Market Overview

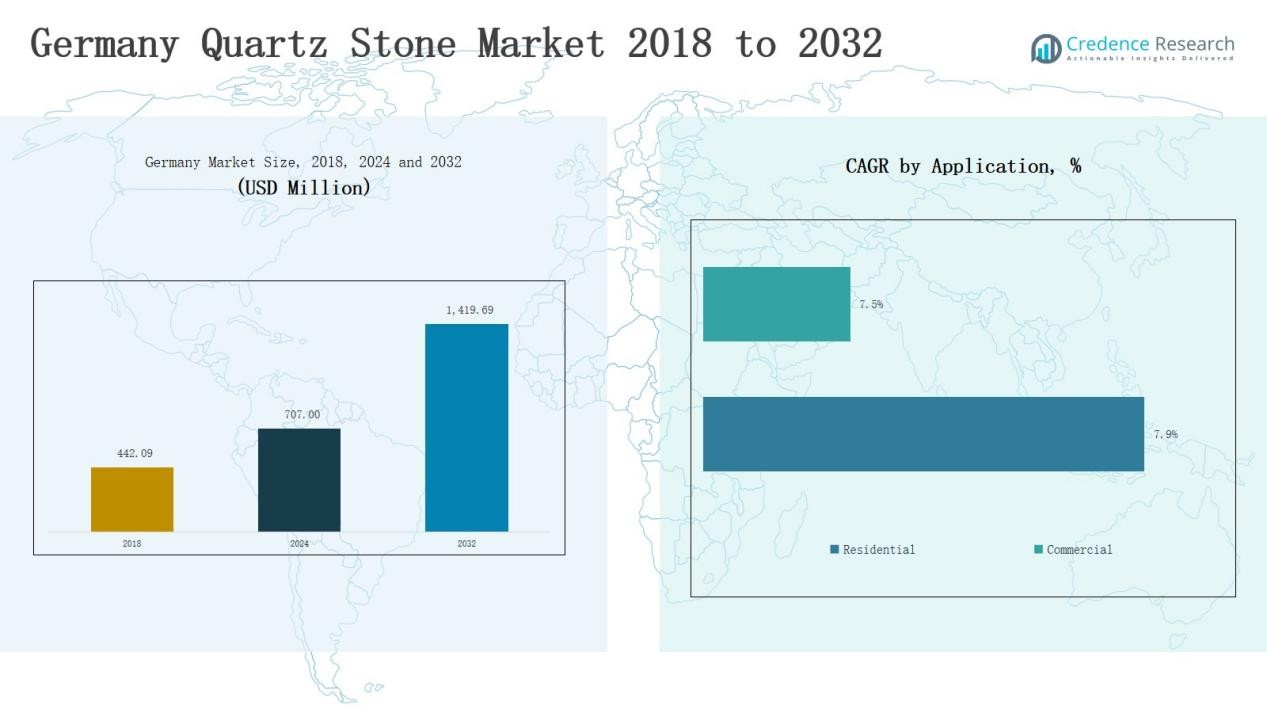

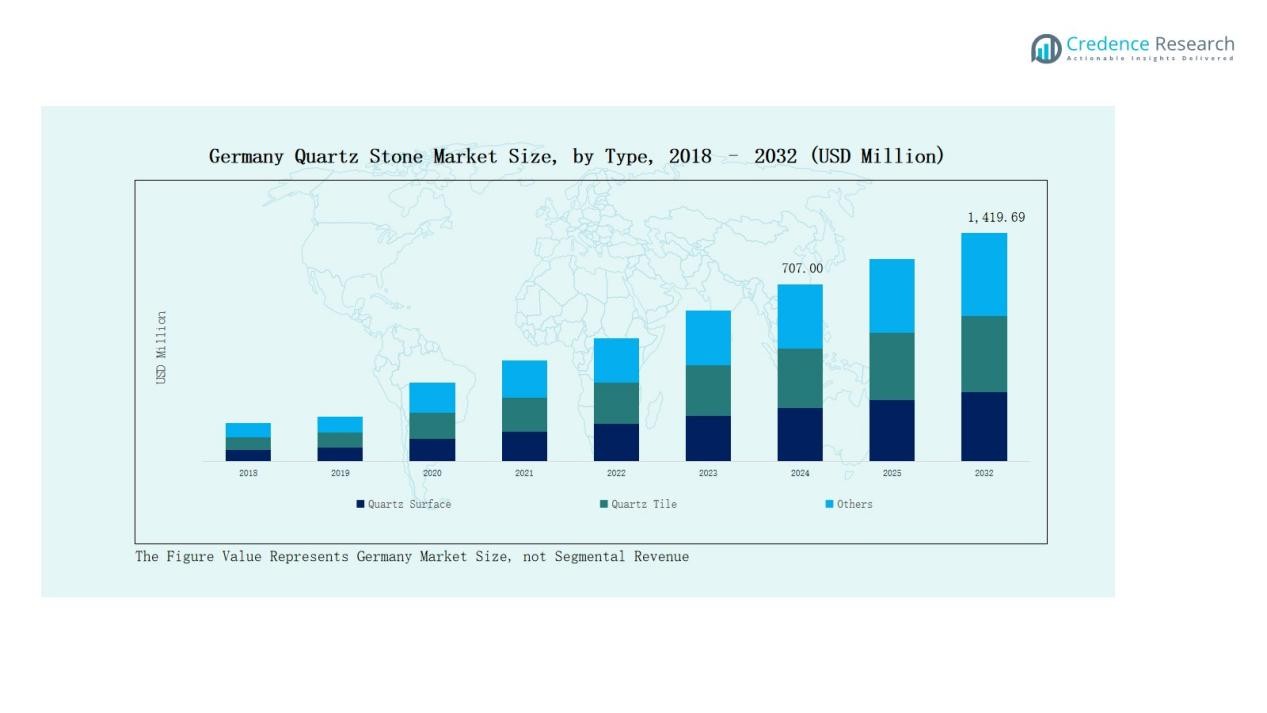

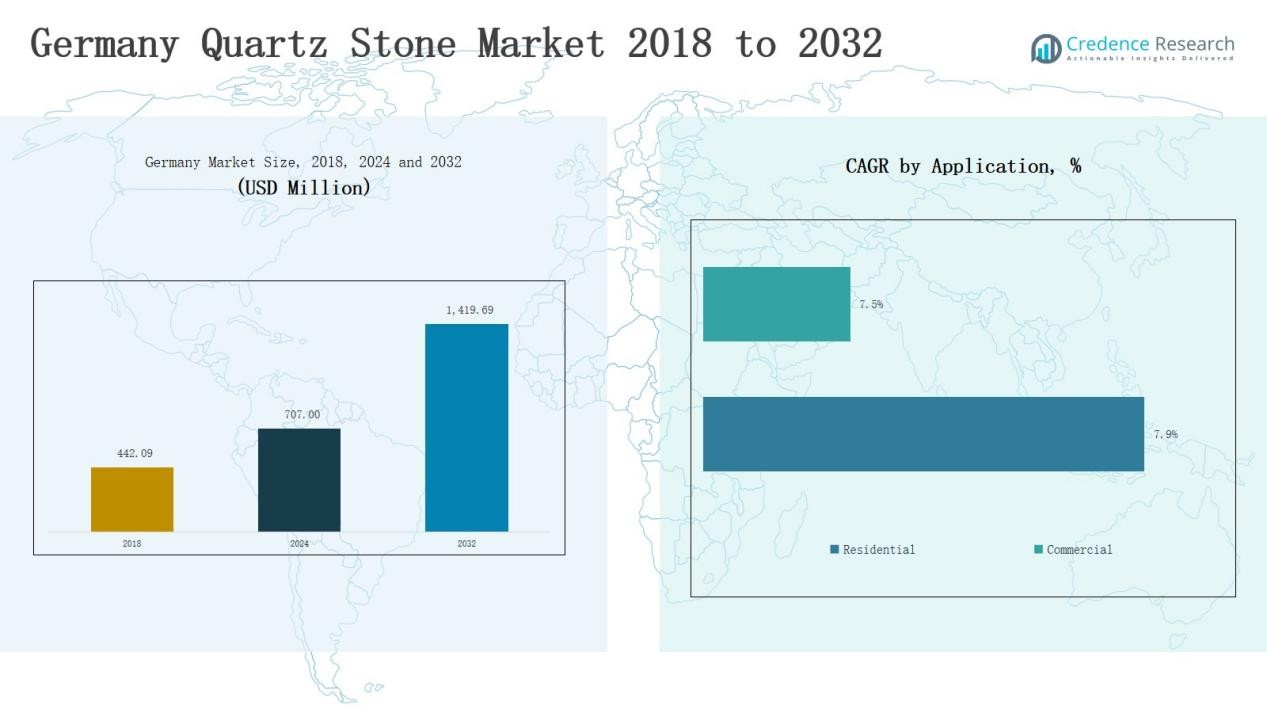

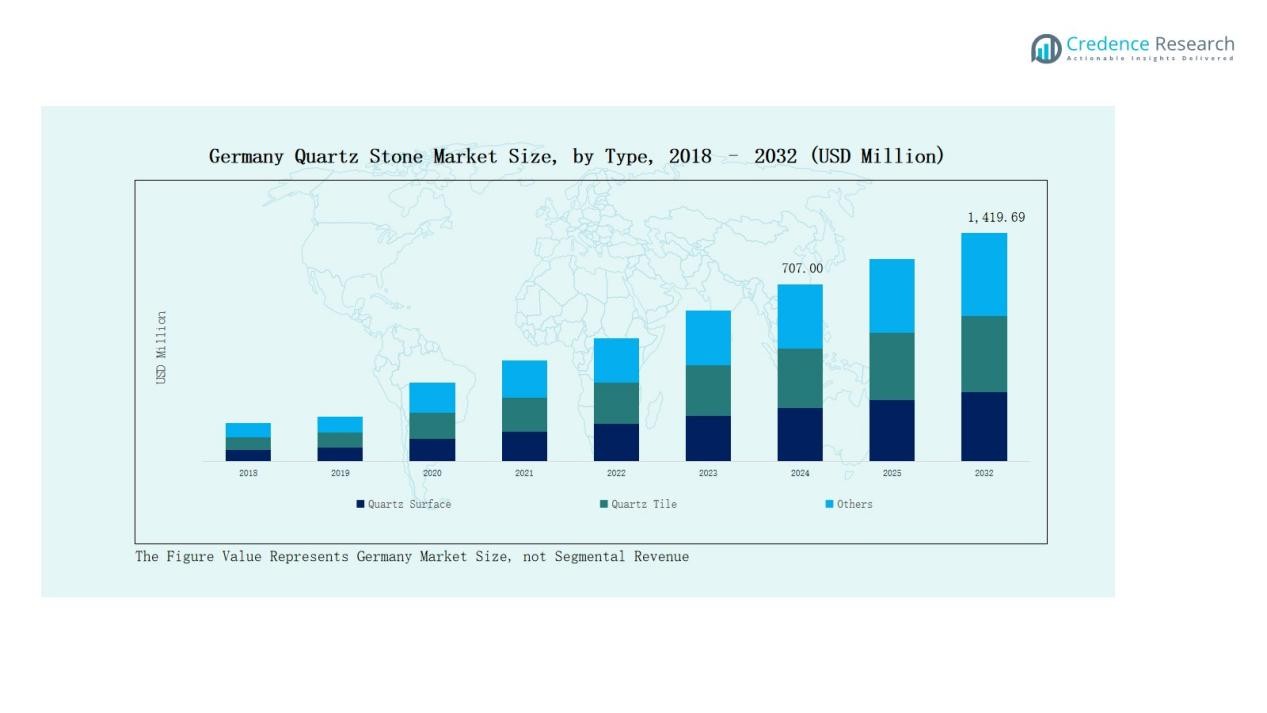

The Germany Quartz Stone Market size was valued at USD 442.09 million in 2018, increased to USD 707.00 million in 2024, and is anticipated to reach USD 1,419.69 million by 2032, growing at a CAGR of 9.11% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Germany Quartz Stone Market Size 2024 |

USD 707.00 Million |

| Germany Quartz Stone Market, CAGR |

9.11% |

| Germany Quartz Stone Market Size 2032 |

USD 1,419.69 Million |

The Germany Quartz Stone Market is driven by leading companies such as Quartzforms S.p.A., FR Meyer & Sohn GmbH & Co. KG, Cargo Partner GmbH, Plazastone GmbH, Juma Natursteinwerke GmbH & Co. KG, Burgtal-Naturstein GmbH, Hartmann Natursteine, Mosafil Germany, and Akemi GmbH. These players emphasize high-quality manufacturing, design innovation, and sustainable production to strengthen their market position. They invest in advanced fabrication technologies and expand product portfolios to meet rising interior design and construction demand. Southern Germany emerged as the leading region in 2024, holding 37% of the total market share, driven by strong residential construction activity, luxury renovation projects, and widespread adoption of engineered quartz surfaces in premium architecture.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Germany Quartz Stone Market was valued at USD 442.09 million in 2018, increased to USD 707.00 million in 2024, and is projected to reach USD 1,419.69 million by 2032, growing at a CAGR of 9.11%.

- Leading companies such as Quartzforms S.p.A., FR Meyer & Sohn GmbH & Co. KG, and Plazastone GmbH drive market growth through innovation, sustainability, and advanced manufacturing.

- The Quartz Surface segment dominated in 2024 with a 59% share, driven by demand for durable, low-maintenance materials in premium interiors and modern construction projects.

- The Residential segment led with a 63% share, supported by renovation trends, luxury housing growth, and increasing preference for eco-friendly, customized interior designs.

- Southern Germany emerged as the leading region with a 37% share, fueled by high-end construction activity, luxury home developments, and widespread use of engineered quartz surfaces.

Market Segment Insights

By Type:

The Quartz Surface segment dominated the Germany Quartz Stone Market in 2024, accounting for 59% of the total share. Its dominance stems from strong demand in kitchen countertops, flooring, and wall cladding applications. The material’s durability, low maintenance, and resistance to stains and scratches make it ideal for residential and commercial use. Increasing preference for premium interior materials and design flexibility drives continued growth for engineered quartz surfaces across the country’s construction and renovation sectors.

- For instance, Cosentino launched its Silestone Urban Crush series in March 2024, featuring recycled materials and a matte texture for modern flooring and wall applications.

By Application:

The Residential segment held the largest share in 2024, contributing 63% of the total market. Growth is driven by rising home renovation projects and expanding luxury housing developments. Quartz stone’s aesthetic appeal, hygiene benefits, and long lifespan make it popular for countertops, flooring, and decorative walls. Increasing consumer preference for eco-friendly and customized interiors further strengthens residential adoption, supported by expanding retail distribution and innovative quartz surface collections targeting homeowners and interior designers.

- For instance, Caesarstone launched the Porcelain Collection in North America, featuring large-format slabs for high-end residential kitchens and bathrooms.

By Material Composition:

The Engineered Quartz segment led the market in 2024 with a 68% share, supported by consistent performance and design versatility. It offers superior hardness, uniform color, and reduced porosity compared to natural stone, making it suitable for modern interiors. Manufacturers emphasize sustainable production using recycled quartz and resin-based composites. Growing demand from premium construction and commercial projects continues to push adoption, while innovations in texture and finish broaden its applications in interior design and architecture.

Key Growth Drivers

Rising Demand for Premium Interior Materials

Germany’s growing preference for luxury interiors drives strong demand for quartz stone surfaces. Homeowners and commercial developers favor quartz for its durability, design versatility, and low maintenance. Increased adoption in kitchen countertops, flooring, and wall applications enhances market growth. The trend toward modern aesthetics, supported by innovations in color and texture, continues to elevate quartz stone’s position as a premium alternative to natural stone across residential and commercial projects nationwide.

- For instance, Technistone launched new quartz collections with enhanced textures and colors tailored to the German market, further supporting premium interior design preferences.

Expanding Residential Renovation and Construction Activities

The expanding home renovation sector in Germany fuels quartz stone demand, especially in modern housing upgrades. Consumers increasingly choose quartz surfaces for their longevity and resistance to wear, aligning with sustainable and aesthetic goals. Government initiatives promoting energy-efficient buildings and urban redevelopment also support construction growth. This shift toward functional and stylish living spaces boosts demand from homebuilders, interior designers, and remodelers, further strengthening the domestic market for engineered quartz products.

Technological Advancements in Manufacturing

Technological progress in surface engineering and automated fabrication significantly improves quartz stone production efficiency. Advanced manufacturing technologies enable precise color matching, better heat resistance, and eco-friendly resin formulations. German manufacturers also invest in digital fabrication and CNC cutting systems, allowing customization and reduced waste. These innovations enhance performance and design consistency, meeting rising customer expectations for premium quality. Such advancements help local producers maintain competitiveness and expand into high-value architectural and design applications.

- For instance, Cosentino Group introduced its next-generation HybriQ+ technology for Silestone surfaces in Germany, featuring a sustainable resin mix with 99% reused water and 100% renewable electricity.

Key Trends & Opportunities

Growing Adoption of Sustainable and Eco-friendly Quartz

Sustainability is shaping product innovation in Germany’s quartz stone industry. Manufacturers increasingly develop eco-friendly quartz made with recycled glass, low-VOC resins, and renewable energy processes. Rising awareness of green building certifications like LEED and DGNB encourages architects and builders to select sustainable surfaces. The integration of environmentally responsible practices and materials offers new opportunities for brands to appeal to eco-conscious customers and secure a competitive edge in the evolving construction landscape.

- For instance, Caesarstone has incorporated recycled glass and quartz offcuts into its eco-friendly quartz surfaces, reducing reliance on virgin materials while maintaining quality.

Rising Popularity of Customized and Digital Designs

Consumers and designers are demanding personalized quartz designs with unique textures, colors, and finishes. Digital printing and 3D surface modeling allow manufacturers to create bespoke products matching individual preferences. This trend aligns with Germany’s premium housing and commercial interior markets, where customization defines luxury. Increased investment in design technology, coupled with strong retail and showroom presence, creates growth opportunities for manufacturers offering tailored solutions that merge functionality with aesthetic appeal.

- For instance, Technistone unveiled its new La Natura 2025 Collection with improved technology to create longer veins that more closely resemble natural stone, appealing to both the private and commercial sectors.

Key Challenges

High Production and Raw Material Costs

Quartz stone manufacturing involves expensive raw materials, including high-purity quartz and specialized resins. Energy-intensive processing and advanced equipment raise operational costs further. Volatility in raw material prices and rising energy costs in Germany create pressure on profit margins. Small and mid-sized producers struggle to balance pricing with quality, affecting competitiveness against lower-cost imports. These challenges emphasize the need for efficiency improvements and supply chain optimization to sustain market profitability.

Environmental Compliance and Regulatory Pressure

Strict environmental regulations in Germany increase operational complexity for quartz stone producers. Compliance with emission standards, waste disposal norms, and sustainable sourcing requirements adds cost and administrative burden. Manufacturers must invest in clean technologies, energy-efficient systems, and eco-friendly resins to align with EU sustainability goals. Although essential for long-term growth, adapting to evolving regulations can slow innovation cycles and limit small manufacturers’ capacity to compete effectively in the domestic market.

Market Competition and Price Pressure

The Germany Quartz Stone Market faces intense competition from both domestic brands and international suppliers. Imports from Asia, particularly low-cost engineered quartz products, challenge local manufacturers on pricing. To maintain market share, companies must focus on differentiation through quality, design innovation, and sustainability. However, competitive pricing strategies often reduce profit margins. The growing presence of global brands increases the need for product diversification, marketing investments, and distribution efficiency to sustain growth.

Regional Analysis

Southern Germany

Southern Germany held the dominant position in the Germany Quartz Stone Market in 2024, accounting for 37% of the total share. It benefits from a strong residential construction base and growing renovation activities across cities like Munich and Stuttgart. The presence of advanced manufacturing facilities and high consumer spending supports market expansion. Demand for luxury kitchen countertops, flooring, and wall panels remains strong in premium housing projects. Regional distributors emphasize eco-friendly engineered quartz and custom finishes. Continuous investment in infrastructure and sustainable housing further strengthens product adoption.

Western Germany

Western Germany captured 28% of the market share in 2024, driven by industrial growth and expanding commercial development. The region’s robust economy and increasing demand from offices, retail complexes, and hospitality sectors promote quartz surface use. Manufacturers focus on supplying durable, low-maintenance materials for large-scale architectural projects. It benefits from proximity to major logistics hubs and easy access to European suppliers. The rising emphasis on modern aesthetics and energy-efficient buildings boosts the use of quartz in commercial interiors and public facilities.

Northern Germany

Northern Germany held a 19% share of the market in 2024, supported by growing adoption in residential remodeling projects and mid-scale commercial applications. Urban centers such as Hamburg lead demand with rising interest in modern and functional design materials. It experiences growth in online sales channels, driven by increasing consumer awareness of engineered quartz advantages. Regional suppliers expand their product portfolios to include eco-friendly and digital design options. The strong focus on product durability and design versatility enhances market penetration across urban developments.

Eastern Germany

Eastern Germany accounted for 16% of the total market share in 2024, supported by ongoing infrastructure development and affordable housing projects. Local demand grows steadily due to rising awareness of quartz stone’s quality and long-term value. It benefits from increasing investments in public infrastructure and interior modernization projects. Domestic suppliers promote cost-effective quartz surfaces tailored to regional construction needs. Growth in small and mid-sized cities, coupled with retail expansion, supports steady adoption. The region’s growing acceptance of engineered materials continues to strengthen its contribution to national market growth.

Market Segmentations:

By Type

- Quartz Surface

- Quartz Tile

- Other Forms

By Application

By Material Composition

- Engineered Quartz

- Natural Quartz Stone

- Eco-friendly Quartz

By Distribution Channel

- Direct Sales

- Retail Sales

- Online Platforms

- Others

By Region

- Southern Germany

- Western Germany

- Northern Germany

- Eastern Germany

Competitive Landscape

The Germany Quartz Stone Market features a competitive landscape defined by a mix of established domestic manufacturers and international brands. Key players include Quartzforms S.p.A., FR Meyer & Sohn GmbH & Co. KG, Cargo Partner GmbH, Plazastone GmbH, Juma Natursteinwerke GmbH & Co. KG, Burgtal-Naturstein GmbH, Hartmann Natursteine, Mosafil Germany, and Akemi GmbH. These companies compete through design innovation, advanced fabrication techniques, and sustainable material sourcing. It emphasizes product quality, surface customization, and eco-friendly production to meet rising architectural and residential demand. Manufacturers focus on expanding distribution networks, enhancing showroom visibility, and developing premium quartz collections with diverse color and texture options. Strategic partnerships, product differentiation, and digital marketing strengthen brand positioning. Increasing competition from imported low-cost quartz products encourages local producers to invest in automation, R&D, and design excellence to sustain growth and maintain leadership in Germany’s evolving surface materials industry.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Players

- Quartzforms S.p.A.

- FR Meyer & Sohn GmbH & Co. KG

- Cargo Partner GmbH

- Plazastone GmbH

- Juma Natursteinwerke GmbH & Co. KG

- Burgtal-Naturstein GmbH

- Hartmann Natursteine

- Mosafil Germany

- Akemi GmbH

Recent Developments

- In January 2025, LATICRETE acquired a majority stake in fuma-Bautec, a German profile manufacturer, to strengthen its innovation and product range in the building materials sector.

- In 2025, Technistone launched its La Natura 2025 collection, introducing new engineered quartz designs aimed at enhancing aesthetic appeal and sustainability across the German market.

- In August 2025, Wilsonart introduced bold-color quartz designs tailored for Germany and the wider European market to expand its premium interior surface portfolio.

Report Coverage

The research report offers an in-depth analysis based on Type, Application, Material Composition, Distribution Channel and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for engineered quartz surfaces will rise across residential and commercial interiors.

- Manufacturers will expand sustainable quartz production using recycled materials and low-emission resins.

- Custom-designed quartz products will gain popularity among architects and homeowners.

- Automation and digital fabrication technologies will enhance production efficiency and precision.

- Online distribution channels will experience steady growth due to changing consumer preferences.

- Increasing renovation projects will continue to drive quartz adoption in modern housing.

- German producers will strengthen export capacity to meet rising European demand.

- Strategic collaborations between manufacturers and design studios will boost product innovation.

- Eco-certified quartz products will attract environmentally conscious consumers and builders.

- Competition will intensify, pushing companies toward advanced designs and high-performance surface solutions.