Market Overview

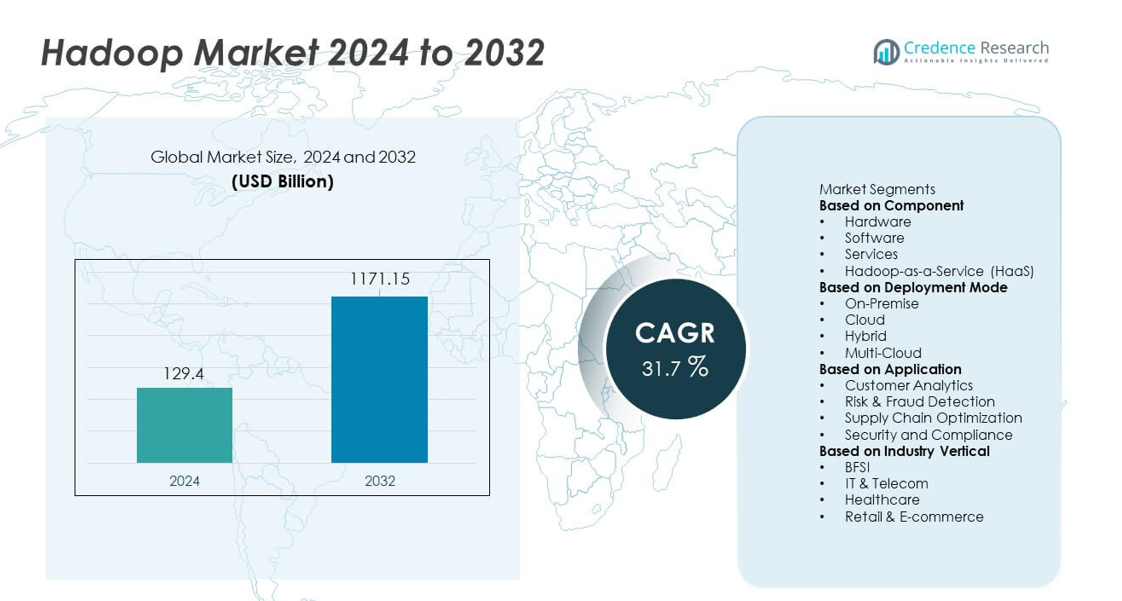

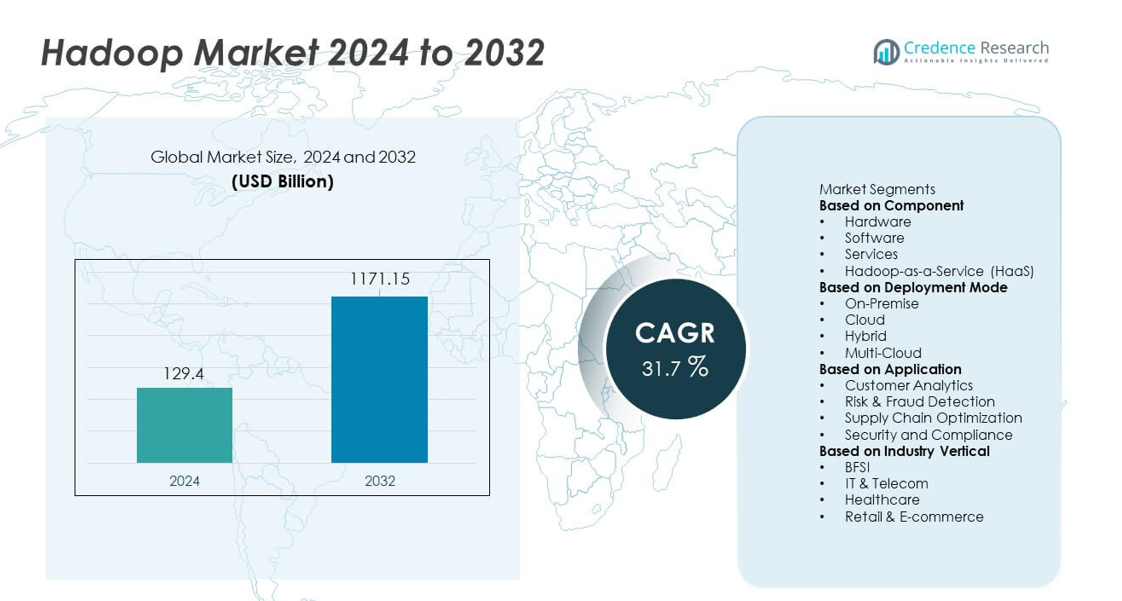

The Hadoop market size reached USD 129.4 billion in 2024 and is expected to grow significantly, reaching USD 1171.15 billion by 2032, driven by a robust CAGR of 31.7% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Hadoop Market Size 2024 |

USD 129.4 billion |

| Hadoop Market, CAGR |

31.7% |

| Hadoop Market Size 2032 |

USD 1171.15 billion |

The Hadoop market is driven by leading players such as Cloudera Inc., Amazon Web Services (AWS), IBM Corporation, Microsoft Corporation, Google LLC, Oracle Corporation, Hortonworks, Teradata Corporation, Databricks, and MapR Technologies, all of which focus on scalable big data platforms, cloud integration, and advanced analytics capabilities. These companies strengthen their portfolios through managed Hadoop services, AI-enabled processing, and multi-cloud architectures that support large enterprise workloads. North America leads the global market with a 36% share, supported by strong digital transformation investments and early technology adoption, while Asia Pacific and Europe continue to expand due to rising data volumes and increasing enterprise reliance on real-time analytics.

Market Insights

- The Hadoop market reached USD 129.4 billion in 2024 and is set to grow at a 31.7% CAGR through 2032, driven by strong demand for scalable data processing and advanced analytics.

- Key drivers include rapid enterprise digitalization, rising demand for real-time analytics, and expanding cloud deployments that strengthen the dominance of the software segment with a 41% market share.

- Major trends include increased integration of Hadoop with AI, machine learning, and multi-cloud architectures, along with growing adoption of managed Hadoop services for simplified deployment.

- Competitive intensity rises as leading players invest in cloud-native enhancements, security upgrades, and open-source innovations, while restraints include skill shortages, deployment complexity, and data governance challenges.

- Regionally, North America holds 36%, Asia Pacific 29%, Europe 27%, Latin America 5%, and Middle East & Africa 3%, reflecting diverse adoption levels influenced by digital maturity, cloud penetration, and industry-specific analytics needs.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Component

Software leads the component segment with a 41% market share, driven by rapid adoption of Hadoop Distributed File System (HDFS), MapReduce, and YARN to manage large-scale data workloads. Enterprises rely on these tools to improve data processing speed, enable real-time analytics, and support cost-efficient storage. Services experience strong demand as organizations require consulting, integration, and support to implement complex big data ecosystems. Hardware contributes to ongoing cluster expansion, while Hadoop-as-a-Service (HaaS) grows due to cloud-based scalability needs. Increasing digital transformation and rising unstructured data volumes strengthen software dominance across global industries.

- For instance, Cloudera expanded its CDP Private Cloud clusters to support over 600 nodes in a single deployment, helping large firms scale analytics workloads.

By Deployment Mode

Cloud deployment dominates this segment with a 48% market share, supported by flexibility, reduced infrastructure costs, and rapid cluster provisioning. Enterprises prefer cloud-based Hadoop clusters to scale workloads dynamically and improve analytics performance. Hybrid deployment expands as organizations combine on-premise security with cloud agility to optimize costs. Multi-cloud adoption rises as businesses reduce vendor lock-in and enhance data resilience. On-premise deployments remain relevant in industries with strict compliance needs. Growing preference for distributed storage, elastic processing, and cost-efficient resource management reinforces cloud’s leadership in the Hadoop market.

- For instance, Microsoft Azure HDInsight scaled its managed Hadoop clusters to more than 1,000 nodes, allowing large firms to run heavy analytics jobs.

By Application

Customer analytics leads the application segment with a 37% market share, driven by increasing use of Hadoop to analyze behavioral patterns, transactional records, and multi-source digital interactions. Enterprises leverage insights from structured and unstructured data to enhance personalization, improve retention, and strengthen decision-making. Risk and fraud detection grows as financial institutions use Hadoop clusters to process high-volume datasets in real time. Supply chain optimization benefits from predictive analytics and inventory visibility, while security and compliance applications expand due to rising data governance needs. Demand for big data-driven strategies strengthens customer analytics dominance.

Key Growth Driver

Rising Adoption of Big Data Analytics Across Industries

The Hadoop market grows rapidly as enterprises manage rising volumes of structured and unstructured data generated from digital platforms, sensors, and business applications. Hadoop’s distributed processing architecture enables faster insights, cost-efficient storage, and real-time analytics at scale. Organizations in BFSI, retail, healthcare, and telecom rely on Hadoop to enhance forecasting, customer understanding, and operational efficiency. The need for scalable analytics platforms intensifies as companies pursue digital transformation. Hadoop’s ability to support diverse data types and high-volume workloads positions it as a core technology for enterprise data modernization.

- For instance, IBM enhanced its data analytics capabilities to support fraud-detection workloads that scan vast transaction streams in real-time across BFSI users.

Expansion of Cloud-Based Hadoop Deployments

Cloud adoption accelerates Hadoop growth as businesses seek flexible, on-demand infrastructure to manage fluctuating data workloads. Cloud-based Hadoop clusters reduce hardware investment, improve scalability, and support rapid deployment, making them ideal for analytics-driven industries. Integration with major cloud providers enhances accessibility and performance. Companies increasingly migrate from legacy systems to cloud-native architectures to streamline data operations. This shift enables faster experimentation, improved processing efficiency, and lower operational costs. The widespread availability of Hadoop-as-a-Service further strengthens cloud-driven market expansion.

- For instance, AWS EMR optimized its autoscaling engine to support clusters exceeding 4,000 nodes, enabling faster data processing for large enterprises.

Increasing Need for Real-Time Data Processing and Decision-Making

Enterprises demand real-time insights to support immediate decision-making in areas such as fraud detection, supply chain visibility, and customer engagement. Hadoop frameworks, combined with tools like Spark and Kafka, enable high-speed data ingestion and processing. This capability helps organizations predict trends, respond quickly to market changes, and optimize operational performance. Industries with time-sensitive operations benefit from faster analytics outputs and improved automation. As businesses invest more in AI and machine learning, the demand for real-time big data processing strengthens Hadoop’s strategic importance across global markets.

Key Trend & Opportunity

Growing Integration of Hadoop with AI and Machine Learning

Hadoop adoption expands as enterprises integrate machine learning pipelines and AI-driven analytics into big data ecosystems. Hadoop’s scalable storage and processing capabilities support complex model training, enabling organizations to leverage predictive insights for automation, segmentation, and risk evaluation. Combining Hadoop with advanced frameworks enhances data exploration and speeds up innovation cycles. Industries use these integrations to improve customer experiences, optimize operations, and increase revenue opportunities. As AI investments grow, companies gain new opportunities to build smarter, more adaptive data platforms powered by Hadoop infrastructure.

- For instance, Databricks integrated optimized data connectors into its lakehouse platform, which is used to support numerous machine learning training jobs, consequently improving pipeline efficiency for global enterprises.

Rising Demand for Multi-Cloud and Hybrid Data Architectures

Hybrid and multi-cloud environments present strong opportunities as organizations seek greater flexibility, cost control, and data resilience. Hadoop integrates well with distributed cloud infrastructures, enabling seamless data movement and workload optimization. Enterprises adopt multi-cloud setups to avoid vendor lock-in and improve disaster recovery. This trend supports the expansion of Hadoop clusters across public, private, and edge environments. As businesses modernize IT environments, multi-cloud strategies offer scalable solutions that enhance performance and accelerate digital transformation. The shift toward flexible architectures strengthens Hadoop’s long-term market potential.

- For instance, Google Dataproc enhanced big data analytics by providing a managed service to run Spark and Hadoop clusters on Google Cloud.

Key Challenge

Complexity in Deployment and Skilled Workforce Shortage

Hadoop implementation requires advanced technical expertise, including cluster configuration, security management, and optimization. Many organizations struggle with deployment complexity due to limited availability of trained professionals. Maintenance challenges, such as monitoring distributed nodes and ensuring system reliability, increase operational burden. Smaller businesses face difficulties integrating Hadoop with existing IT ecosystems. Skill shortages also slow project timelines and raise adoption costs. Without adequate technical support, enterprises may experience performance limitations. The need for skilled engineers and simplified deployment models remains a significant challenge for widespread Hadoop adoption.

Data Security, Governance, and Compliance Limitations

Hadoop environments face security concerns due to distributed architectures that require strict access control, encryption, and monitoring. Industries with sensitive data encounter compliance challenges, as Hadoop lacks native features to meet all regulatory standards. Ensuring data integrity and confidentiality across clusters increases complexity. Misconfigurations or inadequate security protocols can result in breaches or unauthorized access. Organizations must invest in governance frameworks to maintain auditability and regulatory compliance. These challenges restrict adoption in highly regulated sectors and require enhanced security integration to ensure safe enterprise-wide deployment.

Regional Analysis

North America

North America leads the Hadoop market with a 36% share, driven by strong adoption of big data analytics, cloud integration, and AI-driven enterprise applications. Companies in BFSI, healthcare, and retail rely on Hadoop to manage large datasets and enable real-time decision-making. The region benefits from mature IT infrastructure, strong presence of leading technology vendors, and high investment in digital transformation. Cloud-based Hadoop deployments grow rapidly due to the dominance of major cloud providers. Increasing demand for advanced analytics, cybersecurity enhancement, and data governance solutions continues to strengthen Hadoop adoption across the United States and Canada.

Europe

Europe holds a 27% market share, supported by expanding data regulations, enterprise modernization, and growing use of analytics platforms across key industries. Countries such as Germany, the United Kingdom, and France invest heavily in scalable data processing technologies to improve operational efficiency and meet compliance requirements. Hadoop adoption grows as organizations integrate AI, IoT, and automation solutions into digital business frameworks. Growth in cloud migration further supports advanced data management initiatives. Strong focus on data privacy and sustainability influences technology choices, driving steady expansion of Hadoop across European enterprises.

Asia Pacific

Asia Pacific accounts for a 29% share, driven by large-scale digitalization, rapid cloud adoption, and increasing investment in AI and analytics across emerging economies. China, India, Japan, and South Korea lead Hadoop deployment due to expanding digital services and rising enterprise data volumes. The region benefits from a strong technology ecosystem, growing IT spending, and increasing reliance on data-driven decision-making. Hadoop supports key applications such as customer analytics, fraud detection, and supply chain optimization. Fast-growing startups and enterprises accelerate market growth, making Asia Pacific a major contributor to global Hadoop expansion.

Latin America

Latin America holds an 5% market share, driven by rising adoption of cloud-based analytics and increasing digital transformation across banking, telecom, and retail sectors. Countries such as Brazil, Mexico, and Colombia invest in scalable data platforms to improve operational efficiency and customer insights. Hadoop helps organizations manage growing digital user activity and transactional data. Despite budget constraints and limited technical expertise in some markets, cloud deployments support wider accessibility. Government digitalization programs and expanding e-commerce activity contribute to steady Hadoop adoption across the region.

Middle East & Africa

The Middle East & Africa region represents a 3% share, supported by gradual adoption of big data platforms, growing cloud infrastructure, and increasing interest in analytics for security and financial applications. The UAE, Saudi Arabia, and South Africa lead market activity with strong investments in digital transformation and smart city initiatives. Hadoop supports data-intensive sectors such as oil and gas, banking, and telecommunications. Although overall adoption remains moderate due to skill shortages and budget limitations, expanding cloud services and rising enterprise modernization create long-term growth opportunities for Hadoop technologies.

Market Segmentations:

By Component

- Hardware

- Software

- Services

- Hadoop-as-a-Service (HaaS)

By Deployment Mode

- On-Premise

- Cloud

- Hybrid

- Multi-Cloud

By Application

- Customer Analytics

- Risk & Fraud Detection

- Supply Chain Optimization

- Security and Compliance

By Industry Vertical

- BFSI

- IT & Telecom

- Healthcare

- Retail & E-commerce

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Hadoop market is shaped by major players such as Cloudera Inc., Amazon Web Services (AWS), IBM Corporation, Microsoft Corporation, Google LLC, Oracle Corporation, Hortonworks, Teradata Corporation, Databricks, and MapR Technologies, each contributing to advancements in big data processing and analytics. These companies compete by enhancing scalability, performance, and cloud integration within Hadoop ecosystems. Investments in AI-driven analytics, real-time processing frameworks, and multi-cloud compatibility strengthen their market positioning. Strategic partnerships, open-source contributions, and enterprise-focused solutions drive innovation. Vendors also expand managed Hadoop services to simplify deployment for large enterprises. Rising demand for security, governance, and automation encourages continuous product enhancements. Emerging players challenge established vendors through cost-efficient solutions and niche Hadoop applications, intensifying competition in a rapidly evolving data-processing landscape.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Cloudera Inc.

- Amazon Web Services (AWS)

- IBM Corporation

- Microsoft Corporation

- Google LLC

- Oracle Corporation

- Hortonworks (now part of Cloudera)

- Teradata Corporation

- Databricks

- MapR Technologies (acquired by HPE)

Recent Developments

- In April 2025, IBM released Version 5.1.3 of the IBM Software Hub, which included an update to IBM watsonx.data (Version 2.1.3).

- In December 2024, Cloudera Inc. launched significant Cloudera Data Platform (CDP) 7.3.1 updates as a unified stable release for both cloud and on-premises environments.

Report Coverage

The research report offers an in-depth analysis based on Component, Deployment Mode, Application, Industry Vertical and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Hadoop adoption will grow as enterprises expand real-time analytics and data-driven strategies.

- Cloud-based Hadoop deployments will accelerate as companies prioritize scalability and cost efficiency.

- Integration with AI and machine learning will strengthen advanced analytics capabilities.

- Multi-cloud and hybrid architectures will become standard for enterprise data management.

- Demand for managed Hadoop services will increase as businesses reduce operational complexity.

- Security, governance, and compliance enhancements will gain priority in large-scale deployments.

- Industry-specific Hadoop solutions will grow across BFSI, healthcare, telecom, and retail.

- Edge computing integration will expand to support faster data processing at distributed locations.

- Open-source ecosystem advancements will continue to drive innovation and flexibility.

- Emerging markets in Asia Pacific and Latin America will experience faster adoption as digital transformation accelerates.