Market Overview

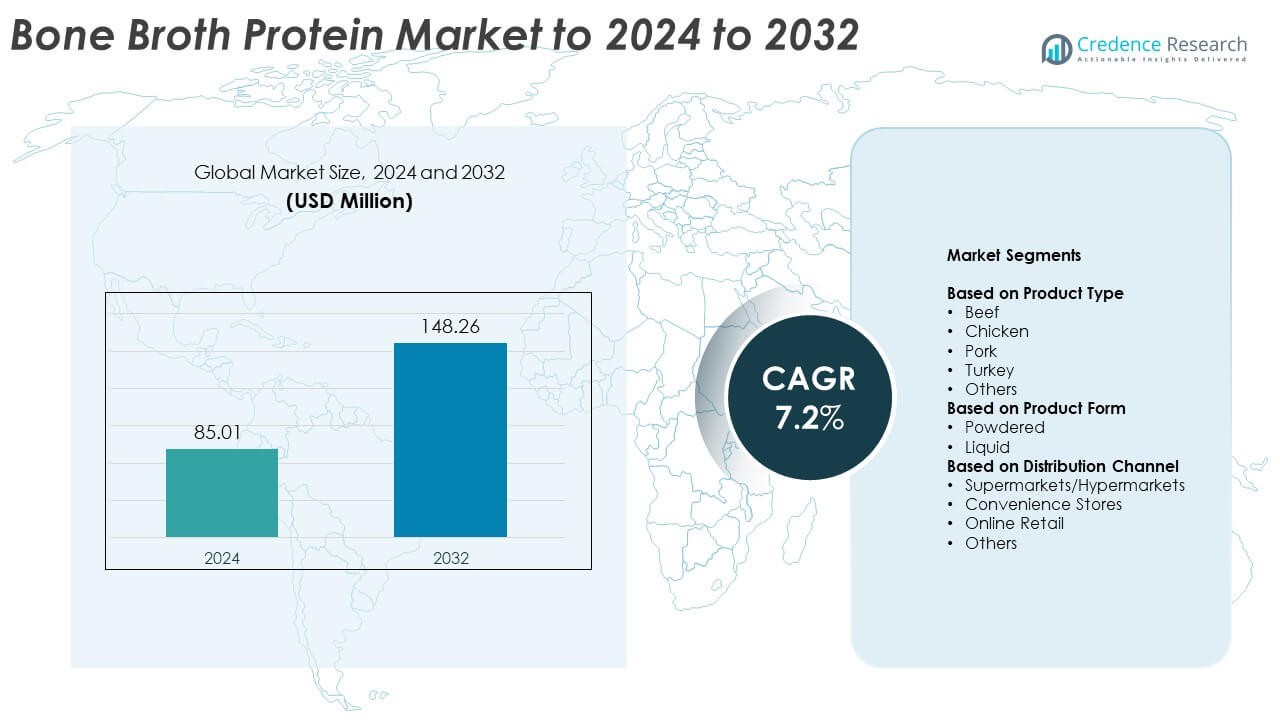

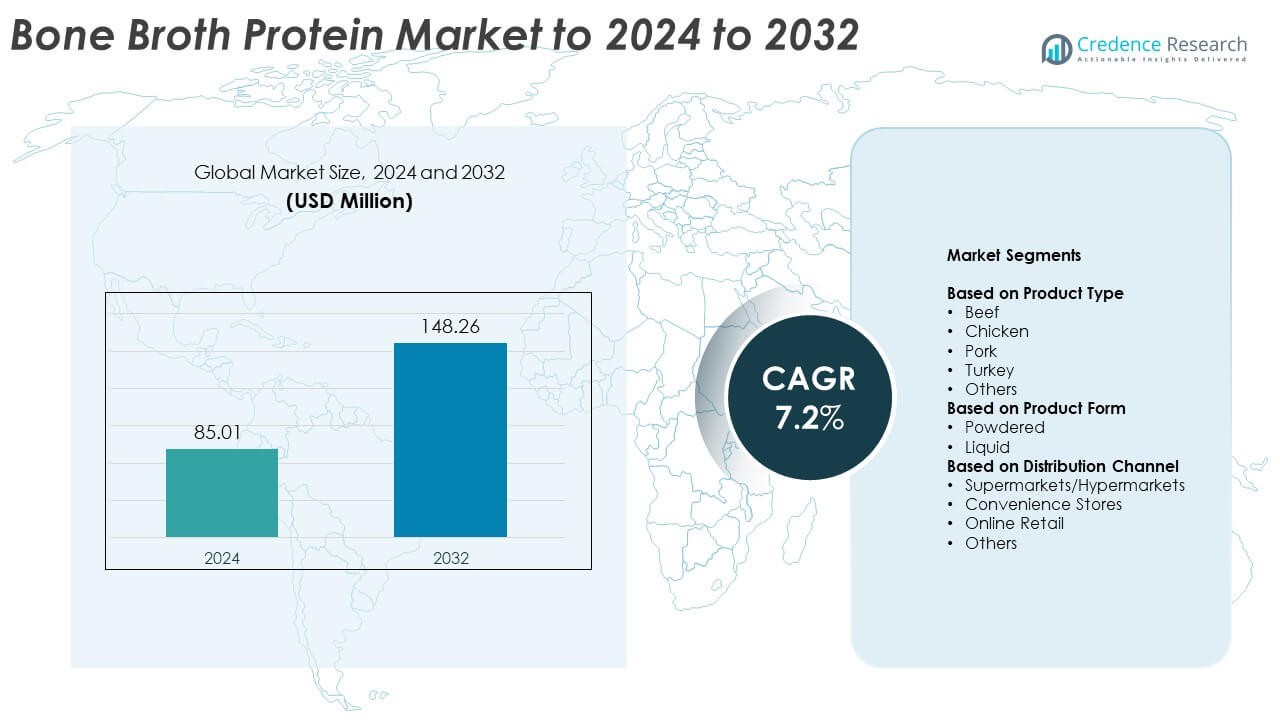

Bone Broth Protein Market size was valued at USD 85.01 million in 2024 and is anticipated to reach USD 148.26 million by 2032, at a CAGR of 7.2% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Bone Broth Protein Market Size 2024 |

USD 85.01 Million |

| Bone Broth Protein Market, CAGR |

7.2% |

| Bone Broth Protein Market Size 2032 |

USD 148.26 Million |

The bone broth protein market features several prominent players, including LonoLife, Bonafide Provisions, Pacific Foods, Erie Bone Broth, Ancient Brands LLC, Essentia Protein Solutions, Campbell Soup Company, FOND Bone Broth LLC, Del Monte Foods Inc., and Nutriment Raw. These companies compete through clean-label innovations, collagen-rich formulations, and strong retail and online distribution strategies. North America leads the global market with about 38% share, driven by high adoption of functional nutrition and strong consumer interest in digestive and joint health. Europe follows with roughly 27% share, supported by growing demand for natural protein supplements and premium wellness products.

Market Insights

- The bone broth protein market reached USD 85.01 million in 2024 and is projected to hit USD 148.26 million by 2032, growing at a CAGR of 7.2%.

- Market growth is driven by strong demand for collagen-rich nutrition and rising adoption of gut-health and clean-label protein products across both powdered and liquid formats.

- Key trends include wider use of multi-functional blends, growing e-commerce subscriptions, and increasing innovation in flavored, ready-to-mix formulations that boost user acceptance.

- Competition intensifies as major brands expand product purity, enhance extraction technology, and diversify offerings, while smaller players gain traction through niche formulations and digital marketing.

- North America leads with about 38% share, followed by Europe at around 27% and Asia Pacific at nearly 22%, while the powdered form dominates the segment with about 78% share due to higher convenience and longer shelf life.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product Type

Beef bone broth protein dominated the product type segment in 2024 with about 46% share, driven by strong demand for high-collagen formulations and broader acceptance among fitness-focused consumers. Many brands promoted beef-based protein due to its richer amino acid profile and cleaner taste when compared with other sources. Chicken variants grew steadily as health-conscious buyers preferred lighter formulations suitable for digestive wellness. Pork and turkey products held smaller shares because of limited global acceptance, while the “others” category expanded slowly through niche launches in multi-species blends.

- For instance, GELITA’s total annual capacity for collagen peptides and gelatin is generally reported to be approximately 80,000 metric tons globally, according to older industry reports.

By Product Form

Powdered bone broth protein led the product form segment in 2024 with nearly 78% share, supported by longer shelf life, easier storage, and high convenience for daily supplementation. Fitness users and wellness consumers favored powdered forms because they mix well with shakes, smoothies, and meal replacements. Liquid formats saw moderate growth due to rising interest in ready-to-drink functional beverages. However, liquid offerings remained costlier to produce and required cold-chain logistics, which restricted wider adoption across developing regions.

- For instance, Vital Proteins Collagen Gummies provide 2.5 g Verisol collagen per serving, in a 120-count, 30-day pack.

By Distribution Channel

Supermarkets and hypermarkets dominated the distribution channel segment in 2024 with close to 41% share, supported by strong in-store visibility, structured promotional displays, and growing shelf space for functional nutrition. Many buyers preferred retail outlets because they could compare brands, ingredients, and certifications before purchase. Online retail expanded rapidly as digital platforms enabled easy subscription purchases, broader product availability, and detailed product reviews. Convenience stores and other channels played a smaller role due to limited assortment and lower demand for specialized nutritional products.

Key Growth Drivers

Rising focus on gut health and digestive wellness

Consumers increasingly choose bone broth protein because it supports digestive balance and gut lining repair. Collagen, gelatin, and amino acids help reduce inflammation and strengthen nutrient absorption, which increases product adoption among fitness and wellness users. The shift toward clean-label nutrition also boosts demand for natural and minimally processed proteins. This trend strengthens the market as health-driven buyers seek functional ingredients that align with long-term preventive wellness goals.

- For instance, Amicogen’s Aminavico joint-venture plant in Vietnam was designed to have a first-phase capacity of approximately 780 to 800 metric tons of combined collagen and gelatin production annually.

Growing adoption in sports nutrition and fitness routines

Athletes and gym users prefer bone broth protein due to its strong amino acid composition, which supports muscle recovery and joint mobility. The product also appeals to individuals with dairy intolerance who seek alternatives to whey protein. Rising fitness memberships and interest in high-protein diets increase demand across both online and offline channels. Expanding promotional efforts by nutrition brands further enhance market growth and awareness among performance-driven consumers.

- For instance, Ancient Nutrition’s Bone Broth Protein – Pure provides 20 g of protein and 80 calories per 22.3 g scoop, with about 20 servings in a 445 g container, as stated on its supplement facts panel for the 445 g Bone Broth Protein – Pure product.

Expansion of clean-label and paleo–keto diets

The growing preference for paleo, keto, and low-carb diets drives interest in collagen-rich protein sources. Bone broth protein fits these dietary profiles and offers flexibility in beverages, smoothies, and meal plans. Brands highlight the absence of artificial additives, allergens, and preservatives to attract health-conscious users. As consumers move toward natural and ancestral nutrition patterns, demand for bone broth protein strengthens across developed and emerging markets.

Key Trends & Opportunities

Growth of collagen-enhanced functional formulations

Companies increasingly integrate bone broth protein into multi-functional blends that target skin health, bone strength, and joint support. Rising demand for collagen-boosting solutions fuels innovation across powders, RTD beverages, and hybrid supplements. This trend expands product visibility in the broader beauty-from-within and healthy-aging categories. The opportunity remains strong as consumers seek simple, natural formulations that deliver comprehensive wellness benefits.

- For instance, The planned Nextida joint venture, which combines Darling Ingredients’ Rousselot collagen and gelatin business with Tessenderlo Group’s PB Leiner business, is projected to have a combined annual capacity of approximately 200,000 metric tons across 23 facilities located globally in South America, North America, Europe, and Asia.

Expansion of e-commerce and subscription-based sales

Online retail provides a major opportunity as digital platforms offer wider product choice, frequent discounts, and flexible delivery cycles. Subscription models strengthen customer retention and support stable monthly demand for bone broth protein. E-commerce also helps smaller brands reach global buyers without heavy retail investment. This trend continues to expand as consumers increasingly rely on digital channels for functional nutrition products.

- For instance, Thrive Market serves more than 1.5 million members and offers over 6,900 products, filterable by more than 90 diets and lifestyles, including paleo and keto.

Innovation in flavor profiles and ready-to-mix products

Brands explore new flavor options and smoother textures to improve user experience and attract first-time buyers. Innovation includes vanilla, chocolate, and spice blends designed to mask natural broth notes while maintaining nutritional value. Ready-to-mix sachets and portable formats create growth opportunities in travel-friendly and on-the-go usage. This trend enhances market reach and encourages repeat purchases from convenience-focused consumers.

Key Challenges

High production cost and supply fluctuations

Bone broth protein requires long extraction cycles and steady access to high-quality animal bones, which increases production cost. Price fluctuations in beef and poultry supply chains also affect overall manufacturing stability. These factors limit affordable offerings in price-sensitive markets. Brands must optimize sourcing and processing efficiency to maintain competitive pricing without compromising product purity.

Taste limitations and consumer acceptance barriers

Bone broth protein often carries a distinct flavor profile that may not appeal to all users, especially beginners. Many consumers prefer sweeter, neutral-tasting protein supplements, which slows broader adoption. Brands must invest in taste-masking techniques and innovative formulations to improve palatability. Addressing flavor concerns remains essential to expanding penetration in mainstream nutrition segments.

Regional Analysis

North America

North America held about 38% share of the bone broth protein market in 2024, supported by strong demand for clean-label nutrition and high adoption of digestive health supplements. Consumers across the United States and Canada preferred collagen-rich formulations that fit paleo, keto, and low-carb diets. The region benefited from a mature wellness industry, wider product availability in supermarkets, and extensive digital marketing by supplement brands. Growth remained strong as fitness enthusiasts and aging populations drove consistent usage of high-protein functional products across both powdered and ready-to-mix formats.

Europe

Europe accounted for nearly 27% share in 2024, driven by rising consumer focus on natural protein alternatives and increased preference for collagen-enhanced wellness products. Countries such as Germany, the United Kingdom, and France recorded steady growth due to expanding health-conscious populations and improved product placement across retail shelves. The market gained momentum through premium offerings marketed for joint support, skin health, and active lifestyle nutrition. Clean-label regulations and interest in sustainable sourcing supported further adoption, although high product prices limited penetration in certain cost-sensitive regions.

Asia Pacific

Asia Pacific captured about 22% share in 2024, supported by rising awareness of digestive wellness and rapid expansion of online supplement sales. Consumers in China, Japan, South Korea, and Australia increasingly adopted bone broth protein due to its benefits for skin elasticity and gut health. The region showed strong potential as e-commerce platforms boosted accessibility for both domestic and international brands. Growth also accelerated with rising fitness participation and wider exposure to Western-style nutritional products. However, taste preferences and product familiarity varied across markets, influencing overall adoption rates.

Latin America

Latin America held roughly 8% share in 2024, with gradual growth driven by increasing interest in functional proteins and improved distribution networks. Markets such as Brazil and Mexico saw rising consumer awareness of collagen-rich supplements for joint mobility and general wellness. Retail expansion and digital commerce helped enhance product visibility, though purchasing power constraints affected demand for premium imported brands. Manufacturers targeted the region with competitively priced formulations and localized marketing strategies, supporting steady but moderate adoption of bone broth protein across health-conscious consumer segments.

Middle East & Africa

Middle East and Africa accounted for around 5% share in 2024, reflecting early-stage market development and limited regional penetration. Demand grew slowly as consumers in Gulf countries explored natural protein sources aligned with wellness and fitness routines. Expansion of modern retail formats and increasing health awareness supported gradual uptake, particularly in the UAE and Saudi Arabia. However, higher product prices and limited local manufacturing restricted broader adoption. As awareness of collagen-based nutrition increases and online retail expands, the region is expected to show steady long-term potential.

Market Segmentations:

By Product Type

- Beef

- Chicken

- Pork

- Turkey

- Others

By Product Form

By Distribution Channel

- Supermarkets/Hypermarkets

- Convenience Stores

- Online Retail

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the bone broth protein market is shaped by key players such as LonoLife, Bonafide Provisions, Pacific Foods, Erie Bone Broth, Ancient Brands LLC, Essentia Protein Solutions, Campbell Soup Company, FOND Bone Broth LLC, Del Monte Foods Inc., and Nutriment Raw. Companies focus on expanding clean-label portfolios and improving collagen-rich formulations to meet rising demand for digestive wellness and fitness nutrition. Brands invest in advanced dehydration and extraction technologies to enhance purity, amino acid density, and product consistency. Many players strengthen e-commerce presence through subscription models and targeted digital campaigns that increase customer retention. Innovation in flavor profiles, ready-to-mix formats, and multi-functional blends supports stronger differentiation in a crowded marketplace. Manufacturers also work on sustainable sourcing and ethical processing to align with consumer expectations for transparency and quality. Growing competition encourages faster product development cycles and wider distribution through retail chains and online channels, reinforcing overall market growth.

Key Player Analysis

Recent Developments

- In 2025, Pacific Foods introduced a new Organic Chicken Bone Broth infused with ginger, turmeric, and black pepper.

- In 2023, Nutriment Raw, a pet food company, launched a new line of nutritious chicken, beef, and lamb bone broths for pets.

- In 2022, Ancient Nutrition introduced three new savory, soup-inspired flavors—Chicken Soup, Butternut Squash, and Tomato Basil—to its Bone Broth Protein line of products.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Product Type, Product Form, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will grow as more consumers seek gut-friendly and collagen-rich protein options.

- Demand will rise through wider adoption of paleo, keto, and low-carb diets.

- Brands will expand flavored and ready-to-mix formulations to improve taste acceptance.

- Online retail channels will strengthen global market reach and repeat purchases.

- Functional blends combining bone broth protein with vitamins and botanicals will gain traction.

- Fitness and sports nutrition users will continue driving consistent product adoption.

- Clean-label claims will shape product development and influence buying behavior.

- Manufacturers will invest in sustainable sourcing and ethical processing methods.

- Price competition will increase as more regional brands enter the market.

- Emerging regions will show faster growth with rising health awareness and digital access.