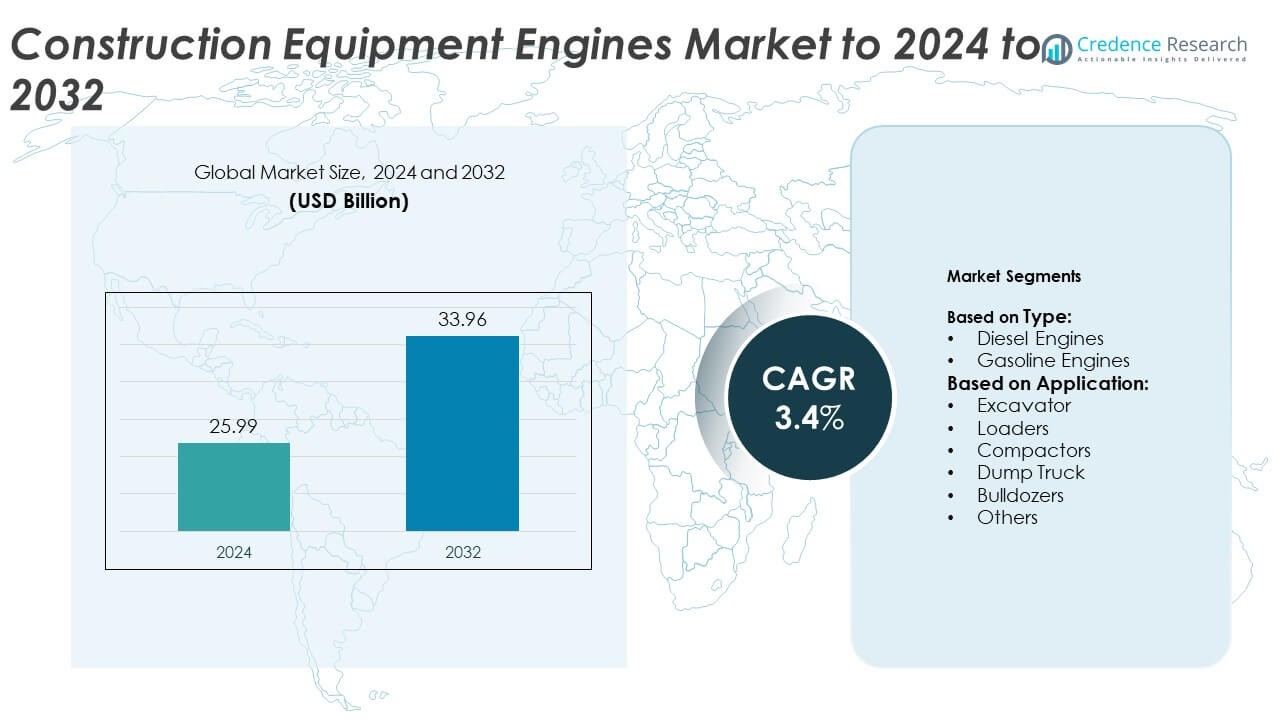

Construction Equipment Engines Market size was valued at USD 25.99 Billion in 2024 and is anticipated to reach USD 33.96 Billion by 2032, at a CAGR of 3.4% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Construction Equipment Engines Market Size 2024 |

USD 25.99 Billion |

| Construction Equipment Engines Market, CAGR |

3.4% |

| Construction Equipment Engines Market Size 2032 |

USD 33.96 Billion |

The Construction Equipment Engines Market is led by key players such as Yanmar, Volvo Penta, John Deere, Caterpillar, Yuchai, Kubota, MAN, DEUTZ, Weichai, and Honda. These companies compete through innovation in fuel efficiency, emission compliance, and hybrid power integration to meet global environmental standards. Strategic partnerships with construction equipment manufacturers and investments in R&D strengthen their market presence. Asia-Pacific emerged as the leading region in 2024, capturing approximately 34% of the total market share. The region’s dominance is supported by rapid urbanization, large-scale infrastructure projects, and expanding industrialization across China, India, and Japan.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Construction Equipment Engines Market was valued at USD 25.99 Billion in 2024 and is projected to reach USD 33.96 Billion by 2032, growing at a CAGR of 3.4%.

- Rising infrastructure development and construction activities across Asia-Pacific, Europe, and North America are driving strong demand for efficient and durable engines.

- The market is witnessing a shift toward hybrid and low-emission powertrains as manufacturers focus on sustainability and regulatory compliance.

- Leading players such as Yanmar, Caterpillar, and DEUTZ are investing in R&D, fuel-efficient technologies, and partnerships with equipment OEMs to maintain competitiveness.

- Asia-Pacific dominated with 34% of the market share in 2024, followed by North America at 31% and Europe at 27%, while the diesel engine segment led globally with about 83% of the total market share.

Market Segmentation Analysis:

By Type

Diesel engines dominated the Construction Equipment Engines Market in 2024, accounting for around 83% of the total share. Their dominance stems from high torque output, superior fuel efficiency, and durability under heavy-duty conditions. Diesel engines are preferred in excavators, loaders, and dump trucks for continuous operation in large-scale construction and mining projects. Leading manufacturers are upgrading diesel powertrains to meet Stage V and Tier 4 emission standards, enhancing engine performance and environmental compliance. The ongoing transition toward hybrid-diesel systems is further reinforcing the demand for advanced diesel engines across global markets.

- For instance, Caterpillar’s C13B industrial diesel engine delivers 430 kW and 2,634 Nm, compliant with EU Stage V and U.S. EPA Tier 4 Final.

By Application

Excavators led the Construction Equipment Engines Market in 2024, securing nearly 37% of the total share. The segment’s leadership is driven by large-scale infrastructure and mining projects requiring powerful engines with consistent performance under variable loads. Excavators depend on high-capacity diesel engines for optimal hydraulic efficiency and extended operational life. Companies are integrating electronically controlled fuel injection systems to improve power density and reduce emissions. The rapid expansion of urban development projects in Asia-Pacific and the Middle East continues to accelerate the demand for robust engine systems in excavators.

- For instance, Komatsu’s PC210LC-11 excavator uses a 123 kW (165 HP) engine and was originally offered in an EU Stage IV configuration for regulated markets. Komatsu has since introduced newer models that meet the stricter EU Stage V standards

Key Growth Drivers

Rising Infrastructure and Construction Investments

Expanding public and private infrastructure projects are driving demand for high-performance construction equipment engines. Governments across Asia, Europe, and North America are increasing spending on transport, housing, and renewable energy infrastructure. These large-scale developments require heavy machinery powered by efficient diesel and hybrid engines. The demand for engines with higher power output and reliability continues to rise as equipment utilization intensifies in large urban and industrial projects worldwide.

- For instance, VINCI opened the D4 motorway in the Czech Republic in December 2024, adding 32 km of new road and highlighting large, engine-intensive works.

Adoption of Fuel-Efficient and Low-Emission Engines

Stringent emission regulations, such as U.S. EPA Tier 4 and EU Stage V standards, are encouraging manufacturers to design fuel-efficient and cleaner engines. Advanced combustion technologies and turbocharging systems improve performance while reducing carbon footprints. Major OEMs are investing in hybrid and electronically controlled diesel engines to meet sustainability goals. The shift toward eco-friendly powertrains is significantly reshaping market competitiveness and supporting long-term growth in engine innovation.

- For instance, DEUTZ’s TCD 5.2 produces up to 170 kW and 950 Nm with Stage V/Tier 4f aftertreatment (DOC+DPF+SCR).

Growth in Equipment Rental and Leasing Activities

The increasing popularity of construction equipment rentals is creating strong demand for durable and low-maintenance engines. Rental fleets prioritize engines with extended life cycles, low downtime, and efficient fuel consumption. Small and medium contractors are opting for leasing models instead of ownership, expanding market volume for engine replacements and upgrades. This trend supports consistent aftermarket revenue and steady demand for reliable engine systems across global rental networks.

Key Trends & Opportunities

Integration of Hybrid and Electric Powertrains

Hybrid and electric powertrains are emerging as a key opportunity within the market. Manufacturers are introducing dual-mode engines combining diesel and electric systems to improve fuel economy and lower emissions. Advances in battery technology and charging infrastructure make hybrid engines viable for medium-duty construction equipment. This integration supports sustainability goals while offering better operational efficiency, particularly in urban construction sites with strict emission norms.

- For instance, the initial version of Volvo CE’s EC230 Electric could run up to 5 hours on a single charge and recharge in about 80 minutes with a fast charger, an updated version of the excavator released in 2025 offers an extended runtime of 7 to 8 hours and can fast-charge from 20% to 80% in approximately one hour.

Advancements in Telematics and Engine Monitoring

The adoption of telematics systems is transforming engine diagnostics and performance management. Connected engine technologies enable real-time data collection for predictive maintenance, fuel optimization, and operational analytics. Leading OEMs are deploying IoT-enabled engines to reduce unplanned downtime and improve service efficiency. This digital transformation is enhancing customer value and creating opportunities for aftermarket software and analytics-driven maintenance solutions.

- For instance, JCB’s LiveLink monitored over 300,000 machines, enabling remote diagnostics and performance tracking across fleets.

Key Challenges

High Development and Compliance Costs

Developing next-generation engines that meet strict emission norms requires significant R&D and testing investments. Compliance with multiple regional standards increases production costs and lengthens approval timelines. Smaller manufacturers face pressure to maintain competitive pricing while integrating advanced technologies. The resulting high product costs can limit adoption in cost-sensitive markets and slow replacement rates for older machinery.

Volatility in Raw Material and Fuel Prices

Fluctuating prices of steel, aluminum, and fuels directly impact engine production and operating costs. Rising material expenses increase manufacturing costs, while unstable fuel prices affect customer purchasing behavior. Engine manufacturers must balance performance efficiency with affordability amid these fluctuations. The industry faces ongoing challenges in managing profit margins and maintaining supply stability under volatile global market conditions.

Regional Analysis

North America

North America held around 31% of the Construction Equipment Engines Market share in 2024. The region benefits from steady demand for heavy machinery across infrastructure, oil and gas, and mining sectors. The U.S. leads adoption due to strict emission standards encouraging the use of advanced diesel and hybrid engines. Engine manufacturers such as Cummins and Caterpillar focus on high-performance and fuel-efficient designs that meet Tier 4 norms. Ongoing federal investments in road and housing projects continue to support the market’s steady expansion through 2032.

Europe

Europe accounted for approximately 27% of the market share in 2024. The region’s growth is driven by sustainable construction initiatives and the adoption of low-emission engine technologies. Countries such as Germany, France, and the U.K. are implementing EU Stage V regulations, pushing manufacturers toward cleaner and more efficient powertrains. Engine producers are integrating hybrid and electrified solutions to align with carbon-neutral targets. The region’s strong manufacturing base and commitment to green construction practices position it as a leader in technological advancements.

Asia-Pacific

Asia-Pacific dominated the Construction Equipment Engines Market in 2024, capturing nearly 34% of the total share. Rapid urbanization, large-scale infrastructure investments, and expanding mining activities drive strong engine demand. China, India, and Japan lead consumption with a focus on high-power and fuel-efficient diesel engines. Major players are expanding regional manufacturing facilities to meet surging equipment requirements. Government-backed infrastructure programs, such as India’s Smart Cities Mission and China’s Belt and Road projects, continue to accelerate market growth across the region.

Latin America

Latin America accounted for about 5% of the market share in 2024. The region’s construction activities are expanding due to investments in mining, transportation, and housing projects. Brazil and Mexico represent the largest markets, driven by steady economic recovery and rising infrastructure spending. The demand for cost-effective diesel engines remains strong, especially in heavy-duty machinery. However, limited regulatory enforcement and fluctuating commodity prices restrain faster technological adoption across the region.

Middle East & Africa

The Middle East & Africa region held a market share of nearly 3% in 2024. Growth is supported by large-scale infrastructure projects, oilfield developments, and urban expansion initiatives in the Gulf countries. The UAE and Saudi Arabia are key contributors, investing heavily in smart city and industrial projects requiring high-performance construction engines. Africa’s mining and transportation sectors are also increasing engine demand. Although market penetration remains moderate, government initiatives in infrastructure modernization are expected to create future opportunities.

Market Segmentations:

By Type:

- Diesel Engines

- Gasoline Engines

By Application:

- Excavator

- Loaders

- Compactors

- Dump Truck

- Bulldozers

- Others

By Geography:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

Key players in the Construction Equipment Engines Market include Yanmar, Volvo Penta, John Deere, Caterpillar, Yuchai, Kubota, MAN, DEUTZ, Weichai, and Honda. The market is highly competitive, with companies focusing on technological innovation, emission compliance, and durability enhancement. Manufacturers are expanding production capacities and adopting advanced fuel systems to meet global environmental standards. Strategic collaborations with equipment OEMs are helping to strengthen distribution networks and improve aftersales support. Engine makers are emphasizing digitalization through telematics integration for performance tracking and predictive maintenance. Continuous investment in hybrid and alternative fuel engine technologies is reshaping the competitive dynamics, with firms aiming to reduce operating costs and improve efficiency. Market players are also focusing on localization strategies in Asia-Pacific and the Middle East to address growing infrastructure and construction equipment demand, ensuring faster service response and better regional market access.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In 2024, Yanmar announced it would begin manufacturing Tier 4 F-compliant engines for export starting in June 2024, demonstrating its global market aspirations. It also launched new Zero Tail excavators, the ViO38-7 and ViO33-7.

- In 2024, Caterpillar Inc. Unveiled the updated Cat D10 Dozer, designed for demanding job sites. Its engine incorporates load-sensing hydraulics and a stator clutch torque converter to efficiently transmit power.

- In 2023, John Deere revealed its first electric excavator, the 145 X-Tier, at CES 2023 in January and used the CONEXPO Show.

Report Coverage

The research report offers an in-depth analysis based on Type, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for fuel-efficient and low-emission engines will increase due to stricter global regulations.

- Hybrid and electric powertrains will gain traction across compact and mid-sized construction equipment.

- Asia-Pacific will remain the key growth hub driven by ongoing infrastructure and mining projects.

- Advanced telematics and predictive maintenance technologies will enhance engine lifecycle management.

- OEMs will invest heavily in R&D to meet evolving environmental and performance standards.

- Engine remanufacturing and refurbishment will rise as cost-effective and sustainable alternatives.

- Integration of AI-based monitoring systems will improve engine reliability and downtime control.

- The aftermarket segment will expand with growing demand for engine servicing and upgrades.

- Partnerships between engine manufacturers and equipment OEMs will strengthen regional supply chains.

- Global initiatives promoting cleaner construction practices will accelerate the transition to hybrid engines.