Market Overview

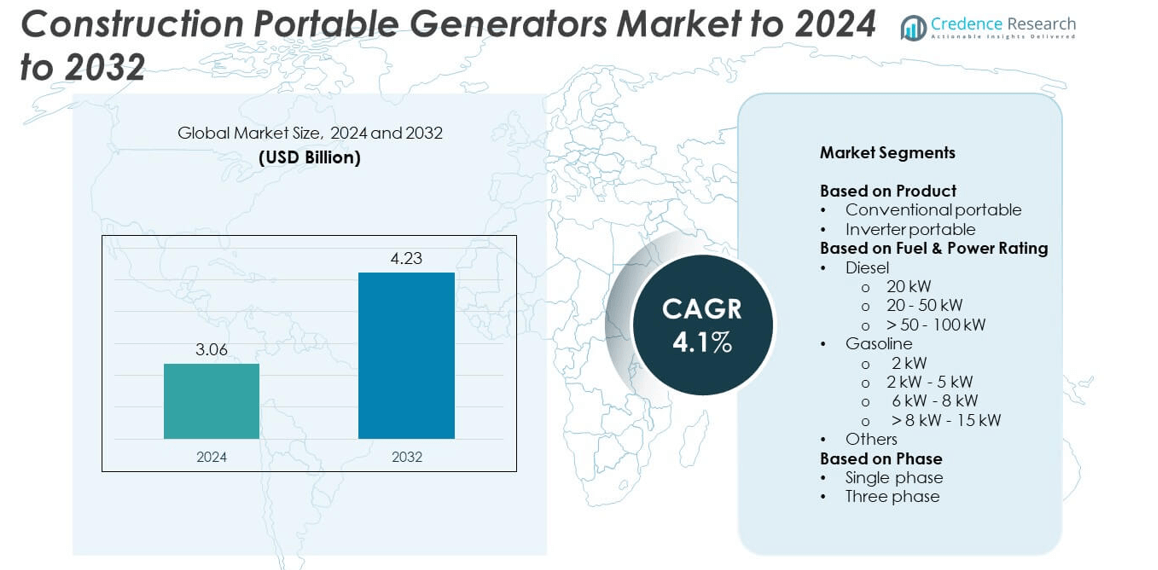

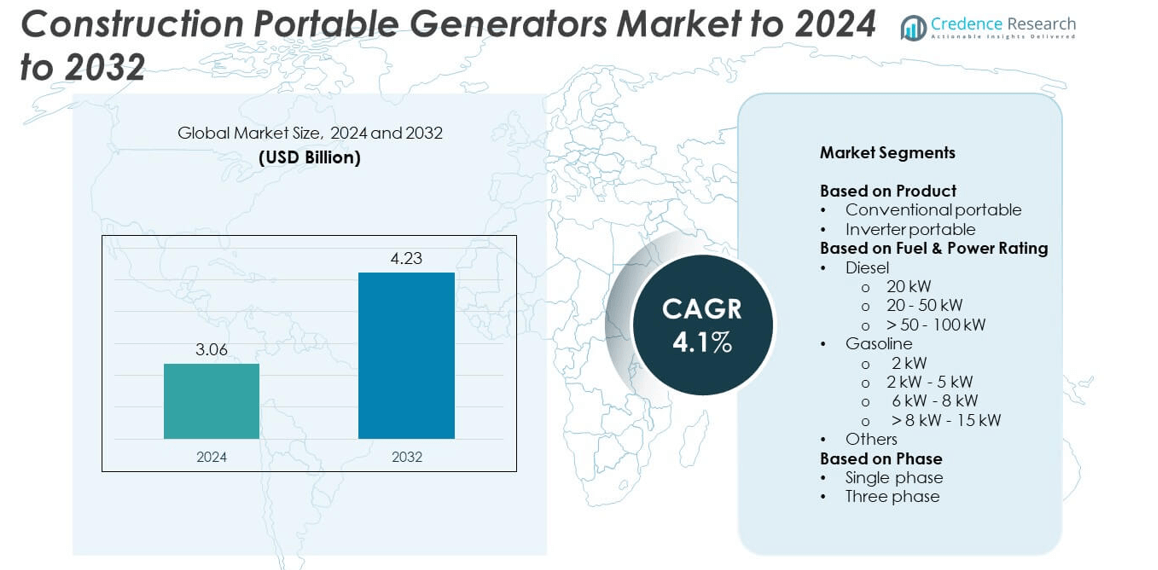

Construction Portable Generators market size was valued at USD 3.06 billion in 2024 and is anticipated to reach USD 4.23 billion by 2032, growing at a CAGR of 4.1% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Portable Generators Market Size 2024 |

USD 3.06 billion |

| Portable Generators Market, CAGR |

4.1% |

| Portable Generators Market Size 2032 |

USD 4.23 billion |

The Construction Portable Generators market is led by prominent manufacturers such as Caterpillar, Generac Power Systems, Atlas Copco, Honda India Power Products, and Cummins, each maintaining strong global and regional distribution networks. These companies focus on developing durable, fuel-efficient, and low-emission portable generators to meet diverse construction power needs. Competitive strategies include product innovation, smart monitoring integration, and expansion into rental and hybrid solutions. In 2024, Asia-Pacific dominated the market with a 38% share, driven by large-scale infrastructure projects, rapid industrialization, and growing demand for reliable on-site power in emerging economies such as China, India, and Indonesia.

Market Insights

- The Construction Portable Generators market was valued at USD 3.06 billion in 2024 and is projected to reach USD 4.23 billion by 2032, growing at a CAGR of 4.1%.

- Rising construction and infrastructure projects worldwide are driving demand for reliable on-site power sources, particularly in remote and off-grid locations.

- The market is witnessing trends toward hybrid and inverter generators with digital controls, focusing on fuel efficiency and low emissions.

- Leading companies are investing in smart, noise-reduced, and portable designs to strengthen competitiveness, with the conventional portable segment holding over 63% market share in 2024.

- Asia-Pacific dominated the market with a 38% regional share, followed by North America at 29% and Europe at 23%, driven by strong industrialization and infrastructure development across major economies.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product

The conventional portable segment dominated the Construction Portable Generators market in 2024 with over 63% share. These generators are widely used on job sites due to their high power output, durability, and cost efficiency. Their capability to operate heavy-duty equipment such as drills, mixers, and lighting systems makes them essential in large-scale projects. Inverter portable generators are gaining traction for their compact design, low noise levels, and fuel efficiency, which support small and medium construction projects focusing on energy conservation and compliance with emission standards.

- For instance, Honda’s EU2200i lists 48–57 dB(A) noise and 8.1 hours at ¼-load per tank.

By Fuel & Power Rating

The diesel segment led the market with nearly 58% share in 2024, driven by its longer runtime, fuel efficiency, and lower maintenance requirements. Within this segment, generators in the 20–50 kW range accounted for the highest demand due to their balanced output and suitability for mid-sized construction sites. Gasoline-powered generators dominated smaller power categories such as 2–5 kW, serving residential and small commercial applications. The growing use of hybrid and alternative fuel types under the “others” category reflects rising interest in sustainable on-site power solutions.

- For instance, the Doosan G25WDO-3A-T4F generator package provides 25 kVA (20 kW) of prime power.

By Phase

Single-phase generators accounted for around 55% market share in 2024, supported by their use in light construction, temporary office setups, and power tools requiring lower load capacities. These units are cost-effective, easy to transport, and ideal for short-duration operations. However, the three-phase segment is expanding rapidly as large construction projects demand higher voltage and stability to run multiple heavy-duty machines simultaneously. The shift toward three-phase units is further encouraged by increased infrastructure investment and the adoption of automated and electrically intensive construction equipment.

Key Growth Drivers

Rising Construction and Infrastructure Activities

Expanding construction and infrastructure projects are driving significant demand for portable power solutions across the globe. Rapid urbanization, industrialization, and government-led investments in residential, commercial, and transport infrastructure are creating a strong need for reliable on-site power. Portable generators are essential in remote and temporary locations where access to grid electricity is limited. They enable continuous operation of heavy machinery, tools, and lighting, improving work efficiency and project timelines. This widespread dependence on portable power makes construction and infrastructure expansion the key growth driver of the market.

- For instance, Wacker Neuson’s GP2500A lists 7.4 hours half-load runtime and 73 dB sound, matching small-site duty.

Growing Demand for Reliable Backup Power

The increasing frequency of power outages and unstable grid supply in developing regions has intensified the demand for reliable backup power systems. Construction sites depend on continuous energy to power critical machinery, safety systems, and communication equipment. Portable generators provide a flexible and immediate solution, ensuring operational consistency and safety during unpredictable grid failures. Diesel-based models remain popular for their high efficiency and endurance, while inverter variants attract attention for cleaner and quieter operation. This rising dependence on backup power generation continues to boost market expansion globally.

- For instance, Generac’s GP6500 specifies 10.5 hours runtime at 50% load on its integrated tank.

Technological Advancements in Generator Design

Ongoing advancements in generator design are transforming the industry, making equipment more efficient, durable, and environmentally compliant. Manufacturers are integrating digital monitoring, automatic load adjustment, and remote diagnostics to enhance performance and reduce maintenance downtime. Lightweight, low-noise designs and hybrid configurations that combine fuel and battery systems are becoming popular in eco-conscious construction zones. These developments also help meet emission norms and lower fuel usage, aligning with global sustainability goals. Such innovations are strengthening the market’s technological foundation and attracting buyers focused on long-term operational efficiency.

Key Trends & Opportunities

Shift Toward Hybrid and Battery-Integrated Systems

The construction portable generators market is witnessing a notable shift toward hybrid power systems that blend internal combustion engines with battery storage technologies. These systems reduce fuel consumption, carbon emissions, and operational noise, appealing to green construction initiatives and energy-efficient projects. With growing emphasis on carbon neutrality and stricter global emission norms, hybrid and renewable-integrated generator systems are becoming key investment areas. This evolution offers manufacturers new opportunities to diversify their portfolios and cater to sustainable construction requirements in developed and emerging economies.

- For instance, HIMOINSA’s EHR line scales to 30 or 45 kVA with storage options, and its new center is ramping battery models to 300 kWh.

Rising Adoption of Smart and Connected Generators

Smart technology integration is emerging as a defining trend in portable power generation. IoT-enabled generators allow operators to track real-time performance, fuel efficiency, and maintenance needs remotely through digital dashboards. Predictive analytics reduce unplanned downtime and optimize power management at construction sites. These connected systems are particularly valuable for large-scale projects requiring multiple power units with synchronized operation. As Industry 4.0 technologies continue to penetrate construction, the demand for intelligent, connected portable generators is set to rise sharply in the coming years.

- For instance, Caterpillar’s Remote Asset Monitoring logged a unit running 25+ hours during an outage and pushed real-time alerts.

Expansion in Emerging Markets

Rapid economic growth and infrastructure development in Asia-Pacific, the Middle East, and Africa are creating vast market opportunities. Countries like India, Indonesia, Saudi Arabia, and Nigeria are investing heavily in smart cities, housing, and industrial parks, leading to higher generator deployment. Limited access to stable electricity grids in rural construction zones further drives the need for portable power sources. Local manufacturing initiatives and increasing availability of cost-effective generators also support wider adoption. This regional expansion presents a crucial opportunity for manufacturers to strengthen their global presence and tap into new customer bases.

Key Challenges

Stringent Emission Regulations and Environmental Concerns

The introduction of strict emission and noise control standards across major economies poses major challenges for traditional generator manufacturers. Compliance with regulations such as EPA Tier 4 and EU Stage V requires costly upgrades, including advanced filtration systems and catalytic converters. These environmental mandates also increase production and maintenance costs while pressuring companies to transition toward hybrid and low-emission models. Additionally, public awareness of carbon reduction and noise pollution drives scrutiny of diesel-powered units, compelling manufacturers to innovate quickly to maintain competitiveness and market access.

Volatility in Fuel Prices and Operating Costs

Fluctuations in fuel prices remain a persistent challenge for the Construction Portable Generators market. Diesel and gasoline costs directly influence the total operating expenditure for construction firms, especially in long-duration projects. Rising fuel expenses, combined with transportation and maintenance costs, can reduce profitability and delay procurement decisions. Small and mid-size contractors are particularly affected, often seeking cheaper or second-hand units. This dependence on volatile energy markets emphasizes the need for more fuel-efficient and hybrid generator technologies, though adoption remains gradual due to higher initial costs.

Regional Analysis

North America

North America held around 29% of the Construction Portable Generators market share in 2024, driven by strong construction activity across the United States and Canada. Ongoing infrastructure modernization, residential renovation, and commercial development projects continue to generate steady demand. Contractors prefer inverter and diesel-based portable units for their reliability, compliance with emission standards, and fuel efficiency. The presence of major manufacturers and growing adoption of connected power solutions also support market expansion. Increasing focus on sustainable and noise-compliant generators is further shaping future demand in the region.

Europe

Europe accounted for nearly 23% of the market share in 2024, supported by robust urban infrastructure and green building initiatives. The region’s strict emission norms encourage adoption of hybrid and low-emission portable generators. Countries such as Germany, the UK, and France are investing heavily in smart cities and renewable-integrated construction technologies. Demand is also rising from refurbishment and small-scale construction projects across Southern Europe. European manufacturers emphasize energy efficiency and noise reduction, aligning with sustainability targets and improving the competitiveness of advanced generator technologies in the regional market.

Asia-Pacific

Asia-Pacific dominated the Construction Portable Generators market with approximately 38% share in 2024. Rapid industrialization, urban growth, and major public infrastructure investments in China, India, and Southeast Asia continue to fuel strong demand. Limited grid access in remote areas further drives the use of portable units for site operations and backup power. Regional manufacturers are introducing cost-effective, durable, and fuel-efficient generators tailored for diverse climatic conditions. Growing construction activity in both developed and developing economies positions Asia-Pacific as the fastest-growing regional market over the forecast period.

Latin America

Latin America captured around 6% of the global market share in 2024, supported by the gradual recovery of construction activities in Brazil, Mexico, and Chile. The region’s expanding commercial infrastructure and residential projects create consistent demand for small and mid-capacity portable generators. Economic reforms and foreign investments in industrial zones are further driving market growth. However, volatility in fuel prices and limited access to advanced equipment remain challenges. Manufacturers focusing on affordable, rugged, and fuel-efficient designs are finding increasing opportunities within Latin America’s evolving construction sector.

Middle East & Africa

The Middle East & Africa region accounted for nearly 4% of the Construction Portable Generators market share in 2024. Ongoing megaprojects in the UAE, Saudi Arabia, and South Africa are driving steady demand for portable power solutions. Infrastructure expansion in mining, oil and gas, and urban housing projects contributes to rising sales. The region’s dependence on off-grid construction sites strengthens the preference for high-capacity diesel and hybrid generators. Increasing investments in renewable energy and smart infrastructure are expected to create future growth opportunities across both the Middle East and African subregions.

Market Segmentations:

By Product

- Conventional portable

- Inverter portable

By Fuel & Power Rating

- Diesel

- 20 kW

- 20 – 50 kW

- > 50 – 100 kW

- Gasoline

- 2 kW

- 2 kW – 5 kW

- 6 kW – 8 kW

- > 8 kW – 15 kW

- Others

By Phase

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Construction Portable Generators market is characterized by strong competition among major manufacturers such as Caterpillar, Generac Power Systems, Atlas Copco, Honda India Power Products, Cummins, Yamaha Motor, Briggs & Stratton, Wacker Neuson, YANMAR HOLDINGS, Champion Power Equipment, Allmand Bros, FIRMAN Power Equipment, GENMAC, John Deere, Kirloskar Oil Engines, DEWALT, DuroMax Power Equipment, Rehlko, Westinghouse Electric Corporation, and HIMOINSA. Market players compete through innovation, product reliability, and energy efficiency to strengthen their global presence. The industry is witnessing a shift toward low-emission, noise-controlled, and hybrid generator technologies to comply with stricter environmental norms. Companies are expanding their distribution networks, developing region-specific models, and offering integrated digital control systems to enhance operational performance. Strategic collaborations, rental service expansion, and sustainable power solutions are also central to competitive differentiation. Continuous investments in R&D and smart monitoring capabilities are shaping the next phase of competition in the construction portable power equipment sector.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Caterpillar

- Generac Power Systems

- Atlas Copco

- Honda India Power Products

- Cummins

- Yamaha Motor

- Briggs & Stratton

- Wacker Neuson

- YANMAR HOLDINGS

- Champion Power Equipment

- Allmand Bros

- FIRMAN Power Equipment

- GENMAC

- John Deere

- Kirloskar Oil Engines

- DEWALT

- DuroMax Power Equipment

- Rehlko

- Westinghouse Electric Corporation

- HIMOINSA

Recent Developments

- In 2025, Cummins launched a groundbreaking 17-liter engine platform generator set as part of its Centum™ Series, producing up to 1 megawatt of power within a compact footprint.

- In 2025, Atlas Copco launched its modular hybrid power generator range (EPH series)

- In 2023, Caterpillar launched the Cat XQ330 mobile diesel generator, powered by a Tier 4 Final compliant engine.

- In 2023, Generac introduced the GP7500E Dual Fuel portable generator, which provided the flexibility of running on both gasoline and LPG.

Report Coverage

The research report offers an in-depth analysis based on Product, Fuel & Power Rating, Phase and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market is expected to grow steadily with increasing construction and infrastructure activities worldwide.

- Demand for hybrid and inverter generators will rise due to efficiency and reduced emissions.

- Asia-Pacific will continue to lead market growth with rapid urbanization and industrial projects.

- North America will witness adoption of smart, low-noise, and emission-compliant generator models.

- Europe will focus on sustainable and hybrid power systems supporting green construction practices.

- Compact and lightweight generator models will gain traction in mobile construction operations.

- IoT integration will enhance monitoring, maintenance, and energy optimization on job sites.

- Manufacturers will prioritize R&D to develop fuel-efficient and eco-friendly designs.

- The rental and leasing segment will expand, offering flexibility for short-term construction needs.

- Emerging markets in the Middle East, Africa, and Latin America will drive future demand growth.