Market Overview

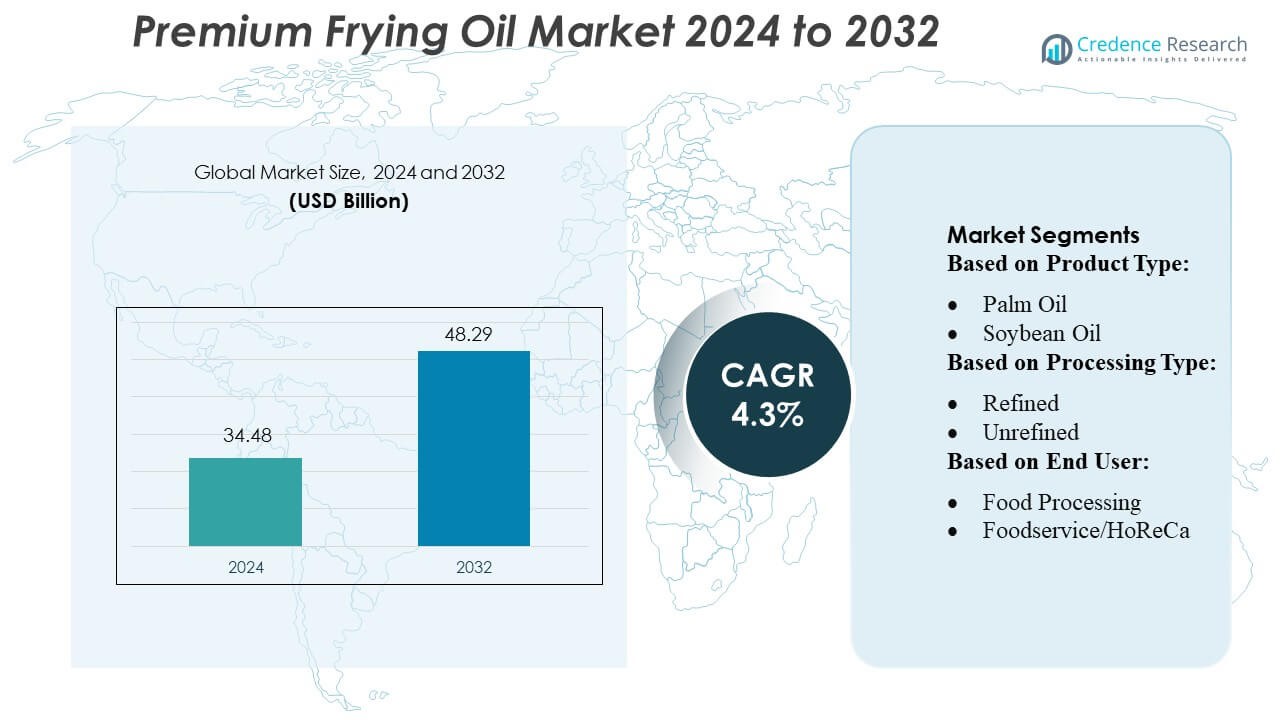

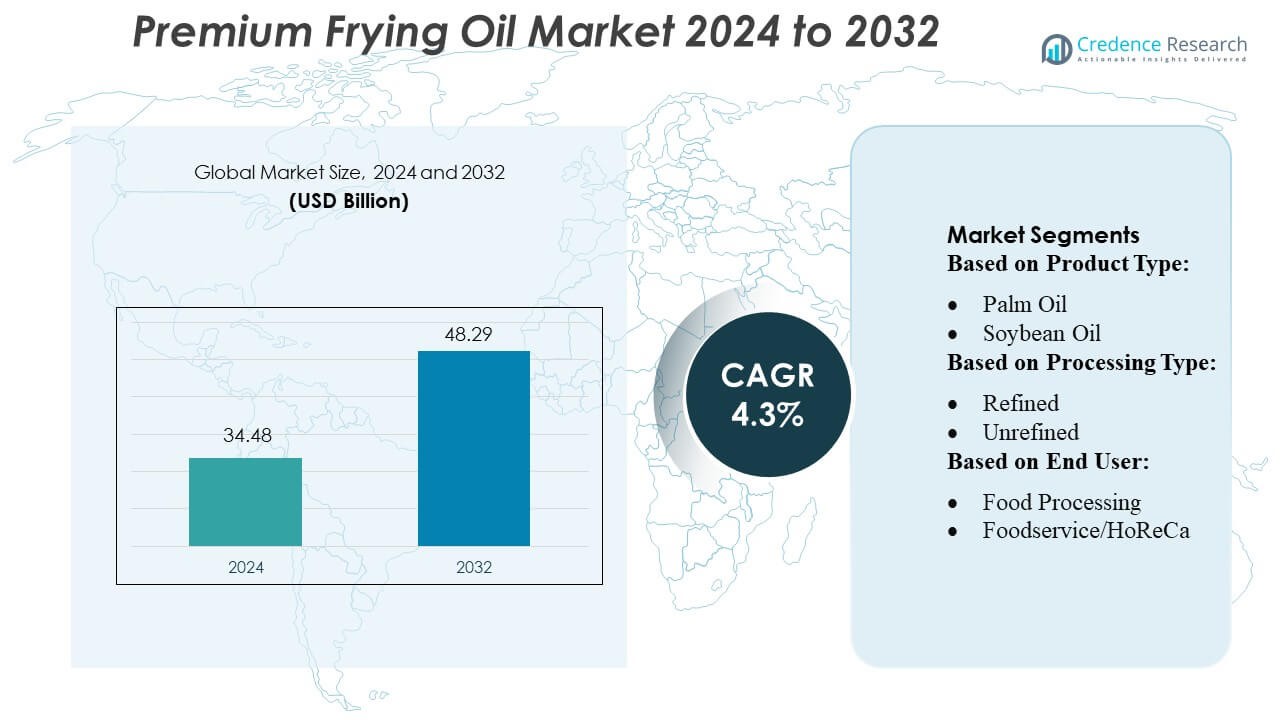

Premium Frying Oil Market size was valued USD 34.48 billion in 2024 and is anticipated to reach USD 48.29 billion by 2032, at a CAGR of 4.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Premium Frying Oil Market Size 2024 |

USD 34.48 Billion |

| Premium Frying Oil Market, CAGR |

4.3% |

| Premium Frying Oil Market Size 2032 |

USD 48.29 Billion |

The premium frying oil market is dominated by leading companies such as Fuji Oil Group, Bunge Limited, Marico, Nutiva, George Weston Foods Limited, Archer Daniels Midland Company, Wilmar International Limited, Cargill, Incorporated, Sime Darby Plantation, and Olam International Limited. These players focus on product innovation, fortified and specialty oil offerings, sustainable sourcing, and expansion into emerging markets to strengthen their market presence. They leverage strategic partnerships with retail chains and foodservice operators to enhance distribution and brand visibility. Among regions, Asia-Pacific leads the market, accounting for approximately 33% share, driven by rapid urbanization, rising disposable incomes, and strong demand from the HoReCa and packaged food sectors. High consumption of fried foods, growing health awareness, and increasing retail penetration continue to support both volume growth and adoption of premium frying oils in the region.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The premium frying oil market size was valued at USD 34.48 billion in 2024 and is projected to reach USD 48.29 billion by 2032, growing at a CAGR of 4.3% during the forecast period.

- Market growth is driven by rising demand for healthier and high-quality frying oils, increasing consumption of fried and convenience foods, and expanding foodservice and HoReCa sectors globally.

- Key trends include innovation in fortified and specialty oils, adoption of sustainable and traceable sourcing, expansion of retail and e-commerce channels, and growing focus on functional oils with improved nutritional profiles.

- The market is highly competitive, with leading players such as Fuji Oil Group, Bunge Limited, Marico, Nutiva, Archer Daniels Midland Company, Wilmar International Limited, Cargill, Sime Darby Plantation, and Olam International Limited focusing on product differentiation, strategic partnerships, and regional expansion.

- Asia-Pacific dominates the market with approximately 33% share, supported by rapid urbanization, rising disposable incomes, and high demand from both HoReCa and retail segments, while palm, soybean, and canola oils hold major product segment shares.

Market Segmentation Analysis:

By Product Type

In the product type segment, Palm Oil dominates the premium frying oil market, capturing approximately 38–40% share due to its high stability, long shelf life, and cost-effectiveness for deep frying applications. Soybean and rapeseed/canola oils follow, valued for their neutral flavor and health benefits. Growth in palm oil consumption is driven by increasing demand from the foodservice and retail sectors, alongside innovations in sustainable and fortified palm oil variants that appeal to health-conscious consumers while meeting regulatory standards for trans-fat and saturated fat content.

- For instance, Bunge reported that for the full year 2024, approximately 97% of its palm oil volumes were sourced from suppliers committed to “No Deforestation, No Peat, No Exploitation” (NDPE) standards, reflecting rigorous traceability practices, with 95% of its volumes traceable to the plantation level.

By Processing Type

Within processing types, Refined oils hold the largest share at roughly 65–68%, owing to their superior clarity, higher smoke point, and longer shelf life, making them ideal for commercial frying and packaged foods. Unrefined oils, though growing in niche health-focused segments, remain limited due to shorter stability and higher cost. The refined segment’s growth is fueled by industrial adoption, regulatory compliance for food safety, and consumer preference for consistent flavor and quality, particularly in HoReCa and food processing applications requiring reliable frying performance.

- For instance, TotalEnergies SE operates the Donges Refinery in France, which has a crude oil processing capacity of approximately 11.5 million tonnes annually.

By End User

Among end users, Foodservice/HoReCa accounts for the dominant share of around 42–45%, driven by high-volume frying requirements and the need for consistent oil performance in restaurants, hotels, and quick-service outlets. The retail segment is expanding steadily due to at-home premium cooking trends, while food processing benefits from technological advancements in frying equipment and oil recycling systems. Growth is underpinned by rising consumer demand for fried convenience foods, menu diversification in foodservice, and increasing awareness of high-quality oils that support both taste and operational efficiency.

Key Growth Drivers

Rising Demand from Foodservice and HoReCa Sector

The growing global foodservice and HoReCa sector is a major driver of the premium frying oil market. Restaurants, hotels, and quick-service outlets require high-quality oils with superior stability, flavor retention, and smoke point performance for deep-frying and commercial cooking. Increasing consumer preference for fried and convenience foods accelerates demand. Additionally, menu diversification, coupled with expansion of fast-food chains in emerging economies, has further boosted the adoption of premium frying oils, contributing significantly to market growth.

- For instance, ExxonMobil’s Baytown complex supports export shipping by integrating with the Houston Ship Channel. The Baytown refinery has a crude input capacity of 588,000 barrels per day. The company is actively developing new hydrogen and CO₂ capture infrastructure projects at the site, including a planned facility designed to capture approximately 7 million metric tons of CO₂ annually once operational, for storage projects.

Health and Nutritional Awareness

Heightened consumer awareness of health and nutrition has encouraged a shift toward oils with better fatty acid profiles and lower trans-fat content. Manufacturers are responding by offering premium frying oils fortified with antioxidants, Omega-3s, and low-saturated-fat formulations. This trend is particularly strong among retail and at-home consumers seeking healthier cooking options. Regulatory frameworks promoting trans-fat reduction and labeling transparency also support growth, as brands leverage these factors to position premium frying oils as both safe and nutritionally advantageous for daily cooking.

- For instance, Kinder Morgan owns or operates approximately 83,000 miles of pipelines and 143 terminals across North America, making it one of the continent’s largest energy infrastructure operators.

Technological Advancements in Oil Processing

Innovations in refining, fractionation, and blending technologies enhance oil stability, shelf life, and frying performance, driving market expansion. Advanced refining techniques reduce impurities, extend smoke points, and improve flavor neutrality, making oils more suitable for industrial and commercial frying. Automation in oil processing and quality monitoring further ensures consistency and efficiency, appealing to both foodservice operators and large-scale food processors. These technological improvements enable manufacturers to offer differentiated premium products, fostering market growth across both mature and emerging regions.

Key Trends & Opportunities

Sustainability and Eco-Friendly Oils

The shift toward sustainable and eco-friendly oil sourcing presents significant opportunities in the premium frying oil market. Consumers and regulatory bodies increasingly demand sustainably sourced palm, soybean, and canola oils, including RSPO-certified and traceable products. Manufacturers are investing in environmentally responsible supply chains and promoting low-carbon, zero-waste initiatives. This trend aligns with global sustainability goals while attracting eco-conscious consumers, providing a competitive edge and creating potential for premium pricing in both retail and foodservice segments.

- For instance, BP operates the Baku–Supsa oil pipeline, which is 833 km long and has an operational capacity of around 145,000 barrels per day of crude from Azerbaijan to Georgia.

Expansion of Retail and E-Commerce Channels

Retail and e-commerce growth is creating opportunities for premium frying oil penetration into household cooking segments. Online platforms allow manufacturers to reach wider audiences, offering convenience, bulk packages, and subscription models. Rising demand for home-prepared fried foods, fueled by changing lifestyles and urbanization, further supports this trend. E-commerce also enables direct consumer engagement, brand loyalty, and rapid feedback integration, helping companies introduce innovative product variants and tailor offerings to regional taste preferences and dietary requirements.

- For instance, Chevron opened its Engineering and Innovation Excellence Center (ENGINE) in Bengaluru, India, covering 312,000 square feet, to centralize AI, digital workflows, and high-performance computing for global operations.

Innovation in Functional and Specialty Oils

There is growing demand for functional and specialty frying oils enriched with nutrients, antioxidants, and natural flavors. Oils targeting cholesterol reduction, heart health, and oxidative stability appeal to health-conscious consumers and premium foodservice providers. This trend encourages manufacturers to develop blended oils or incorporate natural additives to enhance frying performance and nutritional value. Such innovations open avenues for differentiation, higher profit margins, and increased adoption in niche markets, particularly in developed regions with higher disposable incomes and health-driven consumption patterns.

Key Challenges

Volatility in Raw Material Prices

Fluctuating prices of palm, soybean, and rapeseed oils pose a significant challenge for the premium frying oil market. Price volatility can increase production costs, affect profit margins, and impact the affordability of premium oils for both foodservice and retail consumers. Factors such as climate change, crop yield variability, and geopolitical issues exacerbate supply instability. Manufacturers must implement strategic sourcing, hedging, and cost optimization measures to maintain competitiveness while ensuring consistent supply to meet growing market demand.

Regulatory Compliance and Health Concerns

Stringent regulations regarding trans-fats, saturated fats, and labeling requirements pose challenges for manufacturers. Compliance with evolving food safety standards and regional nutritional guidelines necessitates advanced processing, testing, and documentation, increasing operational complexity. Additionally, consumer scrutiny over health impacts and chemical residues in frying oils may limit adoption of certain products. Companies must continuously innovate and maintain transparency to build trust, balance quality with compliance costs, and mitigate risks associated with regulatory penalties or reputational damage.

Regional Analysis

North America

North America holds a significant share of approximately 28–30% in the premium frying oil market, driven by high consumer awareness of quality and health-focused oils. The region benefits from well-established foodservice chains, increasing demand for fast food, and growing retail adoption of premium cooking oils. Technological advancements in refining and fortified oil formulations further support market growth. Health regulations limiting trans-fat and promoting healthier frying options are also shaping product offerings. The U.S. and Canada remain key contributors, with rising preferences for sustainable and non-GMO oils enhancing demand across both retail and HoReCa segments.

Europe

Europe captures around 26–27% of the global premium frying oil market, fueled by growing consumption of fried and convenience foods alongside high nutritional awareness. Countries such as Germany, France, and the UK exhibit strong demand for refined, low-trans-fat oils. Stringent EU regulations regarding food safety and labeling encourage manufacturers to innovate with sustainable and fortified products. The expansion of quick-service restaurants and rising preference for at-home premium cooking also contribute to growth. Additionally, consumer focus on traceable and environmentally friendly oils supports the adoption of certified palm, rapeseed, and specialty oils across both retail and foodservice channels.

Asia-Pacific

Asia-Pacific is the largest and fastest-growing market, accounting for roughly 32–34% share, driven by rapid urbanization, rising disposable incomes, and the expanding foodservice sector. Countries like China, India, and Japan demonstrate high demand for fried snacks, restaurant meals, and packaged foods, supporting premium oil adoption. Increasing health awareness has led to demand for oils with better fatty acid profiles and antioxidant fortification. Additionally, growth in organized retail and e-commerce channels facilitates wider distribution. Manufacturers are focusing on sustainable sourcing, innovative blends, and large-scale HoReCa partnerships to capture the region’s evolving consumer base.

Latin America

Latin America holds approximately 6–7% of the global premium frying oil market, with growth driven by urban population expansion and rising fast-food consumption. Brazil and Mexico are key markets, where increasing disposable income and evolving foodservice trends boost demand for high-quality frying oils. Retail adoption is rising due to at-home cooking trends, while regulatory compliance encourages manufacturers to offer low-trans-fat and refined products. Sustainability initiatives and traceable supply chains are emerging trends in the region. Despite slower growth compared to Asia-Pacific, Latin America presents opportunities for premium and specialty oil products in both industrial and retail channels.

Middle East & Africa (MEA)

The MEA region accounts for around 5–6% of the premium frying oil market, with growth driven by expanding HoReCa and packaged food sectors. Countries such as Saudi Arabia, UAE, and South Africa exhibit increasing demand for refined and high-stability oils suitable for commercial frying. Rapid urbanization, tourism growth, and rising disposable income contribute to market expansion. Consumers show a preference for high-quality, sustainable, and health-oriented oils, encouraging manufacturers to introduce fortified and traceable products. While regulatory frameworks vary, growing awareness of food safety and nutritional content continues to support the adoption of premium frying oils across retail and foodservice segments.

Market Segmentations:

By Product Type:

By Processing Type:

By End User:

- Food Processing

- Foodservice/HoReCa

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The premium frying oil market is highly competitive, with key players including Fuji Oil Group, Bunge Limited, Marico, Nutiva, George Weston Foods Limited, Archer Daniels Midland Company, Wilmar International Limited, Cargill, Incorporated, Sime Darby Plantation, and Olam International Limited. The premium frying oil market is highly competitive, driven by innovation, quality differentiation, and sustainability initiatives. Companies focus on developing advanced refining technologies, fortified oils, and specialty blends to meet rising consumer demand for healthier and high-performance frying solutions. Strategic expansion into emerging markets and enhanced distribution through retail and e-commerce channels strengthen market presence. Competition is further intensified by pricing strategies, product portfolio diversification, and compliance with stringent food safety and labeling regulations. Manufacturers also emphasize partnerships with foodservice operators and retail chains to increase penetration, enhance brand loyalty, and maintain a resilient position in a market influenced by fluctuating raw material prices and evolving consumer preferences.

Key Player Analysis

Recent Developments

- In February 2025, Middleby announced its plan to separate its food processing division into a new, independent public company, which is expected to be completed by early 2026. This strategic move is intended to allow each company to have a sharper focus.

- In October 2024, Stratas Foods signed a binding agreement to acquire the AAK Foodservice business located in Hillside, New Jersey, to expand its manufacturing capabilities and market presence in value-added oils, dressings, sauces, and mayonnaise.

- In July 2024, Louis Dreyfus Company (LDC) relaunched its edible oil brand, Vibhor, in North India to capture the region’s growing demand for high-quality oils. The refreshed product line includes soybean, palm olein, cottonseed, mustard oil, and vanaspati, all fortified with vitamins A and D, and is designed to strengthen LDC’s presence in the consumer market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Product Type, Processing Type, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for healthier and low-trans-fat frying oils is expected to grow steadily.

- Adoption of fortified and specialty oils will increase across retail and foodservice channels.

- Asia-Pacific is likely to maintain its leadership due to urbanization and rising disposable incomes.

- Expansion of e-commerce and organized retail will drive wider market penetration.

- Sustainable and traceable oil sourcing will become a key focus for manufacturers.

- Technological advancements in refining and oil stabilization will enhance product performance.

- Partnerships with HoReCa and packaged food industries will strengthen market presence.

- Rising awareness of nutritional benefits will support premium oil consumption at home.

- Regulatory compliance and labeling standards will shape product development.

- Innovation in blended and functional oils will create new growth opportunities globally.