Market Overview

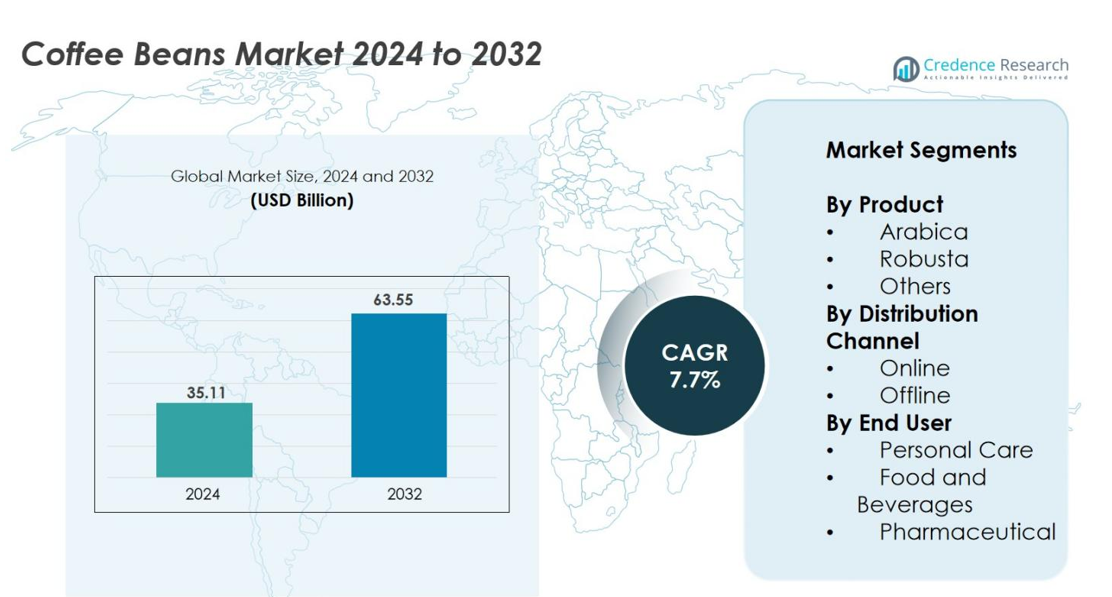

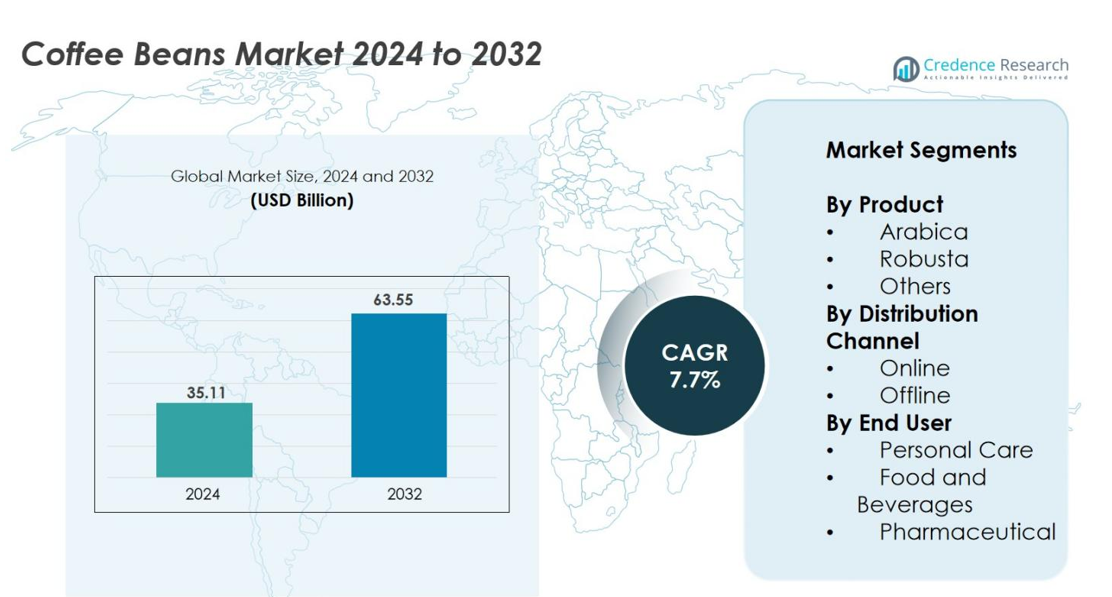

Coffee Beans Market size was valued at USD 35.11 Billion in 2024 and is anticipated to reach USD 63.55 Billion by 2032, at a CAGR of 7.7% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Coffee Beans Market Size 2024 |

USD 35.11 Billion |

| Coffee Beans Market, CAGR |

7.7% |

| Coffee Beans Market Size 2032 |

USD 63.55 Billion |

The Coffee Beans Market is driven by strong participation from leading players such as Luigi Lavazza S.p.A., illycaffè S.p.A., Peet’s Coffee, Caribou Coffee, La Colombe Torrefaction, Coffee Bean International, Kicking Horse Coffee, and Death Wish Coffee, all of whom focus on premium Arabica offerings, sustainable sourcing, and expanded global distribution. These companies increasingly emphasize organic, single-origin, and ethically certified beans to meet rising consumer demand for quality and traceability. Regionally, Europe leads the market with a 31% share in 2024, supported by deep-rooted coffee culture and high consumption of specialty varieties, while Asia-Pacific and North America follow as rapidly growing markets driven by café expansion and premiumization trends.

Market Insights

- Coffee Beans Market was valued at USD 35.11 Billion in 2024 and is projected to reach USD 63.55 Billion by 2032, registering a CAGR of 7.7% during the forecast period.

- Market growth is driven by rising global coffee consumption, expanding café culture, and higher demand for premium, specialty, and sustainably sourced beans across both developed and emerging economies.

- Key trends include strong preference for Arabica, which holds a 61% product share, along with growing traction for organic, single-origin, ethically certified beans and ready-to-drink as well as home-brewing formats.

- The market remains competitive with players such as Luigi Lavazza, illycaffè, Peet’s Coffee, Caribou Coffee, La Colombe, Coffee Bean International, Kicking Horse Coffee, and Death Wish Coffee focusing on quality, branding, and omnichannel reach.

- Regionally, Europe holds 31% share, Asia-Pacific 28%, North America 24%, Latin America 10%, and Middle East & Africa 7%, while offline channels account for 68% and food and beverages end users for 72% of demand.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Market Segmentation Analysis

By Product

The Coffee Beans Market by product is dominated by Arabica, which accounts for 61% of the global share in 2024, driven by its smoother flavor profile, higher consumer preference in premium coffee segments, and strong adoption across specialty cafés. Robusta holds a substantial share supported by its higher caffeine content and demand from instant coffee manufacturers, while the “Others” category includes emerging specialty and blended varieties gaining traction among craft roasters. Growth across all product types is influenced by rising café culture, expanding specialty coffee consumption, and increasing focus on sustainable and ethically sourced beans.

- For instance, Blue Bottle Coffee, a prominent specialty roaster, offers a diverse product portfolio primarily centered on high-quality Arabica single-origins and blends. While their focus remains largely on Arabica, the brand has demonstrated diversification within the specialty channels by occasionally releasing unique, limited-edition specialty Robusta offerings, such as their ‘Brazil Matas de Rondônia Robusta Anaerobic’ in March 2024, reflecting how even high-end brands are exploring niche markets and evolving consumer preferences for novel coffee experiences.”

By Distribution Channel

In the distribution channel segment, the offline channel commands the largest share at 68% in 2024, supported by the dominance of supermarkets, hypermarkets, and specialty coffee stores that allow consumers to physically assess bean quality, aroma, and roast levels. The online segment is rapidly growing due to rising e-commerce adoption, subscription-based coffee delivery services, and greater availability of premium and artisanal coffee brands online. Market growth is reinforced by improved digital retail infrastructure, expanding direct-to-consumer models, and increasing convenience-driven purchasing behavior among urban consumers.

- For instance, Starbucks continues to strengthen its physical store presence, with over 40,000 locations globally (specifically 40,990 as of 2025 data), where customers can experience their coffee in person.

By End User

The food and beverages segment leads the Coffee Beans Market, holding 72% share in 2024, driven by the growing consumption of brewed coffee, ready-to-drink coffee beverages, and increasing café penetration worldwide. Personal care is emerging as a niche segment, leveraging the antioxidant and exfoliating properties of coffee extracts for skincare applications. The pharmaceutical segment, though smaller, benefits from research exploring coffee’s potential therapeutic benefits, including cognitive enhancement and metabolic support. Overall demand is supported by rising global coffee culture, clean-label product trends, and expanding applications across wellness-oriented industries.

Key Growth Drivers

Rising Global Coffee Consumption and Expanding Café Culture

The Coffee Beans Market experiences strong growth driven by the rising global consumption of coffee, which continues to expand across both mature and emerging markets. Urbanization, changing lifestyles, and the increasing penetration of café chains such as Starbucks, Costa Coffee, and Tim Hortons significantly influence consumption patterns, particularly among younger demographics. The emergence of specialty cafés and micro-roasteries further fuels demand for high-quality Arabica beans, while rising interest in premium, single-origin, and sustainably sourced coffee supports market expansion. Rapid adoption of Western café culture in Asia-Pacific, especially in China, India, and South Korea, is accelerating consumption volumes. Growth is also propelled by rising demand for ready-to-drink coffee beverages, at-home brewing machines, and subscription-based coffee delivery models. Collectively, these factors create robust and sustained demand for high-quality coffee beans, enhancing market revenues across both retail and commercial channels.

- For instance, Luckin Coffee in China achieved over 22,000 stores in 2024, reaching a total of 22,340 locations by year-end, tapping into the growing appetite for affordable, high-quality coffee among urban dwellers.

Increasing Demand for Specialty, Organic, and Sustainable Coffee

The rapid shift toward premiumization in the Coffee Beans Market drives significant growth, with consumers increasingly seeking specialty, organic, and sustainably produced coffee. Younger consumers, particularly millennials and Gen Z, are more willing to pay premium prices for beans that offer unique flavor profiles, traceability, and ethical sourcing. Certifications such as Fair Trade, Rainforest Alliance, and USDA Organic have gained importance, encouraging producers to adopt sustainable farming practices and transparent supply chains. The growth of artisanal roasting businesses and direct-to-farm sourcing models further strengthens demand for high-quality beans. Additionally, rising environmental awareness pushes brands to invest in regenerative agriculture, eco-friendly packaging, and carbon-neutral production practices. This shift toward conscious consumption not only supports long-term sustainability but also opens opportunities for new product lines and specialty blends, reinforcing market differentiation and value creation.

- For instance, Nestlé launched a new line of premium, certified organic coffee beans under its Nespresso brand, catering to the growing demand for high-quality, ethically sourced products.

Expansion of E-Commerce and Direct-to-Consumer Coffee Models

The proliferation of e-commerce platforms and direct-to-consumer (D2C) models strongly drives the Coffee Beans Market by broadening consumer access to global varieties. Online retail enables seamless ordering, subscription services, customizable blends, and doorstep delivery, enhancing convenience and frequency of purchase. Small roasters and specialty brands leverage digital platforms to reach wider audiences without high distribution costs, while major players utilize omnichannel strategies to strengthen brand presence. The pandemic accelerated online coffee purchases, and this behavior has persisted due to improved user experiences, diverse payment options, and enhanced logistics. Personalization tools, such as taste-profile quizzes and curated monthly bean subscriptions, further drive customer loyalty. In parallel, social media marketing, influencer collaborations, and digital storytelling elevate brand visibility. As consumers increasingly prioritize convenience and product diversity, the e-commerce and D2C ecosystem continues to drive robust, long-term market expansion.

Key Trends & Opportunities

Growth of Ready-to-Drink Beverages and Home Brewing Innovations

A major trend in the Coffee Beans Market is the rising adoption of ready-to-drink (RTD) coffee beverages and advanced home brewing equipment, creating new opportunities for bean suppliers and brands. RTD coffee appeals to consumers seeking convenience, energy, and premium flavor patterns without the need for preparation, driving demand for high-quality Arabica and specialty blends used in bottled or canned formulations. At the same time, the surge in home brewing—supported by devices such as espresso machines, pour-over kits, cold-brew systems, and smart coffee makers enhances consumer engagement with bean selection. This fuels demand for fresh, whole beans over instant varieties. Manufacturers benefit from offering curated brewing guides, bundle packs, and subscription models catering to home baristas. As lifestyle shifts increasingly favor personalization and at-home experiences, this trend presents attractive revenue opportunities for both established brands and emerging artisanal roasters.

- For instance, in 2024, the broader ready-to-drink (RTD) coffee market saw significant growth, driven by increasing consumer demand for convenience and premium options like cold-brew and nitro coffee.

Technological Advancements in Farming, Processing, and Traceability

Technological innovation across the coffee supply chain is creating transformative opportunities in the Coffee Beans Market. Precision agriculture tools—such as satellite monitoring, soil sensors, and climate analytics—help farmers optimize yields and improve bean quality despite climate-related challenges. Advanced processing methods, including honey processing, carbonic maceration, and controlled fermentation, enable producers to diversify flavor profiles and appeal to specialty buyers. Blockchain-based traceability systems are also gaining traction, allowing transparent tracking from farm to cup. This enhances consumer trust and supports premium pricing for ethically sourced beans. Digital platforms facilitate direct trade between farmers and roasters, reducing intermediaries and improving profitability for growers. As demand rises for transparency, sustainability, and quality consistency, technology-driven innovations provide significant opportunities for differentiation and value creation throughout the global coffee ecosystem.

- For instance, CropX has established a precision agriculture partnership with FarmAgro (a leader in commercializing agroforestry equipment in Costa Rica) in Central America to deploy its farm management platform, which includes soil moisture sensors and data analytics, across various crops, including coffee, bananas, and sugarcane.

Key Challenges

Climate Change and Its Impact on Coffee Production

One of the most critical challenges facing the Coffee Beans Market is the severe impact of climate change on crop yields, quality, and long-term sustainability. Rising temperatures, unpredictable rainfall patterns, and increased incidence of pests and diseases, such as coffee leaf rust and berry borer, threaten major coffee-producing regions. Arabica, which is more climate-sensitive, faces greater risk of reduced yields and compromised flavor quality. Many traditional farming regions may become unsuitable for coffee cultivation by 2050, increasing pressure on supply chains and raising production costs. Smallholder farmers—who contribute a majority of global output often lack resources to adopt climate-resilient farming practices. These disruptions create supply volatility, price fluctuations, and potential shortages of premium beans. Addressing this challenge requires significant investment in sustainable farming, genetic research, resistant coffee varieties, and climate-smart agricultural practices.

Supply Chain Fragmentation and Price Volatility

The Coffee Beans Market faces persistent challenges from supply chain fragmentation, dependency on smallholder farmers, and global price volatility. Coffee production involves numerous intermediaries from growers to exporters, traders, roasters, and retailers—leading to inefficiencies, inconsistent quality, and delayed market responsiveness. The reliance on commodity exchanges, particularly for Robusta and commercial Arabica, exposes the market to sharp price fluctuations driven by weather patterns, currency shifts, and global demand cycles. Small farmers often struggle with unstable income, limited access to finance, and insufficient infrastructure for storage, irrigation, and transport. Political instability in key producing regions further increases supply risks. These factors collectively create uncertainties for manufacturers and retailers, impacting profit margins and long-term planning. Strengthening supply chains with digital integration, fair-trade models, and improved logistics is essential to overcoming these structural challenges.

Regional Analysis

North America

North America holds 24% of the Coffee Beans Market in 2024, driven by strong consumption of premium and specialty coffee, rising café culture, and increasing adoption of at-home brewing machines. The U.S. leads the region due to high demand for single-origin Arabica, sustainable sourcing, and ready-to-drink coffee beverages. Growth is further supported by expanding artisanal roasters, subscription models, and rising interest in ethically certified products. Canada contributes significantly through strong café chains and expanding cold-brew offerings. The region benefits from high consumer purchasing power and advanced retail distribution channels.

Europe

Europe accounts for 31% of the global Coffee Beans Market in 2024, making it the largest regional consumer. The region’s dominance is driven by long-established coffee traditions, strong demand for specialty and organic beans, and the presence of major coffee brands and roasteries. Countries such as Germany, Italy, France, and the Netherlands lead consumption, supported by high café density and growing preference for sustainably sourced coffee. The popularity of espresso-based beverages and premium Arabica varieties further drives demand. Europe’s stringent sustainability standards and expanding fair-trade certified imports continue to elevate market growth.

Asia-Pacific

Asia-Pacific captures 28% of the Coffee Beans Market in 2024, emerging as the fastest-growing region due to rising café culture, increasing urbanization, and growing disposable incomes. China, Japan, South Korea, and India drive consumption trends, supported by a strong shift from traditional tea-drinking habits toward premium coffee beverages. The region also benefits from expanding specialty cafés, higher adoption of home brewing, and growing interest in single-origin and artisanal roasts. Major coffee-producing nations such as Vietnam and Indonesia strengthen supply availability. The region’s youthful demographic and rapid retail modernization further accelerate market expansion.

Latin America

Latin America holds 10% of the Coffee Beans Market in 2024, supported by its dual role as both a major coffee producer and a rising consumer base. Brazil and Colombia lead regional output and domestic consumption, driven by strong café culture and increasingly diverse specialty coffee offerings. Growth is supported by expanding urban demand, rising interest in premium Arabica beans, and growing participation in international specialty coffee competitions. Despite its producer-centric landscape, the region’s retail coffee market is expanding due to improved distribution channels and higher adoption of premium brewing methods among younger consumers.

Middle East & Africa

The Middle East & Africa region accounts for 7% of the Coffee Beans Market in 2024, driven by traditional coffee consumption patterns and the rising popularity of specialty cafés. Countries such as Saudi Arabia, the UAE, Ethiopia, and South Africa contribute significantly, supported by strong cultural coffee traditions and increasing tourism-driven demand. Ethiopia’s role as a major Arabica producer enhances regional supply strength. Growth is further supported by rising retail expansion, greater interest in premium roasts, and improved market access through modern trade channels. Increasing youth-driven café engagement continues to enhance consumption across key markets.

Market Segmentations

By Product

By Distribution Channel

By End User

- Personal Care

- Food and Beverages

- Pharmaceutical

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Coffee Beans Market is characterized by a mix of global coffee giants, specialty roasters, and region-focused producers competing through product quality, sourcing transparency, and brand differentiation. Leading players such as Luigi Lavazza S.p.A., illycaffè S.p.A., Peet’s Coffee, Caribou Coffee, La Colombe Torrefaction, Kicking Horse Coffee, Coffee Bean International, Hawaii Coffee Company, Death Wish Coffee, and The Bean Coffee Company focus on premium Arabica offerings, organic-certified beans, and single-origin varieties to strengthen their market positions. Companies are increasingly investing in sustainable sourcing, direct trade partnerships with farmers, and eco-friendly packaging to appeal to environmentally conscious consumers. Specialty roasters differentiate through unique roasting techniques, limited-edition blends, and artisanal craftsmanship, while major brands leverage large-scale distribution networks and e-commerce platforms to broaden global reach. Innovation in cold-brew products, subscription services, and ready-to-use formats further intensifies competition, prompting players to continually enhance product quality and customer engagement.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Caribou Coffee

- The Bean Coffee Company

- Luigi Lavazza S.p.A.

- Hawaii Coffee Company

- Kicking Horse Coffee Co. Ltd.

- illycaffè S.p.A.

- Peet’s Coffee, Inc.

- Coffee Bean International, Inc.

- Death Wish Coffee

- La Colombe Torrefaction, Inc.

Recent Developments

- In August 2025, Keurig Dr Pepper agreed to acquire JDE Peet’s for approximately $18 billion, signaling a major consolidation in the coffee-beans and beverage space.

- In July 2025, Peet’s Coffee announced a partnership with Southwest Airlines to become the official in-flight coffee provider, beginning service on August 13 with a new “Off the Grid” blend from Colombian and El Salvador beans.

- In 2024, The Coffee Bean & Tea Leaf signed a master-franchise partnership with Ekaagra Ostalaritza to expand across India, targeting 250 cafés over five years.

Report Coverage

The research report offers an in-depth analysis based on Product, Distribution Channel, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Coffee Beans Market will experience steady growth driven by rising global consumption and expanding premium coffee preferences.

- Specialty and single-origin beans will gain stronger traction as consumers prioritize flavor diversity and authenticity.

- Sustainable and ethically sourced coffee will become a core purchasing criterion across developed and emerging markets.

- Climate-resilient coffee varieties and advanced farming practices will play a critical role in long-term supply stability.

- E-commerce and subscription-based coffee delivery models will continue to expand rapidly worldwide.

- Ready-to-drink and cold-brew innovations will intensify demand for high-quality Arabica and specialty blends.

- Digital traceability tools, including blockchain, will strengthen transparency from farm to consumer.

- Coffee-producing regions will invest more in value-added processing to enhance export competitiveness.

- Artisanal roasters and independent cafés will drive market differentiation through unique blends and limited-edition offerings.

- Major brands will increase investments in sustainability, carbon-neutral initiatives, and eco-friendly packaging.