Market Overview

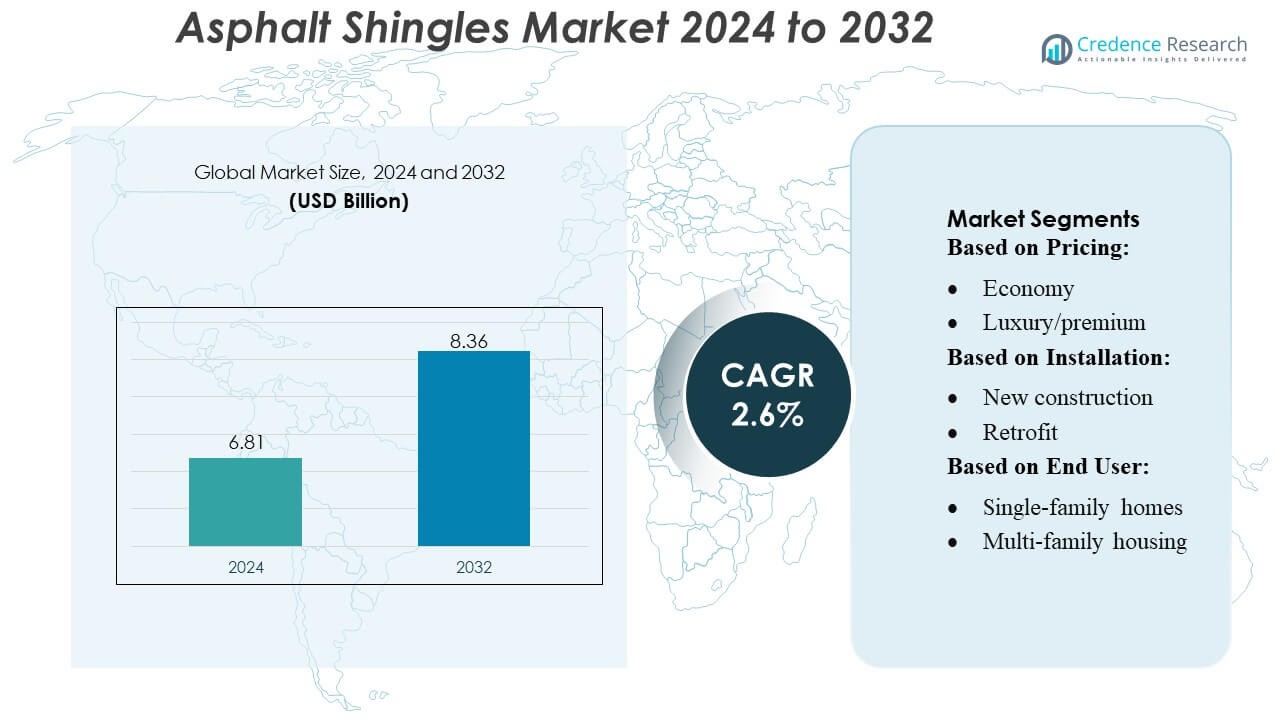

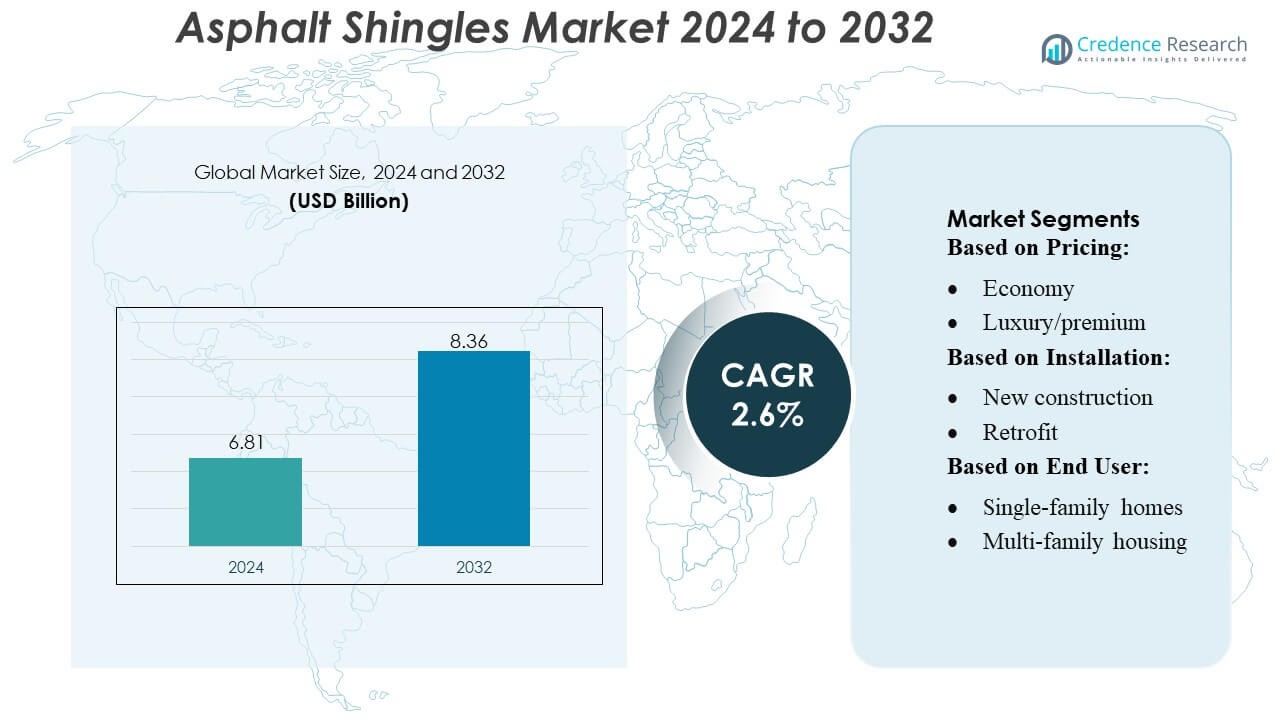

Asphalt Shingles Market size was valued USD 6.81 billion in 2024 and is anticipated to reach USD 8.36 billion by 2032, at a CAGR of 2.6% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Asphalt Shingles Market Size 2024 |

USD 6.81 Billion |

| Asphalt Shingles Market, CAGR |

2.6% |

| Asphalt Shingles Market Size 2032 |

USD 8.36 Billion |

The global Asphalt Shingles Market demonstrates a competitive landscape where a small group of well-established manufacturers lead the field. Companies such as Atlas Roofing Corporation have built strong market positions through extensive distribution networks and focus on durable, weather-resistant shingles. Many leading suppliers concentrate on product differentiation — offering architectural or fiberglass shingles that deliver enhanced longevity, energy efficiency, and aesthetic appeal. The overall market remains fragmented, yet a few key players maintain substantial influence by leveraging economies of scale, broad regional reach, and consistent supply-chain performance. Regionally, North America stands out as the dominant market with approximately 49.8% share of global asphalt-shingle demand.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Asphalt Shingles Market was valued at USD 6.81 billion in 2024 and is projected to reach USD 8.36 billion by 2032, growing at a CAGR of 2.6% during the forecast period.

- Rising demand for durable, cost-efficient roofing materials and increased residential reroofing activity continue to drive market expansion in both mature and developing construction sectors.

- Architectural and fiberglass shingles gain momentum as key trends, supported by improved longevity, enhanced aesthetics, and better energy performance across residential applications.

- Competitive intensity remains strong as leading manufacturers focus on product innovation, weather-resistant technologies, and supply-chain optimization, while market fragmentation limits rapid consolidation.

- North America maintains its position as the leading regional market with 8% share, while the architectural shingle segment dominates global product adoption, reinforced by strong renovation cycles and shifting consumer preference toward premium roofing solutions.

Market Segmentation Analysis:

By Pricing

The economy segment holds the largest market share in the asphalt shingles market, driven by widespread adoption in cost-sensitive residential projects. Contractors prefer economy-grade shingles because they offer acceptable durability, easy installation, and broad color options at lower upfront costs. This segment remains strong in regions experiencing high-volume housing development and budget-oriented reroofing cycles. In contrast, the luxury/premium segment grows steadily due to rising demand for architectural aesthetics, enhanced weather resistance, and higher curb appeal, especially in upscale residential developments and commercial buildings requiring long-term performance.

- For instance, Owens Corning’s Duration® Series shingles use the patented SureNail® Technology, which provides a reinforced nailing zone tested to withstand wind speeds up to 209 km/h, demonstrating how premium-tier designs deliver measurable performance enhancements.

By Installation

Retrofit installations dominate the market, holding the largest share due to continuous replacement demand across aging residential and commercial roofing structures. Homeowners prioritize asphalt shingles for retrofit projects because of their quick installation, compatibility with existing roofs, and relatively low labor costs. The segment further benefits from increasing storm-related reroofing activity and insurance-driven replacements. New construction shows stable growth, supported by expansion in residential housing starts and commercial development; however, its share remains comparatively smaller due to the cyclical nature of new-build construction.

- For instance, GSK reports that its integrated global manufacturing network — comprising 37 medicines and vaccines sites — delivered 2.1 billion packs of medicines and doses of vaccines in total during the year.

By End User

The residential sector accounts for the largest market share, with single-family homes representing the dominant sub-segment due to extensive use of asphalt shingles for durability, ease of maintenance, and cost-effectiveness. Single-family units drive consistent demand through both new construction and periodic reroofing cycles. Multi-family housing and townhouses also contribute steadily as developers adopt shingles for aesthetic uniformity and budget efficiency. In the commercial category, office buildings, retail spaces, and institutional structures adopt shingles in low-slope or pitched-roof applications, while industrial end users represent a smaller niche segment.

Key Growth Drivers

- Rising Residential Construction and Renovation Activities

Growing residential construction and home renovation investments continue to drive demand for asphalt shingles due to their cost efficiency, ease of installation, and broad aesthetic flexibility. Governments in developing regions are supporting residential infrastructure upgrades, while aging housing stocks in developed markets are undergoing frequent reroofing cycles. Asphalt shingles benefit from shorter installation timelines and lower maintenance costs, making them a preferred option for homeowners. This consistent replacement cycle, combined with expanding urban populations, reinforces steady product consumption across both new-build and refurbishment projects.

- For instance, Eagle Roofing offers Secure Guard 60, a self-adhering polymer-modified bituminous underlayment. The product was launched in 2024 to provide a high-quality leak barrier and enhance moisture protection for roofing systems.

- Advancements in Material Engineering and Product Durability

Innovations in shingle manufacturing, including fiberglass-reinforced mats, impact-resistant laminates, and advanced granule coatings, significantly enhance product lifespan and weather resilience. Manufacturers increasingly integrate UV-blocking and algae-resistant technologies, improving long-term roof performance in varied climates. Enhanced tear strength and wind-resistance ratings further elevate adoption in storm-prone regions. These engineering improvements not only reduce lifecycle costs but also strengthen regulatory compliance with evolving building codes, positioning modern asphalt shingles as a durable, high-value roofing solution.

- For instance, EcoStar’s synthetic roofing line is manufactured with up to 80% recycled polymers (rubber and plastics) in many profiles, enhancing sustainability and thermal insulation performance.

- Growing Preference for Energy-Efficient and Sustainable Roofing

Demand for energy-efficient building materials supports wider uptake of cool-roof asphalt shingles that reduce heat absorption and improve overall home energy performance. Reflective granule technologies help decrease cooling loads, aligning with global energy-conservation policies. Manufacturers increasingly introduce recyclable and lower-emission shingles to meet green-building certification requirements. Consumers prioritizing sustainability are adopting shingles with extended lifespans and reduced environmental impact, reinforcing market momentum. The integration of eco-friendly additives and improved manufacturing processes positions asphalt shingles as a competitive, environmentally aligned roofing option.

Key Trends & Opportunities

- Expansion of Architectural and Designer Shingle Categories

Architectural and designer shingles continue gaining traction as homeowners seek premium aesthetics without the high cost of natural materials. These laminated shingles mimic wood, slate, or tile while offering enhanced dimensionality and improved structural performance. Manufacturers capitalize on this trend by introducing broader color palettes and texture options, enabling higher-margin product lines. As consumer preferences shift toward visually appealing and durable roofing solutions, the market sees strong opportunities for innovation in style-forward shingle variants.

- For instance, Atlas Roofing’s Summit® 60 synthetic roof underlayment is offered in 10-square rolls (1,000 sq ft) with dimensions of 48″ × 250′ and supports 60-day UV exposure during installation.

- Increasing Adoption in Disaster-Resilient and Climate-Adapted Roofing

Rising climate impacts, including hurricanes, heavy rain, and temperature extremes, drive demand for shingles engineered to withstand high winds, moisture penetration, and thermal stress. The market sees growing opportunities for impact-resistant and fire-rated shingle lines that help homeowners mitigate insurance risks. This aligns with insurer incentives and stricter disaster-resilience building codes. Manufacturers offering advanced weatherproofing technologies are positioned to capture expanding demand in regions experiencing intensified climate variability.

- For instance, Ross Roof Group’s metal tile system supports a roof underlay requirement that allows a clear ventilated air-gap of at least 25 mm beneath the tile finish to control internal moisture and temperature.

- Digitalization in Product Selection, Installation, and Maintenance

Digital tools—such as AI-based roof design platforms, drone-assisted roof inspections, and augmented-reality visualization—create new opportunities for manufacturers and contractors. Homeowners increasingly rely on online configurators to compare shingle styles and performance attributes, accelerating product decisions. Contractors benefit from digital measurement and project-management solutions that shorten installation time and improve accuracy. The shift toward digital customer engagement enhances transparency and expands market reach, supporting greater adoption across diverse customer segments.

Key Challenges

- Volatility in Raw Material Costs

Fluctuating prices of asphalt, fiberglass, and petrochemical derivatives pose significant challenges for manufacturers. Supply-chain disruptions and crude-oil price instability directly impact production costs, squeezing profit margins and creating pricing uncertainty for contractors and consumers. These cost pressures complicate long-term planning and often lead to higher product prices, potentially limiting adoption in price-sensitive markets. Manufacturers must optimize procurement strategies and develop cost-efficient formulations to mitigate the effects of raw-material volatility.

- Competition from Alternative Roofing Materials

As homeowners explore roofing options with extended lifespans, such as metal, clay, slate, and synthetic composite materials, asphalt shingles face increasing competitive pressure. Alternative materials offer benefits like longer durability, higher fire resistance, and enhanced environmental profiles, appealing to premium market segments. This shift challenges asphalt-shingle manufacturers to differentiate through performance improvements, sustainability enhancements, and value-driven offerings. Without continuous innovation, asphalt shingles risk losing share to more durable or eco-friendly roofing systems.

Regional Analysis

North America

North America holds the largest share of the asphalt shingles market, accounting for about 45% of global demand. The region’s strong residential construction and frequent roof replacement cycles support steady consumption. The United States drives most of the demand due to widespread preference for cost-effective roofing and established roofing contractors. Renovation activity, storm-related repairs, and the popularity of laminated shingles further strengthen regional dominance. Overall, North America remains the leading market, supported by mature construction practices and consistent reroofing needs.

Europe

Europe represents around 22% of the global asphalt shingles market, driven mainly by rising renovation activities and demand for durable, energy-efficient roofing materials. Countries such as Germany, the UK, and France contribute significantly to this demand, especially in residential renovation projects. European consumers increasingly prefer laminated and fiberglass shingles due to their long lifespan and weather resistance. Although growth is moderate due to mature construction markets, the focus on sustainability and compliance with strict building standards continues to support stable demand for asphalt shingles across the region.

Asia-Pacific

Asia-Pacific accounts for around 18% of the asphalt shingles market and is the fastest-growing region. Rapid urbanization, rising housing development, and greater acceptance of modern roofing materials drive demand. Countries like China, India, and Japan are increasing the use of asphalt shingles because they offer durability and easy installation. Growing middle-class housing demand and shifting preferences toward American-style roofing also support the market. As construction activity expands across emerging economies, Asia-Pacific is expected to steadily increase its share in the global asphalt shingles market.

Latin America

Latin America holds around 9% of the global asphalt shingles market, supported by gradual growth in residential construction. Countries such as Brazil, Mexico, and Chile are adopting asphalt shingles due to their affordability and resilience in warm climates. Government housing programs and expanding urban populations contribute to steady market uptake. Although overall consumption remains lower than in developed regions, increasing awareness of cost-efficient roofing solutions and rising renovation activity help maintain consistent demand across Latin America.

Middle East & Africa (MEA)

The Middle East & Africa region captures about 7% of the global asphalt shingles market. Growth is driven by expanding construction activity, rising low-cost housing projects, and increased adoption of weather-resistant roofing materials. Countries like the UAE, Saudi Arabia, and South Africa show rising interest in asphalt shingles due to their ease of installation and adaptability to different climates. While adoption is still developing compared to other regions, ongoing urbanization and infrastructure development continue to create new opportunities for asphalt shingles in MEA.

Market Segmentations:

By Pricing:

By Installation:

- New construction

- Retrofit

By End User:

- Single-family homes

- Multi-family housing

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Asphalt Shingles Market features a diverse mix of global enterprises, referenced collectively in leading sectors such as CanSinoBIO, GlaxoSmithKline plc., Boral Limited, Vaccitech, Green Cross Corp, SK Bioscience, Bridgestone, Geneone Life Science, Pfizer Inc., and Merck & Co., Inc. The Asphalt Shingles Market is shaped by innovation-driven strategies, expanding product portfolios, and a strong focus on performance-enhancing technologies. Leading manufacturers prioritize the development of advanced laminated and architectural shingles that offer improved durability, weather resistance, and energy efficiency. Companies continue to invest in stronger fiberglass bases, enhanced granule adhesion, and algae-resistant formulations to meet rising consumer expectations. Competitive advantage increasingly depends on supply-chain reliability, partnerships with contractors, and broader geographic presence to support both new construction and reroofing demand. Sustainability has also become a key differentiator, with producers adopting low-emission manufacturing practices and recyclable materials to align with evolving environmental standards.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- CanSinoBIO

- GlaxoSmithKline plc.

- Boral Limited

- Vaccitech

- Green Cross Corp

- SK Bioscience

- Bridgestone

- Geneone Life Science

- Pfizer Inc.

- Merck & Co., Inc.

Recent Developments

- In March, 2025, AIM Vaccine Co., Ltd. announced its independently developed mRNA shingles vaccine received clinical trial approval from the U.S. Food and Drug Administration (FDA). AIM holds FDA approval to commence clinical trials for two key mRNA vaccine candidates.

- In March, 2025, GlaxoSmithKline (GSK) announced a research collaboration with the UK Dementia Research Institute (UK DRI) and Health Data Research UK (HDR UK) to study neurodegeneration through a novel dementia study.

- In June 2024, Dynavax Technologies Corporation announced enrollment and dosing of first participant in Phase 1/2 clinical trial for assessing the safety, tolerability, and immune response of Z-1018. This investigational vaccine candidate is being developed to prevent shingles (herpes zoster), a painful condition caused by the varicella-zoster virus.

Report Coverage

The research report offers an in-depth analysis based on Pricing, Installation, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will continue expanding as residential reroofing activity increases across developed regions.

- Manufacturers will adopt more sustainable materials to align with growing environmental regulations.

- Demand for laminated and architectural shingles will rise due to their longer lifespan and improved aesthetics.

- Advanced coatings and impact-resistant technologies will strengthen product performance in extreme weather conditions.

- Smart roofing integrations, such as solar-ready shingles, will gain traction in modern construction.

- Supply chains will become more localized to reduce lead times and improve manufacturing efficiency.

- Contractors and builders will increasingly favor shingles that offer faster installation and lower maintenance needs.

- Renovation-driven demand will grow as aging housing stock prompts more frequent roof replacements.

- Manufacturers will expand distribution networks to capture market share in emerging economies.

- Digital tools and roofing visualization software will support better customer engagement and faster decision-making.