Market Overview

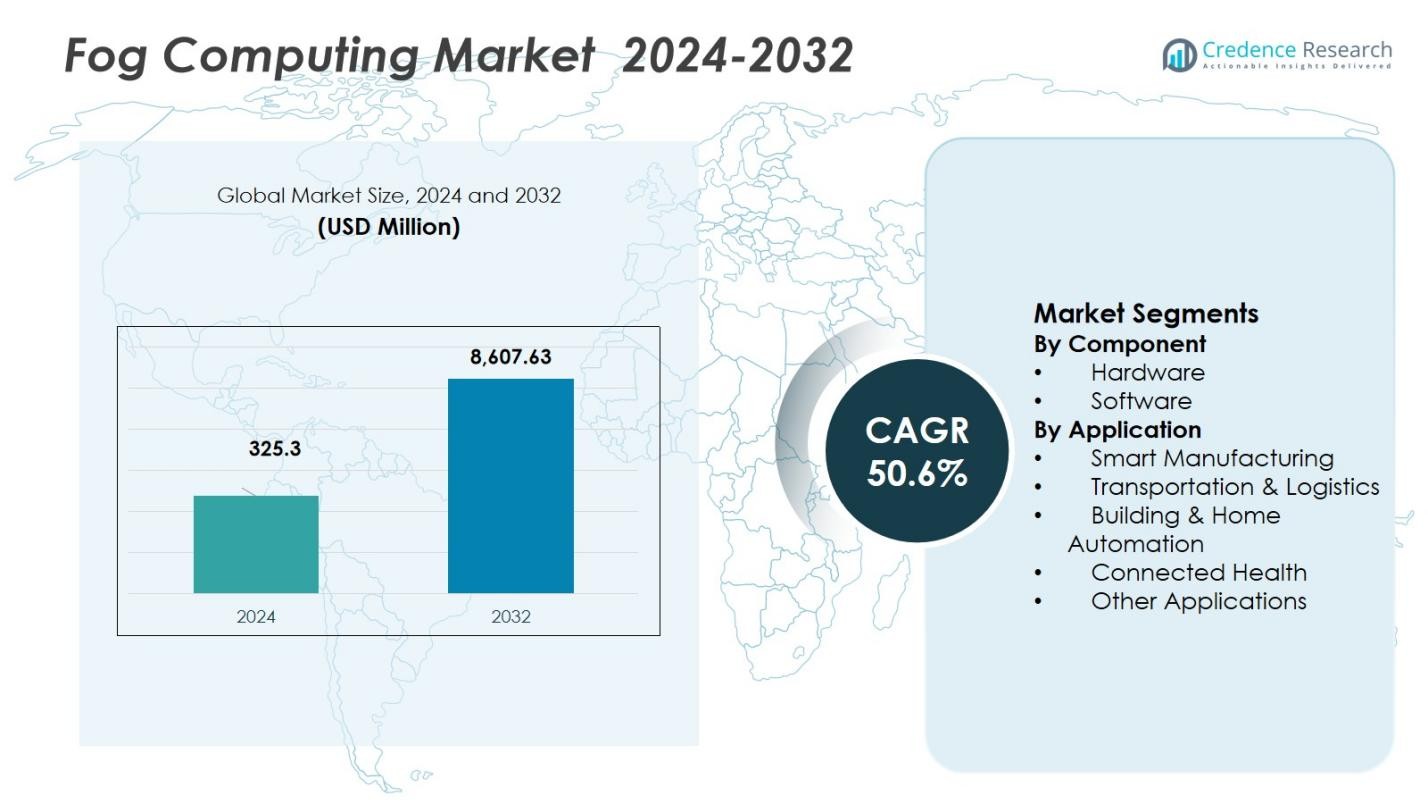

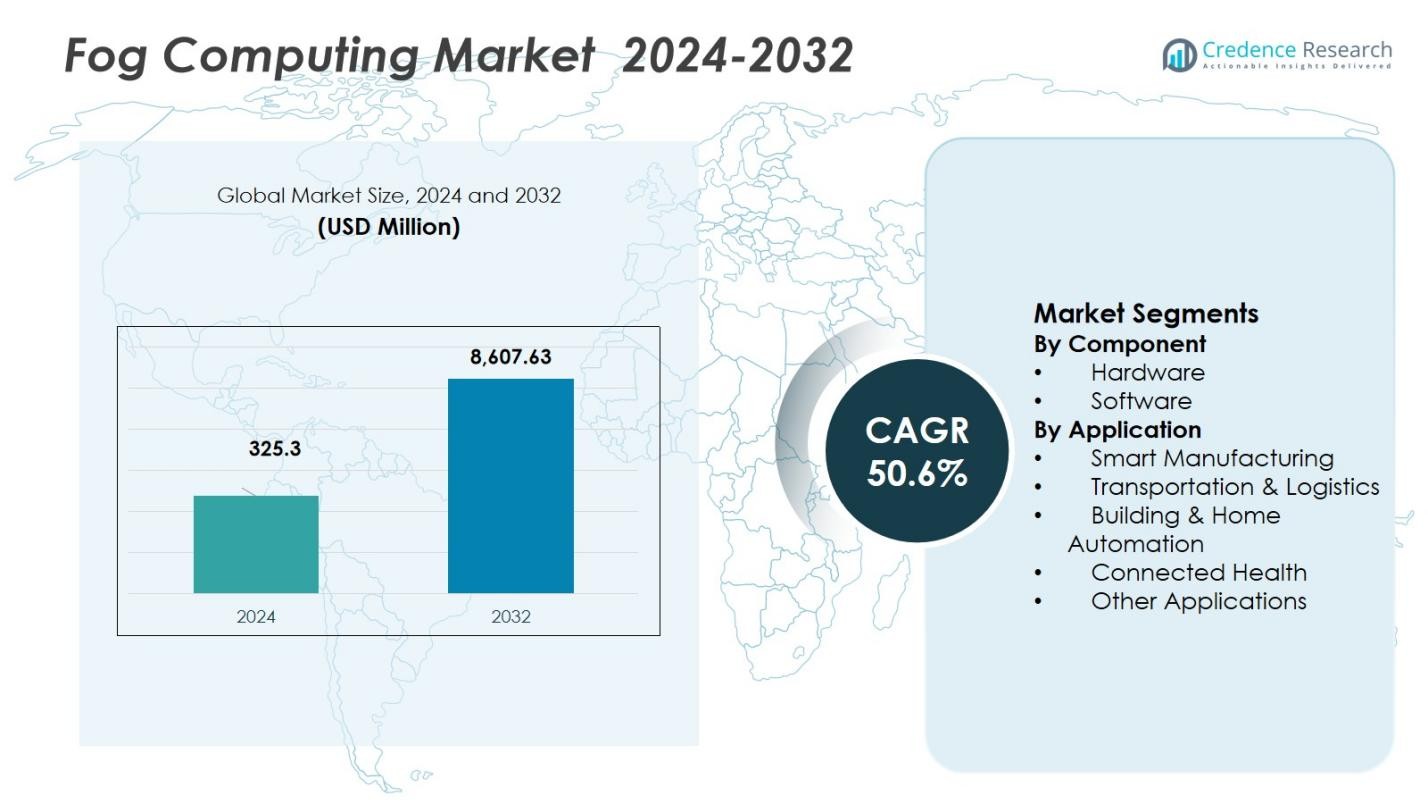

The Fog Computing Market size was valued at USD 325.3 Million in 2024 and is anticipated to reach USD 8,607.63 Million by 2032, at a CAGR of 50.6% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Fog Computing Market Size 2024 |

USD 325.3 Million |

| Fog Computing Market, CAGR |

50.6% |

| Fog Computing Market Size 2032 |

USD 8,607.63 Million |

Fog Computing Market sees leading involvement from companies such as Cisco, IBM, Intel, Microsoft, and GE, which drive innovation and deployment of fog‑edge solutions across global markets. In 2024, the region leading in adoption is North America, capturing 44.6% of the global market share, fueled by its advanced digital infrastructure, early 5G penetration, strong IoT adoption across sectors, and the presence of major technology firms. Asia Pacific and Europe follow as important growth regions, while emerging demand in Latin America and Middle East & Africa adds further global depth.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Fog Computing Market was valued at USD 325.3 Million in 2024 and is projected to reach USD 8,607.63 Million by 2032, growing at a CAGR of 50.6% during the forecast period.

- The market is driven by increasing IoT adoption, real-time data processing requirements, and the need for enhanced data security and privacy, particularly in industries like manufacturing, healthcare, and smart cities

- Key trends include the integration of AI and machine learning with fog computing, enabling faster decision-making and automation across sectors, while the expansion of smart cities and infrastructure presents significant growth opportunities.

- The market faces challenges such as integration complexities with existing infrastructure and concerns around data management and scalability, which could hinder growth if not addressed.

- North America holds the largest market share at 44.6%, followed by Asia Pacific with 30.2%, Europe with 18.4%, Latin America with 4.1%, and the Middle East & Africa at 2.7%.

Market Segmentation Analysis:

Market Segmentation Analysis:

By Component

The Fog Computing Market is divided into hardware and software components. The hardware segment holds the dominant share of 58.2% in 2024. This dominance is attributed to the rising demand for edge computing devices, networking equipment, and sensors that facilitate real-time data processing. As industries like smart manufacturing and transportation increasingly adopt IoT technologies, the need for low-latency, localized data processing continues to drive hardware growth. The increasing reliance on edge devices to enhance performance and reduce latency is expected to fuel further demand in this segment throughout the forecast period.

- For instance, Cisco’s IOx platform enables real-time analytics on routers and switches deployed in industrial environments, reducing latency and bandwidth use.

By Application

In the application segment, smart manufacturing is the leading sub-segment, capturing a 34.5% market share in 2024. The growth of smart manufacturing is propelled by the adoption of Industry 4.0, which focuses on automation and real-time analytics for improved operational efficiency. Fog computing enables real-time decision-making, predictive maintenance, and optimized supply chain management, further boosting its adoption in manufacturing processes. As industries look to minimize downtime and increase productivity, the smart manufacturing application is expected to remain a key driver of the fog computing market’s expansion.

- For instance, General Electric’s Predix system processes industrial IoT data at the network edge to optimize equipment performance and maintenance schedules.

Key Growth Drivers

Increasing IoT Adoption

The rapid expansion of the Internet of Things (IoT) is one of the primary growth drivers for the Fog Computing Market. As more devices become interconnected, there is a growing need for edge computing to handle large volumes of data generated at the device level. Fog computing allows for real-time processing and analytics closer to the data source, reducing latency and improving operational efficiency. This has led to widespread adoption across industries such as manufacturing, healthcare, and transportation, fueling the market’s growth.

- For instance, Cisco Systems implements fog computing in manufacturing for real-time operational analytics and predictive maintenance, allowing faster machine failure detection and reducing downtime.

Demand for Real-time Data Processing

The increasing need for real-time data processing is a significant driver of fog computing adoption. Traditional cloud computing models often face challenges related to latency, especially in applications requiring immediate responses, such as autonomous vehicles and industrial automation. Fog computing enables local processing, which drastically reduces delays and enhances system performance. Industries like manufacturing, healthcare, and logistics are particularly driven by the need for immediate insights and actions based on the data collected from IoT devices.

- For instance, Rockwell Automation applies fog computing to enhance machine control and reduce downtime by enabling predictive maintenance through local data processing, reducing latency in manufacturing environments.

Enhanced Security and Privacy Concerns

With the growing number of connected devices, there is an increasing demand for enhanced security and privacy in data management. Fog computing addresses these concerns by processing data locally at the edge, minimizing the risk of sensitive information being exposed or transmitted over long distances. This decentralized approach reduces the likelihood of data breaches and enhances compliance with stringent data protection regulations. As privacy and security concerns continue to rise, fog computing presents an attractive solution for industries dealing with sensitive data.

Key Trends & Opportunities

Integration with AI and Machine Learning

The integration of artificial intelligence (AI) and machine learning (ML) technologies with fog computing is creating significant opportunities. AI and ML models require substantial data processing, which fog computing facilitates by enabling real-time analytics at the edge. This integration allows for faster decision-making, predictive maintenance, and automation in various sectors, including manufacturing, healthcare, and logistics. As businesses increasingly adopt AI and ML, the demand for fog computing solutions that support these technologies will continue to grow, driving market expansion.

- For instance, IBM’s Watson IoT platform uses fog computing to analyze data from connected devices, enabling real-time predictive maintenance and alert generation in the manufacturing sector.

Expansion in Smart Cities and Infrastructure

Fog computing presents considerable opportunities in the development of smart cities and intelligent infrastructure. With the increasing deployment of IoT devices across urban landscapes, there is a growing need for localized data processing to manage systems like traffic, energy, and public safety. Fog computing helps cities process vast amounts of real-time data, improving efficiency and reducing response times in critical operations. As governments and private entities invest in smart city initiatives, the fog computing market is expected to experience substantial growth in this domain.

- For instance, companies such as PrismTech have be applied fog computing in smart city IoT infrastructures, focusing on reducing data transmission delays in public safety and environmental monitoring systems, thus enabling faster emergency responses and better resource utilization.

Key Challenges

Integration Complexities

One of the major challenges facing the Fog Computing Market is the complexity involved in integrating fog computing systems with existing infrastructure. Many organizations still rely on traditional cloud computing models and face technical barriers when transitioning to edge-based solutions. Integrating fog computing with legacy systems often requires significant investment in hardware, software, and skilled personnel. These integration challenges can delay adoption, particularly for small and medium-sized enterprises (SMEs) that lack the resources to overhaul their infrastructure.

Data Management and Scalability

As the number of connected devices continues to increase, managing the massive volumes of data generated becomes a critical challenge. Fog computing aims to address this issue by processing data closer to the source, but scalability remains a concern. Ensuring that fog computing systems can handle the growing amount of data generated by IoT devices without sacrificing performance or reliability is essential. Companies must invest in scalable solutions that can accommodate future growth, which may involve complex technical development and higher costs.

Regional Analysis

North America

North America leads the global fog computing market, with a market share of 44.6% in 2024. The region’s advanced digital infrastructure, early adoption of IoT and 5G technologies, and substantial investments in smart city, healthcare, manufacturing, and logistics sectors drive this dominance. A dense presence of major technology players and strong R&D ecosystems further support rapid deployment and innovation in fog computing solutions. High demand for low‑latency processing and local data analytics across industries positions North America as a core hub for current and future fog‑computing growth, capturing the largest market share.

Asia Pacific

The Asia Pacific region is emerging as a rapidly expanding market for fog computing, holding a market share of 30.2% in 2024. This growth is fueled by industrialization, smart‑city initiatives, and widespread IoT adoption across countries like China, India, Japan, and South Korea. Growing investments in infrastructure, digital transformation in manufacturing, and government‑led smart city programs support this upward trend. Asia Pacific captures a significant portion of emerging demand and is often cited as the fastest‑growing regional market for fog computing, reflecting strong growth momentum and increasing deployment across multiple sectors.

Europe

Europe holds a market share of 18.4% in the fog computing market in 2024. The region maintains a stable presence, supported by increasing adoption of IoT, growing industrial automation, and expanding smart city and connected‑services initiatives across major economies. Regulatory emphasis on data privacy and local processing, along with rising digital infrastructure investments, drives interest in fog solutions. As organizations across manufacturing, healthcare, and public services seek low‑latency edge computing, Europe remains a significant contributor to the overall global market, providing a balanced mix of demand and steady growth.

Latin America

Latin America contributes to the fog computing market with a share of 4.1% in 2024. The market is seeing gradual uptake of IoT and edge computing solutions, particularly in urban infrastructure, industrial installations, and emerging smart‑city projects. Though its overall market share is smaller compared with regions like North America and Asia Pacific, growing awareness of latency‑sensitive applications, expanding digital infrastructure, and rising demand for localized data processing in industrial and utility sectors indicate incremental growth potential. Market expansion in this region remains contingent on increased investments and broader adoption of connected technologies.

Middle East & Africa

The Middle East & Africa region holds a market share of 2.7% in 2024. This region presents growing opportunities for fog computing, driven by expanding network connectivity, investments in urban infrastructure, and rising demand for real-time data processing in smart‑city, energy, and transportation applications. Although current adoption is moderate compared to leading regions, improving digital infrastructure, increased IoT penetration, and government initiatives towards modernization and urbanization project this region as a potential growth frontier. The region is poised for steady market development as edge computing awareness and deployment increase over the forecast period.

Market Segmentations:

By Component

By Application

- Smart Manufacturing

- Transportation & Logistics

- Building & Home Automation

- Connected Health

- Other Applications

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

Competitive landscape in the Fog Computing Market is driven by major players such as Cisco, IBM, Intel, Microsoft, and GE, all of which are actively innovating and expanding their market presence. These companies leverage strong R&D capabilities, strategic partnerships, and acquisitions to enhance their product portfolios. Cisco, for example, focuses on providing networking solutions that enable seamless edge and fog computing deployments, while IBM emphasizes its AI-driven edge computing solutions. Similarly, Intel is at the forefront of providing hardware components, including processors and networking technologies that support fog infrastructure. Microsoft, with its Azure IoT platform, plays a pivotal role in offering cloud‑edge hybrid solutions, and GE integrates industrial applications with its Predix platform. As fog computing adoption accelerates across industries such as manufacturing, healthcare, and smart cities, competition intensifies, with these key players vying for market leadership by addressing growing demands for low‑latency, secure, and scalable computing solutions.

Key Player Analysis

- Cisco

- IBM

- GE

- Dell

- Inte

- ARM Holdings

- Schneider

- Microsoft

- FogHorn

- Fujitsu

Recent Developments

- In November 2025, Cisco launched its new platform Cisco Unified Edge, a fog‑edge computing solution designed to run AI workloads at the edge- in locations such as retail stores, factories, and healthcare facilities – bringing compute, networking, storage, and security closer to where data is generated.

- In November 2025, Intel collaborated with Cisco to power the Unified Edge platform using its Xeon 6 SoCs, delivering a first‑of‑its‑kind integrated infrastructure for real‑time AI inferencing and edge computing.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Component, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The demand for fog computing will continue to grow as industries increasingly adopt IoT and edge computing technologies.

- Real-time data processing capabilities will become critical for businesses across sectors like manufacturing, healthcare, and transportation.

- With the rise of smart cities, fog computing will play a key role in managing urban infrastructure and public services efficiently.

- The integration of AI and machine learning with fog computing will enhance automation and decision-making processes in various applications.

- The growing need for enhanced data privacy and security will drive the adoption of decentralized fog computing systems.

- Fog computing will become integral in industries requiring low-latency processing, such as autonomous vehicles and industrial automation.

- As 5G networks expand, fog computing will benefit from faster data transmission and better performance in real-time applications.

- Increased investments in edge computing infrastructure will create new growth opportunities for fog computing solutions

- Cloud providers will continue to offer hybrid fog-cloud solutions, creating seamless environments for data processing and storage.

- The market will see a rise in strategic partnerships, acquisitions, and innovations as players compete for dominance in the fog computing space.

Market Segmentation Analysis:

Market Segmentation Analysis: