Market Overview

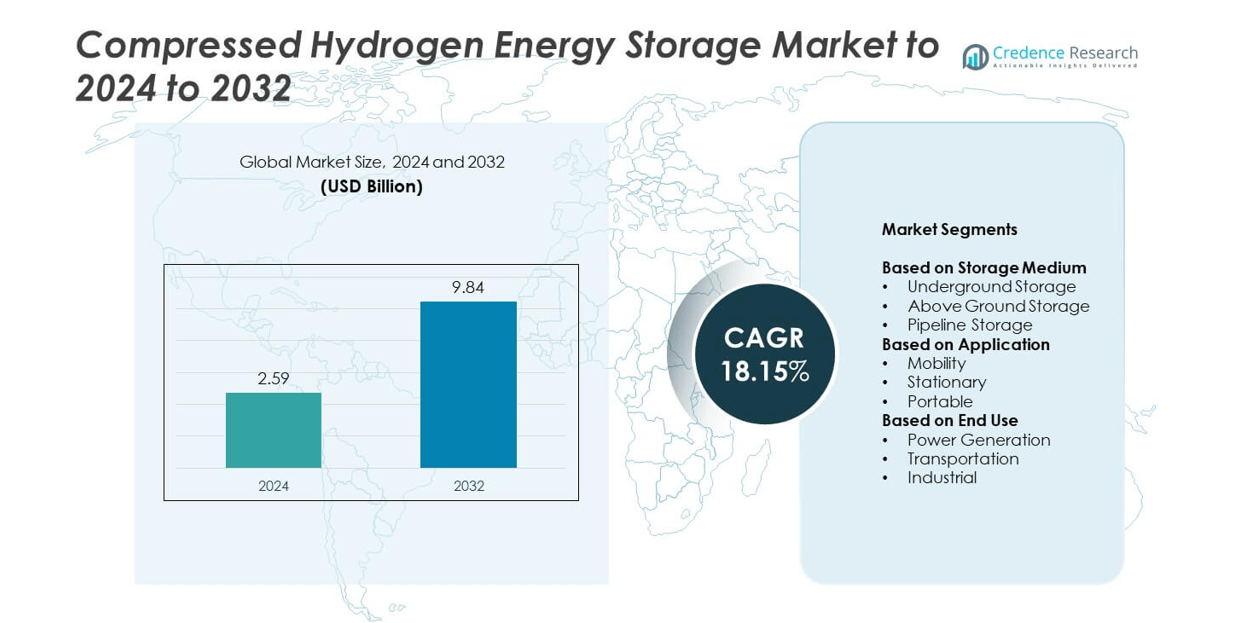

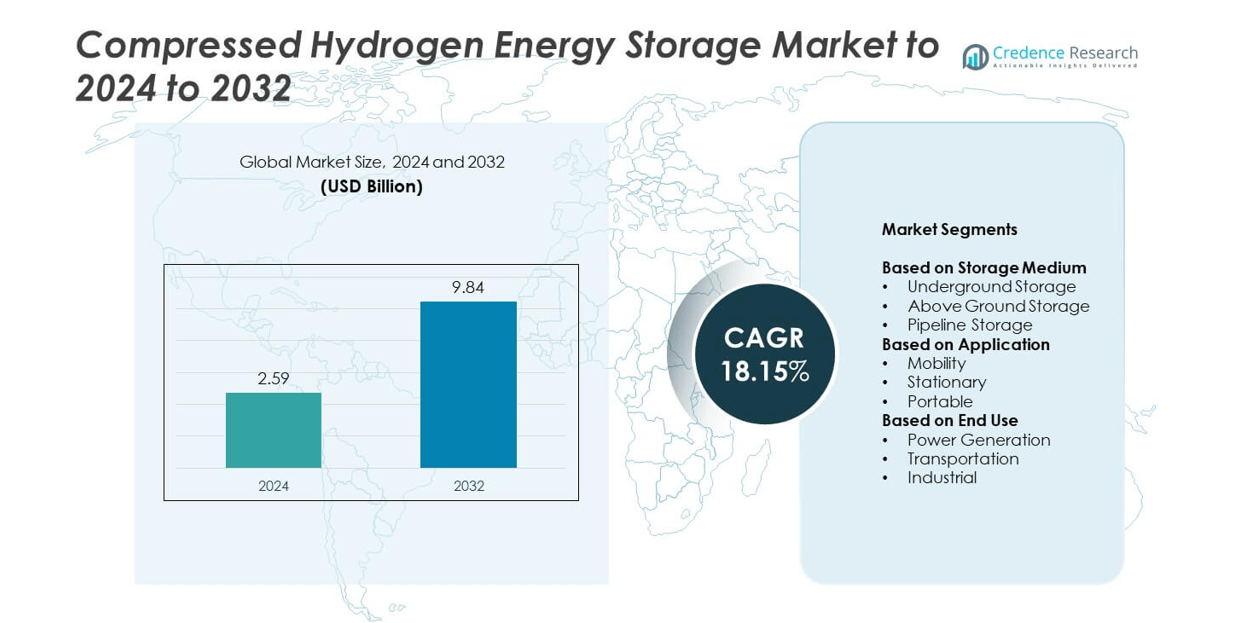

The Compressed Hydrogen Energy Storage market size was valued at USD 2.59 billion in 2024 and is projected to reach USD 9.84 billion by 2032, growing at a CAGR of 18.15% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Compressed Hydrogen Energy Storage Market Size 2024 |

USD 2.59 billion |

| Compressed Hydrogen Energy Storage Market, CAGR |

18.15% |

| Compressed Hydrogen Energy Storage Market Size 2032 |

USD 9.84 billion |

The compressed hydrogen energy storage market is led by prominent companies such as Air Liquide, Linde, TotalEnergies, Hexagon Purus, McPhy Energy, and Chart Industries. These firms focus on developing large-scale hydrogen storage infrastructure, advanced compression systems, and renewable integration technologies to support clean energy transition. Strategic partnerships and investments in underground storage and high-pressure tank systems are enhancing global competitiveness. North America led the market with a 34% share in 2024, supported by government-backed hydrogen hubs and infrastructure funding, followed by Europe at 29% and Asia Pacific at 27%, driven by strong policy support and rapid hydrogen mobility adoption.

Market Insights

- The compressed hydrogen energy storage market was valued at USD 2.59 billion in 2024 and is projected to reach USD 9.84 billion by 2032, growing at a CAGR of 18.15%.

- Rising renewable energy adoption, government-backed hydrogen roadmaps, and advancements in high-pressure storage systems are driving market growth globally.

- The market is witnessing trends toward underground storage expansion, digital monitoring systems, and integration with green hydrogen production for grid stability.

- Major players are investing in large-scale infrastructure and partnerships, with the underground storage segment holding a 47% share in 2024.

- North America led the market with a 34% regional share, followed by Europe at 29% and Asia Pacific at 27%, supported by hydrogen mobility initiatives and large industrial decarbonization projects.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Storage Medium

The underground storage segment dominated the compressed hydrogen energy storage market in 2024, accounting for around 47% share. Its dominance is driven by large-scale capacity, stable geological formations, and cost efficiency over long durations. Salt caverns and depleted gas fields enable secure and scalable hydrogen containment for seasonal and grid-scale energy balancing. Increasing deployment of underground facilities in Europe and North America supports renewable integration projects. Governments are promoting subsurface hydrogen storage as part of decarbonization strategies and to enhance grid reliability during high renewable energy fluctuations.

- For instance, Mitsubishi Power specifies 300 GWh planned cavern storage at ACES Delta.

By Application

The mobility segment held the largest market share of approximately 52% in 2024, supported by the rapid adoption of fuel cell electric vehicles and hydrogen refueling infrastructure. Automotive manufacturers and logistics fleets are investing in high-pressure compressed hydrogen systems for longer driving range and fast refueling. The expansion of hydrogen-powered buses, trucks, and trains in Asia-Pacific and Europe accelerates demand. National hydrogen mobility programs, such as Japan’s Strategic Roadmap for Hydrogen and Fuel Cells, further drive large-scale use of compressed hydrogen in transportation networks.

- For instance, Hyundai Motor reports 48 XCIENT trucks logging 10 million km in Switzerland.

By End Use

The transportation end-use segment led the market in 2024, capturing about 45% share due to growing investments in hydrogen-based mobility infrastructure. Increasing use of compressed hydrogen in commercial fleets and public transit systems strengthens this dominance. Countries such as Germany and South Korea are expanding hydrogen corridors and refueling stations to support zero-emission transportation. Strong policy support, including subsidies for fuel cell vehicles and green hydrogen production, drives adoption across light-duty and heavy-duty vehicle applications. The industrial and power generation sectors are also emerging users for backup and peak-load energy storage.

Market Overview

Rising Renewable Energy Integration

Compressed hydrogen energy storage supports large-scale renewable integration by balancing intermittent solar and wind generation. It enables long-duration storage and grid stability, especially during peak demand or renewable curtailment. Countries with high renewable penetration, such as Germany and Japan, are investing heavily in underground hydrogen storage systems. This integration reduces reliance on fossil fuels and enhances energy security, positioning hydrogen as a key enabler of carbon-neutral energy systems across industrial and utility-scale applications.

- For instance, RAG Austria stored 500,000 m³ hydrogen in a depleted reservoir.

Advancements in Hydrogen Compression and Storage Technology

Technological innovation in high-pressure composite tanks and metal hydride systems is improving hydrogen storage efficiency and safety. Companies are developing advanced compression systems operating up to 700 bar, allowing compact and lightweight solutions for mobility and industrial use. These advancements reduce storage losses and operational costs, making compressed hydrogen storage more viable for decentralized and transport applications. Enhanced materials and digital monitoring further strengthen reliability in large-scale storage deployments.

- For instance, NPROXX’s AH620-70 pressure vessel is a Type IV composite tank specifically engineered for heavy vehicles and long-haul trucks. It is designed to store up to 12.4 kg of hydrogen at a pressure of 700 bar.

Government Policies and Strategic Hydrogen Roadmaps

Supportive policies and funding from global governments are accelerating the development of hydrogen infrastructure. Initiatives such as the EU Hydrogen Strategy and the U.S. Hydrogen Shot program promote large-scale projects and industrial partnerships. These roadmaps prioritize hydrogen storage to stabilize renewable grids and decarbonize transport and industry. Financial incentives, R&D grants, and public-private collaborations continue to strengthen market penetration and technology adoption across multiple end-use sectors.

Key Trends & Opportunities

Expansion of Hydrogen Mobility Infrastructure

The development of hydrogen refueling stations and fuel cell vehicle networks is creating strong growth opportunities. Leading automakers and energy companies are collaborating to deploy large-scale hydrogen corridors for trucks and public transit systems. The increasing use of compressed hydrogen for long-haul logistics and heavy vehicles enhances energy transition goals. This trend is particularly strong in Asia-Pacific and Europe, where national hydrogen mobility programs are advancing rapidly.

- For instance, in March 2025, H2 MOBILITY Germany, Europe’s largest operator of hydrogen refueling stations, announced the permanent closure of 22 of its smaller 700-bar refueling stations in Germany by mid-2025.

Integration with Green Hydrogen Production

The market is shifting toward green hydrogen storage powered by renewable electrolysis. Integration of compressed hydrogen storage with solar and wind projects enhances grid flexibility and decarbonization outcomes. Industrial clusters and utility-scale energy hubs are deploying hybrid systems that store hydrogen for power generation or fuel supply. This alignment with net-zero targets positions compressed hydrogen storage as a vital component of future clean energy infrastructure.

- For instance, the Iberdrola Puertollano green hydrogen plant, one of Europe’s largest, has a 20 MW proton exchange membrane (PEM) electrolyzer. The facility is equipped with 11 hydrogen storage tanks.

Key Challenges

High Infrastructure and Storage Costs

The high capital investment required for hydrogen compression, pipelines, and storage facilities remains a significant barrier. Building underground or high-pressure storage systems demands advanced safety and engineering standards. Operational costs linked to hydrogen leakage control and energy-intensive compression also limit small-scale adoption. Without consistent subsidies and scaling benefits, achieving commercial competitiveness with conventional energy storage systems remains difficult.

Safety and Regulatory Barriers

Hydrogen’s high flammability and low molecular weight present safety challenges in handling and containment. Regulatory frameworks for large-scale storage and transport are still evolving across regions, creating delays in project approvals. Inconsistent international standards complicate cross-border hydrogen infrastructure development. Establishing unified safety codes, robust monitoring systems, and certification protocols will be essential to ensure public trust and accelerate widespread adoption of compressed hydrogen energy storage.

Regional Analysis

North America

North America accounted for around 34% share of the compressed hydrogen energy storage market in 2024. The region’s growth is supported by strong government funding for clean hydrogen and expanding renewable integration projects. The United States leads with multiple large-scale hydrogen hubs backed by the Department of Energy’s Hydrogen Shot initiative. Canada is advancing underground hydrogen storage for seasonal grid balancing. Increasing investment in mobility infrastructure, including hydrogen refueling networks and heavy-duty fuel cell transport, continues to drive market expansion across industrial and energy sectors.

Europe

Europe held a 29% market share in 2024, driven by the EU Hydrogen Strategy and national decarbonization goals. Germany, France, and the Netherlands are at the forefront of underground hydrogen storage in salt caverns and depleted gas fields. The region’s focus on green hydrogen integration and cross-border hydrogen pipeline networks is fueling demand. Large-scale projects such as HyStock and HyNet Europe support grid flexibility and renewable power balancing. The growing role of hydrogen in heavy transport and industrial decarbonization further strengthens Europe’s market position.

Asia Pacific

Asia Pacific captured about 27% share of the global market in 2024, led by strong policy support and rising hydrogen mobility investments. Japan, South Korea, and China are expanding hydrogen refueling stations and large-scale storage projects to support clean transportation. Rapid industrialization and growing renewable energy deployment are boosting compressed hydrogen storage adoption. Governments are promoting public-private partnerships for hydrogen infrastructure under initiatives such as Japan’s Strategic Roadmap for Hydrogen and China’s Hydrogen Industry Plan. The region’s strong manufacturing ecosystem further enhances cost efficiency and technological development.

Latin America

Latin America accounted for nearly 6% share in 2024, supported by emerging renewable hydrogen projects in Chile, Brazil, and Argentina. Countries are leveraging abundant solar and wind resources to develop hydrogen export capacity. Chile’s Atacama region is becoming a hub for compressed hydrogen production and storage integration. Government-backed pilot projects focus on grid support and green ammonia production. Although infrastructure remains limited, increasing foreign investments and partnerships with European and Asian firms are expected to strengthen the region’s hydrogen value chain over the forecast period.

Middle East & Africa

The Middle East & Africa region held about 4% share in 2024, with strong potential driven by green hydrogen export initiatives. The United Arab Emirates and Saudi Arabia are investing in large-scale hydrogen storage and production projects to diversify energy portfolios. South Africa is advancing hydrogen corridor development to support transport and industrial applications. Growing renewable power capacity and interest in hydrogen-based desalination and ammonia production are enhancing regional adoption. Strategic collaborations with European and Asian partners are accelerating technological transfer and market readiness.

Market Segmentations:

By Storage Medium

- Underground Storage

- Above Ground Storage

- Pipeline Storage

By Application

- Mobility

- Stationary

- Portable

By End Use

- Power Generation

- Transportation

- Industrial

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The compressed hydrogen energy storage market is characterized by strong competition among major players such as Air Liquide, Hexagon Purus, McPhy Energy, Proton Technologies, INOXCVA, GKN Hydrogen, TotalEnergies, Linde, Xebec Adsorption, Green Hydrogen Systems, Forvia (formerly Faurecia), Chart Industries, SGH2 Energy, Taiyo Nippon Sanso Corporation, UQE Hydrogen, Cryostar SAS, and Nel ASA. These companies focus on large-scale hydrogen infrastructure development, advanced storage technologies, and integration with renewable energy systems. Strategic partnerships with utilities and industrial firms are expanding hydrogen value chains. Firms are emphasizing modular storage systems, digital monitoring, and enhanced compression technologies to improve efficiency and safety. Many are investing in pilot projects and demonstration plants to strengthen regional presence and technical credibility. Collaborations with governments and research institutions further accelerate innovation and commercialization of large-capacity storage solutions. Continuous R&D in composite materials, low-leakage systems, and automation supports cost reduction and scalability across mobility and industrial sectors.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Air Liquide

- Hexagon Purus

- McPhy Energy

- Proton Technologies

- INOXCVA

- GKN Hydrogen

- TotalEnergies

- Linde

- Xebec Adsorption

- Green Hydrogen Systems

- Forvia (formerly Faurecia)

- Chart Industries

- SGH2 Energy

- Taiyo Nippon Sanso Corporation

- UQE Hydrogen

- Cryostar SAS

- Nel ASA

Recent Developments

- In 2025, Hexagon Purus renewed a multi-year supply agreement with a leading European bus manufacturer for hydrogen storage systems extending through 2028.

- In 2023, Chart Industries partnered with Energy Vault to supply its hydrogen fueling solution for a large-scale green hydrogen energy storage system in California.

- In 2023, Forvia (formerly Faurecia) announced a contract to supply Type IV hydrogen storage systems to a major automotive manufacturer for medium-duty commercial trucks in the North American market.

Report Coverage

The research report offers an in-depth analysis based on Storage Medium, Application, End-Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand rapidly with large-scale renewable energy integration across grids.

- Underground hydrogen storage will remain the preferred option for seasonal and bulk applications.

- Advancements in high-pressure and composite storage technologies will improve efficiency and safety.

- Governments will strengthen policy support through funding, incentives, and hydrogen roadmaps.

- Hydrogen mobility infrastructure will grow, supporting commercial and heavy-duty transport fleets.

- Industrial adoption will increase for backup power, refining, and chemical production uses.

- Integration with green hydrogen projects will enhance sustainability and reduce emissions.

- Public-private collaborations will drive technology standardization and large project deployments.

- Declining equipment and compression costs will improve economic feasibility for emerging markets.

- The market will evolve toward hybrid storage systems combining hydrogen, batteries, and renewables for grid stability.