Market Overview:

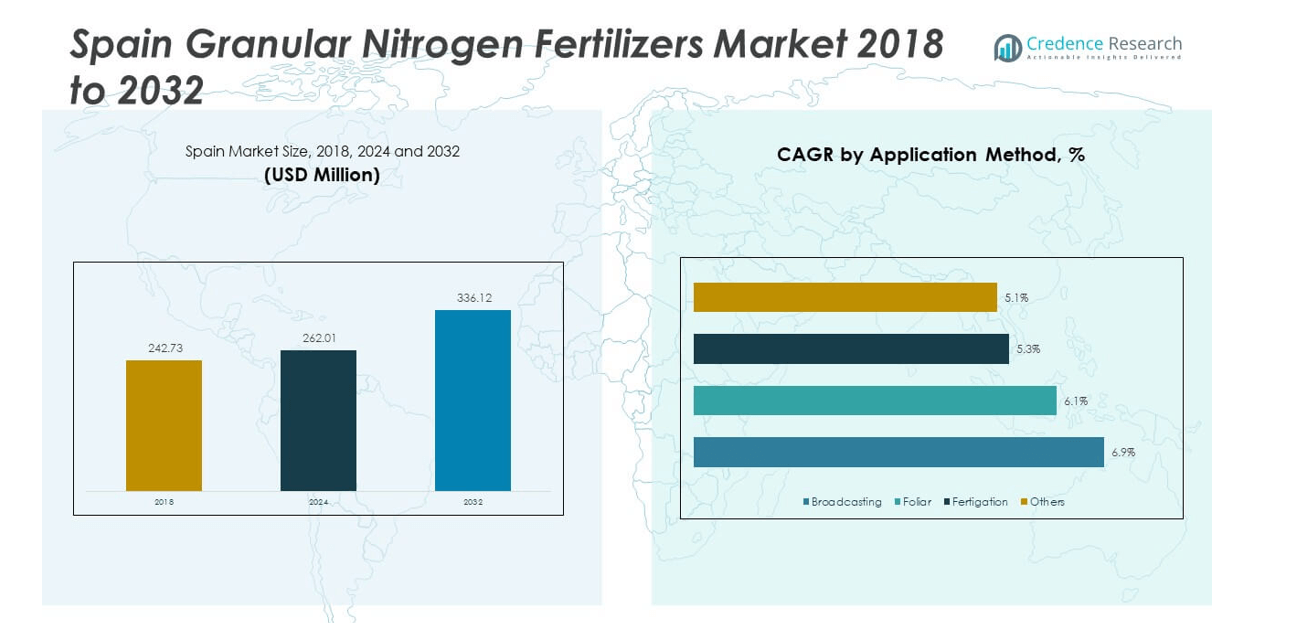

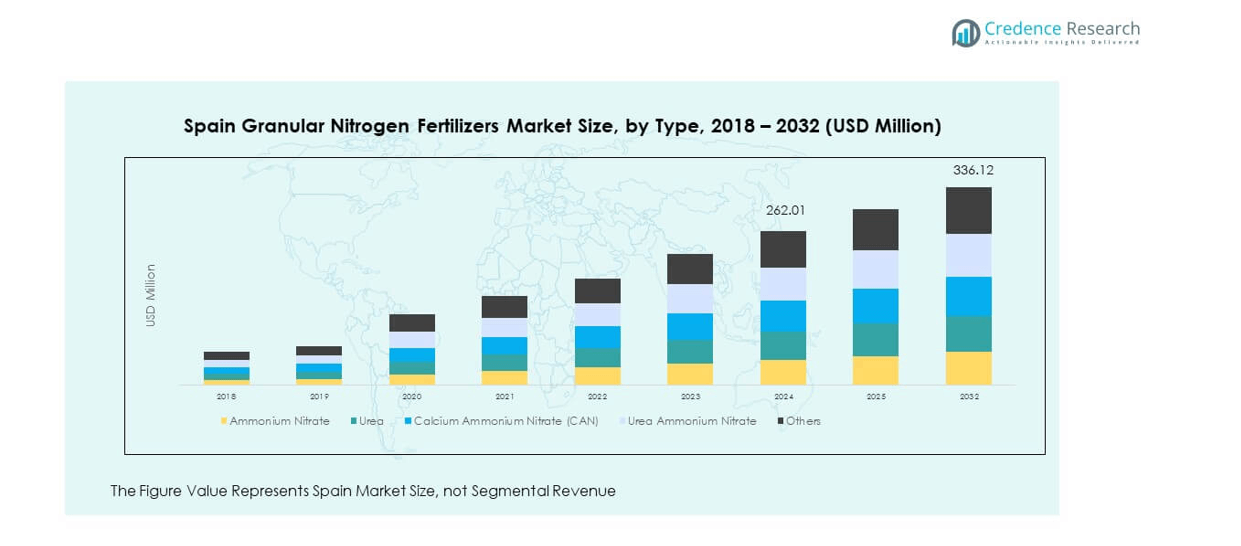

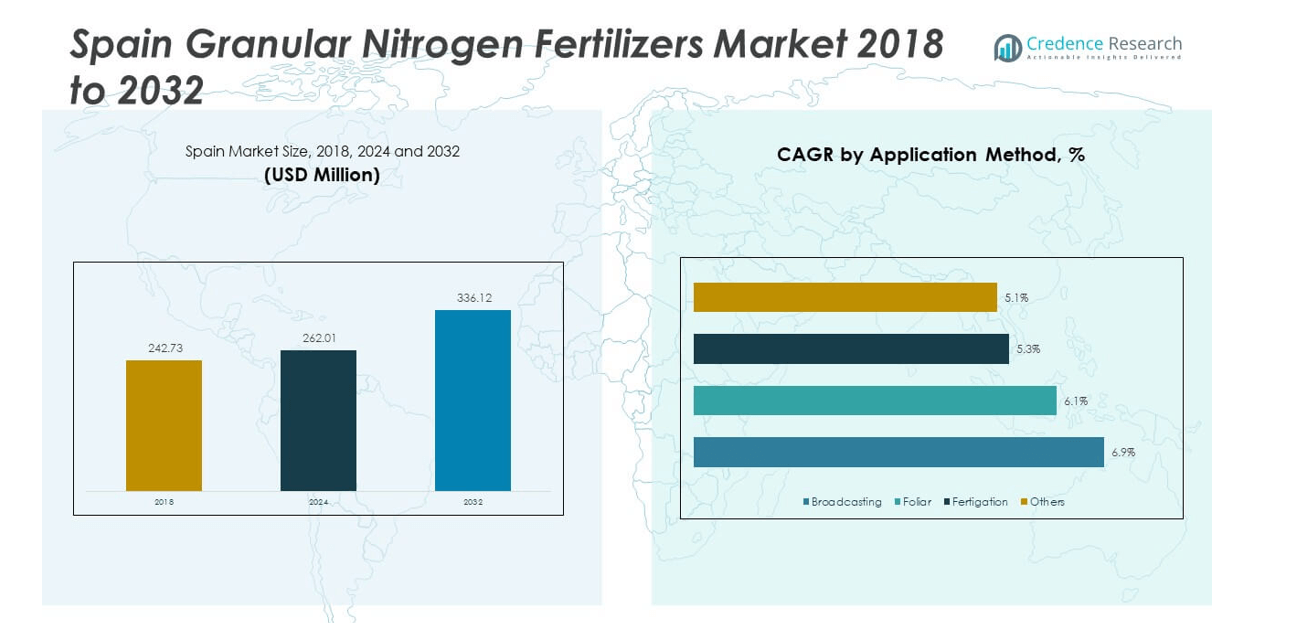

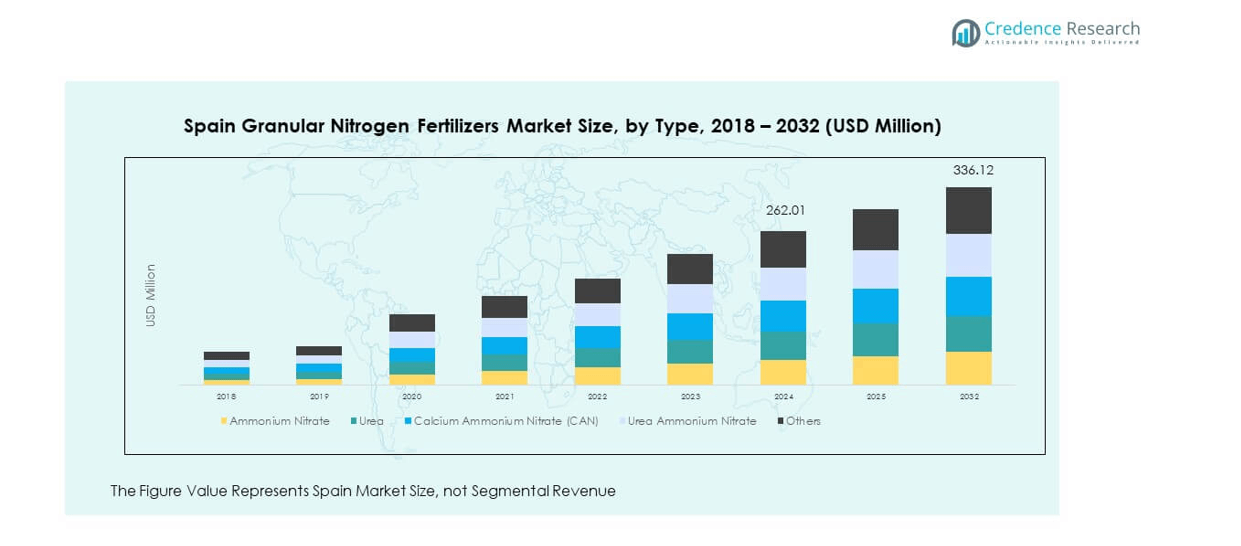

The Spain Granular Nitrogen Fertilizers Market size was valued at USD 242.73 million in 2018 to USD 262.01 million in 2024 and is anticipated to reach USD 336.12 million by 2032, at a CAGR of 3.16% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Spain Granular Nitrogen Fertilizers Market Size 2024 |

USD 262.01 million |

| Spain Granular Nitrogen Fertilizers Market, CAGR |

3.16% |

| Spain Granular Nitrogen Fertilizers Market Size 2032 |

USD 336.12 million |

The market growth is driven by rising crop yield requirements and improved agricultural practices. Farmers in Spain are adopting precision farming and controlled-release fertilizers to boost efficiency and reduce nutrient loss. Supportive government initiatives promoting sustainable agriculture and increasing awareness of balanced soil nutrition are further enhancing product adoption. Expanding horticulture and cereal cultivation also strengthens the demand for granular nitrogen fertilizers across the country.

Regional dynamics indicate strong demand from agricultural hubs such as Andalusia, Castile-La Mancha, and Catalonia due to their large cultivated areas. Northern regions are emerging as potential growth areas with a shift toward high-value crops and better irrigation systems. Increased mechanization and modern fertilizer application technologies are expected to further expand market reach across Spain in the coming years.

Market Insights:

- The Spain Granular Nitrogen Fertilizers Market was valued at USD 242.73 million in 2018, increased to USD 262.01 million in 2024, and is projected to reach USD 336.12 million by 2032, expanding at a CAGR of 3.16% during the forecast period.

- Andalusia (32%), Castile-La Mancha (24%), and Catalonia (18%) dominate the market due to extensive cereal and olive cultivation, favorable climatic conditions, and strong adoption of precision agriculture practices.

- Valencia (12%) is the fastest-growing region, supported by citrus farming, advanced irrigation systems, and rising demand for high-value horticultural crops.

- Urea holds the largest segment share at 38%, driven by its cost-effectiveness and high nitrogen concentration preferred for large-scale crop cultivation.

- Calcium Ammonium Nitrate (CAN) follows with 26% share, favored for its balanced nutrient composition, low environmental impact, and consistent performance across varied soil conditions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Agricultural Productivity Needs and Expanding Crop Diversification

The Spain Granular Nitrogen Fertilizers Market is driven by growing demand for higher agricultural yields and diverse crop production. Farmers are adopting nutrient-balanced fertilizers to improve soil fertility and maximize output. Expanding cultivation of cereals, fruits, and vegetables has strengthened nitrogen fertilizer demand across the country. The government’s support for modern farming practices enhances fertilizer application efficiency. Technological advances in soil testing promote precise nutrient management. Rising population and food security goals encourage continuous agricultural improvement. Demand for consistent crop quality increases fertilizer dependency. It sustains steady market growth across Spain’s farming regions.

- For instance, EuroChem conducted hundreds of field trials globally in 2024, reporting that its use of enhanced nitrogen fertilizers increased wheat protein content and reduced nutrient losses. Their advanced products applied in regional trials showed increased resistance to water stress and a 70% reduction in greenhouse gas emissions compared to traditional methods.

Growing Adoption of Precision Agriculture and Smart Fertilization Methods

Spain’s shift toward precision agriculture supports efficient nitrogen use and minimizes wastage. The adoption of GPS-guided equipment and digital soil analysis tools enhances fertilizer application accuracy. Farmers benefit from controlled-release technologies that improve nutrient absorption rates. Smart agriculture solutions reduce operational costs and environmental risks. It aligns with national sustainability goals and European Union directives on fertilizer use. Increasing collaboration between agri-tech firms and cooperatives boosts digital adoption. Farmers gain insights into soil health and optimize nitrogen input levels. Such advancements strengthen the overall efficiency of Spain’s fertilizer ecosystem.

Government Policies Supporting Sustainable and Efficient Fertilizer Use

Supportive policies drive adoption of eco-friendly nitrogen fertilizers across Spain. Subsidies and incentive programs encourage farmers to shift toward low-emission products. The Spain Granular Nitrogen Fertilizers Market benefits from environmental reforms under the Common Agricultural Policy (CAP). Authorities promote research partnerships focusing on nutrient recycling and emission reduction. Regional governments emphasize water-efficient fertilizer practices in arid zones. It helps reduce nitrate pollution and preserve groundwater quality. Strong regulatory frameworks foster a competitive yet sustainable fertilizer industry. These initiatives ensure balanced growth while meeting environmental compliance.

Technological Innovations in Fertilizer Formulation and Application Equipment

Advances in fertilizer formulation enhance nutrient delivery and crop response efficiency. Coated and stabilized nitrogen products improve release control and minimize leaching. Equipment innovations, including automated spreaders and injectors, ensure precise application. It helps farmers achieve uniform nutrient distribution across large fields. Research institutions collaborate with manufacturers to develop bio-based nitrogen options. Rising demand for sustainable inputs drives ongoing product innovation. Digital tools and remote monitoring enhance productivity and reduce manual effort. These technological improvements reinforce Spain’s leadership in efficient fertilizer management.

Market Trends:

Shift Toward Environmentally Sustainable Fertilizer Solutions and Bio-Based Alternatives

The Spain Granular Nitrogen Fertilizers Market is witnessing a steady shift toward environmentally sustainable fertilizer solutions. Bio-based and slow-release nitrogen formulations are gaining popularity among eco-conscious farmers. Manufacturers are investing in green chemistry to meet European sustainability goals. Demand for low-carbon fertilizers aligns with strict emission control standards. It promotes better soil structure and long-term fertility improvement. Awareness of nitrate contamination drives adoption of cleaner formulations. Consumers support sustainable agriculture through organic food demand. These developments strengthen Spain’s movement toward responsible fertilizer consumption.

- For instance, the Fertiberia Puertollano plant uses green hydrogen from a nearby Iberdrola facility to reduce its natural gas requirements by over 10%. This project is designed to avoid up to 48,000 tonnes of CO₂ emissions per year. The construction phase alone created up to 1,000 jobs, with the overall investment positioning Fertiberia as a leader in large-scale green ammonia for fertilizer production.

Expansion of Digital Agriculture Platforms and Data-Driven Farm Management

Digital agriculture platforms are transforming fertilizer distribution and field management. Spanish farmers increasingly rely on mobile applications for nutrient monitoring and scheduling. The Spain Granular Nitrogen Fertilizers Market benefits from predictive analytics that optimize nitrogen application. Cloud-based data platforms integrate weather, crop type, and soil data for precision farming. Equipment manufacturers introduce sensors and IoT-enabled tools for real-time feedback. It empowers farmers to make informed nutrient decisions and cut excess usage. Agritech firms collaborate with cooperatives to widen access to digital systems. This technological evolution promotes resource efficiency and profitability across the agricultural chain.

- For instance, Yara’s Atfarm platform provides satellite-based nutrient recommendations across millions of hectares, letting Spanish farmers monitor crop development and apply nutrients based on real-time data, reducing wasted fertilizer and boosting efficiency. Atfarm’s latest updates include weather-based spread suggestions and growth-stage simulations for better farm management.

Emerging Demand for Controlled-Release and Polymer-Coated Fertilizers

Controlled-release fertilizers are becoming integral to sustainable nutrient management practices. Farmers prefer polymer-coated products that reduce nitrogen volatilization and extend nutrient supply duration. The Spain Granular Nitrogen Fertilizers Market gains traction through innovative coatings improving nitrogen use efficiency. Such products help reduce runoff and protect water resources. High-value crop cultivators increasingly adopt these fertilizers for yield stability. Technological partnerships enhance coating materials and nutrient encapsulation precision. It supports cost savings and compliance with environmental directives. This trend encourages continuous innovation in product design and application techniques.

Growth in Regional Distribution Networks and Domestic Production Capacity

Expansion in regional distribution and production capacity strengthens Spain’s fertilizer availability. Local manufacturers are increasing investment in logistics and storage facilities. The Spain Granular Nitrogen Fertilizers Market benefits from improved supply chain resilience. Domestic production reduces dependency on imports and stabilizes prices for farmers. New blending facilities offer tailored nutrient formulations suited to regional soil conditions. It enables timely access to fertilizers during peak planting seasons. Strategic partnerships between producers and cooperatives enhance distribution reach. These developments build a robust domestic fertilizer ecosystem that supports national agriculture growth.

Market Challenges Analysis:

Environmental Regulations and Rising Pressure for Emission Reduction Compliance

Stringent environmental regulations pose challenges for manufacturers and distributors. The Spain Granular Nitrogen Fertilizers Market faces restrictions on nitrogen emissions and nitrate runoff. Compliance with European Green Deal objectives increases operational costs for producers. Manufacturers must invest in cleaner production technologies and monitoring systems. Farmers adapt to reduced nitrogen quotas, impacting short-term yields. It creates a need for advanced formulations that balance efficiency and compliance. Regulatory uncertainty affects long-term planning and investment confidence. These pressures encourage companies to prioritize sustainability without sacrificing productivity.

Price Volatility and Supply Chain Disruptions Affecting Fertilizer Accessibility

Unstable raw material prices and logistical constraints challenge fertilizer availability. Energy costs and global ammonia shortages influence product pricing across Spain. The Spain Granular Nitrogen Fertilizers Market experiences fluctuations that impact farmer affordability. Import dependency exposes the market to geopolitical and shipping disruptions. Smaller farmers face margin pressure due to unpredictable input costs. It drives the search for local suppliers and alternative nutrient sources. Companies expand domestic production to stabilize market conditions. Strengthening local value chains becomes essential for ensuring reliable fertilizer supply.

Market Opportunities:

Development of Eco-Friendly and Smart Nitrogen Fertilizer Products

Growing preference for sustainable agriculture opens major opportunities for innovation. The Spain Granular Nitrogen Fertilizers Market can expand through biodegradable and smart nitrogen products. Manufacturers invest in bio-based materials that enhance efficiency and reduce carbon impact. Integration of digital tools improves application precision and waste reduction. It creates new prospects for partnerships between technology firms and fertilizer producers. Government sustainability programs support such advancements in fertilizer technology. These opportunities align with the EU’s green farming objectives and circular economy principles. Companies embracing these trends can capture early competitive advantage.

Expansion into Emerging Agricultural Regions and High-Value Crop Segments

Emerging agricultural zones and specialized crop cultivation create strong future demand. The Spain Granular Nitrogen Fertilizers Market benefits from expanding fruit, vegetable, and greenhouse farming areas. Growth in export-oriented agriculture requires consistent nutrient management. Producers can target these segments through tailored nutrient blends and delivery solutions. It helps farmers achieve premium yields and improved profitability. Increasing adoption of precision farming in rural regions strengthens market penetration. Export diversification and sustainable crop initiatives offer new business avenues. These developments enhance Spain’s potential as a leader in modern fertilizer solutions.

Market Segmentation Analysis:

By Type

The Spain Granular Nitrogen Fertilizers Market is segmented into ammonium nitrate, urea, calcium ammonium nitrate (CAN), urea ammonium nitrate, and others. Urea holds the dominant share due to its high nitrogen concentration and affordability, making it the preferred choice among farmers. Calcium ammonium nitrate is gaining traction for its balanced nutrient release and reduced environmental impact. Ammonium nitrate remains important for high-value crops requiring rapid nitrogen availability. Urea ammonium nitrate solutions support flexible application across varied soil conditions. It benefits from continuous innovation in coating technologies that enhance efficiency and minimize nutrient loss.

- For instance, OCI Global’s Nutramon Low Carbon granular nitrogen fertilizer, which reduces its carbon footprint by up to 50% compared to conventional products by using biomethane instead of fossil gas, has been available to growers in the UK since 2023, is ISCC PLUS-certified for sustainability, and is used for crops like malting barley.

By Application Method

The market is categorized into broadcasting, foliar, fertigation, and others. Broadcasting remains the most common application method due to its ease and low cost across large farmlands. Fertigation is expanding with the growth of drip irrigation and greenhouse farming. Foliar application is preferred for immediate nutrient absorption in horticultural crops. It drives higher yield quality in fruits and vegetables. The adoption of modern spraying equipment enhances precision in fertilizer distribution. Growing demand for resource-efficient agriculture supports the shift toward advanced application methods.

- For instance, John Deere’s ExactShot and ExactRate systems, commercially available in recent years and expanded for 2025 planters, are designed for large-scale row crops like corn, not greenhouse growing. ExactShot reduces starter fertilizer use by over 60% through real-time, seed-level application via smart sensors and robotics.

By End-User

Key end-user segments include agriculture, horticulture, and landscaping and turf. Agriculture dominates due to extensive use in cereal, oilseed, and pulse cultivation. Horticulture represents a growing segment supported by the expansion of greenhouse and orchard farming. Landscaping and turf applications are increasing across golf courses and urban green projects. It benefits from steady fertilizer use to maintain aesthetic and soil health standards. These sectors collectively sustain consistent demand growth for granular nitrogen fertilizers across Spain.

Segmentation:

By Type:

- Ammonium Nitrate

- Urea

- Calcium Ammonium Nitrate (CAN)

- Urea Ammonium Nitrate

- Others

By Application Method:

- Broadcasting

- Foliar

- Fertigation

- Others

By End-User:

- Agriculture

- Horticulture

- Landscaping and Turf

Regional Analysis:

Dominance of Andalusia and Castile-La Mancha

Andalusia leads the Spain Granular Nitrogen Fertilizers Market with a market share of 32% in 2024. The region’s dominance is driven by extensive cereal and olive cultivation, supported by advanced irrigation systems. Fertilizer use remains high due to large-scale commercial farming and favorable climatic conditions. Castile-La Mancha follows closely, holding 24% of the market share, supported by broad agricultural land and high wheat and barley production. Both regions benefit from established supply networks and government support for precision agriculture. It continues to record strong demand for nitrogen-rich formulations that enhance crop yield and soil productivity. Growing emphasis on sustainability strengthens the shift toward eco-efficient fertilizer use.

Emerging Growth in Catalonia and Valencia

Catalonia accounts for 18% of the Spain Granular Nitrogen Fertilizers Market, supported by diversified farming systems and strong horticultural activity. Advanced greenhouse and vegetable farming drive the adoption of fertigation-based applications. Valencia captures 12% of the market share, driven by citrus cultivation and high-value crop production. These regions demonstrate steady uptake of polymer-coated and slow-release nitrogen fertilizers. It benefits from continuous innovation in fertilizer formulations that optimize nutrient absorption. Rising investment in smart irrigation infrastructure strengthens efficient fertilizer utilization. Regional distributors and cooperatives play a key role in expanding fertilizer accessibility and adoption among small and medium farmers.

Northern and Central Regions Offering Future Potential

Northern regions, including Galicia and Navarre, collectively contribute 9% of the national market share, while central areas such as Madrid and Extremadura account for the remaining 5%. These areas are witnessing increased adoption of sustainable agricultural practices and precision-based fertilization. It reflects rising awareness of soil health management and efficient resource use. Government initiatives promoting organic and balanced fertilization techniques are stimulating gradual market penetration. Growing interest in high-value horticultural crops and protected farming supports the development of modern fertilizer applications. The combined influence of climate adaptation programs, irrigation modernization, and eco-friendly product demand is expected to drive consistent growth across these emerging regions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

Competitive Analysis:

The Spain Granular Nitrogen Fertilizers Market features strong competition among domestic and global manufacturers focusing on product efficiency and sustainability. Leading players such as Yara International ASA, Fertiberia, ICL Group Ltd, and Haifa Group dominate through extensive distribution networks and innovative fertilizer solutions. Local producers like Mirat and Fervalle strengthen regional presence by offering customized nitrogen blends suited to Spanish soil types. It experiences moderate consolidation, with firms emphasizing technological improvements in coating and slow-release formulations. Strategic alliances with agri-tech firms and cooperative associations support supply consistency. Competition is driven by pricing strategies, product differentiation, and sustainability alignment.

Recent Developments:

- In July 2025, Fertiberia announced the launch of a new line of enhanced granular nitrogen fertilizers designed for climate-smart agriculture, making the products available nationwide through its distribution channels in Spain.

- In November 2024, Fertiberia and PepsiCo extended their low-carbon fertilizer program for potato and corn production in Spain and Portugal, confirmed through direct press coverage and official statements; Fertiberia’s ‘Impact Zero’ initiative utilizes fertilizers produced from green hydrogen in Spain.

Report Coverage:

The research report offers an in-depth analysis based on type, application method, and end-user segments. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Rising adoption of precision agriculture will improve nitrogen efficiency across major farming regions.

- Technological innovation in coated and controlled-release fertilizers will gain momentum.

- Government support for sustainable fertilizer use will drive eco-friendly product adoption.

- Local manufacturers will expand regional distribution to reduce dependence on imports.

- Demand for customized nutrient blends will grow with crop diversification in Spain.

- Digital farming platforms will enhance real-time nutrient monitoring and soil health management.

- Controlled nitrogen release technologies will help meet environmental compliance targets.

- Fertigation and foliar applications will see strong growth in horticultural segments.

- Strategic partnerships between fertilizer and agri-tech firms will accelerate innovation.

- Long-term focus on resource optimization and soil regeneration will sustain market expansion.