Market Overview

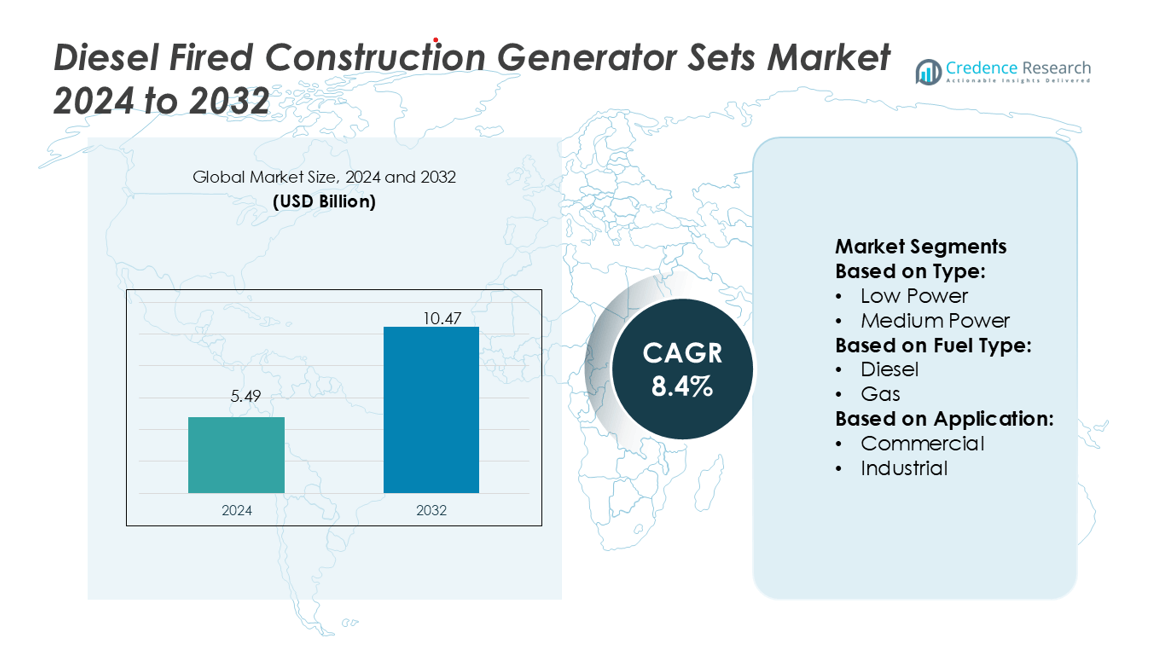

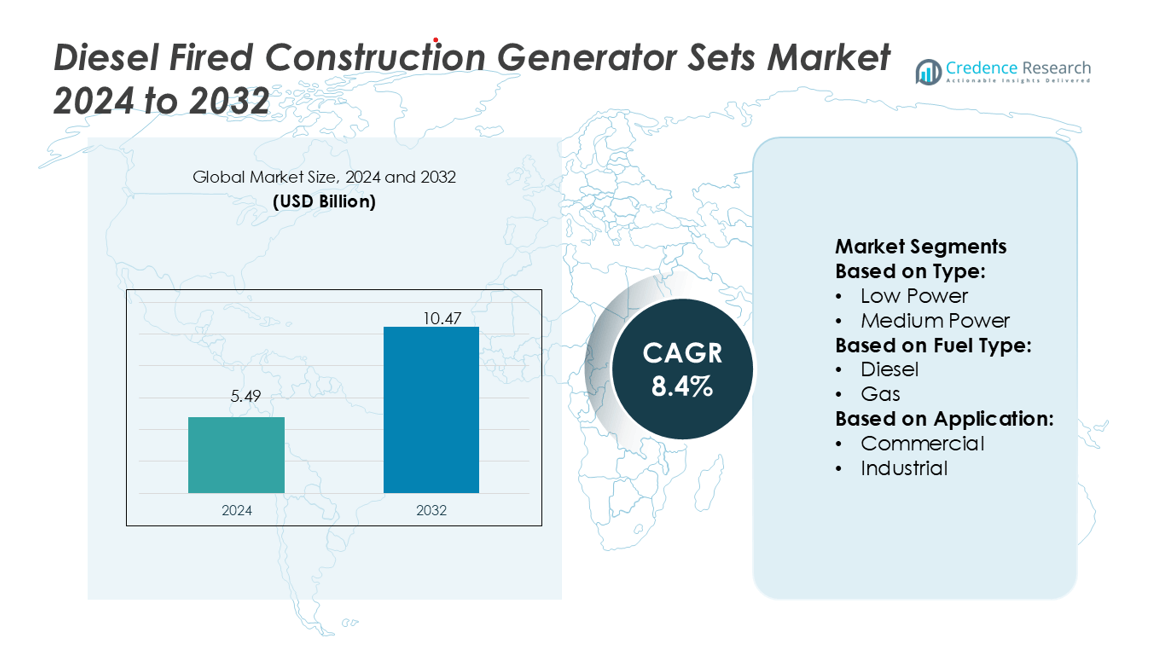

Diesel Fired Construction Generator Sets Market size was valued USD 5.49 billion in 2024 and is anticipated to reach USD 10.47 billion by 2032, at a CAGR of 8.4% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Diesel Fired Construction Generator Sets Market Size 2024 |

USD 5.49 billion |

| Diesel Fired Construction Generator Sets Market, CAGR |

8.4% |

| Diesel Fired Construction Generator Sets Market Size 2032 |

USD 10.47 billion |

Diesel Fired Construction Generator Sets Market size was valued USD 5.49 billion in 2024 and is anticipated to reach USD 10.47 billion by 2032, at a CAGR of 8.4% during the forecast period.The Diesel Fired Construction Generator Sets Market is driven by strong competition among leading players such as Mahindra Powerol, Cummins, Kohler, Greaves Cotton, Atlas Copco, J C Bamford Excavators, Caterpillar, HIMOINSA, Kirloskar, and Generac Power Systems. These companies focus on advanced engine technologies, hybrid power solutions, and smart monitoring systems to meet growing construction demands worldwide. Product durability, low emissions, and efficient fuel performance remain key areas of innovation. Asia Pacific leads the market with a 34% share, supported by rapid infrastructure development, industrial expansion, and frequent power reliability challenges. Strong dealer networks and rental fleet expansions further strengthen the region’s position as the dominant hub for diesel generator deployment.

Market Insights

- The Diesel Fired Construction Generator Sets Market was valued at USD 5.49 billion in 2024 and is projected to reach USD 10.47 billion by 2032, growing at a CAGR of 8.4%.

- Rising infrastructure and construction activities drive steady demand for diesel generator sets across commercial and industrial projects.

- Manufacturers focus on hybrid power solutions, digital monitoring, and low-emission technologies to enhance product performance and meet regulations.

- Asia Pacific leads the market with a 34% share, driven by rapid urbanization and frequent power reliability issues, followed by North America and Europe.

- The high-power segment holds the largest share, supported by large-scale construction projects and rental fleet expansions that boost market penetration in emerging economies.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

The medium power segment holds the dominant share in the Diesel Fired Construction Generator Sets Market. Medium power generator sets offer an optimal balance of fuel efficiency, mobility, and load-handling capacity, making them ideal for construction projects that demand continuous power without excessive operational costs. These generator sets are widely used in mid-sized infrastructure and commercial building projects. The strong adoption is driven by their ability to support both lighting and heavy machinery on-site. Their higher reliability and reduced maintenance needs strengthen their position in the market compared to low and high-power units.

- For instance, Mahindra Powerol offers a 250 kVA diesel generator set featuring a 9.3-liter, 6-cylinder engine. This generator is capable of handling loads up to 200 kW continuously at construction sites, with maintenance intervals extended to 500 hours of operation.

By Fuel Type

The diesel segment commands the largest market share due to its superior energy density and cost efficiency. Diesel-fired generator sets provide stable performance under heavy loads and are well-suited for remote construction sites where grid access is limited. The widespread availability of diesel fuel and longer operational life make these units a preferred choice for contractors. Lower fuel consumption and enhanced durability also contribute to their growing demand. This strong preference positions diesel as the dominant fuel type over gas-based alternatives in construction power generation.

- For instance, Cummins launched its QSK95 Series diesel generator set with a power output of up to 3,500 kW at 60 Hz. The generator is designed to run for extended periods with a major overhaul interval of up to 25,000 hours, making it suitable for mission-critical applications.

By Application

The industrial segment leads the market share, supported by large-scale infrastructure development and energy-intensive operations. Industrial construction projects often require sustained and high-capacity power for cranes, concrete mixers, and other heavy equipment. Diesel-fired generator sets deliver the required reliability, making them integral to operations in mining, road construction, and manufacturing projects. The growing number of large-scale industrial parks and smart city projects further fuels this demand. Their ability to operate continuously in demanding conditions gives industrial applications a clear advantage over commercial use cases.

Key Growth Drivers

Rising Demand for Reliable Power Backup in Construction

The growing reliance on uninterrupted power supply is fueling demand for diesel fired generator sets in construction projects. These generators provide stable energy during peak operations and remote site work. Many construction sites depend on them for heavy-duty equipment and continuous lighting. The increasing number of infrastructure projects, including roads, bridges, and commercial buildings, strengthens this demand. Their cost-effectiveness and ease of refueling further boost adoption. This driver is strongly supported by rapid urbanization and ongoing expansion of large-scale construction activities.

- For instance, Kohler’s KD2250 generator set delivers 2,250 kW (standby) / 2,040 kW (prime) at 60 Hz, using a 62 L V12 engine that consumes about 632 L/h at full load in standby mode.

Rapid Urbanization and Infrastructure Development

Expanding urban infrastructure is a major growth engine for the diesel fired construction generator sets market. Rising government investments in transport networks, smart cities, and residential buildings drive the need for stable power sources. Diesel generators help maintain smooth operations, especially in areas with unstable grid supply. Many contractors choose diesel sets for their proven performance under extreme weather and heavy loads. This expanding infrastructure pipeline continues to create stable, recurring demand for these generators across global construction sites.

- For instance, Greaves Cotton’s GPWII-PII-125S silent diesel generator delivers 125 kVA / 100 kW output at 50 Hz, with fuel consumption of 28.6 litres per hour under full load, displacement of 4.87 L, and maximum exhaust back pressure of 4.5 kPa.

Cost Efficiency and Low Maintenance Benefits

Diesel generator sets offer lower operational costs compared to alternative backup systems. These systems consume less fuel per kWh and have a longer operational life. Their robust design reduces breakdown risks, minimizing downtime during critical construction stages. Many rental fleets and contractors prefer diesel units because of their easy availability and simple servicing requirements. This combination of durability, lower total ownership cost, and minimal maintenance supports wider adoption across small and large construction projects.

Key Trends & Opportunities

Integration of Digital Monitoring and Control

The adoption of IoT-enabled and smart control systems is rising in diesel generator sets. Construction firms increasingly seek real-time performance tracking, remote diagnostics, and predictive maintenance features. These capabilities help reduce downtime and improve fuel efficiency. Many manufacturers are embedding sensors and telematics to enhance fleet management and maintenance scheduling. This shift toward intelligent systems opens new opportunities for service-based revenue models and long-term contracts with construction companies.

- For instance, Atlas Copco’s QAS series includes a Power Management System (PMS) that dynamically controls up to 32 units in parallel to deliver up to 20 MVA of stable output.

Expansion of Rental and Leasing Models

The demand for generator rental services is expanding rapidly in the construction industry. Contractors prefer short-term leasing to avoid high capital costs and simplify maintenance. Rental providers are offering flexible packages and advanced units with better load-handling capabilities. This trend supports rapid scaling of construction projects, especially in emerging markets with large infrastructure pipelines. It also creates a strong aftermarket opportunity for OEMs and service providers.

- For instance, Caterpillar’s XQ570 rental generator delivers 500 kW standby / 455 kW prime output at 60 Hz using a Cat C18 ACERT engine. Cat’s DE110E2 generator (commonly offered for lease), which provides 100 kVA prime / 110 kVA standby and burns 21.7 L/h (prime) under 50 Hz load.

Focus on Low-Emission and Hybrid Technologies

Growing environmental concerns are pushing manufacturers to develop cleaner diesel technologies. Many are investing in hybrid generator sets that combine diesel engines with battery storage. These solutions lower emissions and improve fuel efficiency without compromising power output. This shift aligns with global sustainability goals and upcoming emission regulations. As a result, companies that offer low-emission models stand to gain a strong competitive edge.

Key Challenges

Stringent Emission Regulations

Tightening emission standards present a major challenge for diesel generator manufacturers. Regulatory bodies are imposing limits on nitrogen oxides, particulate matter, and CO₂ emissions. Meeting these standards often requires costly engine upgrades or after-treatment systems. Smaller manufacturers and rental companies may face difficulty adapting to these changes. This regulatory pressure could increase equipment costs and reduce profit margins in the short term.

Growing Competition from Alternative Energy Sources

The rising use of renewable energy solutions and battery storage systems is a growing threat to diesel generator demand. Solar-hybrid systems offer cleaner and sometimes cheaper long-term operation. Construction companies are exploring these technologies to meet sustainability goals and reduce fuel dependency. This shift could limit the market’s growth potential unless manufacturers innovate to remain competitive with hybrid or low-emission diesel technologies.

Regional Analysis

North America

North America holds a 29% share of the diesel fired construction generator sets market. The region benefits from strong investments in commercial infrastructure and data center construction. High power reliability requirements in critical projects drive steady demand. The U.S. leads due to frequent extreme weather events that increase backup power needs. Major construction projects in Canada further support market growth. Stringent emission norms encourage adoption of modern, fuel-efficient models. Demand remains stable across both permanent and temporary power solutions, with growing rental fleet expansion by manufacturers.

Europe

Europe accounts for 23% of the diesel fired construction generator sets market. The region focuses on efficient, low-emission generator sets to align with EU climate goals. High construction activity in Germany, France, and the U.K. drives consistent demand. Infrastructure renewal projects and urban development contribute to stable sales volumes. Strict environmental regulations encourage hybrid and low-noise variants. The market sees strong adoption in residential, commercial, and industrial construction segments. Rising energy transition initiatives further push modernization of power backup systems across the region.

Asia Pacific

Asia Pacific commands the largest share of 34% in the diesel fired construction generator sets market. Rapid urbanization and industrial growth in China, India, and Southeast Asia drive large-scale construction. Frequent power outages and unstable grid supply increase reliance on diesel generator sets. Governments prioritize infrastructure expansion, creating sustained equipment demand. Large-scale projects in transport and smart cities fuel sales growth. Manufacturers expand local production and rental services to meet rising demand. High deployment in construction sites highlights the region’s strong dominance.

Latin America

Latin America accounts for 5% of the diesel fired construction generator sets market. Brazil and Mexico lead with strong demand from commercial and industrial construction. Frequent grid instability and growing infrastructure investment strengthen generator adoption. The construction sector relies heavily on mid-range power rating units. Port expansion, renewable energy projects, and housing developments drive consistent sales. Market growth remains steady due to rental fleet expansion and public-private investments. Local distributors focus on cost-effective, reliable units to meet project timelines efficiently.

Middle East & Africa

The Middle East & Africa region holds a 9% share of the diesel fired construction generator sets market. Massive infrastructure developments, including stadiums, commercial hubs, and industrial zones, support demand. Countries like Saudi Arabia and the UAE invest in large construction projects under national transformation programs. Unstable power supply in parts of Africa drives steady generator usage. Portable and high-power units are favored for remote construction sites. Market growth is supported by flexible rental models and durable equipment suited to harsh conditions.

Market Segmentations:

By Type:

By Fuel Type:

By Application:

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Diesel Fired Construction Generator Sets Market is shaped by key players including Mahindra Powerol, Cummins, Kohler, Greaves Cotton, Atlas Copco, J C Bamford Excavators, Caterpillar, HIMOINSA, Kirloskar, and Generac Power Systems. The competitive landscape of the Diesel Fired Construction Generator Sets Market is defined by rapid product innovation, strong service networks, and expanding rental fleets. Manufacturers focus on delivering high-efficiency, low-emission generator sets to meet growing construction demands. Companies emphasize integrating digital monitoring, hybrid technologies, and automation to improve operational reliability. Strong dealer partnerships and after-sales support help sustain market presence in both developed and emerging economies. The shift toward rental solutions is gaining momentum, driven by short-term project needs and cost flexibility. Continuous investments in R&D enhance performance, durability, and compliance with emission standards, ensuring a competitive edge.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Mahindra Powerol

- Cummins

- Kohler

- Greaves Cotton

- Atlas Copco

- J C Bamford Excavators

- Caterpillar

- HIMOINSA

- Kirloskar

- Generac Power Systems

Recent Developments

- In August 2024, Tata Power and Druk Green Power Corporation (DGPC) entered into a partnership to create the 600 MW Khorlochhu Hydropower facility. DGPC will own 60%, while Tata Power will hold a 40% equity stake in the venture.

- In April 2024, Cummins division, Cummins Power Generation launched its Centum series by introducing the C3000D6EB and C2750D6E models, both powered by the robust QSK78 engine. These high-capacity units deliver outputs of 3,000 kW and 2,750 kW, respectively, and are specifically designed for critical applications such as healthcare facilities, data centers, and wastewater treatment plants.

- In January 2024, Rolls-Royce enhanced its 1600 Gx1 diesel engine by introducing a new generation of 12-cylinder engines capable of delivering up to 100 kW. This upgraded Series 1600 offers a powerful and reliable solution for critical power generation needs, including data centers, hospitals, and airports.

- In February 2023, Caterpillar Inc. announced the launch of the Cat® XQ330 Series of Mobile Diesel Generators. It is a new power solution for standby and mission-critical applications that meets the U.S. EPA Tier 4 Final emission standards

Report Coverage

The research report offers an in-depth analysis based on Type, Fuel Type, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for diesel fired generator sets will grow with rising global construction activity.

- Manufacturers will focus on fuel-efficient and low-emission technologies to meet stricter standards.

- Rental and leasing models will expand to serve short-term and remote construction projects.

- Integration of smart monitoring and IoT systems will improve performance and reliability.

- Hybrid and dual-fuel systems will gain traction to reduce carbon emissions.

- Infrastructure development in emerging economies will drive strong regional market growth.

- Compact and portable models will see higher adoption for flexible site use.

- Companies will strengthen service and distribution networks to enhance market reach.

- Automation and digital control features will improve operational efficiency on construction sites.

- Sustainability goals will shape product innovation and long-term market strategies.