Market Overview

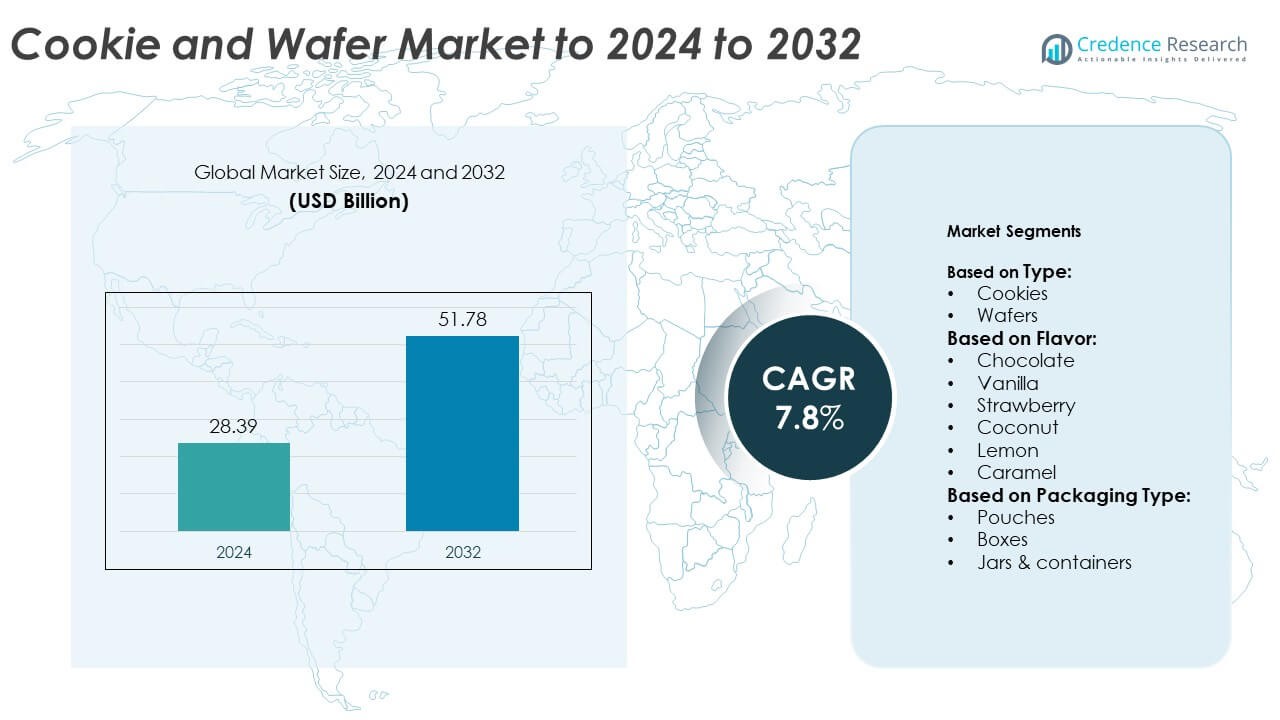

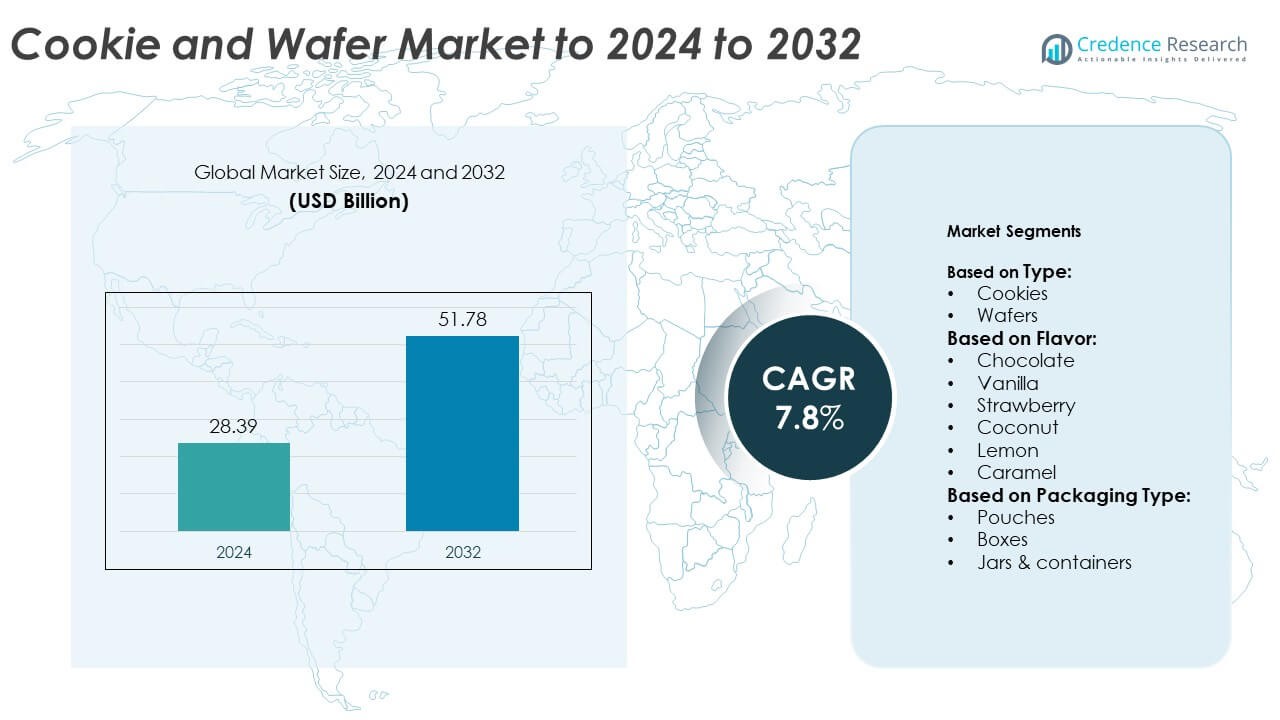

Cookie and Wafer Market size was valued at USD 28.39 Billion in 2024 and is anticipated to reach USD 51.78 Billion by 2032, at a CAGR of 7.8% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Cookie and Wafer Market Size 2024 |

USD 28.39 Billion |

| Cookie and Wafer Market, CAGR |

7.8% |

| Cookie and Wafer Market Size 2032 |

USD 51.78 Billion |

The cookie and wafer market is led by major companies such as Ferrero Group, Britannia Industries Limited, Mondelez International, ITC Limited, and Nestlé S.A., which collectively dominate global production and distribution. These companies focus on flavor innovation, premium ingredients, and sustainable packaging to meet evolving consumer preferences. Regional expansion strategies and digital retail integration have strengthened their global presence. North America led the market in 2024 with a 32% share, supported by strong snack consumption and diverse product portfolios, followed by Europe with 28% and Asia Pacific with 25%, driven by rapid urbanization and rising disposable incomes.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The cookie and wafer market was valued at USD 28.39 Billion in 2024 and is projected to reach USD 51.78 Billion by 2032, growing at a CAGR of 7.8%.

- Growth is driven by rising demand for convenient snacks, flavor diversification, and increasing online retail penetration across developed and emerging markets.

- Key trends include the shift toward healthier, low-sugar, and gluten-free cookies, along with sustainable packaging and premium product innovation.

- The market is competitive with global brands focusing on flavor innovation, marketing, and eco-friendly production to strengthen consumer loyalty and expand distribution networks.

- North America led with a 32% share in 2024, followed by Europe at 28% and Asia Pacific at 25%, while the cookies segment accounted for over 60% of the total market share, driven by strong consumer preference for versatile and indulgent snack options.

Market Segmentation Analysis:

By Type

The cookies segment dominated the cookie and wafer market in 2024 with a market share of over 60%. Cookies are preferred for their wide flavor range, convenience, and longer shelf life. Manufacturers focus on innovative varieties such as protein-rich, gluten-free, and low-sugar cookies to attract health-conscious consumers. The rising popularity of on-the-go snacks and premium cookies across urban areas supports steady demand growth. Meanwhile, wafers are gaining attention through chocolate-coated and cream-filled variants appealing to younger consumers and emerging markets.

- For instance, Van Delft Biscuits (Netherlands) produces over 7 billion kruidnoten annually, reflecting strong scale in cookie production.

By Flavor

The chocolate flavor segment held the largest share of around 45% in 2024, driven by strong global demand for indulgent and familiar tastes. Chocolate-coated cookies and wafers continue to dominate supermarket shelves due to high consumer preference. Vanilla and strawberry flavors follow, supported by their appeal among children and in bakery assortments. Brands increasingly experiment with lemon, coconut, and caramel to expand premium offerings. Flavor diversification, supported by regional preferences and innovation in natural flavoring, drives category expansion and repeat purchases across demographics.

- For instance, Oreo (Mondelez) sells over 60 billion cookies per year globally, reinforcing its position as the world’s best-selling cookie and reflecting the strength of the chocolate-flavored sandwich cookie segment.

By Packaging Type

Pouches accounted for the dominant share of nearly 50% in 2024, favored for their lightweight, resealable, and cost-effective nature. They offer convenience for single-serve and multipack formats, aligning with growing snack-on-the-go trends. The increasing use of eco-friendly flexible packaging further enhances adoption. Boxes are also significant in the premium and gifting segment, offering visual appeal and product protection. Jars and containers cater to family-sized or refillable products, particularly in e-commerce distribution. Sustainable and innovative packaging designs continue to shape consumer purchasing behavior.

Key Growth Drivers

Rising Demand for Convenient Snack Options

Growing urbanization and busy lifestyles are driving demand for ready-to-eat snack products like cookies and wafers. Consumers prefer portable, portion-controlled options that combine taste with convenience. Expanding retail networks and e-commerce platforms further boost accessibility. This shift toward convenience foods, especially among young professionals and students, continues to support consistent market growth across regions.

- For instance, Crumbl Cookies ended 2024 with 1,059 stores, reflecting the scale of its on-the-go distribution

Innovation in Flavors and Premiumization

Manufacturers are investing in flavor innovation and premium product development to attract diverse consumers. The introduction of indulgent flavors such as caramel, hazelnut, and dark chocolate enhances brand differentiation. Premium packaging and healthier ingredients, including whole grains and low-sugar formulations, also appeal to quality-conscious buyers. This trend increases brand value and drives sales in developed markets.

- For instance, Sweet Martha’s Cookies bakes up to 3 million cookies per day during Minnesota State Fair, testing new offerings at scale.

Expanding Distribution Channels

The rapid growth of online retail, along with expanding supermarket and convenience store networks, supports product availability. Digital platforms enable brands to reach a wider consumer base and launch limited-edition products. Retailers emphasize variety and freshness, enhancing consumer experience. The integration of supply chain digitization ensures consistent product quality and quicker delivery. This broad distribution network strengthens global sales.

Key Trends & Opportunities

Shift Toward Healthier and Functional Ingredients

Health-conscious consumers are reshaping the cookie and wafer market by demanding low-fat, high-fiber, and sugar-free alternatives. Companies are introducing fortified products with added proteins, vitamins, and natural sweeteners. This trend aligns with the clean-label and wellness movement, opening new opportunities for innovative product lines. The demand for organic and gluten-free variants continues to grow rapidly, especially in urban markets.

- For instance, Tiff’s Treats operates over 150 locations and uses delivery channels to reach customers beyond stores.

Sustainable and Eco-Friendly Packaging

The focus on sustainability is encouraging manufacturers to adopt recyclable and biodegradable packaging. Brands are replacing plastic materials with paper-based or compostable alternatives to meet environmental standards. This shift not only enhances brand image but also attracts eco-conscious consumers. The use of renewable materials in pouches and boxes presents long-term growth potential, especially in Europe and North America.

- For instance, KIND (snack foods company) aims to have 100 % recyclable packaging by 2030, pushing toward flexible sustainable formats.

Customization and Limited-Edition Launches

Personalized and limited-edition cookie and wafer products are gaining popularity. Seasonal flavors and region-specific variants increase consumer engagement and create exclusivity. Collaborations with confectionery brands or popular franchises boost visibility and drive impulse purchases. This marketing strategy enhances customer loyalty and strengthens brand positioning in competitive markets.

Key Challenges

Rising Raw Material and Production Costs

Fluctuating prices of key ingredients like cocoa, sugar, and wheat pose major cost challenges for manufacturers. Increased packaging and transportation expenses add further pressure on margins. Companies are focusing on supply chain optimization and local sourcing to mitigate risks. However, maintaining product quality while managing cost efficiency remains a significant challenge for producers.

Health Concerns Related to Sugar and Processed Foods

Growing awareness about obesity and diabetes has led some consumers to reduce intake of sugary snacks. Traditional cookies and wafers often face criticism for high sugar and fat content. This trend pushes brands to reformulate recipes with healthier alternatives, which can affect taste and consumer acceptance. Balancing health standards with flavor expectations remains a core challenge in this market.

Regional Analysis

North America

North America held the largest share of 32% in the global cookie and wafer market in 2024. The region benefits from high consumption of baked snacks, product innovation, and strong retail infrastructure. Premium cookies and health-oriented wafer options are gaining traction among urban consumers. Growing demand for on-the-go and indulgent treats also supports steady sales growth. Major brands invest in new flavor profiles and eco-friendly packaging to maintain competitiveness. The United States leads the regional market, supported by high per capita snack consumption and strong online retail penetration.

Europe

Europe accounted for 28% of the global market share in 2024, supported by strong bakery traditions and premium product demand. Countries such as Germany, the United Kingdom, and France dominate due to widespread cookie consumption and evolving flavor preferences. Health-conscious trends have driven the development of reduced-sugar and organic wafer varieties. Manufacturers are adopting sustainable packaging and local ingredient sourcing to meet EU standards. The region’s established retail distribution and innovation in artisanal cookies further enhance its competitive position in the global market.

Asia Pacific

Asia Pacific captured a 25% share of the global cookie and wafer market in 2024, emerging as the fastest-growing region. Rising disposable incomes, urbanization, and a preference for convenient snack foods drive consumption across China, India, and Japan. Local and international brands are expanding manufacturing bases to meet rising demand. Increasing western-style snacking culture and innovative flavor launches contribute to strong growth. The e-commerce boom further strengthens market reach, while affordable price points attract middle-income consumers. Regional players focus on product diversification and packaging innovation to gain share.

Latin America

Latin America represented 9% of the global cookie and wafer market share in 2024. The market benefits from growing demand for sweet bakery products and expanding retail networks in Brazil and Mexico. Consumers favor chocolate-coated wafers and sandwich cookies, driven by affordability and taste appeal. Regional producers are emphasizing cost-effective ingredients and localized flavors. Product accessibility through supermarkets and convenience stores continues to expand. The shift toward modern trade and increased youth population support positive market growth across the region.

Middle East & Africa

The Middle East and Africa accounted for 6% of the global cookie and wafer market share in 2024. Rising urbanization, changing dietary habits, and population growth are key factors driving demand. Countries such as Saudi Arabia, the UAE, and South Africa lead in consumption due to expanding retail infrastructure. International brands are increasing their presence through local partnerships and halal-certified offerings. Growing tourism and the popularity of premium snack products further support sales. The region’s improving logistics and affordability of packaged snacks create growth opportunities for manufacturers.

Market Segmentations:

By Type:

By Flavor:

- Chocolate

- Vanilla

- Strawberry

- Coconut

- Lemon

- Caramel

By Packaging Type:

- Pouches

- Boxes

- Jars & containers

By Geography:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The cookie and wafer market is highly competitive, with leading players such as Ferrero Group, Britannia Industries Limited, Mondelez International, Inc., ITC Limited, Nestlé S.A., General Mills, Inc., Grupo Bimbo, Campbell Soup Company, United Biscuits (UK) Limited Co., and Kellogg’s driving global expansion through innovation and branding. The market is characterized by continuous product diversification, focusing on new flavors, premium ingredients, and healthier formulations. Companies invest heavily in marketing, packaging, and supply chain efficiency to strengthen brand loyalty and reach new consumer segments. Strategic partnerships with retailers and e-commerce platforms enhance accessibility across urban and rural markets. Sustainability initiatives, including recyclable packaging and responsible sourcing, have become central to brand strategies. Competitive differentiation increasingly relies on health-oriented innovations, regional flavor customization, and digital engagement to align with evolving consumer lifestyles and environmental expectations.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Ferrero Group

- Britannia Industries Limited

- Mondelez International, Inc.

- ITC Limited

- Nestlé S.A.

- General Mills, Inc.

- Grupo Bimbo

- Campbell Soup Company

- United Biscuits (UK) Limited Co.

- Kellogg’s

Recent Developments

- In 2025, Nestlé S.A. Unveiled its 2025 seasonal confectionery range, which includes cookie and wafer innovations. Products such as the KitKat Gingerbread 2-finger wafer and the new Quality Street Green Triangle-inspired hazelnut wafer bar were announced.

- In 2025, Ferrero announced the acquisition of WK Kellogg Co, signaling a major strategic move to expand its North American sales, particularly in the breakfast cereal sector.

- In 2023, Britannia Industries Limited Launched Jim Jam Pops, a new type of cream biscuit, in August.

Report Coverage

The research report offers an in-depth analysis based on Type, Flavor, Packaging Type and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The cookie and wafer market will continue to expand with growing global snack consumption.

- Demand for healthier, low-sugar, and high-fiber products will rise steadily.

- Premium and artisanal cookie varieties will gain popularity in developed markets.

- Online retail and direct-to-consumer channels will boost product accessibility.

- Manufacturers will focus on sustainable and biodegradable packaging solutions.

- Flavor innovation and regional customization will strengthen brand competitiveness.

- Strategic partnerships and mergers will enhance distribution and market reach.

- Asia Pacific will remain the fastest-growing region due to urbanization and income growth.

- Investment in automation and efficient production technologies will improve profitability.

- Health regulations and labeling transparency will influence future product formulations.