Market Overview

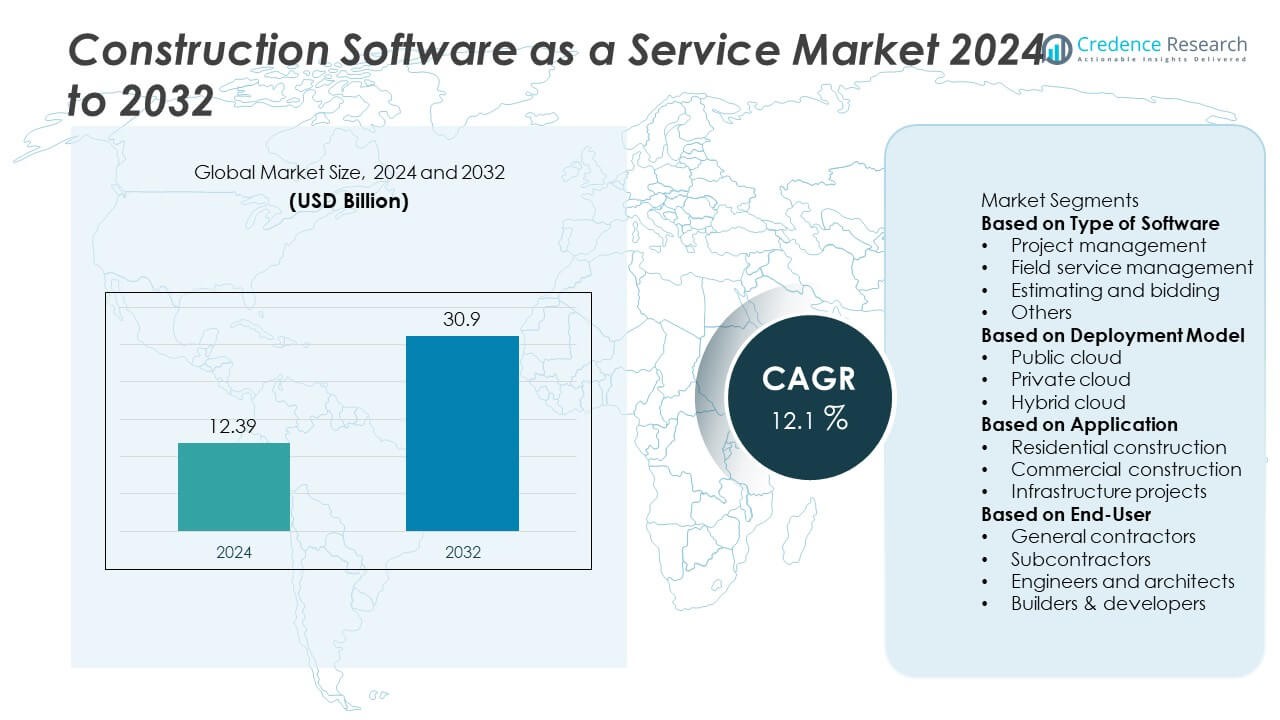

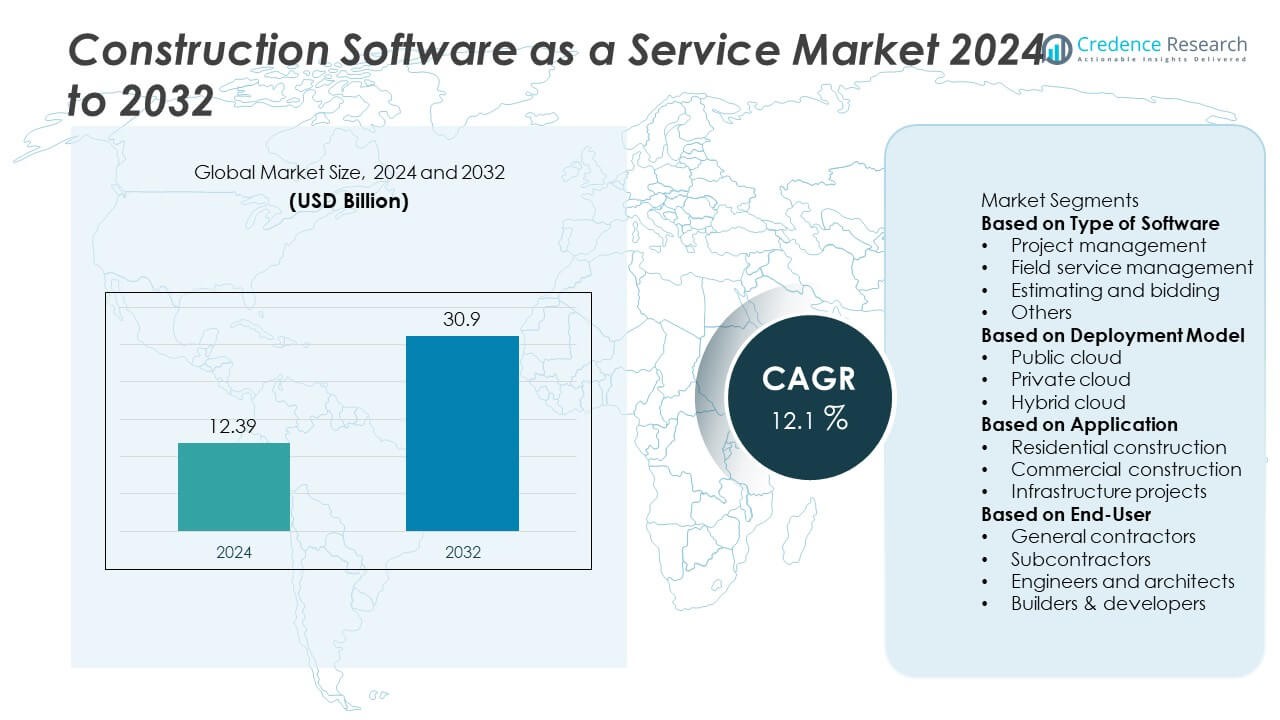

The Construction Software as a Service (SaaS) Market was valued at USD 12.39 billion in 2024 and is projected to reach USD 30.9 billion by 2032, growing at a CAGR of 12.1% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Construction Software as a Service Market Size 2024 |

USD 12.39 Million |

| Construction Software as a Service Market, CAGR |

12.1% |

| Construction Software as a Service Market Size 2032 |

USD 30.9 Million |

The Construction Software as a Service (SaaS) Market is led by major players such as Trimble, Oracle, Buildertrend, Procore Technologies, Sage Group, Jonas Construction Software, Bentley Systems, Newforma, Heavy Construction Systems Specialists (HCSS), and Autodesk. These companies dominate through advanced project management, cloud collaboration, and cost-control solutions tailored for large-scale construction and infrastructure projects. North America emerged as the leading region in 2024, holding a 36% market share, driven by strong digital adoption and the presence of leading software providers. Asia-Pacific followed with a 30% share, supported by rapid urbanization, smart city development, and rising investment in construction digitalization across China, India, and Japan.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Construction Software as a Service Market was valued at USD 12.39 billion in 2024 and is projected to reach USD 30.9 billion by 2032, growing at a CAGR of 12.1%.

- Growing adoption of cloud-based project management and real-time collaboration tools is driving market demand across the global construction sector.

- The market is witnessing strong trends in AI integration, data analytics, and mobile-based SaaS platforms for improved project tracking and cost optimization.

- Leading players such as Trimble, Oracle, Autodesk, and Procore Technologies are focusing on scalable platforms, subscription models, and digital ecosystem expansion to strengthen competitiveness.

- North America led the market with a 36% share, followed by Asia-Pacific at 30% and Europe at 25%; by software type, the project management segment dominated with 42% share, driven by large-scale infrastructure and commercial projects requiring end-to-end digital management.

Market Segmentation Analysis:

By Type of Software

The project management segment dominated the Construction Software as a Service (SaaS) Market in 2024, holding a 42% market share. Its dominance is attributed to the widespread adoption of cloud-based project management platforms that streamline planning, scheduling, and resource allocation. These solutions enable real-time collaboration between contractors, architects, and engineers, improving efficiency and reducing delays. Growing demand for centralized data management and integration with Building Information Modeling (BIM) tools further drives this segment. The need for cost control, workflow transparency, and digital project execution continues to strengthen market growth in this category.

- For instance, Procore Technologies platform has been used on over three million projects in over 150 countries. It offers unlimited storage for documents, photos, and files, and provides a consolidated view of project data.

By Deployment Model

The public cloud segment led the Construction SaaS Market in 2024 with a 48% market share. Public cloud solutions are preferred for their scalability, lower upfront costs, and ease of access across multiple project sites. Construction firms increasingly rely on public cloud services to deploy collaborative software and manage large data volumes without maintaining physical servers. Vendors such as Autodesk and Procore are expanding cloud capabilities with enhanced data security and integration features. The flexibility of subscription-based models and reduced IT maintenance requirements are further fueling adoption among mid-sized and large enterprises.

- For instance, Autodesk operates its Autodesk Construction Cloud on AWS infrastructure, managing petabytes of construction data and supporting millions of users across many countries. The platform encrypts data using 256-bit AES security and provides scalable access, enabling secure, real-time synchronization of design and construction workflows for project teams.

By Application

The commercial construction segment accounted for the largest 46% market share in the Construction SaaS Market in 2024. This dominance stems from high demand for digital project management, cost estimation, and risk control tools across commercial buildings, offices, and retail developments. The need for transparent communication among stakeholders and compliance with safety standards drives the use of SaaS platforms. Rapid urbanization and smart infrastructure projects have increased digital adoption in this sector. Enhanced visualization, real-time reporting, and mobile accessibility are enabling construction firms to optimize timelines and resource utilization in commercial projects.

Key Growth Drivers

Rising Digitalization in Construction Operations

The rapid digital transformation of the construction industry is a major growth driver for the Construction Software as a Service (SaaS) Market. Cloud-based platforms are replacing traditional paper-based workflows, enabling real-time collaboration, cost tracking, and project visibility. Contractors and project managers are adopting SaaS tools for scheduling, document management, and performance analytics. The increasing emphasis on automation, remote access, and integrated communication systems is enhancing project efficiency. Government initiatives promoting digital infrastructure development are further accelerating SaaS adoption across global construction sectors.

- For instance, Trimble Inc.’s Construction One platform provides a suite of connected solutions that enable real-time access to financial, scheduling, and materials data for users across active construction projects.

Growing Demand for Cost and Time Efficiency

Construction projects face challenges related to budget overruns, delays, and resource inefficiencies. SaaS platforms help overcome these issues through data-driven decision-making and centralized project tracking. Real-time monitoring and predictive analytics allow managers to identify delays and optimize resource allocation. Cloud-based estimation and bidding tools also improve cost control and accuracy. As firms focus on minimizing operational waste and maximizing ROI, demand for construction SaaS solutions continues to grow, particularly among mid-sized and large enterprises managing complex projects.

- For instance, Oracle Construction and Engineering Cloud supports many enterprise clients through its Primavera Cloud and Aconex solutions. The platform integrates AI-driven analytics that proactively identify potential project risks and deviations from baseline schedules, helping construction firms maintain precise cost forecasting and efficient resource allocation across multiple job sites.

Expansion of Smart Infrastructure and Urban Development

Rising investments in smart cities and infrastructure modernization are driving SaaS adoption across the construction ecosystem. These projects require advanced planning, monitoring, and reporting tools, which cloud-based software efficiently provides. Governments and private developers are implementing digital construction management platforms to enhance coordination and transparency. Integration with IoT and BIM systems ensures real-time insights into asset performance. The need for sustainable construction practices and compliance tracking is further boosting demand for intelligent SaaS-based construction solutions globally.

Key Trends & Opportunities

Integration of AI and Predictive Analytics

Artificial intelligence and predictive analytics are reshaping the construction SaaS landscape by improving forecasting, safety, and decision-making. AI algorithms analyze project data to predict delays, cost variations, and equipment maintenance needs. These insights help optimize workflows and enhance productivity. SaaS providers are embedding AI-driven dashboards for better project visualization and resource optimization. The growing use of AI in design simulation and risk analysis is creating new opportunities for software vendors and construction companies focused on performance-based project execution.

- For instance, Bentley Systems integrated AI capabilities within its iTwin Platform, utilizing predictive analytics to identify asset deterioration trends. This enables early maintenance scheduling and helps reduce unplanned downtime across various infrastructure projects globally.

Rising Adoption of Mobile and Collaborative Platforms

Mobile-based SaaS platforms are gaining traction as construction teams increasingly work across remote and multi-site environments. These tools facilitate instant data sharing, task updates, and digital approvals through smartphones and tablets. Collaboration tools integrated with cloud-based systems enable seamless communication among architects, engineers, and contractors. The growing preference for mobile-first solutions supports on-site decision-making and faster project execution. This trend is expected to continue as companies prioritize agility, flexibility, and paperless project management.

- For instance, Sage Group offers its Sage Construction Management Mobile Suite, a cloud-based solution with apps for iOS and Android, for small to mid-sized contractors and subcontractors to manage projects and operations.

Key Challenges

High Implementation and Integration Costs

Despite their advantages, the initial setup and integration of SaaS platforms can be costly for small and mid-sized construction firms. Subscription fees, customization requirements, and data migration expenses often limit adoption. Integrating SaaS tools with legacy systems and existing enterprise software also poses technical challenges. These cost and compatibility barriers may slow adoption in developing regions, where budget constraints are common and awareness of digital construction solutions remains limited.

Data Security and Privacy Concerns

As construction companies increasingly rely on cloud platforms, data security remains a major concern. Sensitive project information, including financial data and architectural designs, is vulnerable to cyberattacks and breaches. Ensuring compliance with regional data protection regulations and maintaining secure cloud environments are key challenges for SaaS providers. Companies must invest in encryption, access control, and cybersecurity training to mitigate risks. Addressing these concerns is crucial for maintaining client trust and supporting long-term SaaS adoption in the construction sector.

Regional Analysis

North America

North America held a 36% market share in the Construction Software as a Service (SaaS) Market in 2024. The region’s leadership is supported by early adoption of digital technologies, strong investment in infrastructure, and the presence of leading SaaS providers. The United States dominates demand with widespread use of project management and cloud collaboration tools across large construction firms. The growing focus on automation, safety compliance, and remote monitoring drives SaaS integration in construction workflows. Increasing public and private sector projects continue to strengthen the region’s position as a key hub for software innovation in construction.

Europe

Europe accounted for a 27% market share in the Construction SaaS Market in 2024. The region’s growth is driven by strict construction regulations, emphasis on sustainability, and digitalization of public infrastructure projects. Countries such as Germany, the United Kingdom, and France are leading adopters of cloud-based project management and BIM-integrated platforms. The European Union’s initiatives promoting smart infrastructure and green building technologies further support market expansion. Growing collaboration between construction firms and software providers enhances project efficiency and transparency across complex urban development projects throughout the region.

Asia-Pacific

Asia-Pacific dominated the Construction Software as a Service Market in 2024, capturing a 30% market share. The region’s rapid urbanization, large-scale infrastructure projects, and rising investments in smart city initiatives are key drivers of market growth. China, India, and Japan are major contributors, supported by strong government funding and expanding construction activities. Local contractors and developers are increasingly adopting SaaS platforms for cost estimation, scheduling, and collaboration. The growing presence of cloud service providers and affordable digital solutions is accelerating adoption, positioning Asia-Pacific as a high-growth region for construction technology innovation.

Latin America

Latin America captured a 4% market share in the Construction SaaS Market in 2024. Market growth is supported by urban infrastructure development and modernization projects in Brazil, Mexico, and Chile. Increasing government spending on housing and public works is driving demand for digital construction management tools. Regional construction companies are adopting SaaS platforms to improve project coordination and compliance. The growing use of mobile-based software and cloud collaboration systems is enhancing productivity across mid-scale projects, while international software vendors are expanding partnerships to strengthen market presence in the region.

Middle East & Africa

The Middle East & Africa region held a 3% market share in the Construction SaaS Market in 2024. Growth is driven by large-scale infrastructure projects, smart city developments, and rapid construction expansion in the Gulf Cooperation Council (GCC) countries. Nations such as Saudi Arabia and the United Arab Emirates are adopting cloud-based software for planning and project control across megaprojects. Africa’s emerging construction sector is gradually embracing SaaS solutions to improve efficiency and cost management. Expanding digital infrastructure and investment in construction technology are expected to further boost market growth in this region.

Market Segmentations:

By Type of Software

- Project management

- Field service management

- Estimating and bidding

- Others

By Deployment Model

- Public cloud

- Private cloud

- Hybrid cloud

By Application

- Residential construction

- Commercial construction

- Infrastructure projects

By End-User

- General contractors

- Subcontractors

- Engineers and architects

- Builders & developers

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Construction Software as a Service (SaaS) Market includes key players such as Trimble, Oracle, Buildertrend, Procore Technologies, Sage Group, Jonas Construction Software, Bentley Systems, Newforma, Heavy Construction Systems Specialists (HCSS), and Autodesk. These companies lead the market through innovative software solutions that enhance project management, collaboration, and cost efficiency. Major players are focusing on developing cloud-based platforms with integrated AI, BIM, and IoT functionalities to support real-time decision-making. Strategic partnerships with construction firms, contractors, and technology providers are expanding their global reach. Additionally, companies are investing in product upgrades, mobile compatibility, and user-centric designs to meet the evolving needs of small to large construction enterprises. The competitive environment is further shaped by rising demand for scalable SaaS platforms that improve transparency, sustainability, and operational productivity across commercial and infrastructure projects.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In September 2025, Autodesk introduced Autodesk Forma, its first AI-native industry cloud for AECO, merging Autodesk Construction Cloud into a unified design-to-construction platform.

- In August 2025, Trimble released Construction One Analytics 2025 R6, which introduced a redesigned Job Cost Detail report and a new Spectrum Service Standard report for enhanced project financial visibility.

- In June 2025, Procore Technologies unveiled Procore Helix, an intelligence layer embedding AI across its platform to automate routine tasks and generate data-driven insights.

- In May 2025, Trimble launched Trimble Materials, a module within its Construction One suite to enable end-to-end procurement, inventory and accounts payable workflows.

Report Coverage

The research report offers an in-depth analysis based on Type of Software, Deployment Model, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will grow rapidly with rising adoption of cloud-based construction management platforms.

- AI and machine learning integration will enhance predictive project planning and risk assessment.

- Mobile-first SaaS solutions will gain traction among on-site construction teams for real-time updates.

- Data analytics and BIM integration will drive efficiency and collaboration across project lifecycles.

- Subscription-based pricing models will attract small and medium construction firms.

- Asia-Pacific will emerge as the fastest-growing region due to rapid infrastructure development.

- Sustainability-focused software tools will see higher demand for green construction management.

- Partnerships between SaaS providers and construction companies will expand digital ecosystems.

- Cybersecurity and data protection solutions will become critical for SaaS platform reliability.

- Continuous innovation in automation and interoperability will redefine competitiveness in digital construction.