Market Overview

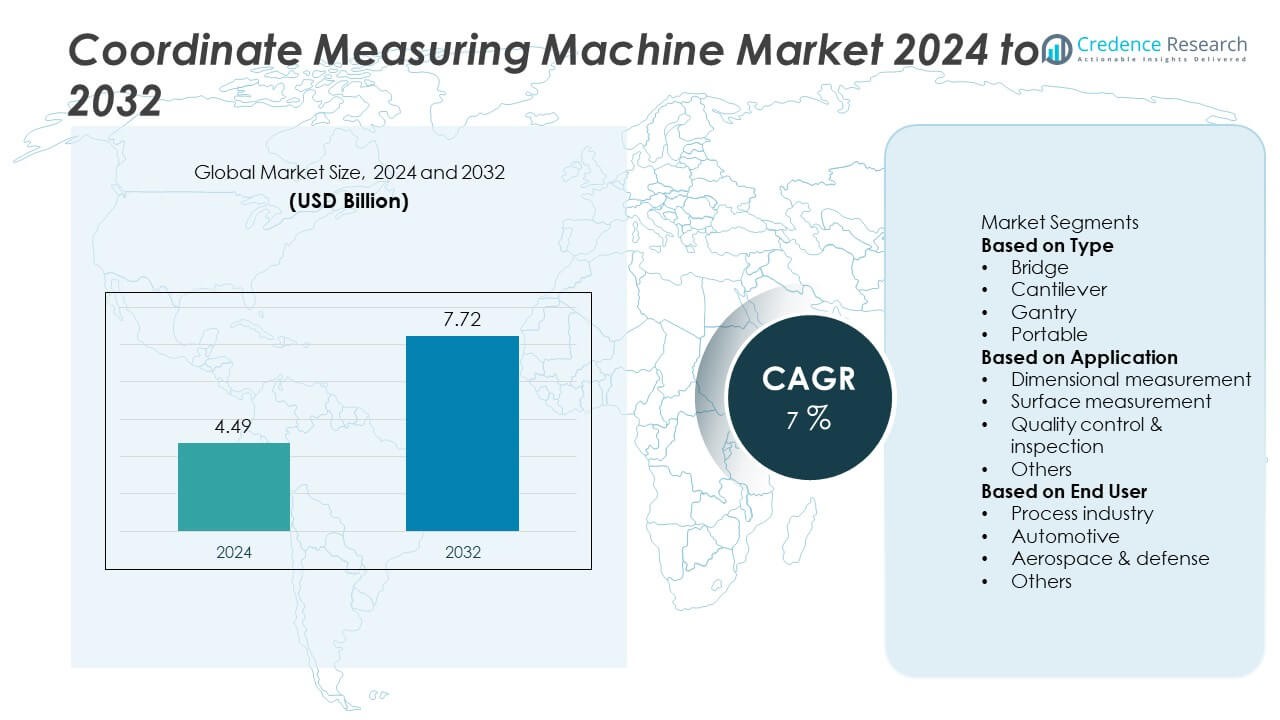

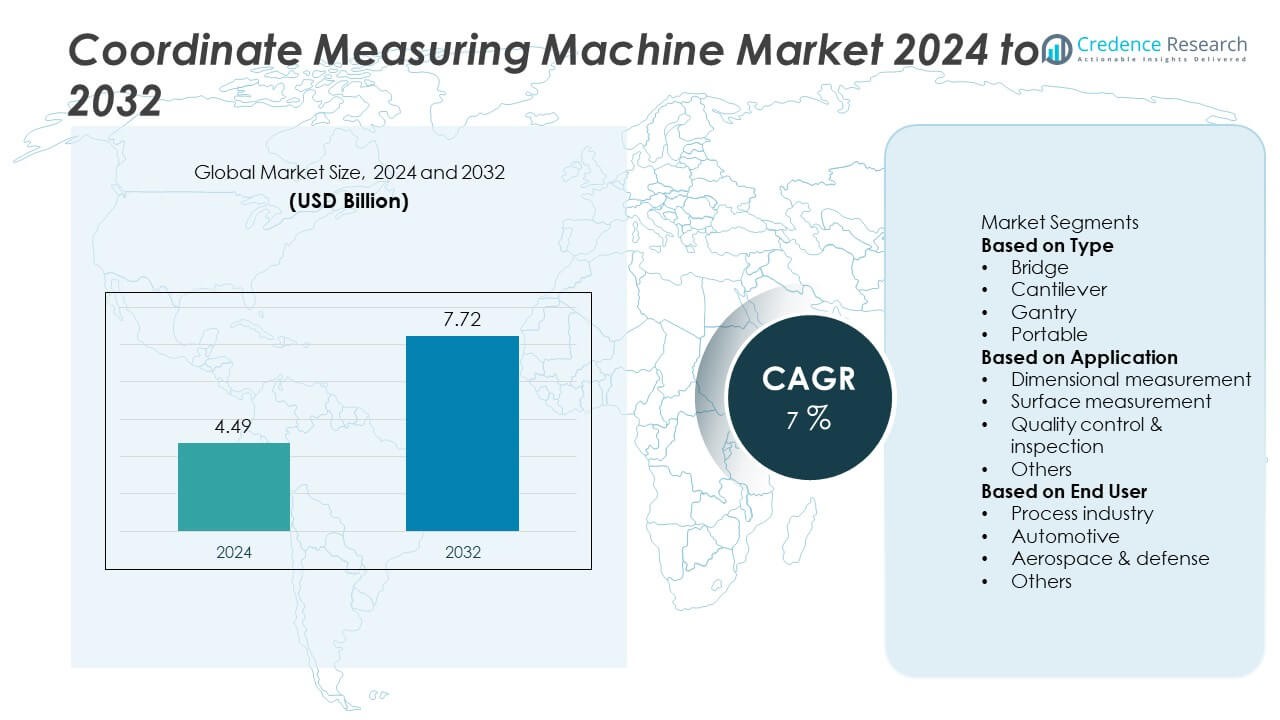

The Coordinate Measuring Machine (CMM) Market was valued at USD 4.49 billion in 2024 and is projected to reach USD 7.72 billion by 2032, growing at a CAGR of 7% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Coordinate Measuring Machine Market Size 2024 |

USD 4.49 Billion |

| Coordinate Measuring Machine Market, CAGR |

7% |

| Coordinate Measuring Machine Market Size 2032 |

USD 7.72 Billion |

The Coordinate Measuring Machine market is dominated by key players including Hexagon AB, ZEISS, FARO, KEYENCE CORPORATION, Nikon Corporation, Perceptron Inc., Mitutoyo Corporation, Wenzel Group GmbH & Co. KG, Creaform Inc., and Sinowon Innovation Metrology Manufacture Limited. These companies lead through advanced CMM solutions featuring multisensor integration, automated inspection, and AI-enabled precision measurement. Hexagon and ZEISS hold a strong global presence with extensive product portfolios serving automotive, aerospace, and industrial manufacturing sectors. Regionally, Asia-Pacific led the market with a 36% share in 2024, driven by rapid industrialization and automation investments, followed by Europe with 29%, supported by strong manufacturing bases in Germany and Italy, while North America accounted for 27%, fueled by technological innovation and adoption of smart metrology systems.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The coordinate measuring machine market was valued at USD 4.49 billion in 2024 and is projected to reach USD 7.72 billion by 2032, growing at a CAGR of 7% during the forecast period.

- Market growth is driven by rising demand for precision measurement and quality assurance in automotive, aerospace, and manufacturing industries.

- Key trends include integration of multisensor technology, portable CMM adoption, and automation in dimensional inspection for smart factories.

- The market is competitive, with Hexagon AB, ZEISS, FARO, and KEYENCE leading innovations in automated and AI-driven metrology systems.

- Asia-Pacific led with a 36% share in 2024, followed by Europe with 29% and North America with 27%, while the bridge-type segment dominated with 41% share due to its high accuracy and use in large-scale industrial applications.

Market Segmentation Analysis:

By Type

The bridge segment dominated the coordinate measuring machine market in 2024, holding a 46% share. Bridge-type CMMs are preferred for their high accuracy, stability, and suitability for inspecting medium to large-sized components. They are extensively used in automotive and aerospace industries for precision measurement of complex geometries. Their rigid construction and compatibility with advanced sensors make them ideal for high-volume production lines. The increasing demand for automated metrology systems and the integration of 3D scanning capabilities further enhance the adoption of bridge-type machines across manufacturing and quality assurance facilities.

- For instance, ZEISS introduced its CONTURA 12/18/10 Bridge CMM featuring a measuring range of 1,200 × 1,800 × 1,000 mm and accuracy up to 1.5 + L/350 µm, equipped with the VAST XXT sensor for high-speed scanning.

By Application

The quality control and inspection segment led the market in 2024, capturing a 51% share. This dominance is driven by the growing emphasis on product accuracy, process validation, and compliance with international manufacturing standards. CMMs play a critical role in ensuring dimensional precision during assembly and production, particularly in automotive and aerospace sectors. The adoption of multi-sensor technology and software-integrated inspection systems enhances measurement speed and repeatability. Rising investments in automated inspection systems across manufacturing plants continue to fuel segment growth globally.

- For instance, Hexagon AB launched its MAESTRO Bridge CMM, a next-generation, all-digital system featuring industry-leading speed, simplified operation, and seamless connectivity. It is integrated with Hexagon’s PC-DMIS software, which helps automate inspection workflows and create repeatable, standard-compliant measurements.

By End User

The automotive segment accounted for the largest market share of 42% in 2024, supported by the increasing demand for high-precision component inspection and process optimization. Automakers use CMMs for verifying engine parts, gear assemblies, and body components to ensure dimensional accuracy and quality consistency. The expansion of electric vehicle manufacturing and complex lightweight component design further increases reliance on advanced metrology solutions. Integration of CMMs with robotic arms and digital production systems enables real-time quality monitoring, driving efficiency and reducing rework rates across global automotive manufacturing networks.

Key Growth Drivers

Rising Demand for Precision Engineering in Manufacturing

The growing emphasis on dimensional accuracy and precision manufacturing is a major driver of the coordinate measuring machine market. Industries such as automotive, aerospace, and electronics increasingly use CMMs to inspect complex components and ensure compliance with tight tolerances. The shift toward automation and advanced manufacturing processes enhances the need for reliable, repeatable measurement systems. As manufacturers pursue quality optimization and process control, the demand for CMMs integrated with digital and optical metrology solutions continues to expand across high-precision production environments.

- For instance, Nikon Corporation introduced its Altera CMM Series equipped with a Laser Scanning Probe (LC15Dx) that achieves measurement probing accuracy within 1.9 µm and captures up to 70,000 data points per second for high-precision inspection of micro-engineered parts.

Expansion of Aerospace and Automotive Sectors

The increasing production of aircraft and vehicles globally is fueling the adoption of coordinate measuring machines. These industries rely heavily on CMMs for inspection of intricate components like turbine blades, engine housings, and chassis assemblies. The rise of electric vehicles and lightweight aircraft manufacturing demands advanced metrology systems for dimensional validation. Manufacturers are investing in high-speed, multi-sensor CMMs to enhance productivity and maintain global quality standards, driving sustained market growth across both traditional and emerging economies.

Integration of Automation and Smart Manufacturing Technologies

Industry 4.0 adoption is accelerating the integration of CMMs with robotics, sensors, and digital data systems. Automated CMMs equipped with AI-driven software enhance real-time inspection, data processing, and predictive maintenance. These innovations enable manufacturers to achieve higher throughput and minimize human error in measurement tasks. The growing trend of smart factories, supported by IoT connectivity and cloud-based quality control systems, strengthens the role of CMMs as a core component in automated manufacturing environments, boosting global market demand.

- For instance, Mitutoyo Corporation launched the MiCAT Planner Automation Module capable of generating CMM measurement programs 95% faster through AI-driven feature recognition, enabling seamless integration between coordinate measuring systems and robotic part-handling units for real-time, automated inspection workflows.

Key Trends & Opportunities

Shift Toward Portable and Flexible CMM Systems

The demand for portable coordinate measuring machines is increasing due to their flexibility and ease of use in on-site inspection. Portable CMMs allow manufacturers to perform real-time measurements directly on the production floor, reducing downtime and improving workflow efficiency. They are increasingly adopted in automotive, aerospace, and heavy machinery industries where large components require in-situ measurement. The development of wireless connectivity and handheld probe systems enhances usability, presenting a strong growth opportunity for manufacturers offering compact, portable metrology solutions.

- For instance, Keyence Corporation introduced its WM Series Wide-Area CMM, capable of measuring objects up to 15 meters in length with its wireless probe, which allows flexible inspection in automotive assembly and aerospace maintenance operations.

Adoption of Multi-Sensor and Non-Contact Measurement Technologies

The introduction of non-contact and multi-sensor CMMs is transforming precision measurement across industries. Laser and optical scanning technologies enable faster data collection, making them ideal for fragile or complex surfaces. These systems reduce inspection time while improving accuracy and repeatability. The increasing use of hybrid systems that combine tactile and optical sensors enhances versatility across various applications. As production speeds rise, manufacturers are adopting these advanced systems to maintain measurement efficiency without compromising quality.

- For instance, Perceptron, Inc. introduced its V7 Laser Line Scanner, integrated with CMM automation software, delivering a data capture rate of up to 64,000 points per second and compatibility with robotic metrology cells for real-time, high-precision part verification in automotive and aerospace production lines.

Key Challenges

High Initial Investment and Maintenance Costs

The high cost of advanced coordinate measuring machines and associated maintenance remains a key restraint. CMMs with multi-sensor technology and automation features require significant capital investment, limiting adoption among small and medium-sized manufacturers. Additionally, calibration, software upgrades, and operator training contribute to ongoing expenses. Despite offering long-term efficiency benefits, the initial financial barrier continues to challenge widespread market penetration, especially in developing regions with cost-sensitive industries.

Shortage of Skilled Operators and Integration Complexity

Operating CMMs and interpreting complex metrology data require specialized expertise, creating a skills gap in the manufacturing workforce. The integration of CMMs with existing production systems also demands technical proficiency and software compatibility. Many firms struggle with aligning CMMs within automated workflows due to interoperability issues. This lack of skilled personnel and integration complexity slows deployment in certain industries. Training programs and user-friendly software interfaces are becoming essential to overcome these adoption barriers.

Regional Analysis

North America

North America held a 31% share of the coordinate measuring machine market in 2024, driven by the presence of major automotive, aerospace, and defense manufacturers. The United States leads regional growth with extensive adoption of precision metrology in industrial quality control and R&D facilities. Technological advancements in multi-sensor and optical CMM systems are strengthening market penetration. Strong investments in advanced manufacturing and automation, coupled with government initiatives promoting smart factories, continue to support demand. The presence of key players and robust infrastructure for metrology services reinforces North America’s leadership in the global market.

Europe

Europe accounted for 28% of the coordinate measuring machine market in 2024, supported by strong industrial automation and high-quality standards in manufacturing. Germany, the U.K., and France are leading contributors, driven by their advanced automotive and aerospace industries. The region’s focus on energy-efficient production and sustainability encourages adoption of automated inspection technologies. Increasing implementation of Industry 4.0 practices enhances integration of CMMs within digitalized manufacturing lines. Growing investments in research, precision engineering, and non-contact measurement technologies further strengthen Europe’s position as a key hub for CMM innovation and technological development.

Asia-Pacific

Asia-Pacific dominated the coordinate measuring machine market with a 33% share in 2024, fueled by rapid industrialization and expanding automotive and electronics production. China, Japan, and India are leading markets with strong government support for manufacturing modernization and automation. The growing presence of OEMs and suppliers investing in high-precision metrology drives adoption of CMMs across production lines. Rising demand for quality assurance in consumer electronics, semiconductors, and aerospace manufacturing supports regional growth. The availability of cost-effective labor combined with increasing local production of CMM systems enhances Asia-Pacific’s long-term market potential.

Middle East & Africa

The Middle East & Africa captured a 5% share of the coordinate measuring machine market in 2024, driven by industrial diversification and infrastructure expansion in Saudi Arabia, the UAE, and South Africa. Growing investments in aerospace component manufacturing and energy sectors are boosting demand for advanced inspection systems. Adoption of CMMs is also increasing in automotive assembly and defense manufacturing facilities. Governments promoting technological transformation and industrial automation under initiatives like Vision 2030 are encouraging modern metrology deployment. The region’s gradual shift toward precision engineering supports sustained market growth.

South America

South America held a 3% share of the coordinate measuring machine market in 2024, led by Brazil, Argentina, and Chile. The region is witnessing rising adoption of CMMs in automotive component manufacturing, metal fabrication, and mining equipment production. Industrial modernization and increasing investments in aerospace and energy sectors drive metrology system integration. The demand for portable and cost-efficient coordinate measuring machines is growing among small and medium enterprises. Although infrastructure challenges and limited skilled labor remain constraints, ongoing industrial expansion and regional trade growth are supporting steady market progress.

Market Segmentations:

By Type

- Bridge

- Cantilever

- Gantry

- Portable

By Application

- Dimensional measurement

- Surface measurement

- Quality control & inspection

- Others

By End User

- Process industry

- Automotive

- Aerospace & defense

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

Competitive landscape of the Coordinate Measuring Machine market features major players such as Hexagon AB, ZEISS, FARO, KEYENCE CORPORATION, Nikon Corporation, Perceptron Inc., Mitutoyo Corporation, Creaform Inc., Wenzel Group GmbH & Co. KG, and Sinowon Innovation Metrology Manufacture Limited. These companies compete through innovation in precision measurement, automation, and multisensor technologies. Hexagon and ZEISS lead the market with advanced bridge and portable CMM systems integrated with AI-based data analysis and 3D scanning. FARO and Nikon focus on portable and laser-based CMMs catering to automotive and aerospace sectors. Market participants are investing heavily in software integration, real-time inspection solutions, and collaborative metrology systems. Strategic mergers, partnerships, and expansion in emerging markets enhance their global presence. The increasing adoption of digital manufacturing and Industry 4.0 technologies continues to drive competition, as manufacturers emphasize accuracy, efficiency, and flexibility in industrial measurement and quality control applications.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In July 2025, AMETEK completed its acquisition of FARO Technologies, consolidating its position in 3D metrology, portable CMMs, and reality capture hardware.

- In May 2025, Hexagon AB launched MAESTRO, a next-generation CMM built from the ground up with a single-cable digital architecture and modular hardware and firmware to support sub-micron measurement accuracy.

- In February 2025, FARO and Topcon announced a strategic agreement to co-develop and distribute laser scanning and metrology solutions, enabling better integration between scanning and measurement platforms.

- In 2025, FARO unveiled the FARO Leap ST handheld 3D scanner, integrating blue laser + infrared + photogrammetry to reduce target requirements and provide metrology-grade capture.

Report Coverage

The research report offers an in-depth analysis based on Type, Application, End User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand steadily with increasing demand for precision measurement in manufacturing.

- Automation and robotics integration will enhance inspection speed and accuracy.

- Portable and multisensor CMM systems will gain higher adoption across industries.

- The automotive and aerospace sectors will continue to drive large-scale deployments.

- Advancements in software analytics will improve data interpretation and quality assurance.

- Asia-Pacific will remain the fastest-growing region due to rapid industrialization.

- Cloud-based data management will strengthen remote monitoring and process optimization.

- Collaboration between CMM manufacturers and automation firms will boost innovation.

- Sustainability initiatives will encourage energy-efficient and lightweight CMM designs.

- Continuous R&D investment will focus on enhancing measurement range and digital connectivity.