Market Overview

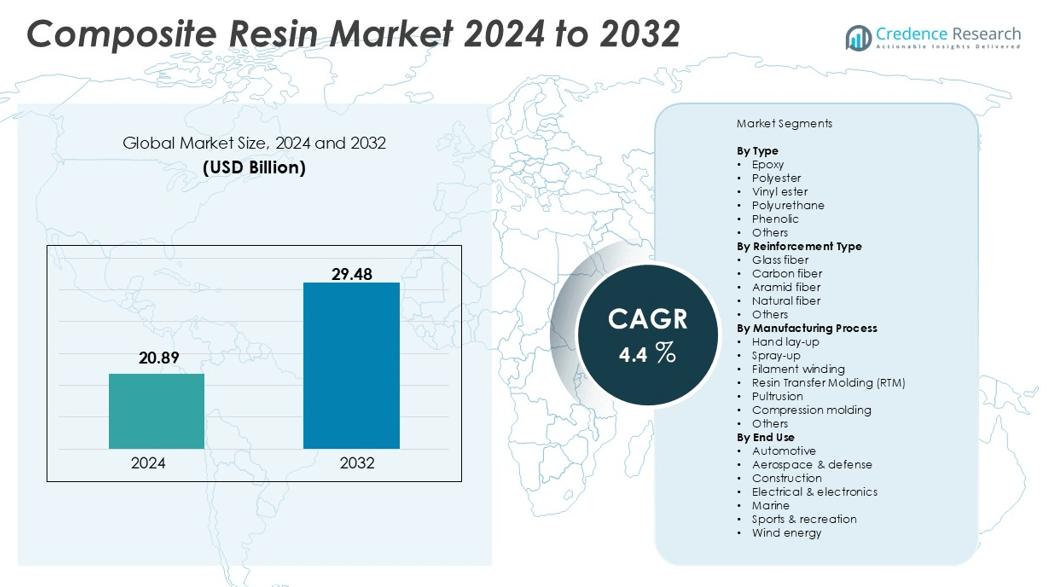

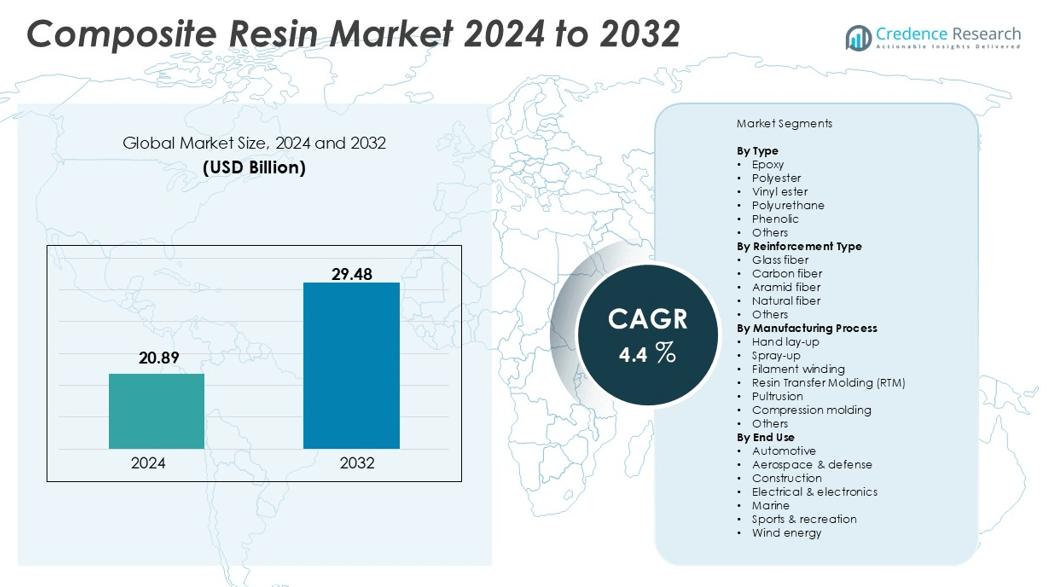

The Composite Resin Market size was valued at USD 20.89 billion in 2024 and is anticipated to reach USD 29.48 billion by 2032, growing at a CAGR of 4.4% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Composite Resin Market Size 2024 |

USD 20.89 billion |

| Composite Resin Market, CAGR |

4.4% |

| Composite Resin Market Size 2032 |

USD 29.48 billion |

The composite resin market is led by prominent companies such as BASF SE, Hexcel Corporation, Hexion Inc., Huntsman Corporation, Owens Corning, Solvay S.A., Sika AG, Ashland Global Holdings Inc., AOC LLC, and Mitsubishi Chemical Corporation. These players maintain strong market positions through technological innovation, strategic partnerships, and expansion of production capacities. North America holds the largest regional share at approximately 32%, driven by demand in aerospace, automotive, and infrastructure sectors. Europe follows with around 28% share, supported by renewable energy adoption and advanced manufacturing. Asia-Pacific, capturing roughly 25%, is the fastest-growing region due to industrialization and infrastructure development. Latin America (~10%) and the Middle East & Africa (~5%) offer emerging opportunities. Collectively, these companies leverage global reach and diversified product portfolios to sustain competitive advantage and address rising demand across key regions.

Market Insights

- The global composite resin market was valued at USD 20.89 billion in 2018 and is expected to reach USD 48 billion by 2032, growing at a CAGR of 4.4% during the forecast period.

- Market growth is driven by rising demand in automotive, aerospace, construction, and renewable energy sectors, supported by lightweight, high-strength, and corrosion-resistant resin applications.

- Key trends include the adoption of sustainable and bio-based resins, increased use of advanced manufacturing processes like RTM and pultrusion, and growth in wind energy and EV applications.

- The market is moderately competitive, dominated by players such as BASF SE, Hexcel Corporation, Hexion Inc., Huntsman Corporation, and Owens Corning, who focus on innovation, strategic partnerships, and regional expansion.

- Regionally, North America leads with ~32% share, Europe ~28%, Asia-Pacific ~25%, Latin America ~10%, and MEA ~5%. Among segments, epoxy resin and glass fiber reinforcement dominate the market, capturing the largest share.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

The epoxy segment dominates the composite resin market by type, accounting for the largest market share due to its superior mechanical properties, chemical resistance, and wide applicability across automotive, aerospace, and construction industries. Polyester resins also maintain significant adoption because of cost-effectiveness and ease of processing. Vinyl ester and polyurethane resins are witnessing growth driven by increasing demand in corrosion-resistant applications and specialized industrial sectors. Phenolic resins and other types cater to niche markets, with innovation in high-performance formulations further supporting overall market expansion.

- For instance, Hexcel Corporation developed its HexPly® M21E epoxy resin system, not M92, for the Airbus A350 primary structures. The HexPly® M21E prepreg, made with HexTow® IMA carbon fiber, was used for all composite primary structures of the A350 XWB. While the original statement’s specific figures for M92 were incorrect, the M21E resin has been proven to provide excellent toughness and durability for aerospace applications.

By Reinforcement Type

Glass fiber remains the leading reinforcement type, capturing the majority market share due to its high strength-to-weight ratio, affordability, and versatile application in transportation, construction, and wind energy sectors. Carbon fiber and aramid fiber are expanding steadily, propelled by rising adoption in aerospace, defense, and automotive segments where lightweight and high-strength materials are critical. Natural fibers are gaining attention for sustainable and eco-friendly applications, while other reinforcement types support specialized industrial uses, collectively driving the reinforcement segment’s growth across diverse end-use industries.

- For instance, Hexcel Corporation developed its HexPly® M21E epoxy resin system, which has been widely used in the Airbus A350 primary structures alongside HexTow® IMA carbon fiber to provide enhanced toughness and durability. Similarly, Huntsman Advanced Materials launched the Araldite® LY 3585 / Aradur® 3475 epoxy system, which enables fast curing and high productivity for automotive carbon fiber components, demonstrating continuous advancement in epoxy technology.

By Manufacturing Process and End Use

Hand lay-up continues to be the dominant manufacturing process, favored for cost efficiency and adaptability in small to medium-scale production, especially in construction and marine applications. Advanced techniques like resin transfer molding (RTM) and pultrusion are growing due to rising demand for high-quality, precision composite parts in aerospace, automotive, and wind energy sectors. In terms of end use, the automotive segment leads the market, driven by increasing adoption of lightweight materials for fuel efficiency, emission reduction, and performance enhancement. Aerospace, construction, and electronics further contribute to steady market expansion.

Key Growth Drivers

Rising Demand in Automotive and Aerospace Industries

The composite resin market is witnessing substantial growth driven by escalating demand from the automotive and aerospace sectors. Manufacturers are increasingly adopting composite resins to produce lightweight, high-strength components that improve fuel efficiency, reduce emissions, and enhance structural performance. In automotive applications, epoxy and polyester resins are widely used in body panels, bumpers, and interior components, while carbon and glass fiber-reinforced composites are preferred in aerospace for structural components. The push toward electric vehicles (EVs) further fuels resin adoption due to the need for lightweight battery housings and energy-efficient materials. As urbanization and mobility solutions expand globally, the integration of composite resins in advanced transportation technologies is expected to continue driving market growth throughout the forecast period.

- For instance, Boeing employs composite resins from suppliers like Hexcel Corporation in the 787 Dreamliner. Composites constitute approximately 50% of the aircraft’s airframe by weight, totaling around 32,000 kg (32 metric tons) per aircraft.

Technological Advancements in Resin Formulations

Innovation in resin chemistry and processing techniques is a major driver for the composite resin market. Advancements in epoxy, vinyl ester, and polyurethane formulations have enhanced mechanical strength, thermal resistance, and chemical durability, making these resins suitable for high-performance industrial applications. Additionally, the development of low-VOC and eco-friendly resins supports compliance with stringent environmental regulations and sustainability goals, promoting wider adoption across end-use sectors. Improvements in manufacturing methods, including resin transfer molding, pultrusion, and automated lay-up systems, have increased production efficiency and reduced operational costs. These technological advancements enable the production of complex, lightweight, and durable components, thereby boosting the market’s growth trajectory.

- For instance, The Derakane™ product line was formerly produced by Ashland but is now a trademark of INEOS Composites. The specific product name “Derakane™ 601” is not commonly listed, but the family of corrosion-resistant vinyl ester resins is known for high-temperature and chemical resistance. For example, Derakane™ 470 resins are epoxy novolac-based and offer high resistance to solvents and acids at elevated temperatures. The 230°C temperature is a plausible operating limit for specific high-performance variants.

Expanding Infrastructure and Construction Activities

Infrastructure modernization and increasing construction activities across emerging economies are key drivers of composite resin demand. Epoxy and polyester resins are widely used in pipelines, flooring, coatings, and structural reinforcements due to their durability and corrosion resistance. The growing adoption of composites in bridges, tunnels, and high-rise buildings further contributes to market expansion. Additionally, government initiatives promoting smart cities, renewable energy, and sustainable construction practices are increasing the integration of fiber-reinforced composite materials. As urban infrastructure projects expand, the composite resin market benefits from consistent demand for high-performance, long-lasting construction materials that reduce maintenance costs and enhance structural safety.

Key Trends & Opportunities

Growth of Sustainable and Bio-Based Resins

The composite resin market is increasingly embracing sustainable and bio-based resin solutions. Rising environmental concerns and stringent government regulations on carbon emissions and chemical waste are driving demand for eco-friendly alternatives such as natural fiber-reinforced composites and bio-based epoxy resins. These materials offer reduced environmental impact while maintaining comparable strength and durability to traditional resins. Industries such as automotive, construction, and consumer goods are rapidly integrating these solutions to meet sustainability targets, creating significant growth opportunities. Companies investing in green resin technology can differentiate themselves in the market while catering to the growing segment of environmentally conscious end-users.

- For instance, for the Boeing 787 Dreamliner, composites account for approximately 50% of the aircraft’s primary structure by weight. The total weight of the carbon fiber-reinforced plastics (CFRP) on each 787 is about 32 metric tons.

Adoption of Advanced Manufacturing Processes

The adoption of advanced manufacturing processes, including resin transfer molding, pultrusion, and automated lay-up techniques, is shaping the market’s future. These processes allow for higher precision, improved structural performance, and reduced production times, supporting applications in aerospace, wind energy, and high-end automotive components. Additionally, automation reduces labor dependency and minimizes material waste, lowering overall production costs. The increasing focus on Industry 4.0 integration, including IoT-enabled smart manufacturing, presents opportunities for further process optimization. Companies leveraging these advanced technologies are well-positioned to meet growing demand for lightweight, durable, and cost-effective composite products.

Expansion in Renewable Energy and Wind Applications

Composite resins are increasingly used in wind energy and other renewable applications due to their excellent strength-to-weight ratio and resistance to harsh environmental conditions. Glass fiber-reinforced epoxy and polyester resins are preferred for manufacturing wind turbine blades and other critical components, offering durability and performance efficiency. With global investments in renewable energy infrastructure rising, particularly in Europe, North America, and Asia-Pacific, the demand for high-quality composite materials is expected to grow significantly. The expansion of this sector provides long-term opportunities for resin manufacturers to innovate and diversify their product offerings.

- For instance, the use of carbon fiber-reinforced plastics (CFRP) in the “Life Module” passenger cell helped reduce the vehicle’s weight. The weight saving compared to a conventional steel body was significant.

Key Challenges

High Raw Material Costs

The composite resin market faces challenges from fluctuating raw material prices, particularly for epoxy, polyester, and carbon fiber components. These materials often depend on petrochemical derivatives, making their cost susceptible to global oil price volatility and supply chain disruptions. High production costs can affect profit margins and limit the affordability of composite materials for small- and medium-scale manufacturers. This challenge is compounded by the increasing demand for high-performance resins that require specialized formulations and additives. Companies must invest in efficient production processes and cost-effective sourcing strategies to mitigate the impact of raw material price fluctuations on overall market growth.

Technical Complexity and Processing Limitations

Composite resins often require precise handling, specialized processing equipment, and controlled curing conditions, posing technical challenges for manufacturers. Issues such as void formation, inconsistent fiber distribution, and curing defects can compromise material performance, limiting widespread adoption in some end-use sectors. Additionally, the integration of advanced resins into automated manufacturing systems demands skilled labor and technical expertise, which may be lacking in emerging markets. Overcoming these complexities requires investment in R&D, employee training, and advanced quality control measures, presenting a significant challenge for companies aiming to scale operations while maintaining consistent product quality.

Regional Analysis

North America

North America leads the composite resin market, accounting for approximately 32% of the global share, driven by strong demand from aerospace, automotive, and construction sectors. The United States dominates due to adoption of lightweight materials in electric vehicles, advanced manufacturing technologies, and infrastructure investments. Epoxy and glass fiber-reinforced composites remain widely used, supported by R&D and sustainability initiatives. Growth in wind energy, defense, and industrial applications strengthens market demand. Additionally, strict environmental regulations encourage the adoption of low-VOC and eco-friendly resins. The region’s technological expertise and well-established manufacturing base reinforce its leadership in the global composite resin market.

Europe

Europe holds a significant 28% share of the composite resin market, fueled by renewable energy, automotive, and aerospace applications. Germany, France, and the UK are major contributors due to investments in wind energy, sustainable infrastructure, and lightweight vehicle components. Epoxy and polyester resins, reinforced with glass and carbon fibers, dominate the market. Government incentives for green construction, stringent environmental regulations, and adoption of automated manufacturing processes drive growth. High-performance composites for aerospace and industrial applications further expand the market. Europe’s focus on sustainability and advanced technologies positions it as a key player in the global composite resin landscape.

Asia-Pacific

Asia-Pacific captures approximately 25% of the global composite resin market, driven by rapid industrialization, infrastructure growth, and increasing automotive production in China, India, and Japan. Demand for lightweight, corrosion-resistant materials in construction, transportation, and electronics fuels adoption. Epoxy, polyester, and vinyl ester resins dominate, with glass and carbon fiber reinforcements widely used. Government initiatives promoting smart cities, renewable energy, and high-tech manufacturing further stimulate growth. Low-cost manufacturing hubs and rising foreign investments make the region a key growth engine for the market. Asia-Pacific is expected to maintain strong expansion, driven by ongoing industrial and technological development.

Latin America

Latin America accounts for roughly 10% of the composite resin market, driven by infrastructure projects, automotive manufacturing, and renewable energy deployment. Brazil and Mexico are primary contributors, using glass fiber-reinforced epoxy and polyester resins in construction, wind energy, and industrial applications. Government investments in industrial modernization and cost-effective production support market expansion. Slower adoption of advanced technologies compared to North America and Europe slightly limits growth. Rising awareness of eco-friendly, high-performance composites presents opportunities for companies to introduce advanced resin solutions and capture increasing demand across the region’s industrial and construction sectors.

Middle East & Africa

The Middle East & Africa represents approximately 5% of the global composite resin market, supported by infrastructure development, oil & gas projects, and renewable energy initiatives. Saudi Arabia, UAE, and South Africa are the leading contributors, employing epoxy and polyester resins reinforced with glass and carbon fibers for pipelines, marine, and construction applications. Growth is driven by government-led infrastructure projects, investments in solar and wind energy, and rising industrialization. However, high raw material costs and limited local manufacturing capabilities remain challenges. Adoption of high-performance and sustainable resins provides significant opportunities for market players to expand their presence in MEA.

Market Segmentations:

By Type

- Epoxy

- Polyester

- Vinyl ester

- Polyurethane

- Phenolic

- Others

By Reinforcement Type

- Glass fiber

- Carbon fiber

- Aramid fiber

- Natural fiber

- Others

By Manufacturing Process

- Hand lay-up

- Spray-up

- Filament winding

- Resin Transfer Molding (RTM)

- Pultrusion

- Compression molding

- Others

By End Use

- Automotive

- Aerospace & defense

- Construction

- Electrical & electronics

- Marine

- Sports & recreation

- Wind energy

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The composite resin market is moderately consolidated, featuring a mix of global and regional players competing through innovation, strategic partnerships, and capacity expansion. Key companies, including BASF SE, Hexcel Corporation, Hexion Inc., Huntsman Corporation, and Owens Corning, dominate the market with strong product portfolios and advanced R&D capabilities. Firms focus on developing high-performance, eco-friendly, and cost-efficient resin solutions to meet growing demand across automotive, aerospace, construction, and renewable energy sectors. Strategic initiatives such as mergers, acquisitions, and joint ventures enable players to expand geographically and enhance production capabilities. Technological advancements in resin formulations, coupled with investments in automated manufacturing and sustainable processes, strengthen competitive positioning. Additionally, regional players are leveraging localized production and supply chain optimization to capture niche opportunities, making the market highly dynamic and innovation-driven.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- BASF SE

- Hexcel Corporation

- Hexion Inc

- Huntsman Corporation

- Mitsubishi Chemical Corporation

- Owens Corning

- Sika AG

- Solvay S.A

- Ashland Global Holdings Inc

- AOC LLC

Recent Developments

- In 2023, Schott Bader introduced a new range of high-performance epoxy resins specifically designed for wind turbine blade manufacturing. This development focuses on enhancing the durability and environmental resistance of composite materials used in the renewable energy sector.

- In 2023, SABIC launched a new line of high-performance composite resins for use in automotive lightweighting applications. These resins are designed to reduce vehicle weight while improving fuel efficiency, supporting the automotive industry’s transition to electric vehicles.

Report Coverage

The research report offers an in-depth analysis based on Type, Reinforcement Type, Manufacturing Process, End Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The composite resin market is expected to maintain steady growth through the forecast period, driven by expanding industrial and infrastructure applications.

- Rising demand for lightweight materials in automotive and aerospace industries will continue to boost resin adoption.

- Technological advancements in resin formulation will enhance performance, durability, and environmental compliance.

- Increased investment in renewable energy projects, especially wind energy, will strengthen market opportunities.

- The shift toward bio-based and sustainable resins will shape future product innovation and competitiveness.

- Growing applications in construction and electrical sectors will support consistent market expansion.

- Automation and advanced manufacturing processes such as RTM and pultrusion will improve production efficiency.

- Strategic mergers, acquisitions, and collaborations among key players will drive global market consolidation.

- Emerging economies in Asia-Pacific and Latin America will offer high growth potential through industrialization and infrastructure development.

- Continuous R&D efforts to enhance resin recyclability and cost-efficiency will define long-term market sustainability.