Market Overview:

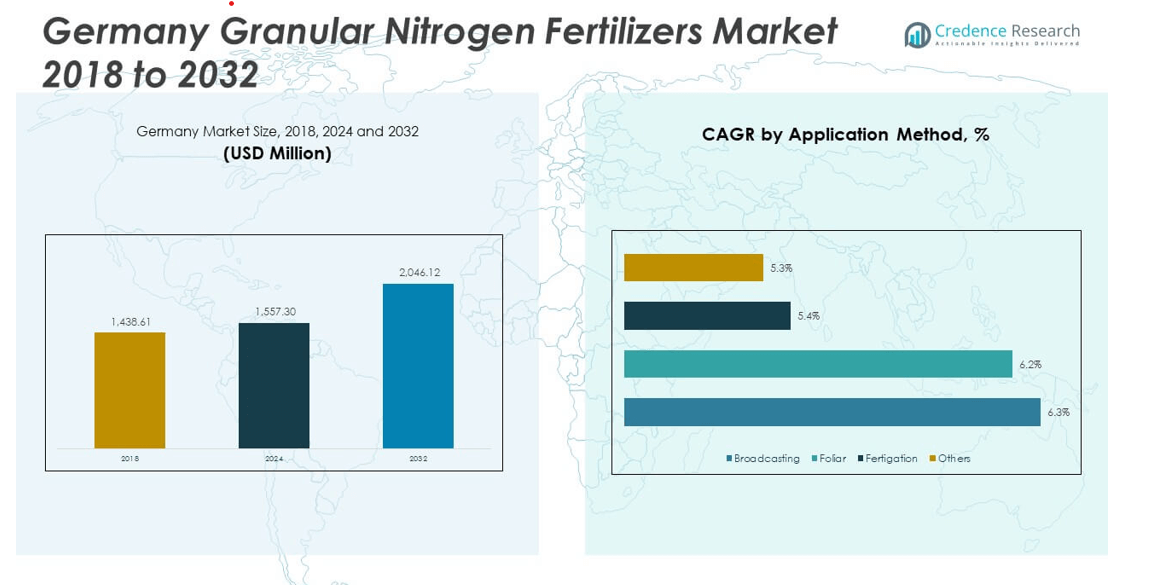

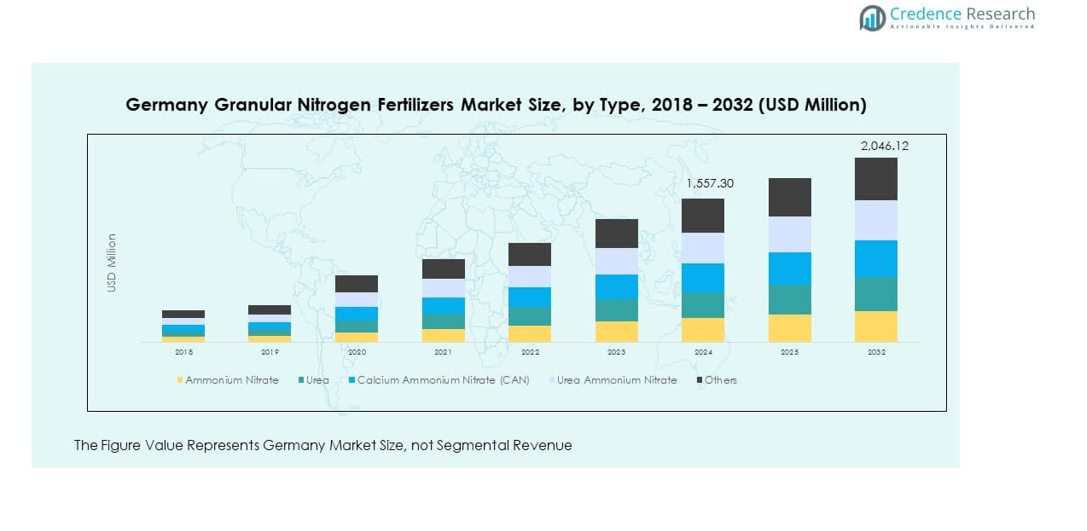

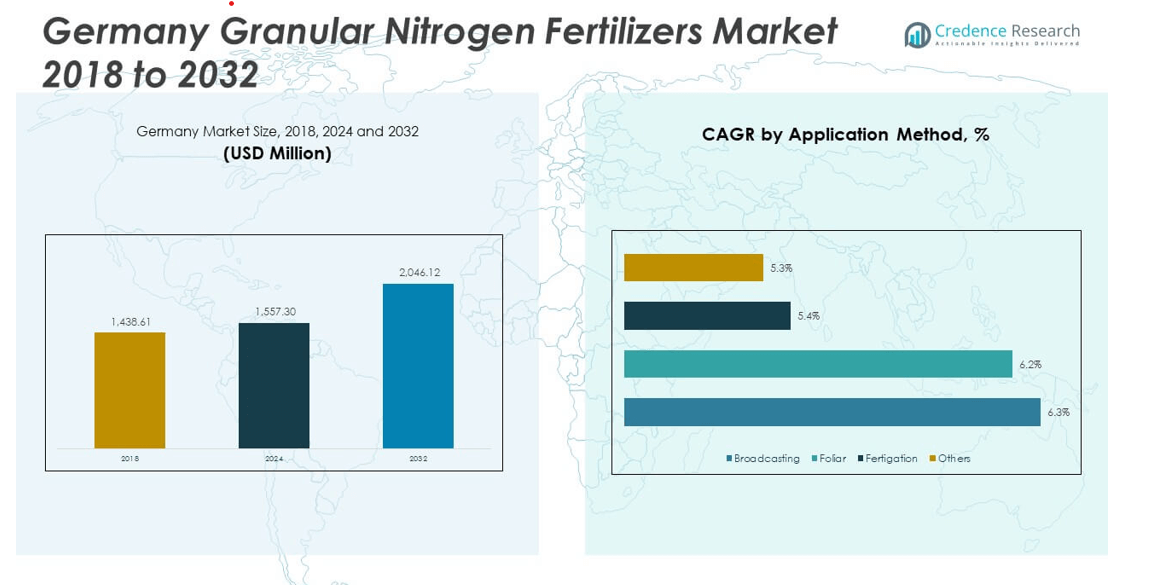

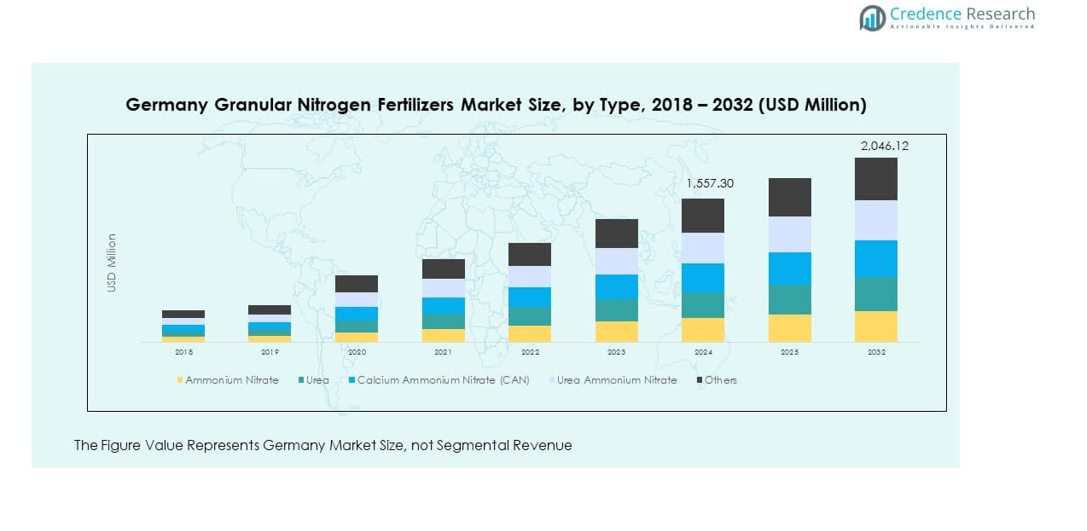

The Germany Granular Nitrogen Fertilizers Market size was valued at USD 1,438.61 million in 2018 to USD 1,557.30 million in 2024 and is anticipated to reach USD 2,046.12 million by 2032, at a CAGR of 3.47% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Germany Granular Nitrogen Fertilizers Market Size 2024 |

USD 1,557.30 million |

| Germany Granular Nitrogen Fertilizers Market, CAGR |

3.47% |

| Germany Granular Nitrogen Fertilizers Market Size 2032 |

USD 2,046.12 million |

Germany’s granular nitrogen fertilizers market is driven by rising crop production demands and precision agriculture practices. Farmers are increasingly adopting nutrient-balanced fertilizer applications to enhance soil health and yield quality. Government initiatives promoting sustainable farming and the use of efficient fertilizer formulations also support market expansion. Additionally, growing awareness of nitrogen efficiency and the adoption of controlled-release fertilizers are boosting product demand.

Within Europe, Germany remains a key agricultural producer with strong adoption of advanced fertilizer technologies. The western and southern regions show higher consumption due to intensive crop cultivation and favorable soil conditions. Emerging demand from eastern regions is increasing as precision farming and digital monitoring spread. The country’s proximity to major chemical producers further enhances supply efficiency and export opportunities across the EU.

Market Insights:

- The Germany Granular Nitrogen Fertilizers Market was valued at USD 1,438.61 million in 2018, reached USD 1,557.30 million in 2024, and is projected to attain USD 2,046.12 million by 2032, growing at a CAGR of 3.47%.

- Northern and Western Germany held the largest share at 42%, supported by large-scale cereal and oilseed cultivation, fertile soils, and advanced precision farming.

- Southern Germany captured 34% of the market, driven by strong horticultural and specialty crop production, while Eastern Germany accounted for 24%, showing rapid adoption of sustainable fertilizer technologies.

- Eastern Germany represents the fastest-growing region, driven by expanding irrigation networks, digital farming integration, and government initiatives promoting eco-efficient nitrogen usage.

- By type, Urea accounted for the dominant segment share of about 38%, followed by Calcium Ammonium Nitrate (CAN) with roughly 27%, reflecting their cost-effectiveness, balanced nutrient composition, and wide crop adaptability.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Demand for High-Yield and Nutrient-Efficient Crop Production

The Germany Granular Nitrogen Fertilizers Market is driven by the growing demand for higher agricultural productivity across major crops. Farmers focus on fertilizers that provide balanced nutrient delivery and long-lasting soil enrichment. It helps maintain consistent crop growth under changing climatic conditions. Controlled-release and coated nitrogen formulations improve fertilizer efficiency and reduce leaching losses. Government programs encouraging sustainable farming practices strengthen adoption among growers. Continuous research on precision farming techniques supports nutrient optimization. The trend aligns with Germany’s target for sustainable agriculture and improved food security.

- For instance, farmers using Yara’s N-Sensor technology in Germany have achieved nitrogen savings of up to 14% per hectare in cereal and oilseed crop production, alongside consistent crop quality and a 3.5% yield increase in cereals, verified by field-scale studies.

Expansion of Precision Farming and Digital Agriculture Practices

Rising adoption of precision farming technologies has accelerated the demand for granular nitrogen fertilizers in Germany. Farmers use data-driven systems to measure soil nutrient levels and apply fertilizers with better accuracy. It ensures targeted nitrogen use and minimizes environmental pollution. Integration of GPS-enabled applicators and smart sensors allows real-time fertilizer monitoring. Growing collaborations between technology firms and agricultural suppliers are promoting digital farming solutions. These initiatives help optimize resource use and enhance profitability for small and large farms. Supportive training programs and digital tools make precision fertilization more efficient and accessible nationwide.

- For instance, BASF’s xarvio FIELD MANAGER platform delivers field-specific, data-driven nitrogen recommendations across Germany, empowering advisors and agribusinesses to optimize nutrient input efficiency for large-scale cereal, maize, and oilseed operations, with the platform supporting multiple farms and tasks with enhanced analytics for agronomic decision-making as of September 2025.

Government Support for Sustainable Fertilizer Application and Soil Health

Government initiatives promoting environmental conservation and soil health improvement play a major role in market expansion. Regulations encourage the use of fertilizers with low nitrogen emissions and high absorption rates. It drives manufacturers to develop products that meet both productivity and sustainability targets. Germany’s nutrient management laws motivate farmers to use fertilizers more responsibly. Subsidy programs and research funding support innovation in eco-friendly nitrogen sources. Partnerships between agronomists and farmers help improve nitrogen application efficiency. The focus on circular economy principles also drives recycling of organic waste for fertilizer production.

Technological Advancements in Fertilizer Manufacturing and Formulation

Ongoing improvements in production technology are reshaping the granular nitrogen fertilizers landscape in Germany. Manufacturers are investing in advanced coating techniques and nanotechnology-based solutions. It enhances nutrient stability, solubility, and resistance to volatilization. Adoption of green ammonia processes reduces carbon emissions during fertilizer production. Continuous R&D supports the introduction of customized formulations for regional crop needs. Expansion of automated blending and packaging systems ensures consistent quality standards. Industry partnerships with research institutions strengthen product innovation pipelines. These developments collectively enhance competitiveness and sustainability in the domestic fertilizer market.

Market Trends:

Shift Toward Eco-Friendly and Low-Emission Nitrogen Fertilizer Products

Manufacturers are focusing on producing low-emission nitrogen fertilizers to meet Germany’s environmental goals. The shift reflects growing awareness about nitrate pollution and greenhouse gas reduction. It promotes the use of stabilized and slow-release formulations that minimize nitrogen loss. Companies are investing in bio-based fertilizers derived from renewable resources. Consumers prefer fertilizers that align with sustainability certifications and climate-neutral farming standards. The trend supports compliance with EU environmental directives. It strengthens the market’s position as an innovation leader in sustainable agricultural inputs.

- For instance, EuroChem’s ENTEC® stabilized fertilizer line has helped reduce ammonia emissions by up to 80% and CO₂ emissions by up to 79% compared to untreated urea, aligning Germany’s fertilizer sector with EU greenhouse gas reduction directives in 2025.

Integration of Digital Platforms and Smart Application Systems

The integration of smart farming tools and digital platforms is reshaping fertilizer use strategies in Germany. Farmers rely on AI-based advisory systems to analyze soil data and forecast fertilizer requirements. It supports precise dosage applications that reduce wastage and improve crop performance. Mobile apps and cloud-based systems enable real-time fertilizer management. Partnerships between agri-tech firms and cooperatives expand digital access for small-scale farmers. Increasing use of IoT sensors in fields enhances nutrient tracking accuracy. The growing trend toward farm digitalization helps optimize cost efficiency and sustainability goals simultaneously.

- For instance, with BASF’s xarvio FIELD MANAGER, German farmers can digitally monitor crop nutrition, growth stages, and field conditions, enabling automatic site-specific dosage adjustments throughout the season for improved sustainability and profitability, as confirmed in the 2025 expansion press release.

Growing Collaboration Between Chemical Companies and Agricultural Cooperatives

Large fertilizer producers are forming partnerships with local cooperatives to strengthen market presence. Such collaborations ensure efficient product distribution and technical support for farmers. It enables the introduction of customized fertilizers designed for regional crop conditions. Joint R&D programs encourage the creation of climate-resilient formulations. Strategic alliances also support training initiatives focused on sustainable fertilization methods. Cooperative-based procurement systems improve affordability for small farmers. The trend contributes to stronger industry integration and knowledge exchange across the fertilizer value chain.

Increased Adoption of Controlled-Release and Coated Fertilizers

Controlled-release fertilizers are gaining popularity due to their high efficiency and reduced environmental footprint. Farmers prefer these products for their steady nutrient supply throughout crop growth stages. It helps maintain consistent soil nitrogen levels and improves overall yield quality. Manufacturers are introducing polymer-coated and sulfur-coated variants for better moisture resistance. Advanced coating technology minimizes nitrogen volatilization and nutrient runoff. The shift supports EU nitrogen management policies promoting sustainable farming. This trend reflects the market’s transition toward technology-driven and environmentally conscious fertilizer solutions.

Market Challenges Analysis:

Stringent Environmental Regulations and High Compliance Costs

The Germany Granular Nitrogen Fertilizers Market faces regulatory challenges linked to strict environmental standards. Government policies limit nitrogen emissions and require precise documentation of fertilizer application. It increases operational costs for both manufacturers and farmers. Small producers struggle to adapt to evolving EU nitrate directives and carbon-neutral targets. Compliance with these norms demands investment in new production technologies and low-emission formulations. High testing and certification costs add to pricing pressure in the domestic market. The need for consistent monitoring of nitrogen usage complicates logistics for large-scale producers. These factors collectively restrain short-term growth opportunities.

Volatile Raw Material Prices and Global Supply Chain Constraints

Unstable raw material prices and geopolitical disruptions continue to challenge fertilizer production economics. It impacts ammonia and natural gas costs, which are critical inputs for nitrogen-based fertilizers. Supply shortages and transport delays affect distribution timelines across Europe. Manufacturers face difficulties in maintaining stable pricing and profitability margins. Dependence on imported feedstock exposes the industry to market fluctuations. The global shift toward renewable ammonia may temporarily increase production expenses. Competition from international suppliers intensifies pricing pressure on domestic firms. These issues limit the market’s ability to achieve consistent long-term growth momentum.

Market Opportunities:

Rising Investment in Sustainable and Precision Fertilization Technologies

Growing investment in precision agriculture and eco-friendly fertilizer technologies presents strong opportunities. The Germany Granular Nitrogen Fertilizers Market benefits from the country’s focus on digital and sustainable farming. It supports the use of nutrient management software, smart applicators, and bio-enhanced fertilizers. Research institutions and private firms are developing solutions that balance yield growth with environmental protection. Integration of automation and AI tools can improve fertilizer efficiency further. Expansion of government-backed innovation funds encourages industrial modernization. The transition toward data-based agriculture will sustain demand for advanced granular nitrogen formulations.

Export Growth Potential and Strategic Industry Partnerships

Germany’s technological leadership and proximity to major European markets create export opportunities for fertilizer manufacturers. It allows producers to meet rising regional demand for sustainable nitrogen-based solutions. Collaboration with EU agricultural networks can expand product reach and enhance technical expertise. Partnerships with logistics and agritech firms improve distribution efficiency and customer access. Growing adoption of environmentally safe fertilizers in neighboring nations reinforces demand consistency. The development of low-carbon and high-performance products strengthens Germany’s competitiveness. These opportunities position the country as a leading hub for advanced fertilizer innovation.

Market Segmentation Analysis:

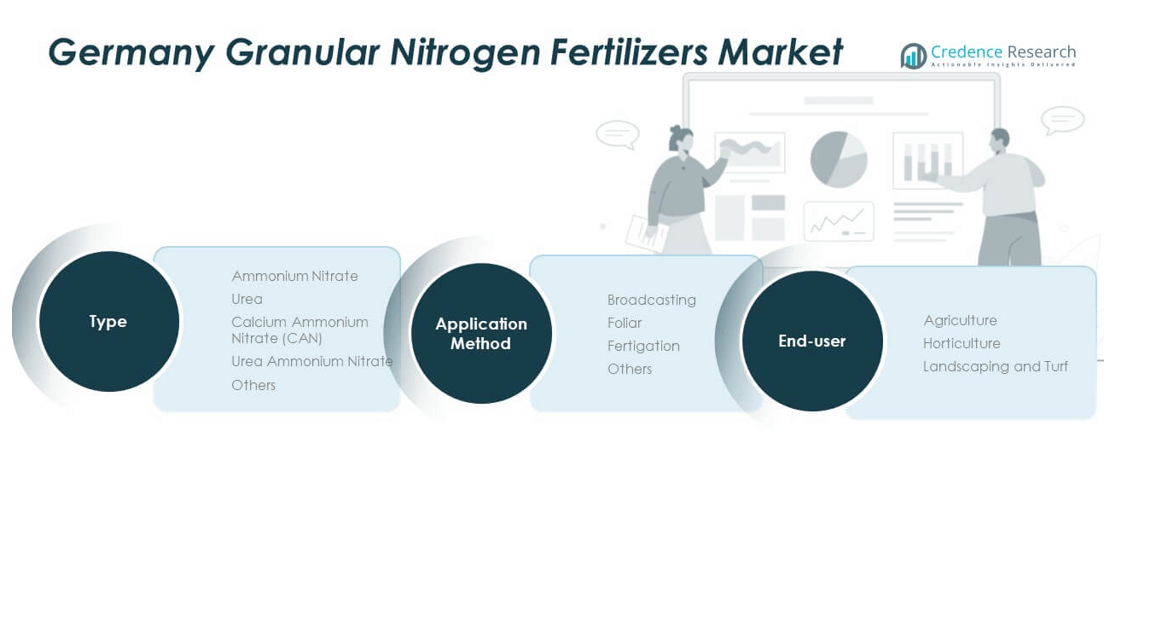

By Type

The Germany Granular Nitrogen Fertilizers Market includes key types such as ammonium nitrate, urea, calcium ammonium nitrate (CAN), urea ammonium nitrate, and others. Urea dominates due to its high nitrogen concentration and cost-effectiveness for large-scale farming. CAN holds strong demand because of its balanced nutrient composition and lower volatility. Ammonium nitrate is preferred for crops requiring quick nitrogen release. Urea ammonium nitrate gains traction for its liquid compatibility and efficient nutrient absorption. Other specialized formulations cater to region-specific soil and crop requirements, improving fertilizer versatility.

- For instance, Yara’s N-Sensor-equipped farms apply urea fertilizers at variable rates, achieving up to 14% less nitrogen wastage versus uniform application while maintaining stable yields, as recorded in independent reports on precision farming.

By Application Method

The market is segmented into broadcasting, foliar, fertigation, and others. Broadcasting remains the most widely used method due to its simplicity and coverage efficiency in large farms. Foliar application is growing in popularity for its precision and faster nutrient uptake in horticultural crops. Fertigation adoption is increasing, driven by expanding irrigation infrastructure and precision agriculture practices. Other niche methods serve specialized crop applications, contributing to localized productivity enhancement.

- For instance, in farms utilizing broadcasting as the primary application method, nitrogen savings of up to 14% and yield improvements of more than 3% in cereals have been verified when using Yara’s N-Sensor variable rate technology across broadacre crops in multiple German regions.

By End-User

The market serves agriculture, horticulture, and landscaping and turf sectors. Agriculture dominates due to high fertilizer use in cereal, oilseed, and vegetable cultivation. Horticulture follows, supported by greenhouse expansion and fruit production. Landscaping and turf management show steady growth due to urban greenery and sports field maintenance. It continues to evolve through innovation in fertilizer composition and sustainable nutrient management tailored to diverse end-user requirements.

Segmentation:

By Type

- Ammonium Nitrate

- Urea

- Calcium Ammonium Nitrate (CAN)

- Urea Ammonium Nitrate

- Others

By Application Method

- Broadcasting

- Foliar

- Fertigation

- Others

By End-User

- Agriculture

- Horticulture

- Landscaping and Turf

Regional Analysis:

Northern and Western Germany – Core Agricultural Hubs

Northern and Western Germany account for nearly 42% of the Germany Granular Nitrogen Fertilizers Market, driven by extensive cultivation of cereals, oilseeds, and fodder crops. The regions benefit from fertile soils, advanced mechanization, and high awareness of nutrient management. It records significant consumption of urea and calcium ammonium nitrate due to the dominance of large-scale crop farms. Strong logistics infrastructure and access to major fertilizer suppliers support distribution efficiency. Government initiatives promoting sustainable soil practices enhance product penetration across rural areas. Rising adoption of precision agriculture further supports the demand for controlled-release nitrogen fertilizers in these regions.

Southern Germany – Expanding Demand in Horticulture and Specialty Crops

Southern Germany captures nearly 34% of the national market share, supported by growing horticultural and specialty crop production. The region has a high concentration of greenhouse farming, vineyards, and fruit cultivation that rely on consistent nutrient supply. It witnesses rising preference for fertigation and foliar application methods that ensure efficient nutrient absorption. The market benefits from the presence of agricultural research centers focusing on fertilizer innovation and soil enhancement. Increasing adoption of urea ammonium nitrate blends helps farmers improve crop yield stability and nutrient efficiency. Regional agricultural cooperatives play a vital role in promoting modern fertilization techniques and product training programs.

Eastern Germany – Emerging Growth Frontier with Sustainable Farming Focus

Eastern Germany holds around 24% of the market share and is emerging as a fast-developing region. The area is transitioning toward precision and organic farming practices supported by state-level sustainability goals. It has increasing demand for eco-friendly and slow-release fertilizers to improve soil fertility and reduce nitrogen runoff. Expansion of irrigated farmland is supporting fertigation-based fertilizer use. The region also benefits from modernization of farm machinery and cooperative distribution networks. It continues to attract investments in agricultural technology and soil restoration projects, strengthening the overall fertilizer consumption base and long-term market growth potential.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- K+S AG

- SKW Stickstoffwerke Piesteritz GmbH

- BASF SE

- Yara International ASA

- CF Industries Holdings, Inc.

- EuroChem Group

- OCI Nitrogen

Competitive Analysis:

The Germany Granular Nitrogen Fertilizers Market features several major global and regional players competing on innovation, distribution reach, and product quality. K+S AG, BASF SE, Yara International, EuroChem Group, CF Industries, SKW Stickstoffwerke, and OCI Nitrogen lead market presence. Firms invest in R&D to launch coated and slow-release nitrogen formulations to gain technical edge. Strong relationships with agricultural cooperatives and direct supply contracts bolster market access. Price competitiveness and supply chain efficiency remain critical success factors in it. Many players adopt sustainability initiatives to comply with evolving environmental norms and to appeal to eco-aware farmers. Strategic mergers or alliances reshape competitive dynamics and can improve scale or technology access.

Recent Developments:

- In February 2025, K+S AG launched the C:LIGHT product family, comprising CO₂-reduced potash and magnesium fertilizers. These products lower carbon emissions by up to 90% compared to traditional fertilizers and mark a significant advance in the company’s sustainability and climate strategy for the German agriculture sector.

- In November 2023, SKW Stickstoffwerke Piesteritz GmbH entered a strategic partnership with STX Group to receive a multi-year supply of biomethane. This collaboration supports the production of green, low-carbon nitrogen fertilizers, advancing the German company’s commitment to de-fossilizing its product range for sustainable agriculture.

- In April 2025, BASF SE launched Ampliqan, a next-generation nitrification inhibitor designed to enhance nitrogen use efficiency in granular fertilizers. Ampliqan reduces nitrogen losses, improves crop yields, and supports climate-smart agricultural practices by minimizing leaching and greenhouse gas emissions within the German market and beyond.

Report Coverage:

The research report offers an in-depth analysis based on type, application method, and end-user segments. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Growing demand for precision agriculture will boost targeted nitrogen usage.

- Adoption of low-emission and slow-release formulations will rise.

- Government policies will favor sustainable fertilizer adoption.

- Integration of digital farming tools will refine nitrogen application.

- Increasing exports to EU neighbors will strengthen manufacturers’ growth.

- Partnerships between agritech firms and fertilizer producers will expand access.

- Innovations in green ammonia production will reduce carbon footprints.

- Irrigation expansion will drive fertigation-based fertilizer demand.

- Landscape and turf sectors will gradually push niche market growth.

- Smallholder farm modernization will create rural fertilizer demand.