Market Overview

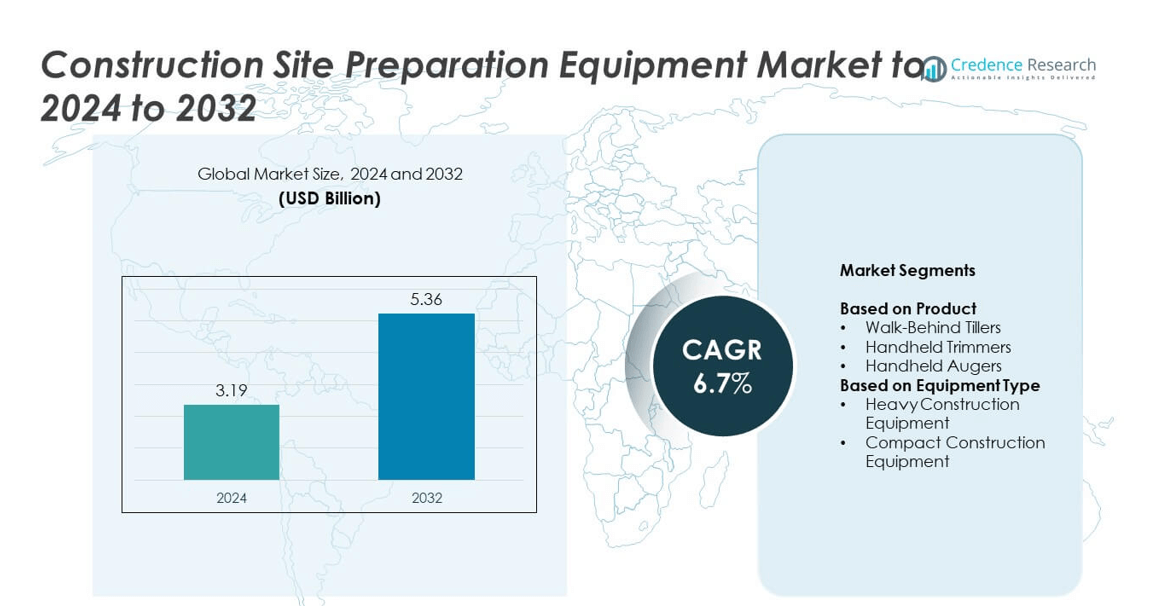

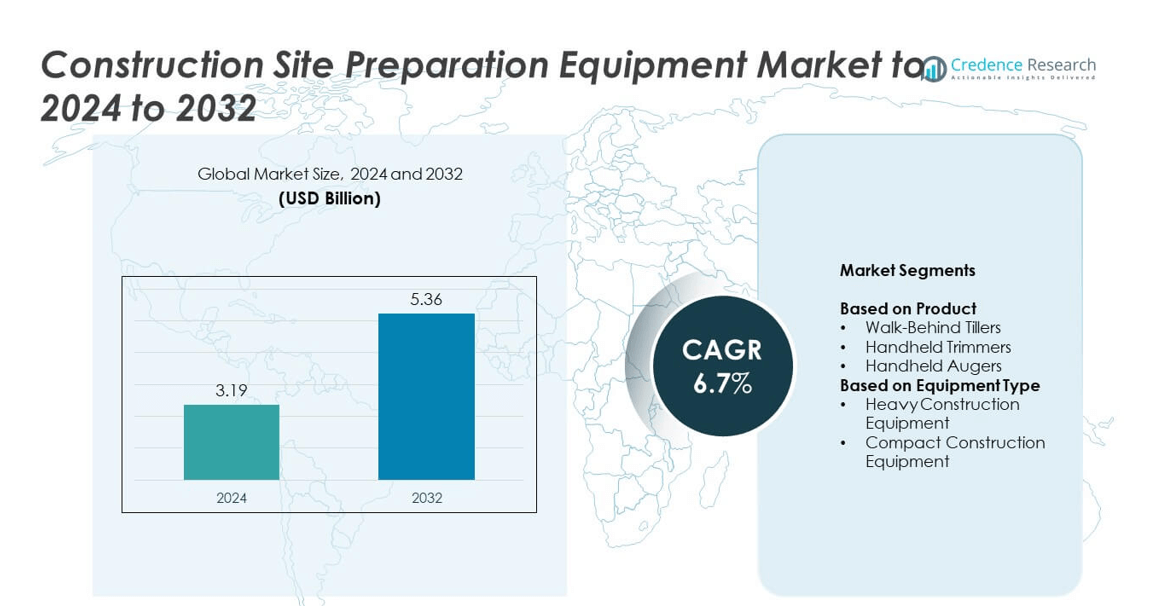

The Construction Site Preparation Equipment Market size was valued at USD 3.19 billion in 2024 and is anticipated to reach USD 5.36 billion by 2032, at a CAGR of 6.7% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Construction Site Preparation Equipment Market Size 2024 |

USD 3.19 billion |

| Construction Site Preparation Equipment Market, CAGR |

6.7% |

| Construction Site Preparation Equipment Market Size 2032 |

USD 5.36 billion |

The Construction Site Preparation Equipment market is led by prominent companies such as Komatsu, Honda Motor Company, STIHL Inc, Caterpillar, BCS America, Barreto Manufacturing, Volvo Construction Equipment, and Mantis. These players maintain strong market positions through continuous innovation, automation, and eco-friendly machinery development. Their strategies emphasize compact, fuel-efficient, and hybrid models to meet evolving sustainability standards and improve site efficiency. Regionally, Asia Pacific led the market with a 30% share in 2024, driven by rapid industrialization, infrastructure investments, and urban development projects. North America followed with 32%, supported by advanced construction technologies and modernization initiatives across commercial and residential sectors.

Market Insights

- The Construction Site Preparation Equipment market was valued at USD 3.19 billion in 2024 and is expected to reach USD 5.36 billion by 2032, growing at a CAGR of 6.7%.

- Rising infrastructure projects, urban expansion, and modernization of construction processes are driving strong demand for heavy and compact equipment.

- Key trends include the adoption of electric and hybrid machinery, automation, and IoT-based fleet management to improve efficiency and sustainability.

- The market is competitive, with leading companies focusing on advanced technologies, rental services, and eco-friendly equipment designs to gain market share.

- Asia Pacific held a 30% market share in 2024, followed by North America at 32% and Europe at 27%, while the heavy construction equipment segment led with 68% share due to its extensive use in large-scale projects.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product

Walk-behind tillers dominated the market in 2024, accounting for over 42% of the total share. These machines are widely used for soil preparation, landscaping, and small-scale construction due to their efficiency and ease of operation. Growing demand for compact and fuel-efficient tillers in urban construction projects is driving this segment’s growth. Handheld trimmers and augers follow closely, supported by increased use in fencing, gardening, and groundwork applications. Technological advancements in lightweight designs and battery-powered tools are further enhancing operational flexibility and safety across small and medium construction sites.

- For instance, Makita’s 40V XGT earth auger spins at 0–400 / 0–1,500 RPM and drills up to 41 in depth with 8 in diameter

By Equipment Type

Heavy construction equipment held the largest market share of around 68% in 2024, driven by extensive use in large-scale excavation, grading, and earthmoving operations. These machines are essential for site leveling, debris removal, and foundation preparation in infrastructure and commercial projects. Rising global investment in smart cities, highways, and industrial zones continues to strengthen demand for heavy machinery. Meanwhile, compact construction equipment is gaining traction due to its lower emissions, maneuverability, and suitability for confined urban worksites, supporting sustainable and efficient construction operations.

- For instance, the new generation of the Volvo ECR25 Electric excavator features a 40 kWh battery, which is double the capacity of its predecessor

Key Growth Drivers

Rising Infrastructure Development Projects

Expanding public and private infrastructure projects are the primary growth driver for the market. Governments across emerging economies are investing heavily in roadways, airports, and housing projects. These initiatives create consistent demand for excavation, grading, and soil-compaction equipment. Rapid urbanization and industrial expansion in Asia-Pacific further support adoption. Construction firms are increasingly deploying advanced machinery to reduce project timelines and enhance productivity, strengthening the overall equipment demand outlook through 2032.

- For instance, JCB marked its 1-millionth backhoe loader produced, reflecting sustained global project demand.

Shift Toward Automation and Advanced Machinery

The integration of automation, GPS, and telematics in site preparation equipment has improved accuracy and efficiency. Automated systems enable better fuel management, precise grading, and reduced labor dependency. Equipment with real-time monitoring and remote control enhances safety and operational reliability on-site. This technological shift is encouraging contractors to upgrade existing fleets, boosting sales of modern, smart machines. The growing use of digital solutions aligns with global trends in smart construction and Industry 4.0 practices.

- For instance, Caterpillar’s VisionLink monitors over 1.5 million connected assets for fleet optimization.

Increasing Demand for Compact and Energy-Efficient Equipment

Compact construction machines are witnessing growing preference due to their versatility and suitability for confined job sites. Urban redevelopment and residential construction projects rely on smaller, fuel-efficient tools for excavation and finishing works. Manufacturers are introducing hybrid and electric-powered compact models to comply with emission standards. Their cost-effectiveness, ease of transport, and low maintenance needs further boost adoption. This demand shift supports sustainable construction practices and contributes to long-term equipment market expansion.

Key Trends & Opportunities

Adoption of Electric and Hybrid Equipment

Sustainability goals and emission control norms are driving the adoption of electric and hybrid site preparation machinery. Equipment manufacturers are focusing on low-noise, zero-emission designs suited for urban areas. Government incentives and carbon reduction targets are accelerating this transition. Electric models also reduce fuel costs and operational downtime, enhancing project efficiency. As battery technology advances, electric machinery is expected to capture a greater market share across small and mid-scale construction sites globally.

- For instance, Hitachi’s ZX55U-6EB packs a 39.4 kWh battery, fast-charges in ~1.25 hours, and offers ~2 hours runtime, with optional tethered operation.

Integration of IoT and Predictive Maintenance Solutions

The integration of IoT sensors and predictive analytics in construction equipment is transforming maintenance strategies. Real-time monitoring enables early fault detection, minimizing downtime and repair costs. Equipment operators gain valuable data insights on usage patterns, fuel efficiency, and productivity. Predictive maintenance systems extend machine life and enhance reliability, creating long-term cost savings. This trend is promoting the use of connected construction fleets, improving site coordination and decision-making efficiency for contractors and developers.

- For instance, Trimble grade-control users report millimeter-level accuracy and up to 50% productivity improvement on projects.

Key Challenges

High Initial Investment and Maintenance Costs

The high capital investment required for advanced construction equipment remains a major challenge. Smaller contractors often face difficulties in acquiring heavy or automated machinery due to limited budgets. Maintenance, fuel, and spare part expenses further add to operational costs. Despite financing options and leasing services, cost sensitivity among small builders restrains market penetration. Manufacturers are addressing this issue through modular equipment design and service-based rental models to improve accessibility and affordability.

Skilled Labor Shortages and Operational Complexity

The growing sophistication of automated and digital equipment demands skilled operators, which many regions lack. Training costs and time constraints hinder efficient equipment utilization. Mismanagement or improper use can lead to delays and mechanical failures, reducing productivity. The shortage of skilled technicians also affects maintenance quality. To address this, companies are investing in operator training programs and remote-assistance systems. However, the skills gap remains a critical barrier to widespread adoption of modern site preparation equipment.

Regional Analysis

North America

North America held a market share of around 32% in 2024, driven by strong investments in infrastructure modernization and commercial construction. The U.S. remains the key contributor, supported by federal infrastructure funding and rising residential development. The presence of leading equipment manufacturers and high adoption of automated machinery enhance market performance. Canada follows with growing construction activities in urban housing and industrial sectors. The region’s focus on sustainable and energy-efficient equipment is encouraging the adoption of electric and hybrid models, maintaining steady demand for both heavy and compact construction machinery through 2032.

Europe

Europe accounted for approximately 27% of the global market in 2024, supported by steady infrastructure upgrades and urban redevelopment projects. Countries such as Germany, France, and the UK are leading adopters of compact and eco-friendly construction equipment. Strict emission regulations and government-backed green building initiatives are encouraging the use of electric and low-noise machinery. The integration of digital and telematics systems in site preparation tools is gaining traction. Growing emphasis on energy efficiency and worker safety is expected to further enhance equipment demand across public and private infrastructure sectors.

Asia Pacific

Asia Pacific dominated the global market with a 30% share in 2024, driven by rapid urbanization, industrial growth, and government infrastructure initiatives. China, India, and Japan lead in equipment adoption due to extensive construction of transportation networks, smart cities, and industrial parks. Increasing investments in residential and commercial projects boost demand for both heavy and compact equipment. Rising awareness of fuel-efficient and low-emission machinery supports sustainable construction goals. The presence of regional manufacturers and lower equipment costs further strengthen Asia Pacific’s competitive advantage in the global market.

Latin America

Latin America captured around 6% of the market share in 2024, supported by infrastructure expansion and urban development projects in Brazil, Mexico, and Argentina. Growing public investment in transportation and housing sectors is fueling equipment demand. Contractors in the region are increasingly adopting compact and cost-efficient site preparation tools to meet diverse project needs. Economic recovery and foreign investment in industrial construction projects are further supporting market growth. However, fluctuations in raw material prices and limited access to financing continue to affect the pace of equipment modernization across the region.

Middle East & Africa

The Middle East & Africa accounted for about 5% of the market share in 2024, led by large-scale infrastructure projects in the UAE, Saudi Arabia, and South Africa. Ongoing construction in energy, transportation, and tourism sectors drives equipment utilization. Governments are investing in sustainable urban development, boosting demand for heavy machinery and compact equipment. The introduction of smart city projects and industrial zones is further accelerating market expansion. However, challenges such as high import costs and dependency on foreign manufacturers limit market penetration, creating opportunities for regional equipment suppliers.

Market Segmentations:

By Product

- Walk-Behind Tillers

- Handheld Trimmers

- Handheld Augers

By Equipment Type

- Heavy Construction Equipment

- Compact Construction Equipment

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Construction Site Preparation Equipment market features leading players such as Komatsu, Honda Motor Company, STIHL Inc, Caterpillar, BCS America, Barreto Manufacturing, Volvo Construction Equipment, Ground Hog, Mantis, VST Tillers Tractors, Little Beaver, Chicago Pneumatic, and General Equipment Company. These companies compete through advanced product design, automation, and fuel-efficient technologies. The market is characterized by continuous innovation, focusing on compact and hybrid equipment to meet environmental regulations and improve site productivity. Strategic partnerships, mergers, and expansion into emerging economies strengthen their global presence. Manufacturers are also prioritizing rental solutions and aftersales services to attract small and mid-scale contractors. The integration of IoT-enabled diagnostics, predictive maintenance, and telematics further enhances operational efficiency. Competitive differentiation now depends on sustainability, digital integration, and customer service, positioning technologically advanced and eco-friendly equipment suppliers to capture higher market share in the evolving construction landscape.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Komatsu

- Honda Motor Company

- STIHL Inc

- Caterpillar

- BCS America, Inc.

- Barreto Manufacturing, Inc.

- Volvo Construction Equipment

- Ground Hog, Inc.

- Mantis (Schiller Grounds Care, Inc.)

- VST Tillers Tractors Ltd.

- Little Beaver, Inc.

- Chicago Pneumatic

- General Equipment Company

Recent Developments

- In 2025, Volvo Construction Equipment Unveiled a new lineup of world-class articulated haulers featuring new electronic systems and an in-house developed transmission, offering up to 15% fuel efficiency improvements. It also announced a strategic global investment of 2,500 MSEK to expand crawler excavator production at three sites to meet growing demand.

- In 2023, Caterpillar Launched updated models like the Cat 995 Wheel Loader and the Cat D10 Dozer, with a focus on improving productivity and meeting strict emissions standards.

- In 2023, Komatsu Partnered with EARTHBRAIN to offer customers a remote control system for construction equipment, aiming to improve safety and productivity. It also continued its focus on electrification, launching a 20-ton PC210LCE electric excavator with an extended battery life.

Report Coverage

The research report offers an in-depth analysis based on Product, Equipment Type and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will witness steady growth driven by rising global infrastructure investments.

- Adoption of electric and hybrid construction equipment will expand across urban projects.

- Automation and digital control systems will enhance operational precision and safety.

- Compact and fuel-efficient machines will gain preference for residential and confined worksites.

- Asia Pacific will continue to lead market growth supported by industrial and urban development.

- North America and Europe will focus on sustainable and low-emission construction equipment.

- Rental and leasing services will increase as contractors seek cost-effective equipment access.

- Integration of IoT and predictive maintenance will reduce downtime and extend machine life.

- Manufacturers will invest in training programs to address the shortage of skilled operators.

- Government policies promoting sustainable construction will create long-term market opportunities.