Market Overview

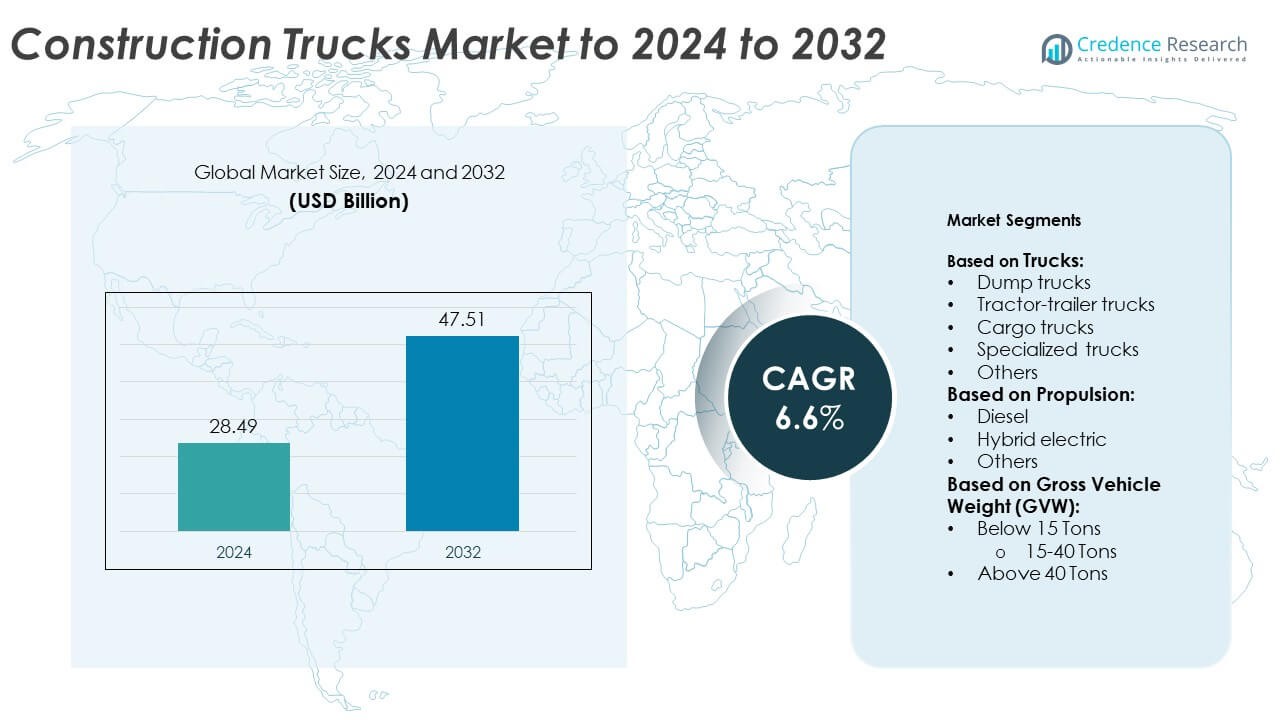

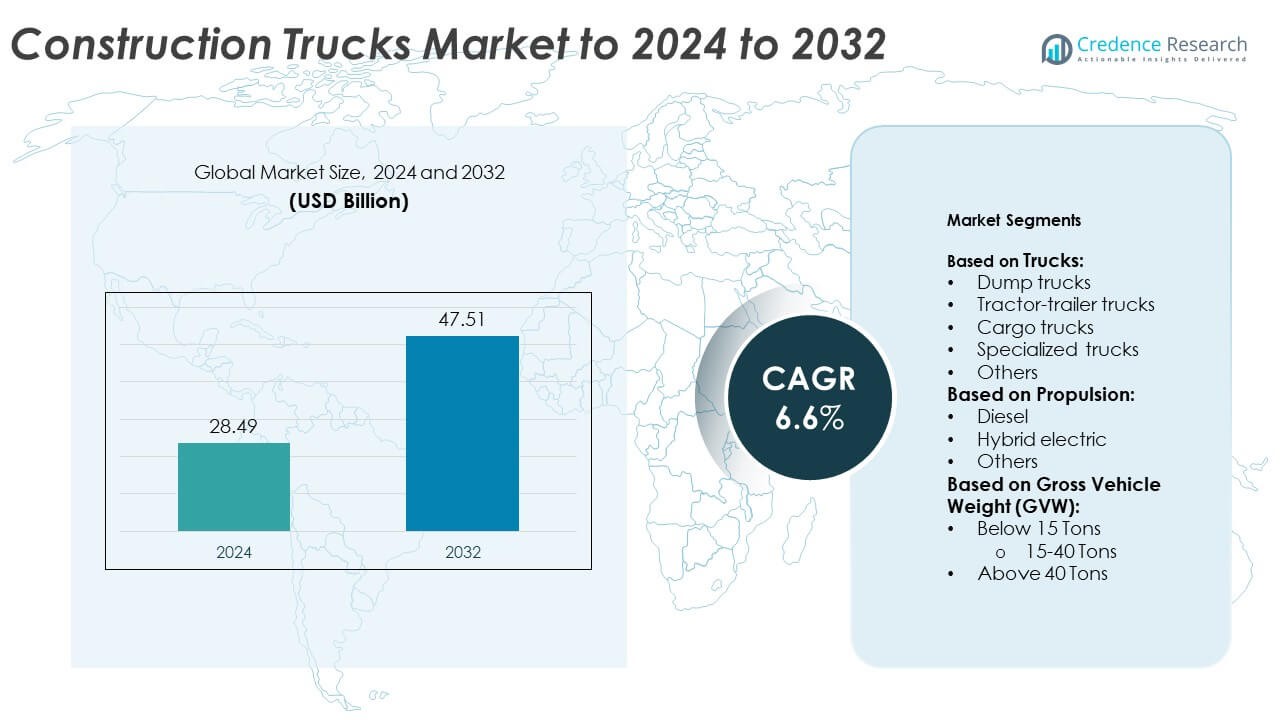

Construction Trucks market size was valued at USD 28.49 billion in 2024 and is anticipated to reach USD 47.51 billion by 2032, at a CAGR of 6.6% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Construction Trucks Market Size 2024 |

USD 28.49 Billion |

| Construction Trucks Market, CAGR |

6.6% |

| Construction Trucks Market Size 2032 |

USD 47.51 Billion |

The Construction Trucks Market is led by major players including Volvo Group, Doosan Corporation, Komatsu Ltd., Liebherr Group, Hyundai Construction Equipment, Terex Corporation, Caterpillar Inc., XCMG Group, Hitachi Construction Machinery Co., Ltd., and SANY Group. These companies maintain strong market positions through technological innovation, extensive distribution networks, and advanced fleet management solutions. Asia Pacific dominated the global market in 2024 with a 34% share, driven by rapid infrastructure growth and expanding urban development projects. North America followed with a 31% share, supported by highway modernization and industrial expansion, while Europe accounted for 27% due to strict emission regulations and increased adoption of hybrid construction trucks.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Construction Trucks Market was valued at USD 28.49 billion in 2024 and is projected to reach USD 47.51 billion by 2032, growing at a CAGR of 6.6%.

- Market growth is driven by large-scale infrastructure expansion, rising urbanization, and increased government investment in construction and public works projects.

- Key trends include the shift toward electric and hybrid propulsion, adoption of telematics for fleet management, and integration of automation for improved productivity.

- The market is highly competitive with major players focusing on innovation, local production, and partnerships to strengthen their presence across developing regions.

- Asia Pacific held the largest share at 34%, followed by North America with 31% and Europe with 27%, while dump trucks dominated the product segment with around 40% market share in 2024.

Market Segmentation Analysis:

By Trucks

Dump trucks dominated the construction trucks market in 2024 with a market share of around 40%. Their dominance stems from widespread use in mining, road construction, and large infrastructure projects. High load capacity and rugged design make them ideal for transporting bulk materials like sand, gravel, and debris. Manufacturers such as Caterpillar and Komatsu are enhancing efficiency through advanced hydraulics and telematics systems that improve payload monitoring. Continuous infrastructure investments and urban development projects worldwide continue to drive demand for heavy-duty dump trucks in both developed and emerging markets.

- For instance, the Komatsu HD785-8 is a rigid-frame off-highway truck rated for a payload of 101.6 U.S. tons (92.2 metric tons).

By Propulsion

Diesel-powered trucks held the largest share of about 75% in the propulsion segment in 2024. These vehicles are preferred for their torque performance, durability, and availability of refueling infrastructure. Heavy-duty applications in remote construction zones still rely on diesel engines for consistent power output. However, companies like Volvo Construction Equipment and Scania are integrating fuel-efficient diesel engines with low-emission technologies to meet tightening emission norms. The growing adoption of hybrid and alternative-fuel models is expected to gain momentum in urban projects and government-funded green construction initiatives.

- For instance, Scania’s Super powertrain, featuring a new 13-liter engine, reduces fuel consumption by up to 8% for long-haulage operations.

By Gross Vehicle Weight (GVW)

Trucks with a gross vehicle weight (GVW) between 15–40 tons captured the largest share in 2024, accounting for nearly 50% of the total market. This range offers the best balance between payload capacity and maneuverability for urban and mid-scale infrastructure applications. Medium-duty trucks in this category are extensively used for material delivery, concrete transport, and equipment movement. Leading OEMs such as Tata Motors and Volvo Trucks are expanding their product lines with enhanced suspension systems and improved fuel efficiency to meet diverse regional construction demands.

Key Growth Drivers

Infrastructure Expansion and Urbanization

Rapid infrastructure development and urban expansion are major growth drivers for the construction trucks market. Large-scale investments in roadways, bridges, and industrial facilities have increased demand for heavy-duty trucks. Countries like India and China are allocating billions toward smart city and transport network projects. These initiatives require continuous material movement and logistics support, fueling steady demand for construction trucks across all weight categories.

- For instance, Volvo Trucks delivered approximately 134,000 trucks worldwide in 2024.

Technological Advancements in Truck Design

Advancements in telematics, automation, and fuel-efficient powertrains are reshaping construction truck operations. Modern trucks now feature intelligent load management, GPS-based tracking, and advanced braking systems to improve safety and productivity. Manufacturers like Volvo Trucks and Komatsu are integrating connected vehicle technology for predictive maintenance. These innovations lower downtime, enhance operational efficiency, and support sustainable fleet performance in demanding construction environments.

- For instance, Caterpillar reported more than 1.5 million connected assets in 2023, leveraging data from these machines to help customers improve operational efficiency and avoid downtime.

Rising Government Investments in Public Infrastructure

Increased government funding in public infrastructure projects, including highways, railways, and housing, drives steady market growth. National infrastructure programs across Europe, North America, and Asia are accelerating heavy-duty truck demand. Governments are emphasizing energy-efficient fleets and emission control regulations, encouraging fleet renewal. The continuous rollout of development programs ensures a robust order pipeline for construction truck manufacturers and component suppliers.

Key Trends and Opportunities

Adoption of Electric and Hybrid Construction Trucks

The shift toward electric and hybrid trucks presents a strong growth opportunity in the market. OEMs like Volvo, Scania, and BYD are launching electric models for short-range construction operations. These vehicles reduce operational emissions and meet tightening environmental regulations. Technological progress in battery systems and fast-charging infrastructure will enhance the commercial viability of hybrid and fully electric construction trucks over the next decade.

- For instance, BYD offers the 8TT Class 8 tandem axle with a standard 422 kWh battery and an extended-range (ER) 563 kWh pack, providing up to 200 miles of range per charge, with an even longer range option available for some fleets.

Integration of Telematics and Fleet Management Systems

The integration of telematics and real-time monitoring tools is transforming fleet management in construction operations. Smart tracking systems optimize routing, fuel use, and maintenance schedules. Companies such as Caterpillar and Komatsu offer data-driven solutions for predictive servicing and operator performance analysis. This trend supports cost control, reduces idle time, and enhances asset utilization, improving overall project efficiency.

- For instance, Mercedes-Benz Trucks’ OM 471 gen-3 engine offers fuel savings of up to 4% for long-haul transport, while a separate high-performance variant of the engine is available for heavy-duty and construction use.

Key Challenges

High Initial and Maintenance Costs

The high capital and operational costs of construction trucks remain a major challenge. Advanced models with hybrid or electric systems require significant upfront investments. Fleet operators also face high maintenance expenses due to frequent use in rugged terrains. This financial burden limits adoption, particularly among small and mid-sized contractors operating in price-sensitive regions.

Stringent Emission Regulations and Compliance Burdens

Tighter global emission standards increase pressure on manufacturers and fleet owners. Compliance with Euro VI, EPA, and similar norms demands costly technology upgrades. Companies are required to invest in low-emission engines, after-treatment systems, and cleaner fuels. These requirements, while essential for sustainability, raise production and operational costs, slowing replacement rates in developing markets.

Regional Analysis

North America

North America held a market share of 31% in the construction trucks market in 2024. The region’s growth is driven by ongoing highway modernization, oil and gas infrastructure projects, and smart city developments. The U.S. leads regional demand with strong investment in heavy-duty dump and tractor-trailer trucks. Key manufacturers such as Caterpillar, Volvo Trucks, and PACCAR dominate through product innovation and efficient distribution networks. The adoption of advanced telematics systems and hybrid powertrains is increasing, supported by government incentives for low-emission construction equipment.

Europe

Europe accounted for 27% of the market share in 2024, driven by large-scale infrastructure renovation and sustainability initiatives. Countries such as Germany, the UK, and France are investing heavily in green construction projects, boosting demand for hybrid and electric trucks. Strict emission norms and advancements in fleet management technology promote cleaner and more efficient trucks. Manufacturers like Scania, MAN, and Daimler Trucks are introducing smart models integrated with digital monitoring systems. The region’s focus on reducing construction emissions continues to shape its evolving market landscape.

Asia Pacific

Asia Pacific dominated the market with a 34% share in 2024, led by China, India, and Japan. Expanding urbanization and industrialization projects, coupled with massive government infrastructure investments, drive high truck demand. The region benefits from affordable manufacturing costs and a strong local production base. Chinese and Indian manufacturers, including Tata Motors and SANY, are introducing fuel-efficient trucks tailored for regional needs. Rapid expansion in construction and mining sectors continues to position Asia Pacific as the global production and consumption hub for heavy-duty construction vehicles.

Latin America

Latin America held a 5% share of the construction trucks market in 2024. The region’s growth is fueled by road expansion and mining activities across Brazil, Chile, and Mexico. Economic recovery efforts and foreign investments in public infrastructure are supporting new truck purchases. Demand is concentrated in medium-duty and off-road segments, where durability and cost efficiency are key. International OEMs are increasing assembly operations and aftersales support to strengthen market presence. However, fluctuating fuel prices and regulatory challenges may slightly affect growth momentum across the region.

Middle East & Africa

The Middle East & Africa region captured a 3% share of the global market in 2024. Growth is primarily supported by large-scale construction and oil infrastructure projects in Saudi Arabia, the UAE, and South Africa. Investments under programs such as Saudi Vision 2030 are accelerating fleet modernization. High demand for heavy-duty and specialized trucks for desert and mining applications sustains market activity. Manufacturers are expanding dealer networks and providing durable models suited to extreme operating environments, ensuring continued growth despite economic and climatic challenges.

Market Segmentations:

By Trucks:

- Dump trucks

- Tractor-trailer trucks

- Cargo trucks

- Specialized trucks

- Others

By Propulsion:

- Diesel

- Hybrid electric

- Others

By Gross Vehicle Weight (GVW):

- Below 15 Tons

- Above 40 Tons

By Geography:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The construction trucks market is characterized by strong competition among leading manufacturers such as Volvo Group, Doosan Corporation, Komatsu Ltd., Liebherr Group, Hyundai Construction Equipment, Terex Corporation, Caterpillar Inc., XCMG Group, Hitachi Construction Machinery Co., Ltd., and SANY Group. These companies compete through technological innovation, product diversification, and global expansion strategies. The focus is shifting toward fuel-efficient engines, hybrid powertrains, and intelligent telematics to enhance performance and reduce operational costs. Manufacturers are also investing in localized production facilities to strengthen regional presence and minimize supply disruptions. Strategic partnerships with component suppliers and digital solution providers are helping improve efficiency and product reliability. Continuous R&D efforts in automation, electric propulsion, and predictive maintenance systems are shaping the next generation of construction trucks. As competition intensifies, companies are emphasizing sustainability, aftersales service, and long-term fleet support to maintain market leadership and strengthen customer relationships across key infrastructure markets.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Volvo Group

- Doosan Corporation

- Komatsu Ltd.

- Liebherr Group

- Hyundai Construction Equipment

- Terex Corporation

- Caterpillar Inc.

- XCMG Group

- Hitachi Construction Machinery Co., Ltd.

- SANY Group

Recent Developments

- In 2024, Tata Hitachi showcased a 20-ton electric excavator concept at the bauma CONEXPO trade show.

- In 2024, Caterpillar launched next-generation loaders with improved power and performance, and expanded its autonomous hauling technology (Cat MineStar™ Command) to the quarry and aggregates sector.

- In 2023, Komatsu announced the acquisition of iVolve, a fleet management system leader, in December. The company also developed a medium-sized hydraulic excavator concept combining a hydrogen fuel cell and key components for carbon-neutral workplaces.

Report Coverage

The research report offers an in-depth analysis based on Trucks, Propulsion, Gross Vehicle Weight (GVW) and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will grow steadily due to ongoing global infrastructure expansion.

- Demand for electric and hybrid trucks will rise with stricter emission standards.

- Manufacturers will focus on telematics integration for real-time performance tracking.

- Asia Pacific will remain the leading production and consumption region.

- Government investment in public works will continue to fuel fleet purchases.

- Advanced automation will improve driver safety and operational efficiency.

- Fleet modernization programs will support adoption of fuel-efficient models.

- Rental and leasing services will gain traction among small contractors.

- Smart load monitoring and digital diagnostics will enhance productivity.

- Collaboration between OEMs and technology firms will drive innovation in connected trucks.