Market Overview

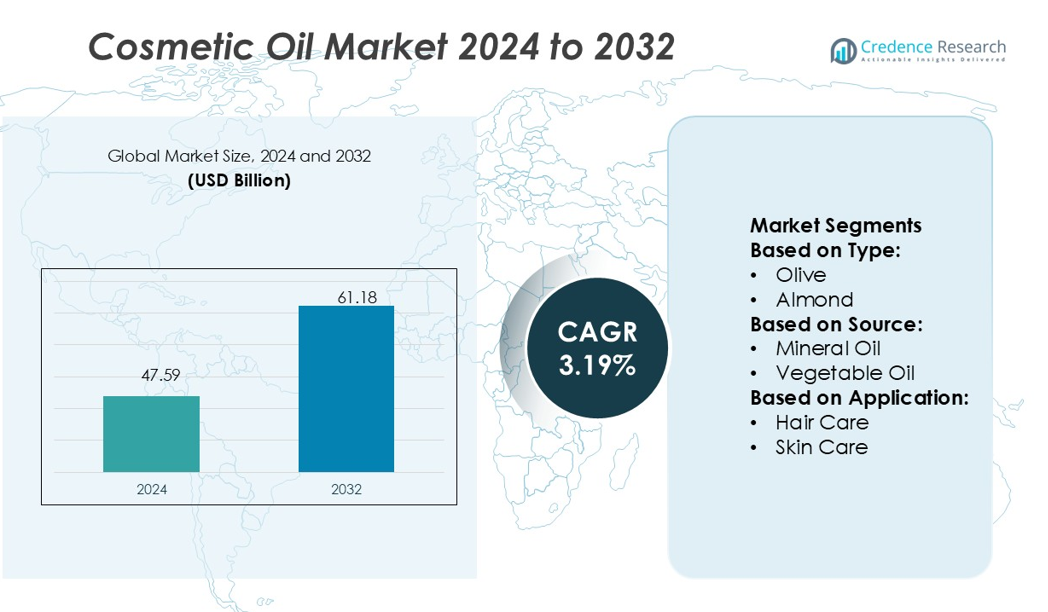

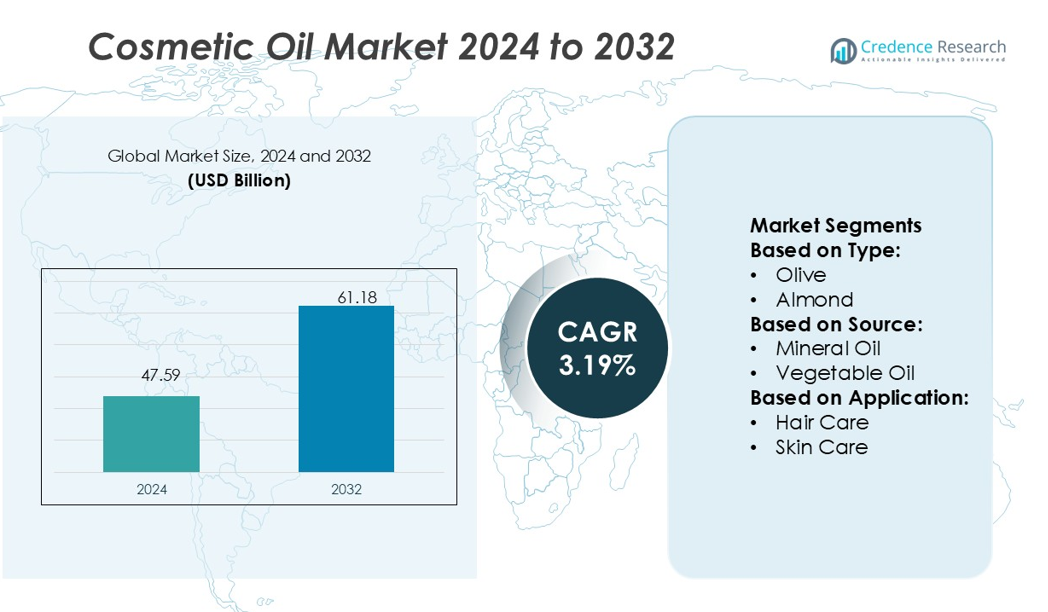

Cosmetic Oil Market size was valued USD 47.59 billion in 2024 and is anticipated to reach USD 61.18 billion by 2032, at a CAGR of 3.19% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Cosmetic Oil Market Size 2024 |

USD 47.59 billion |

| Cosmetic Oil Market, CAGR |

3.19% |

| Cosmetic Oil Market Size 2032 |

USD 61.18 billion |

The Cosmetic Oil Market is shaped by leading players including BASF SE, Clariant AG, Cargill, Givaudan, Do Terra International, ExxonMobil Corporation, Gandhar Oil Refinery India, Henry Lamotte Oil, Maverik Oils, and ATDM. These companies emphasize product innovation, sustainable sourcing, and strategic partnerships to expand their global reach. They focus on developing bio-based, multifunctional oils that meet clean beauty and ethical standards. Asia-Pacific leads the global Cosmetic Oil Market with a 33% share, driven by strong demand for natural skincare and haircare products, robust raw material availability, and growing consumer preference for eco-friendly and organic formulations.

Market Insights

- The Cosmetic Oil Market size was valued at USD 47.59 billion in 2024 and is projected to reach USD 61.18 billion by 2032, growing at a CAGR of 3.19%.

- Rising consumer demand for natural, organic, and multifunctional skincare products drives the market’s steady expansion across global beauty sectors.

- Continuous innovation in bio-based and cold-pressed oil formulations enhances product performance and sustainability, boosting premium brand adoption.

- Competition intensifies as key players invest in sustainable sourcing, partnerships, and product diversification to meet clean beauty standards.

- Asia-Pacific dominates with a 33% share, supported by abundant raw material availability and strong manufacturing capabilities, while coconut oil leads the product segment with 34% share due to its wide use in skincare and haircare applications.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

The Cosmetic Oil Market is segmented into olive, almond, coconut, essential, and other oils. Coconut oil holds the dominant share of 34%, supported by its high demand in both skin and hair care formulations. Its natural moisturizing and antimicrobial properties make it a preferred choice for cosmetics and personal care brands. Rising consumer preference for organic and chemical-free ingredients also fuels coconut oil’s dominance. Olive and almond oils follow closely due to their antioxidant and vitamin-rich profiles that appeal to premium skincare products.

- For instance, Henry Lamotte Oil presses nearly 8,000 tonnes of oilseeds per year at their Oil Mill Lipos, of which 90 percent is from certified organic cultivation, enabling supply of high-purity cosmetic coconut derivative streams.

By Source

The market by source includes mineral oil and vegetable oil, with vegetable oil leading at 61% share. Growing awareness of plant-based and sustainable ingredients drives this segment. Vegetable oils such as coconut, jojoba, and sunflower are favored for being biodegradable, non-comedogenic, and rich in essential fatty acids. Cosmetic manufacturers increasingly replace synthetic and petroleum-based oils with vegetable alternatives to meet clean beauty standards and eco-label certifications. Consumer demand for cruelty-free and vegan cosmetic products continues to strengthen this segment’s growth globally.

- For instance, Cargill Beauty’s BotaniDesign™ emollient is 100% derived-natural and readily biodegradable. Comparative consumer tests showed that it delivered a “smoothness effect” comparable to white petrolatum.

By Application

Based on application, the market is divided into hair care, skin care, lip care, and others. Skin care is the largest segment, capturing 42% market share, driven by rising use of natural oils in moisturizers, serums, and anti-aging products. The segment benefits from the growing focus on hydration and nourishment in daily skincare routines. Cosmetic companies are launching multipurpose oil-based products targeting different skin types and age groups. Increasing disposable incomes and expanding online beauty retail platforms further boost skin care oil consumption.

Key Growth Drivers

Rising Demand for Natural and Organic Ingredients

Consumers increasingly favor natural and organic cosmetic oils due to growing awareness of chemical side effects. Oils such as coconut, argan, and jojoba are used widely in skin and hair care products for their hydrating and antioxidant benefits. Major brands are reformulating product lines with plant-based oils to meet clean beauty standards. This shift toward sustainable and eco-friendly cosmetics strengthens long-term market expansion while encouraging innovations in organic oil extraction and cold-pressing techniques.

- For instance, Maverik Oils supplies cold-pressed and refined specialty oils in packaging sizes from 5-gallon pails up to full tankers, allowing clients to scale formulations without changing supplier.

Expanding Use in Multi-Functional Skincare Products

Cosmetic oils are gaining prominence as versatile ingredients in moisturizers, cleansers, and serums. Their nourishing, anti-aging, and repairing properties make them suitable for various formulations catering to diverse skin concerns. Companies introduce lightweight and non-greasy oils appealing to a broader consumer base. Increasing demand for premium skincare products that offer hydration and radiance fuels growth. The rising adoption of oil-based multipurpose beauty products enhances market opportunities across both mass and luxury segments.

- For instance, Clariant’s GlowCytocin™ active—derived from white hyacinth bulbs—has a 99.6% natural origin index and demonstrated in internal trials a measurable increase in skin luminosity after 28 days of use.

Growth of E-Commerce and Digital Beauty Platforms

Online retail channels significantly boost the accessibility of cosmetic oils worldwide. E-commerce platforms provide direct brand visibility, personalized marketing, and easy access to niche oil-based products. Influencer marketing and social media campaigns promote product awareness among younger consumers. Companies leverage digital platforms to educate customers about benefits and usage, increasing sales conversions. The integration of virtual try-ons and AI-powered recommendations further enhances the shopping experience, driving strong growth in the cosmetic oil sector.

Key Trends & Opportunities

Increasing Preference for Sustainable and Ethical Sourcing

Sustainability is becoming a key purchasing factor in cosmetic oil production. Consumers demand traceable and ethically sourced raw materials such as cold-pressed oils derived from certified organic farms. Brands adopting fair-trade practices and eco-friendly packaging strengthen their market credibility. Investment in biodegradable and recyclable packaging aligns with global environmental goals. This trend provides opportunities for manufacturers to differentiate products and appeal to environmentally conscious consumers seeking transparency in beauty supply chains.

- For instance, doTERRA’s Cō-Impact Sourcing® model sources from over 45 countries and maintains full chain-of-custody records for 140+ botanical oils.

Innovation in Oil Blends and Advanced Formulations

Manufacturers are investing in R&D to create advanced oil blends combining multiple natural extracts. These formulations offer enhanced texture, stability, and absorption without leaving residue. Oils infused with vitamins, botanical extracts, and active ingredients are gaining traction in both skincare and haircare lines. Customizable formulations targeting specific concerns like pigmentation or scalp nourishment also rise. Continuous product innovation and differentiation support brand loyalty and premium positioning in competitive global markets.

- For instance, ExxonMobil’s PureSyn™ hydrogenated C6–C14 olefin fluids are engineered to blend with cosmetic actives, offering non-greasy texture and stability across a pH range from 2 to 12.

Key Challenges

Fluctuating Raw Material Prices

Volatility in raw material prices, especially for plant-based and essential oils, presents a significant challenge. Climate change, crop yield variations, and supply chain disruptions impact oil availability and cost stability. This price instability affects manufacturers’ margins and product pricing strategies. Companie dependent on imports face additional challenges due to currency fluctuations and logistics costs. Developing strong supplier networks and adopting regional sourcing strategies are key to mitigating these financial risks.

Risk of Product Adulteration and Quality Inconsistency

The growing popularity of cosmetic oils has led to an increase in counterfeit and adulterated products. Such low-quality oils can damage consumer trust and brand reputation. Inconsistent quality and lack of standardization in extraction and refining processes affect performance and safety. Regulatory compliance and quality certifications are essential to ensure authenticity. Leading players invest in traceability technologies and rigorous testing to maintain high purity standards, protecting consumer confidence and long-term market stability.

Regional Analysis

North America

North America holds a 29% share of the global Cosmetic Oil Market, driven by high consumer spending on premium skincare and personal care products. The region’s strong presence of major beauty brands and growing adoption of organic formulations boost demand for natural oils such as argan, jojoba, and coconut. U.S. consumers increasingly prefer sustainable, cruelty-free, and dermatologically tested products. The availability of advanced processing technologies and innovative oil-based formulations supports market expansion. Canada also contributes significantly, with rising demand for eco-certified and multifunctional cosmetic oils across online and retail beauty segments.

Europe

Europe accounts for a 27% share of the Cosmetic Oil Market, led by countries such as France, Germany, and the U.K. The region’s strict cosmetic regulations and emphasis on clean beauty drive the use of certified organic and sustainably sourced oils. European manufacturers focus on bio-based, cold-pressed formulations with transparent labeling. The popularity of essential oils in aromatherapy and skincare continues to rise. Premium cosmetic brands are adopting natural oil blends to meet consumer demand for non-toxic and vegan products, reinforcing Europe’s leadership in sustainable cosmetic innovation and high-quality beauty formulations.

Asia-Pacific

Asia-Pacific dominates the global Cosmetic Oil Market with a 33% share, fueled by strong demand from China, Japan, South Korea, and India. Rising disposable incomes, expanding beauty-conscious populations, and cultural preference for natural skincare boost growth. The region’s large-scale production of coconut, almond, and sesame oils ensures cost-effective supply for cosmetic manufacturing. Korean and Japanese brands pioneer innovation in lightweight and multifunctional oils, appealing to global consumers. Rapid growth in e-commerce and influencer-driven beauty trends further accelerate regional adoption, establishing Asia-Pacific as the hub for both production and consumption of cosmetic oils.

Latin America

Latin America holds a 6% share of the Cosmetic Oil Market, supported by increasing awareness of botanical and plant-based ingredients. Brazil leads the region due to its rich biodiversity and strong cosmetics manufacturing base. Oils derived from native plants such as buriti, açaí, and maracujá are gaining popularity for their nutrient-rich and sustainable profiles. Rising consumer preference for natural and organic beauty products aligns with regional environmental initiatives. Expanding middle-class income and growing exports of organic oils also drive market growth, making Latin America a fast-emerging contributor to global cosmetic oil trade.

Middle East & Africa

The Middle East & Africa region captures a 5% share of the Cosmetic Oil Market, with growth driven by rising interest in luxury and natural beauty products. Countries such as the UAE and Saudi Arabia witness increasing demand for argan, almond, and rose oils in skincare and haircare. The region’s expanding retail and e-commerce infrastructure enhances product accessibility. Africa’s rich natural resources, including shea and baobab oils, offer untapped potential for export-oriented production. Cultural traditions favoring oil-based beauty treatments, combined with rising disposable incomes, support steady market expansion across key regional markets.

Market Segmentations:

By Type:

By Source:

- Mineral Oil

- Vegetable Oil

- Others

By Application:

- Hair Care

- Skin Care

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Cosmetic Oil Market features prominent players such as L’Oréal Group, Unilever, BASF SE, Clariant AG, Do Terra International, ExxonMobil Corporation, BASF SE, Givaudan, ATDM, and Gandhar Oil Refinery India. The competitive landscape of the Cosmetic Oil Market is defined by strong innovation, sustainability initiatives, and expanding global distribution networks. Leading manufacturers focus on developing bio-based, cruelty-free, and multifunctional oils to align with clean beauty trends. Companies invest in advanced extraction and refining technologies to enhance purity, stability, and performance across skincare and haircare applications. Strategic partnerships with cosmetic brands and online retailers strengthen market visibility and customer reach. Continuous R&D efforts emphasize the development of lightweight, fast-absorbing oils that deliver hydration and nourishment, ensuring consistent demand in both mass and premium cosmetic segments.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- L’Oréal Group

- Unilever

- Coty Inc.

- BASF SE

- Cargill

- Clariant AG

- DoTERRA International

- ExxonMobil Corporation

- Shiseido Co. Ltd.

- Gandhar Oil Refinery India

- Givaudan

- Henry Lamotte Oil

- Maverik Oils

- Olvea Vegetable Oils

- Innisfree Cosmetics Pvt. Ltd.

- Bramble Berry

- Kao Corporation

- Uncle Harry’s Natural Products

- FARSALI

- SOPHIM IBERIA S.L.

Recent Developments

- In July 2025, Sugar Cosmetics secured a funding round to accelerate its digital-first beauty products and expansion into new markets. The investment will also focus on enhancing their product line and scaling up their e-commerce platform.

- In January 2025, Ras Luxury Skincare raised in Series A funding led by Unilever Ventures to broaden its premium skincare offerings. The capital will be used to expand its brand presence globally, while maintaining its focus on natural ingredients and luxury skincare solutions.

- In Jun 2024, skincare startup CHOSEN raised in a seed funding round to expand its range of personalized skincare products. The funding aims to fuel the brand’s growth in the competitive beauty market and enhance its AI-driven solutions for tailored skincare.

- In December 2023, Uniliver made K18 a part of their portfolio as the firm was gaining rapid popularity because they addressed the issue of hair damage through technology targeting professionals and consumers

Report Coverage

The research report offers an in-depth analysis based on Type, Source, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The demand for natural and organic cosmetic oils will continue to rise globally.

- Sustainable and ethically sourced oils will gain preference among beauty-conscious consumers.

- Innovation in multifunctional oil formulations will expand product applications in skincare and haircare.

- E-commerce platforms will play a major role in driving global cosmetic oil sales.

- Companies will invest more in cold-pressed and bio-based extraction technologies.

- Essential oils will see higher demand in aromatherapy and wellness-based cosmetics.

- Premium cosmetic brands will expand oil-based product lines targeting specific skin needs.

- Asia-Pacific will maintain its dominance due to strong production and consumer base.

- Regulatory emphasis on product safety and ingredient transparency will shape new formulations.

- Strategic collaborations between manufacturers and cosmetic brands will accelerate market expansion.