Market Overview

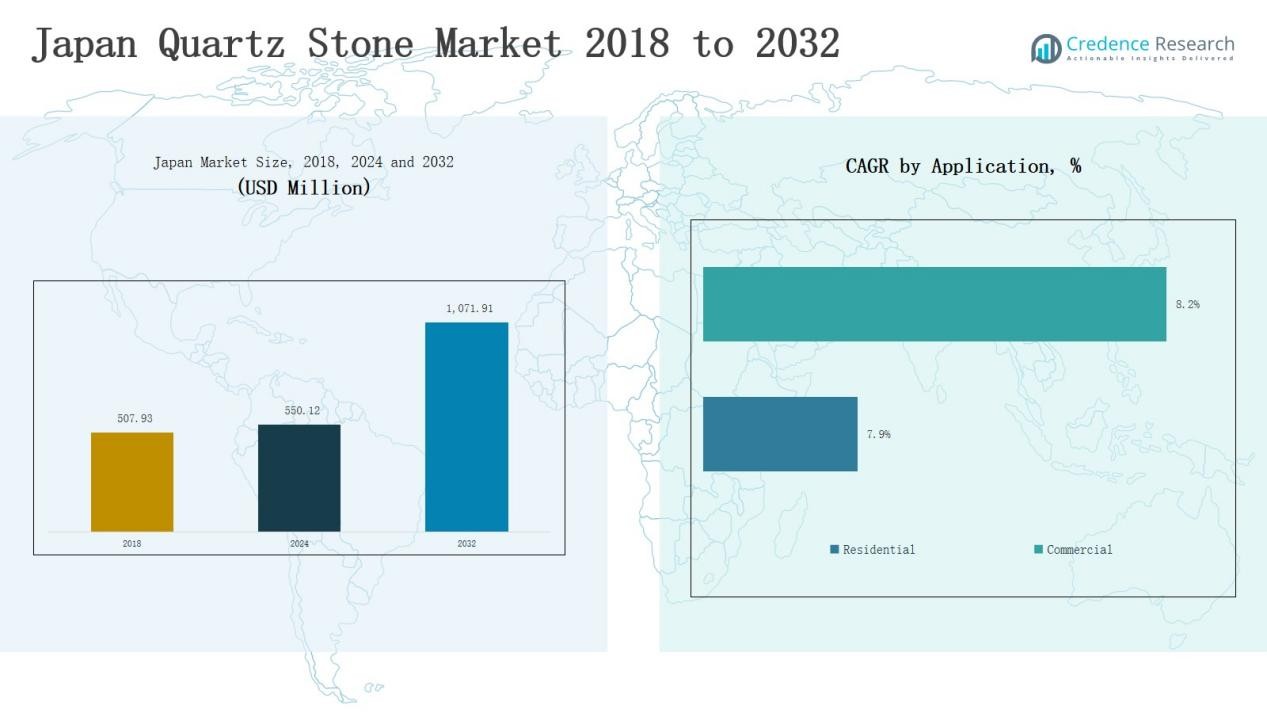

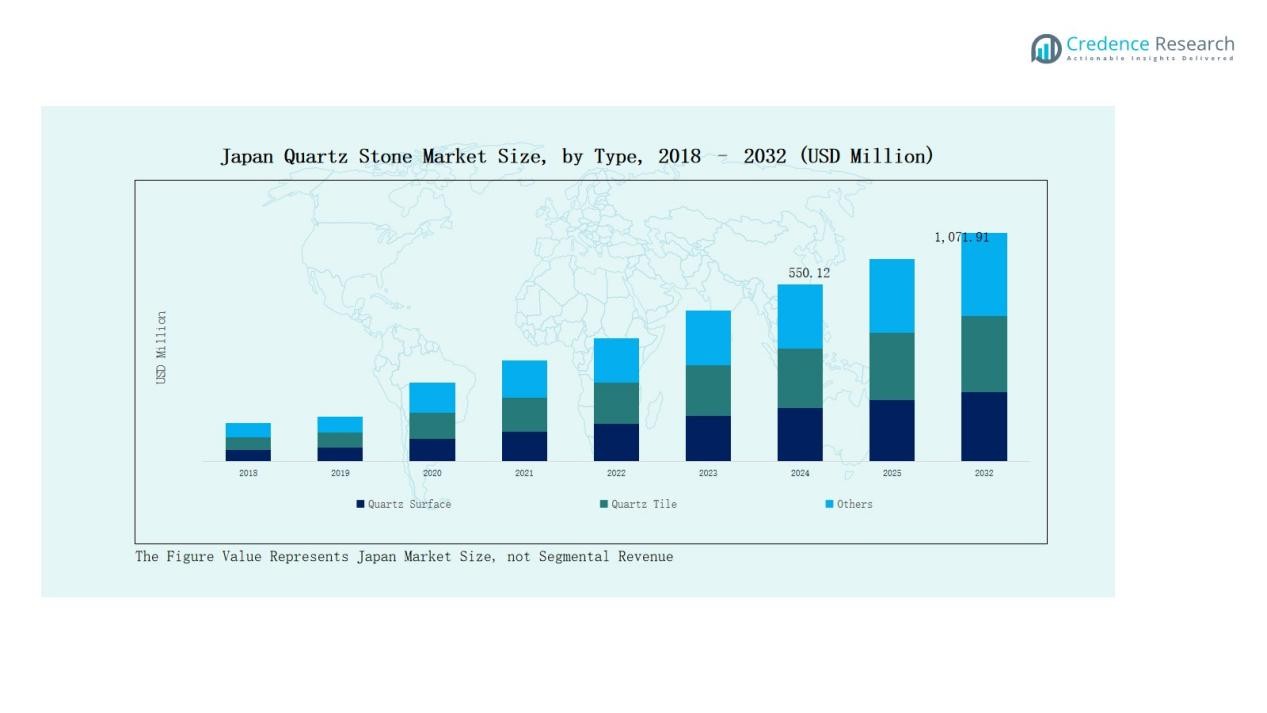

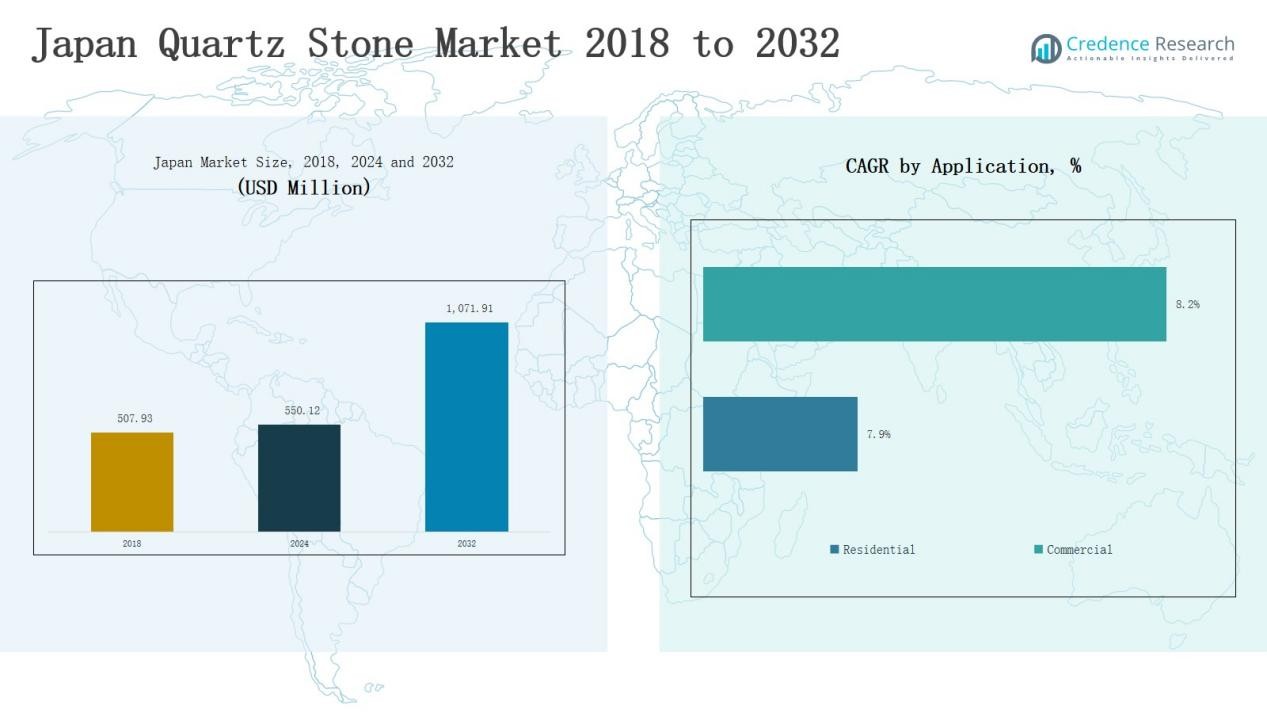

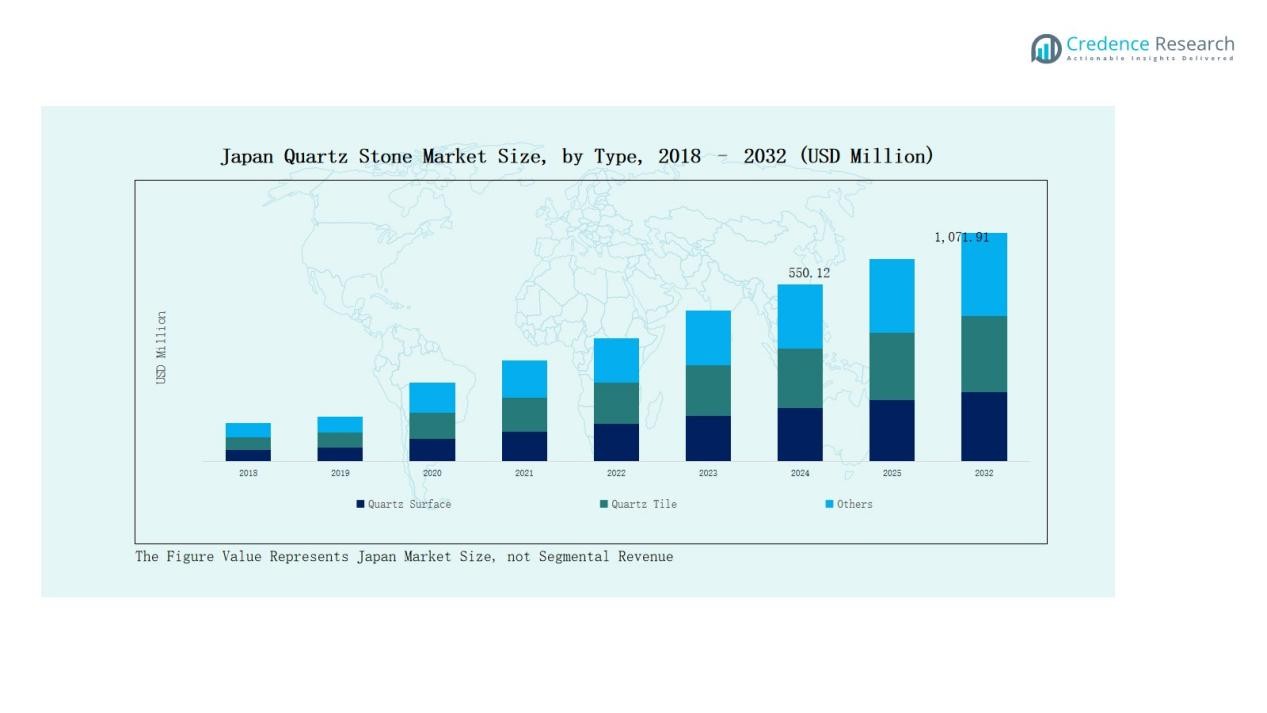

The Japan Quartz Stone Market size was valued at USD 554.88 million in 2018, increased to USD 625.27 million in 2024, and is anticipated to reach USD 1,082.00 million by 2032, growing at a CAGR of 8.71% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Japan Quartz Stone Market Size 2024 |

USD 625.27 Million |

| Japan Quartz Stone Market, CAGR |

8.71% |

| Japan Quartz Stone Market Size 2032 |

USD 1,082.00 Million |

The Japan Quartz Stone Market is led by prominent companies such as Sia Stones, AICA Kogyo Co., Ltd. (Fiore), Shin-Etsu Quartz Products Co., Ltd. (Shin-Etsu Chemical), Cosentino (Silestone), Caesarstone, Hanwha L&C, and LG Hausys. These players focus on advanced manufacturing, design innovation, and sustainable quartz production to meet Japan’s growing demand for premium surfaces. They emphasize customized textures, durable finishes, and eco-friendly materials to strengthen brand presence across residential and commercial sectors. The Kanto region emerged as the leading regional market, accounting for 39% of the total share in 2024, driven by strong construction activity and high consumer preference for luxury interiors in Tokyo and nearby metropolitan areas.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Japan Quartz Stone Market was valued at USD 554.88 million in 2018 and reached USD 625.27 million in 2024, projected to hit USD 1,082.00 million by 2032, growing at a CAGR of 8.71%.

- The Quartz Surface segment dominated with 59% share in 2024, driven by its use in countertops, flooring, and wall cladding for superior durability and design versatility.

- The Residential segment led with 63% share, supported by urban housing growth, premium renovations, and rising preference for low-maintenance, long-lasting quartz surfaces.

- Engineered Quartz accounted for 67% of the market, fueled by consistent quality, advanced resin-binding technology, and growing demand for eco-certified, high-strength materials.

- The Kanto region held the largest share of 39% in 2024, driven by Tokyo’s strong construction activity, luxury interior demand, and robust partnerships among local quartz manufacturers and distributors.

Market Segment Insights

By Type:

The Japan Quartz Stone Market is dominated by the Quartz Surface segment, accounting for 59% of the total share in 2024. Its popularity stems from wide adoption in kitchen countertops, flooring, and wall cladding due to superior durability, scratch resistance, and modern design versatility. The segment benefits from advanced fabrication technologies and strong demand from residential remodeling projects. Growing awareness of aesthetic value and longevity continues to strengthen the dominance of quartz surfaces across urban construction projects.

- For instance, Caesarstone Japan has seen increased adoption of its hygienic and aesthetically versatile quartz surfaces in both high-end residential and commercial construction.

By Application:

The Residential segment leads the Japan Quartz Stone Market, capturing 63% of the total share in 2024. Rising urban housing projects, premium interior upgrades, and increasing consumer preference for low-maintenance surfaces drive this growth. Quartz’s stain resistance, aesthetic flexibility, and long lifespan make it ideal for kitchens and bathrooms. Expanding condominium developments in Tokyo, Osaka, and Yokohama further boost residential adoption, supported by local and international brands offering customized quartz design options.

- For instance, the “Urban Collection” from Viatera was announced in February 2021 by LX Hausys (then LG Hausys). It featured two concrete-inspired colors, Metro and Gotham. The phrase “Urban Interior Series” appears to be a fabrication.

By Material Composition:

The Engineered Quartz segment holds the dominant position in the Japan Quartz Stone Market, with 67% market share in 2024. Its leadership is driven by precise engineering, consistent quality, and superior mechanical strength compared to natural quartz. Manufacturers leverage advanced resin-binding technologies to enhance color uniformity and durability. Increasing preference for eco-certified materials and engineered alternatives in both commercial and residential applications further propels this segment’s growth across Japan’s evolving surface materials market.

Key Growth Drivers

Rising Demand for Premium Interior Materials

The Japan Quartz Stone Market experiences strong growth due to increasing preference for luxury interiors in residential and commercial spaces. Quartz’s superior durability, non-porous nature, and elegant finish make it a popular alternative to natural stones. Expanding renovation activities, especially in urban centers like Tokyo and Osaka, support market expansion. Builders and designers favor quartz for its aesthetic consistency, low maintenance, and resistance to stains, making it the preferred choice for countertops, flooring, and wall cladding applications.

Technological Advancements in Manufacturing

Advanced fabrication methods, including precision cutting and digital polishing, drive efficiency and design flexibility in quartz stone production. Japanese manufacturers integrate automation, resin blending, and color-matching technologies to achieve high-quality finishes. These innovations allow manufacturers to meet growing demand for customized designs and improved mechanical properties. The shift toward digitally controlled manufacturing systems enhances surface uniformity, minimizes waste, and supports large-scale production, strengthening Japan’s competitive position in the premium surface material industry.

- For instance, Tostem uses advanced surface protection technology, such as its patented TEXGUARD system, to create durable, uniform, and high-quality coatings for its architectural materials

Growing Focus on Sustainable Construction

Sustainability initiatives across Japan’s construction and interior sectors significantly contribute to quartz stone adoption. Engineered quartz products with recycled content and low carbon footprints align with Japan’s green building standards. Manufacturers invest in eco-friendly resin formulations and energy-efficient processing systems to appeal to environmentally conscious consumers. The rise in LEED-certified projects and eco-label programs further boosts the use of sustainable quartz surfaces, reinforcing their role as a durable, long-lasting, and environmentally responsible design solution.

- For instance, Iwatani Corporation produces bio-based PET resins using about 30% plant-derived materials, which supports a lower carbon footprint in the production of items like beverage bottles.

Key Trends & Opportunities

Customization and Digital Design Integration

A major trend in the Japan Quartz Stone Market is the growing demand for digitally customized surfaces. Architects and consumers seek personalized textures, colors, and finishes enabled by CAD/CAM technology and 3D surface imaging. Manufacturers leverage digital design tools to create patterns resembling marble, granite, or concrete, offering greater design flexibility. This integration enhances aesthetic diversity, catering to premium retail, hospitality, and residential projects that value individuality and design precision.

- For instance, Caesarstone rolled out its new ICON 2025 collection, featuring advanced mineral surfaces that are crystalline silica-free and use approximately 80% recycled materials. The collection includes new designs inspired by natural marble with delicate veining and layered textures.

Expansion of Online and Retail Distribution Networks

Online platforms and modern retail outlets are transforming quartz stone accessibility in Japan. Digital showrooms and e-commerce portals enable customers to visualize, compare, and purchase quartz products easily. Retail partnerships with interior design brands further boost awareness and adoption among homeowners and small-scale contractors. The growth of omnichannel sales strategies enhances market visibility and supports efficient supply chain management, creating opportunities for both domestic producers and international quartz stone suppliers.

- For instance, LIXIL Corporation continues to partner with both retail chains and industry professionals to supply a wide range of building materials and housing products, including kitchen equipment.

Key Challenges

High Production and Installation Costs

Despite rising demand, the Japan Quartz Stone Market faces challenges due to high manufacturing and installation costs. Advanced resin technology, precision fabrication, and imported raw materials elevate production expenses. Skilled labor shortages further increase installation costs, especially for large-scale projects. Price sensitivity among residential buyers limits adoption compared to cheaper alternatives like ceramic tiles. Addressing these cost challenges through localized production and automation remains crucial for maintaining competitiveness in the domestic market.

Competition from Substitute Materials

Quartz stones face stiff competition from alternative materials such as porcelain slabs, solid surfaces, and engineered ceramics. These substitutes often offer similar aesthetics at lower prices, challenging quartz’s market penetration in cost-sensitive segments. Innovative coatings and lightweight designs in alternative materials attract commercial buyers. To sustain demand, quartz manufacturers must emphasize superior durability, sustainability credentials, and long-term value propositions through strategic marketing and performance-based differentiation.

Environmental and Recycling Constraints

Environmental regulations on resin use and waste management pose a challenge for Japanese quartz producers. The recycling of quartz scrap and polymer resins remains limited due to technological and logistical barriers. Increasing pressure to comply with carbon reduction goals raises operational costs. Manufacturers must develop efficient recycling systems and adopt bio-based resins to maintain compliance. Failure to adapt may restrict production scalability and hinder participation in green construction initiatives driving Japan’s sustainable growth agenda.

Regional Analysis

Kanto

The Kanto region dominates the Japan Quartz Stone Market, holding 39% of the total share in 2024. Strong demand from Tokyo’s residential and commercial construction drives steady growth. The region’s high concentration of architectural firms and interior design studios promotes the adoption of advanced quartz surfaces. Rising urban renovation projects and luxury apartment developments fuel consumption across residential sectors. It benefits from robust distribution networks and partnerships between local manufacturers and retail chains, supporting continuous supply and product innovation.

Kansai

The Kansai region accounts for 27% of the market share in 2024, supported by major construction and hospitality projects in Osaka and Kyoto. Expanding commercial infrastructure and premium retail spaces drive quartz stone installation. The preference for high-end interiors among corporate facilities and hotels sustains consistent market activity. It witnesses growing adoption of eco-friendly quartz materials that align with local sustainability standards. Increasing collaborations between suppliers and property developers continue to enhance market presence in this region.

Chubu

The Chubu region represents 18% of the total market share in 2024, driven by industrial and residential modernization projects. Demand grows across Nagoya and surrounding prefectures, where consumer preference shifts toward durable and low-maintenance materials. It benefits from established manufacturing bases that support the supply of engineered quartz products. Government housing initiatives and urban renewal projects contribute to stable market expansion. The region’s strategic logistics infrastructure aids in efficient material distribution to other parts of Japan.

Kyushu Region

The Kyushu region holds 10% of the market share in 2024, supported by expanding residential developments and infrastructure upgrades. Local construction firms adopt quartz stones for modern housing projects, especially in Fukuoka and Kumamoto. It experiences a rise in imports from international quartz brands catering to mid-range consumers. Regional distributors strengthen sales networks through partnerships with retail chains. The ongoing focus on sustainable construction materials and urban development initiatives sustains gradual growth in this region.

Tohoku and Hokkaido Regions

The Tohoku and Hokkaido regions collectively account for 6% of the total market share in 2024. Market activity centers on small-scale residential applications and public infrastructure projects. It faces challenges from harsh climatic conditions that limit large-scale adoption. Increasing awareness of quartz’s durability and low maintenance features supports slow but steady growth. Local construction initiatives and public building refurbishments gradually contribute to market expansion in northern Japan.

Market Segmentations:

By Type

- Quartz Surface

- Quartz Tile

- Other Forms

By Application

By Material Composition

- Engineered Quartz

- Natural Quartz Stone

- Eco-friendly Quartz

By Distribution Channel

- Direct Sales

- Retail Sales

- Online Platforms

- Others

By Region

- Kanto

- Kansai

- Chubu

- Kyushu

- Tohoku and Hokkaido

Competitive Landscape

The Japan Quartz Stone Market features a moderately consolidated structure, led by domestic and international manufacturers competing through innovation, design, and sustainability. Key players such as Sia Stones, AICA Kogyo Co., Ltd. (Fiore), and Shin-Etsu Quartz Products Co., Ltd. maintain strong positions through advanced material technology and localized distribution networks. Global brands including Caesarstone, Cosentino (Silestone), Hanwha L&C, and LG Hausys enhance market competition by offering diverse product portfolios and customized quartz solutions tailored to Japanese design preferences. The market emphasizes engineered quartz surfaces known for strength, precision, and visual appeal. Companies invest in eco-friendly production, automated fabrication, and digital texture replication to meet sustainability goals and consumer expectations. Strategic collaborations with construction firms and retailers strengthen brand visibility, while continuous R&D in resin formulation and recycled quartz integration helps players expand in Japan’s premium interior and architectural surface market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Players

Recent Developments

- In July 2025, Caesarstone introduced its ICON™ collection in Japan, featuring crystalline-silica-free quartz surfaces made with about 80% recycled materials.

- In July 2025, Vicostone launched 10 new quartz colours for the Fall season in Japan, inspired by natural elements.

- In 2025, Caesarstone introduced its new Lioli® Porcelain collection in Japan, featuring 6 mm slabs designed for multi-application use across residential and commercial interiors.

Report Coverage

The research report offers an in-depth analysis based on Type, Application, Material Composition, Distribution Channel and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for high-performance quartz surfaces will increase across residential and commercial interiors.

- Manufacturers will expand eco-friendly quartz production using recycled materials and bio-based resins.

- Digital fabrication and 3D surface design technologies will enhance product customization.

- Local brands will strengthen competitiveness through partnerships with construction and retail companies.

- Urban redevelopment projects will create new opportunities for premium quartz installations.

- Import reliance will decline as domestic production capacity and innovation improve.

- Smart manufacturing and automation will optimize cost efficiency and product consistency.

- Growing consumer preference for durable and low-maintenance materials will sustain steady demand.

- Online retail platforms will play a larger role in quartz stone sales and customer engagement.

- Global players will continue expanding presence through strategic alliances and localized product offerings.