Market Overview

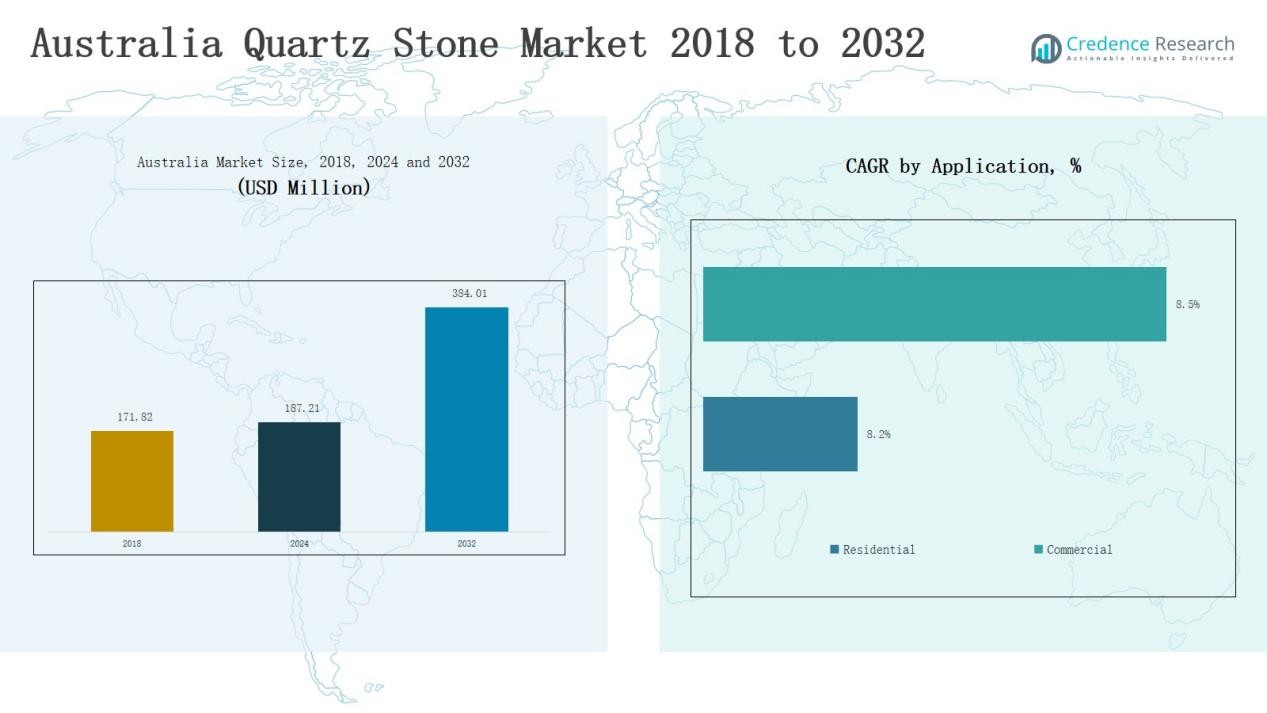

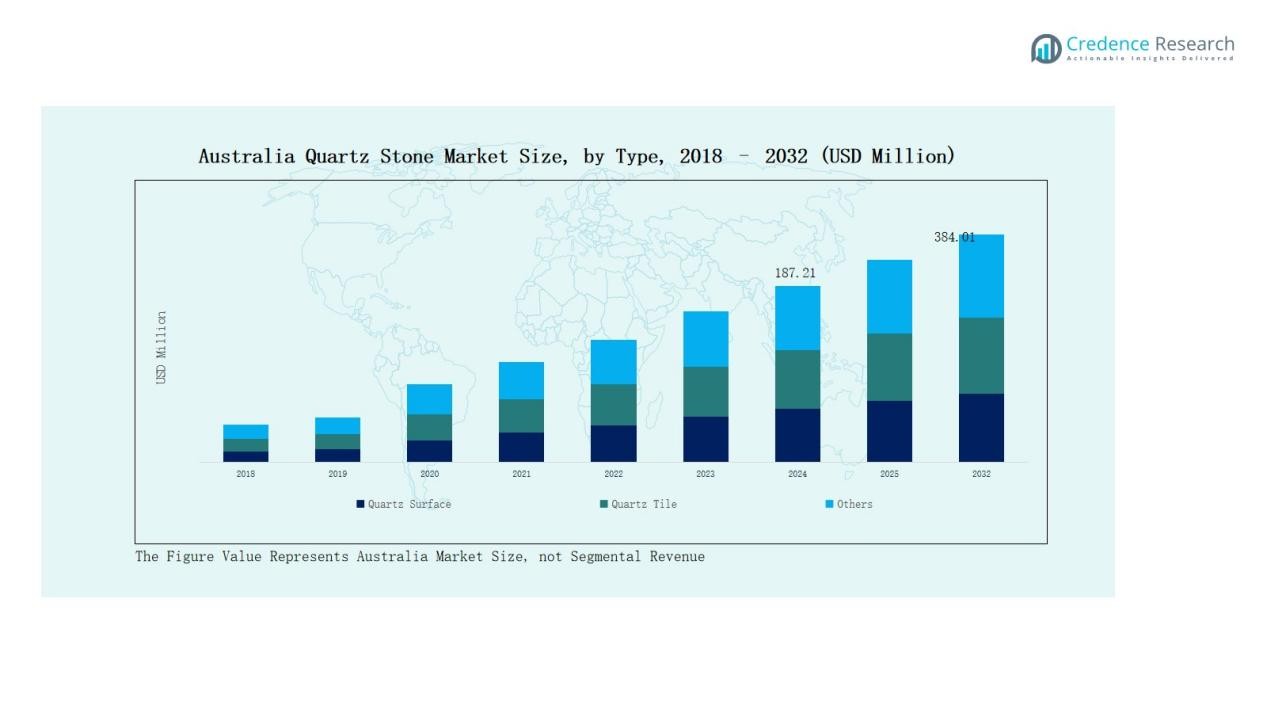

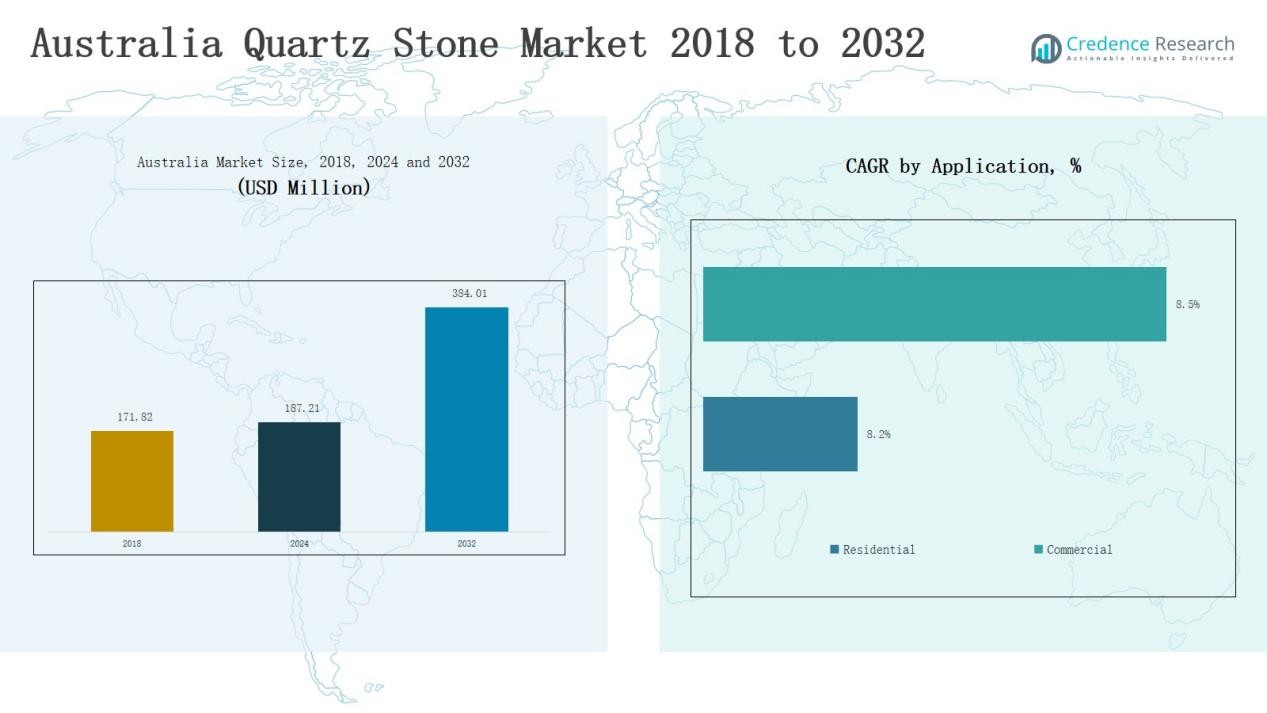

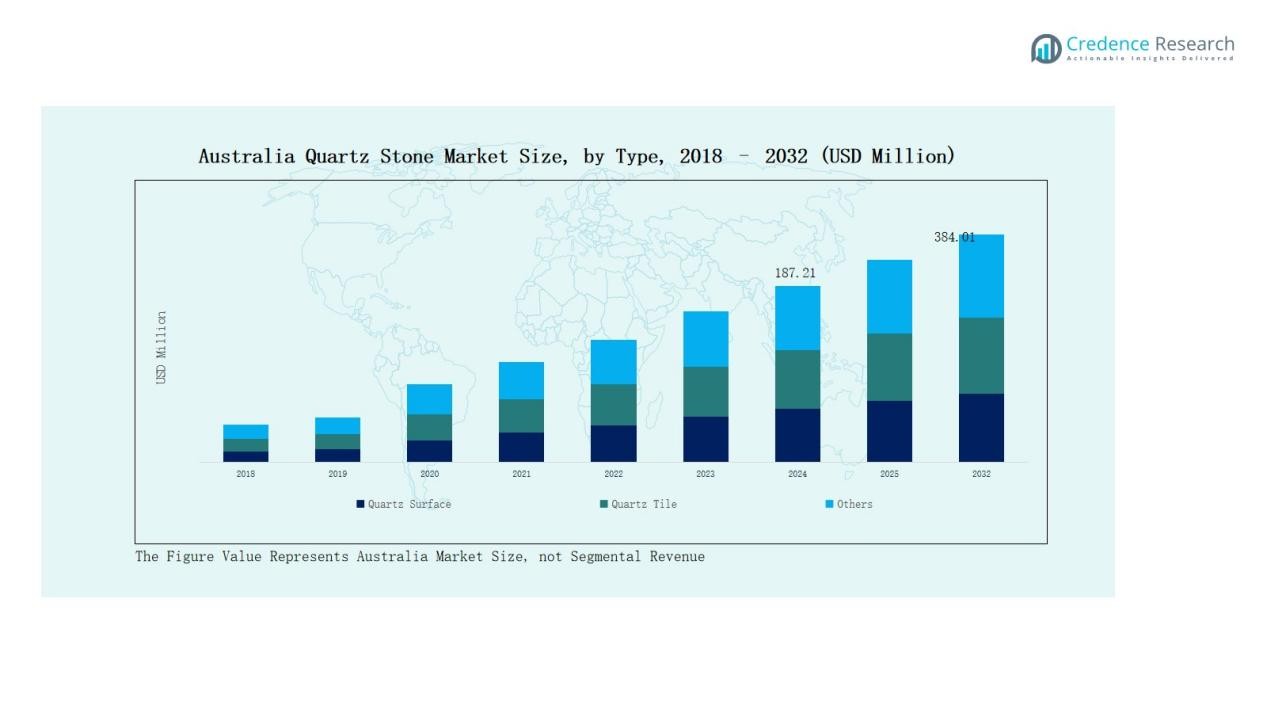

The Australia Quartz Stone Market size was valued at USD 225.43 million in 2018, increased to USD 287.21 million in 2024, and is anticipated to reach USD 384.01 million by 2032, growing at a CAGR of 9.40% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Australia Quartz Stone Market Size 2024 |

USD 287.21 Million |

| Australia Quartz Stone Market, CAGR |

9.40% |

| Australia Quartz Stone Market Size 2032 |

USD 384.01 Million |

The Australia Quartz Stone Market is driven by key players such as Caesarstone, Cosentino (Silestone), LG Hausys, Hanwha L&C, Lapitec Australia, Sia Stones, and Shin-Etsu Quartz Products Co., Ltd. (Shin-Etsu Chemical). These companies focus on advanced surface technologies, durable engineered quartz materials, and sustainable production methods to meet the rising demand from residential and commercial sectors. Product innovation, design customization, and eco-friendly material use are central to their competitive strategies. New South Wales emerged as the leading region in 2024, holding a 34% share, driven by strong construction activity, housing projects, and adoption of premium quartz surfaces in modern architecture.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Australia Quartz Stone Market was valued at USD 225.43 million in 2018, reached USD 287.21 million in 2024, and is projected to hit USD 384.01 million by 2032, growing at a CAGR of 9.40%.

- Leading companies such as Caesarstone, Cosentino (Silestone), LG Hausys, Hanwha L&C, Lapitec Australia, Sia Stones, and Shin-Etsu Quartz Products Co., Ltd. drive market growth through innovation, sustainability, and advanced surface technologies.

- The Quartz Surface segment dominated in 2024 with a 59% share, supported by strong demand in kitchen countertops, flooring, and wall cladding due to high durability and visual appeal.

- The Residential segment led with a 63% share in 2024, driven by rising home renovations, urban housing expansion, and consumer demand for elegant, low-maintenance interiors.

- New South Wales emerged as the top region in 2024 with a 34% share, backed by rapid construction, sustainable housing projects, and widespread use of premium engineered quartz surfaces.

Market Segment Insights

By Type:

The Quartz Surface segment dominated the Australia Quartz Stone Market in 2024, accounting for 59% of the total share. Its strong demand stems from use in kitchen countertops, flooring, and wall cladding due to superior durability and aesthetic versatility. Builders and homeowners prefer quartz surfaces for their non-porous nature, scratch resistance, and minimal maintenance. Increasing adoption in premium interior projects and renovation activities continues to reinforce its leadership across residential and commercial construction sectors.

- For instance, Caesarstone unveiled its Porcelain Collection in Australia, offering quartz-inspired slabs engineered for both indoor and outdoor use, catering to the country’s growing premium renovation market.

By Application:

The Residential segment held the largest share of 63% in the Australia Quartz Stone Market in 2024. The segment’s dominance is driven by rising home renovation projects, increasing disposable incomes, and growing consumer preference for elegant yet durable interior materials. Engineered quartz is widely used in kitchen countertops, vanities, and backsplashes. Expanding urban housing developments and lifestyle upgrades further support demand, while customization options in color and texture attract design-focused homeowners nationwide.

- For instance, Caesarstone Ltd. introduced its Pebble Collection in early 2024, offering five new neutral-toned surfaces tailored for modern kitchen designs.

By Material Composition:

The Engineered Quartz segment led the Australia Quartz Stone Market with a 68% share in 2024. Its dominance arises from high strength, uniform texture, and sustainability compared to natural quartz stone. Manufacturers increasingly use advanced resin-bonding and surface technologies to improve aesthetics and performance. Eco-friendly engineered quartz options with recycled materials are gaining popularity, aligning with Australia’s green building initiatives and consumer demand for sustainable interior solutions in residential and commercial spaces.

Key Growth Drivers

Rising Demand from Residential Construction

The surge in residential development across Australia drives demand for quartz stone in countertops, flooring, and wall cladding. Homeowners prefer quartz for its durability, stain resistance, and visual appeal. Growing renovation activities and rising disposable incomes encourage premium surface adoption. Government housing incentives and urban expansion projects further strengthen demand, making quartz stone a preferred choice for modern interior design and sustainable housing developments.

- For instance, in 2024, WK Stone (the company behind the Quantum Quartz brand) launched a new line of silica-free recycled surface materials called Quantum Zero. This was a direct response to Australia’s ban on engineered stone, and it reflects the industry’s shift toward high-end, durable, and safe finishes in urban residential developments.

Expanding Commercial Infrastructure Projects

Rapid growth in commercial construction, including offices, hotels, and retail spaces, fuels market expansion. Quartz stone is favored for high-traffic areas due to its strength, uniform texture, and low maintenance. Developers are increasingly choosing engineered quartz for its aesthetic consistency and cost efficiency compared to natural materials. Ongoing investments in hospitality and retail infrastructure amplify consumption, with Australia’s focus on sustainable design boosting material replacement in older commercial facilities.

- For instance, LuxQuartz Vietnam, where engineered quartz’s water resistance and long lifespan make it ideal for sustained use in offices and retail environments, reducing repair and replacement costs.

Technological Advancements in Manufacturing

Innovations in quartz stone fabrication, such as automated polishing and resin-binding technologies, enhance product quality and production efficiency. Manufacturers integrate digital design and precision cutting systems to create diverse textures and finishes. These advancements improve customization and reduce waste. Local producers benefit from advanced machinery imports and process automation, enabling them to meet rising domestic demand and export opportunities. Enhanced R&D in eco-friendly resins and recycled aggregates also drives sustainable market growth.

Key Trends & Opportunities

Shift Toward Eco-Friendly Quartz Products

Sustainability is shaping consumer preferences across Australia’s construction sector. Manufacturers are introducing eco-friendly quartz stones made from recycled glass and low-emission resins. These materials reduce environmental impact while maintaining strength and design flexibility. Growing green building certifications such as Green Star are encouraging builders to adopt sustainable surfaces. This shift presents a key opportunity for brands investing in circular manufacturing and renewable material sourcing to capture environmentally conscious buyers.

- For instance, Eco Benchtops has been using recycled crushed glass in their products since 2017, providing durable, safe, and stylish benchtops that reduce reliance on virgin materials.

Growing Popularity of Custom and Premium Designs

Australian consumers increasingly favor customized quartz designs that align with modern architectural aesthetics. High-end patterns mimicking marble and granite textures are gaining traction in luxury residential and hospitality interiors. Manufacturers offer digital printing and color-matching technologies to meet design-specific needs. Rising popularity of open kitchens, smart homes, and boutique commercial interiors enhances demand for visually appealing, durable, and tailored quartz surfaces across premium construction projects.

- For instance, Diresco, introduced its Sublime Collection in January 2025, integrating advanced UV-stable technology for mineral composite surfaces suitable for both indoor and outdoor luxury areas.

Key Challenges

High Production and Installation Costs

Quartz stone manufacturing involves advanced machinery, imported raw materials, and energy-intensive processes, leading to elevated costs. Installation expenses, including cutting and polishing, further raise project budgets. Smaller contractors often find quartz less affordable compared to ceramic or laminate alternatives. This cost sensitivity limits large-scale adoption in mid-range residential and small commercial projects, compelling manufacturers to innovate cost-efficient production methods and optimize supply chains to maintain competitiveness.

Competition from Substitute Materials

The availability of alternative surfacing materials such as granite, marble, and solid surfaces challenges quartz stone adoption. These substitutes offer similar aesthetics at lower costs in some cases. Porcelain and sintered stones also compete with improved heat and scratch resistance. Brand loyalty and local availability influence buyer choices, reducing quartz’s market share in specific regions. Producers must emphasize performance advantages, durability, and sustainability to differentiate their offerings effectively.

Environmental and Regulatory Constraints

The Australian market faces strict environmental standards governing emissions, waste management, and material sourcing. Quartz manufacturing generates silica dust and requires controlled disposal practices, raising compliance costs. Regulations promoting eco-friendly construction and carbon reduction demand investment in cleaner technologies. Smaller firms struggle to meet these evolving requirements, impacting profitability. Companies investing in sustainable production and renewable inputs are better positioned to align with future regulatory frameworks and market expectations.

Regional Analysis

New South Wales

New South Wales dominated the Australia Quartz Stone Market in 2024, holding a 34% share. It benefits from extensive residential construction, strong renovation activity, and the presence of major architectural firms. Sydney’s expanding housing projects and luxury apartment developments drive high consumption of engineered quartz surfaces. Builders prefer quartz for its durability, stain resistance, and aesthetic appeal. The regional government’s focus on sustainable building materials supports eco-friendly quartz adoption. Rising investments in urban infrastructure continue to strengthen regional demand.

Victoria

Victoria accounted for 28% of the market share in 2024. Rapid population growth and consistent urbanization across Melbourne have increased demand for modern interiors. The region’s thriving home renovation and commercial real estate sectors support the steady use of quartz in countertops and flooring applications. Consumers favor engineered quartz for its low maintenance and wide design options. Expanding manufacturing and distribution networks improve product accessibility. Government incentives promoting energy-efficient buildings also boost the adoption of sustainable quartz materials.

Queensland

Queensland captured a 19% share of the market in 2024. It is experiencing steady growth driven by commercial projects, coastal housing developments, and tourism-related infrastructure. Brisbane and the Gold Coast are key consumption hubs, where hotels and retail spaces integrate premium quartz surfaces for aesthetics and durability. The region’s growing focus on eco-conscious design increases the use of recycled quartz materials. Expanding residential communities and luxury resort developments further support market expansion across the state.

Western Australia

Western Australia represented 12% of the market share in 2024. It shows strong adoption in high-end residential and corporate interior projects. Perth’s construction activities and luxury housing developments are key contributors to demand. Rising investments in real estate and retail spaces create consistent opportunities for quartz manufacturers and suppliers. Consumers prefer engineered quartz for its resistance to heat and scratches, making it suitable for premium kitchen installations. Local distributors expand their portfolios to meet growing architectural needs.

South Australia and Others

South Australia and other regions collectively held a 7% share of the market in 2024. The market is driven by gradual growth in residential remodeling and small-scale commercial projects. Adoption of quartz materials is expanding with the spread of modern housing designs. Regional suppliers are focusing on cost-effective product ranges to cater to local builders. Increasing consumer awareness of sustainable and long-lasting materials supports steady growth. The state’s focus on affordable housing further encourages quartz stone utilization.

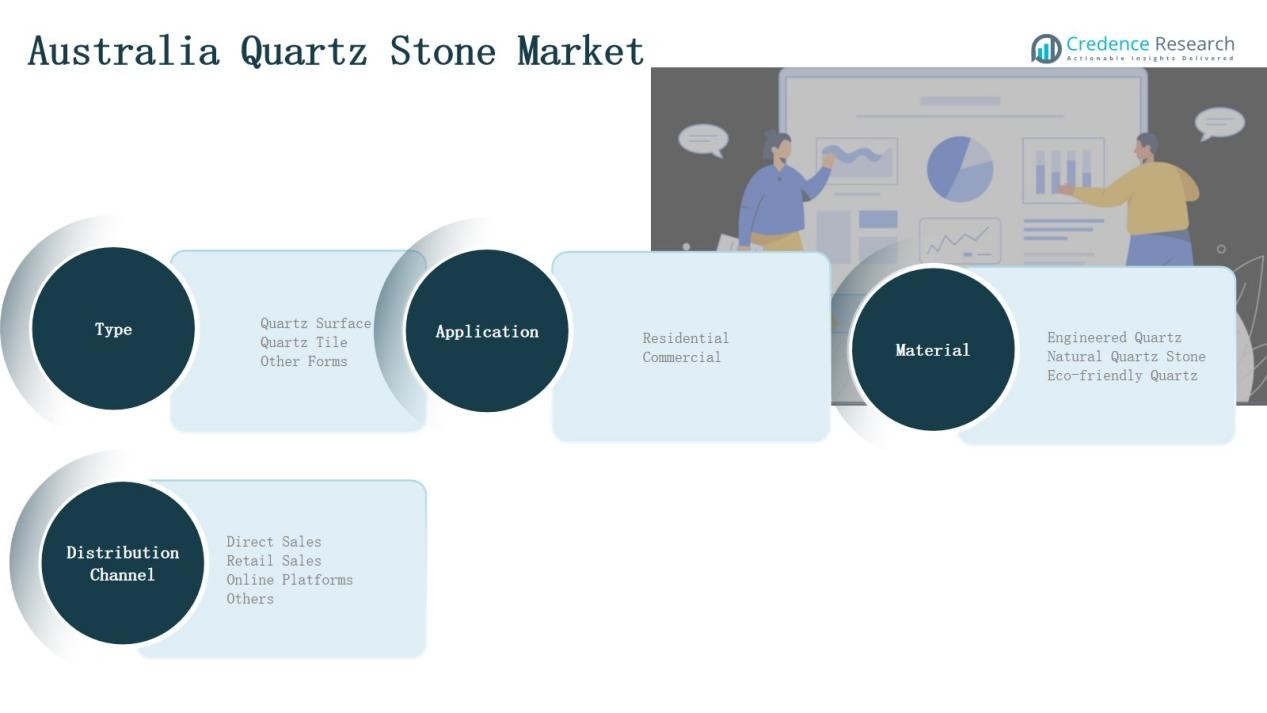

Market Segmentations:

By Type

- Quartz Surface

- Quartz Tile

- Other Forms

By Application

By Material Composition

- Engineered Quartz

- Natural Quartz Stone

- Eco-friendly Quartz

By Distribution Channel

- Direct Sales

- Retail Sales

- Online Platforms

- Others

By Region

- New Southwales

- Victoria

- Queensland

- Western Australia

- South Australia

- Others

Competitive Landscape

The Australia Quartz Stone Market features a competitive landscape driven by global and regional manufacturers focusing on innovation, product quality, and sustainable production. Key players such as Caesarstone, Cosentino (Silestone), LG Hausys, Hanwha L&C, and Lapitec Australia lead through advanced engineering technologies and diversified product portfolios. Local companies like Sia Stones strengthen market reach with tailored solutions and strong distribution networks. It emphasizes engineered quartz surfaces known for durability, design flexibility, and eco-friendly composition. Strategic investments in automation, digital fabrication, and recycling technologies enhance production efficiency and reduce environmental impact. Companies actively pursue mergers, distribution partnerships, and R&D collaborations to maintain competitiveness. With rising demand across residential and commercial projects, competition intensifies around aesthetics, customization, and pricing strategies. Sustainable materials and smart surface innovations are becoming key differentiators for companies aiming to expand their presence across Australia’s construction and interior design industries.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Players

Recent Developments

- In March 2025, WK Stone launched Quantum Zero, a crystalline-silica-free recycled surface replacing its previous Quantum Quartz product line to meet new safety regulations.

- In July 2025, Vadara entered the Australian market, expanding its global presence with premium quartz surface collections targeting residential and commercial applications.

- In March 2025, Mount Isa Minerals secured a funding partnership with Quinbrook Infrastructure Partners to advance high-purity quartz asset development in Australia.

- In early 2024, Caesarstone introduced a new crystalline-silica-free material line in Australia, aligning with sustainable manufacturing trends and regulatory compliance efforts.

Report Coverage

The research report offers an in-depth analysis based on Type, Application, Material Composition, Distribution Channel and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for engineered quartz surfaces will rise due to expanding residential renovation projects.

- Adoption of eco-friendly and recycled quartz materials will gain strong traction across urban markets.

- Increasing use of digital fabrication and automation will enhance production precision and design flexibility.

- Local manufacturing capacity will expand to reduce reliance on imported quartz products.

- Growing investment in sustainable construction will drive demand for low-emission quartz surfaces.

- Commercial infrastructure development will create steady opportunities in hospitality and retail sectors.

- Customizable patterns and colors will become key factors influencing consumer purchasing behavior.

- Strategic partnerships between local distributors and global brands will strengthen market reach.

- Advanced surface technologies offering higher heat and scratch resistance will boost premium adoption.

- Rising consumer focus on modern aesthetics and durability will sustain long-term market expansion.